false000010488900001048892023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 1, 2023

GRAHAM HOLDINGS COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Delaware | 001-06714 | 53-0182885 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | |

1300 North 17th Street, Arlington, Virginia | | 22209 |

| (Address of principal executive offices) | | (Zip Code) |

(703) 345-6300

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

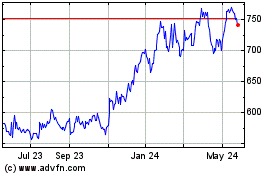

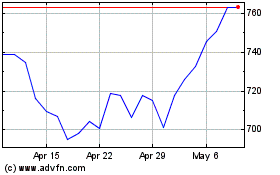

| Class B Common Stock, par value $1.00 per share | GHC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 1, 2023, Graham Holdings Company issued a press release announcing the Company’s earnings for the third quarter ended September 30, 2023. A copy of this press release is furnished with this report as an exhibit to this Form 8-K.

Item 9.01 Financial Statements and Exhibits.

Exhibit 99.1 Graham Holdings Company Earnings Release Dated November 1, 2023.

Exhibit Index

Exhibit 104 Cover Page Interactive Data File, formatted in Inline XBRL and included as Exhibit 101.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | Graham Holdings Company |

| | | (Registrant) |

| | | |

| | | |

| Date: November 1, 2023 | | /s/ Wallace R. Cooney |

| | | Wallace R. Cooney,

Chief Financial Officer

(Principal Financial Officer) |

Exhibit 99.1

| | | | | | | | | | | | | | |

| Contact: | | Wallace R. Cooney | | For Immediate Release |

| | (703) 345-6470 | | November 1, 2023 |

| | | | |

| GRAHAM HOLDINGS COMPANY REPORTS |

| THIRD QUARTER EARNINGS |

ARLINGTON, VA – Graham Holdings Company (NYSE: GHC) today reported a net loss attributable to common shares of $23.0 million ($5.02 per share) for the third quarter of 2023, compared to net income attributable to common shares of $32.8 million ($6.76 per share) for the third quarter of 2022.The results for the third quarter of 2023 and 2022 were affected by a number of items as described in the following paragraphs. Excluding these items, net income attributable to common shares was $48.9 million ($10.45 per share) for the third quarter of 2023, compared to $74.2 million ($15.30 per share) for the third quarter of 2022. (Refer to the Non-GAAP Financial Information schedule at the end of this release for additional details.)

Items included in the Company’s net loss for the third quarter of 2023:

•$98.3 million in goodwill and other long-lived asset impairment charges (after-tax impact of $84.4 million, or $18.18 per share);

•$16.8 million in net gains on marketable equity securities (after-tax impact of $12.3 million, or $2.66 per share);

•$2.8 million in net losses of affiliates whose operations are not managed by the Company (after-tax impact of $2.1 million, or $0.45 per share);

•a $4.6 million credit to interest expense resulting from gains realized related to the termination of interest rate swaps (after-tax impact of $3.3 million, or $0.72 per share); and

•$1.1 million in interest expense to adjust the fair value of the mandatorily redeemable noncontrolling interest (after-tax impact of $1.0 million, or $0.22 per share).

Items included in the Company’s net income for the third quarter of 2022:

•a $1.7 million net credit related to a fair value change in contingent consideration from a prior acquisition at the education division ($0.35 per share);

•$54.2 million in net losses on marketable equity securities (after-tax impact of $40.2 million, or $8.28 per share);

•$2.7 million in net losses of affiliates whose operations are not managed by the Company (after-tax impact of $2.0 million, or $0.42 per share);

•a net non-operating gain of $0.6 million from the write-up of a cost method investment (after-tax impact of $0.4 million, or $0.09 per share); and

•$1.4 million in interest expense to adjust the fair value of the mandatorily redeemable noncontrolling interest (after-tax impact of $1.3 million, or $0.28 per share).

Revenue for the third quarter of 2023 was $1,111.5 million, up 10% from $1,012.4 million in the third quarter of 2022. Revenues increased at education, healthcare and automotive, partially offset by declines at television broadcasting, manufacturing and other businesses. The Company reported an operating loss of $57.1 million for the third quarter of 2023, compared to operating income of $59.5 million for the third quarter of 2022. The decrease in operating results is due to goodwill impairment charges at World of Good Brands (WGB, formerly Leaf Media) and Dekko and declines at television broadcasting, manufacturing, automotive and other businesses, partially offset by an increase at education. The Company reported adjusted operating cash flow (non-GAAP) of $83.7 million for the third quarter of 2023, compared to $99.4 million for the third quarter of 2022. Adjusted operating cash flow declined at television broadcasting, manufacturing, automotive and other businesses, partially offset by increases at education and healthcare.

For the first nine months of 2023, the Company recorded net income attributable to common shares of $152.0 million ($32.14 per share), compared to $60.9 million ($12.48 per share) for the first nine months of 2022. The results for the first nine months of 2023 and 2022 were affected by a number of items as described in the following

paragraphs. Excluding these items, net income attributable to common shares was $151.2 million ($31.96 per share) for the first nine months of 2023, compared to $196.6 million ($40.27 per share) for the first nine months of 2022. (Refer to the Non-GAAP Financial Information schedule at the end of this release for additional details.)

Items included in the Company’s net income for the first nine months of 2023:

•a $4.2 million net credit related to a fair value change in contingent consideration from a prior acquisition at Corporate (after-tax impact of $4.1 million, or $0.89 per share);

•$99.1 million in goodwill and other-long lived asset impairment charges (after-tax impact of $85.0 million, or $18.30 per share);

•$9.6 million in expenses related to non-operating Separation Incentive Programs (SIPs) at other businesses and the education and television broadcasting divisions (after-tax impact of $7.2 million, or $1.54 per share);

•$113.4 million in net gains on marketable equity securities (after-tax impact of $83.6 million, or $17.99 per share);

•$9.7 million in net losses of affiliates whose operations are not managed by the Company (after-tax impact of $7.1 million, or $1.53 per share);

•a non-operating gain of $10.0 million on the sale of Pinna (after-tax-impact of $7.4 million, or $1.59 per share);

•non-operating gain of $3.9 million from the write-up and sales of cost method investments (after-tax impact of $2.9 million, or $0.63 per share);

•a $4.6 million credit to interest expense resulting from gains realized related to the termination of interest rate swaps (after-tax impact of $3.3 million, or $0.72 per share); and

•$1.4 million in net interest expense to adjust the fair value of the mandatorily redeemable noncontrolling interest (after-tax impact of $1.3 million, or $0.27 per share).

Items included in the Company’s net income for the first nine months of 2022:

•a $4.9 million net credit related to fair value changes in contingent consideration from prior acquisitions (after-tax impact of $4.9 million, or $1.00 per share);

•$172.9 million in net losses on marketable equity securities (after-tax impact of $127.9 million, or $26.19 per share);

•$2.8 million in net losses of affiliates whose operations are not managed by the Company (after-tax impact of $2.1 million, or $0.43 per share);

•Non-operating gain of $2.2 million from sales and write-up of cost and equity method investments (after-tax impact of $1.7 million, or $0.34 per share); and

•$12.8 million in interest expense to adjust the fair value of the mandatorily redeemable noncontrolling interest (after-tax impact of $12.3 million, or $2.51 per share).

Revenue for the first nine months of 2023 was $3,248.1 million, up 14% from $2,860.5 million in the first nine months of 2022. Revenues increased at education, healthcare and automotive, partially offset by declines at television broadcasting, manufacturing and other businesses. The Company reported operating income of $28.6 million for the first nine months of 2023, compared to $138.8 million for the first nine months of 2022. The decrease in operating results is due to goodwill impairment charges at WGB and Dekko and declines at television broadcasting, healthcare, and other businesses, partially offset by increases at education and automotive. The Company reported adjusted operating cash flow (non-GAAP) of $255.3 million for the first nine months of 2023, compared to $258.4 million for the first nine months of 2022. Adjusted operating cash flow declined at television broadcasting and other businesses, partially offset by increases at education, healthcare and automotive.

Division Results

Education

Education division revenue totaled $411.8 million for the third quarter of 2023, up 16% from $355.1 million for the same period of 2022. Kaplan reported operating income of $29.9 million for the third quarter of 2023, compared to $18.6 million for the third quarter of 2022.

For the first nine months of 2023, education division revenue totaled $1,192.1 million, up 12% from $1,066.1 million for the same period of 2022. Kaplan reported operating income of $83.0 million for the first nine months of 2023, compared to $57.8 million for the first nine months of 2022.

In the second quarter of 2023, Kaplan modified its segment reporting for Kaplan India, a shared services center that supports Higher Education (previously included in Kaplan corporate and other); prior periods have been reclassified to conform with the current presentation.

A summary of Kaplan’s operating results is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Nine Months Ended | | |

| | | September 30 | | | | September 30 | | |

| (in thousands) | | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Revenue | | | | | | | | | | | | |

| Kaplan international | | $ | 249,976 | | | $ | 193,085 | | | 29 | | | $ | 714,715 | | | $ | 598,469 | | | 19 | |

| Higher education | | 81,925 | | | 82,314 | | | 0 | | | 250,557 | | | 233,990 | | | 7 | |

| Supplemental education | | 78,332 | | | 79,566 | | | (2) | | | 226,535 | | | 233,416 | | | (3) | |

| Kaplan corporate and other | | 3,101 | | | 2,616 | | | 19 | | | 8,360 | | | 7,414 | | | 13 | |

| Intersegment elimination | | (1,497) | | | (2,517) | | | — | | | (8,062) | | | (7,200) | | | — | |

| | | $ | 411,837 | | | $ | 355,064 | | | 16 | | | $ | 1,192,105 | | | $ | 1,066,089 | | | 12 | |

| Operating Income (Loss) | | | | | | | | | | | | |

| Kaplan international | | $ | 22,220 | | | $ | 8,503 | | | — | | | $ | 64,272 | | | $ | 48,130 | | | 34 | |

| Higher education | | 8,465 | | | 9,064 | | | (7) | | | 33,343 | | | 17,423 | | | 91 | |

| Supplemental education | | 9,729 | | | 9,471 | | | 3 | | | 16,992 | | | 17,671 | | | (4) | |

| Kaplan corporate and other | | (7,412) | | | (4,616) | | | (61) | | | (20,074) | | | (13,438) | | | (49) | |

| Amortization of intangible assets | | (3,210) | | | (3,980) | | | 19 | | | (11,133) | | | (12,190) | | | 9 | |

| Impairment of long-lived assets | | — | | | — | | | — | | | (477) | | | — | | | — | |

| Intersegment elimination | | 67 | | | 203 | | | — | | | 92 | | | 166 | | | — | |

| | | $ | 29,859 | | | $ | 18,645 | | | 60 | | | $ | 83,015 | | | $ | 57,762 | | | 44 | |

Kaplan International includes postsecondary education, professional training and language training businesses largely outside the United States. Kaplan International revenue increased 29% and 19% for the third quarter and first nine months of 2023, respectively (25% and 21%, respectively, on a constant currency basis). The increases are due largely to growth at Pathways, Australia, Languages and UK Professional, partially offset by a decline at Singapore. Kaplan International reported operating income of $22.2 million in the third quarter of 2023, compared to $8.5 million in the third quarter of 2022. The improved results are due largely to improved results at Australia, Pathways, UK Professional and Languages. Operating income increased to $64.3 million in the first nine months of 2023, compared to $48.1 million in the first nine months of 2022. The improved results are due largely to improved results at Australia, Pathways and Languages, partially offset by declines at UK Professional and Singapore.

Higher Education includes the results of Kaplan as a service provider to higher education institutions. Higher Education revenue was flat compared to the third quarter of 2022 and increased 7% for the first nine months of 2023. For the third quarter and first nine months of 2023 and 2022, Kaplan recorded a portion of the fee with Purdue Global based on an assessment of its collectability under the TOSA. Enrollments at Purdue Global for the first nine months of 2023 increased 5% compared to the first nine months of 2022. The Company will continue to assess the collectability of the fee with Purdue Global on a quarterly basis to make a determination as to whether to record all or part of the fee in the future and whether to make adjustments to fee amounts recognized in earlier periods. Higher Education results declined in the third quarter of 2023 due to a lower Purdue Global fee recorded compared to the third quarter of 2022, partially offset by a decline in other higher education development costs. Higher Education results improved in the first nine months of 2023 due to an increase in the Purdue Global fee recorded, and a decline in other higher education development costs.

Supplemental Education includes Kaplan’s standardized test preparation programs and domestic professional and other continuing education businesses. Supplemental Education revenue declined 2% and 3% for the third quarter and first nine months of 2023, respectively, driven mostly by softness in Real Estate, Securities and Medical Licensure test preparation, offset in part by growth in CFP, CFA, Architecture and Engineering and MCAT test preparation and publishing activities. Overall, demand for graduate and pre-college test preparation programs has declined due to the strength of U.S. employment markets and the decline in test-takers, while demand for professional programs remained stable. Operating results improved in the third quarter of 2023 due to savings from reduced headcount, partially offset by lower revenues. Operating results declined in the first nine months of 2023 due to lower revenues, partially offset by savings from reduced headcount.

Kaplan corporate and other represents unallocated expenses of Kaplan, Inc.’s corporate office, other minor businesses and certain shared activities. Kaplan corporate and other expenses increased in the third quarter and first nine months of 2023, largely due to increased incentive compensation costs.

Television Broadcasting

Graham Media Group, Inc. owns seven television stations located in Houston, TX; Detroit, MI; Orlando, FL; San Antonio, TX; Jacksonville, FL; and Roanoke, VA, as well as SocialNewsDesk, a provider of social media management tools designed to connect newsrooms with their users. Revenue at the television broadcasting division decreased 14% to $116.1 million in the third quarter of 2023, from $135.2 million in the same period of 2022. The revenue decline is due primarily to a $20.3 million decline in political advertising revenue, partially offset by a modest increase in retransmission revenues. Operating income for the third quarter of 2023 declined 39% to $31.9 million, from $52.3 million in the same period of 2022, due to reduced revenues and higher network fees.

Revenue at the television broadcasting division decreased 9% to $347.8 million in the first nine months of 2023, from $381.0 million in the same period of 2022. The revenue decline is due primarily to a $23.8 million decline in political advertising revenue, winter Olympics and Super Bowl advertising at the Company’s NBC affiliates in the first quarter of 2022, as well as modest declines in digital advertising and retransmission revenues. Operating income for the first nine months of 2023 declined 29% to $93.7 million, from $131.9 million in the same period of 2022, due to reduced revenues and higher network fees. While per subscriber rates from cable, satellite and OTT providers have grown, overall cable and satellite subscribers are down due to cord cutting, resulting in retransmission revenue net of network fees in 2023 expected to be down modestly compared with 2022, and this trend is expected to continue in the future.

Manufacturing

Manufacturing includes four businesses: Hoover, a supplier of pressure impregnated kiln-dried lumber and plywood products for fire retardant and preservative applications; Dekko, a manufacturer of electrical workspace solutions, architectural lighting and electrical components and assemblies; Joyce/Dayton, a manufacturer of screw jacks and other linear motion systems; and Forney, a global supplier of products and systems that control and monitor combustion processes in electric utility and industrial applications.

Manufacturing revenues decreased 11% and 6% in the third quarter and first nine months of 2023, respectively. The revenue declines are due primarily to lower revenues at Hoover and Dekko, partially offset by increased revenues at Joyce and Forney. Revenues declined in the third quarter of 2023 at Hoover due largely to lower wood prices and a decrease in product demand. Revenues declined in the first nine months of 2023 at Hoover due largely to lower wood prices, partially offset by overall increased rates and higher product demand. Revenues declined at Dekko due largely to lower product demand, particularly in the commercial office electrical products sector. Overall, Hoover results included wood gains on inventory sales in the first nine months of 2023 and 2022, with gains in the first nine months of 2023 modestly higher than the prior year. For the third quarter of 2023, Hoover results included wood gains on inventory sales, compared with modest wood losses on inventory sales in the third quarter of 2022. Manufacturing operating results declined in the third quarter and first nine months of 2023 due primarily to a $47.8 million goodwill impairment charge at Dekko, resulting from continued sustained weakness in demand for certain Dekko power and data products, primarily in the commercial office sector. Excluding the impairment charge at Dekko, manufacturing operating results were down in the third quarter of 2023, due to declines at Dekko and Hoover, partially offset by improved results at Joyce and Forney. Excluding the impairment charge at Dekko, manufacturing operating results were down slightly in the first nine months of 2023, due to declines at Dekko, partially offset by improvements at Hoover and Joyce.

Healthcare

Graham Healthcare Group (GHG) provides home health and hospice services in seven states. GHG also provides other healthcare services, including nursing care and prescription services for patients receiving in-home infusion treatments through its 76.5% interest in CSI Pharmacy Holdings Company, LLC (CSI). In May 2022, GHG acquired two small businesses, one of which expanded GHG’s home health operations into Kansas and Missouri. In July 2022, GHG acquired a 100% interest in a multi-state provider of Applied Behavior Analysis clinics and in August 2022, GHG acquired two small businesses, which expanded GHG’s hospice services into Missouri and Ohio. Healthcare revenues increased 33% and 44% for the third quarter and first nine months of 2023, respectively, largely due to significant growth at CSI and from businesses acquired in 2022, along with growth in home health and hospice services.

In 2022, GHG implemented a new pension credit retention program in order to improve employee retention and utilize the Company’s surplus pension assets. The GHG pilot program offers a pension credit up to $50,000 per employee, cliff vested after three years of continuous employment for certain existing employees and new employees hired from January 1, 2022 through December 31, 2024. GHG recorded pension expense of $3.4 million and $10.1 million related to this program in the third quarter and first nine months of 2023, respectively.

The decline in GHG operating results in the third quarter and first nine months of 2023 is due largely to an increase in pension expense related to the new GHG pension credit retention program, partially offset by improved results at CSI and in home health and hospice. Excluding pension expense, GHG operating results increased in the third

quarter and first nine months of 2023. Adjusted operating cash flow (non-GAAP) at GHG increased to $11.8 million in the third quarter of 2023, from $7.7 million in the third quarter of 2022. Adjusted operating cash flow (non-GAAP) at GHG increased to $34.4 million in the first nine months of 2023, from $23.4 million in the first nine months of 2022.

The Company also holds interests in four home health and hospice joint ventures managed by GHG, whose results are included in equity in earnings of affiliates in the Company’s Condensed Consolidated Statements of Operations. The Company recorded equity in earnings of $1.9 million and $1.5 million for the third quarter of 2023 and 2022, respectively, from these joint ventures. The Company recorded equity in earnings of $6.9 million and $5.1 million for the first nine months of 2023 and 2022, respectively. During the first quarter of 2022, GHG, through its Residential Home Health Illinois and Residential Hospice Illinois affiliates, acquired an interest in the home health and hospice assets of NorthShore University HealthSystem, an integrated healthcare delivery system serving patients throughout the Chicago, IL area. The transaction resulted in a decrease to GHG’s interest in Residential Hospice Illinois and a $0.6 million non-operating gain was recorded in the first quarter of 2022 related to the change in interest.

Automotive

Automotive includes seven automotive dealerships in the Washington, D.C. metropolitan area and Richmond, VA: Ourisman Lexus of Rockville, Ourisman Honda of Tysons Corner, Ourisman Jeep Bethesda, Ourisman Ford of Manassas, and Toyota of Woodbridge and Ourisman Chrysler-Dodge-Jeep-Ram (CDJR) of Woodbridge, which were acquired on July 5, 2022 from the Lustine Automotive Group. In addition, on September 27, 2023, the Company acquired a Toyota dealership in Henrico, VA from McGeorge Toyota. Christopher J. Ourisman, a member of the Ourisman Automotive Group family of dealerships, and his team of industry professionals operate and manage the dealerships; the Company holds a 90% stake. The automotive group has also been awarded a KIA Open Point dealership in Bethesda, MD with plans to commence operations by the end of the year.

Revenues for the third quarter of 2023 increased 29% due to sales growth at all dealerships, except for the Jeep dealership, which had lower revenues due to a decline in new vehicle sales. Revenues for the first nine months of 2023 increased 50% due to the acquisitions of the Toyota of Woodbridge and CDJR dealerships and sales growth at the other dealerships, except for the Jeep dealership, which had lower revenues due to a decline in new vehicle sales. Additionally, all of the dealerships reported sales growth for services and parts for the first nine month of 2023. Operating results for the third quarter of 2023 decreased due to declines at the Jeep, CDJR, Ford, and Lexus dealerships and transaction costs related to the McGeorge Toyota acquisition, partially offset by improved results at the Toyota of Woodbridge and Honda dealerships. Operating results for the first nine months of 2023 improved due largely to the Toyota of Woodbridge and CDJR acquisitions, and improved results at the Honda and Lexus dealerships, partially offset by declines at the Jeep dealership due primarily to declines in new vehicle sales and related margins, and declines at the Ford dealership in margins on new vehicle sales.

Other Businesses

A summary of revenue by category for other businesses:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Nine Months Ended | | |

| | September 30 | | % | | September 30 | | % |

| (in thousands) | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Operating Revenues | | | | | | | | | | | | |

Retail (1) | | $ | 28,446 | | | $ | 38,990 | | | (27) | | | $ | 90,215 | | | $ | 122,236 | | | (26) | |

Media (2) | | 27,418 | | | 31,604 | | | (13) | | | 78,105 | | | 95,646 | | | (18) | |

Specialty (3) | | 30,789 | | | 30,613 | | | 1 | | | 100,790 | | | 90,268 | | | 12 | |

| | $ | 86,653 | | | $ | 101,207 | | | (14) | | | $ | 269,110 | | | $ | 308,150 | | | (13) | |

____________ | | | | | |

(1) | Includes Society6 and Saatchi Art (formerly Leaf Marketplace) and Framebridge |

(2) | Includes WGB, Code3, Slate, Foreign Policy, Pinna and City Cast |

(3) | Includes Clyde’s Restaurant Group, Decile and CyberVista |

Overall, revenue from other businesses declined 14% and 13% in the third quarter and first nine months of 2023, respectively. Retail revenue declined in the first nine months of 2023 largely due to significantly lower revenue at Society6, partially offset by revenue growth at Framebridge. Media revenue declined in the first nine months of 2023 due to lower revenue at WGB and Code3, partially offset by revenue growth at Slate and Foreign Policy. Specialty revenue increased in the first nine months of 2023 due to revenue growth at Clyde’s Restaurant Group (CRG). Excluding the former Leaf businesses, revenue from other businesses grew in the third quarter and first nine months of 2023.

Overall, operating results at other businesses declined in the first nine months of 2023 due to a $50.2 million goodwill impairment charge recorded at WGB, increased losses at the former Leaf businesses, Code3, Decile and City Cast; partially offset by improved results at CRG, Slate and Foreign Policy, reduced losses at Framebridge, and a reduction in losses due to the sales of CyberVista and Pinna.

Leaf Group

On June 14, 2021, the Company acquired Leaf Group Ltd. (Leaf), a consumer internet company headquartered in Santa Monica, CA, that builds enduring, creator-driven brands that reach passionate audiences in large and growing lifestyle categories, including fitness and wellness (Well+Good and Livestrong.com), and home, art and design (Saatchi Art, Society6 and Hunker).

In the second quarter of 2023, the Company restructured Leaf into three stand-alone businesses: Society6 (formerly included in Leaf Marketplace), Saatchi Art (formerly included in Leaf Marketplace) and World of Good Brands (WGB, formerly Leaf Media). The transition process for this restructuring involves various cost reduction initiatives, including elimination of shared services costs and functions; transitioning financial and human resources systems; and rationalizing physical facilities and data centers. In the first and second quarters of 2023, Leaf implemented a SIP to reduce the number of employees, which is being funded by the assets of the Company’s pension plan; $2.9 million and $3.9 million in related non-operating pension expense was recorded in the first and second quarters of 2023, respectively. Each of Society6, Saatchi Art and World of Good Brands is continuing with the transition and cost reduction process, which is expected to be completed by the end of the second quarter of 2024.

Revenue at each of the three Leaf businesses declined in the third quarter and first nine months of 2023, with substantial declines at Society6 and WGB. Revenue decreases at Society6 are due to declines in traffic, conversion rates and related sales for both direct to consumer and business to business categories; revenue declines at WGB are due to reduced traffic and the soft digital advertising market for both direct and programmatic categories. Overall, the Leaf businesses reported significant operating losses in each of the third quarters and first nine months of 2023 and 2022, with an increase in operating losses in the third quarter and first nine months of 2023.

As a result of the substantial digital advertising revenue declines and continued significant operating losses at WGB, the Company recorded a $50.2 million goodwill impairment charge in the third quarter of 2023.

Clyde’s Restaurant Group

CRG owns and operates 12 restaurants and entertainment venues in the Washington, D.C. metropolitan area, including Old Ebbitt Grill and The Hamilton. CRG reported an operating loss in the third quarter of 2023 and 2022 and an operating profit for the first nine months of 2023 and 2022. Both revenues and operating results improved in the first nine months of 2023, due to strong guest traffic, modest price increases, and the absence of any significant adverse impact from the COVID-19 pandemic. Operating results in the first nine months of 2022 benefited from a favorable rent concession.

CRG recently announced plans to open new restaurants in Baltimore, MD; Washington, D.C.; and Reston, VA in early 2024, mid 2024 and early 2025, respectively.

Framebridge

Framebridge is a custom framing service company, headquartered in Washington, D.C., with 20 retail locations in the Washington, D.C., New York City, Atlanta, GA, Philadelphia, PA, Boston, MA and Chicago, IL areas and two manufacturing facilities in Kentucky and New Jersey. Framebridge continues to actively explore opportunities for further store expansion. Revenues increased in the third quarter and first nine months of 2023 due to an increase in retail revenue from same-store sales growth and operating additional retail stores compared to the same periods in 2022. Framebridge is an investment stage business and reported significant operating losses in the first nine months of 2023 and 2022.

Other

Other businesses also include Code3, a performance marketing agency focused on driving performance for brands though three core elements of digital success: media, creative and commerce; Slate and Foreign Policy, which publish online and print magazines and websites; and two investment stage businesses, Decile and City Cast. Slate, Foreign Policy and City Cast reported revenue increases in the first nine months of 2023, while Code3 reported a revenue decline. Losses from City Cast, Code3 and Decile in the first nine months of 2023 adversely affected operating results, while Slate and Foreign Policy each reported an operating profit during this period.

Other businesses also included Pinna, which was sold in June 2023 when the Company entered into a merger agreement with Realm of Possibility, Inc. (Realm), a provider of audio entertainment services, to merge Pinna with Realm in return for a noncontrolling financial interest in the merged entity. In connection with the merger, the

Company recorded a $10.0 million non-cash, non-operating gain related to the transaction. The Company held a noncontrolling interest in Realm prior to the transaction and continues to hold a noncontrolling interest in Realm following the transaction. The Company’s investment in Realm is reported as an equity method investment.

Other businesses also included CyberVista, which was sold in October 2022 when the Company announced a strategic merger of CyberVista and CyberWire, a B2B cybersecurity audio network to form a new parent company, N2K Networks. The Company’s investment in N2K Networks is reported as an equity method investment.

In the first and second quarters of 2023, Code3 implemented a SIP to reduce the number of employees, which is being funded by the assets of the Company’s pension plan; $1.2 million and $0.6 million in related non-operating pension expense was recorded in the first and second quarters of 2023, respectively.

Corporate Office

Corporate office includes the expenses of the Company’s corporate office and certain continuing obligations related to prior business dispositions.

Equity in (Losses) Earnings of Affiliates

At September 30, 2023, the Company held an approximate 18% interest in Intersection Holdings, LLC (Intersection), a company that provides digital marketing and advertising services and products for cities, transit systems, airports, and other public and private spaces; a 49.9% interest in N2K Networks on a fully diluted basis; and a 42.3% interest in Realm on a fully diluted basis. The Company also holds interests in several other affiliates, including a number of home health and hospice joint ventures managed by GHG and two joint ventures managed by Kaplan. Overall, the Company recorded equity in losses of affiliates of $0.8 million for the third quarter of 2023, compared to $1.1 million for the third quarter of 2022. These amounts include $2.8 million and $2.7 million in net losses for the third quarter of 2023 and 2022, respectively, from affiliates whose operations are not managed by the Company.

The Company recorded equity in losses of affiliates of $2.2 million for the first nine months of 2023, compared to earnings of $2.9 million for the first nine months of 2022. These amounts include $9.7 million and $2.8 million in net losses for the first nine months of 2023 and 2022, respectively, from affiliates whose operations are not managed by the Company.

Net Interest Expense and Related Balances

In connection with the acquisition of the Toyota of Richmond dealership, in September 2023, the automotive subsidiary of the Company entered into a credit agreement with Truist Bank, which includes (i) a $75.2 million real estate term loan, (ii) a $65.0 million capital term loan, (iii) an undrawn $50.0 million delayed draw term loan available upon request and (iv) establishment of a revolving floor plan credit facility. Additionally, the automotive subsidiary entered into interest rate swaps to fix the interest rate that the Company will pay on the $75.2 million real estate term loan at 6.42% per annum. The proceeds from this borrowing were used to finance the acquisition of the Toyota of Richmond dealership and to repay the outstanding balance of the automotive subsidiary commercial notes that were maturing in 2031 and 2032. The related interest rate swaps were also terminated, resulting in a realized gain of $4.6 million recorded as a credit to interest expense during the third quarter of 2023.

The Company incurred net interest expense of $9.8 million and $33.1 million for the third quarter and first nine months of 2023, respectively, compared to $10.8 million and $36.8 million for the third quarter and first nine months of 2022, respectively. The Company recorded interest expense of $1.1 million and $1.4 million in the third quarter and first nine months of 2023, respectively, to adjust the fair value of the mandatorily redeemable noncontrolling interest at GHG. The Company recorded interest expense of $1.4 million and $12.8 million in the third quarter and first nine months of 2022, respectively, to adjust the fair value of the mandatorily redeemable noncontrolling interest at GHG. Excluding these adjustments, the increase in net interest expense relates primarily to increased debt at the automotive dealerships and higher interest rates on the Company’s variable debt.

At September 30, 2023, the Company had $761.7 million in borrowings outstanding at an average interest rate of 6.3%, and cash, marketable equity securities and other investments of $873.0 million. At September 30, 2023, the Company had $60.9 million outstanding on its $300 million revolving credit facility.

Non-operating Pension and Postretirement Benefit Income, net

The Company recorded net non-operating pension and postretirement benefit income of $35.7 million and $97.3 million for the third quarter and first nine months of 2023, respectively, compared to $50.7 million and $152.1 million for the third quarter and first nine months of 2022, respectively.

In the second quarter of 2023, the Company recorded $5.5 million in expenses related to non-operating SIPs at other businesses and the education and television broadcasting divisions. In the first quarter of 2023, the Company recorded $4.1 million in expenses related to non-operating SIPs at other businesses.

Gain (Loss) on Marketable Equity Securities, net

Overall, the Company recognized $16.8 million and $113.4 million in net gains on marketable equity securities in the third quarter and first nine months of 2023, respectively, compared to $54.3 million and $172.9 million in net losses on marketable equity securities in the third quarter and first nine months of 2022, respectively.

Other Non-Operating Income

The Company recorded total other non-operating income, net, of $3.6 million for the third quarter of 2023, compared to $2.4 million for the third quarter of 2022. The 2023 amounts included $1.7 million in foreign currency gains; $1.1 million in gains related to the sale of businesses and contingent consideration; a $0.1 million gain on sale of a cost method investment, and other items. The 2022 amounts included $1.4 million in gains related to the sale of businesses and contingent consideration; a $0.6 million fair value increase on a cost method investment, and other items; partially offset by $0.4 million in foreign currency losses.

The Company recorded total non-operating income, net, of $22.5 million for the first nine months of 2023, compared to $6.4 million for the first nine months of 2022. The 2023 amounts included a non-cash gain of $10.0 million on the sale of Pinna; $4.3 million in gains related to the sale of businesses and contingent consideration; a $3.1 million fair value increase on cost method investments; $1.8 million in foreign currency gains; a $1.0 million gain on sales of cost method investments, and other items. The 2022 amounts included $3.1 million in gains related to the sale of businesses and contingent consideration; $1.0 million in gains on sales of cost method investments; a $0.6 million gain on sale of an equity affiliate; a $0.6 million fair value increase on a cost method investment, and other items; partially offset by $2.0 million in foreign currency losses.

Provision for Income Taxes

The Company’s effective tax rate for the first nine months of 2023 and 2022 was 31.1% and 29.6%, respectively.

Earnings Per Share

The calculation of diluted earnings per share for the third quarter and first nine months of 2023 was based on 4,601,521 and 4,700,304 weighted average shares outstanding, respectively, compared to 4,819,661 and 4,853,267, respectively, for the third quarter and first nine months of 2022. At September 30, 2023, there were 4,578,889 shares outstanding. On May 4, 2023, the Board of Directors authorized the Company to acquire up to 500,000 shares of its Class B common stock; the Company has remaining authorization for 336,666 shares as of September 30, 2023.

Forward-Looking Statements

All public statements made by the Company and its representatives that are not statements of historical fact, including certain statements in this press release, in the Company’s Annual Report on Form 10-K and in the Company’s 2022 Annual Report to Stockholders, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those projected as a result of certain risks and uncertainties. Other forward-looking statements include comments about expectations related to acquisitions or dispositions or related business activities, including the TOSA, the Company’s business strategies and objectives, the prospects for growth in the Company’s various business operations and the Company’s future financial performance. As with any projection or forecast, forward-looking statements are subject to various risks and uncertainties, including the risks and uncertainties described in Item 1A of the Company’s Annual Report on Form 10-K, that could cause actual results or events to differ materially from those anticipated in such statements. Accordingly, undue reliance should not be placed on any forward-looking statement made by or on behalf of the Company. The Company assumes no obligation to update any forward-looking statement after the date on which such statement is made, even if new information subsequently becomes available.

| | | | | | | | | | | | | | |

| GRAHAM HOLDINGS COMPANY |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Unaudited) |

| | |

| | Three Months Ended | |

| | September 30 | % |

| (in thousands, except per share amounts) | 2023 | | 2022 | Change |

| Operating revenues | $ | 1,111,519 | | | $ | 1,012,438 | | 10 | |

| Operating expenses | 1,036,344 | | | 918,614 | | 13 | |

| Depreciation of property, plant and equipment | 22,207 | | | 19,657 | | 13 | |

| Amortization of intangible assets | 11,759 | | | 14,635 | | (20) | |

| Impairment of goodwill and other long-lived assets | 98,321 | | | — | | — | |

| Operating (loss) income | (57,112) | | | 59,532 | | — | |

| Equity in losses of affiliates, net | (791) | | | (1,111) | | (29) | |

| Interest income | 1,986 | | | 803 | | — | |

| Interest expense | (11,810) | | | (11,579) | | 2 | |

| Non-operating pension and postretirement benefit income, net | 35,653 | | | 50,687 | | (30) | |

Gain (loss) on marketable equity securities, net | 16,759 | | | (54,250) | | — | |

| Other income, net | 3,581 | | | 2,358 | | 52 | |

(Loss) income before income taxes | (11,734) | | | 46,440 | | — | |

Provision for income taxes | 9,400 | | | 12,600 | | (25) | |

Net (loss) income | (21,134) | | | 33,840 | | — | |

| Net income attributable to noncontrolling interests | (1,897) | | | (1,060) | | 79 | |

Net (Loss) Income Attributable to Graham Holdings Company Common Stockholders | $ | (23,031) | | | $ | 32,780 | | — | |

Per Share Information Attributable to Graham Holdings Company Common Stockholders | | | | |

Basic net (loss) income per common share | $ | (5.02) | | | $ | 6.78 | | — | |

| Basic average number of common shares outstanding | 4,602 | | | 4,808 | | |

Diluted net (loss) income per common share | $ | (5.02) | | | $ | 6.76 | | — | |

| Diluted average number of common shares outstanding | 4,602 | | | 4,820 | | |

| | | | | | | | | | | | | | |

| GRAHAM HOLDINGS COMPANY | |

| CONSOLIDATED STATEMENTS OF OPERATIONS | |

| (Unaudited) | |

| | |

| | Nine Months Ended | |

| | September 30 | % |

| (in thousands, except per share amounts) | 2023 | | 2022 | Change |

| Operating revenues | $ | 3,248,064 | | | $ | 2,860,461 | | 14 | |

| Operating expenses | 3,018,057 | | | 2,618,649 | | 15 | |

| Depreciation of property, plant and equipment | 63,335 | | | 58,545 | | 8 | |

| Amortization of intangible assets | 39,007 | | | 44,436 | | (12) | |

Impairment of goodwill and other long-lived assets | 99,066 | | | — | | — | |

| Operating income | 28,599 | | | 138,831 | | (79) | |

Equity in (losses) earnings of affiliates, net | (2,245) | | | 2,920 | | — | |

| Interest income | 4,738 | | | 2,214 | | — | |

| Interest expense | (37,878) | | | (38,969) | | (3) | |

Non-operating pension and postretirement benefit income, net | 97,313 | | | 152,063 | | (36) | |

Gain (loss) on marketable equity securities, net | 113,429 | | | (172,878) | | — | |

| Other income, net | 22,458 | | | 6,410 | | — | |

Income before income taxes | 226,414 | | | 90,591 | | — | |

Provision for income taxes | 70,400 | | | 26,800 | | — | |

Net income | 156,014 | | | 63,791 | | — | |

| Net income attributable to noncontrolling interests | (3,985) | | | (2,872) | | 39 | |

Net Income Attributable to Graham Holdings Company Common Stockholders | $ | 152,029 | | | $ | 60,919 | | — | |

Per Share Information Attributable to Graham Holdings Company Common Stockholders | | | | |

| Basic net income per common share | $ | 32.23 | | | $ | 12.51 | | — | |

| Basic average number of common shares outstanding | 4,686 | | | 4,841 | | |

| Diluted net income per common share | $ | 32.14 | | | $ | 12.48 | | — | |

| Diluted average number of common shares outstanding | 4,700 | | | 4,853 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GRAHAM HOLDINGS COMPANY |

| BUSINESS DIVISION INFORMATION |

| (Unaudited) |

| | | | | | | | | | | | |

| | | Three Months Ended | | | | Nine Months Ended | | |

| | | September 30 | | % | | September 30 | | % |

| (in thousands) | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Operating Revenues | | | | | | | | | | | | |

| Education | | $ | 411,837 | | | $ | 355,064 | | | 16 | | | $ | 1,192,105 | | | $ | 1,066,089 | | | 12 | |

| Television broadcasting | | 116,112 | | | 135,165 | | | (14) | | | 347,818 | | | 380,970 | | | (9) | |

| Manufacturing | | 109,216 | | | 122,964 | | | (11) | | | 343,882 | | | 365,966 | | | (6) | |

| Healthcare | | 116,164 | | | 87,176 | | | 33 | | | 331,505 | | | 230,816 | | | 44 | |

| Automotive | | 272,018 | | | 211,396 | | | 29 | | | 765,251 | | | 509,965 | | | 50 | |

| Other businesses | | 86,653 | | | 101,207 | | | (14) | | | 269,110 | | | 308,150 | | | (13) | |

| Corporate office | | 365 | | | — | | | — | | | 1,215 | | | — | | | — | |

| Intersegment elimination | | (846) | | | (534) | | | — | | | (2,822) | | | (1,495) | | | — | |

| | | $ | 1,111,519 | | | $ | 1,012,438 | | | 10 | | | $ | 3,248,064 | | | $ | 2,860,461 | | | 14 | |

| Operating Expenses | | | | | | | | | | | | |

| Education | | $ | 381,978 | | | $ | 336,419 | | | 14 | | | $ | 1,109,090 | | | $ | 1,008,327 | | | 10 | |

| Television broadcasting | | 84,165 | | | 82,834 | | | 2 | | | 254,098 | | | 249,059 | | | 2 | |

| Manufacturing | | 150,190 | | | 113,317 | | | 33 | | | 365,546 | | | 341,842 | | | 7 | |

| Healthcare | | 110,193 | | | 81,128 | | | 36 | | | 314,221 | | | 212,147 | | | 48 | |

| Automotive | | 263,781 | | | 200,346 | | | 32 | | | 736,711 | | | 484,472 | | | 52 | |

| Other businesses | | 164,206 | | | 122,361 | | | 34 | | | 401,525 | | | 386,392 | | | 4 | |

| Corporate office | | 14,964 | | | 17,035 | | | (12) | | | 41,096 | | | 40,886 | | | 1 | |

| Intersegment elimination | | (846) | | | (534) | | | — | | | (2,822) | | | (1,495) | | | — | |

| | | $ | 1,168,631 | | | $ | 952,906 | | | 23 | | | $ | 3,219,465 | | | $ | 2,721,630 | | | 18 | |

| Operating Income (Loss) | | | | | | | | | | | | |

| Education | | $ | 29,859 | | | $ | 18,645 | | | 60 | | | $ | 83,015 | | | $ | 57,762 | | | 44 | |

| Television broadcasting | | 31,947 | | | 52,331 | | | (39) | | | 93,720 | | | 131,911 | | | (29) | |

| Manufacturing | | (40,974) | | | 9,647 | | | — | | | (21,664) | | | 24,124 | | | — | |

| Healthcare | | 5,971 | | | 6,048 | | | (1) | | | 17,284 | | | 18,669 | | | (7) | |

| Automotive | | 8,237 | | | 11,050 | | | (25) | | | 28,540 | | | 25,493 | | | 12 | |

| Other businesses | | (77,553) | | | (21,154) | | | — | | | (132,415) | | | (78,242) | | | (69) | |

| Corporate office | | (14,599) | | | (17,035) | | | 14 | | | (39,881) | | | (40,886) | | | 2 | |

| | $ | (57,112) | | | $ | 59,532 | | | — | | | $ | 28,599 | | | $ | 138,831 | | | (79) | |

Amortization of Intangible Assets and Impairment of Goodwill and Other Long-Lived Assets | | | | | | | | | | | | |

| Education | | $ | 3,210 | | | $ | 3,980 | | | (19) | | | $ | 11,610 | | | $ | 12,190 | | | (5) | |

| Television broadcasting | | 1,363 | | | 1,360 | | | 0 | | | 4,088 | | | 4,080 | | | 0 | |

| Manufacturing | | 51,489 | | | 5,076 | | | — | | | 60,683 | | | 15,403 | | | — | |

| Healthcare | | 866 | | | 905 | | | (4) | | | 2,702 | | | 2,822 | | | (4) | |

| Automotive | | 3 | | | — | | | — | | | 3 | | | — | | | — | |

| Other businesses | | 53,149 | | | 3,314 | | | — | | | 58,987 | | | 9,941 | | | — | |

| Corporate office | | — | | | — | | | — | | | — | | | — | | | — | |

| | | $ | 110,080 | | | $ | 14,635 | | | — | | | $ | 138,073 | | | $ | 44,436 | | | — | |

Operating Income (Loss) before Amortization of Intangible Assets and Impairment of Goodwill and Other Long-Lived Assets | | | | | | | | | | | | |

| Education | | $ | 33,069 | | | $ | 22,625 | | | 46 | | | $ | 94,625 | | | $ | 69,952 | | | 35 | |

| Television broadcasting | | 33,310 | | | 53,691 | | | (38) | | | 97,808 | | | 135,991 | | | (28) | |

| Manufacturing | | 10,515 | | | 14,723 | | | (29) | | | 39,019 | | | 39,527 | | | (1) | |

| Healthcare | | 6,837 | | | 6,953 | | | (2) | | | 19,986 | | | 21,491 | | | (7) | |

| Automotive | | 8,240 | | | 11,050 | | | (25) | | | 28,543 | | | 25,493 | | | 12 | |

| Other businesses | | (24,404) | | | (17,840) | | | (37) | | | (73,428) | | | (68,301) | | | (8) | |

| Corporate office | | (14,599) | | | (17,035) | | | 14 | | | (39,881) | | | (40,886) | | | 2 | |

| | $ | 52,968 | | | $ | 74,167 | | | (29) | | | $ | 166,672 | | | $ | 183,267 | | | (9) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | Nine Months Ended | | |

| | | September 30 | | % | | September 30 | | % |

| (in thousands) | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Depreciation | | | | | | | | | | | | |

| Education | | $ | 10,000 | | | $ | 8,360 | | | 20 | | | $ | 28,428 | | | $ | 25,396 | | | 12 | |

| Television broadcasting | | 3,120 | | | 2,961 | | | 5 | | | 9,243 | | | 9,335 | | | (1) | |

| Manufacturing | | 2,388 | | | 2,358 | | | 1 | | | 6,957 | | | 7,109 | | | (2) | |

| Healthcare | | 1,411 | | | 590 | | | — | | | 3,802 | | | 1,455 | | | — | |

| Automotive | | 1,304 | | | 1,067 | | | 22 | | | 3,565 | | | 2,596 | | | 37 | |

| Other businesses | | 3,832 | | | 4,169 | | | (8) | | | 10,882 | | | 12,198 | | | (11) | |

| Corporate office | | 152 | | | 152 | | | — | | | 458 | | | 456 | | | 0 | |

| | | $ | 22,207 | | | $ | 19,657 | | | 13 | | | $ | 63,335 | | | $ | 58,545 | | | 8 | |

| Pension Expense | | | | | | | | | | | | |

| Education | | $ | 2,226 | | | $ | 2,233 | | | 0 | | | $ | 6,680 | | | $ | 6,700 | | | 0 | |

| Television broadcasting | | 833 | | | 884 | | | (6) | | | 2,498 | | | 2,666 | | | (6) | |

| Manufacturing | | 280 | | | 276 | | | 1 | | | 836 | | | 828 | | | 1 | |

| Healthcare | | 3,521 | | | 138 | | | — | | | 10,563 | | | 417 | | | — | |

| Automotive | | 16 | | | 6 | | | — | | | 26 | | | 17 | | | 53 | |

| Other businesses | | 662 | | | 552 | | | 20 | | | 1,847 | | | 1,549 | | | 19 | |

| Corporate office | | 952 | | | 1,468 | | | (35) | | | 2,856 | | | 4,404 | | | (35) | |

| | | $ | 8,490 | | | $ | 5,557 | | | 53 | | | $ | 25,306 | | | $ | 16,581 | | | 53 | |

Adjusted Operating Cash Flow (non-GAAP)(1) | | | | | | | | | | | | |

| Education | | $ | 45,295 | | | $ | 33,218 | | | 36 | | | $ | 129,733 | | | $ | 102,048 | | | 27 | |

| Television broadcasting | | 37,263 | | | 57,536 | | | (35) | | | 109,549 | | | 147,992 | | | (26) | |

| Manufacturing | | 13,183 | | | 17,357 | | | (24) | | | 46,812 | | | 47,464 | | | (1) | |

| Healthcare | | 11,769 | | | 7,681 | | | 53 | | | 34,351 | | | 23,363 | | | 47 | |

| Automotive | | 9,560 | | | 12,123 | | | (21) | | | 32,134 | | | 28,106 | | | 14 | |

| Other businesses | | (19,910) | | | (13,119) | | | (52) | | | (60,699) | | | (54,554) | | | (11) | |

| Corporate office | | (13,495) | | | (15,415) | | | 12 | | | (36,567) | | | (36,026) | | | (2) | |

| | $ | 83,665 | | | $ | 99,381 | | | (16) | | | $ | 255,313 | | | $ | 258,393 | | | (1) | |

____________ | | | | | |

(1) | Adjusted Operating Cash Flow (non-GAAP) is calculated as Operating Income (Loss) before Amortization of Intangible Assets and Impairment of Goodwill and Other Long-Lived Assets plus Depreciation Expense and Pension Expense. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GRAHAM HOLDINGS COMPANY |

| EDUCATION DIVISION INFORMATION |

| (Unaudited) |

| | | | | | | | |

| | | Three Months Ended | | | | Nine Months Ended | | |

| | | September 30 | | % | | September 30 | | % |

| (in thousands) | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Operating Revenues | | | | | | | | | | | | |

| Kaplan international | | $ | 249,976 | | | $ | 193,085 | | | 29 | | | $ | 714,715 | | | $ | 598,469 | | | 19 | |

| Higher education | | 81,925 | | | 82,314 | | | 0 | | | 250,557 | | | 233,990 | | | 7 | |

| Supplemental education | | 78,332 | | | 79,566 | | | (2) | | | 226,535 | | | 233,416 | | | (3) | |

| Kaplan corporate and other | | 3,101 | | | 2,616 | | | 19 | | | 8,360 | | | 7,414 | | | 13 | |

| Intersegment elimination | | (1,497) | | | (2,517) | | | — | | | (8,062) | | | (7,200) | | | — | |

| | | $ | 411,837 | | | $ | 355,064 | | | 16 | | | $ | 1,192,105 | | | $ | 1,066,089 | | | 12 | |

| Operating Expenses | | | | | | | | | | | | |

| Kaplan international | | $ | 227,756 | | | $ | 184,582 | | | 23 | | | $ | 650,443 | | | $ | 550,339 | | | 18 | |

| Higher education | | 73,460 | | | 73,250 | | | 0 | | | 217,214 | | | 216,567 | | | 0 | |

| Supplemental education | | 68,603 | | | 70,095 | | | (2) | | | 209,543 | | | 215,745 | | | (3) | |

| Kaplan corporate and other | | 10,513 | | | 7,232 | | | 45 | | | 28,434 | | | 20,852 | | | 36 | |

| Amortization of intangible assets | | 3,210 | | | 3,980 | | | (19) | | | 11,133 | | | 12,190 | | | (9) | |

| Impairment of long-lived assets | | — | | | — | | | — | | | 477 | | | — | | | — | |

| Intersegment elimination | | (1,564) | | | (2,720) | | | — | | | (8,154) | | | (7,366) | | | — | |

| | $ | 381,978 | | | $ | 336,419 | | | 14 | | | $ | 1,109,090 | | | $ | 1,008,327 | | | 10 | |

| Operating Income (Loss) | | | | | | | | | | | | |

| Kaplan international | | $ | 22,220 | | | $ | 8,503 | | | — | | | $ | 64,272 | | | $ | 48,130 | | | 34 | |

| Higher education | | 8,465 | | | 9,064 | | | (7) | | | 33,343 | | | 17,423 | | | 91 | |

| Supplemental education | | 9,729 | | | 9,471 | | | 3 | | | 16,992 | | | 17,671 | | | (4) | |

| Kaplan corporate and other | | (7,412) | | | (4,616) | | | (61) | | | (20,074) | | | (13,438) | | | (49) | |

| Amortization of intangible assets | | (3,210) | | | (3,980) | | | 19 | | | (11,133) | | | (12,190) | | | 9 | |

| Impairment of long-lived assets | | — | | | — | | | — | | | (477) | | | — | | | — | |

| Intersegment elimination | | 67 | | | 203 | | | — | | | 92 | | | 166 | | | — | |

| | | $ | 29,859 | | | $ | 18,645 | | | 60 | | | $ | 83,015 | | | $ | 57,762 | | | 44 | |

Operating Income (Loss) before Amortization of Intangible Assets and Impairment of Long-Lived Assets | | | | | | | | | | | | |

| Kaplan international | | $ | 22,220 | | | $ | 8,503 | | | — | | | $ | 64,272 | | | $ | 48,130 | | | 34 | |

| Higher education | | 8,465 | | | 9,064 | | | (7) | | | 33,343 | | | 17,423 | | | 91 | |

| Supplemental education | | 9,729 | | | 9,471 | | | 3 | | | 16,992 | | | 17,671 | | | (4) | |

| Kaplan corporate and other | | (7,412) | | | (4,616) | | | (61) | | | (20,074) | | | (13,438) | | | (49) | |

| Intersegment elimination | | 67 | | | 203 | | | — | | | 92 | | | 166 | | | — | |

| | $ | 33,069 | | | $ | 22,625 | | | 46 | | | $ | 94,625 | | | $ | 69,952 | | | 35 | |

| Depreciation | | | | | | | | | | | | |

| Kaplan international | | $ | 7,599 | | | $ | 5,709 | | | 33 | | | $ | 20,832 | | | $ | 17,258 | | | 21 | |

| Higher education | | 1,258 | | | 1,050 | | | 20 | | | 3,431 | | | 3,256 | | | 5 | |

| Supplemental education | | 1,117 | | | 1,570 | | | (29) | | | 4,087 | | | 4,787 | | | (15) | |

| Kaplan corporate and other | | 26 | | | 31 | | | (16) | | | 78 | | | 95 | | | (18) | |

| | | $ | 10,000 | | | $ | 8,360 | | | 20 | | | $ | 28,428 | | | $ | 25,396 | | | 12 | |

| Pension Expense | | | | | | | | | | | | |

| Kaplan international | | $ | 83 | | | $ | 67 | | | 24 | | | $ | 244 | | | $ | 202 | | | 21 | |

| Higher education | | 958 | | | 961 | | | 0 | | | 2,803 | | | 2,862 | | | (2) | |

| Supplemental education | | 1,063 | | | 1,029 | | | 3 | | | 3,110 | | | 3,106 | | | 0 | |

| Kaplan corporate and other | | 122 | | | 176 | | | (31) | | | 523 | | | 530 | | | (1) | |

| | | $ | 2,226 | | | $ | 2,233 | | | 0 | | | $ | 6,680 | | | $ | 6,700 | | | 0 | |

Adjusted Operating Cash Flow (non-GAAP)(1) | | | | | | | | | | | | |

| Kaplan international | | $ | 29,902 | | | $ | 14,279 | | | — | | | $ | 85,348 | | | $ | 65,590 | | | 30 | |

| Higher education | | 10,681 | | | 11,075 | | | (4) | | | 39,577 | | | 23,541 | | | 68 | |

| Supplemental education | | 11,909 | | | 12,070 | | | (1) | | | 24,189 | | | 25,564 | | | (5) | |

| Kaplan corporate and other | | (7,264) | | | (4,409) | | | (65) | | | (19,473) | | | (12,813) | | | (52) | |

| Intersegment elimination | | 67 | | | 203 | | | — | | | 92 | | | 166 | | | — | |

| | $ | 45,295 | | | $ | 33,218 | | | 36 | | | $ | 129,733 | | | $ | 102,048 | | | 27 | |

____________ | | | | | |

(1) | Adjusted Operating Cash Flow (non-GAAP) is calculated as Operating Income (Loss) before Amortization of Intangible Assets and Impairment of Long-Lived Assets plus Depreciation Expense and Pension Expense. |

NON-GAAP FINANCIAL INFORMATION

GRAHAM HOLDINGS COMPANY

(Unaudited)

In addition to the results reported in accordance with accounting principles generally accepted in the United States (GAAP) included in this press release, the Company has provided information regarding Adjusted Operating Cash Flow and Net Income excluding certain items described below, reconciled to the most directly comparable GAAP measures. Management believes that these non-GAAP measures, when read in conjunction with the Company’s GAAP financials, provide useful information to investors by offering:

▪the ability to make meaningful period-to-period comparisons of the Company’s ongoing results;

▪the ability to identify trends in the Company’s underlying business; and

▪a better understanding of how management plans and measures the Company’s underlying business.

Adjusted Operating Cash Flow and Net income, excluding certain items, should not be considered substitutes or alternatives to computations calculated in accordance with and required by GAAP. These non-GAAP financial measures should be read only in conjunction with financial information presented on a GAAP basis.

The gains and losses on marketable equity securities relate to the change in the fair value (quoted prices) of its portfolio of equity securities. The mandatorily redeemable noncontrolling interest represents the ownership portion of a group of minority shareholders at a subsidiary of the Company’s Healthcare business. The Company measures the redemption value of this minority ownership on a quarterly basis with changes in the fair value recorded as interest expense or income, which is included in net income for the period. The effect of gains and losses on marketable equity securities and net interest expense related to fair value adjustments of the mandatorily redeemable noncontrolling interest are not directly related to the core performance of the Company’s business operations since these items do not directly relate to the sale of the Company’s services or products. The accounting principles generally accepted in the United States (“GAAP”) require that the Company include the gains and losses on marketable equity securities and net interest expense related to fair value adjustments of the mandatorily redeemable noncontrolling interest in net income on the Condensed Consolidated Statements of Operations. The Company excludes the gains and losses on marketable equity securities and net interest expense related to fair value adjustments of the mandatorily redeemable noncontrolling interest from the non-GAAP adjusted net income because these items are independent of the Company’s core operations and not indicative of the performance of the Company’s business operations.

The following tables reconcile the non-GAAP financial measures for Net income, excluding certain items, to the most directly comparable GAAP measures:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30 | | | | |

| 2023 | | 2022 | | | | |

| (in thousands, except per share amounts) | (Loss) Income before income taxes | | Income Taxes | | Net (Loss) Income | | Income before income taxes | | Income Taxes | | Net Income | | | | |

| Amounts attributable to Graham Holdings Company Common Stockholders | | | | | | | | | | | | | | | |

| As reported | $ | (11,734) | | | $ | 9,400 | | | $ | (21,134) | | | $ | 46,440 | | | $ | 12,600 | | | $ | 33,840 | | | | | |

| Attributable to noncontrolling interests | | | | | (1,897) | | | | | | | (1,060) | | | | | |

| Attributable to Graham Holdings Company Stockholders | | | | | (23,031) | | | | | | | 32,780 | | | | | |

Adjustments: | | | | | | | | | | | | | | | |

Net credit related to a fair value change in contingent consideration from prior acquisitions | — | | | — | | | — | | | (1,720) | | | — | | | (1,720) | | | | | |

| Goodwill and other long-lived asset impairment charges | 98,321 | | | 13,876 | | | 84,445 | | | — | | | — | | | — | | | | | |

| | | | | | | | | | | | | | | |

Net (gains) losses on marketable equity securities | (16,758) | | | (4,411) | | | (12,347) | | | 54,250 | |

| 14,094 | | | 40,156 | | | | | |

Net losses of affiliates whose operations are not managed by the Company | 2,836 | |

| 746 | | | 2,090 | | | 2,732 | |

| 709 | | | 2,023 | | | | | |

Non-operating gain from the write-up of a cost method investment | — | | | — | | | — | | | (560) | |

| (146) | | | (414) | | | | | |

| Credit to interest expense resulting from gains realized related to the termination of interest rate swaps | (4,581) | | | (1,252) | | | (3,329) | | | — | | | — | | | — | | | | | |

| Interest expense related to the fair value adjustment of the mandatorily redeemable noncontrolling interest | 1,132 | | | 105 | | | 1,027 | | | 1,369 | | | 21 | | | 1,348 | | | | | |

| | | | | | | | | | | | | | | |

Net income, adjusted (non-GAAP) | | | | | $ | 48,855 | | | |

| | | $ | 74,173 | | | | | |

| | | | | | | | | | | | | | | |

| Per share information attributable to Graham Holdings Company Common Stockholders | | | | | | | | | | | | | | | |

Diluted income (loss) per common share, as reported | | | | | $ | (5.02) | | | | | | | $ | 6.76 | | | | | |

| Adjustments: | | | | | | | | | | | | | | | |

Net credit related to a fair value change in contingent consideration from prior acquisitions | | | | | — | | | | | | | (0.35) | | | | | |

| Goodwill and other long-lived asset impairment charges | | | | | 18.18 | | | | | | | — | | | | | |

| | | | | | | | | | | | | | | |

Net (gains) losses on marketable equity securities | | | | | (2.66) | | | | | | | 8.28 | | | | | |

Net losses of affiliates whose operations are not managed by the Company | | | | | 0.45 | | | | | | | 0.42 | | | | | |

Non-operating gain from the write-up of a cost method investment | | | | | — | | | | | | | (0.09) | | | | | |

| Credit to interest expense resulting from gains realized related to the termination of interest rate swaps | | | | | (0.72) | | | | | | | — | | | | | |

| Interest expense related to the fair value adjustment of the mandatorily redeemable noncontrolling interest | | | | | 0.22 | | | | | | | 0.28 | | | | | |

| | | | | | | | | | | | | | | |

| Diluted income per common share, adjusted (non-GAAP) | | | | | $ | 10.45 | | | | | | | $ | 15.30 | | | | | |

| | | | | | | | | | | | | | | |

| The adjusted diluted per share amounts may not compute due to rounding. | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30 |

| 2023 | | 2022 |

| (in thousands, except per share amounts) | Income before income taxes | | Income Taxes | | Net Income | | Income before income taxes | | Income Taxes | | Net Income |

| Amounts attributable to Graham Holdings Company Common Stockholders | | | | | | | | | | | |

| As reported | $ | 226,414 | | | $ | 70,400 | | | $ | 156,014 | | | $ | 90,591 | | | $ | 26,800 | | | $ | 63,791 | |

| Attributable to noncontrolling interests | | | | | (3,985) | | | | | | | (2,872) | |

| Attributable to Graham Holdings Company Stockholders | | | | | 152,029 | | | | | | | 60,919 | |

Adjustments: | | | | | | | | | | | |

Net credit related to a fair value change in contingent consideration from prior acquisitions | (4,150) | | | (26) | | | (4,124) | | | (4,883) | | | (24) | | | (4,859) | |

| Goodwill and other long-lived asset impairment charges | 99,066 | | | 14,078 | | | 84,988 | | | — | | | — | | | — | |

Charges related to non-operating Separation Incentive Programs | 9,646 | | | 2,481 | | | 7,165 | | | — | | | — | | | — | |

Net (gains) losses on marketable equity securities | (113,429) | | | (29,861) | | | (83,568) | | | 172,878 | | | 45,013 | | | 127,865 | |

Net losses of affiliates whose operations are not managed by the Company | 9,657 | | | 2,542 | | | 7,115 | | | 2,806 | | | 729 | | | 2,077 | |

Gain on sale of Pinna | (10,033) | | | (2,641) | | | (7,392) | | | — | | | — | | | — | |

Non-operating gain from write-up and sales of equity and cost method investments | (3,935) | | | (1,008) | | | (2,927) | | | (2,239) | | | (567) | | | (1,672) | |

| Credit to interest expense resulting from gains realized related to the termination of interest rate swaps | (4,581) | | | (1,252) | | | (3,329) | | | — | | | — | | | — | |

| Net interest expense related to the fair value adjustment of the mandatorily redeemable noncontrolling interest | 1,421 | | | 152 | | | 1,269 | | | 12,799 | | | 531 | | | 12,268 | |

| | | | | | | | | | | |

Net income, adjusted (non-GAAP) | | | | | $ | 151,226 | | | | | | | $ | 196,598 | |

| | | | | | | | | | | |

| Per share information attributable to Graham Holdings Company Common Stockholders | | | | | | | | | | | |

| Diluted income per common share, as reported | | | | | $ | 32.14 | | | | | | | $ | 12.48 | |

| Adjustments: | | | | | | | | | | | |

Net credit related to a fair value change in contingent consideration from prior acquisitions | | | | | (0.89) | | | | | | | (1.00) | |

| Goodwill and other long-lived asset impairment charges | | | | | 18.30 | | | | | | | — | |

Charges related to non-operating Separation Incentive Programs | | | | | 1.54 | | | | | | | — | |

Net (gains) losses on marketable equity securities | | | | | (17.99) | | | | | | | 26.19 | |

Net losses of affiliates whose operations are not managed by the Company | | | | | 1.53 | | | | | | | 0.43 | |

Gain on sale of Pinna | | | | | (1.59) | | | | | | | — | |

Non-operating gain from write-up and sales of equity and cost method investments | | | | | (0.63) | | | | | | | (0.34) | |

| Credit to interest expense resulting from gains realized related to the termination of interest rate swaps | | | | | (0.72) | | | | | | | — | |

| Net interest expense related to the fair value adjustment of the mandatorily redeemable noncontrolling interest | | | | | 0.27 | | | | | | | 2.51 | |

| | | | | | | | | | | |

| Diluted income per common share, adjusted (non-GAAP) | | | | | $ | 31.96 | | | | | | | $ | 40.27 | |

| | | | | | | | | | | |

| The adjusted diluted per share amounts may not compute due to rounding. |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |