UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 30, 2023

FREEDOM

ACQUISITION I CORP.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Cayman Islands |

|

001-40117 |

|

N/A |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 14 Wall Street, 20th Floor

New York, NY |

|

10005 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (212)

618-1798

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instruction A.2. below):

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A ordinary shares, par value $0.0001 per share |

|

FACT |

|

The New York Stock Exchange |

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

FACT WS |

|

The New York Stock Exchange |

| Units, each consisting of one Class A ordinary share and one-fourth of one redeemable warrant |

|

FACT.U |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

On June 30, 2023, Freedom Acquisition I Corp. (“Freedom”) and Complete Solaria, Inc. (“Complete Solaria”) made available

an investor presentation concerning Complete Solaria and the previously announced proposed business combination between Freedom and Complete Solaria. A copy of the investor presentation is attached hereto as Exhibit 99.1

Important Information and Where to Find It

This Current

Report on Form 8-K may contain information relating to a proposed business combination between Freedom and Complete Solaria. In connection with the proposed transaction, Freedom has filed a registration

statement on Form S-4 (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”), which was declared effective by the SEC on June 30, 2023 and

which includes a proxy statement for the solicitation of Freedom shareholder approval and a prospectus for the offer and sale of Freedom securities in the proposed transaction with Complete Solaria, and other relevant documents with the SEC to be

used at its extraordinary general meeting of shareholders to approve the proposed transaction with Complete Solaria. The proxy statement/prospectus will be mailed to shareholders as of the record date established for voting on the proposed business

combination between Freedom and Complete Solaria. INVESTORS AND SECURITY HOLDERS OF FREEDOM AND COMPLETE SOLARIA ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT, PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND

IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of documents filed by Freedom with the SEC, through the

website maintained by the SEC at www.sec.gov.

Participants in Solicitation

Freedom, Complete Solaria and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from

Freedom’s shareholders in connection with the proposed transaction between Freedom and Complete Solaria. A list of the names of such directors and executive officers and information regarding their interests in the proposed transaction is

contained in the proxy statement/prospectus pertaining to the proposed transaction at www.sec.gov.

No Offer or Solicitation

This Current Report on Form 8-K is for informational purposes only and is not intended to and shall not constitute a

proxy statement or the solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction and is not intended to and shall not constitute an offer to sell or the solicitation of an offer to

sell or the solicitation of an offer to buy or subscribe for any securities or a solicitation of any vote of approval, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Forward-Looking Statements

This Current Report on Form 8-K may contain certain forward-looking statements within the meaning of the federal

securities laws with respect to the referenced and proposed transaction. These forward-looking statements generally are identified by the words “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would,” and

similar expressions, but the absence of these words does not mean that a statement is not a forward-looking statement. Forward-looking statements are forecasts, predictions, projections and other statements about future events that are based on

current expectations, hopes, beliefs, intentions, strategies and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this

Current Report on Form 8-K, including but not limited to: (i) the risk that the proposed business combination may not be completed in a timely manner or at all; (ii) the risk that the proposed

business combination between Freedom and Complete Solaria may not be completed by Freedom’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by Freedom; (iii) the

failure to satisfy the conditions to the consummation of the proposed business combination; (iv) the effect of the announcement or pendency of the proposed business combination on Complete Solaria’s business relationships, operating

results, and business generally; (v) risks that the proposed business combination disrupts current plans and operations of the companies or diverts managements’ attention from Complete Solaria’s ongoing business operations and

potential difficulties in employee retention as a result of the announcement and consummation of the proposed business combination; (vi) the outcome of any legal proceedings that may be instituted in connection with the proposed business

combination; (vii) the ability to maintain the listing of Freedom’s securities on a national securities exchange; (viii) the price of Freedom’s securities may be volatile due to a variety of factors, including changes in the

applicable competitive or regulatory landscapes, variations in operating performance across competitors, changes in laws and regulations affecting Freedom’s or Complete Solaria’s business, and changes in the combined capital structure;

(ix) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed business combination, and identify and realize additional opportunities; (x) the ability to recognize the anticipated

benefits of the previously consummated Complete Solaria merger and the proposed business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain

relationships with customers and suppliers and retain its management and key employees; (xi) the evolution of the markets in which Complete Solaria will compete; (xii) the costs related to the previously consummated Complete Solaria merger

and the proposed business combination; (xiii) any impact of the COVID-19 pandemic on Complete Solaria’s business; and (xiv) Freedom and Complete Solaria’s expectations regarding market

opportunities.

The foregoing list of factors is not exhaustive. Readers should carefully consider the foregoing factors and the other risks and

uncertainties described in the “Risk Factors” section of the Registration Statement and other documents filed by Freedom from time to time with the SEC. Such filings identify and address other important risks and uncertainties that could

cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking

statements, and Freedom and Complete Solaria assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Freedom nor Complete Solaria gives

any assurance that any of them will achieve its expectations.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Investor Presentation, dated June 30, 2023. |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

FREEDOM ACQUISITION I CORP. |

|

|

|

|

| Date: July 3, 2023 |

|

|

|

By: |

|

/s/ Adam Gishen |

|

|

|

|

Name: |

|

Adam Gishen |

|

|

|

|

Title: |

|

Chief Executive Officer |

Exhibit 99.1 Special Presentation to Shareholders June 30, 2023 T.J.

Rodgers We put solar on homes in the US (and Europe). We do “EPC”: engineering, procurement & construction — and also take care of insurance, building permits, utility requirements and maintenance problems. Our successful

one-stop shopping model is estimated to achieve $200 million in annualized sales.

Disclaimer This presentation may not be retained by you, and neither

this presentation nor the information contained herein may be reproduced, redistributed or provided to any other person or published, in whole or in part, for any purpose, without the express and prior written consent of Complete Solaria, Inc.

(“Complete Solaria”), and Freedom Acquisition I Corp. (“Freedom”). This presentation contains “forward-looking” statements about Complete Solaria and Freedom and their industries, and that involve substantial

risks and uncertainties. All statements other than statements of historical facts, including statements regarding Complete Solaria and Freedom’s strategies, future financial condition, future operations, projected costs, prospects, plans,

objectives of management and expected market growth, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,”

“believe,” “contemplate,” “continue,” “could,” “design,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,”

“objective,” “plan,” “positioned,” “potential,” “predict,” “seek,” “should,” “target,” “will,” “would” and other similar

expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. Complete Solaria and Freedom have based applicable forward-looking statements largely on their current

expectations, estimates, forecasts and projections about future events and financial trends that Complete Solaria and Freedom believe may affect their financial condition, results of operations, business strategy and financial needs. Although

Complete Solaria and Freedom believe that they have a reasonable basis for each forward-looking statement contained in this presentation, Complete Solaria and Freedom cannot guarantee that the future results, levels of activity, performance or

events and circumstances reflected in the forward-looking statements will be achieved or occur at all. Furthermore, if the forward-looking statements prove to be inaccurate, the inaccuracy may be material. Except as required by law, Complete Solaria

and Freedom undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. You are cautioned not to place undue reliance on forward looking statements. You should carefully

consider the risks and uncertainties described in the “Risk Factors” section of the registration statement on Form S-4, initially filed by Freedom with the U.S. Securities and Exchange Commission (the “SEC”) on February 10,

2023 (as may be amended and supplemented from time to time, “Registration Statement”) and in other documents filed by Freedom with the SEC. The financial, operational, industry and market projections, estimates and targets in this

presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Complete Solaria's and Freedom's control. While all financial,

operational, industry and market projections, estimates and targets are necessarily speculative, Complete Solaria and Freedom believe that the preparation of prospective financial, operational, industry and market information involves increasingly

higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. Complete Solaria's independent auditors have not studied, reviewed, completed or performed any procedures with respect to the

projections for the purpose of their inclusion in this presentation, and, accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this presentation. The assumptions and estimates

underlying the projected, expected or target results are inherently uncertain and are subject to a wider variety of significant business, economic, regulatory and competitive risks and uncertainties that could cause actual results to differ

materially from those contained in the financial, operational, industry and market projections, estimates and targets, including assumptions, risks and uncertainties described in connection with “forward-looking” statements above. The

inclusion of financial, operational, industry and market projections, estimates and targets in this presentation should not be regarded as an indication that Complete Solaria or Freedom, or their representatives, considered or consider such

financial, operational, industry and market projections, estimates and targets to be a reliable prediction of future events. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities of Complete

Solaria or Freedom, nor shall there be any sale of any securities of Complete Solaria or Freedom in any jurisdiction in which, or to any investor to whom, such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. In connection with the proposed transaction, Freedom has filed the Registration Statement with the SEC, which contains a preliminary prospectus and proxy statement of Freedom, referred to as a

proxy statement/prospectus. The Registration Statement was declared effective on June 30, 2023, and a final proxy statement/prospectus will be sent to all Freedom shareholders. Freedom will also file other documents regarding the proposed

transaction with the SEC. Shareholders of Freedom are advised to read the Registration Statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as

they become available because they will contain important information. Shareholders can obtain free copies of the Registration Statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by

Freedom (when available) through the website maintained by the SEC at http://www.sec.gov or upon written request to Freedom Acquisition I Corp., 14 Wall Street, 20th Floor, New York, NY 10005. Freedom and Complete Solaria and their respective

directors and executive officers may be deemed to be participants in the solicitation of proxies from Freedom’s shareholders in connection with the proposed transaction. A list of the names of such directors and executive officers and

information regarding their interests in the proposed transaction is contained in the proxy statement/prospectus. You may obtain free copies of these documents as described in the preceding paragraph. This presentation is not intended to be

all-inclusive or to contain all the information that a person may desire in considering an investment in Complete Solaria or Freedom and is not intended to form the basis of any investment decision in Complete Solaria or Freedom. You should consult

your own legal, regulatory, tax, business, financial and accounting advisors to the extent you deem necessary, and you must make your own investment decision and perform your own independent investigation and analysis of an investment in Complete

Solaria or Freedom and the transactions contemplated in this presentation. 2 ©2023 Complete Solaria

Disclaimer NEITHER THE SEC NOR ANY STATE OR TERRITORIAL SECURITIES

COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE. This presentation contains information concerning Complete Solaria’s products, services and industry, including market

information and growth rates of the markets in which Complete Solaria participates, that may be based on industry surveys and publications or other publicly available information, other third-party survey data and research reports. Such information

involves assumptions and limitations; therefore, there can be no guarantee as to the accuracy or reliability of such assumptions and you are cautioned not to give undue weight to this information. Further, no representation is made as to the

reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future

performance. Such modelling data is subject to change. Neither Complete Solaria nor Freedom has independently verified any third-party information. Similarly, any third-party survey data and research reports, while believed by the Complete Solaria

to be reliable, may be based on limited sample sizes and have not been independently verified by Complete Solaria or Freedom. In addition, projections, assumptions, estimates, goals, targets, plans and trends of the future performance of the

industry in which Complete Solaria operates, and their future performance, are necessarily subject to uncertainty and risk due to a variety of factors, including those described above. Such and other factors could cause results to differ materially

from those expressed in any estimates made by independent parties and by Complete Solaria and Freedom. Neither Complete Solaria nor Freedom assumes any obligation to update the information in this presentation. Certain financial information and data

contained in this presentation may be unaudited and may not conform to Regulation S-X promulgated under the Securities Act of 1933, as amended. Accordingly, such information and data may not be included in, may be adjusted in or may be presented

differently in, any proxy statement or registration statement to be filed by Complete Solaria or Freedom with the SEC. This presentation may contain “non-GAAP financial measures” that are financial measures that either exclude or include

amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”). Because not all companies use identical calculations,

any presentations of non-GAAP financial measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company. Complete Solaria and Freedom, as applicable, own or have rights to

various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation may also contain trademarks, service marks, trade names and copyrights of third parties, which are the

property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with Complete Solaria or Freedom, or an

endorsement or sponsorship by or of Complete Solaria or Freedom. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this presentation may appear without the TM, SM, * or © symbols, but such

references are not intended to indicate, in any way, that Complete Solaria or Freedom, as applicable, will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service

marks, trade names and copyrights. All trademarks, names, logos, text, graphics, and other content that are the property of Complete Solaria or Freedom may not be used or reproduced without the express written consent of Complete Solaria or Freedom,

as applicable. All rights reserved. 3 ©2023 Complete Solaria

Complete Solaria Corporation 2500 Executive Pkwy, Suite 450 Fab: Lehi,

Utah 4 ©2023 Complete Solaria

Utah’s Solar Cluster Downtown Salt Lake Provo

Agenda • Manufacturing slow down • Impaired April and May

revenue — now fixed • Q3 is on track for $50 million • Status of Complete Solaria public company readiness • Funding request to current SPAC and potential PIPE investors 6 ©2023 Complete Solaria

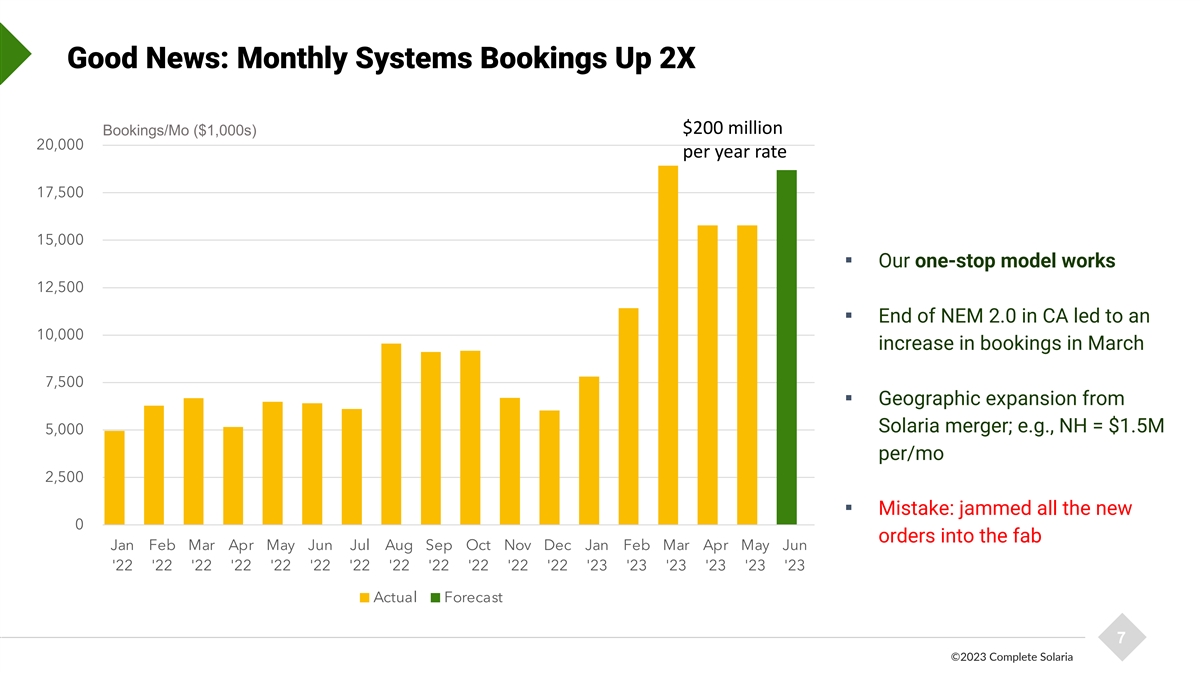

Good News: Monthly Systems Bookings Up 2X Monthly Systems Bookings $200

million Bookings/Mo ($1,000s) 20,000 per year rate 17,500 15,000 ▪ Our one-stop model works 12,500 ▪ End of NEM 2.0 in CA led to an 10,000 increase in bookings in March 7,500 ▪ Geographic expansion from Solaria merger; e.g., NH =

$1.5M 5,000 per/mo 2,500 ▪ Mistake: jammed all the new 0 orders into the fab Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun '22 '22 '22 '22 '22 '22 '22 '22 '22 '22 '22 '22 '23 '23 '23 '23 '23 '23 Actual Forecast 7

©2023 Complete Solaria

Problem: Lehi Utah Fab Overloaded, Running Below Q1 Rate Revenue/day

($1,000s) 1,500 1,250 1,000 ▪ Fab now has 2,685 projects (WW25) in WIP (Work In Process) 750 ▪ Fab running at half speed: 286 day $589K/day = Q1 rate cycle time vs. 140 days in 2021. 500 Low speed = low output 390 368 337 314 301 271 266

▪ Overloading the fab is a common 250 startup mistake made when they become fab-limited rather than order-limited 0 14 15 16 17 18 19 20 Actual Work Week 8 ©2023 Complete Solaria ($000)

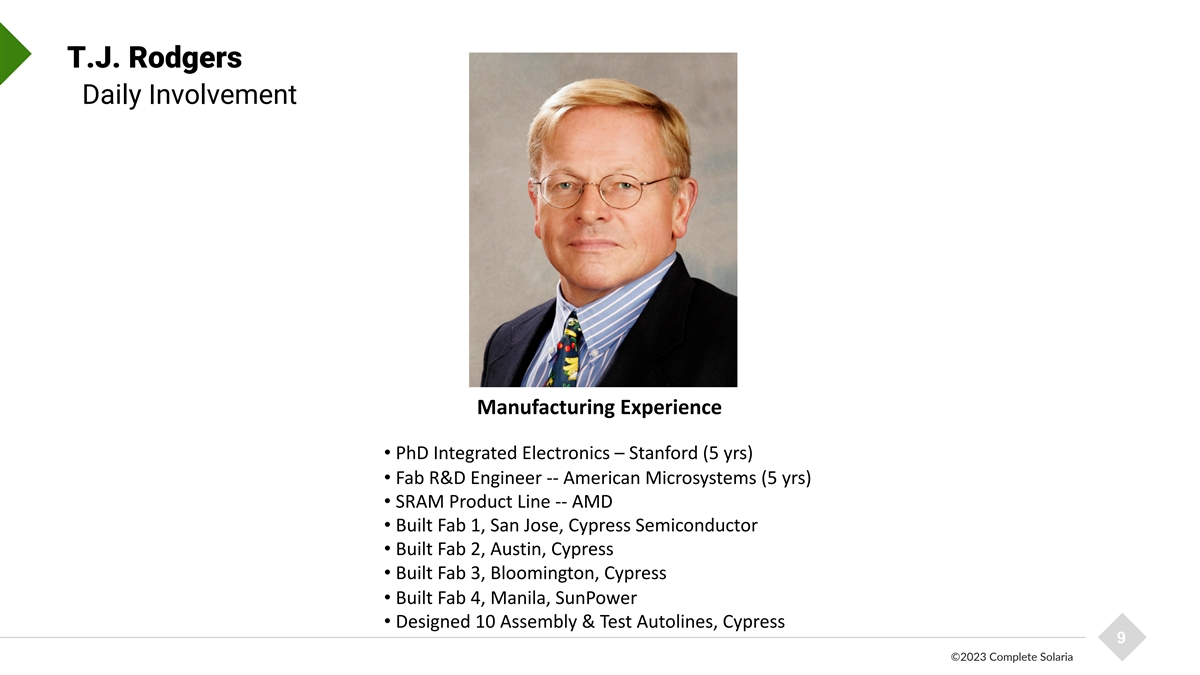

T.J. Rodgers Daily Involvement Manufacturing Experience • PhD

Integrated Electronics – Stanford (5 yrs) • Fab R&D Engineer -- American Microsystems (5 yrs) • SRAM Product Line -- AMD • Built Fab 1, San Jose, Cypress Semiconductor • Built Fab 2, Austin, Cypress • Built

Fab 3, Bloomington, Cypress • Built Fab 4, Manila, SunPower • Designed 10 Assembly & Test Autolines, Cypress 9 ©2023 Complete Solaria

Silicon Scars 10 ©2023 Complete Solaria

Problem: Lehi Utah Fab Overloaded, Running Below Q1 Rate Revenue/week

($1,000s) 1,500 1,250 1,000 ▪ Daily work since May 22 ▪ Named Executive Chair 6/27 750 $589K/day = Q1 rate ▪ Launched teams in fab operations, IT, quality and public-company 500 408 390 368 readiness 337 314 301 271 266 250 0 14 15

16 17 18 19 20 21 Work Week Actual 11 ©2023 Complete Solaria ($000)

… 12 ©2023 Complete Solaria

… 13 ©2023 Complete Solaria

Minh Pham In Utah 24x7 Manufacturing Experience • Ran Mostek Fab,

Texas • Ran Cypress Fab 2, Austin • Ran Cypress Fab 3, Bloomington • Ran Cypress Assy & Test, Philippines • Built original SunPower Fab, Manila • Turned around Cypress Fab 3 • My No. 1 manufacturing exec.

— ever 14 ©2023 Complete Solaria

Dozens of Small Meetings 15 ©2023 Complete Solaria

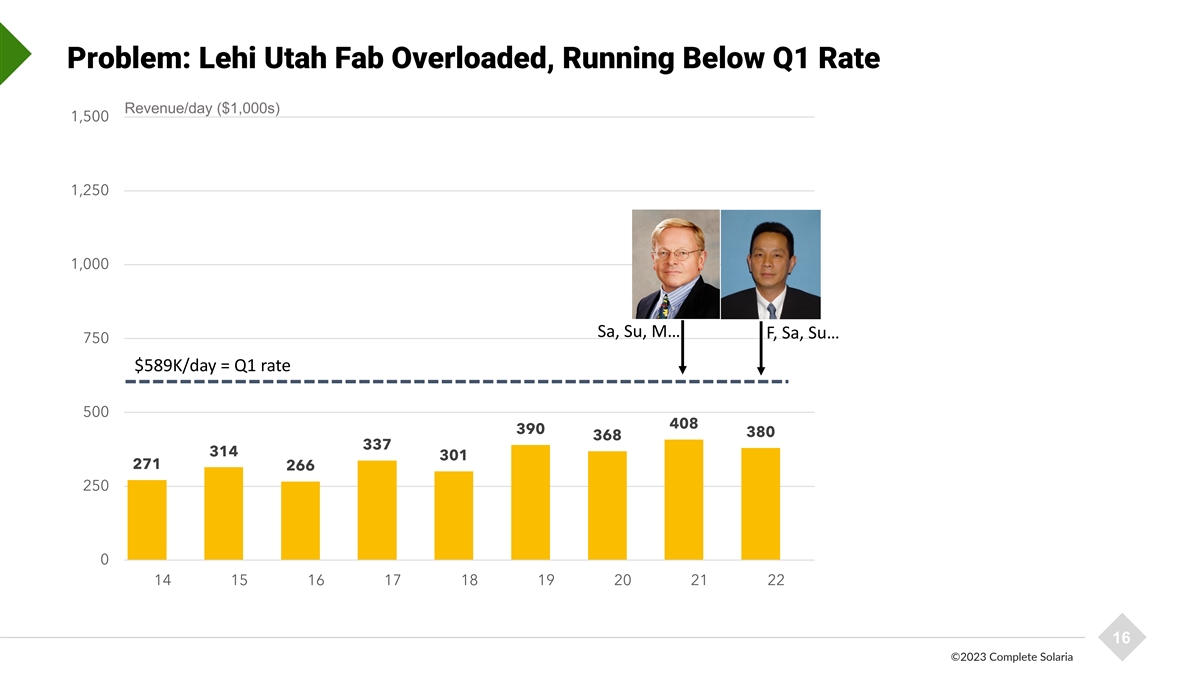

Problem: Lehi Utah Fab Overloaded, Running Below Q1 Rate Revenue/day

($1,000s) 1,500 1,250 1,000 Sa, Su, M… F, Sa, Su… 750 $589K/day = Q1 rate 500 408 390 380 368 337 314 301 271 266 250 0 14 15 16 17 18 19 20 21 22 Actual 16 ©2023 Complete Solaria ($000)

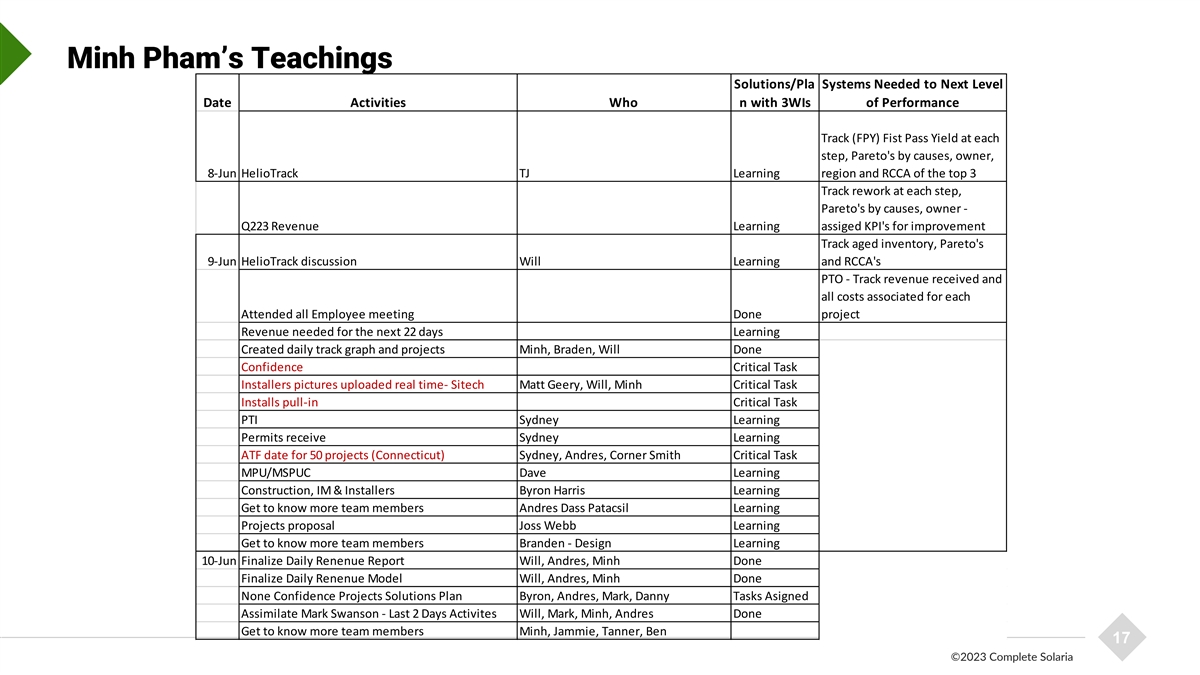

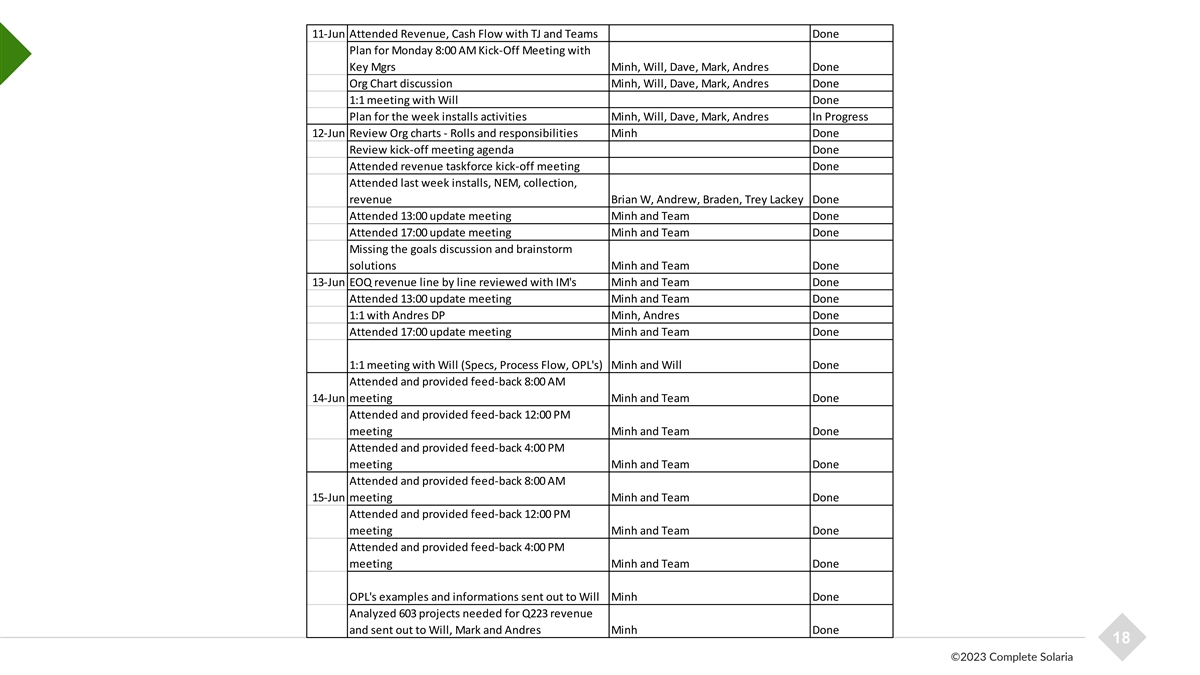

Minh Pham’s Teachings Solutions/Pla Systems Needed to Next Level

Date Activities Who n with 3WIs of Performance Track (FPY) Fist Pass Yield at each step, Pareto's by causes, owner, 8-Jun HelioTrack TJ Learning region and RCCA of the top 3 Track rework at each step, Pareto's by causes, owner - Q223 Revenue

Learning assiged KPI's for improvement Track aged inventory, Pareto's 9-Jun HelioTrack discussion Will Learning and RCCA's PTO - Track revenue received and all costs associated for each Attended all Employee meeting Done project Revenue needed for

the next 22 days Learning Created daily track graph and projects Minh, Braden, Will Done Confidence Critical Task Installers pictures uploaded real time- Sitech Matt Geery, Will, Minh Critical Task Installs pull-in Critical Task PTI Sydney Learning

Permits receive Sydney Learning ATF date for 50 projects (Connecticut) Sydney, Andres, Corner Smith Critical Task MPU/MSPUC Dave Learning Construction, IM & Installers Byron Harris Learning Get to know more team members Andres Dass Patacsil

Learning Projects proposal Joss Webb Learning Get to know more team members Branden - Design Learning 10-Jun Finalize Daily Renenue Report Will, Andres, Minh Done Finalize Daily Renenue Model Will, Andres, Minh Done None Confidence Projects

Solutions Plan Byron, Andres, Mark, Danny Tasks Asigned Assimilate Mark Swanson - Last 2 Days Activites Will, Mark, Minh, Andres Done Get to know more team members Minh, Jammie, Tanner, Ben 17 ©2023 Complete Solaria

11-Jun Attended Revenue, Cash Flow with TJ and Teams Done Plan for

Monday 8:00 AM Kick-Off Meeting with Key Mgrs Minh, Will, Dave, Mark, Andres Done Org Chart discussion Minh, Will, Dave, Mark, Andres Done 1:1 meeting with Will Done Plan for the week installs activities Minh, Will, Dave, Mark, Andres In Progress

12-Jun Review Org charts - Rolls and responsibilities Minh Done Review kick-off meeting agenda Done Attended revenue taskforce kick-off meeting Done Attended last week installs, NEM, collection, revenue Brian W, Andrew, Braden, Trey Lackey Done

Attended 13:00 update meeting Minh and Team Done Attended 17:00 update meeting Minh and Team Done Missing the goals discussion and brainstorm solutions Minh and Team Done 13-Jun EOQ revenue line by line reviewed with IM's Minh and Team Done Attended

13:00 update meeting Minh and Team Done 1:1 with Andres DP Minh, Andres Done Attended 17:00 update meeting Minh and Team Done 1:1 meeting with Will (Specs, Process Flow, OPL's) Minh and Will Done Attended and provided feed-back 8:00 AM 14-Jun

meeting Minh and Team Done Attended and provided feed-back 12:00 PM meeting Minh and Team Done Attended and provided feed-back 4:00 PM meeting Minh and Team Done Attended and provided feed-back 8:00 AM 15-Jun meeting Minh and Team Done Attended and

provided feed-back 12:00 PM meeting Minh and Team Done Attended and provided feed-back 4:00 PM meeting Minh and Team Done OPL's examples and informations sent out to Will Minh Done Analyzed 603 projects needed for Q223 revenue and sent out to Will,

Mark and Andres Minh Done 18 ©2023 Complete Solaria

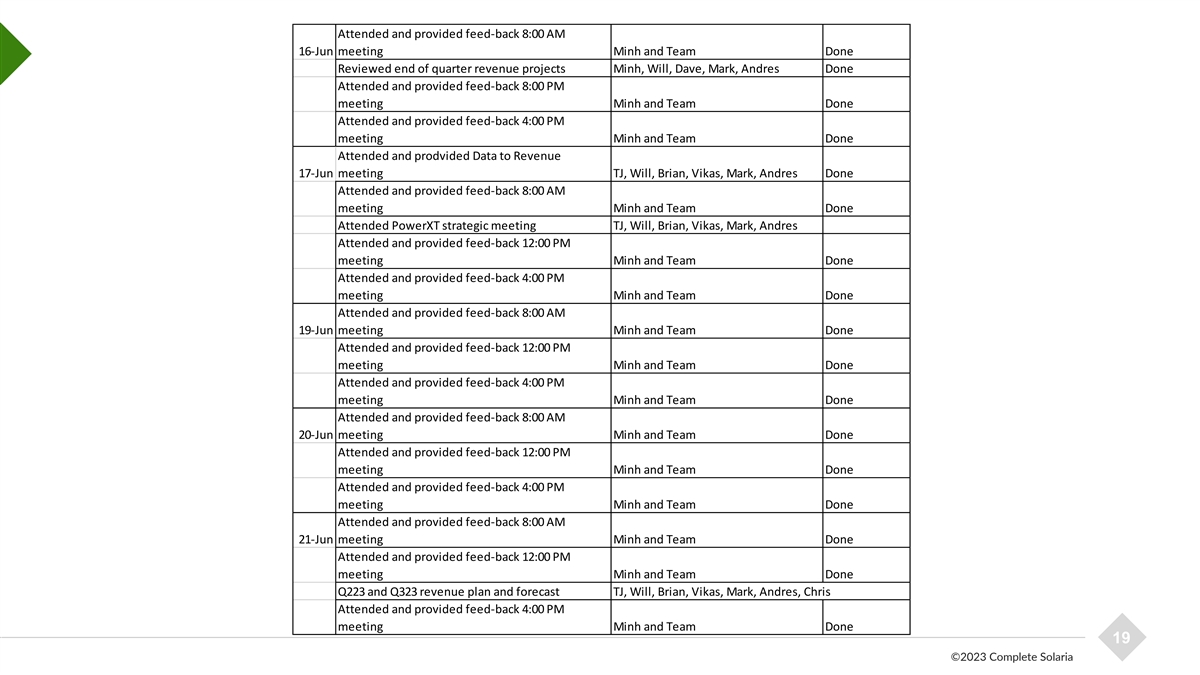

Attended and provided feed-back 8:00 AM 16-Jun meeting Minh and Team

Done Reviewed end of quarter revenue projects Minh, Will, Dave, Mark, Andres Done Attended and provided feed-back 8:00 PM meeting Minh and Team Done Attended and provided feed-back 4:00 PM meeting Minh and Team Done Attended and prodvided Data to

Revenue 17-Jun meeting TJ, Will, Brian, Vikas, Mark, Andres Done Attended and provided feed-back 8:00 AM meeting Minh and Team Done Attended PowerXT strategic meeting TJ, Will, Brian, Vikas, Mark, Andres Attended and provided feed-back 12:00 PM

meeting Minh and Team Done Attended and provided feed-back 4:00 PM meeting Minh and Team Done Attended and provided feed-back 8:00 AM 19-Jun meeting Minh and Team Done Attended and provided feed-back 12:00 PM meeting Minh and Team Done Attended and

provided feed-back 4:00 PM meeting Minh and Team Done Attended and provided feed-back 8:00 AM 20-Jun meeting Minh and Team Done Attended and provided feed-back 12:00 PM meeting Minh and Team Done Attended and provided feed-back 4:00 PM meeting Minh

and Team Done Attended and provided feed-back 8:00 AM 21-Jun meeting Minh and Team Done Attended and provided feed-back 12:00 PM meeting Minh and Team Done Q223 and Q323 revenue plan and forecast TJ, Will, Brian, Vikas, Mark, Andres, Chris Attended

and provided feed-back 4:00 PM meeting Minh and Team Done 19 ©2023 Complete Solaria

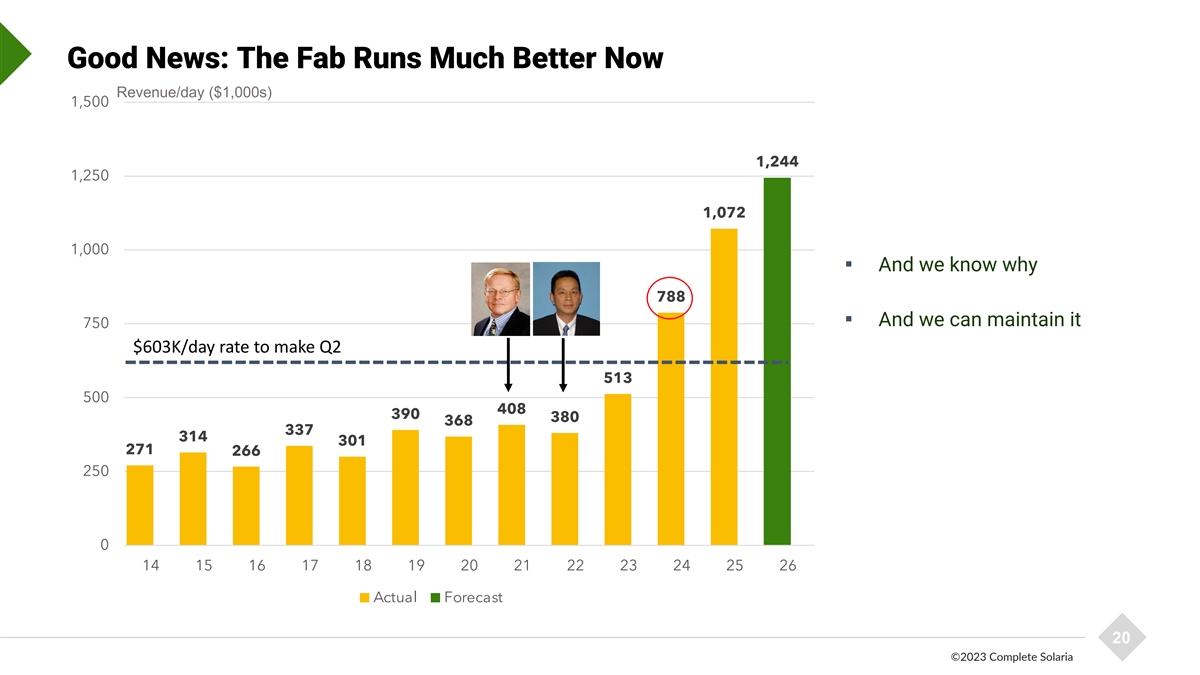

Good News: The Fab Runs Much Better Now Revenue/day ($1,000s) 1,500

1,244 1,250 1,072 1,000 ▪ And we know why 788 ▪ And we can maintain it 750 $603K/day rate to make Q2 513 500 408 390 380 368 337 314 301 271 266 250 0 14 15 16 17 18 19 20 21 22 23 24 25 26 Actual Forecast 20 ©2023 Complete Solaria

($000)

This “virtual fab” has the Complete Solaria Fab Flow same

organization and operating prT. inci Jpl . e R so ad s g a e sirls icon ’s A fan b a inl y th s ei s 1990s 1 WIP Report 2 One Page Spec QA QA 3 Kanban in out Responsible parties 21 ©2023 Complete Solaria

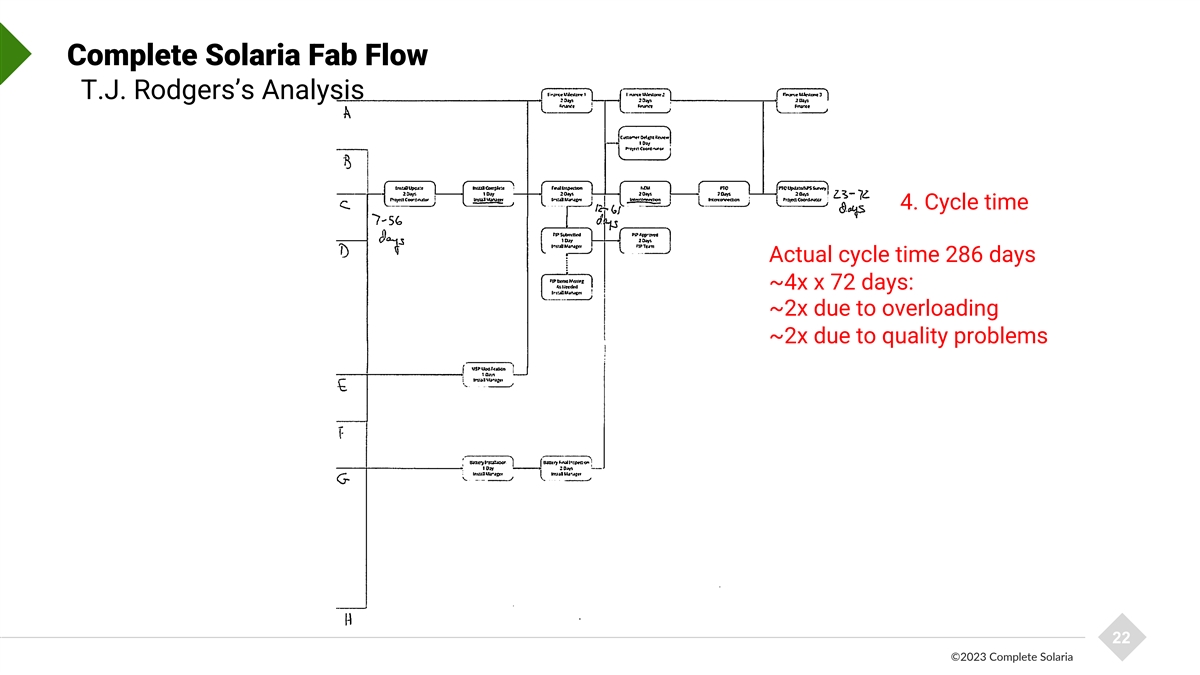

Complete Solaria Fab Flow T.J. Rodgers’s Analysis 4. Cycle time

Actual cycle time 286 days ~4x x 72 days: ~2x due to overloading ~2x due to quality problems 22 ©2023 Complete Solaria

Arnaud Lepert New COO Manufacturing Experience • Ecole

Polytechnique • Perovskite solar cells • Applied Materials, BU, Gate module • Fab Section Manager, ST Micro (France) • Process integration, Maxim Semi (SV) • Semiconductor Lasers, Coherent (SV) 23 ©2023 Complete

Solaria

Spec Creation — Team Effort 24 ©2023 Complete

Solaria

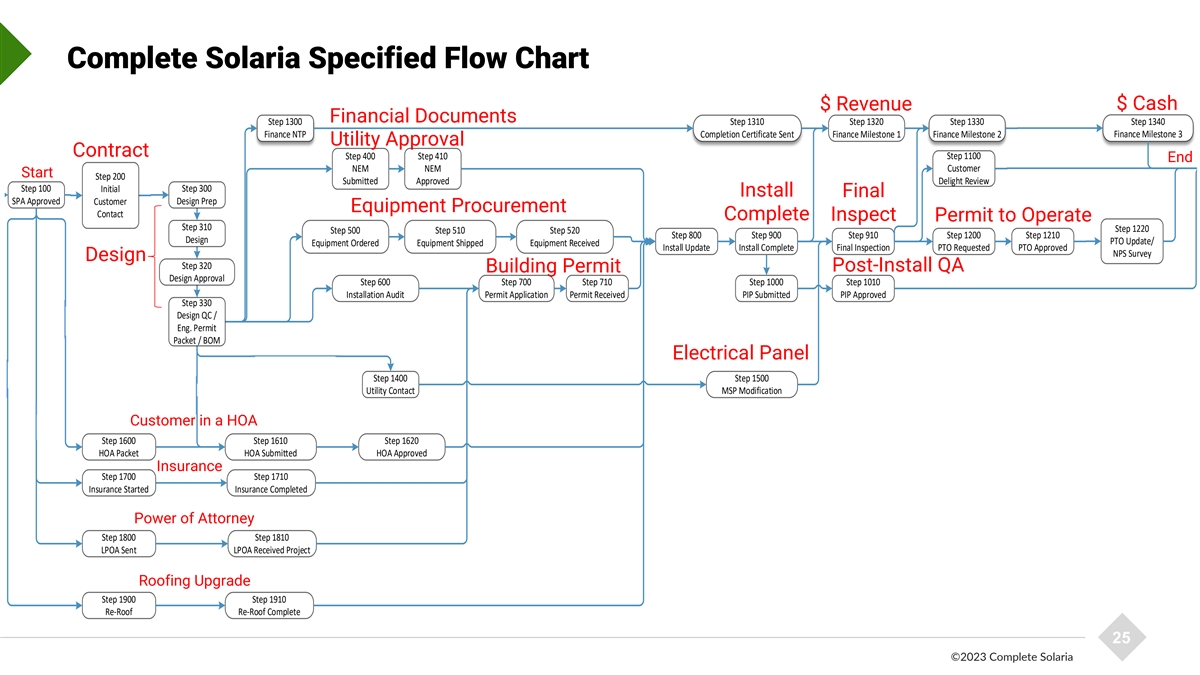

Complete Solaria Specified Flow Chart $ Cash $ Revenue Financial

Documents Step 1300 Step 1310 Step 1320 Step 1330 Step 1340 Finance NTP Completion Certificate Sent Finance Milestone 1 Finance Milestone 2 Finance Milestone 3 Utility Approval Contract Step 1100 Step 400 Step 410 End Customer END NEM NEM Start Step

200 Delight Review Submitted Approved Start Step 100 Initial Step 300 Install Final (SPA Audit) SPA Approved Customer Design Prep Equipment Procurement Contact Complete Inspect Permit to Operate Step 310 Step 1220 Step 500 Step 510 Step 520 Step 800

Step 900 Step 910 Step 1200 Step 1210 Design PTO Update/ Equipment Ordered Equipment Shipped Equipment Received Install Update Install Complete Final Inspection PTO Requested PTO Approved NPS Survey Design Step 320 Post-Install QA Building Permit

Design Approval Step 600 Step 700 Step 710 Step 1000 Step 1010 Installation Audit Permit Application Permit Received PIP Submitted PIP Approved Step 330 Design QC / Customer in Eng. Permit a HOA Packet / BOM Electrical Modifications Electrical Panel

Necessary Roof Work Step 1400 Step 1500 Needed Customer in a HOA Utility Contact MSP Modification Project in Customer in a HOA Florida Step 1600 Step 1610 Step 1620 HOA Packet HOA Submitted HOA Approved Insurance Step 1700 Step 1710 Insurance

Started Insurance Completed Power of Attorney Step 1800 Step 1810 LPOA Sent LPOA Received Project Roofing Upgrade Step 1900 Step 1910 Re-Roof Re-Roof Complete 25 ©2023 Complete Solaria

Alan Hawse IT Systems Specs Technical Memos MES — Helio Track

Experience • MSEE Georgia Tech • VP IT Cypress, Spec System, MES, CAD • VP IT Enovix, Fab MES System 26 ©2023 Complete Solaria

27 ©2023 Complete Solaria

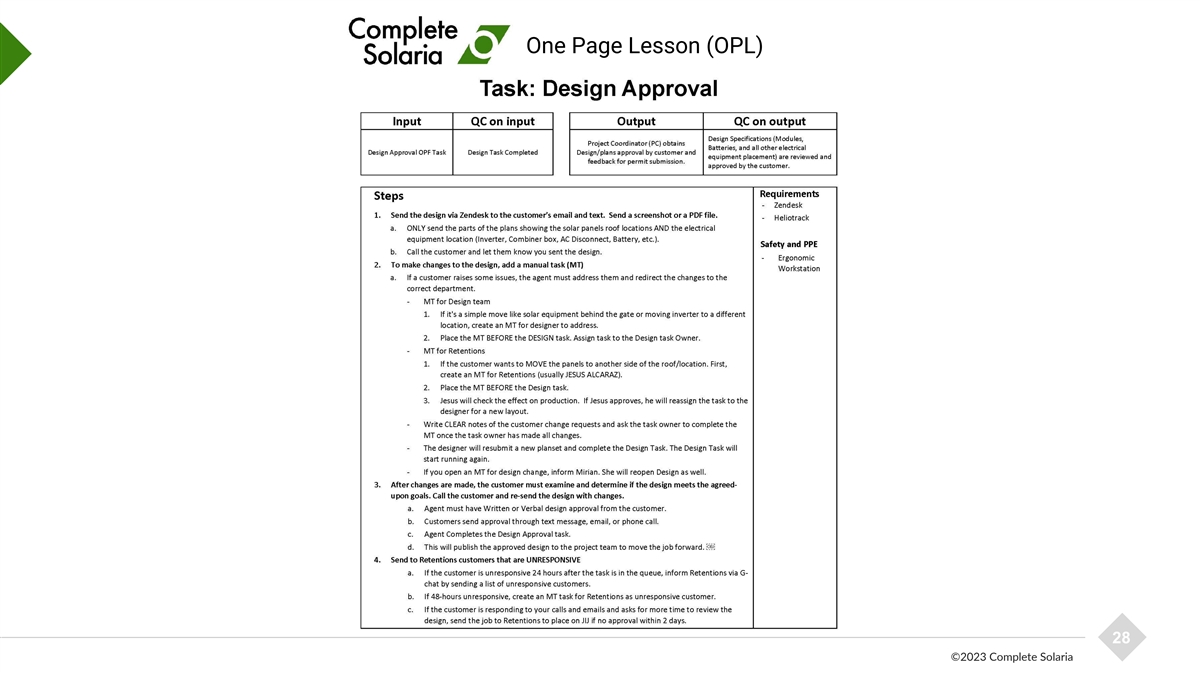

One Page Lesson (OPL) 28 ©2023 Complete Solaria

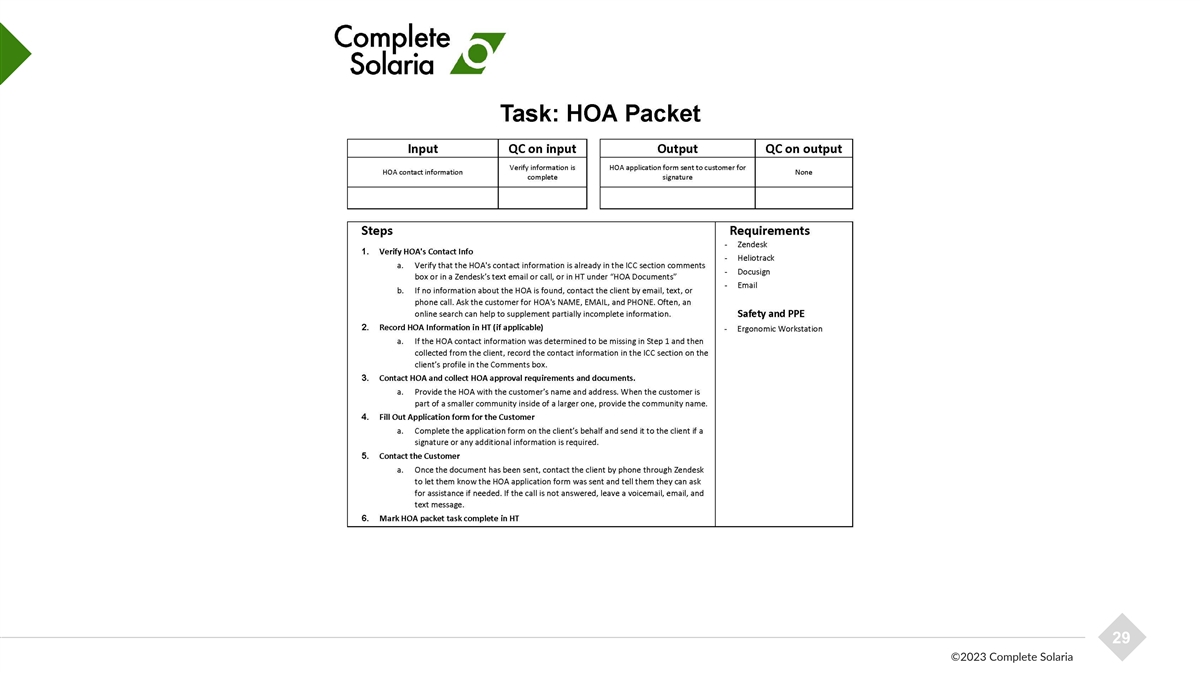

29 ©2023 Complete Solaria

30 ©2023 Complete Solaria

31 ©2023 Complete Solaria

32 ©2023 Complete Solaria

33 ©2023 Complete Solaria

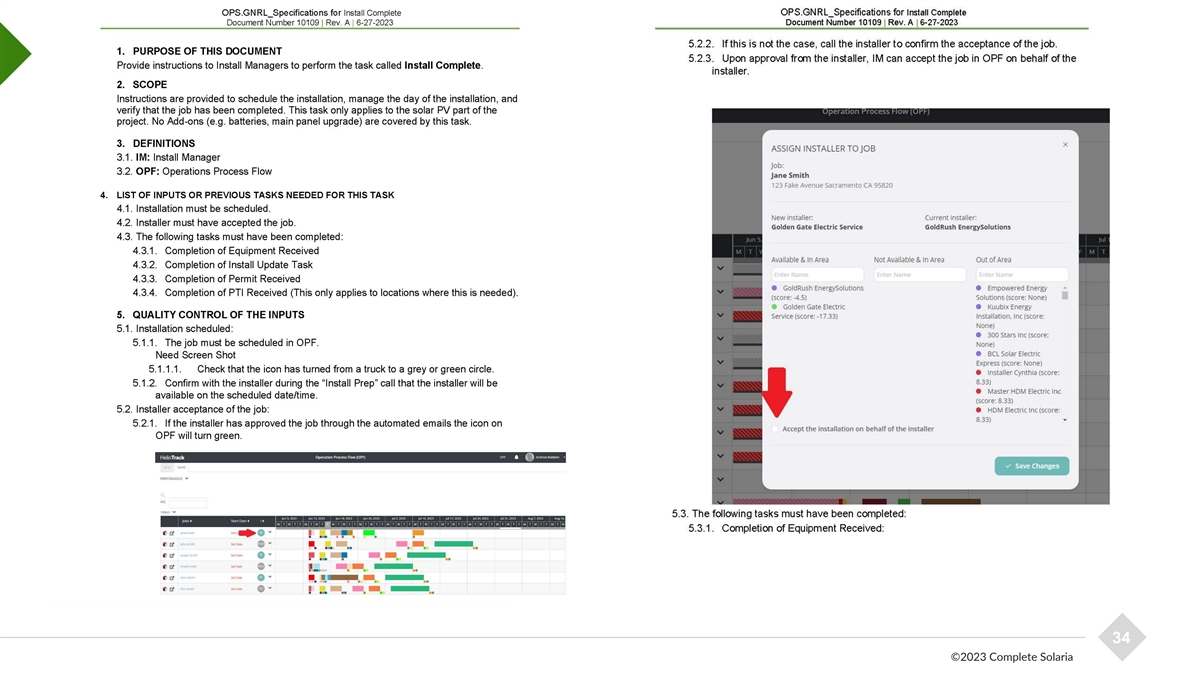

34 ©2023 Complete Solaria

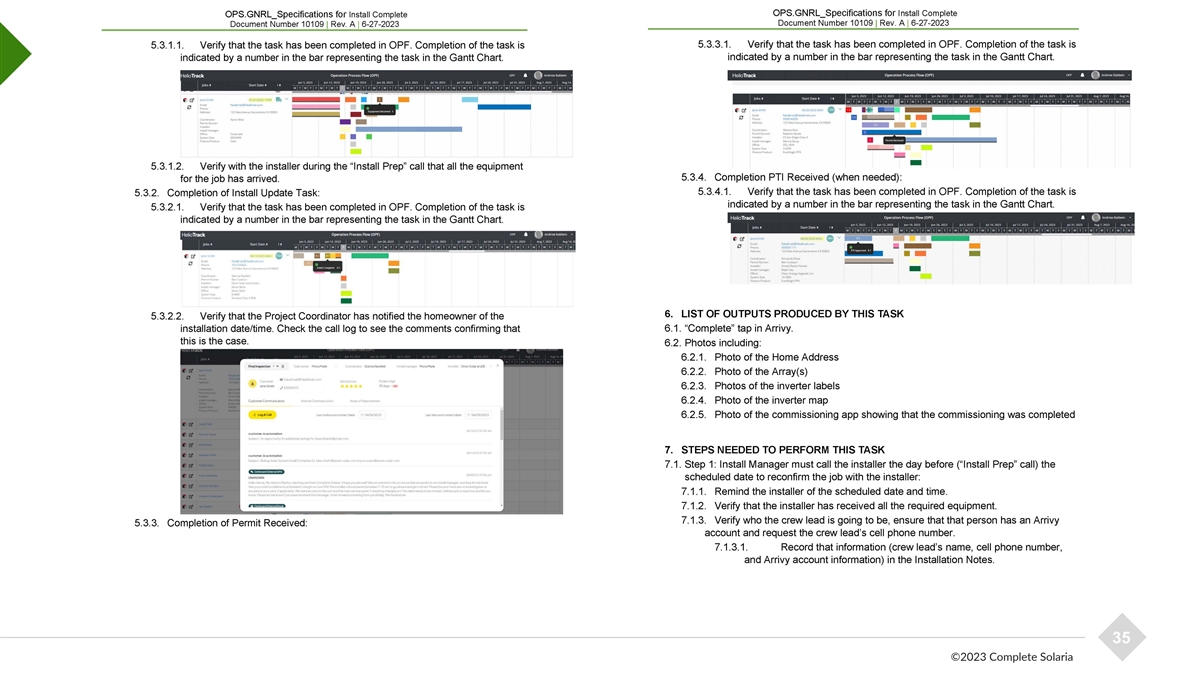

35 ©2023 Complete Solaria

36 ©2023 Complete Solaria

37 ©2023 Complete Solaria

38 ©2023 Complete Solaria

39 ©2023 Complete Solaria

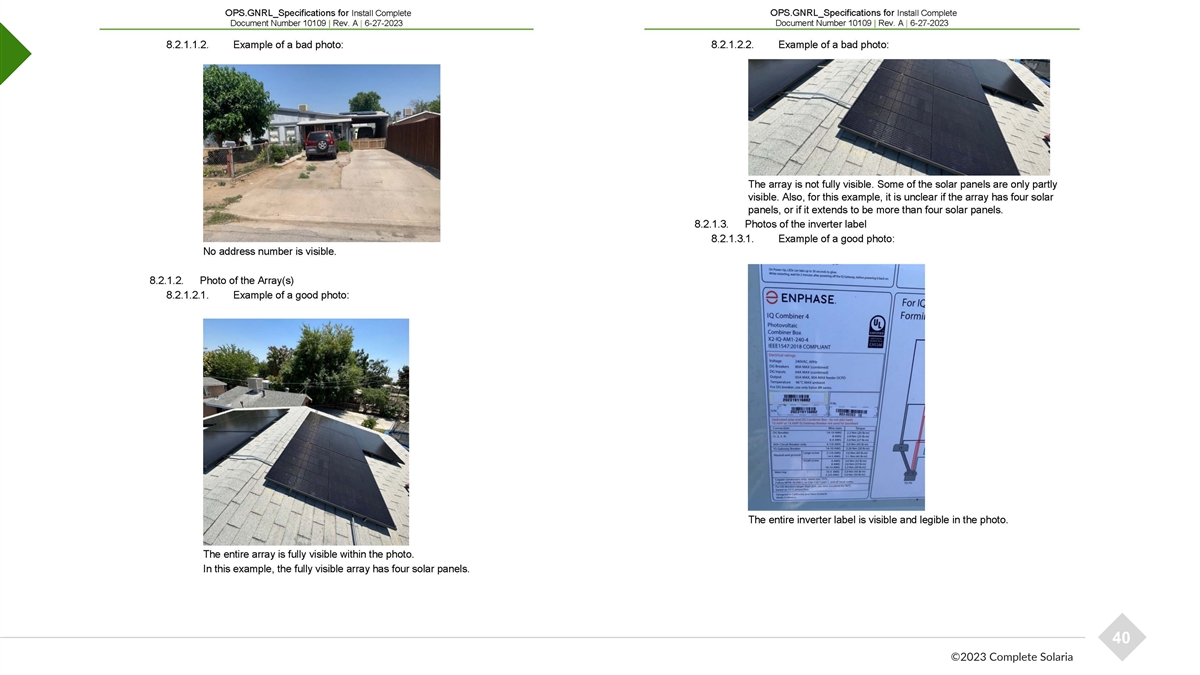

40 ©2023 Complete Solaria

41 ©2023 Complete Solaria

Strong Finish: Q2 Revenue WW24-WW26 Q2 Daily Revenue Revenue/day

($1,000s) 1,500 WW24-26 Daily Avg. Revenue: $1,035K 1,000 ▪ First ~$1 million day, WW24, six since. ▪ Projected avg. daily revenue for last week of the quarter: WW14-23 Daily Avg. Revenue: $355K 500 $1.2 million ▪ $1 million/day x

65 days/qtr = $65 million/qtr + panel 0 revenue 14 15 16 17 18 19 20 21 22 23 24 25 26 Work Week Actual Forecast 42 ©2023 Complete Solaria Daily Revenue ($000)

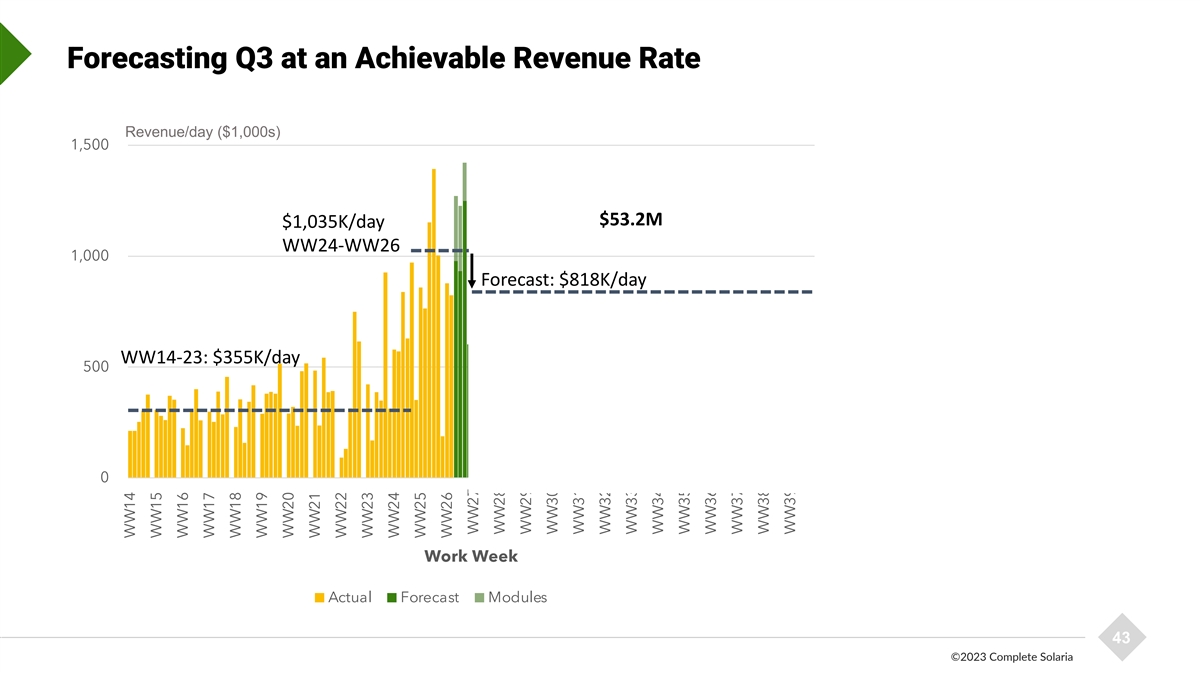

Forecasting Q3 at an Achievable Revenue Rate Q2 & Q3 Daily Revenue

Revenue/day ($1,000s) 1,500 $53.2M $1,035K/day WW24-WW26 1,000 Forecast: $818K/day WW14-23: $355K/day 500 0 Work Week Actual Forecast Modules 43 ©2023 Complete Solaria Daily Revenue ($000) WW14 WW15 WW16 WW17 WW18 WW19 WW20 WW21 WW22 WW23 WW24

WW25 WW26 WW27 WW28 WW29 WW30 WW31 WW32 WW33 WW34 WW35 WW36 WW37 WW38 WW39

Average Daily Revenue Per Week Q3 2023 Average Daily Revenue / Week Q3

2023 Revenue/day ($1,000s) 1,500 1,244 1,250 $50 million $1,035K/day 1,072 (with 6.4% upside) WW24-26 Forecast Q3: 964 1,000 910 892 890 $818K/day 860 841 841 775 819 811 805 788 696 750 534 513 WW14-23: $355K/day 500 408 390 380 368 337 271 314 301

266 250 0 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 Actual Forecast Forecasted revenue 44 ©2023 Complete Solaria ($000)

Nagging Issue: Daily Cash Collections (Quality Issues) Average Daily

Collections / Week Q2 2023 Cash/day ($1,000s) 1,500 1,250 1,103 1,000 875 $37.6 million 759 750 643 536 Average Daily Cash Collection: $575K 554 446 500 432 525 400 506 366 335 250 0 14 15 16 17 18 19 20 21 22 23 24 25 26 Actual Forecast 45

©2023 Complete Solaria ($000)

Jeff McNeil For Quality • Cypress VP WW Mfg. • Enphase COO

2020-22 Fastest Growing on S&P 500 • Enphase Quality 46 ©2023 Complete Solaria

Reward So Far >100:1 TJR on board Jan. 10, 2017 Invest $5 million

> $500 million New COO, April 10, 2017 Badri Kothandaraman New CEO, Sept. 3, 2017 Badri Kothandaraman

Fab Work in Process (WIP) Fab Position WW25 Active Tasks* No.

Installations 700 • Cypress VP WW Mfg. Install • Enphase COO 2020-22 ($ Revenue) Fastest Growing on S&P 500 600 • Enphase quality 500 $38.4 million revenue $25.5 million AR 2,685 total projects Should be ~1,400 PTO Granted 400

($ Cash) 300 200 100 12 51 29 20 5 2 16 49 682 149 19 32 37 318 82 67 140 146 620 323 337 58 180 353 0 200. ICC 310. 320. 330. 1600. 1610. 1620. 400. NEM 410. NEM 510. 520 EQUIP 600. 700. 710. 1900. 1910. 800. 900. 910. 1010. PIP 1400. 1500. 1200.

PTO 1210. PTO DESIGN DESIGN PERM HOA PCKT HOA SUB HOA SUB APVD EQUIP RECVD INSTALL PERM APP PERM REROOF REROOF INSTALL INSTALL FINAL APVD MSP MSP MOD RQST GRANTD APVD PCKT APVD SHIPPED AUDIT RECVD PREP CMPLT UPDATE INSPEC SCHED *Note: 2,685 Total

projects, some of which have multiple active tasks. 48 ©2023 Complete Solaria TASKS

Conclusion • 2X orders swamped our Fab for the first two months

of Q2 (our fault, no kanban) • Our Q2 revenue has suffered due to a bloated 286-day fab cycle time (our fault) • The line is now running well with upgraded systems installed by managers committed to “making the quarters,” but

not yet committed to quality as a way of life. • We have the orders and expect revenue to be $50 million in Q3 • Our current order rate allows for growth beyond that • Our breakeven revenue is about $80 million per quarter •

We are an American company that builds things here • We are committed to Utah as our largest site 49 ©2023 Complete Solaria

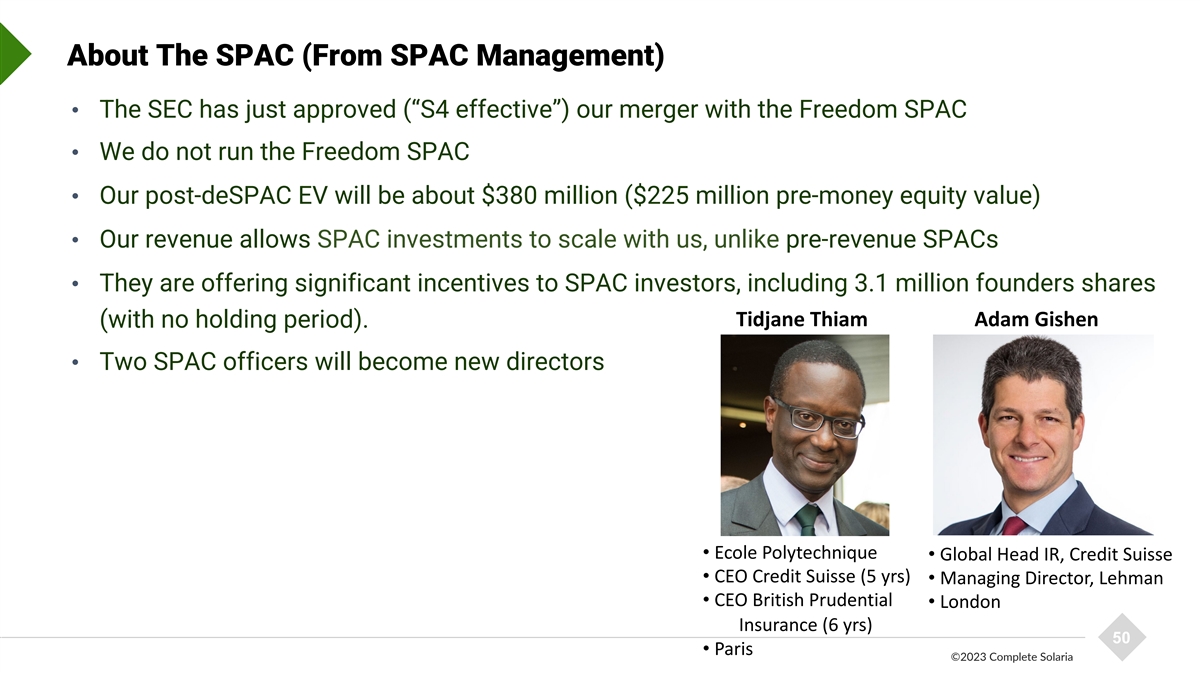

About The SPAC (From SPAC Management) • The SEC has just approved

(“S4 effective”) our merger with the Freedom SPAC • We do not run the Freedom SPAC • Our post-deSPAC EV will be about $380 million ($225 million pre-money equity value) • Our revenue allows SPAC investments to scale

with us, unlike pre-revenue SPACs • They are offering significant incentives to SPAC investors, including 3.1 million founders shares Tidjane Thiam Adam Gishen (with no holding period). • Two SPAC officers will become new directors

• Ecole Polytechnique • Global Head IR, Credit Suisse • CEO Credit Suisse (5 yrs) • Managing Director, Lehman • CEO British Prudential • London Insurance (6 yrs) 50 • Paris ©2023 Complete

Solaria

Manny Hernandez To Management & Employees Public Company Readiness

• The Company’s problems are your problems — DO NOT TOLERATE them • When you commit to do something, DO IT as a matter of personal pride. When “the group” commits, nobody is responsible • I received a

Stanford PhD and still knew nothing about quality — until Japan, Inc almost wiped out my company. For my last 10 years at Cypress, my primary job was quality • Today, you will see my 1986 quality lecture that launched Cypress on its

journey to be a quality company (and later Enphase) • Embrace memos (your documented personal contributions) and specifications (your company’s written record of knowledge & • CFO of both Cypress Semiconductor and SunPower

learning). You cannot become a great company without • Created SunPower’s formal financial infrastructure • Managed SPWR IPO embracing them fully. Neil Armstrong left footprints on the moon • Chairman of audit committee, ON

Semiconductor • Board Director of SPAC that acquired Enovix (ENVX) Say what you do and do what you say! 51 ©2023 Complete Solaria

Enovix TJR talk 52 ©2023 Complete Solaria

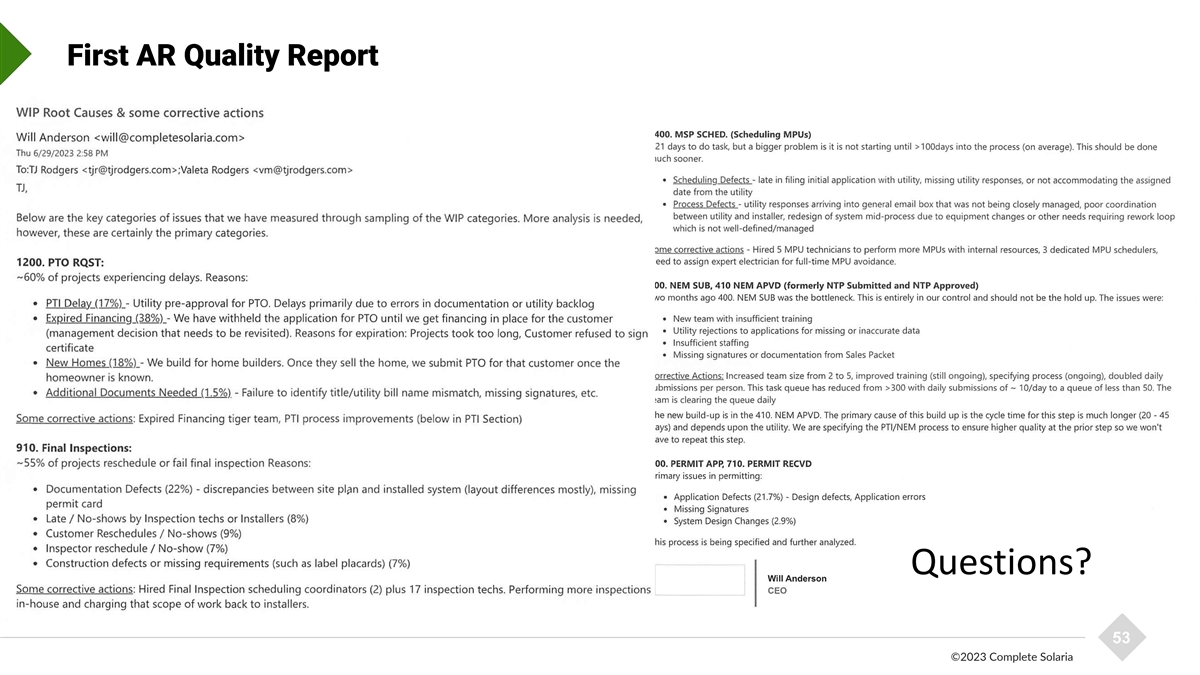

First AR Quality Report Questions? 53 ©2023 Complete

Solaria

Freedom Acquisition I (NYSE:FACT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Freedom Acquisition I (NYSE:FACT)

Historical Stock Chart

From Apr 2023 to Apr 2024