SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

FOMENTO ECONÓMICO MEXICANO, S.A.B. DE C.V.

(Exact name of Registrant as specified in its charter)

Mexican Economic Development, Inc.

(Translation of Registrant’s name into English)

United Mexican States

(Jurisdiction of incorporation or organization)

General Anaya No. 601 Pte.

Colonia Bella Vista

Monterrey, Nuevo León 64410

México

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports

under cover of Form 20-F or Form 40-F:

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as

permitted by Regulation S-T

Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7):

¨

Indicate by check mark whether by furnishing the

information contained in this

Form, the registrant is also thereby furnishing

the information to the

Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ¨

No x

If "Yes" is marked, indicate below the

file number assigned to the registrant in

connection with Rule 12g3-2(b): 82-_____________

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the

registrant has duly caused this report to be signed

on its behalf of the

undersigned, thereunto duly authorized.

| |

FOMENTO ECONÓMICO MEXICANO, S.A. DE C.V. |

| |

|

| |

By: |

/s/ Eugenio Garza y Garza |

| |

Eugenio Garza y Garza |

| |

Director of Finance and Corporate Development |

Date: August, 29, 2023

Exhibit 99.1

FEMSA Forward

BradyIFS and Envoy Solutions come together to create

a compelling new platform

Monterrey, Mexico, August 29, 2023 —

Fomento Económico Mexicano, S.A.B. de C.V. (“FEMSA” or the “Company”) (NYSE: FMX; BMV: FEMSAUBD, FEMSAUB)

announced today that it has entered into definitive agreements with BradyIFS to create a new platform within the facility care, foodservice

disposables, and packaging distribution industries in the United States. The combined platform will bring together Envoy Solutions LLC

and BradyIFS in a highly complementary combination, positioned to serve and provide value to its customers and suppliers effectively and

efficiently across the country.

Transaction Highlights

| · | Upon closing, FEMSA will receive approximately

US$1.7 billion in cash and retain an ownership stake of approximately 37% in the combined entity, which is expected to have pro-forma

revenues approaching US$5 billion. |

| · | For the purposes of this transaction,

the Envoy Solutions valuation implies an unlevered double-digit annualized rate of return on the accumulated capital invested by FEMSA

since entering this business in 2020. |

| · | Approximately 63% of the combined entity will

be owned by existing BradyIFS equity holders led by Kelso & Company and its affiliate funds and including BradyIFS management; by

funds managed by Warburg Pincus LLC; and by the current minority shareholders of Envoy Solutions. |

Transaction Rationale

| · | The transaction will allow Envoy Solutions and

BradyIFS to combine their strengths and complementary footprints to create a strong customer-focused platform to effectively provide its

customers with high-value solutions, and its supplier partners with excellent market reach, delivering more products and solutions in

more locations across the United States. |

Investor Contact

(52) 818-328-6000

investor@femsa.com.mx

femsa.gcs-web.com |

|

Media Contact

(52) 555-249-6843

comunicacion@femsa.com.mx

femsa.com |

|

August 29, 2023 |

| Page 1 |

FEMSA Forward and Strategic Update

| · | This transaction allows the Company to implement

FEMSA Forward with regards to Envoy Solutions while maximizing shareholder value, within a reasonable timeframe. Reaching this

milestone was made possible by the tireless effort of the Envoy Solutions team. FEMSA will aim to contribute to the governance and continued

value creation at the combined entity, mainly through FEMSA’s participation on the Board of Directors. FEMSA does not expect to

contribute incremental capital to the combined entity going forward. |

| · | With this announcement, FEMSA has now addressed

a major portion of the divestiture plans outlined in the FEMSA Forward strategy. Our focus will remain on the continued execution

of the Company’s long-range plans in retail, beverages and digital, which will include a combination of organic growth and inorganic

investments within these core verticals, as well as other capital allocation actions that pursue the maximization of long-term intrinsic

value per share, with a balanced combination of yield and growth. The Company will share more details of this strategy in the months to

come. |

The transaction announced today is subject to

customary regulatory approvals and is expected to close in the coming months.

About Kelso

Kelso is one of the oldest and most established

firms specializing in private equity investing. Since 1980, Kelso has raised a total of 11 private equity funds and invested approximately

$19 billion of equity capital in more than 140 companies. Kelso was founded by the inventor of the Employee Stock Ownership Plan (ESOP)

and, as a result, the principles of partnership and alignment of interest serve as the foundation of the firm's investment philosophy.

Kelso benefits from a successful investment track record, deep sector expertise, a long-tenured investing team, and a reputation as a

preferred partner to management teams and corporates. Kelso has significant experience investing in distribution/packaging, having deployed

approximately $1.4 billion of equity capital in the sector since 2015. For more information, please visit www.kelso.com.

About Warburg Pincus

Warburg Pincus LLC is a leading global growth

investor. The firm has more than $83 billion in assets under management. The firm’s active portfolio of more than 250 companies

is highly diversified by stage, sector, and geography. Warburg Pincus is an experienced partner to management teams seeking to build durable

companies with sustainable value. Founded in 1966, Warburg Pincus has raised 21 private equity and 2 real estate funds, which have invested

more than $112 billion in over 1,000 companies in more than 40 countries. Warburg Pincus is an active investor in industrials, with current

and historical investments including, Consolidated Precision Products, Duravant, El Carwash, Extant Aerospace, Infinite Electronics, Pregis,

Service Logic, Sundyne, TransDigm, TriMark USA, Wencor, among others. The firm is headquartered in New York with offices in Amsterdam,

Beijing, Berlin, Hong Kong, Houston, London, Luxembourg, Mumbai, Mauritius, San Francisco, São Paulo, Shanghai, and Singapore.

For more information please visit www.warburgpincus.com. Follow us on LinkedIn.

About FEMSA

FEMSA is a company that creates economic and social

value through companies and institutions and strives to be the best employer and neighbor to the communities in which it operates. It

participates in the retail industry through a Proximity Americas Division operating OXXO, a small-format store chain, and other related

retail formats, and Proximity Europe which includes Valora, our European retail unit which operates convenience and foodvenience formats.

In the retail industry it also participates though a Health Division, which includes drugstores and related activities and Digital@FEMSA,

which includes Spin by OXXO and Spin Premia, among other digital financial services initiatives. In the beverage industry, it participates

through Coca-Cola FEMSA, the largest franchise bottler of Coca-Cola products in the world by volume. FEMSA also participates in the logistics

and distribution industry through its Strategic Business Unit, which additionally provides point-of-sale refrigeration and plastic solutions

to its business units and third-party clients. Across its business units, FEMSA has more than 350,000 employees in 18 countries. FEMSA

is a member of the Dow Jones Sustainability MILA Pacific Alliance, the FTSE4Good Emerging Index and the Mexican Stock Exchange Sustainability

Index: S&P/BMV Total México ESG, among other indexes that evaluate its sustainability performance.

Investor Contact

(52) 818-328-6000

investor@femsa.com.mx

femsa.gcs-web.com |

|

Media Contact

(52) 555-249-6843

comunicacion@femsa.com.mx

femsa.com |

|

August 29, 2023 |

| Page 2 |

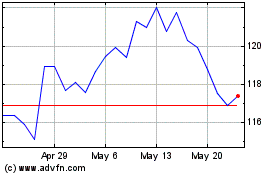

Fomento Economico Mexica... (NYSE:FMX)

Historical Stock Chart

From Apr 2024 to May 2024

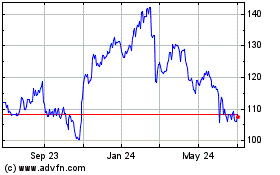

Fomento Economico Mexica... (NYSE:FMX)

Historical Stock Chart

From May 2023 to May 2024