Certified Semi-annual Shareholder Report for Management Investment Companies (n-csrs)

June 30 2020 - 10:36AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21727

First Trust Mortgage Income Fund

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

registrant’s telephone number,

including area code: 630-765-8000

Date of fiscal year end: October 31

Date of reporting period: April 30,

2020

Form N-CSR is to be used by management

investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report

that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking

roles.

A registrant is required to disclose

the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to

respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management

and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden

estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington,

DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

First Trust

Mortgage Income

Fund (FMY)

Semi-Annual

Report

For the Six

Months Ended

April 30,

2020

First Trust Mortgage Income Fund

(FMY)

Semi-Annual Report

April 30, 2020

|

1

|

|

2

|

|

3

|

|

5

|

|

12

|

|

13

|

|

14

|

|

15

|

|

16

|

|

24

|

Caution Regarding

Forward-Looking Statements

This report contains

certain forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the goals,

beliefs, plans or current expectations of First Trust Advisors L.P. (“First Trust” or the “Advisor”) and its representatives, taking into account the information currently available to them.

Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as “anticipate,”

“estimate,” “intend,” “expect,” “believe,” “plan,” “may,” “should,” “would” or other words that convey uncertainty of

future events or outcomes.

Forward-looking

statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of First Trust Mortgage Income Fund (the “Fund”) to be materially

different from any future results, performance or achievements expressed or implied by the forward-looking statements. When evaluating the information included in this report, you are cautioned not to place undue

reliance on these forward-looking statements, which reflect the judgment of the Advisor and its representatives only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking

statements to reflect events and circumstances that arise after the date hereof.

Performance and Risk

Disclosure

There is no assurance

that the Fund will achieve its investment objectives. The Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and that the value of the

Fund’s shares may therefore be less than what you paid for them. Accordingly, you can lose money by investing in the Fund. See “Risk Considerations” in the Additional Information section of this

report for a discussion of certain other risks of investing in the Fund.

Performance data quoted

represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.ftportfolios.com or speak with your financial advisor. Investment returns, net asset value and common share price will fluctuate and Fund shares, when sold,

may be worth more or less than their original cost.

The Advisor may also

periodically provide additional information on Fund performance on the Fund’s web page at www.ftportfolios.com.

How to Read This

Report

This report contains

information that may help you evaluate your investment in the Fund. It includes details about the Fund and presents data and analysis that provide insight into the Fund’s performance and investment approach.

By reading the portfolio

commentary by the portfolio management team of the Fund, you may obtain an understanding of how the market environment affected the Fund’s performance. The statistical information that follows may help you

understand the Fund’s performance compared to that of a relevant market benchmark.

It is important to keep

in mind that the opinions expressed by personnel of the Advisor are just that: informed opinions. They should not be considered to be promises or advice. The opinions, like the statistics, cover the period through the

date on the cover of this report. The material risks of investing in the Fund are spelled out in the prospectus, the statement of additional information, this report and other Fund regulatory filings.

First Trust Mortgage Income Fund

(FMY)

Semi-Annual Letter from the Chairman

and CEO

April 30, 2020

Dear Shareholders,

First Trust is pleased

to provide you with the semi-annual report for the First Trust Mortgage Income Fund (the “Fund”), which contains detailed information about the Fund for the six months ended April 30, 2020.

Just one month ago, I

noted in a letter to shareholders that a handful of states were set to open some “nonessential” businesses by early May. As of May 20, 2020, I am pleased to report that all 50 states and U.S. territories

have eased some restrictions on businesses and social activity. Keep in mind, however, that the plan does entail governors phasing in the opening of businesses in the coming weeks or potentially months, so I see this

news as essentially marking the beginning of the rebuilding process for the U.S. economy. We all need to be aware as well of the possibility of an uptick or even surge in the coronavirus (“COVID-19”)

infections as more people venture out of their homes. Prior to the last couple of weeks or so, the stay-at-home mandate severely restricted the movements of close to 315 million Americans, according to The Washington

Post. To put this further into perspective, because so many stores have been closed and so many people have been hunkering down at home, retail-store traffic in the U.S. plunged 91.2% year-over-year for the week ended

May 16, 2020, according to Bloomberg. Truly amazing!

In this COVID-19

pandemic, there appears to be a notable disconnect between the state of the U.S. economy, which is expected to go from bad to downright terrible between the first quarter and second quarter of the year, and the

performance of the stock market, which has been much better than expected. While the data and commentary in this report are technically supposed to run through April 30, 2020, I feel compelled to offer insight that is

as up to date as possible. The 2020 peak in the stock market, as measured by the S&P 500® Index (the “Index”), occurred on February 19. That day also marked the all-time high for the Index. From

February 19, 2020, through March 23, 2020, the Index declined by 33.92% on a price-only basis (no dividends included), according to Bloomberg. We should note that the Index slid into bear market territory on March 12,

2020. A bear market is defined by a 20% or greater decline in price from its most recent peak. That took just 16 trading days, the quickest plunge into a bear market ever. From March 23, 2020 through May 20, 2020, the

Index staged an impressive rebound, posting a price-only gain of 32.82%, according to Bloomberg. As of May 20, 2020, the Index stood just 12.24% below its all-time high set on February 19, 2020. But the game, as they

say, is not over. Even though stocks have rebounded significantly from their March lows, 68% of the money managers that participated in the most recent Bank of America global fund manager survey believe that stocks

are still in a bear market, according to MarketWatch. What are they likely concerned about? In addition to a dismal economic outlook for the near-term, research from Bespoke Investment Group, an independent research

firm, indicates that there have been 25 bear markets since 1928 and 60% of the time the Index declined a second time during the bear market and went on to establish a new low for the period.

With respect to the

state of the economy, the Congressional Budget Office announced on May 19, 2020, that it sees real U.S. gross domestic product (“GDP”) declining by an annualized 38% in the second quarter of 2020,

reportedly in line with Wall Street economists, according to CNBC. Some estimates are more dire. The GDP estimate from the Atlanta Federal Reserve calls for a 42% plunge. These numbers are so large in scope they are

mind-boggling. The Bureau of Economic Analysis is scheduled to release its GDP report on July 30, 2020. Until then, we may continue to have a disconnect between the economy and the markets. Let us hope it is as

positive as the one we are currently enjoying.

The U.S. government shut

down huge chunks of our economy in order to protect lives and prevent our health care system from being overwhelmed by COVID-19 patients. Our economic woes, in other words, are man-made. The remedies to this pandemic

will also likely be man-made. They could come in the form of therapeutics and/or a vaccine. Perhaps more than one vaccine. At this stage of the pandemic fight, we have one message for investors: Stay the course!

Thank you for giving

First Trust the opportunity to play a role in your financial future. We value our relationship with you and will report on the Fund again in six months.

Sincerely,

James A. Bowen

Chairman of the Board of Trustees

Chief Executive Officer of First Trust

Advisors L.P.

First Trust Mortgage Income Fund (FMY)

“AT A GLANCE”

As of April 30, 2020

(Unaudited)

|

Fund Statistics

|

|

|

Symbol on New York Stock Exchange

|

FMY

|

|

Common Share Price

|

$13.29

|

|

Common Share Net Asset Value (“NAV”)

|

$14.52

|

|

Premium (Discount) to NAV

|

(8.47)%

|

|

Net Assets Applicable to Common Shares

|

$61,168,559

|

|

Current Distribution per Common Share(1)

|

$0.0600

|

|

Current Annualized Distribution per Common Share

|

$0.7200

|

|

Current Distribution Rate on Common Share Price(2)

|

5.42%

|

|

Current Distribution Rate on NAV(2)

|

4.96%

|

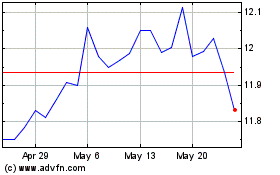

Common Share Price & NAV (weekly closing price)

|

Performance

|

|

|

|

|

|

|

|

|

Average Annual Total Returns

|

|

|

6 Months Ended

4/30/20

|

1 Year Ended

4/30/20

|

5 Years Ended

4/30/20

|

10 Years Ended

4/30/20

|

Inception

(5/25/05)

to 4/30/20

|

|

Fund Performance(3)

|

|

|

|

|

|

|

NAV

|

-0.06%

|

1.96%

|

3.16%

|

3.91%

|

5.38%

|

|

Market Value

|

-2.51%

|

3.61%

|

3.58%

|

3.91%

|

4.44%

|

|

Index Performance

|

|

|

|

|

|

|

Bloomberg Barclays U.S. Mortgage Backed Securities (MBS) Index

|

3.47%

|

7.77%

|

3.06%

|

3.29%

|

4.17%

|

|

Portfolio Characteristics

|

|

|

Weighted Average Effective Duration

|

1.68 Years

|

|

Weighted Average Effective Maturity

|

3.91 Years

|

|

Asset Classification

|

% of Total

Investments

|

|

U.S. Government Agency MBS

|

53.1%

|

|

Mortgage-Backed Securities

|

39.8

|

|

Asset-Backed Securities

|

1.0

|

|

Cash & Cash Equivalents

|

6.1

|

|

Total

|

100.0%

|

|

Credit Quality(4)

|

% of Total

Fixed-Income

Investments

|

|

AAA

|

3.1%

|

|

AA+

|

6.3

|

|

AA

|

3.8

|

|

AA-

|

0.8

|

|

A+

|

2.1

|

|

A

|

1.7

|

|

A-

|

0.3

|

|

BBB+

|

0.3

|

|

BBB

|

0.3

|

|

BBB-

|

0.8

|

|

BB+

|

0.1

|

|

BB-

|

0.3

|

|

B+

|

0.3

|

|

B

|

0.7

|

|

B-

|

0.1

|

|

CCC

|

0.9

|

|

CCC-

|

0.1

|

|

CC

|

4.5

|

|

Not Rated

|

14.3

|

|

Government

|

53.1

|

|

Cash & Cash Equivalents

|

6.1

|

|

Total

|

100.0%

|

|

(1)

|

Most recent distribution paid or declared through 4/30/2020. Subject to change in the future.

|

|

(2)

|

Distribution rates are calculated by annualizing the most recent distribution paid or declared through the report date and then dividing by Common Share Price or NAV, as applicable, as of 4/30/2020.

Subject to change in the future.

|

|

(3)

|

Total return is based on the combination of reinvested dividend, capital gain, and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan and changes in NAV per

share for NAV returns and changes in Common Share Price for market value returns. Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not indicative of

future results.

|

|

(4)

|

The ratings are by Standard & Poor’s. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO), of the creditworthiness of an issuer with

respect to debt obligations. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Investment grade is defined as those issuers that have a long-term credit rating of BBB- or higher.

Sub-investment grade ratings are those rated BB+ or lower. The credit ratings shown relate to the credit worthiness of the issuers of the underlying securities in the fund, and not to the fund or its shares. U.S.

Treasury, U.S. Agency and U.S. Agency mortgage-backed securities appear under “Government”. Credit ratings are subject to change.

|

Portfolio Commentary

First Trust Mortgage

Income Fund (FMY)

Semi-Annual Report

April 30, 2020

(Unaudited)

Advisor

First Trust Advisors L.P.

(“First Trust” or the “Advisor”) serves as the investment advisor to the First Trust Mortgage Income Fund (the “Fund” or “FMY”) and offers customized portfolio

management using its structured, quantitative approach to security selection.

Portfolio Management

Team

Jeremiah Charles –

Senior Vice President and Senior Portfolio Manager, First Trust Securitized Products Group

James Snyder – Senior

Vice President and Senior Portfolio Manager, First Trust Securitized Products Group

Commentary

First Trust Mortgage Income

Fund

The Fund’s primary

investment objective is to seek a high level of current income. As a secondary objective the Fund seeks to preserve capital. The Fund pursues its objectives by investing primarily in mortgage-backed securities

(“MBS”) representing part ownership in a pool of either residential or commercial mortgage loans that, in the opinion of the Fund’s investment advisor, offer an attractive combination of credit

quality, yield and maturity. There can be no assurance the Fund will achieve its investment objectives. The Fund may not be appropriate for all investors.

Market Recap

The 2020 fiscal year

began relatively calm compared to recent events, being driven primarily by policy decisions related to the trade war between the U.S. and China. Now with the coronavirus (“COVID-19”) pandemic and its

effects rippling through the domestic and global economies, profound changes can be seen in both bond and equity market fundamentals, risk factors and valuations. Due to the nature of this pandemic, the reversal in

monetary policy driven by the trade war was put into overdrive. In response, the Federal Reserve (the “Fed”) began a new phase of seemingly limitless quantitative easing, and reinstated programs that were

last relied upon during the Great Recession. It also began to roll out new programs, expanding the range of covered asset classes, providing a backstop to the significant dislocations and severe illiquidity that

occurred. The Fed further aided markets by cutting rates 1.00%, and also setting the lower bound of the Fed Funds rate at 0%. The Fed was not alone in providing aid, as Congress stepped in with a large stimulus

package to help Americans weather COVID-19 and its effects. An additional round of aid is being debated as certain states begin the process of reopening. Treasury issuance as a result has soared to buoy government

spending, with rates reaching record lows on certain maturities as the appetite for safe haven assets remains elevated. For example, 10-Year Treasury rates declined precipitously by 105 basis points

(“bps”) to close at 0.64% on April 30, 2020. COVID-19 did not discriminate, affecting nearly every aspect of the broader markets, including Agency MBS, which initially saw large spread widening moves

following ramp ups in refinancing activity. This was followed by leveraged funds coming under massive pressure as Agency MBS spreads widened dramatically from the low 40’s Treasury option-adjusted spread

(“OAS”), to a wide of 136 OAS before tightening to 85 OAS by the end of the period. At 85 OAS, Agency mortgages are still meaningfully wide to historical trends, but new challenges await. Forbearance has

been rising as payment relief is offered to borrowers that have been negatively impacted by the economic fallout from Covid-19.

Performance Analysis

During the first half of

the 2020 fiscal year, the Fund returned -0.06% on a net asset value (“NAV”) basis, and -2.51% on a market price basis.

During the same period,

the Bloomberg Barclays U.S. MBS Index (the “Index”) returned 3.47%.

During this period, the

Fund underperformed the Index by 3.53% net of fees, on a NAV basis and 5.98% on a market price basis. The Fund owns a significant amount of Non-Agency and Interest Only Agency MBS securities that experienced

substantially more spread widening than the generic Agency MBS pass-through sub-sector, which makes up the benchmark, leading to noticeable underperformance. The Fund also utilized short positions in treasury futures,

which were mildly detrimental to the Fund’s performance over the same period. Duration continues to be managed and is now relatively neutral versus the benchmark.

Fund and Market Outlook

The Fed has stated that

they will do whatever it takes to get through COVID-19. We believe this will keep the front end of the yield curve anchored in place in the near term, as progress on a vaccine or cure is still distant. We expect

consumer and overall economic data to be almost without precedent as we expect unemployment to soar. The growing stress on individual households, small businesses, and even global companies alike will continue to

increase as long as lockdowns remain in place. Even once lifted, we do not forecast an immediate return to normal and, as such, do not forecast the broader economic strength exhibited over the last several years to

return over the short term. Over the near term, we expect no rise in inflation, but given the surge in the money supply, we

Portfolio Commentary (Continued)

First Trust Mortgage

Income Fund (FMY)

Semi-Annual Report

April 30, 2020

(Unaudited)

could see inflationary

pressure build over the medium term. We remain positive on MBS spread valuations over the longer term and believe there is significant capacity for spread tightening to occur. Lastly, we expect interest rate

volatility to remain somewhat muted through year-end due to ongoing fiscal and monetary programs deployed to assist in fighting COVID-19, chiefly quantitative easing.

Given our outlook on the

broader bond markets, we plan to continue to actively manage the Fund versus the Index from a duration standpoint, especially after a 115-bps rally in the 5-Year U.S. Treasury Yield. To the extent the curve sees a

large bear steepening, likely due to inflation or supply, we will look to take advantage. From an asset allocation perspective, we plan to reinvest legacy portfolio runoff into certain sub-sectors of Agency MBS. With

spreads on Agency MBS still fairly wide compared to historical averages, this serves as an opportunity to lock in longer, more certain mortgage cash flows in government backed guaranteed sectors with limited to no

credit loss risk, in our opinion. In our view, this approach would provide some yield, income, dividend, and spread protection for shareholders. As part of the investment team’s Agency MBS strategy, a

substantial portion of the agency securities have been, and will continue to be, invested in the collateralized mortgage obligation and interest-only sectors to increase the income, economic earnings and tradability

of the portfolio. We believe this strategy can be very effective with proper security selection, particularly when combined with appropriate yield curve management.

First Trust Mortgage Income Fund (FMY)

Portfolio of Investments

April 30, 2020

(Unaudited)

Principal

Value

|

|

Description

|

|

Stated

Coupon

|

|

Stated

Maturity

|

|

Value

|

|

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES – 52.7%

|

|

|

|

Collateralized Mortgage Obligations – 38.3%

|

|

|

|

|

|

|

|

|

|

Federal Home Loan Mortgage Corp.

|

|

|

|

|

|

|

|

$2

|

|

Series 1007, Class H, 1 Mo. LIBOR x -1.35 + 20.88% (a)

|

|

19.78%

|

|

10/15/20

|

|

$2

|

|

15,614

|

|

Series 1394, Class ID, Cost of Funds 11th District of San Fransisco x -4.67 + 44.56%, Capped at 9.57% (a)

|

|

9.57%

|

|

10/15/22

|

|

16,983

|

|

16,449

|

|

Series 2303, Class SW, Cost of Funds 11th District of San Fransisco x -15.87 + 121.11%, Capped at 10.00% (a)

|

|

10.00%

|

|

03/01/24

|

|

2,229

|

|

61,487

|

|

Series 2334, Class QS, 1 Mo. LIBOR x -3.5 + 28.18% (a)

|

|

25.33%

|

|

07/15/31

|

|

102,253

|

|

261,864

|

|

Series 2439, Class XI, IO, if 1 Mo. LIBOR x -1 + 7.74% is less than 7.50%, then 6.50%, otherwise 0.00% (a)

|

|

6.50%

|

|

03/01/32

|

|

47,493

|

|

575,664

|

|

Series 2807, Class SB, IO, 1 Mo. LIBOR x -1 + 7.45% (a)

|

|

6.64%

|

|

11/15/33

|

|

112,687

|

|

1,393,185

|

|

Series 2975, Class SJ, IO, 1 Mo. LIBOR x -1 + 6.65% (a)

|

|

5.84%

|

|

05/15/35

|

|

262,886

|

|

286,809

|

|

Series 3012, Class GK, 1 Mo. LIBOR x -4.5 + 24.75% (a)

|

|

21.09%

|

|

06/15/35

|

|

555,815

|

|

233,470

|

|

Series 3108, Class QZ

|

|

6.00%

|

|

02/01/36

|

|

361,028

|

|

13,874

|

|

Series 3195, Class SX, 1 Mo. LIBOR x -6.5 + 46.15% (a)

|

|

40.86%

|

|

07/15/36

|

|

59,125

|

|

317,898

|

|

Series 3210, Class ZA

|

|

6.00%

|

|

09/01/36

|

|

419,685

|

|

122,913

|

|

Series 3410, Class HC

|

|

5.50%

|

|

02/01/38

|

|

141,794

|

|

90,870

|

|

Series 3451, Class SB, IO, 1 Mo. LIBOR x -1 + 6.03% (a)

|

|

5.22%

|

|

05/15/38

|

|

14,291

|

|

460,275

|

|

Series 3471, Class SD, IO, 1 Mo. LIBOR x -1 + 6.08% (a)

|

|

5.27%

|

|

12/15/36

|

|

84,072

|

|

146,067

|

|

Series 3784, Class BI, IO

|

|

3.50%

|

|

01/01/21

|

|

1,399

|

|

250,000

|

|

Series 3797, Class KB

|

|

4.50%

|

|

01/01/41

|

|

303,406

|

|

30,329

|

|

Series 3898, Class NI, IO

|

|

5.00%

|

|

07/01/40

|

|

116

|

|

496,639

|

|

Series 3985, Class GI, IO

|

|

3.00%

|

|

10/01/26

|

|

17,536

|

|

45,685

|

|

Series 4021, Class IP, IO

|

|

3.00%

|

|

03/01/27

|

|

2,519

|

|

674,434

|

|

Series 4057, Class YI, IO

|

|

3.00%

|

|

06/01/27

|

|

44,953

|

|

1,282,855

|

|

Series 4082, Class PI, IO

|

|

3.00%

|

|

06/01/27

|

|

80,358

|

|

804,125

|

|

Series 4206, Class IA, IO

|

|

3.00%

|

|

03/01/33

|

|

82,044

|

|

909,517

|

|

Series 4258, Class CO

|

|

(b)

|

|

06/01/43

|

|

858,294

|

|

469,145

|

|

Series 4615, Class GT, 1 Mo. LIBOR x -4 + 16.00%, Capped at 4.00% (a)

|

|

4.00%

|

|

10/15/42

|

|

490,248

|

|

4,949,105

|

|

Series 4619, Class IB, IO

|

|

4.00%

|

|

12/01/47

|

|

174,746

|

|

10,567,768

|

|

Series 4938, Class IB, IO

|

|

4.00%

|

|

07/01/49

|

|

1,380,923

|

|

|

|

Federal Home Loan Mortgage Corp. Structured Pass-Through

Certificates

|

|

|

|

|

|

|

|

49,838

|

|

Series T-56, Class APO

|

|

(b)

|

|

05/01/43

|

|

48,008

|

|

|

|

Federal Home Loan Mortgage Corp., STRIPS

|

|

|

|

|

|

|

|

74,637

|

|

Series 177, IO

|

|

7.00%

|

|

06/17/26

|

|

10,254

|

|

613,509

|

|

Series 243, Class 2, IO

|

|

5.00%

|

|

11/01/35

|

|

105,054

|

|

4,217,651

|

|

Series 303, Class C17, IO

|

|

3.50%

|

|

01/01/43

|

|

559,196

|

|

|

|

Federal National Mortgage Association

|

|

|

|

|

|

|

|

67,211

|

|

Series 1996-46, Class ZA

|

|

7.50%

|

|

11/01/26

|

|

75,835

|

|

246,918

|

|

Series 1997-85, Class M, IO

|

|

6.50%

|

|

12/01/27

|

|

21,660

|

|

45,379

|

|

Series 2002-80, Class IO, IO

|

|

6.00%

|

|

09/01/32

|

|

6,437

|

|

84,793

|

|

Series 2003-15, Class MS, IO, 1 Mo. LIBOR x -1 + 8.00% (a)

|

|

7.51%

|

|

03/25/33

|

|

16,883

|

|

112,139

|

|

Series 2003-44, Class IU, IO

|

|

7.00%

|

|

06/01/33

|

|

27,289

|

|

645,742

|

|

Series 2003-62, Class PO

|

|

(b)

|

|

07/01/33

|

|

612,563

|

|

549,978

|

|

Series 2004-49, Class SN, IO, 1 Mo. LIBOR x -1 + 7.10% (a)

|

|

6.61%

|

|

07/25/34

|

|

108,913

|

|

16,750

|

|

Series 2004-74, Class SW, 1 Mo. LIBOR x -2 + 15.50% (a)

|

|

14.06%

|

|

11/25/31

|

|

24,064

|

|

378,045

|

|

Series 2004-W10, Class A6

|

|

5.75%

|

|

08/01/34

|

|

433,778

|

|

273,214

|

|

Series 2005-122, Class SN, 1 Mo. LIBOR x -4 + 28.60% (a)

|

|

26.65%

|

|

01/25/36

|

|

542,445

|

|

26,947

|

|

Series 2005-59 SU, 1 Mo. LIBOR x -5 + 25.50% (a)

|

|

23.06%

|

|

06/25/35

|

|

47,030

|

|

101,564

|

|

Series 2005-6, Class SE, IO, 1 Mo. LIBOR x -1 + 6.70% (a)

|

|

6.21%

|

|

02/25/35

|

|

21,274

|

|

420,983

|

|

Series 2005-74, Class NZ

|

|

6.00%

|

|

09/01/35

|

|

599,185

|

|

228,824

|

|

Series 2006-105, Class ZA

|

|

6.00%

|

|

11/01/36

|

|

323,676

|

|

696,154

|

|

Series 2006-5, Class 3A2, 1 Mo. LIBOR + 2.08% (c)

|

|

3.80%

|

|

05/01/35

|

|

727,890

|

|

61,437

|

|

Series 2007-100, Class SM, IO, 1 Mo. LIBOR x -1 + 6.45% (a)

|

|

5.96%

|

|

10/25/37

|

|

12,156

|

See Notes to Financial Statements

Page 5

First Trust Mortgage Income Fund (FMY)

Portfolio of Investments

(Continued)

April 30, 2020

(Unaudited)

Principal

Value

|

|

Description

|

|

Stated

Coupon

|

|

Stated

Maturity

|

|

Value

|

|

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES (Continued)

|

|

|

|

Collateralized Mortgage Obligations (Continued)

|

|

|

|

|

|

|

|

|

|

Federal National Mortgage Association (Continued)

|

|

|

|

|

|

|

|

$238,660

|

|

Series 2007-30, Class ZM

|

|

4.25%

|

|

04/01/37

|

|

$299,033

|

|

292,846

|

|

Series 2007-37, Class SB, IO, 1 Mo. LIBOR x -1 + 6.75% (a)

|

|

6.26%

|

|

05/25/37

|

|

66,695

|

|

294,177

|

|

Series 2008-17, Class BE

|

|

5.50%

|

|

10/01/37

|

|

372,015

|

|

182,000

|

|

Series 2008-2, Class PH

|

|

5.50%

|

|

02/01/38

|

|

231,355

|

|

494,000

|

|

Series 2009-28, Class HX

|

|

5.00%

|

|

05/01/39

|

|

630,888

|

|

188,674

|

|

Series 2009-37, Class NZ

|

|

5.71%

|

|

02/01/37

|

|

246,436

|

|

1,304,849

|

|

Series 2010-103, Class ID, IO

|

|

5.00%

|

|

09/01/40

|

|

281,168

|

|

440

|

|

Series 2010-104, Class CI, IO

|

|

4.00%

|

|

09/01/20

|

|

1

|

|

13,023

|

|

Series 2010-145, Class TI, IO

|

|

3.50%

|

|

12/01/20

|

|

40

|

|

86,041

|

|

Series 2010-99, Class SG, 1 Mo. LIBOR x -5 + 25.00% (a)

|

|

20.08%

|

|

09/01/40

|

|

158,012

|

|

12,109

|

|

Series 2011-5, Class IK, IO

|

|

8.00%

|

|

02/01/21

|

|

187

|

|

825,000

|

|

Series 2011-52, Class LB

|

|

5.50%

|

|

06/01/41

|

|

953,774

|

|

399,051

|

|

Series 2011-66, Class QI, IO

|

|

3.50%

|

|

07/01/21

|

|

6,116

|

|

1,807,176

|

|

Series 2011-81, Class PI, IO

|

|

3.50%

|

|

08/01/26

|

|

100,668

|

|

106,907

|

|

Series 2012-111, Class B

|

|

7.00%

|

|

10/01/42

|

|

128,279

|

|

1,499,342

|

|

Series 2012-112, Class BI, IO

|

|

3.00%

|

|

09/01/31

|

|

92,540

|

|

1,734,122

|

|

Series 2012-125, Class MI, IO

|

|

3.50%

|

|

11/01/42

|

|

234,613

|

|

20,975

|

|

Series 2012-74, Class OA

|

|

(b)

|

|

03/01/42

|

|

20,074

|

|

20,975

|

|

Series 2012-75, Class AO

|

|

(b)

|

|

03/01/42

|

|

20,057

|

|

147,071

|

|

Series 2013-132, Class SW, 1 Mo. LIBOR x -2.67 + 10.67% (a)

|

|

8.04%

|

|

01/01/44

|

|

184,875

|

|

275,135

|

|

Series 2013-28, Class AQ

|

|

2.00%

|

|

07/01/38

|

|

275,344

|

|

1,563,662

|

|

Series 2013-32, Class IG, IO

|

|

3.50%

|

|

04/01/33

|

|

164,372

|

|

403,356

|

|

Series 2013-51, Class PI, IO

|

|

3.00%

|

|

11/01/32

|

|

35,268

|

|

2,856,595

|

|

Series 2015-20, Class ES, IO, 1 Mo. LIBOR x -1 + 6.15% (a)

|

|

5.66%

|

|

04/25/45

|

|

526,580

|

|

999,053

|

|

Series 2015-76, Class BI, IO

|

|

4.00%

|

|

10/01/39

|

|

69,782

|

|

2,914,254

|

|

Series 2015-97, Class AI, IO

|

|

4.00%

|

|

09/01/41

|

|

171,562

|

|

168,142

|

|

Series 2016-74, Class LI, IO

|

|

3.50%

|

|

09/01/46

|

|

57,065

|

|

7,253,479

|

|

Series 2017-109, Class SJ, IO, 1 Mo. LIBOR x -1+ 6.20% (a)

|

|

5.71%

|

|

01/25/48

|

|

1,188,416

|

|

|

|

Federal National Mortgage Association, STRIPS

|

|

|

|

|

|

|

|

50,190

|

|

Series 305, Class 12, IO (d)

|

|

6.50%

|

|

12/01/29

|

|

8,257

|

|

60,175

|

|

Series 355, Class 18, IO

|

|

7.50%

|

|

11/01/33

|

|

14,102

|

|

2,093,330

|

|

Series 387, Class 10, IO

|

|

6.00%

|

|

04/01/38

|

|

362,579

|

|

1,237,694

|

|

Series 406, Class 6, IO (d)

|

|

4.00%

|

|

01/01/41

|

|

174,029

|

|

|

|

Government National Mortgage Association

|

|

|

|

|

|

|

|

359,750

|

|

Series 2004-95, Class QZ

|

|

4.50%

|

|

11/01/34

|

|

400,608

|

|

238,157

|

|

Series 2005-33, Class AY

|

|

5.50%

|

|

04/01/35

|

|

272,825

|

|

90,737

|

|

Series 2005-68, Class DP, 1 Mo. LIBOR x -2.41 + 16.43% (a)

|

|

14.52%

|

|

06/17/35

|

|

119,331

|

|

328,418

|

|

Series 2005-68, Class KI, IO, 1 Mo. LIBOR x -1 + 6.30% (a)

|

|

5.58%

|

|

09/20/35

|

|

74,324

|

|

46,720

|

|

Series 2006-28, Class VS, 1 Mo. LIBOR x -13 + 87.10% (a)

|

|

77.76%

|

|

06/20/36

|

|

156,640

|

|

516,432

|

|

Series 2007-14, Class PB

|

|

5.40%

|

|

03/01/37

|

|

584,504

|

|

82,979

|

|

Series 2007-50, Class AI, IO, 1 Mo. LIBOR x -1 + 6.78% (a)

|

|

6.06%

|

|

08/20/37

|

|

14,351

|

|

275,959

|

|

Series 2007-68, Class PI, IO, 1 Mo. LIBOR x -1 + 6.65% (a)

|

|

5.93%

|

|

11/20/37

|

|

42,834

|

|

100,000

|

|

Series 2008-2, Class HB

|

|

5.50%

|

|

01/01/38

|

|

123,992

|

|

304,000

|

|

Series 2008-32, Class JD

|

|

5.50%

|

|

04/01/38

|

|

386,917

|

|

231,943

|

|

Series 2008-73, Class SK, IO, 1 Mo. LIBOR x -1 + 6.74% (a)

|

|

6.02%

|

|

08/20/38

|

|

43,975

|

|

499,103

|

|

Series 2009-100, Class SL, IO, 1 Mo. LIBOR x -1 + 6.50% (a)

|

|

5.71%

|

|

05/16/39

|

|

23,387

|

|

191,466

|

|

Series 2009-12, Class IE, IO

|

|

5.50%

|

|

03/01/39

|

|

32,526

|

|

22,495

|

|

Series 2009-65, Class NJ, IO

|

|

5.50%

|

|

07/01/39

|

|

528

|

|

133,577

|

|

Series 2009-79, Class PZ

|

|

6.00%

|

|

09/01/39

|

|

177,859

|

|

715,000

|

|

Series 2010-61, Class KE

|

|

5.00%

|

|

05/01/40

|

|

905,117

|

|

69,795

|

|

Series 2011-131, Class EI, IO

|

|

4.50%

|

|

08/01/39

|

|

547

|

|

420,738

|

|

Series 2013-104, Class YS, IO, 1 Mo. LIBOR x -1 + 6.15% (a)

|

|

5.36%

|

|

07/16/43

|

|

82,267

|

|

985,784

|

|

Series 2014-41, Class St, 1 Mo. LIBOR x -2.67 + 11.47% (a)

|

|

9.55%

|

|

11/20/42

|

|

1,056,964

|

|

7,394,760

|

|

Series 2015-158, Class KS, IO, 1 Mo. LIBOR x -1 + 6.25% (a)

|

|

5.53%

|

|

11/20/45

|

|

1,550,229

|

Page 6

See Notes to Financial Statements

First Trust Mortgage Income Fund (FMY)

Portfolio of Investments

(Continued)

April 30, 2020

(Unaudited)

Principal

Value

|

|

Description

|

|

Stated

Coupon

|

|

Stated

Maturity

|

|

Value

|

|

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES (Continued)

|

|

|

|

Collateralized Mortgage Obligations (Continued)

|

|

|

|

|

|

|

|

|

|

Government National Mortgage Association (Continued)

|

|

|

|

|

|

|

|

$72,385

|

|

Series 2016-139, Class MZ

|

|

1.50%

|

|

07/01/45

|

|

$72,264

|

|

145,501

|

|

Series 2017-4, Class CZ

|

|

3.00%

|

|

01/01/47

|

|

164,802

|

|

112,568

|

|

Series 2017-H18, Class DZ (d)

|

|

4.59%

|

|

09/01/67

|

|

152,370

|

|

|

|

|

|

23,453,818

|

|

|

|

Commercial Mortgage-Backed Securities – 7.2%

|

|

|

|

|

|

|

|

|

|

Federal Home Loan Mortgage Corp. Multifamily Structured

Pass-Through Certificates

|

|

|

|

|

|

|

|

19,950,731

|

|

Series K087, Class X1, IO (e)

|

|

0.51%

|

|

12/01/28

|

|

575,010

|

|

|

|

Government National Mortgage Association

|

|

|

|

|

|

|

|

218,000

|

|

Series 2013-57, Class D (d)

|

|

2.35%

|

|

06/01/46

|

|

225,298

|

|

4,461,322

|

|

Series 2016-11, Class IO (d)

|

|

0.89%

|

|

01/01/56

|

|

254,448

|

|

7,811,179

|

|

Series 2016-143, Class IO

|

|

0.96%

|

|

10/01/56

|

|

561,955

|

|

10,823,074

|

|

Series 2016-166, Class IO (d)

|

|

1.04%

|

|

04/01/58

|

|

775,540

|

|

16,867,315

|

|

Series 2017-126, Class IO (e)

|

|

0.79%

|

|

08/01/59

|

|

1,120,268

|

|

13,534,541

|

|

Series 2017-7, Class IO (d)

|

|

0.96%

|

|

12/01/58

|

|

898,056

|

|

|

|

|

|

4,410,575

|

|

|

|

Pass-through Security – 7.2%

|

|

|

|

|

|

|

|

|

|

Federal Home Loan Mortgage Corp.

|

|

|

|

|

|

|

|

172,329

|

|

Pool A94738

|

|

4.50%

|

|

11/01/40

|

|

186,003

|

|

526,177

|

|

Pool K36017

|

|

5.00%

|

|

09/01/47

|

|

564,304

|

|

893,482

|

|

Pool U99176

|

|

4.00%

|

|

12/01/47

|

|

980,589

|

|

|

|

Federal National Mortgage Association

|

|

|

|

|

|

|

|

3,241

|

|

Pool 535919

|

|

6.50%

|

|

05/01/21

|

|

3,611

|

|

699,740

|

|

Pool 831145

|

|

6.00%

|

|

12/01/35

|

|

807,803

|

|

598,121

|

|

Pool 843971

|

|

6.00%

|

|

11/01/35

|

|

678,515

|

|

1,099,689

|

|

Pool AB5688

|

|

3.50%

|

|

07/01/37

|

|

1,176,096

|

|

|

|

|

|

4,396,921

|

|

|

|

Total U.S. Government Agency Mortgage-Backed Securities

|

|

32,261,314

|

|

|

|

(Cost $31,579,699)

|

|

|

|

|

|

|

|

MORTGAGE-BACKED SECURITIES – 39.5%

|

|

|

|

Collateralized Mortgage Obligations – 36.0%

|

|

|

|

|

|

|

|

|

|

Accredited Mortgage Loan Trust

|

|

|

|

|

|

|

|

260,061

|

|

Series 2003-2, Class A1

|

|

4.98%

|

|

10/01/33

|

|

261,409

|

|

|

|

ACE Securities Corp. Home Equity Loan Trust

|

|

|

|

|

|

|

|

803,704

|

|

Series 2006-ASAP6, Class A2D, 1 Mo. LIBOR + 0.22% (c)

|

|

0.71%

|

|

12/25/36

|

|

379,829

|

|

|

|

Asset Backed Securities Corp Home Equity Loan Trust

|

|

|

|

|

|

|

|

122,399

|

|

Series 2005-HE4, Class M4, 1 Mo. LIBOR + 0.95% (c)

|

|

1.43%

|

|

05/25/35

|

|

122,315

|

|

|

|

Banc of America Funding Corp.

|

|

|

|

|

|

|

|

23,721

|

|

Series 2008-R2, Class 1A4 (f)

|

|

6.00%

|

|

09/01/37

|

|

23,785

|

|

|

|

Banc of America Mortgage Trust

|

|

|

|

|

|

|

|

48,897

|

|

Series 2002-L, Class 1A1 (e)

|

|

3.25%

|

|

12/01/32

|

|

36,780

|

|

133,419

|

|

Series 2005-A, Class 2A1 (e)

|

|

3.68%

|

|

02/01/35

|

|

124,677

|

|

|

|

Chase Mortgage Finance Trust

|

|

|

|

|

|

|

|

102,788

|

|

Series 2007-A1, Class 1A3 (e)

|

|

4.22%

|

|

02/01/37

|

|

97,631

|

|

|

|

Citigroup Mortgage Loan Trust

|

|

|

|

|

|

|

|

172,890

|

|

Series 2005-6, Class A1, US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 2.10% (c)

|

|

3.84%

|

|

09/01/35

|

|

168,987

|

|

40,509

|

|

Series 2009-10, Class 1A1 (e) (f)

|

|

4.31%

|

|

09/01/33

|

|

38,655

|

|

458,422

|

|

Series 2012-7, Class 10A2 (e) (f)

|

|

4.70%

|

|

09/01/36

|

|

417,114

|

|

|

|

Countrywide Home Loan Mortgage Pass-Through Trust

|

|

|

|

|

|

|

|

236,217

|

|

Series 2003-46, Class 2A1 (e)

|

|

3.87%

|

|

01/01/34

|

|

213,137

|

See Notes to Financial Statements

Page 7

First Trust Mortgage Income Fund (FMY)

Portfolio of Investments

(Continued)

April 30, 2020

(Unaudited)

Principal

Value

|

|

Description

|

|

Stated

Coupon

|

|

Stated

Maturity

|

|

Value

|

|

MORTGAGE-BACKED SECURITIES (Continued)

|

|

|

|

Collateralized Mortgage Obligations (Continued)

|

|

|

|

|

|

|

|

|

|

Countrywide Home Loan Mortgage Pass-Through Trust (Continued)

|

|

|

|

|

|

|

|

$80,409

|

|

Series 2005-HYB3, Class 2A6B (e)

|

|

4.00%

|

|

06/01/35

|

|

$77,658

|

|

226,520

|

|

Series 2006-21, Class A8

|

|

5.75%

|

|

02/01/37

|

|

172,689

|

|

405,653

|

|

Series 2006-HYB5, Class 3A1A (e)

|

|

4.01%

|

|

09/01/36

|

|

345,200

|

|

|

|

Credit Suisse First Boston Mortgage Securities Corp.

|

|

|

|

|

|

|

|

336,947

|

|

Series 2004-AR2, Class 1A1 (e)

|

|

3.75%

|

|

03/01/34

|

|

308,686

|

|

113,061

|

|

Series 2004-AR8, Class 6A1 (e)

|

|

4.01%

|

|

09/01/34

|

|

113,334

|

|

95,072

|

|

Series 2005-5, Class 3A2, 1 Mo. LIBOR + 0.30% (c)

|

|

0.79%

|

|

07/25/35

|

|

89,416

|

|

|

|

Credit Suisse Mortgage Trust

|

|

|

|

|

|

|

|

10,842

|

|

Series 2011-12R, Class 3A1 (e) (f)

|

|

3.65%

|

|

07/27/36

|

|

10,741

|

|

10,402

|

|

Series 2014-11R, Class 9A1, 1 Mo. LIBOR + 0.14% (c) (f)

|

|

1.09%

|

|

10/27/36

|

|

10,413

|

|

370,331

|

|

Series 2017-FHA1, Class A1 (f)

|

|

3.25%

|

|

04/01/47

|

|

368,821

|

|

|

|

Deutsche ALT-A Securities, Inc., Mortgage Loan Trust

|

|

|

|

|

|

|

|

2,734

|

|

Series 2003-3, Class 3A1

|

|

5.00%

|

|

10/25/33

|

|

2,738

|

|

|

|

DSLA Mortgage Loan Trust

|

|

|

|

|

|

|

|

479,882

|

|

Series 2004-AR3, Class 2A2A, 1 Mo. LIBOR + 0.74% (c)

|

|

1.46%

|

|

07/19/44

|

|

418,303

|

|

577,874

|

|

Series 2007-AR1, Class 2A1A, 1 Mo. LIBOR + 0.14% (c)

|

|

0.86%

|

|

04/19/47

|

|

490,049

|

|

|

|

Galton Funding Mortgage Trust

|

|

|

|

|

|

|

|

226,471

|

|

Series 2018-2, Class A41 (f)

|

|

4.50%

|

|

10/01/58

|

|

231,372

|

|

|

|

GSR Mortgage Loan Trust

|

|

|

|

|

|

|

|

6,599

|

|

Series 2003-10, Class 1A12 (e)

|

|

4.62%

|

|

10/01/33

|

|

6,078

|

|

174,408

|

|

Series 2005-AR1, Class 4A1 (e)

|

|

3.38%

|

|

01/01/35

|

|

151,109

|

|

|

|

Harborview Mortgage Loan Trust

|

|

|

|

|

|

|

|

295,995

|

|

Series 2004-6, Class 3A1 (e)

|

|

4.33%

|

|

08/01/34

|

|

267,828

|

|

|

|

Home Equity Asset Trust

|

|

|

|

|

|

|

|

31,111

|

|

Series 2005-3, Class M4, 1 Mo. LIBOR + 0.64% (c)

|

|

1.13%

|

|

08/25/35

|

|

30,933

|

|

451,714

|

|

Series 2005-9, Class M1, 1 Mo. LIBOR + 0.41% (c)

|

|

0.90%

|

|

04/25/36

|

|

440,152

|

|

|

|

Impac CMB Trust

|

|

|

|

|

|

|

|

151,477

|

|

Series 2004-6, Class 1A2, 1 Mo. LIBOR + 0.78% (c)

|

|

1.27%

|

|

10/25/34

|

|

144,331

|

|

|

|

IXIS Real Estate Capital Trust

|

|

|

|

|

|

|

|

1,071,572

|

|

Series 2007-HE1, Class A3, 1 Mo. LIBOR + 0.16% (c)

|

|

0.65%

|

|

05/25/37

|

|

326,264

|

|

|

|

JP Morgan Mortgage Trust

|

|

|

|

|

|

|

|

727,187

|

|

Series 2005-ALT1, Class 4A1 (e)

|

|

4.28%

|

|

10/01/35

|

|

617,889

|

|

461,699

|

|

Series 2006-A2, Class 4A1 (e)

|

|

4.67%

|

|

08/01/34

|

|

453,787

|

|

117,685

|

|

Series 2006-A2, Class 5A3 (e)

|

|

4.11%

|

|

11/01/33

|

|

113,102

|

|

82,000

|

|

Series 2014-2, Class 1A1 (f)

|

|

3.00%

|

|

06/01/29

|

|

83,457

|

|

|

|

MASTR Adjustable Rate Mortgages Trust

|

|

|

|

|

|

|

|

30,702

|

|

Series 2004-13, Class 3A7B, US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 2.00% (c)

|

|

2.14%

|

|

11/01/34

|

|

29,809

|

|

|

|

MASTR Alternative Loan Trust

|

|

|

|

|

|

|

|

3,579,993

|

|

Series 2006-2, Class 2A3, 1 Mo. LIBOR + 0.35% (c)

|

|

0.84%

|

|

03/25/36

|

|

266,452

|

|

|

|

MASTR Asset Backed Securities Trust

|

|

|

|

|

|

|

|

755,862

|

|

Series 2006-HE5, Class A3, 1 Mo. LIBOR + 0.16% (c)

|

|

0.65%

|

|

11/25/36

|

|

518,114

|

|

1,220,593

|

|

Series 2006-NC2, Class A3, 1 Mo. LIBOR + 0.11% (c)

|

|

0.60%

|

|

08/25/36

|

|

594,954

|

|

557,142

|

|

Series 2006-NC2, Class A5, 1 Mo. LIBOR + 0.24% (c)

|

|

0.73%

|

|

08/25/36

|

|

282,125

|

|

|

|

MASTR Asset Securitization Trust

|

|

|

|

|

|

|

|

12,740

|

|

Series 2003-11, Class 5A2

|

|

5.25%

|

|

12/01/23

|

|

12,336

|

|

50,893

|

|

Series 2003-11, Class 6A16

|

|

5.25%

|

|

12/01/33

|

|

52,937

|

|

|

|

Mellon Residential Funding Corp. Mortgage Pass-Through Trust

|

|

|

|

|

|

|

|

227,749

|

|

Series 2001-TBC1, Class A1, 1 Mo. LIBOR + 0.70% (c)

|

|

1.51%

|

|

11/15/31

|

|

217,094

|

|

214,726

|

|

Series 2002-TBC2, Class A, 1 Mo. LIBOR + 0.86% (c)

|

|

1.67%

|

|

08/15/32

|

|

192,769

|

|

|

|

Meritage Mortgage Loan Trust

|

|

|

|

|

|

|

|

2,469

|

|

Series 2004-2, Class M3, 1 Mo. LIBOR + 0.98% (c)

|

|

1.46%

|

|

01/25/35

|

|

2,165

|

|

|

|

Morgan Stanley Mortgage Loan Trust

|

|

|

|

|

|

|

|

357,256

|

|

Series 2004-7AR, Class 2A6 (e)

|

|

3.94%

|

|

09/01/34

|

|

332,538

|

Page 8

See Notes to Financial Statements

First Trust Mortgage Income Fund (FMY)

Portfolio of Investments

(Continued)

April 30, 2020

(Unaudited)

Principal

Value

|

|

Description

|

|

Stated

Coupon

|

|

Stated

Maturity

|

|

Value

|

|

MORTGAGE-BACKED SECURITIES (Continued)

|

|

|

|

Collateralized Mortgage Obligations (Continued)

|

|

|

|

|

|

|

|

|

|

MortgageIT Trust

|

|

|

|

|

|

|

|

$209,779

|

|

Series 2005-2, Class 2A, 1 Mo. LIBOR + 1.65% (c)

|

|

2.63%

|

|

05/01/35

|

|

$201,883

|

|

|

|

New Residential Mortgage Loan Trust

|

|

|

|

|

|

|

|

438,804

|

|

Series 2014-2A, Class A2 (f)

|

|

3.75%

|

|

05/01/54

|

|

450,703

|

|

532,617

|

|

Series 2016-1A, Class A1 (f)

|

|

3.75%

|

|

03/01/56

|

|

545,942

|

|

410,227

|

|

Series 2016-3A, Class A1 (f)

|

|

3.75%

|

|

09/01/56

|

|

420,353

|

|

|

|

Nomura Asset Acceptance Corporation

|

|

|

|

|

|

|

|

789,843

|

|

Series 2004-AR4, Class M1, 1 Mo. LIBOR + 1.10% (c)

|

|

1.59%

|

|

12/25/34

|

|

765,493

|

|

|

|

Nomura Resecuritization Trust

|

|

|

|

|

|

|

|

1,196,171

|

|

Series 2015-6R, Class 2A4 (e) (f)

|

|

6.01%

|

|

01/02/37

|

|

971,829

|

|

|

|

Oakwood Mortgage Investors, Inc.

|

|

|

|

|

|

|

|

109,270

|

|

Series 2001-B, Class A2, 1 Mo. LIBOR + 0.38% (c) (f)

|

|

1.17%

|

|

08/15/30

|

|

108,415

|

|

|

|

Provident Funding Mortgage Loan Trust

|

|

|

|

|

|

|

|

49,874

|

|

Series 2004-1, Class 1A1 (e)

|

|

3.92%

|

|

04/01/34

|

|

46,455

|

|

83,663

|

|

Series 2005-1, Class 1A1 (e)

|

|

3.64%

|

|

05/01/35

|

|

84,183

|

|

|

|

Residential Accredit Loans, Inc.

|

|

|

|

|

|

|

|

120,262

|

|

Series 2006-QO1, Class 2A1, 1 Mo. LIBOR + 0.27% (c)

|

|

0.76%

|

|

02/25/46

|

|

78,049

|

|

1,275,563

|

|

Series 2006-QS6, Class 1AV, IO (e)

|

|

0.76%

|

|

06/01/36

|

|

29,544

|

|

|

|

Residential Asset Securitization Trust

|

|

|

|

|

|

|

|

27,453

|

|

Series 2004-A3, Class A7

|

|

5.25%

|

|

06/01/34

|

|

28,865

|

|

|

|

Saxon Asset Securities Trust

|

|

|

|

|

|

|

|

807,109

|

|

Series 2007-2, Class A2D, 1 Mo. LIBOR + 0.30% (c)

|

|

0.79%

|

|

05/25/47

|

|

657,816

|

|

|

|

Sequoia Mortgage Trust

|

|

|

|

|

|

|

|

551,001

|

|

Series 2017-CH2, Class A10 (f)

|

|

4.00%

|

|

12/01/47

|

|

559,268

|

|

145,462

|

|

Series 2018-CH2, Class A12 (f)

|

|

4.00%

|

|

06/01/48

|

|

148,189

|

|

|

|

Structured Adjustable Rate Mortgage Loan Trust

|

|

|

|

|

|

|

|

226,570

|

|

Series 2004-2, Class 4A2 (e)

|

|

3.65%

|

|

03/01/34

|

|

206,579

|

|

|

|

Structured Asset Securities Corp. Mortgage Pass-Through

Certificates

|

|

|

|

|

|

|

|

37,682

|

|

Series 2001-SB1, Class A2

|

|

3.38%

|

|

08/01/31

|

|

35,646

|

|

|

|

Thornburg Mortgage Securities Trust

|

|

|

|

|

|

|

|

192,946

|

|

Series 2003-4, Class A1, 1 Mo. LIBOR + 0.64% (c)

|

|

1.13%

|

|

09/25/43

|

|

181,590

|

|

|

|

Towd Point Mortgage Trust

|

|

|

|

|

|

|

|

464,528

|

|

Series 2015-1, Class AES (f)

|

|

3.00%

|

|

10/01/53

|

|

466,637

|

|

759,663

|

|

Series 2015-2, Class 2A1 (f)

|

|

3.75%

|

|

11/01/57

|

|

766,634

|

|

731,331

|

|

Series 2016-1, Class A3B (f)

|

|

3.00%

|

|

02/01/55

|

|

737,543

|

|

1,045,000

|

|

Series 2016-2, Class M2 (f)

|

|

3.00%

|

|

08/01/55

|

|

1,014,555

|

|

|

|

Wachovia Mortgage Loan Trust, LLC

|

|

|

|

|

|

|

|

148,049

|

|

Series 2006-A, Class 3A1 (e)

|

|

4.33%

|

|

05/01/36

|

|

132,119

|

|

|

|

WaMu Mortgage Pass-Through Certificates

|

|

|

|

|

|

|

|

164,242

|

|

Series 2003-AR5, Class A7 (e)

|

|

4.52%

|

|

06/01/33

|

|

154,277

|

|

261,707

|

|

Series 2004-AR1, Class A (e)

|

|

3.84%

|

|

03/01/34

|

|

246,023

|

|

311,132

|

|

Series 2004-AR10, Class A1B, 1 Mo. LIBOR + 0.42% (c)

|

|

0.91%

|

|

07/25/44

|

|

288,827

|

|

263,433

|

|

Series 2004-AR13, Class A1A, 1 Mo. LIBOR + 0.72% (c)

|

|

1.21%

|

|

11/25/34

|

|

243,746

|

|

44,448

|

|

Series 2004-AR3, Class A2 (e)

|

|

4.07%

|

|

06/01/34

|

|

41,514

|

|

369,741

|

|

Series 2005-AR1, Class A1A, 1 Mo. LIBOR + 0.64% (c)

|

|

1.13%

|

|

01/25/45

|

|

349,960

|

|

486,595

|

|

Series 2005-AR11, Class A1A, 1 Mo. LIBOR + 0.32% (c)

|

|

0.81%

|

|

08/25/45

|

|

468,168

|

|

543,043

|

|

Series 2005-AR6, Class 2A1A, 1 Mo. LIBOR + 0.46% (c)

|

|

0.95%

|

|

04/25/45

|

|

510,485

|

|

193,497

|

|

Series 2005-AR9, Class A1A, 1 Mo. LIBOR + 0.64% (c)

|

|

1.13%

|

|

07/25/45

|

|

175,521

|

|

320,470

|

|

Series 2006-AR2, Class 1A1 (e)

|

|

3.71%

|

|

03/01/36

|

|

282,786

|

|

|

|

Washington Mutual Alternative Mortgage Pass-Through Certificates

|

|

|

|

|

|

|

|

18,966

|

|

Series 2007-5, Class A11, 1 Mo. LIBOR x -6 + 39.48% (a)

|

|

36.56%

|

|

06/25/37

|

|

42,434

|

|

|

|

Washington Mutual MSC Mortgage Pass-Through Certificates

|

|

|

|

|

|

|

|

234,474

|

|

Series 2004-RA1, Class 2A

|

|

7.00%

|

|

03/01/34

|

|

243,731

|

See Notes to Financial Statements

Page 9

First Trust Mortgage Income Fund (FMY)

Portfolio of Investments

(Continued)

April 30, 2020

(Unaudited)

Principal

Value

|

|

Description

|

|

Stated

Coupon

|

|

Stated

Maturity

|

|

Value

|

|

MORTGAGE-BACKED SECURITIES (Continued)

|

|

|

|

Collateralized Mortgage Obligations (Continued)

|

|

|

|

|

|

|

|

|

|

WinWater Mortgage Loan Trust

|

|

|

|

|

|

|

|

$430,514

|

|

Series 2015-3, Class B1 (e) (f)

|

|

3.90%

|

|

03/01/45

|

|

$431,757

|

|

228,825

|

|

Series 2015-5, Class A5 (f)

|

|

3.50%

|

|

08/01/45

|

|

230,540

|

|

|

|

|

|

22,008,021

|

|

|

|

Commercial Mortgage-Backed Securities – 3.5%

|

|

|

|

|

|

|

|

|

|

Hudsons Bay Simon JV Trust

|

|

|

|

|

|

|

|

510,000

|

|

Series 2015-HBFL, Class DFL, 1 Mo. LIBOR + 3.90% (c) (f)

|

|

5.28%

|

|

08/05/34

|

|

457,297

|

|

|

|

Morgan Stanley Capital I Trust

|

|

|

|

|

|

|

|

1,787,000

|

|

Series 2017-CLS, Class D, 1 Mo. LIBOR + 1.40% (c) (f)

|

|

2.21%

|

|

11/15/34

|

|

1,715,171

|

|

|

|

|

|

2,172,468

|

|

|

|

Total Mortgage-Backed Securities

|

|

24,180,489

|

|

|

|

(Cost $26,196,345)

|

|

|

|

|

|

|

|

ASSET-BACKED SECURITIES – 1.1%

|

|

|

|

Green Tree Financial Corp.

|

|

|

|

|

|

|

|

38,442

|

|

Series 1998-4, Class A7

|

|

6.87%

|

|

04/01/30

|

|

39,314

|

|

|

|

Mid-State Capital Corp. Trust

|

|

|

|

|

|

|

|

273,392

|

|

Series 2004-1, Class M1

|

|

6.50%

|

|

08/01/37

|

|

289,363

|

|

309,859

|

|

Series 2005-1, Class A

|

|

5.75%

|

|

01/01/40

|

|

325,316

|

|

|

|

Total Asset-Backed Securities

|

|

653,993

|

|

|

|

(Cost $624,570)

|

|

|

|

|

|

|

|

|

Total Investments – 93.3%

|

|

57,095,796

|

|

|

(Cost $58,400,614) (g)

|

|

|

|

|

Net Other Assets and Liabilities – 6.7%

|

|

4,072,763

|

|

|

Net Assets – 100.0%

|

|

$61,168,559

|

Futures Contracts (See Note 2D - Futures Contracts in the Notes to Financial Statements):

|

Futures Contracts

|

|

Position

|

|

Number of

Contracts

|

|

Expiration

Date

|

|

Notional

Value

|

|

Unrealized

Appreciation

(Depreciation)/

Value

|

|

U.S. Treasury CBT Ultra Bond Futures

|

|

Short

|

|

7

|

|

Jun 2020

|

|

$ (1,573,469)

|

|

$(110,703)

|

|

|

(a)

|

Inverse floating rate security.

|

|

(b)

|

Zero coupon security.

|

|

(c)

|

Floating or variable rate security.

|

|

(d)

|

Weighted Average Coupon security. Coupon is based on the blended interest rate of the underlying holdings, which may have different coupons. The coupon may change in any period.

|

|

(e)

|

Collateral Strip Rate security. Coupon is based on the weighted net interest rate of the investment’s underlying collateral. The interest rate resets periodically.

|

|

(f)

|

This security, sold within the terms of a private placement memorandum, is exempt from registration upon resale under Rule 144A under the Securities Act of 1933, as amended (the

“1933 Act”), and may be resold in transactions exempt from registration, normally to qualified institutional buyers. Pursuant to procedures adopted by the Fund’s Board of Trustees, this security has

been determined to be liquid by First Trust Advisors L.P. (the “Advisor”). Although market instability can result in periods of increased overall market illiquidity, liquidity for each security is

determined based on security specific factors and assumptions, which require subjective judgment. At April 30, 2020, securities noted as such amounted to $10,209,191 or 16.7% of net assets.

|

|

(g)

|

Aggregate cost for financial reporting purposes approximates the aggregate cost for federal income tax purposes. As of April 30, 2020, the aggregate gross

unrealized appreciation for all investments in which there was an excess of value over tax cost was $3,374,663 and the aggregate gross unrealized depreciation for all investments in which there was an excess of tax

cost over value was $4,790,184. The net unrealized depreciation was $1,415,521. The amounts presented are inclusive of derivative contracts.

|

Page 10

See Notes to Financial Statements

First Trust Mortgage Income Fund (FMY)

Portfolio of Investments

(Continued)

April 30, 2020

(Unaudited)

|

IO

|