Fidelity Information Services Tops 250 Client Conversions to Mercury(TM) Core Processing Solution

January 12 2005 - 7:30AM

PR Newswire (US)

Fidelity Information Services Tops 250 Client Conversions to

Mercury(TM) Core Processing Solution At a Rate of More Than 20 per

Month, Mid-size Credit Unions Respond to Mercury's Ease of

Migration, Integration Capabilities and Extensive Service Options

JACKSONVILLE, Fla., Jan. 12 /PRNewswire-FirstCall/ -- Fidelity

National Financial, Inc. (NYSE:FNF), a Fortune 500 provider of

products and outsourced services and solutions to financial

institutions and the real estate industry, and its Fidelity

Information Services ("Fidelity") division announce the 250th

client conversion to the company's Microsoft(R) Windows(R)-complete

Mercury core processing platform, designed specifically to meet the

needs of mid-tier credit unions. With its conversion in October,

Utah-based Dugway Federal Credit Union became Fidelity's 250th

Mercury client. Momentum in the mid-size credit union market has

been fueled by numerous system enhancements and value- added

capabilities ranging from ATM and debit card services to electronic

statements to collection management. Fidelity is currently

scheduled to convert an additional 20 legacy-based clients per

month through the end of the first quarter 2005. "Our conversion to

Mercury went like clockwork," said Lisa Stewart, chief executive

officer of Dugway Federal Credit Union of Dugway, Utah. "We found

the system to be flexible and highly intuitive which enabled our

staff to adapt to it quickly. Looking forward, we believe Mercury's

complete and integrated capabilities will deliver the true

advantage we need to improve member service and grow our credit

union," Stewart added. As the 250th client to implement Mercury,

Dugway Federal Credit Union now uses the system to serve the needs

of its more than 1,000 members. And Dugway's staff will leverage

the solution's open and integrated design -- which is optimized for

Microsoft Windows 2000 professional architecture -- to streamline

operations and generate additional income opportunities. Mercury

users represent a diverse cross-section of the mid-size credit

union market including select employee group (SEG), professional or

religious-affiliated and community-based institutions. Today,

Mercury meets the core processing needs of credit unions throughout

North America -- from high-service institutions like Dugway Federal

Credit Union to high-volume credit unions like Pennsylvania-based

Mennonite Financial Federal Credit Union, a $55 million faith-based

institution that serves the full range of financial services needs

of nearly 8,000 members. Since its upgrade to Mercury in February

2004, Mennonite has sharply expanded its service offerings,

particularly in the lending area. "With Mercury, our marketing

choices became unlimited," stated Larry Miller, chief executive

officer of Mennonite Financial Federal Credit Union. "We quickly

took advantage of Mercury's user-definable loan types, offering our

members many more ways to do business with us. We are effectively

loaned out consistently in part thanks to the adaptability of our

core system. Mercury provides the backbone we need to deliver the

innovative solutions and efficiency opportunities that clearly set

us apart from other institutions." In order to help its credit

union clients continue to expand their service portfolios through

the use of third-party solutions, Mercury has adopted qbt Systems'

MultiPoint(TM) Integrator, a real-time transaction processing

engine that provides seamless connectivity across a wide variety of

best-of-breed financial services systems -- giving Mercury clients

absolute control over their choice of third-party solutions

providers. In addition, Fidelity has integrated multiple

capabilities from its expansive portfolio of existing solutions

with the Mercury platform, ranging from home banking to real-time

ATM and debit card services to electronic statements to advanced

collection management to shared branching. A representative

sampling of additional clients among the company's latest

conversions include Artesian City Federal Credit Union of Albany,

Georgia; German Coast Credit Union of Luling, Louisiana; Delmarva

Power Credit Union of Salisbury, Maryland; Fairview Employees

Credit Union of Costa Mesa, California; Kingsville Community Credit

Union of Kingsville, Texas; Nashville Credit Union of Nashville,

Georgia; and FCI Credit Union of Texarkana, Texas. "Mercury

represents the best the industry has to offer for credit unions

under $150 million in assets," said Santo Cannone, senior vice

president of Fidelity's Integrated Financial Solutions division and

executive in charge of the company's credit union business. "And

because Mercury is built with the most advanced technology and

capabilities available, it not only has the power to meet our

clients' needs today, but can scale according to their growth and

member demands well into the future." About Fidelity National

Financial Fidelity National Financial, Inc., number 262 on the

Fortune 500, is a provider of products and outsourced services and

solutions to financial institutions and the real estate industry.

FNF had total revenue of more than $6.2 billion and earned more

than $560 million for the first nine months of 2004, with cash flow

from operations of more than $925 million for that same period. FNF

is the nation's largest title insurance company, with more than 30

percent national market share, and is also a provider of other

specialty insurance products, including flood insurance, homeowners

insurance and home warranty insurance. Through its subsidiary

Fidelity National Information Services, Inc. ("FIS"), the Company

is a leading provider of technology solutions, processing services

and information services to the financial services and real estate

industries. FIS' software processes nearly 50 percent of all U.S.

residential mortgages, it has processing and technology

relationships with 45 of the top 50 U.S. banks and more than 3,600

small and mid-sized U.S. financial institutions and it has clients

in more than 50 countries who rely on its processing and

outsourcing products and services. FIS also provides customized

business process outsourcing related to aspects of the origination

and management of mortgage loans to national lenders and servicers.

FIS offers information services, including property data and real

estate-related services that are used by lenders, mortgage

investors and real estate professionals to complete residential

real estate transactions throughout the U.S. More information about

the FNF family of companies can be found at http://www.fnf.com/ and

http://www.fidelityinfoservices.com/ . This press release contains

statements related to future events and expectations and, as such,

constitutes forward-looking statements. These forward-looking

statements are subject to known and unknown risks, uncertainties

and other factors that may cause actual results, performance or

achievements of the Company to be different from those expressed or

implied above. The Company expressly disclaims any duty to update

or revise forward- looking statements. The risks and uncertainties

which forward-looking statements are subject to include, but are

not limited to, the effect of governmental regulations, the

economy, competition and other risks detailed from time to time in

the "Management's Discussion and Analysis" section of the Company's

Form 10-K and other reports and filings with the Securities and

Exchange Commission. DATASOURCE: Fidelity National Financial, Inc.

CONTACT: Daniel Kennedy Murphy, Senior Vice President, Finance and

Investor Relations, Fidelity National Financial, Inc.,

+1-904-854-8120, or Web site: http://www.fnf.com/

http://www.fidelityinfoservices.com/

Copyright

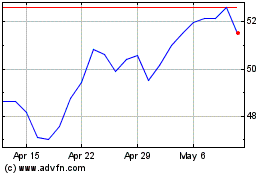

Fidelity National Financ... (NYSE:FNF)

Historical Stock Chart

From Jun 2024 to Jul 2024

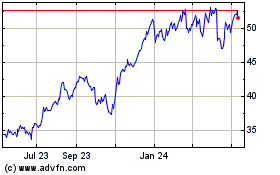

Fidelity National Financ... (NYSE:FNF)

Historical Stock Chart

From Jul 2023 to Jul 2024