Fidelity National Financial Announces a 39 Percent Increase in its Quarterly Dividend to $0.25

September 07 2004 - 2:41PM

PR Newswire (US)

Fidelity National Financial Announces a 39 Percent Increase in its

Quarterly Dividend to $0.25 JACKSONVILLE, Fla., Sept. 7

/PRNewswire-FirstCall/ -- Fidelity National Financial, Inc.

(NYSE:FNF), a Fortune 500 provider of products and outsourced

services to financial institutions and the real estate industry,

announced today that its Board of Directors has declared an

increase in the quarterly cash dividend to $0.25 per share. The

dividend will be payable on December 1, 2004 to stockholders of

record as of November 17, 2004. The $0.25 dividend represents a 39

percent increase over the most recent quarterly cash dividend of

$0.18. "We are very confident in the future prospects of FNF and we

hope that this significant increase in the dividend conveys that

confidence to our shareholders," said FNF Chairman William P.

Foley, II. "FNF shareholders now enjoy an annualized dividend yield

of more than 2.5 percent." Fidelity National Financial, Inc.,

number 262 on the Fortune 500, is a provider of products and

outsourced services and solutions to financial institutions and the

real estate industry. The Company had total revenue of more than

$7.7 billion and earned more than $860 million in 2003, with cash

flow from operations of nearly $1.3 billion for that same period.

FNF is a leading provider of information-based technology solutions

and processing services to financial institutions and the mortgage

and financial services industries through its subsidiary Fidelity

Information Services, Inc. Fidelity Information Services' software

processes nearly 50 percent of all U.S. residential mortgages, it

has processing and technology relationships with 45 of the top 50

U.S. banks and has clients in more than 50 countries who rely on

its processing and outsourcing products and services. Additionally,

FNF is the nation's largest title insurance company and also

provides other real estate-related services such as escrow, flood

and tax certifications with life of loan monitoring, merged credit

reporting, property valuations and appraisals, default management,

relocation services, flood, homeowners and home warranty insurance,

exchange intermediary services, mortgage loan aggregation and

fulfillment, multiple listing services software, mortgage loan

origination software, collateral scoring analytics and real

property data. More information about the FNF family of companies

can be found at http://www.fnf.com/ and

http://www.fidelityinfoservices.com/ . This press release contains

statements related to future events and expectations and, as such,

constitutes forward-looking statements. These forward-looking

statements are subject to known and unknown risks, uncertainties

and other factors that may cause actual results, performance or

achievements of the Company to be different from those expressed or

implied above. The Company expressly disclaims any duty to update

or revise forward- looking statements. The risks and uncertainties

which forward-looking statements are subject to include, but are

not limited to, the effect of governmental regulations, the

economy, competition and other risks detailed from time to time in

the "Management's Discussion and Analysis" section of the Company's

Form 10-K and other reports and filings with the Securities and

Exchange Commission. DATASOURCE: Fidelity National Financial, Inc.

CONTACT: Daniel Kennedy Murphy, Senior Vice President, Finance and

Investor Relations, Fidelity National Financial, Inc.,

+1-904-854-8120, or Web site: http://www.fnf.com/

http://www.fidelityinfoservices.com/

Copyright

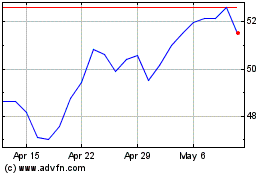

Fidelity National Financ... (NYSE:FNF)

Historical Stock Chart

From Jun 2024 to Jul 2024

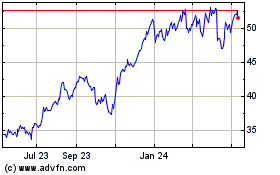

Fidelity National Financ... (NYSE:FNF)

Historical Stock Chart

From Jul 2023 to Jul 2024