Form 425 - Prospectuses and communications, business combinations

June 29 2023 - 1:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

June 25, 2023

FAST Acquisition Corp. II

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40214 |

|

86-1258014 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

109 Old Branchville Road

Ridgefield, CT 06877

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (201) 956-1969

Not Applicable

(Former name or former address, if changed since

last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one share of Class A common stock and one-quarter of one redeemable warrant |

|

FZT.U |

|

The New York Stock Exchange |

| Class A common stock, par value $0.0001 per share |

|

FZT |

|

The New York Stock Exchange |

| Redeemable warrants, each warrant exercisable for one share of Class A common stock, each at an exercise price of $11.50 per share |

|

FZT WS |

|

The New York Stock Exchange |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive

Agreement.

On June 25, 2023, Falcon’s Beyond Global, LLC,

a Florida limited liability company (the “Company”), Falcon’s Beyond Global, Inc., a Delaware corporation and

a wholly owned subsidiary of the Company (“Pubco”), Palm Merger Sub LLC, a Delaware limited liability company and a

wholly owned subsidiary of Pubco (“Merger Sub”), and FAST Acquisition Corp. II, a Delaware corporation (“SPAC”),

executed the first amendment to that certain Amended and Restated Agreement and Plan of Merger, dated as of January 31, 2023, among SPAC,

the Company, Pubco and Merger Sub (the “Merger Agreement”), which (i) gave the Company the right to, at least three

(3) business days prior to the merger of the Company and Merger Sub (the “Acquisition Merger”), elect to reclassify

a number of the limited liability company units of the Company (“Company Units”) issued and outstanding immediately

prior to the effective time of the Acquisition Merger that is necessary to meet initial listing requirements into the right to receive

the consideration for each such Company Unit in one share of Pubco’s Class A common stock, par value $0.0001 per share, in lieu

of and not in addition to the same number of shares of Pubco’s non-economic Class B common stock, par value $0.0001 per share and

limited liability company interests of the Company, (ii) amended the Pubco EBITDA (as defined in the Merger Agreement) earnout milestone

for the fourth quarter of 2024 from $28,030,530 to an amount equal to $44,848,848 (which is the Company’s projected annual Pubco

EBITDA for 2024) minus the sum of the actual Pubco EBITDA generated in the first, second and third quarters of 2024, (iii) amended the

Pubco Revenue (as defined in the Merger Agreement) milestone for the fourth quarter of 2024 from $87,577,270 to an amount equal to $140,123,632

(which is the Company’s projected annual Pubco Revenue for 2024) minus the sum of the actual Pubco Revenue generated in the first,

second and third quarters of 2024, (iv) reduced the amount of Earnout Shares (as defined in the Merger Agreement) corresponding to each

of the Pubco Revenue for the fourth quarter of 2024 and Pubco EBITDA for the fourth quarter of 2024 earnouts from 2,500,000 to 1,250,000

and (v) revised the allocation of the Seller Earnout Shares (as defined in the Merger Agreement) and Earnout Units (as defined in the

Merger Agreement) among the holders of the Company Units.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

Number |

|

Description |

| 2.1 |

|

Amendment No 1, dated June 25, 2023 to Amended and Restated Agreement and Plan of Merger, dated January 31, 2023, by and among FAST Acquisition Corp. II, Falcon’s Beyond Global, LLC, Falcon’s Beyond Global, Inc. and Palm Merger Sub, LLC (incorporated herein by reference to Exhibit 2.2 to Falcon’s Beyond Global, Inc.’s registration statement on Form S-4/A filed by Falcon’s Beyond Global, Inc. on June 29, 2023). |

| 104 |

|

Cover Page Interactive Data File (embedded with the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| FAST ACQUISITION CORP. II |

|

| |

|

| By: |

/s/ Garrett Schreiber |

|

| |

Name: |

Garrett Schreiber |

|

| |

Title: |

Chief Financial Officer |

|

Dated: June 29, 2023

2

FAST Acquisition Corp II (NYSE:FZT)

Historical Stock Chart

From Apr 2024 to May 2024

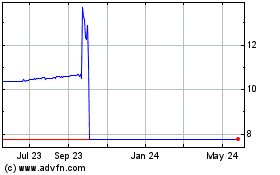

FAST Acquisition Corp II (NYSE:FZT)

Historical Stock Chart

From May 2023 to May 2024