UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

Euronav NV

(Name of Subject Company)

Compagnie Maritime Belge NV

(Name of Filing Person) (Offeror)

Ordinary Shares, no par value

(Title of Class of Securities)

B38564108

(CUSIP Number

of Class of Securities)

Ludovic Saverys

Chief Financial Officer

Compagnie Maritime Belge NV

De Gerlachekaai 20

2000

Antwerp, Belgium

Telephone: +32 3 247 59 11

With a Copy to:

Robert E. Lustrin, Esq.

Reed Smith LLP

599

Lexington Avenue

New York, NY 10022-7650

Telephone: (212) 521-5400

(Name, Address, and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

CALCULATION OF FILING FEE

|

|

|

| Transaction Valuation* |

|

Amount of Filing Fee* |

| Not applicable |

|

Not applicable |

| |

| * |

A filing fee is not required in connection with this filing as it relates solely to preliminary communications

made before the commencement of a tender offer. |

| ☐ |

Check the box if any part of the fee is offset as provided by Rule

0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

| Amount Previously Paid: |

|

None |

|

Filing Party: |

|

Not applicable |

| Form of Registration No.: |

|

Not applicable |

|

Date Filed: |

|

Not applicable |

| ☒ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a

tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| |

☒ |

third-party tender offer subject to Rule 14d-1 |

| |

☐ |

issuer tender offer subject to Rule 13e-4 |

| |

☐ |

going-private transaction subject to Rule 13e-3 |

| |

☐ |

amendment to Schedule 13D under Rule 13d-2 |

Check the following box if the filing is a final amendment reporting the results of the tender offer.

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| |

☐ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

☒ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

This Tender Offer Statement on Schedule TO relates solely to preliminary communications made

before the commencement of a planned tender offer by Compagnie Maritime Belge NV, a public limited liability company (“naamloze vennootschap”) under Belgian law (the “Offeror”) to acquire all outstanding

Ordinary Shares, no par value (the “Ordinary Shares”), of Euronav NV, a public limited liability company (“naamloze vennootschap”) under Belgian law (the “Issuer”) not owned by CMB or its

affiliates.

Additional Information and Where to Find It

The tender offer by the Offeror referred to herein has not yet commenced. Each of the presentation filed herewith as Exhibit 99.1 and the

article filed herewith as Exhibit 99.2 is for informational purposes only, and is neither an offer to purchase nor a solicitation of an offer to sell any Ordinary Shares of the Issuer or any other securities, nor is it a substitute for the Tender

Offer Statement on Schedule TO and other necessary filings that the Offeror will file with the Securities and Exchange Commission (the “Commission”), and the Solicitation/Recommendation Statement on Schedule

14D-9 and other necessary filings that the Issuer will file with the Commission, at the time the tender offer is commenced. Any solicitation and offer to buy Ordinary Shares will only be made pursuant to an

offer to purchase and related tender offer materials. At the time the tender offer is commenced, the Offeror will file with the Commission a Tender Offer Statement on Schedule TO and other necessary filings, and in connection therewith, the Issuer

will file with the Commission a Solicitation/Recommendation Statement on Schedule 14D-9 and other necessary filings.

The Tender Offer Statement (including an offer to purchase, a related letter of transmittal and certain other offer documents) and the

Solicitation/Recommendation Statement on Schedule 14D-9 will contain important information. U.S. Holders of Ordinary Shares are urged to read these documents carefully when they become available because they

will contain important information that U.S. Holders of Ordinary Shares should consider before making any decision with respect to the tender offer.

When the tender offer is commenced, the offer to purchase, the related letter of transmittal and the solicitation/recommendation statement and

other filings related to the offer will be made available for free at the Commission’s website at www.sec.gov. U.S. Holders of Ordinary Shares also may obtain free copies of the Tender Offer Statement and other offer documents that the Offeror

will file with the Commission by contacting the information agent for the tender offer that will be named in the Tender Offer Statement and the Solicitation/Recommendation Statement.

Forward-Looking Statements

This Schedule

TO and the exhibit filed herewith may contain “forward-looking statements”, many of which are beyond the Offeror’s ability to control or predict. These include, without limitation, forward-looking statements related to the

Offeror’s commencement of the tender offer. Words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “project,”

“predict,” “should,” “would” and “will” and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements are based on the Offeror’s

expectations as of the date they were first made and involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as of their dates. Unless as otherwise stated or required by applicable law, the Offeror undertakes no obligation and does not intend to update these forward-looking statements, whether

as a result of new information, future events or otherwise. All forward-looking statements in this Schedule TO and the exhibits filed herewith are qualified in their entirety by this cautionary statement.

Item 12. Exhibits

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Presentation dated January 12, 2024 for the Issuer’s Capital Markets Day relating to its planned acquisition of CMB.TECH NV |

|

|

| 99.2 |

|

Tradewinds article dated January 12, 2024 |

Exhibit 99.1

Forward-looking statements (1/2) This presentation includes certain

statements, expectations, estimates and projections provided by Euronav NV (the “Company”) and certain other sources believed by the Company to be reliable, and statements of the Company’s beliefs and intentions about future

events. The statements included in the presentation that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements

by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,”

“contemplate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” or the negative of these terms or other similar expressions, although not all forward-looking

statements contain these words. Such statements, expectations, estimates and projections reflect various assumptions by the Company concerning anticipated results and are subject to significant business, economic and competitive uncertainties and

contingencies, and known and unknown risks, many of which are beyond the Company’s control and are impossible to predict. Accordingly, there can be no assurance that such statements, expectations, estimates and projections will be realized.

Any forecast made or contained herein and actual results will likely vary and those variations may be material. The Company makes no representation or warranty as to the accuracy or completeness of such statements, expectations, estimates and

projections contained in this presentation or that any forecast made or contained herein will be achieved. Our forward-looking statements are subject to certain risks and uncertainties, which include, but are not limited to, the following: •

The transaction pursuant to which the Company has agreed to purchase CMB.TECH from CMB NV may not occur as expected or at all. • The global clean energy transition may not accelerate as expected, including in the shipping industry. •

Governmental and regulatory focus on a zero-carbon future in accordance with current target dates may not continue without delay or abatement or may be changed. • The shipping industry may not adopt hydrogen and ammonia as a primary fuel

source for ocean-going vessels or any adoption may take longer than expected. • The obsolescence and scrapping of older vessels that are powered by traditional fuels that emit carbon and their replacement may not occur as expected or at all.

• CMB.TECH’s hydrogen and ammonia engine and fuel technology may not be successfully applied in longer haul routes. • The business divisions of CMB.TECH may not be successfully integrated into the Company’s business. •

The delivery of CMB.TECH’s vessels on order may not occur as expected or without unanticipated costs. • Charters at attractive or expected rates may not be available for the Company’s vessels upon expiration of current charters or

upon delivery of newbuildings on order. • CMB.TECH may not complete as expected various hydrogen and ammonia projects upon which the Company’s business plans are based around the world both at sea and ashore as expected. •

Continuing demand for transportation of crude oil may not sustain charter rates for VLCCs and Suezmax tankers and the expected reduction in supply of such vessels due to scrapping or obsolescence may not occur. • Improving supply and demand

dynamics over the next several years in the dry bulk shipping sectors may not occur as expected. • A recovery and growth over the next several years in the chemical tanker sector of the shipping industry may not occur as expected. •

Demand for eco-friendly container vessels may decline. • Continued increases for demand for service vessels is the offshore wind industry may not occur as expected. • The impact of general economic and geopolitical factors on the

shipping industry. • Other statements and projections relating to the Company’s business objectives and plans may not occur as expected. In addition, certain industry data and information contained in this presentation has been derived

from industry sources. The Company has not undertaken any independent investigation to confirm the accuracy or completeness of such data and information, some of which may be based on estimates and subjective judgments. Accordingly, the Company

makes no representation or warranty as to such accuracy or completeness. This presentation speaks only as of today’s date, and the Company does not undertake to update any forward-looking statements to reflect future events or circumstances.

Information about the Company The Company is subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended, applicable to foreign private issuers and in accordance therewith is required to file reports and

other information with the SEC relating to its business, financial condition, and other matters. The Company’s Annual Report on Form 20-F for the fiscal year ended December 31, 2022 (the “Form 20-F”) and other filings are available

at the SEC’s website at http://www.sec.gov. We refer you to Item 3.D. (Risk Factors) in the Form 20-F for a discussion of certain risks of the Company’s business activities, financial condition, results of operations and prospects

relating to its ownership and operation of crude oil tankers. © 2024 – CMB.TECH 2

Forward-looking statements (2/2) Additional information CMB N has

announced previously that it will conduct a mandatory tender offer for all of the Company shares that it and its affiliates do not already own. The tender offer has not yet commenced. This presentation is for informational purposes only, and is

neither an offer to purchase nor a solicitation of an offer to sell any ordinary shares of Euronav NV or any other securities, nor is it a substitute for (i) the prospectus of CMB NV and the response memorandum of the supervisory board of Euronav NV

to be approved by the Belgian Financial Services and Markets Authority or (ii) the Tender Offer Statement on Schedule TO and other necessary filings that CMB NV will file with the Securities and Exchange Commission (the “Commission”),

and the Solicitation/Recommendation Statement on Schedule 14D-9 and other necessary filings that Euronav NV will file with the Commission, at the time the tender offer is commenced. Any solicitation and offer to buy ordinary shares of Euronav NV

will only be made pursuant to a public takeover bid within the meaning of the Belgian Law of 1 April 2007 and the Belgian Royal Decree of 27 April 2007 on public takeover bids addressed to shareholders of Euronav NV wherever located (the

“Belgian Offer”) and a concurrent offer to purchase and related tender offer materials in accordance with applicable U.S. federal securities laws addressed to U.S. holders (within the meaning of Rule 14d-1(d) under the Securities

Exchange Act of 1934, as amended) of Euronav NV’s ordinary shares (the “U.S. Offer ). At the time the tender offer is commenced, CMB NV will file with the Commission a Tender Offer Statement on Schedule TO and other necessary filings,

and in connection therewith, Euronav NV will file with the Commission a Solicitation/Recommendation Statement on Schedule 14D-9 and other necessary filings. The prospectus of CMB NV and the response memorandum of the supervisory board of Euronav NV

will contain important information in relation to the Belgian offer. Shareholders of Euronav NV are urged to read these documents carefully when they become available because they will contain important information that shareholders of Euronav NV

should consider before making any decision with respect to the Belgian Offer. The Tender Offer Statement (including an offer to purchase, a related letter of transmittal and certain other offer documents) and the Solicitation/Recommendation

Statement on Schedule 14D-9 will contain important information in relation to the U.S. Offer. U.S. holders of Euronav NV’s ordinary shares are urged to read these documents carefully when they become available because they will contain

important information that U.S. holders of Euronav NV’s ordinary shares should consider before making any decision with respect to the tender offer U.S. Offer. When the tender offer is commenced, (i) the prospectus and the response memorandum

will be made available for free at the website of Euronav NV, and (ii) the offer to purchase, the related letter of transmittal and the solicitation/recommendation statement and other filings related to the offer will be made available for free at

the Commission’s website at www.sec.gov. U.S. holders of Euronav’s ordinary shares also may obtain free copies of the Tender Offer Statement and other offer documents that the Offeror will file with the Commission by contacting the

information agent for the tender offer that will be named in the Tender Offer Statement and the Solicitation/Recommendation Statement. © 2024 – CMB.TECH 3

Presentation topics 1. CMB.TECH transaction 2. Creating the reference in

sustainable shipping 3. Value creation 4. Business units and markets 5. Annex - focus section on hydrogen market and shipping, fleet list © 2024 – CMB.TECH 4

© 2024 – CMB.TECH

Euronav company profile nd 2 largest quoted crude oil tanker company

Euronav in numbers (1) ▪ Euronav is the world’s second largest independent quoted crude Type # of vessels Average age oil tanker company (dwt) engaged in the ocean transportation and storage of crude oil NH 3 17 3 VLCC 9.9 years ▪

Sustainability is a core value at Euronav 22 4 Suezmax 7.8 years (2) ▪ Fleet rejuvenation and future-proof newbuilding program at the heart of its long-term value creation strategy Ship on water 2 FSO Under construction (3) Each $5k per day

uplift in VLCC and Suezmax rates improves EBITDA by $70m $ 770 million Shareholder return Stock listed platform $ 350million since 2015 $ 210 million BASE $ 70 million $1.5bn $200m $3.5 bn + $ 5,000 + $ 15,000 + $ 25,000 + $ 55,000 Cash dividends

Share buyback Market Cap Uplift in rates: per day per day per day per day on 14/12/2023 Industry-leading shareholder returns, tier 1 customer portfolio, and at the centre of the on-going energy transition. Older tanker tonnage provides excellent

opportunities to recycle capital into more future-proof (tanker) tonnage. (1) Age calculation: new building fleet set at 0 years. (1) (2) Age calculation: new building fleet set at 0 For purposes of this presentation, “future-proof”

means owning and operating efficient low-carbon emitting ships and/or ships powered by hydrogen and/or ships powered by ammonia. (3) These firms have not consented to the use of their names in this presentation, nor have they endorsed the

transaction or made any recommendations relating thereto. © 2024 – CMB.TECH 6 Storage Trading

CMB.TECH company profile Marine CMB.TECH marine in numbers CMB.TECH is a

division of the CMB Group that designs, builds and operates a future-proof fleet powered by hydrogen and ammonia: Total of 60+46 vessels Crew Transfer Vessels (CTV) (1) Dry-Bulk carriers powered by NH with an average age of 0.17 years 3 powered by

MDO and H 2 Commissioning service operation vessels (CSOV) powered by H 2 (2) Chemical tankers powered by NH Category 3 Tugboats powered by H 2 Ferry units powered by H 2+26 2+6 1+4 3 2 52+10 Container vessels powered by NH 3 off-shore wind dry-bulk

chemical container other Energy H2 Infra Industry Technology & Dev NH 3 Technology and infrastructure A well-equipped technology Design and retrofit of port 35 50 21 to produce and distribute green centre powered by highly and industrial

applications to ammonia ready conventional dual fuel hydrogen H and NH , which we believe run on hydrogen – in skilled engineers specialized in 2 3 ammonia fitted will be the fuel of the future cooperation with leading H systems 2 OEMs and

port operators CMB.TECH’s business model is to own/lease out or sell assets to customers looking for low/zero carbon solutions. CMB.TECH solves the chicken and egg discussion by offering H and NH molecules, either through own production or by

sourcing it from third party producers. 2 3 (1) (2) Age calculation: new building fleet set at 0, excluding CTV’s (Avg. age 8.9 years) Data format: fleet on the water + new building orders Note: Bocimar, Bochem and Delphis are the trade names

of CMB’s dry bulk carrier, chemical tankers and container vessel divisions, respectively. In the Transaction, CMB will give Euronav a worldwide royalty-free license to use these names for $ 0. © 2024 – CMB.TECH 7

Financial terms: enterprise value to equity value bridge The Acquisition

Price for 100% of the shares in CMB.TECH is $ 1.150 billion in cash. Approximate enterprise value of $ 3.649 billion and an equity value of $ 1.150 billion Financial terms The transaction includes $ 2.496 billion roll-over debt (bank, leasing and

shipyard liabilities). This includes: Net existing financial debt of $ 510 million Total nominal outstanding capital commitments of $ 1.986 billion – to be paid over the coming 3 years: (i) $ 1.625 billion has been secured and will be rolled

over; (ii) remaining unfunded capital commitment of $ 361 million will come from Euronav’s own cash. The Acquisition Price will be financed by Euronav from the cash proceeds of the sale of 24 VLCCs fleet to Frontline plc Financing by Euronav

(which was announced by Euronav on 9 October 2023) (1) $ 22 (1) $ 89 In $ millions $ 181 $ 510 $ 679 Unfunded – comes 67 Vessels $ 361 from Euronav cash $ 394 8 Vessels 5 Vessels $ 441 $ 1,625 Secured – rolled $ 3,649 over $ 1,986 $

1,888 28 Vessels $ 1,153 Dry Bulk Container Chemical Off-Shore Industry H2 Infrastructure (-) Overheads (-) Net Debt (-) Net Debt Enterprise Equity Value FMV FMV FMV Wind, Others DCF DCF and HQ Costs Net Existing Finacial Total Nominal Value FMV DCF

Debt 0utstanding Capital Commitments Note: Based on valuations as of 28/11/2023. Fair Market Value (FMV) sources: Arrow, BRS, Howe Robinson, Maersk Broker, SSY, and Hagland Shipbrokers. Others: Tugboats & Ferries. These firms have not consented

to the use of their names in this presentation, nor have they endorsed the transaction or made any recommendations relating thereto. Discounted cash Flow (DCF): intrinsic and prospective method valuing the business until end of holding period

through its future free cash flows discounted using the weighted average cost of capital (WACC) to obtain Enterprise Value (EV). © 2024 – CMB.TECH 8

Creating the leading, future-proof shipping platform ✓

Best-in-class tanker platform✓ Market leader in green ships ✓ High-quality asset base: VLCC,✓ Modern fleet comprising over 100 (1) Suezmax, and FSO low-carbon future-proof vessels expected ✓ Strong customer portfolio at

the center✓ Integrated hydrogen and of the energy transition ammonia value chain (2) Euronav to be renamed ✓ The reference in sustainable shipping ✓ The only investable diversified green shipping platform for ESG funds and

investors ✓ Creating value through a diversified fleet and a strong focus on decarbonization ✓ Intended to continue NYSE and EURONEXT listings under future symbol “CMBT” ✓ Use, produce, distribute, and carry low

carbon fuels ~ 6.9 $ Billion 53.37% Marine Asset FMV Strong anchor shareholder CMB (fleet on the water + new building orders) (by voting rights) (1) Upon completion of newbuilding deliveries expected in 2026 (2) After the closing of the acquisition

transaction and CMB’s announced mandatory take-over bid for all shares in Euronav that CMB and its affiliates do not currently own (the “MTO”), Euronav will propose to its shareholders to change its corporate name to

“CMB.TECH NV” and CMB.TECH will change its corporate name. The trading symbol for the re-named company will also be changed to “CMBT” on both the NYSE and BE Euronext. © 2024 – CMB.TECH 9

Expected timing SGM - Special SGM - Special Shareholder Meeting

Shareholder Meeting Shareholders approve conditionality of (i) SGM scheduled on 7 February 2023 to Frontline’s acquisition of 24 VLCC for $ approve CMB.TECH transaction 2.35 billion and (ii) termination of (pursuant to Art. 7:152 CCA)

arbitration case against Frontline plc / Famatown Finance Ltd, following which Expected closing of the transaction CMB acquired Frontline’s 26.12% stake for $ 18.43 and a new Euronav Targeted approval date of MTO Prospectus Euronav intends to

change Supervisory Board and Management Convening of SGM to approve CMB expects to launch MTO for Euronav name to CMB.TECH CMB.TECH transaction Board was installed (CMBT NYSE / BE EURONEXT) on 14 February 2024 09 October 2023 21/22 November 2023 22

December 2023 February 2024 15 March 2024 Capital Market Day 12 January 2024 Agreement Announcement of Close Mandatory CMB.TECH transaction Take-Over Bid CMB and Frontline plc/ Famatown As a consequence of exceeding the 30% Euronav and CMB announced

that Finance Ltd, reach an agreement on a threshold in November 2023 – CMB will they entered into a SPA for the transaction that puts an end to the offer all shareholders $ 17.86, i.e. $ acquisition of 100% of the share in deadlock arising

from their entrenched 18.43 minus dividend of $ 0.57 paid in CMB.TECH differences over the future strategy of December 2023 (1) the company Target for Euronav to remain listed on NYSE and EURONEXT (1) The offer price may be further reduced by the

gross amount of any future dividends distributions paid by Euronav to its shareholders with an ex-dividend date prior to the end of acceptance period in settlement date of the MTO. © 2024 – CMB.TECH 10

After the closing of the acquisition transaction and CMB’s

announced mandatory take-over bid for all shares in Euronav that CMB and its affiliates do not currently own (the “MTO”), Euronav will propose to its shareholders to change its corporate name to “CMB.TECH NV” and CMB.TECH

will change its corporate name. The trading symbol for the re-named company will also be changed to “CMBT” on both the NYSE and BE Euronext. Further reference made to CMB.TECH in this presentation is forward-looking and describes the

Company and its business plans after the renaming from Euronav NV to CMB.TECH NV, as the context requires. Further reference to Euronav will be as the crude oil tanker business unit of CMB.TECH (CMBT), as the context requires.

CMB.TECH (CMBT) has a strong, experienced management team with a

successful track record The founders of CMB.TECH and driving Alexander Saverys force behind the rapid technological Chief Executive Officer advancements which result in proprietary H and NH technologies Alexander Saverys serves on the Management

Board of Euronav as Chief 2 3 Executive Officer as of 22 November 2023. He founded Delphis in 2004, a short sea container shipping company. He became director of CMB in 2006 and is Chief Executive Officer of CMB since Combined they hold over 100

years of September 2014. shipping experience – financial, commercial, and operational Michael Saverys Michael Saverys Ludovic Saverys Have been instrumental to the Chief Chartering Officer Chief Financial Officer Chief Chartering Officer

success and growth of Euronav and Ludovic Saverys joined Euronav on the Michael Saverys joined Euronav on the CMB.TECH during the last decade Management Board as Chief Financial Officer as Management Board as Chief Chartering Officer on of 22

November 2023. 22 November 2023. He is also the CFO of CMB and the General In 2009 he joined CMB as Chartering Director of Manager of Saverco NV. He was on EURN board Bocimar International, and he is a member of the from 2015 to 2021. Board and

Executive Committee of CMB NV. Ambitious strategy for CMBT to be a leading green shipping growth stock – Maxime Van Eecke Benoit Timmermans on both NYSE and EURONEXT Chief Commercial Officer Chief Strategy Officer Maxime Van Eecke joined

Euronav on the Benoit Timmermans joined Euronav on the Management Board as Chief Commercial Officer Management Board as Chief Strategy Officer on 22 on 22 November 2023. November 2023. Clear vision on how to become the reference in green shipping

– and to He started as Legal Counsel for the CMB group in He is in charge of the Chemical division and zero 2005 and became MD of Delphis in 2014. In 2021 carbon fuel procurement. He is an executive board provide real ESG investment he was

appointed CCO of the CMB group. He is member of CMB NV. opportunities an executive board member of CMB NV. Source: Public information © 2024 – CMB.TECH 12

Euronav and CMB’s value creating pathways cross again CMB

Technologies MV Hydroville was CMB acquires Windcat CMB.TECH and Ohlthaver & was added to the christened in Workboats from List Group create Cleanergy group Antwerp Seacor Marine Solutions Namibia JV Euronav Luxembourg is formed between CMB

founds CMB acquires The Saverys CMB.TECH orders $ CMB rebuilds Compagnie Nationale de the subsidiary Delphis family take 3 billion of H and ownership in Navigation (CNN) and 2 Bochem CMB private NH powered ships Euronav to 24.97% Compagnie Maritime

3 CMB acquires Belge (CMB) 26,12% stake of Famatown/Frontline, Euronav sells 24 VLCCs for $ 2.35 billion 2007 2017 2019 2020 2022 2014 2015 1991 1995 1997 2004 2023 2024 Saverys family 2004 2013 2015 2018 2020 2021 Announcement acquires controlling

CMB.TECH stake in CMB transaction Euronav becomes Euronav Euronav concludes Euronav concludes First CDP Euronav fleet Agreement between the tanker division acquires Tanklog the merger with the acquisition of 15 submission rejuvenation CMB and of CMB

Gener8 Maritime VLCCs of Maersk Oil gaining B rating program Frontline/Famatown Tankers to solve the structural deadlock First bond issue for Euronav demerges from CMB The Company successfully EURN $150m in Oslo and starts trading on Euronext

concludes its IPO on the under the ticker EURN New York Stock Exchange © 2024 – CMB.TECH 13

Investment highlights CMB.TECH (CMBT) Creating THE reference platform

in sustainable shipping • CMB.TECH builds, owns, operates the largest pool of large marine applications that run on hydrogen and ammonia • Proven and scalable CMB.TECH technology of monofuel and dual fuel combustion engines that use

hydrogen and ammonia Grey-to-green that becomes available for the combined fleet solution for the • Tier 1 customer portfolio located at the center of the energy transition maritime industry • Ensuring availability of hydrogen and

ammonia fuel to its customers, either through own production or by sourcing it from third party producers • Diversification across different shipping types enables to invest for the future through shipping cycles: 41+7 oil tankers, 2+26

dry-bulk vessels, 52+10 offshore wind vessels, 1+4 container vessels, 2+6 chemical tankers, and 3 other segment (H2 tug & H2 ferry) Diversified, young ~ 6.9 $ Billion • Exposed to attractive end markets and to different contract types

(balancing operational gearing with steady cashflows) and growing fleet (2) Marine Asset FMV • Extensive current project pipeline of 53 committed new building vessels for delivery – and a pipeline of + 125 vessels • Modern and

growing fleet to meet tomorrow’s sustainability requirements • Positioned for the global fuel transition Ideally positioned in • At the center of the on-going energy transition. Older tanker tonnage provides excellent opportunity

to recycle capital the growing market into more future-proof (tanker) tonnage of sustainable • Increasing premium on TC rates for ecological vessels shipping (1) • Significant addressable market where over time 118,928 merchant vessels

are expected to be replaced by low carbon emitting ships 53.37% • CMBT a NYSE and EURONEXT listed growth stock rewarding its shareholders CMB as anchor • Successfully grown and developed CMB.TECH since it was founded in 2015 under the

CMB umbrella Strong anchor shareholder shareholder CMB • At the helm when Euronav became the tanker division of CMB in 1997 and primordial for its succes during the years thereafter (by voting rights) (1) UNCTAD Handbook of Statistics 2023 (2)

Fair Market Value (FMV) sources: Arrow, BRS, Howe Robinson, Maersk Broker, SSY, Vessels Value and Hagland Shipbrokers – FVM entails fleet on the water + new building orders . Data format: fleet on the water + new building orders. These firms

have not consented to the use of their names and logos in this presentation, nor have they endorsed the transaction or made any recommendations relating thereto. © 2024 – CMB.TECH 14

What do we stand for? To be the global reference in sustainable

shipping. We create diverse, sustainable, and high-quality CMB.TECH focuses on hydrogen for small ships and ammonia for large ships. cash-flows. 1 2 We power green marine value chains: We reward our shareholders. shipping assets, port assets, and H

/NH production infrastructure. 2 3 We attract and inspire We serve our clients with reliable, qualitative, 3 4 the best talents. and safe services. CMB NV (Compagnie Maritime Belge) as a strong anchor shareholder © 2024 – CMB.TECH

15

CMB.TECH (CMBT) company profile Marine CMB.TECH marine in numbers

Design, building and operate a future-proof fleet powered by hydrogen and ammonia: Total of 101+53 vessels Tugboats powered by H 2 (1) Dry-Bulk carriers powered by NH with an average age of 4.59 years 3 Ferry units powered by H 2 Crew Transfer

Vessels (CTV) powered by MDO and H (2) 2 Category Chemical tankers powered by NH 3 Commissioning service operation vessels (CSOV) powered by H 2 Suezmax tankers / VLCC tankers 52+10 41+7 2+26 2+6 1+4 3 Container vessels powered by NH Floating

Storage and Offloading units 3 off-shore wind oil dry-bulk chemical container other Storage tankers (FSO) Energy H2 Infra Industry Technology & Dev NH 3 Design and retrofit of port A well-equipped technology Technology and infrastructure 95 38

21 and industrial applications centre powered by highly to produce and distribute conventional ammonia ready dual fuel hydrogen to run on hydrogen – in skilled engineers specialized in green H and NH , the fuel 2 3 ammonia fitted cooperation

with leading H systems of the future 2 OEMs and port operators CMB.TECH’s business model is designed to enable the grey-to-green transition of the maritime industry with a focus on hydrogen for small ships and ammonia for large ships –

whilst creating value for our shareholders, serving customers with reliable, qualitative and safe services, and attracting and inspiring the best talents. (1) Age calculation: new building fleet set at 0, excluding CTV’s (Avg. age 8.9 years)

(2) Data format: fleet on the water + new building orders © 2024 – CMB.TECH 16

Marine – the leading diversified green shipping platform Oil

Tankers Dry-bulk vessels Container vessels Chemical Tankers Off-shore wind + + + + 41+7 2+26 1+4 2+6 52+10 <1 y Avg. CSOV 9.2 years 3,455 <1 years 1,888 <1 years 441 <1 years 394 679 Avg. age FMV $ millions Avg. age FMV $ millions Avg.

age FMV $ millions Avg. age FMV $ millions 8.9 y Avg. CTV FMV $ millions Energy type Energy type Energy type Energy type Energy type NH NH NH NH NH 3 3 3 3 3 45 3 0 4 0 0 46 22 2 5 0 8 0 0 17 Conventional NH Ammonia ready Dual-fuel hydrogen # number

of vessels 3 In-house expertise to seize new opportunities across end-markets whilst pursuing a fuel transition of the fleet towards ammonia and hydrogen ~6.9 $billion 101+53 >3,000 >450 4.59 >70 >15y Combined FMV Vessels seafarers

shore-based staff average fleet age engineers experience in H2 Fair Market Value (FMV) sources: Arrow, BRS, Howe Robinson, Maersk Broker, SSY, and Hagland Shipbrokers – basis fleet on the water + new building orders. These firms have not

consented to the use of their names and logos in this presentation, nor have they endorsed the transaction or made any recommendations relating thereto. Sum of the fleet composition is current fleet and committed newbuilds. Data format Vessels

Count: fleet on the waters + new building orders © 2024 – CMB.TECH 17

Flywheel strategy of the CMB.TECH marine division CMB.TECH is ideally

positioned to tap into each step of the energy transition ... with a clear vision on value creation towards low carbon shipping ... for stakeholders Low carbon Hydrogen and Ammonia molecules Integration across entire value chain in (Engine

technology & Production) sustainable shipping (H / NH ) 2 3 Diversify cashflows which allows to Enabler of NH /H Enabler to decarbonize 3 2 invest through shipping cycles production shipping of goods (cfr. offshore wind) (fuel + engine)

Capitalize on fleet size and strategic investments in infrastructure Contributing cash to business and shareholders Oil tanker business + accelerated Offshore industry with CSOVs, Diversified green shipping decarbonization + growth of CTVs, Tugboats

business powered by NH /H 3 2 energy tanker industry Low carbon shipping of goods Powered by CMB.TECH © 2024 – CMB.TECH 18

Future-proof and commercial attractive vessels hitting the water Firm

newbuilding orders of dual fuel NH 3 2 + 6 x 25.000dwt chemical tankers 2 + 24 x 210.000 dwt Newcastlemax bulkers 1 + 3 x 6.000 TEU ice class 1A reefer container ships NH as a fuel (ready) NH as a fuel (ready/fitted) NH as a fuel (ready) 3 3 3 +3

VLCC tankers +4 Suezmax tankers Hydrotug NH as a fuel (ready/fitted) NH as a fuel (ready) dual fuel 65t BP tractor tug 3 3 © 2024 – CMB.TECH 19

CMBT a NYSE and EURONEXT listed growth stock Real low-carbon Proven

technology Significant market solution ready to scale for green energy Growth Long-term trend & Competitive Addressable + + = stock structural shift advantage market The Paris Agreement’s overarching CMB.TECH has proven, competitive We

intend to be part of gradually goal is to hold the increase in the and accredited H / NH production replacing 118,928 merchant vessels 2 3 (2) global average temperature to well and engine technology available with low carbon emitting ships below

2°C above pre-industrial TODAY (1) levels “We have a plan. The strategy is working, and our people are fully behind it. Now it is about execution – operationally and strategically.” (1) United Nations Climate Change CEO

CMB.TECH (2) UNCTAD Handbook of Statistics 2023 © 2024 – CMB.TECH 20

Governments have stepped up their commitment to policy action th EU

Green China's 14 U.S. Inflation IMO GHG Deal and Five-Year Reduction Act strategy 2023 EU Fit for 55 Plan CMB.TECH targets new capital deployment of 3-5 $ billion over the next five years GREEN MARINE AMMONIA ASSETS GREEN MARINE HYDROGEN ASSETS

© 2024 – CMB.TECH 21

EU ETS and FuelEU can offer significant competitive advantage EU ETS

and FuelEU maritime cost comparison Start today – pilot projects offer a compelling commercial case € 4,00 FuelEU Maritime penalties can only be reduced significantly € 3,50 ✓ by changing fuel technologies FuelEU Maritime

effectively rewards early adopters by the potential to offset -80% € 3,00 ✓ an entire fleet or pool’s penalties with just a few over-performing vessels € 2,50 A pool of ten container vessels could avoid around € 226

million in FuelEU Maritime ✓ penalties over five years (2030-2034) if they are joined by a single vessel fueled with e- ammonia: x 6 € 2,00 NH € 1,50 3 x10 x1 x10 2030 € 38 million 2030 2031 € 42 million € 1,00

2031 2032 € 45 million 2032 2033 € 49 million 2033 2034 € 52 million 2034 € 0,50 -14,5% Total € 226 million Total 0 € -2% € - Rough Order Magnitude (ROM) € 30 million cost saving taking additional

fuelex green NH , capex NH engine, 3 3 2025 2030 2035 2040 2045 2050 2055 and EU ETS into account Fuel EU EU ETS Assumptions Assumptions • Large handy bulk carrier emitting 9,725 tonnes of CO2 equivalents (CO2e) on voyages to and from the EU,

• 60% of cargoes heading to EU/EAA discharge/load ports, 19k TEU container vessel, 215 days per year at sea, average sailing consumption 170 T VLFSO and 1,399 CO2e tonnes on intra-EU voyages or at berth in EU ports per day • EUA Carbon

Price: $ 92.63 /ton• To calculate the GHGIE intensity limit, 2020 reference value is set to 91.16 [gCO2eq/MJ] • To calculate the GHGIE intensity limit, 2020 reference value is set to 91.16 [gCO2eq/MJ] • VLSFO's well-to-wake carbon

intensity is set to 91.40 [gCO2eq/MJ] • VLSFO's well-to-wake carbon intensity is set to 91.40 [gCO2eq/MJ]• Green ammonia’s CMB.TECH dual fuel engine: well-to-wake carbon intensity is set as 9-15 [gCO2eq/MJ] • VLFSO 91.4 with

target at 85.69 in 2030: gap of 5,71 11:1 ratio • E-Ammonia 15 with target at 85.69 in 2030: surplus of 63,6 (1) Own calculations based on Llyod's Register case study. Llyod’s Register has not consented to the use of its name and data in

this presentation, nor has it endorsed the transaction or made any recommendation relating thereto. © 2024 – CMB.TECH 22 (1) LR indicative panamax Millions Wait and see Pilot project

CMB.TECH: at the forefront of hydrogen & ammonia rollout

Establishing the market for hydrogen and ammonia today for the transportation sector CMB.TECH hydrogen rollout versus Hydrogen Council’s timeline CMB.TECH intends to accelerate the transition of utilising hydrogen ✓ as an energy source

in transportation industries CMB.TECH H ICE engines and 2 ammonia-ready vessel designs are available today at an attractive initial investment cost without ✓ compromising performance (economic or environmental) and reliability CMB.TECH

solution available Source: Hydrogen Council. These firms have not consented to the use of its name and data in this presentation, nor has it endorsed the transaction or made any recommendation relating thereto. © 2024 – CMB.TECH

23

Proven technology with a significant addressable market (1) (1) The

current CMBT marine client base CMBT industry clients and partners (1) . These firms have not consented to the use of their names in this presentation, nor have they endorsed the transaction or made any recommendations relating thereto © 2024

– CMB.TECH 24

Grow current CMB.TECH market position Current pipeline of approximately

120 marine projects and 5 H infra projects worldwide – and growing by the day 2 Marine – H powered H Infrastructure Marine – NH powered 2 2 3 20 H tugboats Own production of 185,000 tons pa of green 2 20 NH Ultramax bulkers 3

ammonia in Namibia 20 Hydrocats 20 NH 4,000-10,000 TEU container vessels 3 Offtake agreement of: 10 H CSOV’s 2 10 NH LR2 tankers 100,000 ton per annum of green ammonia Europe 3 10 H 5,000 dwt 500,000 to 750,000 ton per annum of blue ammonia

USA 2 10 NH 25,000 dwt chemical tankers 3 280,000 to 560,000 ton per annum of blue ammonia USA 1,000 T pa of green hydrogen Europe 83 99 6 +5 +74 +94 60 4 60 34 14 1 1 9 5 Delivered / For delivery / Under Total Delivered / For delivery / Off-take

Total Delivered / For delivery / Under Total acquired under development Acquired Under agreements acquired under development construction construction under construction development Note: Under development includes tenders, feasibility studies,

currently under discussion and similar © 2024 – CMB.TECH 25

Financial terms: enterprise value to equity value bridge The

Acquisition Price for 100% of the shares in CMB.TECH is $ 1.150 billion in cash. Approximate enterprise value of $ 3.649 billion and an equity value of $ 1.150 billion Financial terms The transaction includes $ 2.496 billion roll-over debt (bank,

leasing and shipyard liabilities). This includes: Net existing financial debt of $ 510 million Total nominal outstanding capital commitments of $ 1.986 billion – to be paid over the coming 3 years: (i) $ 1.625 billion has been secured and will

be rolled over; (ii) remaining unfunded capital commitment of $ 361 million will come from Euronav’s own cash. The Acquisition Price will be financed by Euronav from the cash proceeds of the sale of 24 VLCCs fleet to Frontline plc Financing by

Euronav (which was announced by Euronav on 9 October 2023) (1) $ 22 (1) $ 89 In $ millions $ 181 $ 510 $ 679 Unfunded – comes 67 Vessels $ 361 from Euronav cash $ 394 8 Vessels 5 Vessels $ 441 $ 1,625 Secured – rolled $ 3,649 over $

1,986 $ 1,888 28 Vessels $ 1,153 Dry Bulk Container Chemical Off-Shore Industry H2 Infrastructure (-) Overheads (-) Net Debt (-) Net Debt Enterprise Equity Value FMV FMV FMV Wind, Others DCF DCF and HQ Costs Net Existing Finacial Total Nominal Value

FMV DCF Debt 0utstanding Capital Commitments Note: Based on valuations as of 28/11/2023. Fair Market Value (FMV) sources: Arrow, BRS, Howe Robinson, Maersk Broker, SSY, and Hagland Shipbrokers. Others: Tugboats & Ferries. These firms have not

consented to the use of their names in this presentation, nor have they endorsed the transaction or made any recommendations relating thereto. Discounted cash Flow (DCF): intrinsic and prospective method valuing the business until end of holding

period through its future free cash flows discounted using the weighted average cost of capital (WACC) to obtain Enterprise Value (EV). © 2024 – CMB.TECH 27

Financial terms: Marine FMV Broker 1 Broker 2 Broker 3 Broker 4 Broker

5 Broker 6 Internal valuation Sub Total FMV Total FMV In $ Calculation methodology: Average FMV/vessel Average FMV/vessel Average FMV/vessel Average FMV/vessel Average FMV/vessel Average FMV/vessel Average FMV/vessel $ 3,402 millions • FMV

basis 28 November 2023 • Brokers used: Arrow, BRS, 3 $ 12.4 $ 1.0 Howe Robinson, Maersk $ 14.6 Other Hydrotug Hydroville/Hydrobingo Broker, SSY, and Hagland 67 (1) Shipbrokers 52+5 $ 679 $ 6.0 (1) $ 2.4 $ 164.2 Vessels CTV Newbuilding CTVs

• Desk appraisals without physical inspection $ 6.8 0+5 (2) $ 76.5 $ 500.0 $ 679 CSOV H2 premium CSOV• Average of FMV if multiple broker reports were available • FMV includes value of charter 8 2+6 $ 394 $ 51.2 $ 47.2 $ 393.8 $ 394

(if applicable) Vessels 25.000 dwt chem • No valuation has been requested for the NB CTVs, 1+3 NB 1400 TEU (value assumed $ 104.0 $ 90.0 $ 388 6,000 TEU 5 to be equal to the contract $ 441 Vessels price) 0+1 $ 52.7 $ 52.7 $ 441 1,400 TEU

• No valuation was provided for Hydroville and Hydrobingo – internal assessment made • FMV represents the % share in case of JV’s (1) • A 25% premium to FMV has been applied to reflect the Windcat platform's premium

offering in terms of predominant number 28 2+24 of CTV vessels in the market, $ 1,888 $ 71.7 $ 71.7 $ 1,864 Vessels Newcastlemax global recognition, unique contractual operational know- how ($ 33 million) (2) • CSOV broker valuation has 0+2 $

23,5 $ 1,888 $ 11.7 been complemented to reflect 5000 dwt the H2 dual fuel capabilities. 1 more CSOV option is held by CMB.TECH NV and has been Marine FMV valued accordingly (1) These firms have not consented to the use of their names in this

presentation, nor have they endorsed the transaction or made any recommendations relating thereto. © 2024 – CMB.TECH 28

Financial terms: Industry DCF Business plan (in $ millions) Equity

value (in $ millions) $ million 2024E 2025E 2026E (# units) WACC 10.5% 18.0 35.9 39.5 Truck (75 #) (150 #) (165 #) Perpetual growth rate 2.5% 0.2 0.6 0.8 Generator Present value of Free Cash Flow 116 (10 #) (30 #) (36 #) Present value of Terminal

Value 65 0.8 0.8 6.1 Port Equipment (5 #) (5 #) (40 #) 3.2 7.4 12.6 Behydro Enterprise value of $ 181 million (in $ millions) (9 #) (21 #) (36 #) - 0.8 Locomotive - Perpetual Growth Rate (%) (2 #) (4 #) Total Revenue 22.1 44.7 59.8 -0.4% -0.2% -

+0.2% +0.4% OPEX -15.2 -31.1 -40.9 2.1% 2.3% 2.5% 2.7% 2.9% -0.4% 10.1% 192 193 195 198 200 EBITDA 0.8 7.4 12.6 -0.2% 10.3% 184 186 188 190 192 EBIT 0.8 7.4 12.3 - 10.5% 178 179 181 183 185 NOPAT 0.6 5.5 9.3 +0.2% 10.7% 171 173 174 176 178 Free Cash

Flow 0.6 2.8 4.1 +0.4% 10.9% 165 167 168 170 171 Discounted Cash Flow 0.6 2.4 3.2 Calculation methodology & comments: • Valuation as of 31 December 2023• Financials in group share for Engineering (100%), Truck (100%), Generator

(100%), BeHydro (50%), Port equipment (100%) and Locomotive (50%); Capex mainly represents acquisition; • Normative year reached in 2044 (20-year DCF) • EV=EqV as debt free cash free • Perpetual growth rate (PGR) of 2,5% in line

with peers average • Macroeconomic assumption 2% inflation on the costs of allocated FTEs from Engineering division • Normative EBITDA margin of 19% in line with best-in class industrial margins • Net working capital variation

assumed to be nil for all segments • WACC of 10.5% based on bottom-up calculation • Terminal Value: calculated using the Gordon Shapiro formula © 2024 – CMB.TECH 29 WACC (%)

Financial terms: Industry DCF Business plan – main operational

assumptions Truck Generator BeHydro Port Locomotive • Fixed price by straddle • Locomotive leased on • Fixed price by truck times • Fixed price by generator • Fixed price by engine times carrier retrofit kit times

annual basis number of trucks sold times number of generators number of engines sold number of kits sold• Number of locomotives to • Number of trucks sold sold • Number of engines sold • Number of kits sold reach 20 in 2030

then assumed to grow by 10% • Number of generators sold assumed to grow by 10% forecasted to grow over the assumed to grow annually until 2030 and 5% onwards assumed to grow by 20% business plan period by 5% • Includes the cost per truck

• Includes the cost per • Includes the retrofit cost per • Includes the cost per engine • Includes yearly maintenance and the retrofit cost which straddle carrier retrofit kit generator which is assumed which is assumed to be

per locomotive, assumed to are assumed to be constant which is assumed to be to be constant over the constant over the business be constant over the over the business plan constant over the business business plan period plan period business plan

period period plan period • D&A: Linear depreciation of locomotives over 10 years • Overhead costs: allocated Overhead costs: allocated full time equivalents (FTEs) from the Engineering division FTEs from Engineering No maintenance

capex required as all applications are sold hence no depreciation & amortization (D&A) division • Capex corresponding to locomotive acquisition and retrofitting cost 100% CMB.TECH 100% CMB.TECH 50% CMB.TECH 100% CMB.TECH 50% CMB.TECH

© 2024 – CMB.TECH 30 Ownership Overhead & CAPEX OPEX Revenue

Financial terms: H2 infra DCF Business plan (in $ millions) Equity

value (in $ millions) Business plan (in $ million) Equity value (in $ million) WACC 24E-29E 12.0% $ million 2024E 2025E 2026E 2027E 2028E 2029E 2030E 2031E WACC 30E-31E 9.0% Perpetual growth rate 2.5% PV2Fuel pilot - - 1.3 1.3 1.3 1.4 1.4 1.4

Present value of Free Cash Flow -126 Present value of Terminal Value 215 PV2Fuel - - - - - 117.8 120.2 122.6 Refueling station 1.5 1.4 1.4 1.4 1.4 1.3 1.3 1.3 Enterprise value of $ 89 million (in $ millions) Total Revenue 1.5 1.4 2.7 2.7 2.8 120.5

122.9 125.3 Perpetual Growth Rate (%) OPEX -1.0 -1.3 -1.8 -1.7 -1.7 -18.5 -18.6 -19.0 -0.2% -0.1% - +0.1% +0.2% 2.3% 2.4% 2.5% 2.6% 2.7% EBITDA -0.9 -1.5 -0.7 -0.6 -0.6 100.3 102.5 104.5 -0.5% 8.5% 140 144 149 154 158 EBIT -1.1 -1.7 -1.5 -1.4 -1.3

73.1 75.3 77.3 -0.25% 8.8% 110 114 118 122 126 - 9.0% 82 85 89 92 96 NOPAT -1.1 -1.7 -1.5 -1.4 -1.3 49.7 51.2 52.6 +0.25 9.3% 56 59 62 65 69 Free Cash Flow -20.1 -71.0 -277.4 -300.0 -132.0 76.9 78.4 79.8 % +0.5% 9.5% 32 35 37 40 43 Discounted CF

-19.0 -60.4 -214.7 -213.6 -87.4 47.9 44.8 41.8 Calculation methodology & comments:• Financials in group share for PV2Fuel pilot (49%), PV2Fuel (25%) and Refueling station (100%) • Valuation as of 31 December 2023 • EV=EqV as

debt free cash free • Normative year reached in 2044 (20-year DCF) • Implied tax rate resulting from H2 Infra consolidated cash-flows • Perpetual growth rate (PGR) of 2,5% in line with selected peers average • Macroeconomic

assumptions: 2% inflation on the costs of allocated FTEs • Normative EBITDA margin of 84.6% in line with the average EBITDA margin since from Engineering division, opex inflation of 1%, and inflation on green FCF breakeven in 2029E until the

end of the forecast period ammonia’s price of 2% • Rolling WACC retained: 12.0% in 2024E and 9.0% from 2030E onwards • Net working capital variation assumed to be nil for all segments • Terminal Value: calculated using the

Gordon Shapiro formula © 2024 – CMB.TECH 31 WACC (%)

Financial terms: H2 infra DCF Business plan – main operational

assumptions PV2Fuel Pilot PV2Fuel Refueling Station • Volume of hydrogen produced times hydrogen price • Green ammonia price per kg times volume produced• Green ammonia price per kg times volume produced which is assumed flat from

2029E onwards • Includes fixed and variable costs (electricity, water and • Includes the various costs associated with the • Includes the various costs associated with the facilities other) facilities • Maintenance costs

D&A: Linear depreciation of the equipment Overhead costs: allocated FTEs from Engineering division • Capex includes group’s share of investment• Capex includes group’s share of investment• Capex includes

group’s share of investment Replacement • Replacement and maintenance capex are treated as opex • Replacement and maintenance capex are treated as and maintenance capex are treated as opex hence no hence no additional depreciation

opex hence no additional depreciation additional depreciation • Total capex of circa $ 40 million (excluding subsidy)• Total capex of approximately $ 2.8 billion • Total capex of approximately $ 4.4 million • Front End

Engineering Design (FEED) phase on-going • Construction ongoing, delivery expected June 2024• Final Investment Decision (FID) – Q4 2024• Delivered & in operation • In operation expected 2029 • 49%

CMB.TECH• 25% CMB.TECH• 100% CMB.TECH © 2024 – CMB.TECH 32 Ownership Status CAPEX Overhead OPEX Revenue

Fairness opinion: agreed valuation versus fairness opinion 22 89 181

2,496 3,649 3,402 1,153 • Overall, the Enterprise Value is aligned between the internal valuation (-) Overheads excersize, and the fairness opinion Industry H Infrastructure Enterprise 2 Equity Value Marine FMV and HQ Costs (-) Net Debt

performed by Degroof Petercam DCF DCF Value DCF • Differing methodology in regard of the capital commitments (discounted 1,327 capital commitments versus capital commitments) 3,377 3,648 2,321 215 57 0 Note: Based on valuations as of

28/11/2023. Fair Market Value (FMV) sources: Arrow, BRS, Howe Robinson, Maersk Broker, SSY, and Hagland Shipbrokers. Others: Tugboats & Ferries. These firms have not consented to the use of their names in this presentation, nor have they

endorsed the transaction or made any recommendations relating thereto. Discounted Cash Flow (DCF) © 2024 – CMB.TECH 33 Degroof Petercam valuation Agreed valuation

Fairness opinion Extract out of the fairness opinion (1) performed by

Degroof Petercam • Estimated Equity Value of CMB.TECH based (3) on the DCF valuation method within the range (1) of $ 1,157-1,449 million with a midpoint of $ 1,302 million. • Secondary method, the NAV, yields a valuation (2) range of $

1,105-1,435 million with a midpoint of $ 1,327 million • Based on the aforementioned valuation range for the primary and secondary valuation method, Degroof Petercam concluded that the Acquisition Price is within its valuation range •

Hence, in the context of the intended Acquisition announced on all the shares of CMB.TECH, Degroof Petercam is of the opinion that the Acquisition Price is fair to Euronav shareholders CMB.TECH acquisition price is at the lower end of the valuation

range (1) Fairness opinion of Degroof Petercam is available at Euronav’s website: https://www.euronav.com/media/67615/20231222_project-cmb2_valuation-opinion_.pdf (2) Based on the maximum and minimum of the upper and lower limits of each

sensitivity (3) WACC = weighted-average cost of capital © 2024 – CMB.TECH 34

CMB.TECH company profile 44+6 3 52+5 3 CTV Other CTV Other 0+5 2+24

CSOV Newcastlemax 0+4 0+8 25.000 dwt chem Newcastlemax 2+6 0+2 2 years 25.000 dwt chem 5000 dwt 0+12 0+1 1+3 6,000 TEU 6,000 TEU 1,400 TEU (2) (1) 60+46 FMV $ 3,402 million 47+30 ~FMV $ 1,787 million Cleanergy Solutions Namibia kicks off

construction works for Africa's first public 2023 refuelling station with onsite green hydrogen production 2023 Delivery of the world’s first hydrogen powered tugboat, Hydrotug, powered by 2 x 2MW BeHydro engines 2023 ATS & CMB.TECH launch

World's First Hydrogen Dual Fuel Straddle Carrier 2023 WinGD and CMB.TECH agree to co-develop large ammonia-fuelled two-stroke engines 2022 Opening CMB.TECH dual fuel workshop 2022 Volvo Penta & CMB.TECH partner on dual fuel hydrogen engines

2022 BeHydro launches 100% hydrogen engines for heavy-duty applications 2021 CMB, ITOCHU Corporation and Nippon Coke & Engineering Company join forces to build a company dedicated to local hydrogen production 2021 Launch of hydrogen-powered

truck & launch of hydrogen-powered excavator 2021 Launch of first multimodal hydrogen refuelling station 2020 Delivery of Asia’s first hydrogen powered ferry, HydroBingo, powered by 2020 CMB.TECH’s converted Volvo Penta D13 engines

BeHydro launches the first hydrogen-powered dual-fuel engine 2017 Delivery of the world’s first hydrogen powered ship, Hydroville, powered by CMB.TECH’s converted Volvo Penta D4 engines Time (1) Based on Vessels Value data of 01/01/2022.

CTV valuation based on 28/11/2023. (2) Based on valuations as of 28/11/2023. Fair Market Value (FMV) sources: Arrow Valuations Ltd. (“Arrow”), Barry Rogliano Salles International S.A. (“BRS”), Howe Robinson Partners UK Ltd

(“Howe Robinson”), Maersk Broker Advisory Services A/S (“Maersk Broker”), SSY Valuation Services Ltd. (“SSY”), and Hagland Shipbrokers ApS (“Hagland Shipbrokers”). These firms have not consented to the

use of their names in this presentation, nor have they endorsed the transaction or made any recommendations relating thereto. © 2024 – CMB.TECH 35 H2 infra and industry Marine Technology performance and scalability Q4 2021 Q4 2023

CMB.TECH is committed to creating value Building, owning, and operating

high-specification assets that generate predictable and A uncorrelated cash flows Targeting long-term contracts with blue-chip counterparties – where risks and rewards are B being shared between all parties Solving our customers’ scope 3

emission challenges by providing low carbon maritime C transportation assets A Targeting a large market cap, large trading liquidity, and to remain forward-looking on ESG Providing investment opportunities in the energy transition of the maritime

value chain B Creating investment opportunities for long-term buy-and-hold stories, and for partners C looking to smoothen the inherent cyclical volatility of shipping earnings Greening end-to-end Long-term contracts Investment Dual fuel mix

flexibility Opp ortunit y for Opportunity the supply chain of and predictable and reliability – ready green to invest opportunities for the our customers cash-flow today investments with impact long-term © 2024 – CMB.TECH

36

P&L break-even levels versus actual Time Charter Equivalent (TCE)

In $ per vessel per day 10,115 7,228 9,121 10,720 18,461 29,432 29,750 27,677 50,912 85,962 75,847 22,204 18,556 19,030 32,451 29,800 15,500 6,450 6,350 5,550 Newcastlemax bulk carrier 6000 TEU container vessel 25K DWT chemical tanker CSOV FSO - TC

OPEX OPEX OPEX OPEX OPEX (1) P&L break-even 2024 / day P&L break-even 2024 / day P&L break-even 2024 / day P&L break-even 2024 / day P&L break-even 2024 / day Actual Q4 2023 TCE / day Actual Q4 2023 TCE / day Actual Q4 2023 TCE /

day Forecast TCE / day Estimate Q4 2023 TCE / day TCE calculations: • Actual Q4 2023: Newcastlemax bulk carrier, 25K DWT chemical tanker • Actual Q3 2023: FSO, VLCC, and 13,038 14,693 Suezmax 21,874 21,976 • 6000 TEU container

vessel: all fixed under long-term time charter (10 39,475 42,708 46,617 38,192 years) • CSOV TCE rate is based on forecast 26,437 23,499 time charter rate (incl. other income) 24,743 20,732 • P&L break-even for 2024: includes 8,300

8,600 8,500 9,250 OPEX (incl. insurance and ship mgt fees), depreciation, interests, special VLCC - spot Suezmax - spot VLCC -TC Suezmax - TC expenses, arrangement fees & pool fees OPEX OPEX OPEX OPEX Comments P&L break-even 2024 / day

P&L break-even 2024 / day P&L break-even 2024 / day P&L break-even 2024 / day (1) • FSO’s are depreciated to nil value Estimate Q4 2023 TCE / day Estimate Q4 2023 TCE / day Estimate Q4 2023 TCE / day Estimate Q4 2023 TCE /

day under Qatar’s depreciation schedule, Note: The charter rate, financial and operating data included herein is provided for illustrative purposes only, is not based on historical finacial data and has not been reviewed by Euronav’s

auditors. all other vessels are depreciated over 20 years to scrap value © 2024 – CMB.TECH 37

P&L break-even levels versus TCE analyst consensus In $ per vessel

per day 1,394 10,840 9,216 12,096 10,720 34,300 29,750 29,750 19,950 19,950 41,667 41,667 86,687 85,962 31,950 18,556 75,847 32,451 22,204 19,030 Newcastlemax bulk carrier 6000 TEU container vessel 25K DWT chemical tanker CSOV FSO - TC P&L

break-even 2024 / day P&L break-even 2024 / day P&L break-even 2024 / day P&L break-even 2024 / day P&L break-even 2024 / day Time Charter Rate 2024 / day Consensus 2024 TCE / day Consensus 2024 TCE / day Consensus 2024 TCE / day

Time Charter Rate 2024 / day Time Charter Rate 2025 / day Consensus 2025 TCE / day Consensus 2025 TCE / day Consensus 2025 TCE / day Time Charter Rate 2025 / day (1) TCE consensus : • Newcastlemax: Fearnleys, DNB and Arctic, corrected for pool

points 15,380 21,176 • 6000 TEU: time charter rates 2024, 33,738 28,155 2025, 2026 • 25 dwt chemical tanker: time charter 60,175 48,887 46,140 45,919 38,735 38,879 47,690 rates for 4/8 vessels 49,090 • CSOV: Fearnleys, DNB and

Arctic 23,499 24,743 26,437 20,732 • FSO TC, VLCC TC, Suezmax TC: time charter rates 2024, 2025, and 2026 (if applicable) VLCC - spot Suezmax - spot VLCC -TC Suezmax - TC • VLCC and Suezmax: Gibson, Braemar SSY, BRS, Clarksons (adjusted

for P&L break-even 2024 / day P&L break-even 2024 / day P&L break-even 2024 / day P&L break-even 2024 / day scrubber and eco) Consensus 2024 TCE / day Consensus 2024 TCE / day Consensus 2024 TCE / day Consensus 2024 TCE / day

Consensus 2025 TCE / day Consensus 2025 TCE / day Consensus 2025 TCE / day Consensus 2025 TCE / day (1) Average of the different TCE rates. These firms have not consented to the use of their names and data in this presentation, nor have they

endorsed the transaction or made any recommendations relating thereto. Note: The charter rate, financial and operating data included herein is provided for illustrative purposes only, is not based on historical finacial data and has not been

reviewed by Euronav’s auditors. © 2024 – CMB.TECH 38

Available days In days Newcastlemax bulk carriers 6000 TEU container

vessels 25K DWT chemical tankers CSOV 0 0 0 0 0 0 0 0 0 0 822 733 732 1,460 1,460 1,460 2,243 5,187 8,842 953 1,460 1,460 1,613 447 2024 2025 2026 2024 2025 2026 2024 2025 2026 2024 2025 2026 Open days Fixed days FSO VLCC Suezmax Total 0 0 0 0 0 303

671 984 3,652 4,939 1,832 4,921 14,861 19,922 6,278 26,400 5,608 7,707 5,759 6,117 8,368 732 732 732 2024 2025 2026 2024 2025 2026 2024 2025 2026 2024 2025 2026 Open days Fixed days 19,782 24,861 30,052 days days days Assumptions: • Open days

and fixed days provide the total available days - aligned with newbuilding delivery schedules © 2024 – CMB.TECH 39

(1) Illustrative balance sheet : Euronav, CMB.TECH, and combined CMB -

CMB.TECH Elimination Other EURONAV CMB.TECH COMBINED CMB.TECH Illustrative in k USD receivable participation & consolidation 15/02/2024 15/02/2024 15/02/2024 acquisition price 15/02/2024 settlement receivable entries ASSETS NON-CURRENT ASSETS

1,840,681 991,094 2,831,775 1,150,000 0 -361,371 -788,629 2,831,775 Vessels 1,711,995 426,344 2,138,339 2,138,339 Assets under construction 82,264 525,233 607,497 607,497 CMB,TECH participation 0 0 0 1,150,000 -1,150,000 0 Other non-current assets

46,422 39,517 85,939 788,629 -788,629 85,939 CURRENT ASSETS 2,066,938 49,696 2,116,634 -1,150,000 0 -65,000 0 901,634 Trade and other receivables 242,496 39,899 282,395 65,000 -65,000 282,395 Cash and cash equivalents 1,823,642 0 1,823,642

-1,150,000 -65,000 0 608,642 Other current assets 800 9,797 10,597 10,597 TOTAL ASSETS 3,907,619 1,040,790 4,948,409 0 0 -426,371 -788,629 3,733,409 EQUITY and LIABILITIES EQUITY 2,843,007 361,371 3,204,378 0 0 -361,371 -788,629 2,054,378 Equity

attributable to equity holders of the Company 2,843,007 361,371 3,204,378 -361,371 -788,629 2,054,378 Non-controlling interest 0 0 0 0 NON-CURRENT LIABILITIES 737,290 552,446 1,289,736 0 0 0 0 1,289,736 Loans and borrowings 735,302 552,334 1,287,636

1,287,636 Other non-current liabilaties 1,988 112 2,100 2,100 CURRENT LIABILITIES 327,322 126,973 454,296 0 0 -65,000 0 389,296 Loans and borrowings 254,199 113,051 367,250 -65,000 302,250 Trade and other payables 70,313 13,570 83,883 83,883 Other

current liabilities 2,811 352 3,163 3,163 TOTAL EQUITY and LIABILITIES 3,907,619 1,040,790 4,948,409 0 0 -426,371 -788,629 3,733,409 (1) The Balance Sheet is provided for illustrative purposes only, is not a pro forma, is not based on historical

financial data and has not been reviewed by Euronav’s auditors. © 2024 – CMB.TECH 40

Disciplined capital allocation strategy Delivering returns to

Reinvesting in core business shareholders Sufficient working capital, Focus on leveraging solid asset performance, proven NH /H 03 3 2 01 and a favorable technology to become leader in our industry. capitalization structure. CMBT is a growth stock

We concentrate on with above-average building up our revenue, revenue and earnings even if it comes at the growth potential. cost of delaying increased profitability. Investing in growth and Maintaining balance sheet development strength 02 04

© 2024 – CMB.TECH 41

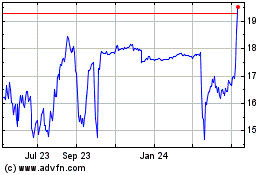

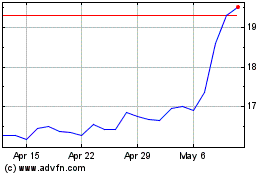

Current valuation presents attractive entry point Asset transfer

CMB.TECH transaction Upside NAV Acquisition Price for 100% of the shares in CMB.TECH is $ 1.150 billion in cash. Frontline will acquire 24 VLCC for $ 2.35 $/share 18.43 17.86 Enterprise value of $ 3.649 billion and billion – i.e. a transaction

at NAV an equity value of $ 1.153 billion Financed with $ 1.150 billion cash and $ Assets and liabilities are being replaced Significant growth in 2.496 billion roll-over debt (bank, leasing by cash and shipyard liabilities) energy transition

Potential industry/H Assets are added for cash 2 and liabilities. spin-offs Exposure to strong 09 October 2023 22 November 2023 12 December 2023 February 2024 current tanker cycle Strong project pipeline Oil tanker asset recycle opportunities

Agreement Q3 2023 dividend within portfolio Dividend payment to shareholders Agreement between CMB and of $ 0.57 Frontline/Famatown to solve the structural deadlock 18.43 17.86 At the time of the agreement, Base NAV the Euronav fleet is valued by 3

independent brokers © 2024 – CMB.TECH 42

CMB.TECH’s diversified green fleet fuels future CMBT growth (1)

SFDR Article 8 and 9 equity funds have received Asset prices and cycle showing that high tanker values 3.4x the cumulative inflows vs. non-ESG counterparts (Article give opportunity to recycle capital in the future-proof fleet 6) since 2019 SFDR

Article 6 Grey-to-Green Transition Future-proof Oil tanker LPG/LNG fleet Chem tanker SFDR Article 8 Dry Container Offshore Grey fleet SFDR Article 9 Time Inflow of capital (1) The Sustainable Finance Disclosure Regulation (SFDR) is a European

regulation introduced to improve transparency in the market for sustainable investment products, to prevent greenwashing and to increase transparency around sustainability claims made by financial market participants. © 2024 – CMB.TECH 43

TCE level

Our value proposition for investors LISTED.. LISTED.. EURONEXT NYSE

ACCESS TO ENERGY TRANSITION IN A LARGE LIQUID TOP RANKED BY TIER 1 ESG RATING AGENCIES ✓✓ STOCK BUSINESS MODEL FOCUSED ON LONG-TERM VALUE ✓✓ 3 CONSECUTIVE YEARS “B” RATING FOR CDP CREATION DIVERSIFIED FLEET,

DIVERSE END-MARKETS CURRENT VALUATION PRESENTS ATTRACTIVE ✓✓ ENTRY POINT TIER 1 CLIENTS, HIGH CONTRACTED VALUE STRONG ANCHOR SHAREHOLDER ENSURING ✓✓ STABILITY (1) (1) These firms have not consented to the use of their

names and logos in this presentation, nor have they endorsed the transaction or made any recommendations relating thereto. © 2024 – CMB.TECH 44

(1) A swift, just and equitable transition Oil demand scenarios (in

mb/d) NetZero scenario – VLCC tonnage requirements (# vessels) Million barrels per day # vessels VLCC orderbook stood >40% as percent of fleet 105 900 between 2006-2011. These VLCC’s will start ageing out of the fleet in the coming

years, boosting the supply-side story from ~2026 95 800 onward 85 700 75 75 ~2035: supply & demand tipping- 600 point and upscaling of regulations 65 21 (EU ETS/Fuel EU, IMO) 500 54 55 400 45 27 35 300 27 25 200 15 New Momentum Net Zero required

VLCC # 100 Accelerated Available VLCC – no new building 5 NetZero Available VLCCs – 25 new buildings per annum 0 2020 2025E 2030E 2035E 2040E 2045E 2050E 2015 2020 2025E 2030E 2035E 2040E 2045E 2050E (1) United Nations Climate Change

Conference (COP28) closed with an agreement that signals the “beginning of the end” of the fossil fuel era by laying the ground for a swift, just and equitable transition, underpinned by deep emissions cuts and scaled-up finance Source:

own calculations – basis BP, TotalEnergies, Equinor and IEA crude oil demand scenarios, Bloomberg. These firms have not consented to the use of their names and data in this presentation, nor have they endorsed the transaction or made any

recommendations relating thereto. © 2024 – CMB.TECH 47

The opportunity to recycle older tanker tonnage over time 10-year old

tanker asset value (in $ million) Regulatory frameworks expected impacts on (older) tanker tonnage VLCC 10 year $ million asset value Suezmax 10 year Number of ships Fuel EU/EU ETS 75 Euronav conventional fleet 42 Natural decline in Euronav

futureproof fleet Secondhand VLCC asset 70 Euronav conventional values are at a 14-year high, VLCC Newbuilding x1.2 38 fleet (20-year age cut-off) or at an all-time high if one excludes the 2005-2008 65 x1.4 VLCC 5 year 34 super cycle Growing

combined x1.6 60 Fuel EU, EU 30 ETS cost 55 26 22 50 x1.3 18 45 14 40 Accelerated recycling of older tonnage. 10 Future-proof tonnage on order: 3 x 35 ammonia powered ECO VLCC, and 6 4 x ECO Suezmax 30 2 0 year 0 2025E 2030E 2035E 2040E 2045E 2050E

2055E 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 year Source: own calculations – based on Evercorse ISI, Clarkson Research, Poten & Partners, BIMCO, Llyod’s Register. These firms have not consented to the use of their names

and data in this presentation, nor have they endorsed the transaction or made any recommendations relating thereto. © 2024 – CMB.TECH 48

Crude oil tankers Opec+ production cuts are delaying the short-term

demand story, but very compelling supply dynamics (1) Stock listed Crude Oil Tanker Fleet (VLCC & Suezmax) Euronav Fleet Fleet positioned for upcycle 15 17+3 22+4 2 Total DWT million VLCC ▪ The second biggest publicly listed crude oil VLCC

Suezmax Storage platform (dwt capacity perspective) Total DWT million Suezmax 10 ▪ Trading fleet of 17 VLCC and 22 Suezmax on the water 11 9.2 years 3,455 7 ▪ Future-proof tonnage on order: 3 x ammonia Avg. age FMV $ millions 6 6 powered

ECO VLCC, and 4 x ECO Suezmax 4 ▪ 2 long-term FSO contracts (2032), 2 T/C contracts Energy Type 4 3 3 7 VLCC, 5 T/C + profit share contracts Suezmax 4 4 2 4 3 ▪ High exposure and operational gearing into the NH 3 2 1 spot market FRO EUR

DHT INSW TNK NAT OET 45 3 0 Market Overview Order book Growing oil market imbalances drive tanker improvements Multi-year low crude tanker orderbook in combination with aging tonnage, fuels vessel valuation • Global oil consumption is expected

to hit a new record of 102.9 MBPD in 2024 • The tanker orderbook is now standing at 5.9% in total, with crude standing at 3.8% • Opec+ production cuts are delaying the crude transportation demand story • Currently, the fleet above

20 years of age comprises 13.8% in the crude space. Fast forward to the beginning of 2026 with the current fleet and age profile, expected to be • Modest crude ton-mile growth of 3% in 2024 24.5% • The age composition of the fleet

suggests that vessels will likely be scrapped • New oil supply is coming mainly from the Americas while new refinery capacity is added mainly in Asia, causing longer sailing distances It is expected that lack of tonnage entering the market,

combined with a gradual recovery in oil demand should result in a tight market. Utilization is still slowly moving upwards, and rates should improve going forward (1) Frontline and Euronav fleet figures give effect to the vessel sale. Basis fleet on

the water + new building orders. Source: IAE, Arctic, Clarksons. Fair Market Value (FMV) sources: Arrow, BRS, Howe Robinson, Maersk Broker, SSY, and Hagland Shipbrokers – basis fleet on the water + new building orders. These firms have not

consented to the use of their names and data in this presentation, nor have they endorsed the transaction or made any recommendations relating thereto. © 2024 – CMB.TECH 49

Dry-bulk vessels The supply/demand balance should remain stable in 2024

and is expected to tighten into 2025 Order book and utilization CMB.TECH Bocimar fleet Long-term dry-bulk vessel supply backdrop appears supportive overall 2+24 0+2 Newbuilding program aligned with the • In October 2023, the current Capesize

orderbook was 20 million DWT, a mere improving utilization levels (2024e-2026e) 5% of the Capesize fleet. Over all the different classes, a net supply growth of 3.0% in 2023, and 2.5%, 1.1%, and 0.4% the years 2024e through 2026e Newcastlemax 5.000

dwt• 26 super-eco 210,000 DWT Newcastlemax bulk carriers being delivered between July 2023 and • Lower fleet growth will help maintaining market balance. Basis market and order September 2026 (Qingdao Beihai shipyard) book, utilization

curve is forecasted at 85.1% in 2023, and to be 85.5%, 87.0%, • NH ready and NH fitted as soon as engine 3 3 and 87,9% in the years 2024 through 2026e <1 years 1,888 technology is available (as of second half 2025) Avg. age Avg. FMV $

• By 2027 (year after last Newcastlemax delivery) 70% of the capesize fleet (180 millions • Future-proof fleet with increasing commercial dwt or 782 vessels) is expected to be 15 years and more value in a changing regulatory landscape

Energy Type • Most fuel-efficient large dry-bulk vessels in the • By 2030 70% of the capesize fleet is expected to be 18 years and older world NH 3 • Current trading patterns suggest that only very specific clients can trade

vessels • 2 x 5,000 dwt coasters H powered 2 4 older than 15 years in Port Hedland (less than 1% of the fleet) and above 18 22 2 years no more capes are trading West Australia at all Newcastlemax Baby Cape > 20 years by 2030 Market Overview

618 Cape VLOC 34 Long term improved economic conditions is expected to in crease utilization as of ‘24 499 • Net demand estimated at -0.1% for 2023, and 3.0%, 2.9%, and 1.5% for 2024e through 117 2026, mainly driven by a forecasted

increasing demand for iron ore, grains, and minor bulks 467 309 307 in the period 240 106 • Iron ore shipments are estimated to grow 3.0% from 2023 to 2025 201 157 40 • Between 2023 and 2025, grain shipments may increase by 5.1% due to

maize 116 121 62 59 81 shipments growth in 2024 wheat volumes recovery in 2025 152 60 11 81 2 23 83 2 71 54 57 • 46 27 Bauxite trade up by 8 % in 2023 and forecasted to keep growing by 5-6% per year 3 4 6 8 • Other market supporting

factors : slower vessels speeds and increased EST time as 1993-2003 2004-2007 2008-2011 2012-2015 2016-2019 2020-2023 2024-2027E newbuilding environmental regulations impact, re-routing due to Panama Canal droughts Source: Cleaves, BIMCO, Clarksons.

Fair Market Value (FMV) sources: Arrow, BRS, Howe Robinson, Maersk Broker, SSY, and Hagland Shipbrokers – basis fleet on the water + new building orders. These firms have not consented to the use of their names and data in this presentation,

nor have they endorsed the transaction or made any recommendations relating thereto. © 2024 – CMB.TECH 51

Dry-bulk vessels Most fuel-efficient large bulkers in the world AND NH

ready 3 Capesize fleet compliance with IMO CII West Australia - China rountrip (in Ton LFSO) A C E +53.4% 71% B D 1,074 An estimated ~59% of existing Capesize bulkers will have a non-compliant CII rating (D or E) in 2023, growing to ~70% in 2026 and

~89% in 2031, based on 2019 performance 40% 888 30% 30% 29% 25% 19% 18% 37% 29% 18% 700 12% 10% 2% 8% 8% 7% 6% 5% 2019 2023 2026 2030 Mineral Maureen Mineral Qingdao Mineral Belgie Beihai HHI 2012, 206 dwt Yangfan 2020, 206 dwt 2023, 210 dwt

•• For ships that achieve a D rating for three consecutive years, or an E rating CMB.TECH’s Newcastlemax fleet fleet is expected to comply with EEDI/EEXI by a in a single year, a corrective action plan must be developed and

authorized / clear margin, while a large share of the Capesize fleet is likely to install energy approved by flag state or RO (Classification Society) power limitations to achieve compliance • Speed reductions are inevitable for non-compliant

vessels, resulting in • Cargo owners will likely seek to reduce their emissions throughout their value strengthened market fundamentals chains (scope 3), resulting in a chase for top-rated vessels (with low carbon dual fuel capabilities)

Source: Clarksons and own calculations. Clarksons has not consented to the use of their names and data in this presentation, nor have they endorsed the transaction or made any recommendations relating thereto. © 2024 – CMB.TECH

52

Chemical tankers Accelerated recovery expected to be aided by favorable

supply-side dynamics CMB.TECH Bochem fleet Order book Supportive supply side with a significant number of 2+6 vessels abov 20-years old (16%) Newbuilding program under favorable long-term charter contracts with Stolt Tankers ▪ Orderbook is at

historical low levels: total orderbook (in DWT) at 4.1% of the current core chemical tankers fleet (max 50% epoxy capacity and at least 14 segregations) ▪ Chemical tankers 8 super-eco 25,000 DWT chemical tankers NH 3 ready (CMJL Dingheng