Essex Property Trust Executes Agreement for $200 Million Private Placement of Unsecured Notes and Announces Favorable Rating ...

March 15 2012 - 7:58PM

Marketwired

Essex Property Trust, Inc. (NYSE: ESS), announced today that the

Company and its operating partnership, Essex Portfolio, L.P., have

entered into a note purchase agreement to issue $200 million of

senior unsecured notes as outlined in the following overview of the

transaction:

Issuer: Essex Portfolio, L.P.

Security Type: Guaranteed Senior Unsecured Notes

Structure: Private Placement

Size: $200 million

Term: 9 years

Funding Amount/Date: $100 million / April 30, 2012

$50 million / June 29, 2012

$50 million / August 30, 2012

Pay Rate: 4.27% (April 30); 4.30% (June 29); 4.37% (August 30)

Type: Semi-annual; 360 day

Use of Proceeds: For general corporate purpose, including the

repayment of a portion of the outstanding

indebtedness under its $425 million unsecured line

of credit.

Lead placement agent: Mitsubishi UFJ Securities (USA), Inc.

Co-placement agents: BMO Capital Markets

PNC Capital Markets LLC

US Bancorp Investments, Inc.

Mark J. Mikl, Senior Vice President, Capital Markets for the

company commented, "The private placement debt market has proven to

be a flexible capital option through the use of delayed fundings,

tailored maturity dates and more manageable offering sizes."

In February, Moody's Investor Services issued an initial issuer

credit rating for the Company of Baa2 and in March, Fitch upgraded

the Company's credit rating outlook from BBB Stable to

Positive.

This press release shall not constitute an offer to sell, or the

solicitation of an offer to buy, any security and shall not

constitute an offer, solicitation or sale in any jurisdiction in

which such offer, solicitation or sale would be unlawful.

Essex Property Trust, Inc., located in Palo Alto, California and

traded on the New York Stock Exchange (ESS), is a fully integrated

real estate investment trust (REIT) that acquires, develops,

redevelops, and manages multifamily residential properties in

selected West Coast markets. Essex currently has ownership

interests in 160 apartment communities with an additional 5

properties in various stages of active development. Additional

information about Essex can be found on the Company's web site at

www.essexpropertytrust.com.

Bryan Hunt (650) 849-5823

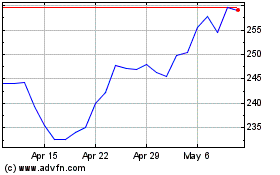

Essex Property (NYSE:ESS)

Historical Stock Chart

From Apr 2024 to May 2024

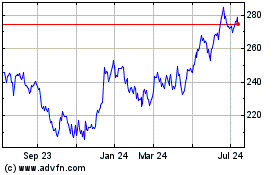

Essex Property (NYSE:ESS)

Historical Stock Chart

From May 2023 to May 2024