SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Report of Foreign Issuer

pursuant to Rule 13-a-16 or 15d-16

of the Securities Exchange

Act of 1934

FOR THE MONTH

OF NOVEMBER 2023

FORM 6-K

COMMISSION FILE NUMBER

1-15150

The Dome Tower

Suite

3000, 333 – 7th Avenue S.W.

Calgary, Alberta

Canada T2P 2Z1

(403) 298-2200

US

Bank Tower

Suite 2200, 950 – 17th Street

Denver, Colorado

United States of

America 80202-2805

(720) 279-5500

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

EXHIBIT

INDEX

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

ENERPLUS CORPORATION

| BY: |

/s/ |

David A. McCoy |

|

| |

|

David A. McCoy |

|

| |

|

Vice President, General Counsel & Corporate Secretary |

|

| |

|

|

|

DATE: November 2, 2023

Exhibit 99.1

Enerplus Announces Third Quarter 2023 Results;

Increases 2023 Production Guidance

| All amounts in this news release are presented in United States dollars unless otherwise specified. All financial information contained within this news release has been prepared in accordance with U.S. GAAP. Production information, unless otherwise stated, is presented on a net basis (after deduction of royalty obligations). This news release includes forward-looking statements and information within the meaning of applicable securities laws. Readers are advised to review the "Forward-Looking Information and Statements" at the conclusion of this news release. Readers are also referred to "Non-GAAP and Other Financial Measures" at the end of this news release for information regarding the presentation of the financial and operational information in this news release, as well as the use of certain financial measures that do not have standard meaning under U.S. GAAP and "Notice Regarding Information Contained in this News Release", "Non-GAAP Measures" in Enerplus' third quarter 2023 MD&A for supplementary financial measures, which information is incorporated by reference to this news release. A copy of Enerplus' 2023 interim and 2022 annual Financial Statements and associated MD&A are or will be available on our website at www.enerplus.com, under our profile on SEDAR+ at www.sedarplus.ca and on the EDGAR website at www.sec.gov. |

CALGARY, AB, Nov. 2, 2023 /CNW/ - Enerplus Corporation

("Enerplus" or the "Company") (TSX: ERF) (NYSE: ERF) today announced financial and operating results for the third

quarter of 2023 and increased production guidance. The Company reported third quarter 2023 cash flow from operating activities and adjusted

funds flow of $212.2 million and $263.7 million, respectively, compared to $409.9 million and $355.6 million, respectively, in the third

quarter of 2022. Cash flow from operating activities and adjusted funds flow decreased from the same period in 2022 primarily due to lower

realized commodity prices and production.

HIGHLIGHTS

- Third quarter total production

was 103,192 BOE per day (up 8% from the prior quarter) including liquids production of 66,625 barrels per day (up 14% from the prior

quarter)

- Adjusted funds flow was $263.7

million in the third quarter, which exceeded capital spending of $121.4 million, generating free cash flow(1) of $142.3 million

- Total return of capital to shareholders

during the third quarter was $67.7 million (inclusive of share repurchases and dividends), with $200.8 million returned through the first

three quarters of 2023

- On track to return approximately

70% of full-year 2023 free cash flow to shareholders which is expected to result in fourth quarter return of capital of approximately

$100 million, based on the current commodity price environment. Enerplus has repurchased $41 million of stock in the fourth quarter through

November 1, with additional repurchases planned

- 2023 total production and liquids

production guidance was increased by 2,000 BOE per day and 1,000 barrels per day at the midpoint, respectively, due to continued strong

operational performance

- 2023 capital spending guidance

was narrowed to $520 to $540 million (from the previous range of $510 to $550 million)

- Enerplus expects to exceed its

2030 scope 1 and 2 greenhouse gas ("GHG") emissions intensity reduction target this year, representing an approximate 40% reduction

from the 2021 baseline (and 55% from 2019)

| (1) |

This is a non-GAAP financial measure. Refer to "Non-GAAP and Other Financial Measures" section for more information. |

"Enerplus' third quarter results demonstrate

our consistent operational execution and the capital efficient well productivity from our high-quality Bakken asset," said Ian C.

Dundas, President and CEO. "We expect a solid finish to the year with annual production growth in North Dakota tracking 9%, capital

spending on budget, and a robust free cash flow profile that supports an increase in the pace of share repurchases in the fourth quarter."

THIRD QUARTER SUMMARY

Production in the third quarter of 2023 was 103,192

BOE per day, an increase of 8% compared to the prior quarter and 4% lower than the same period a year ago. Crude oil and natural gas liquids

production in the third quarter of 2023 was 66,625 barrels per day, an increase of 14% compared to the prior quarter and 3% lower than

the same period a year ago. Production increased from the prior quarter primarily due to strong well productivity and operational execution

in North Dakota. Production was lower compared to the prior year period as a result of the sale of substantially all of Enerplus' Canadian

assets in the fourth quarter of 2022 and limited capital activity in the Marcellus in 2023.

Enerplus reported third quarter 2023 net income of

$127.7 million, or $0.61 per share (basic), compared to net income of $305.9 million, or $1.32 per share (basic), in the same period in

2022. Adjusted net income(1) for the third quarter of 2023 was $137.2 million, or $0.65 per share (basic), compared to $207.9

million, or $0.90 per share (basic), during the same period in 2022. Net income and adjusted net income were lower compared to the prior

year period primarily due to lower realized commodity prices and production during the third quarter of 2023.

Enerplus' third quarter 2023 realized Bakken crude

oil price differential was $0.20 per barrel above WTI, compared to $2.41 per barrel above WTI in the third quarter of 2022. Bakken crude

oil prices have weakened in the fourth quarter due to increased basin production and lower seasonal refinery demand resulting from planned

maintenance outages. Consequently, Enerplus expects its 2023 realized Bakken crude oil price differential to average $0.25 per barrel

below WTI, compared to at par with WTI previously.

The Company's realized Marcellus natural gas price

differential widened to $1.24 per Mcf below NYMEX during the third quarter of 2023, compared to $0.99 per Mcf below NYMEX in the third

quarter of 2022. As a result of the weaker pricing, Enerplus has revised its full-year 2023 Marcellus natural gas price differential to

$0.85 per Mcf below NYMEX, from $0.75 per Mcf below NYMEX previously.

In the third quarter of 2023, Enerplus' operating

expenses were $10.17 per BOE, compared to $10.47 per BOE during the third quarter of 2022. The Company continues to expect operating expenses

in the fourth quarter to increase compared to the third quarter due to planned workover activity. Full-year operating expenses are tracking

the lower end of the previous guidance range. As a result, Enerplus has revised its full-year 2023 operating expense guidance to $10.75–$11.00

per BOE, from $10.75–$11.50 per BOE.

Capital spending totaled $121.4 million in the third

quarter of 2023.

Net debt was $212.1 million at September 30, 2023

compared to $199.6 million at June 30, 2023. The increase in net debt was primarily due to the non-cash operating and investing working

capital deficit decreasing by approximately $85 million. A portion of this is expected to reverse in the fourth quarter of 2023.

OPERATIONS

North Dakota production averaged 77,702 BOE per day

during the third quarter of 2023, an increase of 13% compared to the prior quarter and 6% compared to the same period a year ago. Enerplus

drilled 15 gross operated wells (80% working interest) during the third quarter and brought 19 operated wells (91% working interest) on

production. The wells were brought on production across three pads in Fort Berthold Indian Reservation and one pad in Williams County.

Marcellus production averaged 145 MMcf per day during

the third quarter of 2023, a decrease of 12% compared to the same period in 2022 and 6% lower than the prior quarter. The reduced Marcellus

production reflects the limited capital activity directed to the asset in 2023 following the lower natural gas price environment compared

to 2022.

RETURN OF CAPITAL TO SHAREHOLDERS

In the third quarter, Enerplus returned $67.7 million

to shareholders through the repurchase of 3.3 million common shares under its normal course issuer bid ("NCIB") at an average

price of $16.85 per share and $12.6 million in dividends. During the nine months ended September 30, 2023, a total of $200.8 million was

returned to shareholders through dividends and share repurchases.

Subsequent to September 30, 2023 and up to November

1, 2023, Enerplus repurchased 2.5 million common shares under its NCIB at an average price of $16.65 per share, for total consideration

of $40.9 million.

The Board of Directors approved a fourth quarter dividend

of $0.06 per share to be paid in December 2023, for shareholders of record on November 30, 2023.

Based on current market conditions and the Company's

low financial leverage, Enerplus expects to continue to return significant free cash flow to shareholders in 2024. Enerplus anticipates

its return of capital will equal approximately 70% of free cash flow in 2024.

UPDATED GHG EMISSIONS TARGETS

Enerplus has made significant progress in reducing

its GHG emissions intensity through improved operational processes and planning, and investment in emissions reduction projects. The Company

now expects to exceed its 2030 scope 1 and 2 emissions intensity reduction target this year, representing an approximate reduction of

40% from the 2021 baseline (and 55% from 2019). Enerplus is also tracking ahead of its existing methane intensity reduction targets in

2023, where it expects to achieve an approximate 45% reduction from the 2021 baseline (and 65% from 2019).

As a result of the outperformance noted above, Enerplus

is revising its GHG and methane emissions intensity targets as follows:

- Scope 1 GHG emissions intensity

of 7 kg CO2e/BOE by 2030; an approximate 60% reduction from 2023

- Scope 1 & 2 GHG emissions

intensity of 13 kg CO2e/MBOE by 2030; an approximate 30% reduction from 2023

- Methane emissions intensity of

0.02 kg CH4/MBOE by 2030; an approximate 45% reduction from 2023

In addition, Enerplus is endorsing the World Bank

Zero Routine Flaring by 2030 initiative and has established a flare intensity target of less than 2% per thousand cubic feet of natural

gas produced by 2026.

2023 GUIDANCE UPDATE

Capital spending guidance in 2023 has been narrowed

to $520 to $540 million from the prior range of $510 to $550 million.

Annual production guidance has been revised to 98,000

to 99,000 BOE per day from the prior range of 94,500 to 98,500 BOE per day, representing an increase of 2,000 BOE per day at the midpoint.

Annual liquids production guidance has been revised to 60,500 to 61,500 barrels per day from the prior range of 58,500 to 61,500 barrels

per day, representing an increase of 1,000 barrels per day at the midpoint.

Enerplus is providing fourth quarter 2023 production

guidance of 95,000 to 99,000 BOE per day, including liquids production of 60,500 to 64,500 barrels per day.

A summary of the changes to Enerplus' 2023 guidance

is provided in the tables below.

2023 Guidance Summary

| |

Updated Guidance |

Previous Guidance |

| Capital spending |

$520 – 540 million |

$510 – 550 million |

| Average total production |

98,000 – 99,000 BOE/day |

94,500 – 98,500 BOE/day |

| Average liquids production |

60,500 – 61,500 bbls/day |

58,500 – 61,500 bbls/day |

| Fourth quarter total production |

95,000 – 99,000 BOE/day |

n/a |

| Fourth quarter liquids production |

60,500 – 64,500 bbls/day |

n/a |

|

Average production tax rate

(% of net sales, before transportation) |

8% (No change) |

8 % |

| Operating expense |

$10.75 - $11.00/BOE |

$10.75 - $11.50/BOE |

| Transportation expense |

$4.05/BOE |

$4.20/BOE |

| Cash G&A expense |

$1.35/BOE (No change) |

$1.35/BOE |

| Current tax expense |

3 - 4% of adjusted funds flow before tax

(No change) |

3 - 4% of adjusted funds flow before tax |

2023 Differential/Basis Outlook(1)

| |

Updated Guidance |

Previous Guidance |

|

U.S. Bakken crude oil differential

(compared to WTI crude oil) |

$(0.25)/bbl |

Par with WTI |

|

Marcellus natural gas sales price differential

(compared to last day NYMEX natural gas) |

$(0.85)/Mcf |

$(0.75)/Mcf |

| (1) Excluding transportation costs. |

Q3 2023 Conference Call Details

A conference call hosted by Ian C. Dundas, President

and CEO will be held at 9:00 AM MT (11:00 AM ET) on November 3, 2023, to discuss these results. Details of the conference call are as

follows:

| Date: |

Friday, November 3, 2023 |

| Time: |

9:00 AM MT (11:00 AM ET) |

| Dial-In: |

1-888-390-0546 (Toll Free) |

| Conference ID: |

18470310 |

| Audiocast: |

https://app.webinar.net/Vl8X1bX2M37 |

To ensure timely participation in the conference call,

callers are encouraged to join 15 minutes prior to the start time to register for the event. A telephone replay will be available for

30 days following the conference call and can be accessed at the following numbers:

| Replay Dial-In: |

1-888-390-0541 (Toll Free) |

| Replay Passcode: |

470310 # |

PRICE RISK MANAGEMENT

The following is a summary of Enerplus' financial

commodity hedging contracts at September 30, 2023 and positions entered into subsequent to September 30, 2023 and up to November 1, 2023.

| |

|

WTI Crude Oil ($/bbl)(1)(2) |

|

NYMEX Natural Gas ($/Mcf)(2) |

| |

|

Oct 1, 2023 – Dec 31, 2023 |

|

Jan 1, 2024 – Jun 30, 2024 |

|

Oct 1, 2023 – Oct 31, 2023 |

| Swaps |

|

|

|

|

|

|

| Volume (bbls/day) |

|

10,000 |

|

– |

|

– |

| Brent - WTI Spread |

|

$ 5.47 |

|

– |

|

– |

| |

|

|

|

|

|

|

| 3 Way Collars |

|

|

|

|

|

|

| Volume (bbls/day) |

|

10,000 |

|

5,000 |

|

– |

| Sold Puts |

|

$ 65.00 |

|

$ 65.00 |

|

– |

| Purchased Puts |

|

$ 81.00 |

|

$ 77.00 |

|

– |

| Sold Calls |

|

$ 111.58 |

|

$ 95.00 |

|

– |

| |

|

|

|

|

|

|

| Collars |

|

|

|

|

|

|

| Volume (Mcf/day) |

|

– |

|

– |

|

50,000 |

| Volume (bbls/day)(3) |

|

2,000 |

|

– |

|

– |

| Purchased Puts |

|

$ 5.00 |

|

– |

|

$ 4.05 |

| Sold Calls |

|

$ 75.00 |

|

– |

|

$ 7.00 |

| (1) |

The total average deferred premium spent on our outstanding crude oil contracts is $1.19/bbl from October 1, 2023 – June 30, 2024. |

| (2) |

Transactions with a common term have been aggregated and presented at weighted average prices and volumes. |

| (3) |

Outstanding commodity derivative instruments acquired as part of the Company's acquisition of Bruin E&P Holdco, LLC completed in 2021. |

THIRD QUARTER 2023 PRODUCTION AND OPERATIONAL SUMMARY

TABLES

Summary of Average Daily Production(1)

| |

Three Months Ended September 30, 2023 |

|

Nine Months Ended September 30, 2023 |

|

| |

Williston Basin |

Marcellus |

Other(2) |

Total |

|

Williston Basin |

Marcellus |

Other(2) |

Total |

| Tight oil (bbl/d) |

53,002 |

- |

1,193 |

54,195 |

|

48,815 |

- |

875 |

49,690 |

| Total crude oil (bbl/d) |

53,002 |

- |

1,193 |

54,195 |

|

48,815 |

- |

875 |

49,690 |

| |

|

|

|

|

|

|

|

|

|

| Natural gas liquids (bbl/d) |

12,347 |

- |

83 |

12,430 |

|

10,774 |

- |

97 |

10,871 |

| |

|

|

|

|

|

|

|

|

|

| Shale gas (Mcf/d) |

74,120 |

144,523 |

758 |

219,401 |

|

69,299 |

159,509 |

783 |

229,591 |

| Total natural gas (Mcf/d) |

74,120 |

144,523 |

758 |

219,401 |

|

69,299 |

159,509 |

783 |

229,591 |

| Total production (BOE/d) |

77,702 |

24,087 |

1,403 |

103,192 |

|

71,139 |

26,585 |

1,102 |

98,826 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Table may not add due to rounding. |

| (2) |

Largely comprises the DJ Basin. |

Summary of Wells Drilled(1)

| |

Three months ended

September 30, 2023 |

|

Nine months ended

September 30, 2023 |

| |

Operated |

|

Non-Operated |

|

Operated |

|

Non-Operated |

| |

Gross |

Net |

|

Gross |

Net |

|

Gross |

Net |

|

Gross |

Net |

| Williston Basin |

15 |

12.0 |

|

11 |

0.5 |

|

46 |

39.6 |

|

66 |

7.0 |

| Marcellus |

- |

- |

|

14 |

0.4 |

|

- |

- |

|

40 |

0.8 |

| DJ Basin |

- |

- |

|

- |

- |

|

3 |

2.9 |

|

- |

- |

| Total |

15 |

12.0 |

|

25 |

0.9 |

|

49 |

42.5 |

|

106 |

7.7 |

| (1) Table may not add due to rounding. |

Summary of Wells Brought On-Stream(1)

| |

Three months ended

September 30, 2023 |

|

Nine months ended

September 30, 2023 |

| |

Operated |

|

Non-Operated |

|

Operated |

|

Non-Operated |

| |

Gross |

Net |

|

Gross |

Net |

|

Gross |

Net |

|

Gross |

Net |

| Williston Basin |

19 |

17.2 |

|

26 |

3.3 |

|

46 |

40.0 |

|

40 |

6.5 |

| Marcellus |

- |

- |

|

1 |

0.0 |

|

- |

- |

|

22 |

0.3 |

| DJ Basin |

3 |

2.9 |

|

- |

- |

|

3 |

2.9 |

|

10 |

0.2 |

| Total |

22 |

20.2 |

|

27 |

3.3 |

|

49 |

43.0 |

|

72 |

7.0 |

| (1) Table may not add due to rounding. |

| |

|

Three months ended |

|

Nine months ended |

| SELECTED FINANCIAL RESULTS |

|

September 30, |

|

September 30, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Financial (US$, thousands, except ratios) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income/(Loss) |

|

$ |

127,655 |

|

$ |

305,945 |

|

$ |

339,374 |

|

$ |

583,594 |

| Adjusted Net Income(1) |

|

|

137,184 |

|

|

207,913 |

|

|

362,317 |

|

|

525,992 |

| Cash Flow from Operating Activities |

|

|

212,245 |

|

|

409,946 |

|

|

640,244 |

|

|

856,798 |

| Adjusted Funds Flow |

|

|

263,684 |

|

|

355,622 |

|

|

720,717 |

|

|

914,910 |

| Dividends to Shareholders - Declared |

|

|

12,612 |

|

|

11,516 |

|

|

36,361 |

|

|

29,374 |

| Net Debt |

|

|

212,072 |

|

|

391,059 |

|

|

212,072 |

|

|

391,059 |

| Capital Spending |

|

|

121,354 |

|

|

114,459 |

|

|

440,943 |

|

|

346,357 |

| Property and Land Acquisitions |

|

|

2,275 |

|

|

16,252 |

|

|

5,661 |

|

|

19,662 |

| Property and Land Divestments |

|

|

1,563 |

|

|

4,214 |

|

|

1,702 |

|

|

19,386 |

| Net Debt to Adjusted Funds Flow Ratio |

|

|

0.2x |

|

|

0.3x |

|

|

0.2x |

|

|

0.3x |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Financial per Weighted Average Shares Outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income/(Loss) - Basic |

|

$ |

0.61 |

|

$ |

1.32 |

|

$ |

1.59 |

|

$ |

2.47 |

| Net Income/(Loss) - Diluted |

|

|

0.59 |

|

|

1.28 |

|

|

1.54 |

|

|

2.40 |

| Weighted Average Number of Shares Outstanding (000's) - Basic |

|

|

210,337 |

|

|

231,565 |

|

|

213,621 |

|

|

237,835 |

| Weighted Average Number of Shares Outstanding (000's) - Diluted |

|

|

216,857 |

|

|

239,136 |

|

|

220,093 |

|

|

245,403 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Selected Financial Results per BOE(2)(3) |

|

|

|

|

|

|

|

|

|

|

|

|

| Crude Oil & Natural Gas Sales(4) |

|

$ |

48.65 |

|

$ |

66.90 |

|

$ |

45.44 |

|

$ |

67.38 |

| Commodity Derivative Instruments |

|

|

0.56 |

|

|

(8.92) |

|

|

1.99 |

|

|

(11.19) |

| Operating Expenses |

|

|

(10.17) |

|

|

(10.47) |

|

|

(10.32) |

|

|

(10.10) |

| Transportation Costs |

|

|

(3.87) |

|

|

(4.16) |

|

|

(4.04) |

|

|

(4.29) |

| Production Taxes |

|

|

(4.21) |

|

|

(4.86) |

|

|

(3.65) |

|

|

(4.76) |

| General and Administrative Expenses |

|

|

(1.27) |

|

|

(1.10) |

|

|

(1.31) |

|

|

(1.18) |

| Cash Share-Based Compensation |

|

|

(0.20) |

|

|

(0.12) |

|

|

(0.04) |

|

|

(0.13) |

| Interest, Foreign Exchange and Other Expenses |

|

|

(0.40) |

|

|

(0.61) |

|

|

(0.36) |

|

|

(0.64) |

| Current Income Tax Expense |

|

|

(1.32) |

|

|

(0.80) |

|

|

(1.00) |

|

|

(0.93) |

| Adjusted Funds Flow |

|

$ |

27.77 |

|

$ |

35.86 |

|

$ |

26.71 |

|

$ |

34.16 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Nine months ended |

| SELECTED OPERATING RESULTS |

|

September 30, |

|

September 30, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Average Daily Production(3) |

|

|

|

|

|

|

|

|

|

|

|

|

| Crude Oil (bbls/day) |

|

|

54,195 |

|

|

57,482 |

|

|

49,690 |

|

|

51,146 |

| Natural Gas Liquids (bbls/day) |

|

|

12,430 |

|

|

10,900 |

|

|

10,871 |

|

|

9,319 |

| Natural Gas (Mcf/day) |

|

|

219,401 |

|

|

236,558 |

|

|

229,591 |

|

|

225,845 |

| Total (BOE/day) |

|

|

103,192 |

|

|

107,808 |

|

|

98,826 |

|

|

98,106 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| % Crude Oil and Natural Gas Liquids |

|

|

65 % |

|

|

63 % |

|

|

61 % |

|

|

62 % |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Average Selling Price(3)(4) |

|

|

|

|

|

|

|

|

|

|

|

|

| Crude Oil (per bbl) |

|

$ |

82.66 |

|

$ |

92.48 |

|

$ |

77.50 |

|

$ |

97.44 |

| Natural Gas Liquids (per bbl) |

|

|

19.21 |

|

|

32.04 |

|

|

18.36 |

|

|

34.13 |

| Natural Gas (per Mcf) |

|

|

1.37 |

|

|

6.53 |

|

|

1.91 |

|

|

5.79 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net Wells Drilled |

|

|

12.9 |

|

|

9.0 |

|

|

50.2 |

|

|

40.2 |

| (1) |

This non-GAAP measure may not be directly comparable to similar measures presented by other entities See "Non-GAAP and Other Financial Measures" section in this news release. |

| (2) |

Non-cash amounts have been excluded. |

| (3) |

Based on net production volumes. See "Basis of Presentation" section in this news release. |

| (4) |

Before transportation costs and commodity derivative instruments. |

Condensed Consolidated Balance Sheets

| |

|

|

|

|

|

|

| (US$ thousands) unaudited |

|

September 30, 2023 |

|

December 31, 2022 |

| Assets |

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

46,205 |

|

$ |

38,000 |

| Accounts receivable, net of allowance for doubtful accounts |

|

|

305,991 |

|

|

276,590 |

| Other current assets |

|

|

57,332 |

|

|

56,552 |

| Derivative financial assets |

|

|

2,047 |

|

|

36,542 |

| |

|

|

411,575 |

|

|

407,684 |

| Property, plant and equipment: |

|

|

|

|

|

|

| Crude oil and natural gas properties (full cost method) |

|

|

1,520,074 |

|

|

1,322,904 |

| Other capital assets |

|

|

9,501 |

|

|

10,685 |

| Property, plant and equipment |

|

|

1,529,575 |

|

|

1,333,589 |

| Other long-term assets |

|

|

7,028 |

|

|

21,154 |

| Right-of-use assets |

|

|

21,117 |

|

|

20,556 |

| Deferred income tax asset |

|

|

143,123 |

|

|

154,998 |

| Total Assets |

|

$ |

2,112,418 |

|

$ |

1,937,981 |

| |

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

| Accounts payable |

|

$ |

375,806 |

|

$ |

398,482 |

| Current portion of long-term debt |

|

|

80,600 |

|

|

80,600 |

| Derivative financial liabilities |

|

|

7,324 |

|

|

10,421 |

| Current portion of lease liabilities |

|

|

11,655 |

|

|

13,664 |

| |

|

|

475,385 |

|

|

503,167 |

| Long-term debt |

|

|

177,677 |

|

|

178,916 |

| Asset retirement obligation |

|

|

117,903 |

|

|

114,662 |

| Lease liabilities |

|

|

11,502 |

|

|

9,262 |

| Deferred income tax liability |

|

|

114,069 |

|

|

55,361 |

| Total Liabilities |

|

|

896,536 |

|

|

861,368 |

| |

|

|

|

|

|

|

| Shareholders' Equity |

|

|

|

|

|

|

|

Share capital – authorized unlimited common shares, no

par value

Issued and outstanding: September 30, 2023 – 208 million

shares

December 31, 2022 – 217 million shares |

|

|

2,745,597 |

|

|

2,837,329 |

| Paid-in capital |

|

|

43,887 |

|

|

50,457 |

| Accumulated deficit |

|

|

(1,272,261) |

|

|

(1,509,832) |

| Accumulated other comprehensive loss |

|

|

(301,341) |

|

|

(301,341) |

| |

|

|

1,215,882 |

|

|

1,076,613 |

| Total Liabilities & Shareholders' Equity |

|

$ |

2,112,418 |

|

$ |

1,937,981 |

Condensed Consolidated Statements of Income/(Loss)

and Comprehensive Income/(Loss)

| |

Three months ended |

Nine months ended |

| |

September 30, |

|

September 30, |

| (US$ thousands, except per share amounts) unaudited |

|

2023 |

|

2022 |

|

2023 |

2022 |

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

| Crude oil and natural gas sales |

|

$ |

461,836 |

|

$ |

663,532 |

|

$ |

1,225,957 |

|

$ |

1,804,701 |

| Commodity derivative instruments gain/(loss) |

|

|

(14,602) |

|

|

56,995 |

|

|

20,324 |

|

|

(197,368) |

| |

|

|

447,234 |

|

|

720,527 |

|

|

1,246,281 |

|

|

1,607,333 |

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating |

|

|

96,573 |

|

|

103,841 |

|

|

278,493 |

|

|

270,451 |

| Transportation |

|

|

36,745 |

|

|

41,312 |

|

|

108,946 |

|

|

114,949 |

| Production taxes |

|

|

39,959 |

|

|

48,169 |

|

|

98,847 |

|

|

127,351 |

| General and administrative |

|

|

18,862 |

|

|

15,745 |

|

|

53,368 |

|

|

48,013 |

| Depletion, depreciation and accretion |

|

|

91,825 |

|

|

82,225 |

|

|

264,051 |

|

|

219,006 |

| Interest |

|

|

4,832 |

|

|

6,471 |

|

|

12,742 |

|

|

18,624 |

| Foreign exchange (gain)/loss |

|

|

641 |

|

|

16,109 |

|

|

(250) |

|

|

13,764 |

| Other expense/(income) |

|

|

(7,935) |

|

|

(368) |

|

|

(6,873) |

|

|

12,020 |

| |

|

|

281,502 |

|

|

313,504 |

|

|

809,324 |

|

|

824,178 |

| Income/(Loss) Before Taxes |

|

|

165,732 |

|

|

407,023 |

|

|

436,957 |

|

|

783,155 |

| Current income tax expense/(recovery) |

|

|

12,500 |

|

|

7,929 |

|

|

27,000 |

|

|

24,929 |

| Deferred income tax expense/(recovery) |

|

|

25,577 |

|

|

93,149 |

|

|

70,583 |

|

|

174,632 |

| Net Income/(Loss) |

|

$ |

127,655 |

|

$ |

305,945 |

|

$ |

339,374 |

|

$ |

583,594 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other Comprehensive Income/(Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized gain/(loss) on foreign currency translation |

|

|

— |

|

|

28,582 |

|

|

— |

|

|

29,939 |

Foreign exchange gain/(loss) on net investment hedge, net

of tax |

|

|

— |

|

|

(24,276) |

|

|

— |

|

|

(32,995) |

| Total Comprehensive Income/(Loss) |

|

$ |

127,655 |

|

$ |

310,251 |

|

$ |

339,374 |

|

$ |

580,538 |

| Net Income/(Loss) per Share |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.61 |

|

$ |

1.32 |

|

$ |

1.59 |

|

$ |

2.47 |

| Diluted |

|

$ |

0.59 |

|

$ |

1.28 |

|

$ |

1.54 |

|

$ |

2.40 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Cash Flows

| |

|

Three months ended |

|

Nine months ended |

| |

|

September 30, |

|

September 30, |

| (US$ thousands) unaudited |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Operating Activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income/(loss) |

|

$ |

127,655 |

|

$ |

305,945 |

|

$ |

339,374 |

|

$ |

583,594 |

| Non-cash items add/(deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

| Depletion, depreciation and accretion |

|

|

91,825 |

|

|

82,225 |

|

|

264,051 |

|

|

219,006 |

| Changes in fair value of derivative instruments |

|

|

19,924 |

|

|

(145,480) |

|

|

33,515 |

|

|

(103,423) |

| Deferred income tax expense/(recovery) |

|

|

25,577 |

|

|

93,149 |

|

|

70,583 |

|

|

174,632 |

| Unrealized foreign exchange (gain)/loss on working capital |

|

|

679 |

|

|

16,997 |

|

|

(33) |

|

|

14,876 |

| Share-based compensation and general and administrative |

|

|

4,881 |

|

|

3,665 |

|

|

16,869 |

|

|

13,959 |

| Other expense/(income) |

|

|

(5,411) |

|

|

(289) |

|

|

(2,322) |

|

|

12,267 |

| Amortization of debt issuance costs |

|

|

388 |

|

|

366 |

|

|

1,176 |

|

|

1,070 |

| Translation of U.S. dollar cash held in parent company |

|

|

— |

|

|

(956) |

|

|

— |

|

|

(1,071) |

| Investing activities in Other income |

|

|

(1,834) |

|

|

— |

|

|

(2,496) |

|

|

— |

| Asset retirement obligation settlements |

|

|

(2,448) |

|

|

(1,560) |

|

|

(11,318) |

|

|

(12,704) |

| Changes in non-cash operating working capital |

|

|

(48,991) |

|

|

55,884 |

|

|

(69,155) |

|

|

(45,408) |

| Cash flow from/(used in) operating activities |

|

|

212,245 |

|

|

409,946 |

|

|

640,244 |

|

|

856,798 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Financing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Drawings from/(repayment of) bank credit facilities |

|

|

42,172 |

|

|

(130,315) |

|

|

79,361 |

|

|

(186,015) |

| Repayment of senior notes |

|

|

(21,000) |

|

|

(21,000) |

|

|

(80,600) |

|

|

(100,600) |

| Purchase of common shares under Normal Course Issuer Bid |

|

|

(55,127) |

|

|

(111,800) |

|

|

(164,465) |

|

|

(241,935) |

| Share-based compensation – tax withholdings settled in cash |

|

|

(50) |

|

|

— |

|

|

(16,470) |

|

|

(11,567) |

| Dividends |

|

|

(12,612) |

|

|

(11,516) |

|

|

(36,361) |

|

|

(29,374) |

| Cash flow from/(used in) financing activities |

|

|

(46,617) |

|

|

(274,631) |

|

|

(218,535) |

|

|

(569,491) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Investing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Capital and office expenditures |

|

|

(170,635) |

|

|

(121,382) |

|

|

(439,440) |

|

|

(311,449) |

| Canadian divestments |

|

|

15,128 |

|

|

— |

|

|

27,362 |

|

|

— |

| Property and land acquisitions |

|

|

(2,275) |

|

|

(16,252) |

|

|

(5,661) |

|

|

(19,662) |

| Property and land divestments |

|

|

1,563 |

|

|

4,214 |

|

|

4,202 |

|

|

6,333 |

| Cash flow from/(used in) investing activities |

|

|

(156,219) |

|

|

(133,420) |

|

|

(413,537) |

|

|

(324,778) |

| Effect of exchange rate changes on cash and cash equivalents |

|

|

(679) |

|

|

14,884 |

|

|

33 |

|

|

18,308 |

| Change in cash and cash equivalents |

|

|

8,730 |

|

|

16,779 |

|

|

8,205 |

|

|

(19,163) |

| Cash and cash equivalents, beginning of period |

|

|

37,475 |

|

|

25,406 |

|

|

38,000 |

|

|

61,348 |

| Cash and cash equivalents, end of period |

|

$ |

46,205 |

|

$ |

42,185 |

|

$ |

46,205 |

|

$ |

42,185 |

About Enerplus

Enerplus is an independent North American oil and

gas exploration and production company focused on creating long-term value for its shareholders through a disciplined, returns-based capital

allocation strategy and a commitment to safe, responsible operations. For more information, visit the Company's website at www.enerplus.com.

NOTICE REGARDING INFORMATION CONTAINED IN THIS

NEWS RELEASE

Readers are encouraged to review the 2023 interim

Management's Discussion & Analysis (MD&A) and financial statements, and 2022 MD&A and financial statements filed on SEDAR+

and as part of our Form 6-K and Form 40-F, respectively, on EDGAR concurrently with this news release for more complete disclosure on

our operations.

Currency and Accounting Principles

All amounts in this news release are stated in

U.S. dollars unless otherwise specified. All financial information in this news release has been prepared and presented in accordance

with U.S. GAAP, except as noted below under "Non-GAAP and Other Financial Measures".

Barrels of Oil Equivalent

This news release contains references to "BOE"

(barrels of oil equivalent), "MBOE" (one thousand barrels of oil equivalent), and "MMBOE" (one million barrels of

oil equivalent). Enerplus has adopted the standard of six thousand cubic feet of gas to one barrel of oil (6 Mcf: 1 bbl) when converting

natural gas to BOEs. BOE, MBOE and MMBOE may be misleading, particularly if used in isolation. The foregoing conversion ratios

are based on an energy equivalency conversion method primarily applicable at the burner tip and do not represent a value equivalency at

the wellhead. Given that the value ratio based on the current price of oil as compared to natural gas is significantly different from

the energy equivalent of 6:1, utilizing a conversion on a 6:1 basis may be misleading.

Basis of Presentation

All production volumes presented in this news release

are reported on a "net" basis (the Company's working interest share after deduction of royalty obligations, plus the Company's

royalty interests), unless expressly indicated that it is being presented on a "gross" basis.

All references to "liquids" in this news

release include light and medium crude oil, heavy oil and tight oil (all together referred to as "crude oil") and NGLs on a

combined basis. All references to "natural gas" in this news release include conventional natural gas and shale gas on a combined

basis.

FORWARD-LOOKING INFORMATION AND STATEMENTS

This news release contains certain forward-looking

information and statements ("forward-looking information") within the meaning of applicable securities laws. The use of any

of the words "expect", "anticipate", "continue", "estimate", "guidance", "ongoing",

"may", "will", "project", "plans", "budget", "strategy" and similar expressions

are intended to identify forward-looking information. In particular, but without limiting the foregoing, this news release contains forward-looking

information pertaining to the following: 2023 production and capital spending guidance; fourth quarter 2023 production guidance; Enerplus'

return of capital plans, including expectations regarding payment of dividends and the source of funds related thereto; the funding of

dividends and the share repurchase program from free cash flow; the anticipated percentage of free cash flow planned to be returned to

shareholders, based on current commodity prices; expectations regarding Enerplus' share purchase program, including the timing and amounts

thereof; expectations regarding the number of net operated wells brought on production during the remainder of 2023; expected operating

strategy in 2023 and expectations regarding our drilling program; expectations regarding oil production growth and free cash flow profile

for the remainder of 2023; anticipated reduction levels of Enerplus' scope 1 and 2 GHG emissions intensities targets and its flare intensity

target and the timing thereof; methane emissions targets and expectations; oil and natural gas prices and differentials and expectations

regarding the market environment and our commodity risk management program in 2023; 2023 Bakken and Marcellus differential guidance; capital

spending guidance; expectations regarding realized oil and natural gas prices; and expected operating, transportation and cash G&A

expenses and production taxes and 2023 guidance with respect thereto.

The forward-looking information contained in this

news release reflects several material factors and expectations and assumptions of Enerplus including, without limitation: the ability

to fund our return of capital plans, including both dividends at the current level and the share repurchase program, from free cash flow

as expected; that our common share trading price will be at levels, and that there will be no other alternatives, that, in each case,

make share repurchases an appropriate and best strategic use of our free cash flows; that we will conduct our operations and achieve results

of operations as anticipated; the continued operation of the Dakota Access Pipeline; that our development plans will achieve the expected

results; that lack of adequate infrastructure will not result in curtailment of production and/or reduced realized prices beyond our current

expectations; current and anticipated commodity prices, differentials and cost assumptions; the general continuance of current or, where

applicable, assumed industry conditions, the impact of inflation, weather conditions and storage fundamentals; the continuation of assumed

tax, royalty and regulatory regimes; the accuracy of the estimates of our reserve and contingent resource volumes; the continued availability

of adequate debt and/or equity financing and adjusted funds flow to fund our capital, operating and working capital requirements, and

dividend payments as needed; our ability to comply with our debt covenants; our ability to meet the targets associated with our credit

facilities; the availability of third party services; expected transportation expenses; the extent of our liabilities; and the availability

of technology and process to achieve environmental targets.

In addition, our 2023 guidance described in this

news release is based on rest of year commodity prices of: a WTI price of $80.00/bbl, a NYMEX price of $3.00/Mcf and a CDN/USD exchange

rate of 0.72. Enerplus believes the material factors, expectations and assumptions reflected in the forward-looking information are reasonable

but no assurance can be given that these factors, expectations and assumptions will prove to be correct. Current conditions, economic

and otherwise, render assumptions, although reasonable when made, subject to greater uncertainty.

The forward-looking information included in this

news release is not a guarantee of future performance and should not be unduly relied upon. Such information involves known and unknown

risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking

information including, without limitation: continued instability, or further deterioration, in global economic and market environment,

including from inflation and/or the Ukraine/Russia conflict and heightened geopolitical risks; decreases in commodity prices or volatility

in commodity prices; changes in realized prices of Enerplus' products from those currently anticipated; changes in the demand for or supply

of our products, including global energy demand; volatility in our common share trading price and free cash flow that could impact our

planned share repurchases and dividend levels; unanticipated operating results, results from our capital spending activities or production

declines; legal proceedings or other events inhibiting or preventing operation of the Dakota Access Pipeline; curtailment of our production

due to low realized prices or lack of adequate infrastructure; changes in tax or environmental laws, royalty rates or other regulatory

matters; changes in our capital plans or by third party operators of our properties; increased debt levels or debt service requirements;

inability to comply with debt covenants under our credit facilities and/or outstanding senior notes; inaccurate estimation of our oil

and gas reserve and contingent resource volumes; limited, unfavourable or a lack of access to capital markets; increased costs; a lack

of adequate insurance coverage; the impact of competitors; reliance on industry partners and third party service providers; changes in

law or government programs or policies in Canada or the United States; and certain other risks detailed from time to time in our public

disclosure documents (including, without limitation, those risks identified in our third quarter 2023 MD&A, our annual information

form for the year ended December 31, 2022, our 2022 annual MD&A and Form 40-F as at December 31, 2022).

The forward-looking information contained in this

news release speaks only as of the date of this news release. Enerplus does not undertake any obligation to publicly update or revise

any forward-looking information contained herein, except as required by applicable laws. Any forward-looking information contained herein

are expressly qualified by this cautionary statement.

NON-GAAP AND OTHER FINANCIAL MEASURES

Readers are referred to "Non-GAAP Measures"

in Enerplus' third quarter 2023 MD&A for supplementary financial measures, which information is incorporated by reference to this

new release.

Non-GAAP Financial Measures

This news release includes references to certain non-GAAP financial measures and non-GAAP ratios used by the Company to evaluate its financial

performance, financial position or cash flow. Non-GAAP financial measures are financial measures disclosed by a company that (a) depict

historical or expected future financial performance, financial position or cash flow of a company, (b) with respect to their composition,

exclude amounts that are included in, or include amounts that are excluded from, the composition of the most directly comparable financial

measure disclosed in the primary financial statements of the company, (c) are not disclosed in the financial statements of the company

and (d) are not a ratio, fraction, percentage or similar representation. Non-GAAP ratios are financial measures disclosed by a company

that are in the form of a ratio, fraction, percentage or similar representation that has a non-GAAP financial measure as one or more of

its components, and that are not disclosed in the financial statements of the company.

These non-GAAP financial measures and non-GAAP ratios

do not have standardized meanings or definitions as prescribed by U.S. GAAP and may not be comparable with the calculation of similar

financial measures by other entities.

For each measure, we have: (a) indicated the composition

of the measure; (b) identified the most directly comparable GAAP financial measure and provided comparative detail where appropriate;

(c) indicated the reconciliation of the measure to the most directly comparable GAAP financial measure to the extent one exists; and (d)

provided details on the usefulness of the measure for the reader. These non-GAAP financial measures and non-GAAP ratios should not be

considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP.

"Adjusted net income/(loss)" is used

by Enerplus and is useful to investors and securities analysts in evaluating the financial performance of the company by adjusting for

certain unrealized items and other items that the company considers appropriate to adjust given their irregular nature. The most directly

comparable GAAP measure is net income/(loss).

| |

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

| ($ millions) |

|

2023 |

|

2022 |

|

| Net income/(loss) |

|

$ |

127.7 |

|

$ |

305.9 |

|

| Unrealized derivative instrument, foreign exchange and marketable securities (gain)/loss |

|

|

15.6 |

|

|

(128.5) |

|

| Other expense/(income) related to investing activities |

|

|

(1.4) |

|

|

- |

|

| Tax effect on above items |

|

|

(4.7) |

|

|

30.5 |

|

| Adjusted net income/(loss) |

|

$ |

137.2 |

|

$ |

207.9 |

|

| Adjusted net income/(loss) per share (basic) |

|

$ |

0.65 |

|

$ |

0.90 |

|

"Free cash flow" is used by Enerplus

and is useful to investors and securities analysts in analyzing operating and financial performance, leverage and liquidity. Free cash

flow is calculated as adjusted funds flow minus capital spending. The most directly comparable GAAP measure is cash flow from operating

activities.

| |

Three months ended September 30, |

| ($ millions) |

2023 |

|

2022 |

| Cash flow from/(used in) operating activities |

$ |

212.2 |

|

$ |

409.9 |

| Asset retirement obligation settlements |

|

2.5 |

|

|

1.6 |

| Changes in non-cash operating working capital |

|

49.0 |

|

|

(55.9) |

| Adjusted funds flow |

$ |

263.7 |

|

$ |

355.6 |

| Capital spending |

|

(121.4) |

|

|

(114.5) |

| Free cash flow |

$ |

142.3 |

|

$ |

241.1 |

Other Financial Measures

CAPITAL MANAGEMENT MEASURES

Capital management measures are financial measures

disclosed by a company that (a) are intended to enable an individual to evaluate a company's objectives, policies and processes for managing

the company's capital, (b) are not a component of a line item disclosed in the primary financial statements of the company, (c) are disclosed

in the notes to the financial statements of the company, and (d) are not disclosed in the primary financial statements of the company.

The following section provides an explanation of the composition of those capital management measures if not previously provided:

"Adjusted funds flow" is used

by Enerplus and is useful to investors and securities analysts, in analyzing operating and financial performance, leverage and liquidity.

The most directly comparable GAAP measure is cash flow from operating activities. Adjusted funds flow is calculated as cash flow from

operating activities before asset retirement obligation expenditures and changes in non-cash operating working capital.

"Net debt" is calculated as current

and long-term debt associated with senior notes plus any outstanding bank credit facilities balances, less cash and cash equivalents.

"Net debt" is useful to investors and securities analysts in analyzing financial liquidity and Enerplus considers net debt to

be a key measure of capital management. For further details, see Note 5 to the Interim Financial Statements.

"Net debt to adjusted funds flow ratio"

is used by Enerplus and is useful to investors and securities analysts in analyzing leverage and liquidity. The net debt to adjusted funds

flow ratio is calculated as net debt divided by a trailing twelve months of adjusted funds flow. There is no directly comparable GAAP

equivalent for this measure, and it is not equivalent to any of our debt covenants.

SUPPLEMENTARY FINANCIAL MEASURES

Supplementary financial measures are financial measures

disclosed by a company that (a) are, or are intended to be, disclosed on a periodic basis to depict the historical or expected future

financial performance, financial position or cash flow of a company, (b) are not disclosed in the financial statements of the company,

(c) are not non-GAAP financial measures, and (d) are not non-GAAP ratios. The following section provides an explanation of the composition

of those supplementary financial measures if not previously provided:

"Capital spending" Capital and office

expenditures, excluding other capital assets/office capital and property and land acquisitions and divestments.

"Cash general and administrative expenses"

or "Cash G&A expenses" General and administrative expenses that are settled through cash payout, as opposed to expenses

that relate to accretion or other non-cash allocations that are recorded as part of general and administrative expenses.

Electronic copies of Enerplus' 2023 interim and 2022

annual Financial Statements and associated MD&As, along with other public information including investor presentations, are or will

be available on the Company's website at www.enerplus.com. For further information, please contact Investor Relations at 1-800-319-6462

or email investorrelations@enerplus.com.

SOURCE Enerplus Corporation

View original content: http://www.newswire.ca/en/releases/archive/November2023/02/c2089.html

%CIK: 0001126874

For further information: Investor Contacts: Drew Mair, 403-298-1707;

Krista Norlin, 403-298-4304

CO: Enerplus Corporation

CNW 17:00e 02-NOV-23

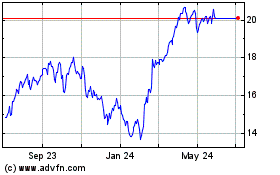

Enerplus (NYSE:ERF)

Historical Stock Chart

From Apr 2024 to May 2024

Enerplus (NYSE:ERF)

Historical Stock Chart

From May 2023 to May 2024