Earnings Preview: Ecolab - Analyst Blog

February 27 2012 - 10:00AM

Zacks

Leading cleaning and sanitation

products maker Ecolab Inc. (ECL) is scheduled to

reveal its fourth-quarter fiscal 2011 results before the opening

gong on Tuesday, February 28. The Minnesota-based company envisions

adjusted earnings between 69 cents and 71 cents a share for the

quarter.

The forecast assumes a dilution of

roughly 20 cents a share, primarily associated with merger and

integration costs related to the company’s buyout of water

treatment company Nalco Holding. Analysts polled by Zacks are

currently looking for revenues and earnings per share of $1,934

million and 70 cents, respectively, for the quarter.

With respect to earnings surprises,

Ecolab has met the Zacks Consensus Estimates in the last two

quarters while it has beaten and trailed the estimates on two other

occasions. Ecolab has produced an average positive earnings

surprise of 0.32% over the last four quarters, implying that it has

beaten the Zacks Consensus Estimate by that measure.

Third Quarter

Flashback

Ecolab’s third quarter earnings per

share of 75 cents were in line with the Zacks Consensus Estimate.

Profit fell 11% year over year as double-digit growth in sales was

eclipsed by charges associated with the company’s European

restructuring and acquisition.

Revenues for the quarter climbed

11% year over year to $1,736.1 million, matching the Zacks

Consensus Estimate. Sales were boosted by healthy growth at the

company’s Food & Beverage business coupled with contributions

from Asia-Pacific, Canada and Latin American operations.

Acquisitions and new products also aided growth.

Hefty restructuring charges

contributed to the decline in margins. The company tightened its

earnings forecast for fiscal 2011.

Estimate Revisions

Trend

Agreement

Estimates for the December quarter

elicit an absolute lack of activity with no movements in either

direction over the last week and month. An identical trend applies

for the estimates for fiscal 2011.

Magnitude

Given the lack of analyst revision,

estimates for the fourth quarter and fiscal 2011 have been

stationary over the last 7 and 30 days. The current Zacks Consensus

Estimate for 2011 is $2.54, representing an estimated

year-over-year growth of 14.01%.

Our View

Ecolab’s strong international

presence has been driving growth and we believe will continue doing

so in the December quarter, buoyed by emerging markets.

Asia-Pacific and Latin America represent the key growth engine for

the company’s overseas operations. Moreover, the uptick in hotel

lodging demand and favorable food and beverage market trends

represents healthy tailwinds.

Ecolab expects profit in the fourth

quarter to be boosted by higher sales volume, pricing, margin

leverage, new products as well as synergies from acquisitions and

European restructuring.

Management remains optimistic

regarding improvement in end-market demand, its ability to attract

new customers, and opportunities for greater customer penetration

through new product development. Ecolab is also active on the

acquisition front and continues to explore opportunities to expand

into emerging markets.

To drive efficiency and

profitability, Ecolab is restructuring its European business. The

restructuring, once completed, would fetch annual cost savings of

more than $120 million. Ecolab also remains committed to delivering

incremental returns to investors, leveraging a solid balance sheet

and healthy cash flows.

While we derive comfort from

Ecolab’s strong international exposure and recovery across its

end-markets, we remain wary about aggressive competition and the

impact of foreign exchange movements on overseas sales. The

company’s U.S. Cleaning & Sanitizing and International

divisions face stiff competition from Clorox (CLX)

and Church & Dwight (CHD).

Although Ecolab is employing

effective pricing strategies to offset raw material inflation, raw

material costs are expected to impact results in the fourth

quarter. We are also aware of the dilutive impact of the hefty

restructuring expenses on the company’s bottom line. Our Neutral

recommendation on the stock is supported by a short-term Zacks #3

Rank (Hold).

CHURCH & DWIGHT (CHD): Free Stock Analysis Report

CLOROX CO (CLX): Free Stock Analysis Report

ECOLAB INC (ECL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

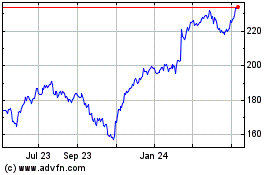

Ecolab (NYSE:ECL)

Historical Stock Chart

From Jul 2024 to Aug 2024

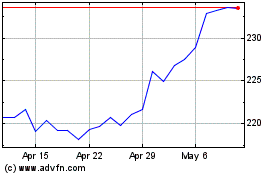

Ecolab (NYSE:ECL)

Historical Stock Chart

From Aug 2023 to Aug 2024