0001319947false00013199472023-12-052023-12-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 5, 2023

Designer Brands Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| | | | | |

| Ohio | | 001-32545 | | 31-0746639 |

| (State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

| | | |

810 DSW Drive, Columbus, Ohio | | 43219 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (614) 237-7100 | | |

| |

| N/A |

| (Former name or former address if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Shares, without par value | DBI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On December 5, 2023, Designer Brands Inc. (the "Company") issued a press release announcing its consolidated financial results for the quarter ended October 28, 2023. A copy of the press release is attached as Exhibit 99.1 hereto and incorporated by reference herein. A copy of the press release is furnished herewith as Exhibit 99.1. Information on the Company’s website is not, and will not be deemed to be, a part of this Current Report on Form 8-K or incorporated into any other filings the Company may make with the Securities and Exchange Commission.

Pursuant to General Instruction B.2 of Current Report on Form 8-K, the information in this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of such section. Furthermore, the information in this Item 2.02 shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | Designer Brands Inc. |

| | | By: | /s/ Michelle C. Krall |

| | | | Michelle C. Krall |

| | | | Senior Vice President, Chief Legal Officer and Corporate Secretary |

| | | | |

| Date: | December 5, 2023 | | | |

Designer Brands Inc. Reports Third Quarter 2023 Financial Results

COLUMBUS, Ohio, December 5, 2023 - Designer Brands Inc. (NYSE: DBI) (the "Company" and "Designer Brands"), one of the world's largest designers, producers, and retailers of footwear and accessories, announced financial results for the third quarter ended October 28, 2023.

"This quarter, we were impacted by a footwear market that contracted for the first time since COVID coupled with unseasonably warm weather, which significantly reduced customer demand for shoes and pressured our heavily seasonal assortment," stated Doug Howe, Chief Executive Officer. “We saw improved performance in casual and clearance categories this quarter, but this was not enough to offset the broader lack of demand. While macro pressures notably impacted our business, we clearly recognize the need to operate with even greater speed and increase the level of innovation, newness, and fashion into our assortments, returning to our roots as a merchant organization and a fashion footwear retailer."

Howe continued, "As we look ahead, we do not anticipate pressures alleviating in the near-term, and we will continue to adjust accordingly. Our team is already executing several initiatives to address areas for improvement within our business. Ongoing refreshment of our assortment, including new specialty sizes, and new marketing initiatives are two ways we are actively reinforcing our business as the best in shoes. We have also made some difficult decisions regarding leadership across our organization and believe that we are making progress in positioning our business well for the long-term while continuing to generate strong cash flow and ample liquidity."

Third Quarter Operating Results (Unless otherwise stated, all comparisons are to the third quarter of 2022)

•Net sales decreased 9.1% to $786.3 million.

•Total comparable sales decreased by 9.3%.

•Gross profit decreased to $256.4 million versus $285.8 million last year, and gross margin was 32.6% compared to 33.0% for the same period last year.

•Reported net income attributable to Designer Brands Inc. was $10.1 million, or diluted earnings per share ("EPS") of $0.17, including net after-tax charges of $0.07 per diluted share from adjusted items, primarily related to restructuring, integration, and Chief Executive Officer ("CEO") transition costs as well as valuation allowance change on deferred tax assets.

•Adjusted net income was $14.8 million, or adjusted diluted EPS of $0.24.

Liquidity

•Cash and cash equivalents totaled $54.6 million at the end of the third quarter of 2023, compared to $62.5 million at the end of the same period last year, with $213.3 million available for borrowings under our senior secured asset-based revolving credit facility and $85.0 million available for borrowings under our new senior secured term loan credit agreement ("Term Loan"). On October 31, 2023, we borrowed an additional $25.0 million under the Term Loan with any remaining borrowings to be taken by January 31, 2024. Debt totaled $375.5 million at the end of the third quarter of 2023 compared to $415.5 million at the end of the same period last year.

•Net cash provided by operating activities was $202.5 million for the first nine months of 2023 compared to $37.9 million during the same period last year.

•The Company ended the third quarter with inventories of $601.5 million compared to $681.8 million at the end of the same period last year.

Return to Shareholders

•During the third quarter of 2023, the Company repurchased an aggregate 7.6 million Class A common shares at an aggregate cost of $79.7 million, including transaction costs and excise tax. As of October 28, 2023, $87.7 million of Class A common shares remained available for repurchase under the share repurchase program.

•A dividend of $0.05 per share of Class A and Class B common shares will be paid on December 14, 2023 to shareholders of record at the close of business on November 30, 2023.

Store Openings and Closings

During the third quarter of 2023, we opened one store in the U.S. and six stores in Canada, resulting in a total of 499 U.S. stores and 144 Canadian stores as of October 28, 2023.

Updated 2023 Financial Outlook

The Company is reaffirming the following guidance for the full year 2023:

| | | | | | | | | | | | | | | | |

| Metric | | | | Previous Guidance | | Current Guidance |

| Net Sales: | | | | | | |

| Designer Brands net sales growth, excluding Keds | | | | Down mid- to high-single digits | | Down high-single digits |

| Incremental net sales from Keds acquisition | | | | $75.0 million to $85.0 million | | $60.0 million to $70.0 million |

| Diluted EPS: | | | | | | |

| Designer Brands, excluding Keds | | | | $1.20 - $1.50 | | $0.40 - $0.70 |

| Contribution from Keds acquisition | | | | ~$0.00 | | ~$0.00 |

Webcast and Conference Call

The Company is hosting a conference call today at 8:30 am Eastern Time. Investors and analysts interested in participating in the call are invited to dial 1-888-317-6003, or the international dial in, 1-412-317-6061, and reference conference ID number 7417878 approximately ten minutes prior to the start of the conference call. The conference call will also be broadcast live over the internet and can be accessed through the following link, as well as through the Company's investor website at investors.designerbrands.com:

https://app.webinar.net/06YrEpem8ZW

For those unable to listen to the live webcast, an archived version will be available at the same location until December 19, 2023. A replay of the teleconference will be available by dialing the following numbers:

U.S.: 1-877-344-7529

Canada: 1-855-669-9658

International: 1-412-317-0088

Passcode: 1276880

Important information may be disseminated initially or exclusively via the Company’s investor website; investors should consult the site to access this information.

About Designer Brands

Designer Brands is one of the world's largest designers, producers, and retailers of the most recognizable footwear brands and accessories, transforming and defining the footwear industry through a mission of inspiring self-expression. With a diversified, world-class portfolio of coveted brands, including Keds, Lucky Brand, Crown Vintage, Vince Camuto, Topo Athletic, Jessica Simpson, Le Tigre and others, Designer Brands designs and produces on-trend footwear and accessories for all of life's occasions delivered to the consumer through a robust direct-to-consumer omni-channel infrastructure and powerful national wholesale distribution. Powered by a billion-dollar digital commerce business across multiple domains and over 640 DSW Designer Shoe Warehouse and The Shoe Company stores in North America, Designer Brands delivers current, in-line footwear and accessories from the largest national brands in the industry and holds leading market share positions in key product categories across Women's, Men's, and Kids'. Designer Brands also distributes its brands internationally through select wholesale and distributor relationships while also leveraging design and sourcing expertise to build private label product for national retailers. Designer Brands is committed to being a difference maker in the world, taking steps forward to advance diversity, equity, and inclusion in the footwear industry and supporting a global community and the health of the planet by donating approximately nine million pairs of shoes to the global non-profit Soles4Souls. To learn more, visit www.designerbrands.com.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

Certain statements in this press release may constitute forward-looking statements and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by the use of forward-looking words such as "outlook," "could," "believes," "expects," "potential," "continues," "may," "will," "should," "would," "seeks," "approximately," "predicts," "intends," "plans," "estimates," "anticipates," or the negative version of those words or other comparable words. These statements are based on the Company's current views and expectations and involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. These factors include, but are not limited to: uncertain general economic conditions, including recession concerns, inflationary pressures and

rising interest rates, and the related impacts to consumer discretionary spending; supply chain challenges; risks related to adverse public health developments; our ability to anticipate and respond to fashion trends, consumer preferences and changing customer expectations; our ability to maintain strong relationships with our vendors, manufacturers, licensors, and retailer customers; risks related to losses or disruptions associated with our distribution systems, including our distribution centers and stores, whether as a result of reliance on third-party providers, or otherwise; our ability to retain our existing management team, and continue to attract qualified new personnel; risks related to cyber security threats and privacy or data security breaches or the potential loss or disruption of our information technology ("IT") systems; risks related to the implementation of an enterprise resource planning system software solution and other IT systems; our reliance on our loyalty programs and marketing to drive traffic, sales, and customer loyalty; our ability to protect our reputation and to maintain the brands we license; our competitiveness with respect to style, price, brand availability, and customer service; risks related to our international operations, including international trade, our reliance on foreign sources for merchandise, exposure to political, economic, operational, compliance and other risks, and fluctuations in foreign currency exchange rates; our ability to comply with privacy laws and regulations, as well as other legal obligations; domestic and global political and social conditions; geopolitical tensions, including relating to the ongoing war in Ukraine and the Israel-Hamas war; risks associated with climate change and other corporate responsibility issues; and uncertainties related to future legislation, regulatory reform, policy changes, or interpretive guidance on existing legislation. Risks and other factors that could cause our actual results to differ materially from our forward-looking statements are described in the Company's latest Annual Report on Form 10-K or other reports made or filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the time when made. The Company undertakes no obligation to update or revise the forward-looking statements included in this press release to reflect any future events or circumstances.

DESIGNER BRANDS INC.

SEGMENT RESULTS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Sales |

| Three months ended | | | | |

| (dollars in thousands) | October 28, 2023 | | October 29, 2022 | | Change |

| Amount | | % of Segment Net Sales | | Amount | | % of Segment Net Sales | | Amount | | % |

| Segment net sales: | | | | | | | | | | | |

| U.S. Retail | $ | 631,610 | | | 78.8 | % | | $ | 706,391 | | | 78.8 | % | | $ | (74,781) | | | (10.6) | % |

| Canada Retail | 75,610 | | | 9.5 | % | | 82,289 | | | 9.2 | % | | (6,679) | | | (8.1) | % |

Brand Portfolio | 94,057 | | | 11.7 | % | | 107,458 | | | 12.0 | % | | (13,401) | | | (12.5) | % |

| Total segment net sales | 801,277 | | | 100.0 | % | | 896,138 | | | 100.0 | % | | (94,861) | | | (10.6) | % |

| Elimination of intersegment net sales | (14,948) | | | | | (31,118) | | | | | 16,170 | | | (52.0) | % |

| Consolidated net sales | $ | 786,329 | | | | | $ | 865,020 | | | | | $ | (78,691) | | | (9.1) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine months ended | | |

| (dollars in thousands) | October 28, 2023 | | October 29, 2022 | | Change |

| Amount | | % of Segment Net Sales | | Amount | | % of Segment Net Sales | | Amount | | % |

| Segment net sales: | | | | | | | | | | | |

| U.S. Retail | $ | 1,903,038 | | | 80.2 | % | | $ | 2,143,199 | | | 81.5 | % | | $ | (240,161) | | | (11.2) | % |

| Canada Retail | 199,831 | | | 8.4 | % | | 216,888 | | | 8.2 | % | | (17,057) | | | (7.9) | % |

Brand Portfolio | 271,257 | | | 11.4 | % | | 271,265 | | | 10.3 | % | | (8) | | | — | % |

| Total segment net sales | 2,374,126 | | | 100.0 | % | | 2,631,352 | | | 100.0 | % | | (257,226) | | | (9.8) | % |

| Elimination of intersegment net sales | (53,498) | | | | | (76,470) | | | | | 22,972 | | | (30.0) | % |

| Consolidated net sales | $ | 2,320,628 | | | | | $ | 2,554,882 | | | | | $ | (234,254) | | | (9.2) | % |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Sales by Brand Categories |

| (in thousands) | U.S. Retail | | Canada Retail | | Brand Portfolio | | Eliminations | | Consolidated |

| Three months ended October 28, 2023 | | | | | | | | | |

Owned Brands:(1) | | | | | | | | | |

| Direct-to-consumer | $ | 123,973 | | | $ | — | | | $ | 17,204 | | | $ | — | | | $ | 141,177 | |

| External customer wholesale, commission income, and other | — | | | — | | | 61,905 | | | — | | | 61,905 | |

| Intersegment wholesale and commission income | — | | | — | | | 14,948 | | | (14,948) | | | — | |

| Total Owned Brands | 123,973 | | | — | | | 94,057 | | | (14,948) | | | 203,082 | |

| National brands | 507,637 | | | — | | | — | | | — | | | 507,637 | |

Canada Retail(2) | — | | | 75,610 | | | — | | | — | | | 75,610 | |

| Total net sales | $ | 631,610 | | | $ | 75,610 | | | $ | 94,057 | | | $ | (14,948) | | | $ | 786,329 | |

| Three months ended October 29, 2022 | | | | | | | | | |

Owned Brands:(1) | | | | | | | | | |

| Direct-to-consumer | $ | 153,311 | | | $ | — | | | $ | 9,810 | | | $ | — | | | $ | 163,121 | |

| External customer wholesale, commission income, and other | — | | | — | | | 66,530 | | | — | | | 66,530 | |

| Intersegment wholesale and commission income | — | | | — | | | 31,118 | | | (31,118) | | | — | |

| Total Owned Brands | 153,311 | | | — | | | 107,458 | | | (31,118) | | | 229,651 | |

| National brands | 553,080 | | | — | | | — | | | — | | | 553,080 | |

Canada Retail(2) | — | | | 82,289 | | | — | | | — | | | 82,289 | |

| Total net sales | $ | 706,391 | | | $ | 82,289 | | | $ | 107,458 | | | $ | (31,118) | | | $ | 865,020 | |

| Nine months ended October 28, 2023 | | | | | | | | | |

Owned Brands:(1) | | | | | | | | | |

| Direct-to-consumer | $ | 362,931 | | | $ | — | | | $ | 43,604 | | | $ | — | | | $ | 406,535 | |

| External customer wholesale, commission income, and other | — | | | — | | | 174,155 | | | — | | | 174,155 | |

| Intersegment wholesale and commission income | — | | | — | | | 53,498 | | | (53,498) | | | — | |

| Total Owned Brands | 362,931 | | | — | | | 271,257 | | | (53,498) | | | 580,690 | |

| National brands | 1,540,107 | | | — | | | — | | | — | | | 1,540,107 | |

Canada Retail(2) | — | | | 199,831 | | | — | | | — | | | 199,831 | |

| Total net sales | $ | 1,903,038 | | | $ | 199,831 | | | $ | 271,257 | | | $ | (53,498) | | | $ | 2,320,628 | |

| Nine months ended October 29, 2022 | | | | | | | | | |

Owned Brands:(1) | | | | | | | | | |

| Direct-to-consumer | $ | 440,343 | | | $ | — | | | $ | 24,130 | | | $ | — | | | $ | 464,473 | |

| External customer wholesale, commission income, and other | — | | | — | | | 170,665 | | | — | | | 170,665 | |

| Intersegment wholesale and commission income | — | | | — | | | 76,470 | | | (76,470) | | | — | |

| Total Owned Brands | 440,343 | | | — | | | 271,265 | | | (76,470) | | | 635,138 | |

| National brands | 1,702,856 | | | — | | | — | | | — | | | 1,702,856 | |

Canada Retail(2) | — | | | 216,888 | | | — | | | — | | | 216,888 | |

| Total net sales | $ | 2,143,199 | | | $ | 216,888 | | | $ | 271,265 | | | $ | (76,470) | | | $ | 2,554,882 | |

| | | | | | | | | |

(1) "Owned Brands" refers to those brands we have rights to sell through ownership or license arrangements. Beginning in the first quarter of 2023, sales of the Keds brand are included in Owned Brands as a result of our acquisition of Keds. Sales of the Keds brand in periods prior to the first quarter of 2023 are not restated, as this brand was considered a national brand during those periods.

(2) We currently do not report the Canada Retail segment net sales by brand categories.

| | | | | | | | | | | | | | | | | | | | | | | |

| Comparable Sales |

| Three months ended | | Nine months ended |

| October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| Change in comparable sales: | | | | | | | |

| U.S. Retail segment | (9.8) | % | | 1.1 | % | | (10.2) | % | | 5.5 | % |

| Canada Retail segment | (7.7) | % | | 18.8 | % | | (4.8) | % | | 33.5 | % |

| Brand Portfolio segment - direct-to-consumer channel | 7.0 | % | | 27.0 | % | | 6.0 | % | | 29.6 | % |

| Total | (9.3) | % | | 3.0 | % | | (9.5) | % | | 7.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Store Count |

| (square footage in thousands) | October 28, 2023 | | October 29, 2022 |

| Number of Stores | | Square Footage | | Number of Stores | | Square Footage |

| U.S. Retail segment - DSW stores | 499 | | | 9,966 | | | 504 | | | 10,188 | |

| Canada Retail segment: | | | | | | | |

| The Shoe Company stores | 119 | | | 622 | | | 113 | | | 596 | |

| DSW stores | 25 | | | 496 | | | 25 | | | 496 | |

| 144 | | | 1,118 | | | 138 | | | 1,092 | |

| Total number of stores | 643 | | | 11,084 | | | 642 | | | 11,280 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross Profit |

| Three months ended | | | | | | |

| (dollars in thousands) | October 28, 2023 | | October 29, 2022 | | Change |

| Amount | | % of Segment Net Sales | | Amount | | % of Segment Net Sales | | Amount | | % | | Basis Points |

| Segment gross profit: | | | | | | | | | | | | | |

| U.S. Retail | $ | 200,268 | | | 31.7 | % | | $ | 232,058 | | | 32.9 | % | | $ | (31,790) | | | (13.7) | % | | (120) |

| Canada Retail | 26,606 | | | 35.2 | % | | 31,298 | | | 38.0 | % | | (4,692) | | | (15.0) | % | | (280) |

| Brand Portfolio | 28,654 | | | 30.5 | % | | 23,839 | | | 22.2 | % | | 4,815 | | | 20.2 | % | | 830 |

| Total segment gross profit | 255,528 | | | 31.9 | % | | 287,195 | | | 32.0 | % | | (31,667) | | | (11.0) | % | | (10) |

| Net recognition (elimination) of intersegment gross profit | 878 | | | | | (1,376) | | | | | 2,254 | | | | | |

| Consolidated gross profit | $ | 256,406 | | | 32.6 | % | | $ | 285,819 | | | 33.0 | % | | $ | (29,413) | | | (10.3) | % | | (40) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine months ended | | |

| (dollars in thousands) | October 28, 2023 | | October 29, 2022 | | Change |

| Amount | | % of Segment Net Sales | | Amount | | % of Segment Net Sales | | Amount | | % | | Basis Points |

| Segment gross profit: | | | | | | | | | | | | | |

| U.S. Retail | $ | 622,850 | | | 32.7 | % | | $ | 716,268 | | | 33.4 | % | | $ | (93,418) | | | (13.0) | % | | (70) |

| Canada Retail | 67,591 | | | 33.8 | % | | 81,145 | | | 37.4 | % | | (13,554) | | | (16.7) | % | | (360) |

| Brand Portfolio | 75,037 | | | 27.7 | % | | 59,975 | | | 22.1 | % | | 15,062 | | | 25.1 | % | | 560 |

| Total segment gross profit | 765,478 | | | 32.2 | % | | 857,388 | | | 32.6 | % | | (91,910) | | | (10.7) | % | | (40) |

| Net recognition (elimination) of intersegment gross profit | 2,054 | | | | | (154) | | | | | 2,208 | | | | | |

| Consolidated gross profit | $ | 767,532 | | | 33.1 | % | | $ | 857,234 | | | 33.6 | % | | $ | (89,702) | | | (10.5) | % | | (50) |

| | | | | | | | | | | |

| Intersegment Eliminations |

| Three months ended |

| (in thousands) | October 28, 2023 | | October 29, 2022 |

| Intersegment recognition and elimination activity: | | | |

| Net sales recognized by Brand Portfolio segment | $ | (14,948) | | | $ | (31,118) | |

| Cost of sales: | | | |

| Cost of sales recognized by Brand Portfolio segment | 9,857 | | | 21,426 | |

| Recognition of intersegment gross profit for inventory previously purchased that was subsequently sold to external customers during the current period | 5,969 | | | 8,316 | |

| $ | 878 | | | $ | (1,376) | |

| | | | | | | | | | | |

| Nine months ended |

| (in thousands) | October 28, 2023 | | October 29, 2022 |

| Intersegment recognition and elimination activity: | | | |

| Net sales recognized by Brand Portfolio segment | $ | (53,498) | | | $ | (76,470) | |

| Cost of sales: | | | |

| Cost of sales recognized by Brand Portfolio segment | 38,134 | | | 52,149 | |

| Recognition of intersegment gross profit for inventory previously purchased that was subsequently sold to external customers during the current period | 17,418 | | | 24,167 | |

| $ | 2,054 | | | $ | (154) | |

DESIGNER BRANDS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited and in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| Net sales | $ | 786,329 | | | $ | 865,020 | | | $ | 2,320,628 | | | $ | 2,554,882 | |

| Cost of sales | (529,923) | | | (579,201) | | | (1,553,096) | | | (1,697,648) | |

| Gross profit | 256,406 | | | 285,819 | | | 767,532 | | | 857,234 | |

| Operating expenses | (230,788) | | | (222,232) | | | (665,437) | | | (674,348) | |

| Income from equity investments | 2,503 | | | 2,290 | | | 6,972 | | | 6,670 | |

| Impairment charges | — | | | (1,349) | | | (649) | | | (4,237) | |

| Operating profit | 28,121 | | | 64,528 | | | 108,418 | | | 185,319 | |

| Interest expense, net | (8,767) | | | (4,826) | | | (22,296) | | | (10,530) | |

| Loss on extinguishment of debt and write-off of debt issuance costs | — | | | — | | | — | | | (12,862) | |

| Non-operating income (expense), net | (162) | | | (152) | | | 83 | | | (109) | |

| Income before income taxes | 19,192 | | | 59,550 | | | 86,205 | | | 161,818 | |

| Income tax provision | (8,987) | | | (14,379) | | | (27,372) | | | (44,252) | |

| Net income | 10,205 | | | 45,171 | | | 58,833 | | | 117,566 | |

| Net income attributable to redeemable noncontrolling interest | (64) | | | — | | | (73) | | | — | |

| Net income attributable to Designer Brands Inc. | $ | 10,141 | | | $ | 45,171 | | | $ | 58,760 | | | $ | 117,566 | |

| Diluted earnings per share attributable to Designer Brands Inc. | $ | 0.17 | | | $ | 0.65 | | | $ | 0.90 | | | $ | 1.60 | |

| Weighted average diluted shares | 61,405 | | | 69,140 | | | 65,292 | | | 73,287 | |

DESIGNER BRANDS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited and in thousands)

| | | | | | | | | | | | | | | | | |

| October 28, 2023 | | January 28, 2023 | | October 29, 2022 |

| ASSETS | | | | | |

| Current assets: | | | | | |

| Cash and cash equivalents | $ | 54,638 | | | $ | 58,766 | | | $ | 62,507 | |

| Receivables, net | 106,916 | | | 77,763 | | | 228,746 | |

| Inventories | 601,470 | | | 605,652 | | | 681,843 | |

| Prepaid expenses and other current assets | 36,785 | | | 47,750 | | | 53,950 | |

| Total current assets | 799,809 | | | 789,931 | | | 1,027,046 | |

| Property and equipment, net | 224,638 | | | 235,430 | | | 233,515 | |

| Operating lease assets | 742,384 | | | 700,373 | | | 691,032 | |

| Goodwill | 123,759 | | | 97,115 | | | 93,655 | |

| Intangible assets, net | 83,032 | | | 31,866 | | | 19,273 | |

| Deferred tax assets | 47,199 | | | 48,285 | | | — | |

| Equity investments | 62,239 | | | 63,820 | | | 64,246 | |

| Other assets | 49,518 | | | 42,798 | | | 42,611 | |

| Total assets | $ | 2,132,578 | | | $ | 2,009,618 | | | $ | 2,171,378 | |

| LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST AND SHAREHOLDERS' EQUITY | | | | | |

| Current liabilities: | | | | | |

| Accounts payable | $ | 310,113 | | | $ | 255,364 | | | $ | 315,996 | |

| Accrued expenses | 183,383 | | | 190,676 | | | 213,905 | |

| Current maturities of long-term debt | 2,500 | | | — | | | — | |

| Current operating lease liabilities | 182,259 | | | 190,086 | | | 187,619 | |

| Total current liabilities | 678,255 | | | 636,126 | | | 717,520 | |

| Long-term debt | 372,965 | | | 281,035 | | | 415,467 | |

| Non-current operating lease liabilities | 669,494 | | | 631,412 | | | 628,820 | |

| Other non-current liabilities | 21,072 | | | 24,989 | | | 26,059 | |

| Total liabilities | 1,741,786 | | | 1,573,562 | | | 1,787,866 | |

| Redeemable noncontrolling interest | 3,208 | | | 3,155 | | | — | |

| Total shareholders' equity | 387,584 | | | 432,901 | | | 383,512 | |

| Total liabilities, redeemable noncontrolling interest, and shareholders' equity | $ | 2,132,578 | | | $ | 2,009,618 | | | $ | 2,171,378 | |

DESIGNER BRANDS INC.

NON-GAAP RECONCILIATION

(unaudited and in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| Operating expenses | $ | (230,788) | | | $ | (222,232) | | | $ | (665,437) | | | $ | (674,348) | |

| Non-GAAP adjustments: | | | | | | | |

| CEO transition costs | 1,029 | | | — | | | 3,983 | | | — | |

| Restructuring and integration costs | 2,252 | | | 850 | | | 5,190 | | | 2,456 | |

| Acquisition-related costs | — | | | 400 | | | 1,597 | | | 400 | |

| | | | | | | |

| Total non-GAAP adjustments | 3,281 | | | 1,250 | | | 10,770 | | | 2,856 | |

| Adjusted operating expenses | $ | (227,507) | | | $ | (220,982) | | | $ | (654,667) | | | $ | (671,492) | |

| Operating profit | $ | 28,121 | | | $ | 64,528 | | | $ | 108,418 | | | $ | 185,319 | |

| Non-GAAP adjustments: | | | | | | | |

| CEO transition costs | 1,029 | | | — | | | 3,983 | | | — | |

| Restructuring and integration costs | 2,252 | | | 850 | | | 5,190 | | | 2,456 | |

| Acquisition-related costs | — | | | 400 | | | 1,597 | | | 400 | |

| | | | | | | |

| Impairment charges | — | | | 1,349 | | | 649 | | | 4,237 | |

| Total non-GAAP adjustments | 3,281 | | | 2,599 | | | 11,419 | | | 7,093 | |

| Adjusted operating profit | $ | 31,402 | | | $ | 67,127 | | | $ | 119,837 | | | $ | 192,412 | |

| Net income attributable to Designer Brands Inc. | $ | 10,141 | | | $ | 45,171 | | | $ | 58,760 | | | $ | 117,566 | |

| Non-GAAP adjustments: | | | | | | | |

| CEO transition costs | 1,029 | | | — | | | 3,983 | | | — | |

| Restructuring and integration costs | 2,252 | | | 850 | | | 5,190 | | | 2,456 | |

| Acquisition-related costs | — | | | 400 | | | 1,597 | | | 400 | |

| | | | | | | |

Impairment charges | — | | | 1,349 | | | 649 | | | 4,237 | |

| Loss on extinguishment of debt and write-off of debt issuance costs | — | | | — | | | — | | | 12,862 | |

| Foreign currency transaction losses (gains) | 162 | | | 152 | | | (83) | | | 109 | |

| Total non-GAAP adjustments before tax effect | 3,443 | | | 2,751 | | | 11,336 | | | 20,064 | |

| Tax effect on above non-GAAP adjustments | (853) | | | (711) | | | (2,885) | | | (5,085) | |

| Discrete and permanent tax on non-deductible CEO transition costs | 907 | | | — | | | 2,804 | | | — | |

| Valuation allowance change on deferred tax assets | 1,109 | | | (1,070) | | | (1,615) | | | (3,565) | |

| Total non-GAAP adjustments, after tax | 4,606 | | | 970 | | | 9,640 | | | 11,414 | |

| Net income attributable to redeemable noncontrolling interest | 64 | | | — | | | 73 | | | — | |

| Adjusted net income | $ | 14,811 | | | $ | 46,141 | | | $ | 68,473 | | | $ | 128,980 | |

| Diluted earnings per share | $ | 0.17 | | | $ | 0.65 | | | $ | 0.90 | | | $ | 1.60 | |

| Adjusted diluted earnings per share | $ | 0.24 | | | $ | 0.67 | | | $ | 1.05 | | | $ | 1.76 | |

Non-GAAP Measures

To supplement amounts presented in our consolidated financial statements determined in accordance with accounting principles generally accepted in the United States ("GAAP"), the Company uses certain non-GAAP financial measures, including adjusted operating expenses, adjusted operating profit, adjusted net income, and adjusted diluted earnings per share as shown in the table above. These measures adjust for the effects of: (1) CEO transition costs; (2) restructuring and integration costs, including severance charges other than those included in CEO transition costs; (3) acquisition-related costs; (4) impairment charges; (5) loss on extinguishment of debt and write-off of debt issuance costs; (6) foreign currency transaction losses (gains); (7) the net tax impact of such items, including discrete and permanent tax on non-deductible CEO transition costs; (8) the change in the valuation allowance on deferred tax assets; and (9) net income attributable to redeemable noncontrolling interest. The unaudited adjusted results should not be construed as an alternative to the reported results determined in accordance with GAAP. These financial measures are not based on any standardized methodology and are not necessarily comparable to similar measures presented by other companies. The Company believes these non-GAAP financial measures provide useful information to both management and investors to increase comparability to prior periods by adjusting for certain items that may not be indicative of core operating measures and to better identify trends in our business. The adjusted financial results are used by management to, and allow investors to, evaluate the operating performance of the Company compared to prior periods, when reviewed in conjunction with the Company’s GAAP statements. These amounts are not determined in accordance with GAAP and therefore should not be used exclusively in evaluating the Company’s business and operations.

Comparable Sales Performance Metric

We consider the percent change in comparable sales from the same previous year period, a primary metric commonly used throughout the retail industry, to be an important measurement for management and investors of the performance of our direct-to-consumer businesses. We include in our comparable sales metric sales from stores in operation for at least 14 months at the beginning of the applicable year. Stores are added to the comparable base at the beginning of the year and are dropped for comparative purposes in the quarter in which they are closed. Comparable sales include the e-commerce sales of the U.S. Retail and Canada Retail segments. Comparable sales for the Canada Retail segment exclude the impact of foreign currency translation and are calculated by translating

current period results at the foreign currency exchange rate used in the comparable period of the prior year. Comparable sales include the e-commerce sales of the Brand Portfolio segment from the direct-to-consumer e-commerce site for the Vince Camuto brand. The e-commerce sales for Topo, Keds, and Hush Puppies will be added to the comparable base for the Brand Portfolio segment beginning with the first quarter of 2024, the second quarter of 2024, and the third quarter of 2024, respectively. The calculation of comparable sales varies across the retail industry and, as a result, the calculations of other retail companies may not be consistent with our calculation.

CONTACT: Stacy Turnof, DesignerBrandsIR@edelman.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

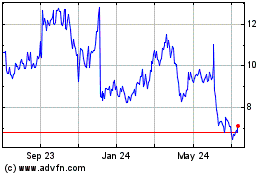

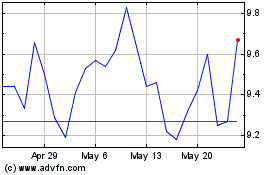

Designer Brands (NYSE:DBI)

Historical Stock Chart

From Apr 2024 to May 2024

Designer Brands (NYSE:DBI)

Historical Stock Chart

From May 2023 to May 2024