0000860546false00008605462023-10-262023-10-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 26, 2023

____________________________________________

COPT DEFENSE PROPERTIES

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 1-14023 | | 23-2947217 |

| (State or other jurisdiction | | (Commission File | | (IRS Employer |

| of incorporation) | | Number) | | Identification No.) |

| | | | | |

6711 Columbia Gateway Drive, Suite 300, Columbia, MD | 21046 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (443) 285-5400

____________________________________________

CORPORATE OFFICE PROPERTIES TRUST

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

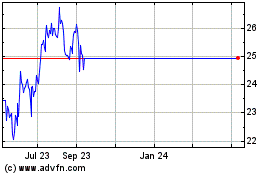

| Common Shares of beneficial interest, $0.01 par value | | CDP | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On October 26, 2023, COPT Defense Properties (the “Company”) issued a press release relating to its financial results for the period ended September 30, 2023 and, in connection with this release, is making available certain supplemental information pertaining to its properties and operations. The earnings release and supplemental information are included as Exhibit 99.1 to this report and are incorporated herein by reference.

The information included herein, including the exhibits, shall not be deemed “filed” for any purpose, including the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or subject to liabilities of that Section. The information included herein, including the exhibits, shall also not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Exhibit Title |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | COPT DEFENSE PROPERTIES |

| |

| |

| |

| |

| /s/ Anthony Mifsud |

| | Anthony Mifsud |

| | Executive Vice President and Chief Financial Officer |

| |

| Date: | October 26, 2023 |

COPT Defense Properties

Supplemental Information + Earnings Release - Unaudited

For the Period Ended 9/30/23

| | | | | | | | | | | | | | | |

| | | | | |

| OVERVIEW | | Summary Description | | | |

| Equity Research Coverage | | |

| Selected Financial Summary Data | | |

| Selected Portfolio Data | | |

| | | | |

| | | | |

| FINANCIAL STATEMENTS | | Consolidated Balance Sheets | | |

| Consolidated Statements of Operations | | |

| Funds from Operations | | |

| Diluted Share + Unit Computations | | |

| Adjusted Funds from Operations | | |

| EBITDAre + Adjusted EBITDA | | |

| | | | |

| | | | |

| PORTFOLIO INFORMATION | | Properties by Segment | | |

| Consolidated Real Estate Revenues + NOI by Segment | | |

| Cash NOI by Segment | | |

| NOI from Real Estate Operations + Occupancy by Property Grouping | | |

| Same Property Average Occupancy Rates by Segment | | |

| Same Property Period End Occupancy Rates by Segment | | |

| Same Property Real Estate Revenues + NOI by Segment | | |

| Same Property Cash NOI by Segment | | |

| Leasing | | |

| Lease Expiration Analysis | | |

| 2024 Defense/IT Portfolio Quarterly Lease Expiration Analysis | | |

| Top 20 Tenants | | |

| | | | |

| | | | |

| INVESTING ACTIVITY | | Property Dispositions | | |

| Summary of Development Projects | | |

| | | |

| Development Placed in Service | | |

| Summary of Land Owned/Controlled | | |

| | | | |

| | | | |

| CAPITALIZATION | | Capitalization Overview | | |

| Summary of Outstanding Debt | | |

| Debt Analysis | | |

| Consolidated Real Estate Joint Ventures | | |

| Unconsolidated Real Estate Joint Ventures | | | Please refer to the section entitled “Definitions” for definitions of non-GAAP measures and other terms we use herein that may not be customary or commonly known. |

| | | | |

| | | | |

| RECONCILIATIONS + DEFINITIONS | | Supplementary Reconciliations of Non-GAAP Measures | | |

|

| Definitions | | |

| | | | |

| EARNINGS RELEASE | | | | |

COPT Defense Properties

Summary Description

THE COMPANY

COPT Defense Properties (the “Company” or “CDP”), an S&P MidCap 400 Company, is a self-managed real estate investment trust (“REIT”) focused on owning, operating and developing properties in locations proximate to, or sometimes containing, key U.S. Government (“USG”) defense installations and missions (which we refer to herein as our Defense/IT Portfolio). Our tenants include the USG and their defense contractors, who are primarily engaged in priority national security activities, and who generally require mission-critical and high security property enhancements. In September 2023, we changed our name from Corporate Office Properties Trust to COPT Defense Properties to better describe our investment strategy’s focus on locations serving our country’s priority defense activities. The ticker symbol under which our common shares are publicly traded on the New York Stock Exchange changed from “OFC” to “CDP”. As of September 30, 2023, our Defense/IT Portfolio of 188 properties, including 24 owned through unconsolidated joint ventures, encompassed 21.3 million square feet and was 97.0% leased.

| | | | | | | | | | | | | | |

| | | | |

| MANAGEMENT | Stephen E. Budorick, President + CEO | | INVESTOR RELATIONS | Venkat Kommineni, VP |

| Anthony Mifsud, EVP + CFO | | 443.285.5587 | venkat.kommineni@copt.com |

| | | |

| | Michelle Layne, Manager |

| | 443.285.5452 | michelle.layne@copt.com |

CORPORATE CREDIT RATING

Fitch: BBB- Stable | Moody’s: Baa3 Stable | S&P: BBB- Stable

DISCLOSURE STATEMENT

This supplemental package contains forward-looking statements within the meaning of the Federal securities laws. Forward-looking statements can be identified by the use of words such as “may,” “will,” “should,” “could,” “believe,” “anticipate,” “expect,” “estimate,” “plan” or other comparable terminology. Forward-looking statements are inherently subject to risks and uncertainties, many of which we cannot predict with accuracy and some of which we might not even anticipate. Although we believe that the expectations, estimates and projections reflected in such forward-looking statements are based on reasonable assumptions at the time made, we can give no assurance that these expectations, estimates and projections will be achieved. Future events and actual results may differ materially from those discussed in the forward-looking statements and we undertake no obligation to update or supplement any forward-looking statements. The areas of risk that may affect these expectations, estimates and projections include, but are not limited to, those risks described in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2022.

COPT Defense Properties

Equity Research Coverage

| | | | | | | | | | | | | | | | | | | | |

|

| Firm | | Senior Analyst | | Phone | | Email |

| Bank of America Securities | | Camille Bonnel | | 416.369.2140 | | camille.bonnel@bofa.com |

| BTIG | | Tom Catherwood | | 212.738.6410 | | tcatherwood@btig.com |

| Citigroup Global Markets | | Michael Griffin | | 212.816.5871 | | michael.a.griffin@citi.com |

| Evercore ISI | | Steve Sakwa | | 212.446.9462 | | steve.sakwa@evercoreisi.com |

| Green Street | | Dylan Burzinski | | 949.640.8780 | | dburzinski@greenstreet.com |

| Jefferies & Co. | | Peter Abramowitz | | 212.336.7241 | | pabramowitz@jefferies.com |

| JP Morgan | | Tony Paolone | | 212.622.6682 | | anthony.paolone@jpmorgan.com |

| Raymond James | | Bill Crow | | 727.567.2594 | | bill.crow@raymondjames.com |

| Truist Securities | | Michael Lewis | | 212.319.5659 | | michael.r.lewis@truist.com |

| Wedbush Securities | | Richard Anderson | | 212.938.9949 | | richard.anderson@wedbush.com |

| Wells Fargo Securities | | Blaine Heck | | 443.263.6529 | | blaine.heck@wellsfargo.com |

With the exception of Green Street, the above-listed firms are those whose analysts publish research material on the Company and whose estimates of our FFO per share can be tracked through Refinitiv. Any opinions, estimates or forecasts the above analysts make regarding CDP’s future performance are their own and do not represent the views, estimates or forecasts of CDP’s management.

COPT Defense Properties

Selected Financial Summary Data

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Page | | Three Months Ended | | Nine Months Ended |

| SUMMARY OF RESULTS | | Refer. | | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| Net (loss) income | | 7 | | $ | (221,207) | | | $ | 31,642 | | | $ | 80,398 | | | $ | 52,087 | | | $ | 32,316 | | | $ | (109,167) | | | $ | 126,735 | |

| NOI from real estate operations | | 13 | | $ | 96,494 | | | $ | 95,024 | | | $ | 93,903 | | | $ | 93,810 | | | $ | 91,096 | | | $ | 285,421 | | | $ | 268,494 | |

| Same Property NOI | | 17 | | $ | 87,176 | | | $ | 86,254 | | | $ | 84,452 | | | $ | 84,795 | | | $ | 84,485 | | | $ | 257,882 | | | $ | 249,518 | |

| Same Property cash NOI | | 18 | | $ | 85,940 | | | $ | 85,037 | | | $ | 83,194 | | | $ | 82,808 | | | $ | 82,228 | | | $ | 254,171 | | | $ | 239,422 | |

| Adjusted EBITDA | | 11 | | $ | 90,260 | | | $ | 89,044 | | | $ | 87,443 | | | $ | 87,787 | | | $ | 86,386 | | | $ | 266,747 | | | $ | 253,922 | |

| | | | | | | | | | | | | | | | |

| FFO per NAREIT | | 8 | | $ | 70,016 | | | $ | 70,033 | | | $ | 68,816 | | | $ | 70,282 | | | $ | 68,071 | | | $ | 208,865 | | | $ | 204,057 | |

| Diluted AFFO avail. to common share and unit holders | | 10 | | $ | 64,122 | | | $ | 46,003 | | | $ | 38,616 | | | $ | 26,122 | | | $ | 53,439 | | | $ | 148,741 | | | $ | 152,291 | |

| Dividend per common share | | N/A | | $ | 0.285 | | | $ | 0.285 | | | $ | 0.285 | | | $ | 0.275 | | | $ | 0.275 | | | $ | 0.855 | | | $ | 0.825 | |

| | | | | | | | | | | | | | | | |

| Per share - diluted: | | | | | | | | | | | | | | | | |

| EPS | | 9 | | $ | (1.94) | | | $ | 0.27 | | | $ | 0.70 | | | $ | 0.45 | | | $ | 0.27 | | | $ | (0.96) | | | $ | 1.08 | |

| FFO - Nareit | | 9 | | $ | 0.60 | | | $ | 0.60 | | | $ | 0.59 | | | $ | 0.60 | | | $ | 0.58 | | | $ | 1.79 | | | $ | 1.75 | |

| FFO - as adjusted for comparability | | 9 | | $ | 0.60 | | | $ | 0.60 | | | $ | 0.59 | | | $ | 0.60 | | | $ | 0.58 | | | $ | 1.79 | | | $ | 1.75 | |

| | | | | | | | | | | | | | | | |

| Numerators for diluted per share amounts: | | | | | | | | | | | | | | | | |

| Diluted EPS | | 7 | | $ | (217,179) | | | $ | 30,138 | | | $ | 78,467 | | | $ | 50,290 | | | $ | 30,806 | | | $ | (108,214) | | | $ | 122,107 | |

| Diluted FFO available to common share and unit holders | | 8 | | $ | 68,512 | | | $ | 68,323 | | | $ | 67,651 | | | $ | 68,696 | | | $ | 66,391 | | | $ | 204,486 | | | $ | 199,490 | |

| Diluted FFO available to common share and unit holders, as adjusted for comparability | | 8 | | $ | 68,593 | | | $ | 68,569 | | | $ | 67,651 | | | $ | 68,794 | | | $ | 66,595 | | | $ | 204,813 | | | $ | 200,171 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

COPT Defense Properties

Selected Financial Summary Data (continued)

(in thousands, except ratios)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Page | | Three Months Ended | | Nine Months Ended |

| PAYOUT RATIOS AND CAPITALIZATION | | Refer. | | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| GAAP | | | | | | | | | | | | | | | | |

| Payout ratio: | | | | | | | | | | | | | | | | |

| Net income | | N/A | | N/A | | 103.1% | | 40.6% | | 60.3% | | 97.1% | | N/A | | 74.3% |

| | | | | | | | | | | | | | | | |

| Capitalization and debt ratios: | | | | | | | | | | | | | | | | |

| Total assets | | 6 | | $ | 4,239,257 | | | $ | 4,246,346 | | | $ | 4,177,992 | | | $ | 4,257,275 | | | $ | 4,269,329 | | | | | |

| | | | | | | | | | | | | | | | |

| Total equity | | 6 | | $ | 1,525,873 | | | $ | 1,776,695 | | | $ | 1,768,814 | | | $ | 1,721,455 | | | $ | 1,700,666 | | | | | |

| Debt per balance sheet | | 6 | | $ | 2,415,783 | | | $ | 2,176,174 | | | $ | 2,123,012 | | | $ | 2,231,794 | | | $ | 2,269,834 | | | | | |

| Debt to assets | | 32 | | 57.0% | | 51.2% | | 50.8% | | 52.4% | | 53.2% | | N/A | | N/A |

| Net income to interest expense ratio | | 32 | | N/A | | 1.9x | | 4.9x | | 3.1x | | 2.1x | | N/A | | 2.9x |

| Debt to net income ratio | | 32 | | N/A | | 17.2x | | 6.6x | | 10.7x | | 17.6x | | N/A | | N/A |

| | | | | | | | | | | | | | | | |

| Non-GAAP | | | | | | | | | | | | | | | | |

| Payout ratios: | | | | | | | | | | | | | | | | |

| Diluted FFO | | N/A | | 47.3% | | 47.5% | | 47.9% | | 45.5% | | 47.1% | | 47.6% | | 47.0% |

| Diluted FFO - as adjusted for comparability | | N/A | | 47.3% | | 47.3% | | 47.9% | | 45.4% | | 46.9% | | 47.5% | | 46.8% |

| Diluted AFFO | | N/A | | 50.6% | | 70.5% | | 83.9% | | 119.7% | | 58.5% | | 65.4% | | 61.6% |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Capitalization and debt ratios: | | | | | | | | | | | | | | | | |

| Total Market Capitalization | | 29 | | $ | 5,172,058 | | | $ | 4,914,516 | | | $ | 4,856,761 | | | $ | 5,214,423 | | | $ | 4,943,129 | | | | | |

| Total Equity Market Capitalization | | 29 | | $ | 2,726,295 | | | $ | 2,717,000 | | | $ | 2,711,499 | | | $ | 2,959,469 | | | $ | 2,650,311 | | | | | |

| Net debt | | 38 | | $ | 2,293,005 | | | $ | 2,234,633 | | | $ | 2,181,408 | | | $ | 2,294,261 | | | $ | 2,305,878 | | | | | |

| Net debt to adjusted book | | 32 | | 40.5% | | 38.4% | | 38.1% | | 39.8% | | 40.3% | | N/A | | N/A |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Adjusted EBITDA fixed charge coverage ratio | | 32 | | 4.6x | | 4.9x | | 5.0x | | 4.7x | | 5.1x | | 4.9x | | 5.2x |

| | | | | | | | | | | | | | | | |

| Net debt to in-place adj. EBITDA ratio | | 32 | | 6.2x | | 6.3x | | 6.2x | | 6.3x | | 6.7x | | N/A | | N/A |

| Pro forma net debt to in-place adjusted EBITDA ratio (1) | | N/A | | N/A | | N/A | | N/A | | 6.0x | | N/A | | N/A | | N/A |

| Net debt adjusted for fully-leased development to in-place adj. EBITDA ratio | | 32 | | 5.9x | | 5.7x | | 5.8x | | 6.1x | | 5.9x | | N/A | | N/A |

| Pro forma net debt adj. for fully-leased development to in-place adj. EBITDA ratio (1) | | N/A | | N/A | | N/A | | N/A | | 5.7x | | N/A | | N/A | | N/A |

(1)Includes, for the 12/31/22 period, adjustments associated with our sale on 1/10/23 of a 90% interest in three data center shell properties.

COPT Defense Properties

Selected Portfolio Data (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | |

| # of Properties | | | | | | | | | | |

| Total Portfolio | 196 | | 194 | | 194 | | 194 | | 188 | |

| Consolidated Portfolio | 172 | | 170 | | 170 | | 173 | | 169 | |

| Defense/IT Portfolio | 188 | | 186 | | 186 | | 186 | | 180 | |

| Same Property | 180 | | 180 | | 180 | | 180 | | 180 | |

| | | | | | | | | | |

| % Occupied | | | | | | | | | | |

| Total Portfolio | 94.1 | % | | 93.4 | % | | 92.8 | % | | 92.7 | % | | 92.7 | % | |

| Consolidated Portfolio | 92.7 | % | | 91.9 | % | | 91.2 | % | | 91.4 | % | | 91.4 | % | |

| Defense/IT Portfolio | 95.9 | % | | 95.3 | % | | 94.4 | % | | 94.1 | % | | 93.9 | % | |

| Same Property | 93.4 | % | | 92.8 | % | | 92.1 | % | | 92.0 | % | | 92.2 | % | |

| | | | | | | | | | |

| % Leased | | | | | | | | | | |

| Total Portfolio | 95.1 | % | | 94.9 | % | | 95.0 | % | | 95.2 | % | | 94.9 | % | |

| Consolidated Portfolio | 94.0 | % | | 93.7 | % | | 93.9 | % | | 94.3 | % | | 94.0 | % | |

| Defense/IT Portfolio | 97.0 | % | | 96.8 | % | | 96.7 | % | | 96.7 | % | | 96.3 | % | |

| Same Property | 94.5 | % | | 94.4 | % | | 94.5 | % | | 94.7 | % | | 94.5 | % | |

| | | | | | | | | | |

| Square Feet (in thousands) | | | | | | | | | | |

| Total Portfolio | 23,479 | | 23,035 | | 23,020 | | 23,006 | | 22,085 | |

| Consolidated Portfolio | 19,184 | | 18,740 | | 18,725 | | 19,458 | | 18,903 | |

| Defense/IT Portfolio | 21,339 | | 20,895 | | 20,878 | | 20,869 | | 19,949 | |

| Same Property | 20,609 | | 20,609 | | 20,609 | | 20,609 | | 20,609 | |

| | | | | | | | | | |

(1)Except for the Consolidated Portfolio, includes properties owned through unconsolidated real estate joint ventures (see page 34).

COPT Defense Properties

Consolidated Balance Sheets

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 |

| Assets | | | | | | | | | |

| Properties, net: | | | | | | | | | |

| Operating properties, net | $ | 3,148,434 | | | $ | 3,272,670 | | | $ | 3,272,873 | | | $ | 3,258,899 | | | $ | 3,169,992 | |

| Development and redevelopment in progress, including land (1) | 141,854 | | | 206,130 | | | 151,910 | | | 109,332 | | | 320,354 | |

| Land held (1) | 177,909 | | | 193,435 | | | 189,292 | | | 188,167 | | | 201,065 | |

| Total properties, net | 3,468,197 | | | 3,672,235 | | | 3,614,075 | | | 3,556,398 | | | 3,691,411 | |

| Property - operating right-of-use assets | 40,487 | | | 41,652 | | | 42,808 | | | 37,020 | | | 37,541 | |

| | | | | | | | | |

| Assets held for sale, net | — | | | — | | | — | | | 161,286 | | | — | |

| Cash and cash equivalents | 204,238 | | | 14,273 | | | 15,199 | | | 12,337 | | | 12,643 | |

| Investment in unconsolidated real estate joint ventures | 41,495 | | | 41,928 | | | 42,279 | | | 21,460 | | | 38,644 | |

| Accounts receivable, net | 40,211 | | | 47,363 | | | 46,149 | | | 43,334 | | | 39,720 | |

| Deferred rent receivable | 142,041 | | | 136,382 | | | 130,153 | | | 125,147 | | | 124,146 | |

| Lease incentives, net | 60,506 | | | 59,541 | | | 49,679 | | | 49,757 | | | 49,083 | |

| Deferred leasing costs, net | 68,033 | | | 69,218 | | | 68,930 | | | 69,339 | | | 68,122 | |

| Investing receivables, net | 87,535 | | | 86,708 | | | 85,499 | | | 84,621 | | | 102,550 | |

| | | | | | | | | |

| | | | | | | | | |

| Prepaid expenses and other assets, net | 86,514 | | | 77,046 | | | 83,221 | | | 96,576 | | | 105,469 | |

| Total assets | $ | 4,239,257 | | | $ | 4,246,346 | | | $ | 4,177,992 | | | $ | 4,257,275 | | | $ | 4,269,329 | |

| Liabilities and equity | | | | | | | | | |

| Liabilities: | | | | | | | | | |

| Debt | $ | 2,415,783 | | | $ | 2,176,174 | | | $ | 2,123,012 | | | $ | 2,231,794 | | | $ | 2,269,834 | |

| Accounts payable and accrued expenses | 135,605 | | | 135,784 | | | 128,509 | | | 157,998 | | | 156,815 | |

| Rents received in advance and security deposits | 32,063 | | | 32,021 | | | 34,653 | | | 30,016 | | | 29,056 | |

| Dividends and distributions payable | 32,645 | | | 32,636 | | | 32,630 | | | 31,400 | | | 31,407 | |

| Deferred revenue associated with operating leases | 24,590 | | | 9,199 | | | 9,022 | | | 11,004 | | | 9,382 | |

| | | | | | | | | |

| Property - operating lease liabilities | 32,940 | | | 33,923 | | | 34,896 | | | 28,759 | | | 29,088 | |

| | | | | | | | | |

| | | | | | | | | |

| Other liabilities | 17,936 | | | 27,699 | | | 21,008 | | | 18,556 | | | 17,634 | |

| Total liabilities | 2,691,562 | | | 2,447,436 | | | 2,383,730 | | | 2,509,527 | | | 2,543,216 | |

| Redeemable noncontrolling interests | 21,822 | | | 22,215 | | | 25,448 | | | 26,293 | | | 25,447 | |

| Equity: | | | | | | | | | |

| CDP’s shareholders’ equity: | | | | | | | | | |

| | | | | | | | | |

| Common shares | 1,125 | | | 1,125 | | | 1,125 | | | 1,124 | | | 1,124 | |

| Additional paid-in capital | 2,489,717 | | | 2,486,996 | | | 2,484,501 | | | 2,486,116 | | | 2,484,702 | |

| Cumulative distributions in excess of net income | (1,010,885) | | | (762,617) | | | (760,820) | | | (807,508) | | | (827,072) | |

| Accumulated other comprehensive income | 6,094 | | | 5,224 | | | 1,353 | | | 2,071 | | | 2,632 | |

| Total CDP’s shareholders’ equity | 1,486,051 | | | 1,730,728 | | | 1,726,159 | | | 1,681,803 | | | 1,661,386 | |

| Noncontrolling interests in subsidiaries: | | | | | | | | | |

| Common units in the Operating Partnership | 25,337 | | | 29,563 | | | 29,268 | | | 25,808 | | | 25,524 | |

| | | | | | | | | |

| Other consolidated entities | 14,485 | | | 16,404 | | | 13,387 | | | 13,844 | | | 13,756 | |

| Total noncontrolling interests in subsidiaries | 39,822 | | | 45,967 | | | 42,655 | | | 39,652 | | | 39,280 | |

| Total equity | 1,525,873 | | | 1,776,695 | | | 1,768,814 | | | 1,721,455 | | | 1,700,666 | |

| Total liabilities, redeemable noncontrolling interests and equity | $ | 4,239,257 | | | $ | 4,246,346 | | | $ | 4,177,992 | | | $ | 4,257,275 | | | $ | 4,269,329 | |

(1)Refer to pages 26 and 28 for detail.

COPT Defense Properties

Consolidated Statements of Operations

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| Revenues | | | | | | | | | | | | | |

| Lease revenue | $ | 155,268 | | | $ | 153,682 | | | $ | 150,560 | | | $ | 150,022 | | | $ | 146,481 | | | $ | 459,510 | | | $ | 430,147 | |

| Other property revenue | 1,339 | | | 1,271 | | | 1,121 | | | 1,163 | | | 1,206 | | | 3,731 | | | 3,066 | |

| Construction contract and other service revenues | 11,949 | | | 14,243 | | | 15,820 | | | 24,062 | | | 34,813 | | | 42,012 | | | 130,570 | |

| Total revenues | 168,556 | | | 169,196 | | | 167,501 | | | 175,247 | | | 182,500 | | | 505,253 | | | 563,783 | |

| Operating expenses | | | | | | | | | | | | | |

| Property operating expenses | 61,788 | | | 61,600 | | | 59,420 | | | 58,470 | | | 57,663 | | | 182,808 | | | 168,960 | |

| Depreciation and amortization associated with real estate operations | 37,620 | | | 37,600 | | | 36,995 | | | 36,907 | | | 35,247 | | | 112,215 | | | 104,323 | |

| Construction contract and other service expenses | 11,493 | | | 13,555 | | | 15,201 | | | 23,454 | | | 33,555 | | | 40,249 | | | 126,509 | |

| Impairment losses | 252,797 | | | — | | | — | | | — | | | — | | | 252,797 | | | — | |

| General and administrative expenses | 7,582 | | | 7,287 | | | 7,996 | | | 7,766 | | | 6,558 | | | 22,865 | | | 19,695 | |

| Leasing expenses | 2,280 | | | 2,345 | | | 1,999 | | | 2,235 | | | 2,340 | | | 6,624 | | | 6,102 | |

| Business development expenses and land carry costs | 714 | | | 726 | | | 495 | | | 1,157 | | | 552 | | | 1,935 | | | 2,036 | |

| Total operating expenses | 374,274 | | | 123,113 | | | 122,106 | | | 129,989 | | | 135,915 | | | 619,493 | | | 427,625 | |

| Interest expense | (17,798) | | | (16,519) | | | (16,442) | | | (16,819) | | | (15,123) | | | (50,759) | | | (44,355) | |

| Interest and other income, net | 2,529 | | | 2,143 | | | 2,256 | | | 4,671 | | | 597 | | | 6,928 | | | 4,399 | |

| Gain on sales of real estate | — | | | 14 | | | 49,378 | | | 19,238 | | | 16 | | | 49,392 | | | 12 | |

| | | | | | | | | | | | | |

| Loss on early extinguishment of debt | — | | | — | | | — | | | (267) | | | — | | | — | | | (342) | |

| | | | | | | | | | | | | |

| (Loss) income from continuing operations before equity in (loss) income of unconsolidated entities and income taxes | (220,987) | | | 31,721 | | | 80,587 | | | 52,081 | | | 32,075 | | | (108,679) | | | 95,872 | |

| Equity in (loss) income of unconsolidated entities | (68) | | | 111 | | | (64) | | | 229 | | | 308 | | | (21) | | | 1,514 | |

| Income tax expense | (152) | | | (190) | | | (125) | | | (223) | | | (67) | | | (467) | | | (224) | |

| (Loss) income from continuing operations | (221,207) | | | 31,642 | | | 80,398 | | | 52,087 | | | 32,316 | | | (109,167) | | | 97,162 | |

| Discontinued operations | — | | | — | | | — | | | — | | | — | | | — | | | 29,573 | |

| Net (loss) income | (221,207) | | | 31,642 | | | 80,398 | | | 52,087 | | | 32,316 | | | (109,167) | | | 126,735 | |

| Net loss (income) attributable to noncontrolling interests: | | | | | | | | | | | | | |

| Common units in the Operating Partnership | 3,691 | | | (516) | | | (1,293) | | | (775) | | | (476) | | | 1,882 | | | (1,828) | |

| | | | | | | | | | | | | |

| Other consolidated entities | 1,329 | | | (839) | | | (326) | | | (833) | | | (919) | | | 164 | | | (2,357) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net (loss) income attributable to common shareholders | $ | (216,187) | | | $ | 30,287 | | | $ | 78,779 | | | $ | 50,479 | | | $ | 30,921 | | | $ | (107,121) | | | $ | 122,550 | |

| Amount allocable to share-based compensation awards | (992) | | | (98) | | | (248) | | | (129) | | | (75) | | | (1,093) | | | (334) | |

| Redeemable noncontrolling interests | — | | | (51) | | | (64) | | | (60) | | | (40) | | | — | | | (109) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Numerator for diluted EPS | $ | (217,179) | | | $ | 30,138 | | | $ | 78,467 | | | $ | 50,290 | | | $ | 30,806 | | | $ | (108,214) | | | $ | 122,107 | |

COPT Defense Properties

Funds from Operations

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| Net (loss) income | $ | (221,207) | | | $ | 31,642 | | | $ | 80,398 | | | $ | 52,087 | | | $ | 32,316 | | | $ | (109,167) | | | $ | 126,735 | |

| Real estate-related depreciation and amortization | 37,620 | | | 37,600 | | | 36,995 | | | 36,907 | | | 35,247 | | | 112,215 | | | 104,323 | |

| Impairment losses on real estate | 252,797 | | | — | | | — | | | — | | | — | | | 252,797 | | | — | |

| Gain on sales of real estate (1) | — | | | (14) | | | (49,378) | | | (19,238) | | | (16) | | | (49,392) | | | (28,576) | |

| Depreciation and amortization on unconsolidated real estate JVs (2) | 806 | | | 805 | | | 801 | | | 526 | | | 524 | | | 2,412 | | | 1,575 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| FFO - per Nareit (3) | 70,016 | | | 70,033 | | | 68,816 | | | 70,282 | | | 68,071 | | | 208,865 | | | 204,057 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| FFO allocable to other noncontrolling interests (4) | (1,059) | | | (1,239) | | | (708) | | | (1,227) | | | (1,348) | | | (3,006) | | | (3,568) | |

| Basic FFO allocable to share-based compensation awards | (481) | | | (480) | | | (466) | | | (360) | | | (354) | | | (1,427) | | | (1,073) | |

| Basic FFO available to common share and common unit holders (3) | 68,476 | | | 68,314 | | | 67,642 | | | 68,695 | | | 66,369 | | | 204,432 | | | 199,416 | |

| | | | | | | | | | | | | |

| Redeemable noncontrolling interests | — | | | (28) | | | (30) | | | (27) | | | (5) | | | (58) | | | (7) | |

| Diluted FFO adjustments allocable to share-based compensation awards | 36 | | | 37 | | | 39 | | | 28 | | | 27 | | | 112 | | | 81 | |

| Diluted FFO available to common share and common unit holders - per Nareit (3) | 68,512 | | | 68,323 | | | 67,651 | | | 68,696 | | | 66,391 | | | 204,486 | | | 199,490 | |

| Loss on early extinguishment of debt | — | | | — | | | — | | | 267 | | | — | | | — | | | 342 | |

| Gain on early extinguishment of debt on unconsolidated real estate JVs (2) | — | | | — | | | — | | | (168) | | | — | | | — | | | — | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Executive transition costs | 82 | | | 248 | | | — | | | — | | | 206 | | | 330 | | | 343 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Diluted FFO comparability adjustments allocable to share-based compensation awards | (1) | | | (2) | | | — | | | (1) | | | (2) | | | (3) | | | (4) | |

| Diluted FFO available to common share and common unit holders, as adjusted for comparability (3) | $ | 68,593 | | | $ | 68,569 | | | $ | 67,651 | | | $ | 68,794 | | | $ | 66,595 | | | $ | 204,813 | | | $ | 200,171 | |

(1)Refer to the section entitled “Supplementary Reconciliations of Non-GAAP Measures” for reconciliation.

(2)See page 34 for additional disclosure regarding our unconsolidated real estate JVs.

(3)Refer to the section entitled “Definitions” for a definition of this measure.

(4)Pertains to noncontrolling interests in consolidated real estate JVs reported on page 33.

COPT Defense Properties

Diluted Share + Unit Computations

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| EPS Denominator: | | | | | | | | | | | | | |

| Weighted average common shares - basic | 112,196 | | | 112,188 | | | 112,127 | | | 112,096 | | | 112,093 | | | 112,170 | | | 112,066 | |

| Dilutive effect of share-based compensation awards | — | | | 426 | | | 410 | | | 435 | | | 433 | | | — | | | 429 | |

| | | | | | | | | | | | | |

| Dilutive effect of redeemable noncontrolling interests | — | | | 62 | | | 91 | | | 102 | | | 105 | | | — | | | 121 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Weighted average common shares - diluted | 112,196 | | | 112,676 | | | 112,628 | | | 112,633 | | | 112,631 | | | 112,170 | | | 112,616 | |

| Diluted EPS | $ | (1.94) | | | $ | 0.27 | | | $ | 0.70 | | | $ | 0.45 | | | $ | 0.27 | | | $ | (0.96) | | | $ | 1.08 | |

| | | | | | | | | | | | | |

| Weighted Average Shares for period ended: | | | | | | | | | | | | | |

| Common shares | 112,196 | | | 112,188 | | | 112,127 | | | 112,096 | | | 112,093 | | | 112,170 | | | 112,066 | |

| Dilutive effect of share-based compensation awards | 429 | | | 426 | | | 410 | | | 435 | | | 433 | | | 422 | | | 429 | |

| Common units | 1,520 | | | 1,514 | | | 1,489 | | | 1,476 | | | 1,477 | | | 1,508 | | | 1,446 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Redeemable noncontrolling interests | — | | | 62 | | | 91 | | | 102 | | | 105 | | | 51 | | | 121 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Denominator for diluted FFO per share and as adjusted for comparability | 114,145 | | | 114,190 | | | 114,117 | | | 114,109 | | | 114,108 | | | 114,151 | | | 114,062 | |

| Weighted average common units | (1,520) | | | (1,514) | | | (1,489) | | | (1,476) | | | (1,477) | | | (1,508) | | | (1,446) | |

| Redeemable noncontrolling interests | — | | | — | | | — | | | — | | | — | | | (51) | | | — | |

| Dilutive effect of additional share-based compensation awards | (429) | | | — | | | — | | | — | | | — | | | (422) | | | — | |

| | | | | | | | | | | | | |

| Denominator for diluted EPS | 112,196 | | | 112,676 | | | 112,628 | | | 112,633 | | | 112,631 | | | 112,170 | | | 112,616 | |

| Diluted FFO per share - Nareit (1) | $ | 0.60 | | | $ | 0.60 | | | $ | 0.59 | | | $ | 0.60 | | | $ | 0.58 | | | $ | 1.79 | | | $ | 1.75 | |

| Diluted FFO per share - as adjusted for comparability (1) | $ | 0.60 | | | $ | 0.60 | | | $ | 0.59 | | | $ | 0.60 | | | $ | 0.58 | | | $ | 1.79 | | | $ | 1.75 | |

(1)Refer to the section entitled “Definitions” for a definition of this measure.

COPT Defense Properties

Adjusted Funds from Operations

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| Diluted FFO available to common share and common unit holders, as adjusted for comparability (1) | $ | 68,593 | | | $ | 68,569 | | | $ | 67,651 | | | $ | 68,794 | | | $ | 66,595 | | | $ | 204,813 | | | $ | 200,171 | |

| Straight line rent adjustments and lease incentive amortization | 12,882 | | | (3,161) | | | (3,516) | | | (3,043) | | | 605 | | | 6,205 | | | (5,782) | |

| Amortization of intangibles and other assets included in NOI | 26 | | | 17 | | | (19) | | | 15 | | | 50 | | | 24 | | | (273) | |

| Share-based compensation, net of amounts capitalized | 2,280 | | | 2,213 | | | 1,733 | | | 2,247 | | | 2,188 | | | 6,226 | | | 6,453 | |

| Amortization of deferred financing costs | 639 | | | 628 | | | 632 | | | 619 | | | 540 | | | 1,899 | | | 1,678 | |

| Amortization of net debt discounts, net of amounts capitalized | 750 | | | 622 | | | 618 | | | 615 | | | 612 | | | 1,990 | | | 1,825 | |

| | | | | | | | | | | | | |

| Replacement capital expenditures (1) | (21,122) | | | (22,664) | | | (28,210) | | | (43,283) | | | (17,528) | | | (71,996) | | | (52,603) | |

| Other | 74 | | | (221) | | | (273) | | | 158 | | | 377 | | | (420) | | | 822 | |

| Diluted AFFO available to common share and common unit holders (“diluted AFFO”) (1) | $ | 64,122 | | | $ | 46,003 | | | $ | 38,616 | | | $ | 26,122 | | | $ | 53,439 | | | $ | 148,741 | | | $ | 152,291 | |

| | | | | | | | | | | | | |

| Replacement capital expenditures (1) | | | | | | | | | | | | | |

| Tenant improvements and incentives | $ | 14,457 | | | $ | 32,619 | | | $ | 19,986 | | | $ | 33,439 | | | $ | 8,848 | | | $ | 67,062 | | | $ | 29,513 | |

| Building improvements | 6,307 | | | 2,766 | | | 2,141 | | | 8,468 | | | 7,477 | | | 11,214 | | | 21,060 | |

| Leasing costs | 1,902 | | | 3,542 | | | 1,750 | | | 4,389 | | | 3,073 | | | 7,194 | | | 7,091 | |

| Net (exclusions from) additions to tenant improvements and incentives | (813) | | | (16,007) | | | 4,839 | | | (75) | | | (57) | | | (11,981) | | | 2,225 | |

| Excluded building improvements and leasing costs | (731) | | | (256) | | | (506) | | | (2,938) | | | (1,813) | | | (1,493) | | | (7,286) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Replacement capital expenditures | $ | 21,122 | | | $ | 22,664 | | | $ | 28,210 | | | $ | 43,283 | | | $ | 17,528 | | | $ | 71,996 | | | $ | 52,603 | |

(1)Refer to the section entitled “Definitions” for a definition of this measure.

COPT Defense Properties

EBITDAre + Adjusted EBITDA

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| Net (loss) income | $ | (221,207) | | | $ | 31,642 | | | $ | 80,398 | | | $ | 52,087 | | | $ | 32,316 | | | $ | (109,167) | | | $ | 126,735 | |

| Interest expense | 17,798 | | | 16,519 | | | 16,442 | | | 16,819 | | | 15,123 | | | 50,759 | | | 44,355 | |

| Income tax expense | 152 | | | 190 | | | 125 | | | 223 | | | 67 | | | 467 | | | 224 | |

| Real estate-related depreciation and amortization | 37,620 | | | 37,600 | | | 36,995 | | | 36,907 | | | 35,247 | | | 112,215 | | | 104,323 | |

| Other depreciation and amortization | 615 | | | 609 | | | 602 | | | 602 | | | 602 | | | 1,826 | | | 1,761 | |

| Impairment losses on real estate | 252,797 | | | — | | | — | | | — | | | — | | | 252,797 | | | — | |

| Gain on sales of real estate (1) | — | | | (14) | | | (49,378) | | | (19,238) | | | (16) | | | (49,392) | | | (28,576) | |

| | | | | | | | | | | | | |

| Adjustments from unconsolidated real estate JVs | 1,743 | | | 1,559 | | | 1,704 | | | 1,033 | | | 762 | | | 5,006 | | | 2,280 | |

| EBITDAre (2) | 89,518 | | | 88,105 | | | 86,888 | | | 88,433 | | | 84,101 | | | 264,511 | | | 251,102 | |

| Credit loss expense (recoveries) | 372 | | | 238 | | | 67 | | | (1,331) | | | 1,693 | | | 677 | | | 1,602 | |

| Business development expenses | 313 | | | 394 | | | 241 | | | 794 | | | 386 | | | 948 | | | 1,097 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Executive transition costs | 82 | | | 307 | | | 247 | | | 387 | | | 206 | | | 636 | | | 343 | |

| Loss on early extinguishment of debt | — | | | — | | | — | | | 267 | | | — | | | — | | | 342 | |

| Gain on early extinguishment of debt on unconsolidated real estate JVs | — | | | — | | | — | | | (168) | | | — | | | — | | | — | |

| | | | | | | | | | | | | |

| Net gain on other investments | (25) | | | — | | | — | | | (595) | | | — | | | (25) | | | (564) | |

| Adjusted EBITDA (2) | 90,260 | | | 89,044 | | | 87,443 | | | 87,787 | | | 86,386 | | | $ | 266,747 | | | $ | 253,922 | |

| Pro forma NOI adjustment for property changes within period | 1,647 | | | 56 | | | (318) | | | 2,704 | | | — | | | | | |

| Change in collectability of deferred rental revenue | — | | | 28 | | | 899 | | | — | | | 13 | | | | | |

| | | | | | | | | | | | | |

| In-place adjusted EBITDA (2) | 91,907 | | | 89,128 | | | 88,024 | | | 90,491 | | | 86,399 | | | | | |

| Pro forma NOI adjustment from subsequent event transactions (3) | N/A | | N/A | | N/A | | (2,903) | | | N/A | | | | |

| Pro forma in-place adjusted EBITDA (2) | $ | 91,907 | | | $ | 89,128 | | | $ | 88,024 | | | $ | 87,588 | | | $ | 86,399 | | | | | |

(1)Refer to the section entitled “Supplementary Reconciliations of Non-GAAP Measures” for reconciliation.

(2)Refer to the section entitled “Definitions” for a definition of this measure.

(3)Includes, for the 12/31/22 period, NOI adjustment from our sale on 1/10/23 of a 90% interest in three data center shell properties.

COPT Defense Properties

Properties by Segment - 9/30/23

(square feet in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | # of

Properties | | Operational

Square Feet | | % Occupied | | % Leased |

| | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | |

| Fort Meade/Baltimore Washington (“BW”) Corridor: | | | | | | | | |

| National Business Park | | 33 | | | 4,106 | | | 98.7% | | 99.4% |

| Howard County | | 35 | | | 2,862 | | | 93.7% | | 94.3% |

| Other | | 23 | | | 1,725 | | | 93.9% | | 95.1% |

| Total Fort Meade/BW Corridor | | 91 | | | 8,693 | | | 96.1% | | 96.9% |

| Northern Virginia (“NoVA”) Defense/IT | | 16 | | | 2,501 | | | 89.5% | | 92.4% |

| Lackland AFB (San Antonio, Texas) | | 8 | | | 1,062 | | | 100.0% | | 100.0% |

| Navy Support | | 22 | | | 1,273 | | | 86.8% | | 89.7% |

| Redstone Arsenal (Huntsville, Alabama) | | 22 | | | 2,300 | | | 95.8% | | 98.0% |

| Data Center Shells: | | | | | | | | |

| Consolidated Properties | | 5 | | | 1,215 | | | 100.0% | | 100.0% |

| Unconsolidated JV Properties (1) | | 24 | | | 4,295 | | | 100.0% | | 100.0% |

| Total Defense/IT Portfolio | | 188 | | | 21,339 | | | 95.9% | | 97.0% |

| | | | | | | | |

| Other (2) | | 8 | | | 2,140 | | | 75.4% | | 75.9% |

| Total Portfolio | | 196 | | | 23,479 | | | 94.1% | | 95.1% |

| Consolidated Portfolio | | 172 | | | 19,184 | | | 92.7% | | 94.0% |

(1)See page 34 for additional disclosure regarding our unconsolidated real estate JVs.

(2)Includes our reclassification in the quarter ended 9/30/23 of a portfolio of office properties located in the Greater Washington, DC/Baltimore region that we previously reported as a separate segment referred to as Regional Office.

(3)Refer to the section entitled “Definitions” for a definition of this measure.

COPT Defense Properties

Consolidated Real Estate Revenues + NOI by Segment

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| Consolidated real estate revenues | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | $ | 73,350 | | | $ | 72,176 | | | $ | 69,777 | | | $ | 69,778 | | | $ | 69,209 | | | $ | 215,303 | | | $ | 204,012 | |

| NoVA Defense/IT | 20,333 | | | 19,841 | | | 19,829 | | | 18,695 | | | 18,611 | | | 60,003 | | | 55,290 | |

| Lackland Air Force Base | 16,193 | | | 17,595 | | | 15,605 | | | 17,118 | | | 15,951 | | | 49,393 | | | 45,793 | |

| Navy Support | 8,190 | | | 8,118 | | | 7,925 | | | 8,247 | | | 8,253 | | | 24,233 | | | 24,507 | |

| Redstone Arsenal | 13,768 | | | 12,978 | | | 13,414 | | | 10,114 | | | 9,976 | | | 40,160 | | | 28,479 | |

| Data Center Shells-Consolidated | 6,811 | | | 6,287 | | | 6,692 | | | 10,008 | | | 9,069 | | | 19,790 | | | 25,714 | |

| Total Defense/IT Portfolio | 138,645 | | | 136,995 | | | 133,242 | | | 133,960 | | | 131,069 | | | 408,882 | | | 383,795 | |

| | | | | | | | | | | | | |

| Wholesale Data Center | — | | | — | | | — | | | — | | | — | | | — | | | 1,980 | |

| Other (2) | 17,962 | | | 17,958 | | | 18,439 | | | 17,225 | | | 16,618 | | | 54,359 | | | 49,418 | |

| Consolidated real estate revenues (1) | $ | 156,607 | | | $ | 154,953 | | | $ | 151,681 | | | $ | 151,185 | | | $ | 147,687 | | | $ | 463,241 | | | $ | 435,193 | |

| | | |

| NOI from real estate operations (3) | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | $ | 48,134 | | | $ | 47,988 | | | $ | 45,257 | | | $ | 45,784 | | | $ | 44,759 | | | $ | 141,379 | | | $ | 130,279 | |

| NoVA Defense/IT | 12,433 | | | 12,158 | | | 12,257 | | | 11,862 | | | 11,835 | | | 36,848 | | | 35,488 | |

| Lackland Air Force Base | 7,626 | | | 7,644 | | | 7,660 | | | 7,690 | | | 7,670 | | | 22,930 | | | 22,920 | |

| Navy Support | 4,257 | | | 4,602 | | | 4,382 | | | 4,712 | | | 4,588 | | | 13,241 | | | 14,041 | |

| Redstone Arsenal | 8,820 | | | 8,228 | | | 8,778 | | | 6,204 | | | 5,652 | | | 25,826 | | | 16,789 | |

| Data Center Shells: | | | | | | | | | | | | | |

| Consolidated properties | 6,133 | | | 5,544 | | | 6,098 | | | 8,951 | | | 7,953 | | | 17,775 | | | 22,399 | |

| CDP’s share of unconsolidated real estate JVs | 1,675 | | | 1,671 | | | 1,642 | | | 1,095 | | | 1,072 | | | 4,988 | | | 3,232 | |

| Total Defense/IT Portfolio | 89,078 | | | 87,835 | | | 86,074 | | | 86,298 | | | 83,529 | | | 262,987 | | | 245,148 | |

| | | | | | | | | | | | | |

| Wholesale Data Center | — | | | — | | | — | | | (4) | | | — | | | — | | | 1,005 | |

| Other (2) | 7,416 | | | 7,189 | | | 7,829 | | | 7,516 | | | 7,567 | | | 22,434 | | | 22,341 | |

| NOI from real estate operations (1) | $ | 96,494 | | | $ | 95,024 | | | $ | 93,903 | | | $ | 93,810 | | | $ | 91,096 | | | $ | 285,421 | | | $ | 268,494 | |

(1)Refer to the section entitled “Supplementary Reconciliations of Non-GAAP Measures” for reconciliation.

(2)Includes our retrospective reclassification in the quarter ended 9/30/23 of a portfolio of office properties located in the Greater Washington, DC/Baltimore region that we previously reported as a separate segment referred to as Regional Office.

(3)Refer to the section entitled “Definitions” for a definition of this measure.

COPT Defense Properties

Cash NOI by Segment

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| Cash NOI from real estate operations (1) | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | $ | 45,513 | | | $ | 45,727 | | | $ | 43,662 | | | $ | 45,106 | | | $ | 44,723 | | | $ | 134,902 | | | $ | 129,607 | |

| NoVA Defense/IT | 12,765 | | | 12,642 | | | 11,423 | | | 10,274 | | | 10,197 | | | 36,830 | | | 30,607 | |

| Lackland Air Force Base | 7,913 | | | 7,919 | | | 7,915 | | | 7,889 | | | 7,757 | | | 23,747 | | | 23,134 | |

| Navy Support | 4,621 | | | 4,911 | | | 5,023 | | | 5,257 | | | 4,951 | | | 14,555 | | | 14,719 | |

| Redstone Arsenal | 4,861 | | | 3,707 | | | 4,988 | | | 5,263 | | | 4,631 | | | 13,556 | | | 14,013 | |

| Data Center Shells: | | | | | | | | | | | | | |

| Consolidated properties | 4,904 | | | 4,918 | | | 5,379 | | | 6,960 | | | 7,020 | | | 15,201 | | | 19,016 | |

| CDP’s share of unconsolidated real estate JVs | 1,396 | | | 1,385 | | | 1,351 | | | 1,012 | | | 985 | | | 4,132 | | | 2,955 | |

| Total Defense/IT Portfolio | 81,973 | | | 81,209 | | | 79,741 | | | 81,761 | | | 80,264 | | | 242,923 | | | 234,051 | |

| | | | | | | | | | | | | |

| Wholesale Data Center | — | | | — | | | — | | | (4) | | | — | | | — | | | 1,014 | |

| Other (2) | 7,400 | | | 7,350 | | | 7,583 | | | 6,876 | | | 7,606 | | | 22,333 | | | 20,114 | |

| Cash NOI from real estate operations (3) | $ | 89,373 | | | $ | 88,559 | | | $ | 87,324 | | | $ | 88,633 | | | $ | 87,870 | | | $ | 265,256 | | | $ | 255,179 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(1)Refer to the section entitled “Definitions” for a definition of this measure.

(2)Includes our retrospective reclassification in the quarter ended 9/30/23 of a portfolio of office properties located in the Greater Washington, DC/Baltimore region that we previously reported as a separate segment referred to as Regional Office.

(3)Refer to the section entitled “Supplementary Reconciliations of Non-GAAP Measures” for reconciliation.

COPT Defense Properties

NOI from Real Estate Operations + Occupancy by Property Grouping - 9/30/23

(dollars and square feet in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of Period End | | NOI from Real Estate Operations (3) |

| | # of

Properties | | Operational Square Feet | | % Occupied (1) | | % Leased (1) | | Annualized

Rental Revenue (2) | | % of Total

Annualized

Rental Revenue (2) | |

| Property Grouping | | | | | | | | Three Months Ended | | Nine Months Ended |

| Defense/IT Portfolio: | | | | | | | | | | | | | | | | |

| Same Property: (2) | | | | | | | | | | | | | | | | |

| Consolidated properties | | 153 | | | 15,287 | | | 94.5% | | 96.0% | | $ | 511,359 | | | 80.7 | % | | $ | 78,867 | | | $ | 232,836 | |

| Unconsolidated real estate JV | | 19 | | | 3,182 | | | 100.0% | | 100.0% | | 4,898 | | | 0.8 | % | | 1,078 | | | 3,227 | |

| Total Same Property in Defense/IT Portfolio | | 172 | | | 18,469 | | | 95.5% | | 96.7% | | 516,257 | | | 81.5 | % | | 79,945 | | | 236,063 | |

| Properties Placed in Service (4) | | 11 | | | 1,757 | | | 98.4% | | 98.4% | | 47,570 | | | 7.5 | % | | 8,537 | | | 24,820 | |

| Other unconsolidated JV properties (5) | | 5 | | | 1,113 | | | 100.0% | | 100.0% | | 1,818 | | | 0.3 | % | | 596 | | | 2,104 | |

| Total Defense/IT Portfolio | | 188 | | | 21,339 | | | 95.9% | | 97.0% | | 565,645 | | | 89.3 | % | | 89,078 | | | 262,987 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Other | | 8 | | | 2,140 | | | 75.4% | | 75.9% | | 67,753 | | | 10.7 | % | | 7,416 | | | 22,434 | |

| Total Portfolio | | 196 | | | 23,479 | | | 94.1% | | 95.1% | | $ | 633,398 | | | 100.0 | % | | $ | 96,494 | | | $ | 285,421 | |

| Consolidated Portfolio | | 172 | | | 19,184 | | | 92.7% | | 94.0% | | $ | 626,681 | | | 98.9 | % | | $ | 94,819 | | | $ | 280,433 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

(1)Percentages calculated based on operational square feet.

(2)Refer to the section entitled “Definitions” for a definition of this measure.

(3)Refer to the section entitled “Supplementary Reconciliations of Non-GAAP Measures” for reconciliation.

(4)Newly developed or redeveloped properties placed in service that were not fully operational by 1/1/22.

(5)Includes data center shell properties in which we sold ownership interests and retained 10% interests through unconsolidated real estate JVs in 2023 and 2022. See page 34 for additional disclosure regarding our unconsolidated real estate JVs.

COPT Defense Properties

Same Property (1) Average Occupancy Rates by Segment

(square feet in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | # of Properties | | Operational Square Feet | | Three Months Ended | | Nine Months Ended |

| | | | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| | | | | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | 90 | | | 8,510 | | | 95.7 | % | | 94.7 | % | | 92.9 | % | | 92.5 | % | | 91.9 | % | | 94.4 | % | | 90.7 | % |

| NoVA Defense/IT | 16 | | | 2,501 | | | 89.8 | % | | 89.9 | % | | 90.6 | % | | 89.9 | % | | 89.3 | % | | 90.1 | % | | 88.8 | % |

| Lackland Air Force Base | 8 | | | 1,062 | | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Navy Support | 21 | | | 1,244 | | | 87.2 | % | | 87.6 | % | | 88.9 | % | | 90.4 | % | | 91.3 | % | | 87.9 | % | | 91.8 | % |

| Redstone Arsenal | 16 | | | 1,512 | | | 91.6 | % | | 87.8 | % | | 87.0 | % | | 87.6 | % | | 87.8 | % | | 88.8 | % | | 88.8 | % |

| Data Center Shells: | | | | | | | | | | | | | | | | | |

| Consolidated properties | 2 | | | 458 | | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Unconsolidated JV properties | 19 | | | 3,182 | | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Total Defense/IT Portfolio | 172 | | | 18,469 | | | 95.1 | % | | 94.4 | % | | 93.6 | % | | 93.5 | % | | 93.2 | % | | 94.4 | % | | 92.7 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Other (2) | 8 | | | 2,140 | | | 75.2 | % | | 75.0 | % | | 78.6 | % | | 80.0 | % | | 80.7 | % | | 76.3 | % | | 80.2 | % |

| Total Same Property | 180 | | | 20,609 | | | 93.0 | % | | 92.3 | % | | 92.1 | % | | 92.1 | % | | 91.9 | % | | 92.5 | % | | 91.4 | % |

| | | | | | | | | | | | | | | | | |

Same Property (1) Period End Occupancy Rates by Segment (square feet in thousands) |

| # of Properties | | Operational Square Feet | | | | |

| | | | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | | | |

| | | | | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | 90 | | | 8,510 | | | 96.0 | % | | 95.3 | % | | 93.3 | % | | 92.5 | % | | 92.2 | % | | | | |

| NoVA Defense/IT | 16 | | | 2,501 | | | 89.5 | % | | 89.9 | % | | 90.7 | % | | 90.0 | % | | 89.9 | % | | | | |

| Lackland Air Force Base | 8 | | | 1,062 | | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | | | |

| Navy Support | 21 | | | 1,244 | | | 87.4 | % | | 87.4 | % | | 88.4 | % | | 89.7 | % | | 91.4 | % | | | | |

| Redstone Arsenal | 16 | | | 1,512 | | | 94.7 | % | | 90.1 | % | | 86.7 | % | | 88.0 | % | | 88.1 | % | | | | |

| Data Center Shells: | | | | | | | | | | | | | | | | | |

| Consolidated properties | 2 | | | 458 | | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | | | |

| Unconsolidated JV properties | 19 | | | 3,182 | | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | | | |

| Total Defense/IT Portfolio | 172 | | | 18,469 | | | 95.5 | % | | 94.8 | % | | 93.8 | % | | 93.5 | % | | 93.5 | % | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Other (2) | 8 | | | 2,140 | | | 75.4 | % | | 74.9 | % | | 77.6 | % | | 78.8 | % | | 81.0 | % | | | | |

| Total Same Property | 180 | | | 20,609 | | | 93.4 | % | | 92.8 | % | | 92.1 | % | | 92.0 | % | | 92.2 | % | | | | |

(1)Includes properties stably owned and 100% operational since at least 1/1/22.

(2)Includes our retrospective reclassification in the quarter ended 9/30/23 of a portfolio of office properties located in the Greater Washington, DC/Baltimore region that we previously reported as a separate segment referred to as Regional Office.

COPT Defense Properties

Same Property Real Estate Revenues + NOI by Segment

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| Same Property real estate revenues | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | $ | 71,668 | | | $ | 70,510 | | | $ | 68,112 | | | $ | 68,673 | | | $ | 69,183 | | | $ | 210,290 | | | $ | 203,983 | |

| NoVA Defense/IT | 20,333 | | | 19,840 | | | 19,829 | | | 18,695 | | | 18,611 | | | 60,002 | | | 55,290 | |

| Lackland Air Force Base | 16,193 | | | 17,596 | | | 15,605 | | | 17,118 | | | 15,951 | | | 49,394 | | | 45,793 | |

| Navy Support | 8,035 | | | 7,964 | | | 7,771 | | | 8,092 | | | 8,098 | | | 23,770 | | | 24,184 | |

| Redstone Arsenal | 9,629 | | | 8,972 | | | 9,499 | | | 9,204 | | | 9,310 | | | 28,100 | | | 27,220 | |

| Data Center Shells-Consolidated | 2,479 | | | 2,538 | | | 2,505 | | | 2,395 | | | 2,379 | | | 7,522 | | | 7,165 | |

| Total Defense/IT Portfolio | 128,337 | | | 127,420 | | | 123,321 | | | 124,177 | | | 123,532 | | | 379,078 | | | 363,635 | |

| | | | | | | | | | | | | |

| Other (2) | 15,953 | | | 15,964 | | | 16,790 | | | 16,059 | | | 15,503 | | | 48,707 | | | 46,010 | |

| Same Property real estate revenues | $ | 144,290 | | | $ | 143,384 | | | $ | 140,111 | | | $ | 140,236 | | | $ | 139,035 | | | $ | 427,785 | | | $ | 409,645 | |

| | | | | | | | | | | | | |

| Same Property NOI from real estate operations (“NOI”) | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | $ | 46,721 | | | $ | 46,489 | | | $ | 43,887 | | | $ | 44,858 | | | $ | 44,760 | | | $ | 137,097 | | | $ | 130,280 | |

| NoVA Defense/IT | 12,433 | | | 12,158 | | | 12,257 | | | 11,862 | | | 11,835 | | | 36,848 | | | 35,488 | |

| Lackland Air Force Base | 7,625 | | | 7,645 | | | 7,660 | | | 7,690 | | | 7,670 | | | 22,930 | | | 22,920 | |

| Navy Support | 4,177 | | | 4,510 | | | 4,293 | | | 4,610 | | | 4,487 | | | 12,980 | | | 13,811 | |

| Redstone Arsenal | 5,746 | | | 5,197 | | | 5,465 | | | 5,307 | | | 5,280 | | | 16,408 | | | 16,057 | |

| Data Center Shells: | | | | | | | | | | | | | |

| Consolidated properties | 2,166 | | | 2,170 | | | 2,238 | | | 2,088 | | | 2,032 | | | 6,574 | | | 6,098 | |

| CDP’s share of unconsolidated real estate JVs | 1,078 | | | 1,073 | | | 1,076 | | | 1,076 | | | 1,072 | | | 3,227 | | | 3,232 | |

| Total Defense/IT Portfolio | 79,946 | | | 79,242 | | | 76,876 | | | 77,491 | | | 77,136 | | | 236,064 | | | 227,886 | |

| | | | | | | | | | | | | |

| Other (2) | 7,230 | | | 7,012 | | | 7,576 | | | 7,304 | | | 7,349 | | | 21,818 | | | 21,632 | |

| Same Property NOI (1) | $ | 87,176 | | | $ | 86,254 | | | $ | 84,452 | | | $ | 84,795 | | | $ | 84,485 | | | $ | 257,882 | | | $ | 249,518 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(1)Refer to the section entitled “Supplementary Reconciliations of Non-GAAP Measures” for reconciliation.

(2)Includes our retrospective reclassification in the quarter ended 9/30/23 of a portfolio of office properties located in the Greater Washington, DC/Baltimore region that we previously reported as a separate segment referred to as Regional Office.

COPT Defense Properties

Same Property Cash NOI by Segment

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | | 9/30/23 | | 9/30/22 |

| Same Property cash NOI from real estate operations (“cash NOI”) | | | | | | | | | | | | | |

| Defense/IT Portfolio: | | | | | | | | | | | | | |

| Fort Meade/BW Corridor | $ | 45,783 | | | $ | 45,894 | | | $ | 43,949 | | | $ | 45,285 | | | $ | 44,723 | | | $ | 135,626 | | | $ | 129,607 | |

| NoVA Defense/IT | 12,764 | | | 12,642 | | | 11,423 | | | 10,274 | | | 10,197 | | | 36,829 | | | 30,607 | |

| Lackland Air Force Base | 7,913 | | | 7,919 | | | 7,915 | | | 7,889 | | | 7,757 | | | 23,747 | | | 23,134 | |

| Navy Support | 4,545 | | | 4,825 | | | 4,940 | | | 5,163 | | | 4,857 | | | 14,310 | | | 14,503 | |

| Redstone Arsenal | 4,894 | | | 3,706 | | | 4,704 | | | 4,746 | | | 4,582 | | | 13,304 | | | 14,021 | |

| Data Center Shells: | | | | | | | | | | | | | |

| Consolidated properties | 1,894 | | | 1,954 | | | 2,020 | | | 1,866 | | | 1,810 | | | 5,868 | | | 5,404 | |

| CDP’s share of unconsolidated real estate JVs | 1,013 | | | 1,005 | | | 1,000 | | | 994 | | | 986 | | | 3,018 | | | 2,956 | |

| Total Defense/IT Portfolio | 78,806 | | | 77,945 | | | 75,951 | | | 76,217 | | | 74,912 | | | 232,702 | | | 220,232 | |

| | | | | | | | | | | | | |

| Other (1) | 7,134 | | | 7,092 | | | 7,243 | | | 6,591 | | | 7,316 | | | 21,469 | | | 19,190 | |

| Same Property cash NOI (2) | $ | 85,940 | | | $ | 85,037 | | | $ | 83,194 | | | $ | 82,808 | | | $ | 82,228 | | | $ | 254,171 | | | $ | 239,422 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Percentage change in total Same Property cash NOI (2) | 4.5% | | | | | | | | | | 6.2% | | |

| Percentage change in Defense/IT Portfolio Same Property cash NOI (3) | 5.2% | | | | | | | | | | 5.7% | | |

(1)Includes our retrospective reclassification in the quarter ended 9/30/23 of a portfolio of office properties located in the Greater Washington, DC/Baltimore region that we previously reported as a separate segment referred to as Regional Office.

(2)Refer to the section entitled “Supplementary Reconciliations of Non-GAAP Measures” for reconciliation.

(3)Represents the change between the current period and the same period in the prior year.

COPT Defense Properties

Leasing (1)(2)

Three Months Ended 9/30/23

(square feet in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Defense/IT Portfolio | | | | | | | | |

| | Ft Meade/BW Corridor | | NoVA Defense/IT | | | | Navy Support | | Redstone Arsenal | | | | Total Defense/IT Portfolio | | | | Other | | Total | | | | |

| Renewed Space | | | | | | | | | | | | | | | | | | | | | | | |

| Leased Square Feet | 328 | | | 17 | | | | | 20 | | | 3 | | | | | 368 | | | | | 2 | | | 370 | | | | | |

| Expiring Square Feet | 375 | | | 47 | | | | | 23 | | | 3 | | | | | 448 | | | | | 4 | | | 452 | | | | | |

| Vacating Square Feet | 47 | | | 30 | | | | | 3 | | | — | | | | | 80 | | | | | 1 | | | 81 | | | | | |

| Retention Rate (% based upon square feet) | 87.5 | % | | 36.6 | % | | | | 85.8 | % | | 100.0 | % | | | | 82.2 | % | | | | 64.4 | % | | 82.0 | % | | | | |

| Statistics for Completed Leasing: | | | | | | | | | | | | | | | | | | | | | | | |

| Per Annum Average Committed Cost per Square Foot | $ | 3.27 | | | $ | 2.52 | | | | | $ | 1.20 | | | $ | 1.04 | | | | | $ | 3.11 | | | | | $ | 5.14 | | | $ | 3.12 | | | | | |

| Weighted Average Lease Term in Years | 4.1 | | | 5.0 | | | | | 4.6 | | | 3.2 | | | | | 4.2 | | | | | 9.6 | | | 4.2 | | | | | |

| Straight-line Rent Per Square Foot | | | | | | | | | | | | | | | | | | | | | | | |

| Renewal Straight-line Rent | $ | 33.19 | | | $ | 43.86 | | | | | $ | 30.90 | | | $ | 26.12 | | | | | $ | 33.52 | | | | | $ | 39.27 | | | $ | 33.56 | | | | | |

| Expiring Straight-line Rent | $ | 30.60 | | | $ | 39.56 | | | | | $ | 25.07 | | | $ | 25.50 | | | | | $ | 30.69 | | | | | $ | 30.73 | | | $ | 30.69 | | | | | |

| Change in Straight-line Rent | 8.5 | % | | 10.9 | % | | | | 23.3 | % | | 2.4 | % | | | | 9.2 | % | | | | 27.8 | % | | 9.3 | % | | | | |

| Cash Rent Per Square Foot | | | | | | | | | | | | | | | | | | | | | | | |

| Renewal Cash Rent | $ | 32.60 | | | $ | 42.05 | | | | | $ | 29.46 | | | $ | 26.78 | | | | | $ | 32.83 | | | | | $ | 36.29 | | | $ | 32.85 | | | | | |

| Expiring Cash Rent | $ | 32.14 | | | $ | 41.19 | | | | | $ | 27.97 | | | $ | 26.13 | | | | | $ | 32.29 | | | | | $ | 36.29 | | | $ | 32.32 | | | | | |

| Change in Cash Rent | 1.4 | % | | 2.1 | % | | | | 5.3 | % | | 2.5 | % | | | | 1.7 | % | | | | — | % | | 1.7 | % | | | | |

| Average Escalations Per Year | 2.7 | % | | 2.8 | % | | | | 2.9 | % | | 2.5 | % | | | | 2.7 | % | | | | 2.5 | % | | 2.7 | % | | | | |

| New Leases | | | | | | | | | | | | | | | | | | | | | | | |

| Development and Redevelopment Space | | | | | | | | | | | | | | | | | | | | | | | |

| Leased Square Feet | — | | | — | | | | | — | | | — | | | | | — | | | | | — | | | — | | | | | |

| Statistics for Completed Leasing: | | | | | | | | | | | | | | | | | | | | | | | |

| Per Annum Average Committed Cost per Square Foot | $ | — | | | $ | — | | | | | $ | — | | | $ | — | | | | | $ | — | | | | | $ | — | | | $ | — | | | | | |

| Weighted Average Lease Term in Years | — | | | — | | | | | — | | | — | | | | | — | | | | | — | | | — | | | | | |

| Straight-line Rent Per Square Foot | $ | — | | | $ | — | | | | | $ | — | | | $ | — | | | | | $ | — | | | | | $ | — | | | $ | — | | | | | |

| Cash Rent Per Square Foot | $ | — | | | $ | — | | | | | $ | — | | | $ | — | | | | | $ | — | | | | | $ | — | | | $ | — | | | | | |

| Vacant Space | | | | | | | | | | | | | | | | | | | | | | | |

| Leased Square Feet | 21 | | | 79 | | | | | 37 | | | 10 | | | | | 147 | | | | | 4 | | | 151 | | | | | |

| Statistics for Completed Leasing: | | | | | | | | | | | | | | | | | | | | | | | |

| Per Annum Average Committed Cost per Square Foot | $ | 5.79 | | | $ | 10.43 | | | | | $ | 7.01 | | | $ | 6.50 | | | | | $ | 8.65 | | | | | $ | 12.70 | | | $ | 8.75 | | | | | |

| Weighted Average Lease Term in Years | 5.4 | | | 10.1 | | | | | 5.8 | | | 10.0 | | | | | 8.4 | | | | | 10.0 | | | 8.4 | | | | | |

| Straight-line Rent Per Square Foot | $ | 36.45 | | | $ | 34.25 | | | | | $ | 27.41 | | | $ | 28.44 | | | | | $ | 32.46 | | | | | $ | 60.58 | | | $ | 33.18 | | | | | |

| Cash Rent Per Square Foot | $ | 35.35 | | | $ | 33.07 | | | | | $ | 27.92 | | | $ | 27.00 | | | | | $ | 31.70 | | | | | $ | 55.76 | | | $ | 32.32 | | | | | |

| Total Square Feet Leased | 349 | | | 96 | | | | | 57 | | | 13 | | | | | 515 | | | | | 6 | | | 521 | | | | | |

| Average Escalations Per Year | 2.7 | % | | 2.6 | % | | | | 2.7 | % | | 2.5 | % | | | | 2.6 | % | | | | 2.7 | % | | 2.6 | % | | | | |

| Average Escalations Excl. Data Center Shells | | | | | | | | | | | | | | | | | | | 2.6 | % | | | | |

(1)Activity excludes owner occupied space, leases with less than a one-year term and expirations associated with space removed from service. Weighted average lease term is based on the term defined in the lease assuming no exercise of early termination rights. Committed costs for leasing are reported above in the period of lease execution. Actual capital expenditures for leasing are reported on page 10 in the period such costs are incurred.

(2)Refer to the section entitled “Definitions” for definitions of certain terms on this schedule.

COPT Defense Properties

Leasing (1)(2)

Nine Months Ended 9/30/23

(square feet in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Defense/IT Portfolio | | | | | | |

| | Ft Meade/BW Corridor | | NoVA Defense/IT | | | | Navy Support | | Redstone Arsenal | | Data Center Shells | | Total Defense/IT Portfolio | | | | Other | | Total |

| Renewed Space | | | | | | | | | | | | | | | | | | | |

| Leased Square Feet | 1,009 | | | 240 | | | | | 113 | | | 3 | | | — | | | 1,365 | | | | | 2 | | | 1,367 | |

| Expiring Square Feet | 1,089 | | | 324 | | | | | 147 | | | 3 | | | — | | | 1,562 | | | | | 94 | | | 1,656 | |

| Vacating Square Feet | 80 | | | 84 | | | | | 34 | | | — | | | — | | | 198 | | | | | 91 | | | 289 | |

| Retention Rate (% based upon square feet) | 92.6 | % | | 74.2 | % | | | | 76.9 | % | | 100.0 | % | | — | % | | 87.3 | % | | | | 2.5 | % | | 82.5 | % |

| Statistics for Completed Leasing: | | | | | | | | | | | | | | | | | | | |

| Per Annum Average Committed Cost per Square Foot | $ | 2.64 | | | $ | 4.27 | | | | | $ | 1.98 | | | $ | 1.04 | | | $ | — | | | $ | 2.87 | | | | | $ | 5.14 | | | $ | 2.87 | |

| Weighted Average Lease Term in Years | 4.5 | | | 4.8 | | | | | 2.8 | | | 3.2 | | | — | | | 4.4 | | | | | 9.6 | | | 4.4 | |

| Straight-line Rent Per Square Foot | | | | | | | | | | | | | | | | | | | |

| Renewal Straight-line Rent | $ | 37.12 | | | $ | 36.69 | | | | | $ | 23.25 | | | $ | 26.12 | | | $ | — | | | $ | 35.88 | | | | | $ | 39.27 | | | $ | 35.88 | |

| Expiring Straight-line Rent | $ | 34.57 | | | $ | 34.01 | | | | | $ | 21.62 | | | $ | 25.50 | | | $ | — | | | $ | 33.38 | | | | | $ | 30.73 | | | $ | 33.38 | |

| Change in Straight-line Rent | 7.4 | % | | 7.9 | % | | | | 7.5 | % | | 2.4 | % | | — | % | | 7.5 | % | | | | 27.8 | % | | 7.5 | % |

| Cash Rent Per Square Foot | | | | | | | | | | | | | | | | | | | |

| Renewal Cash Rent | $ | 37.19 | | | $ | 38.27 | | | | | $ | 23.49 | | | $ | 26.78 | | | $ | — | | | $ | 36.23 | | | | | $ | 36.29 | | | $ | 36.23 | |

| Expiring Cash Rent | $ | 36.67 | | | $ | 38.20 | | | | | $ | 23.06 | | | $ | 26.13 | | | $ | — | | | $ | 35.79 | | | | | $ | 36.29 | | | $ | 35.79 | |

| Change in Cash Rent | 1.4 | % | | 0.2 | % | | | | 1.9 | % | | 2.5 | % | | — | % | | 1.2 | % | | | | — | % | | 1.2 | % |

| Average Escalations Per Year | 2.7 | % | | 2.3 | % | | | | 2.4 | % | | 2.5 | % | | — | % | | 2.6 | % | | | | 2.5 | % | | 2.6 | % |

| New Leases | | | | | | | | | | | | | | | | | | | |

| Development and Redevelopment Space | | | | | | | | | | | | | | | | | | | |

| Leased Square Feet | — | | | — | | | | | — | | | 77 | | | 418 | | | 495 | | | | | — | | | 495 | |

| Statistics for Completed Leasing: | | | | | | | | | | | | | | | | | | | |

| Per Annum Average Committed Cost per Square Foot | $ | — | | | $ | — | | | | | $ | — | | | $ | 7.77 | | | $ | — | | | $ | 1.21 | | | | | $ | — | | | $ | 1.21 | |

| Weighted Average Lease Term in Years | — | | | — | | | | | — | | | 10.4 | | | 15.0 | | | 14.3 | | | | | — | | | 14.3 | |

| Straight-line Rent Per Square Foot | $ | — | | | $ | — | | | | | $ | — | | | $ | 33.39 | | | $ | 31.69 | | | $ | 31.96 | | | | | $ | — | | | $ | 31.96 | |

| Cash Rent Per Square Foot | $ | — | | | $ | — | | | | | $ | — | | | $ | 30.46 | | | $ | 27.40 | | | $ | 27.88 | | | | | $ | — | | | $ | 27.88 | |

| Vacant Space | | | | | | | | | | | | | | | | | | | |

| Leased Square Feet | 132 | | | 127 | | | | | 42 | | | 11 | | | — | | | 312 | | | | | 26 | | | 337 | |

| Statistics for Completed Leasing: | | | | | | | | | | | | | | | | | | | |

| Per Annum Average Committed Cost per Square Foot | $ | 6.83 | | | $ | 10.57 | | | | | $ | 7.49 | | | $ | 6.45 | | | $ | — | | | $ | 8.42 | | | | | $ | 13.16 | | | $ | 8.79 | |

| Weighted Average Lease Term in Years | 6.6 | | | 10.0 | | | | | 5.8 | | | 9.3 | | | — | | | 8.0 | | | | | 6.3 | | | 7.9 | |

| Straight-line Rent Per Square Foot | $ | 30.39 | | | $ | 33.83 | | | | | $ | 27.91 | | | $ | 28.51 | | | $ | — | | | $ | 31.39 | | | | | $ | 37.95 | | | $ | 31.89 | |

| Cash Rent Per Square Foot | $ | 29.71 | | | $ | 33.30 | | | | | $ | 28.44 | | | $ | 27.07 | | | $ | — | | | $ | 30.90 | | | | | $ | 37.58 | | | $ | 31.41 | |

| Total Square Feet Leased | 1,141 | | | 367 | | | | | 155 | | | 91 | | | 418 | | | 2,172 | | | | | 28 | | | 2,199 | |

| Average Escalations Per Year | 2.6 | % | | 2.4 | % | | | | 2.6 | % | | 2.8 | % | | 2.3 | % | | 2.5 | % | | | | 2.7 | % | | 2.5 | % |

| Average Escalations Excl. Data Center Shells | | | | | | | | | | | | | | | | | | | 2.6 | % |

(1)Activity excludes owner occupied space, leases with less than a one-year term and expirations associated with space removed from service. Weighted average lease term is based on the term defined in the lease assuming no exercise of early termination rights. Committed costs for leasing are reported above in the period of lease execution. Actual capital expenditures for leasing are reported on page 10 in the period such costs are incurred.

(2)Refer to the section entitled “Definitions” for definitions of certain terms on this schedule.

COPT Defense Properties

Lease Expiration Analysis as of 9/30/23 (1)

(dollars and square feet in thousands, except per square foot amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Segment of Lease and Year of Expiration (2) | | Square Footage of Leases Expiring | | Annualized Rental

Revenue of Expiring Leases (3) | | % of Defense/IT

Annualized

Rental

Revenue

Expiring (3) | | Annualized Rental

Revenue of

Expiring Leases per Occupied Sq. Foot (3) | | | | | | | | | | | |

| Defense/IT Portfolio | | | | | | | | | | | | | | | | | | | |

| Ft Meade/BW Corridor | | 423 | | | $ | 17,596 | | | 3.1 | % | | $ | 41.58 | | | | | | | | | | | | |

| NoVA Defense/IT | | 48 | | | 1,561 | | | 0.3 | % | | 32.79 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Navy Support | | 15 | | | 393 | | | 0.1 | % | | 26.46 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 2023 | | 486 | | | 19,551 | | | 3.5 | % | | 40.25 | | | | | | | | | | | | |

| Ft Meade/BW Corridor | | 1,180 | | | 45,333 | | | 8.0 | % | | 38.38 | | | | | | | | | | | | |

| NoVA Defense/IT | | 251 | | | 9,164 | | | 1.6 | % | | 36.56 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Navy Support | | 465 | | | 11,824 | | | 2.1 | % | | 25.45 | | | | | | | | | | | | |

| Redstone Arsenal | | 102 | | | 3,073 | | | 0.5 | % | | 30.01 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Data Center Shells-Unconsolidated JV Properties | | 546 | | | 718 | | | 0.1 | % | | 13.15 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 2024 | | 2,544 | | | 70,112 | | | 12.4 | % | | 34.14 | | | | | | | | | | | | |

| Ft Meade/BW Corridor | | 1,789 | | | 67,540 | | | 11.9 | % | | 37.70 | | | | | | | | | | | | |

| NoVA Defense/IT | | 281 | | | 11,781 | | | 2.1 | % | | 41.97 | | | | | | | | | | | | |

| Lackland Air Force Base | | 703 | | | 39,521 | | | 7.0 | % | | 56.24 | | | | | | | | | | | | |

| Navy Support | | 154 | | | 3,994 | | | 0.7 | % | | 25.97 | | | | | | | | | | | | |

| Redstone Arsenal | | 296 | | | 6,933 | | | 1.2 | % | | 23.40 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Data Center Shells-Unconsolidated JV Properties | | 121 | | | 170 | | | — | % | | 14.09 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 2025 | | 3,344 | | | 129,940 | | | 23.0 | % | | 40.14 | | | | | | | | | | | | |

| Ft Meade/BW Corridor | | 807 | | | 32,001 | | | 5.7 | % | | 39.64 | | | | | | | | | | | | |

| NoVA Defense/IT | | 66 | | | 2,211 | | | 0.4 | % | | 33.26 | | | | | | | | | | | | |

| Lackland Air Force Base | | 250 | | | 12,565 | | | 2.2 | % | | 50.26 | | | | | | | | | | | | |

| Navy Support | | 173 | | | 5,813 | | | 1.0 | % | | 33.58 | | | | | | | | | | | | |

| Redstone Arsenal | | 46 | | | 1,157 | | | 0.2 | % | | 25.28 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Data Center Shells-Unconsolidated JV Properties | | 446 | | | 804 | | | 0.1 | % | | 18.03 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 2026 | | 1,788 | | | 54,552 | | | 9.6 | % | | 39.32 | | | | | | | | | | | | |

| Ft Meade/BW Corridor | | 685 | | | 25,922 | | | 4.6 | % | | 37.76 | | | | | | | | | | | | |

| NoVA Defense/IT | | 190 | | | 6,269 | | | 1.1 | % | | 32.94 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Navy Support | | 188 | | | 7,482 | | | 1.3 | % | | 39.80 | | | | | | | | | | | | |

| Redstone Arsenal | | 163 | | | 4,378 | | | 0.8 | % | | 26.84 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Data Center Shells-Unconsolidated JV Properties | | 364 | | | 486 | | | 0.1 | % | | 13.36 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 2027 | | 1,590 | | | 44,538 | | | 7.9 | % | | 35.22 | | | | | | | | | | | | |

| Thereafter | | | | | | | | | | | | | | | | | | | |

| Consolidated Properties | | 7,900 | | | 242,415 | | | 42.9 | % | | 30.01 | | | | | | | | | | | | |

| Unconsolidated JV Properties | | 2,819 | | | 4,537 | | | 0.8 | % | | 16.10 | | | | | | | | | | | | |

| Total Defense/IT Portfolio | | 20,471 | | | $ | 565,645 | | | 100.0 | % | | $ | 33.73 | | | | | | | | | | | | |

COPT Defense Properties

Lease Expiration Analysis as of 9/30/23 (1) (continued)

(dollars and square feet in thousands, except per square foot amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Segment of Lease and Year of Expiration (2) | | Square Footage of Leases Expiring | | Annualized Rental

Revenue of Expiring Leases (3) | | % of Total

Annualized

Rental

Revenue

Expiring (3) | | Annualized Rental

Revenue of

Expiring Leases per Occupied Sq. Foot (3) |