As filed with the Securities and Exchange Commission

on August 28, 2023

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Corporación América Airports S.A.

(Exact name of registrant as specified in its

charter)

| |

|

|

| Luxembourg |

|

N/A |

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

128, Boulevard de la Pétrusse, L-2330,

Luxembourg, Grand Duchy of Luxembourg

Tel.: +35226258274

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

(302) 738-6680

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Alejandro A. Gordano, Esq.

Shearman & Sterling LLP

599 Lexington Avenue

New York, New York 10022

(212) 848-5350

Approximate date of commencement of proposed sale to the public:

From time to time after this Registration Statement becomes effective.

If only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction

I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the

Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement

filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule

413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ¨

If an emerging growth company that prepares its financial statements

in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

Corporación América Airports S.A. (the “Registrant”)

hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall

file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with

Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting

pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete

and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission

is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction

where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED

AUGUST 28, 2023

Prospectus

Corporación América Airports S.A.

U.S.$250,000,000 Common Shares and

7,022,471 Common Shares Offered by the Selling

Shareholder

Corporación América Airports S.A. (the “Company”)

may use this prospectus to offer from time to time in one or more offerings up to an aggregate of U.S.$250,000,000 of common shares with

a nominal value of U.S.$1.00 per share (“Common Shares”). The selling shareholder named in this prospectus (the “Selling

Shareholder”) may offer and sell from time to time up to 7,022,471 of Common Shares, covered by this prospectus. The Common Shares

will be offered in amounts, at prices and on terms to be determined at the time of their offering and will be described in the supplement

to this prospectus. We will not receive any proceeds from sales of our Common Shares sold by the Selling Shareholder.

The Common Shares covered by this prospectus may be offered and sold

from time to time in one or more offerings, which may be through one or more underwriters, dealers and agents, or directly to the purchasers.

See “Plan of Distribution.” The names of any underwriters, dealers or agents, if any, will be included in a supplement to

this prospectus.

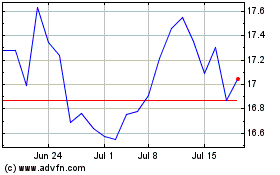

Our Common Shares are traded on The New York Stock Exchange (“NYSE”)

under the symbol “CAAP”. On August 25, 2023, the last reported sales price of the Common Shares was U.S.$14.09 per Common

Share.

See “Risk Factors” on page 2 to read about factors you

should consider before investing in our Common Shares.

This prospectus may not be used to offer and sell any securities unless

accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission (“SEC”)

nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy

or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus has not been approved by and

will not be submitted for approval to (i) the Luxembourg financial sector regulator (the Commission de surveillance du secteur financier)

for the purposes of (a) a public offering or sale of the notes in Luxembourg, (b) admission to the official list of the Luxembourg Stock

Exchange (“LuxSE”) or (c) trading on the LuxSE’s regulated market or (ii) the LuxSE for the purposes of admitting the

notes to the official list of the LuxSE and trading on the LuxSE’s Euro MTF market (the “Euro MTF Market”). Accordingly,

the notes may not be offered or sold to the public in Luxembourg, directly or indirectly, or listed or traded on the LuxSE’s regulated

market or the Euro MTF Market, and neither this prospectus nor any other circular, prospectus, form of application, advertisement or other

material may be distributed, or otherwise made available in or from, or published in, Luxembourg except in circumstances which do not

constitute a public offer of securities to the public subject to prospectus requirements in accordance with Regulation (EU) 2017/1129

of 14 June 2017 on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market

and repealing Directive 2003/71/EC, as amended or the Luxembourg act of July 16, 2019 on prospectuses for securities, as applicable.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

Neither we nor the Selling Shareholder have

authorized any dealer, salesperson or other person to give any information or to make any representation other than those contained or

incorporated by reference in this prospectus and the accompanying supplement to this prospectus. You must not rely upon any information

or representation not contained or incorporated by reference in this prospectus or the accompanying prospectus supplement. This prospectus

and the accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other

than the registered securities to which they relate, nor do this prospectus and the accompanying prospectus supplement constitute an offer

to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer

or solicitation in such jurisdiction. The information contained or incorporated by reference in this prospectus and any supplement to

this prospectus is accurate as of the dates of the applicable documents. Our business, financial condition, results of operations and

prospects may have changed since the applicable dates. When this prospectus or a supplement is delivered or a sale pursuant to this prospectus

or a supplement is made, neither we nor the Selling Shareholder is implying that the information is current as of the date of the delivery

or sale. You should not consider any information in this prospectus or in the documents incorporated by reference herein to be investment,

legal or tax advice. We encourage you to consult your own counsel, accountant and other advisors for legal, tax, business, financial and

related advice regarding an investment in our securities. You should not assume that the information contained in this prospectus and

the accompanying prospectus supplement is accurate on any date subsequent to the date set forth on the front of the document.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

on Form F-3 that we filed with the SEC using a “shelf” registration process. Under this shelf process, we may, from time to

time, sell up to U.S.$250,000,000 of our Common Shares in one or more offerings and the Selling Shareholder may, from time to time, offer

and sell an aggregate of 7,022,471 of our Common Shares in one or more offerings.

We will not receive any proceeds from the sale

of Common Shares to be offered by the Selling Shareholder pursuant to this prospectus. The Selling Shareholder will pay any underwriting

discounts and commissions and expenses incurred by it for brokerage, accounting, tax or legal services or any other expenses incurred

by it in disposing of its Common Shares. We will bear all other costs, fees and expenses incurred in effecting the registration of the

shares covered by this prospectus, including, without limitation, all registration and filing fees, NYSE listing fees and fees and expenses

of our counsel and our independent registered public accountants. We and the Selling Shareholder, as applicable, will deliver a prospectus

supplement with this prospectus to update the information contained in this prospectus. The prospectus supplement may also add, update

or change information included in this prospectus. You should read both this prospectus and any applicable prospectus supplement, together

with additional information described below under the captions “Where You Can Find More Information and Incorporation of Certain

Information by Reference.”

Unless the context indicates otherwise, the terms

“Company,” “we,” “us” and “our” refer to Corporación América Airports S.A.

WHERE YOU CAN FIND MORE INFORMATION AND INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

As required by the Securities Act of 1933 (the

“Securities Act”), we have filed a registration statement relating to the securities offered by this prospectus with the SEC.

This prospectus is a part of that registration statement, which includes additional information.

We file annual and other reports with the SEC.

You may read and copy any document we file at the SEC’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549.

The public may obtain information on the operation of the SEC’s Public Reference Room by calling the SEC in the United States at

1-800-SEC-0330. The SEC also maintains a web site at http://www.sec.gov that contains reports, proxy statements and other information

regarding registrants that file electronically with the SEC.

The SEC allows us to “incorporate by reference”

information into this prospectus, which means that we can disclose important information about us by referring you to another document

filed separately with the SEC. The information incorporated by reference is considered to be a part of this prospectus. Any information

that we file later with the SEC and that is deemed incorporated by reference will automatically update and supersede the information in

this prospectus. In all such cases, you should rely on the later information over different information included in this prospectus.

This prospectus incorporates by reference the

documents and reports listed below, unless otherwise indicated therein:

| · | any future annual reports on Form 20-F filed with the SEC after the date of this prospectus and prior

to the termination of the offering of the securities offered by this prospectus; and |

| · | any future reports on Form 6-K that we furnish to the SEC after the date of this prospectus that are identified

in such reports as being incorporated by reference in this prospectus. |

If you make a request for such information in

writing or by telephone, we will provide you, without charge, a copy of any or all of the information incorporated by reference into this

prospectus. Any such request should be directed to:

Corporación América Airports S.A.

128, Boulevard de la Pétrusse, L-2330,

Luxembourg, Grand Duchy of Luxembourg

Tel.: +35226258274

CAUTIONARY STATEMENT WITH RESPECT TO FORWARD-LOOKING

STATEMENTS

This prospectus, any accompanying prospectus supplement

and the documents incorporated by reference may contain and refer to certain forward-looking statements with respect to our financial

condition, results of operations and business. These statements constitute forward-looking statements within the meaning of Section 27A

of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking

statements are statements of future expectations that are based on management’s current expectations and assumptions and involve

known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed

or implied in these statements. Forward-looking statements include, among others, statements concerning the potential exposure to market

risks, statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions and statements

that are not limited to statements of historical or present facts or conditions.

Forward-looking statements are typically identified

by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,”

“may,” “plan,” “objectives,” “outlook,” “probably,” “project,”

“will,” “seek,” “target” and other words of similar meaning.

Our estimates and forward-looking statements are

based mainly on our current expectations and estimates on projections of future events and trends, which affect or may affect our businesses

and results of operations. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions,

they are subject to certain risks and uncertainties and are made in light of information currently available to us. Our estimates and

forward-looking statements may be influenced by the following factors, among others:

| · | our business strengths and future results of operations; |

| · | delays or unexpected casualties related to construction under our investment plan and master plans; |

| · | our ability to generate or obtain the requisite capital to fully develop and operate our airports; |

| · | the COVID-19 pandemic impact, as well as other epidemics, pandemics, and public health crises; |

| · | general economic, political, demographic and business conditions in the geographic markets we serve; |

| · | decreases in passenger traffic; |

| · | changes in the fees we may charge under our concession agreements; |

| · | inflation and hyperinflation, depreciation, and devaluation of the Argentine peso, euro, Brazilian real, Uruguayan peso or Armenian

dram, against the U.S. dollar; |

| · | the early termination, revocation, or failure to renew or extend any of our concession agreements; |

| · | the right of the Argentine government to buy out the AA2000 Concession Agreement; |

| · | changes in our investment commitments or our ability to meet our obligations thereunder; |

| · | existing and future governmental regulations; |

| · | natural disaster-related losses which may not be fully insurable; |

| · | escalation of conflicts between Russia and Ukraine and other war events; and |

| · | cyberterrorism in the international markets we serve. |

Estimates and forward-looking statements are intended

to be accurate only as of the date they were made, and we undertake no obligation to update or to review any estimate and/or forward-looking

statement because of new information, future events or other factors. Estimates and forward-looking statements involve risks and uncertainties

and are not guarantees of future performance. Our future results may differ materially from those expressed in these estimates and forward-looking

statements. You should therefore not make any investment decision based on these estimates and forward-looking statements.

See “Risk Factors” herein and

incorporated from our Annual Report and other filings we make with the SEC for a more complete discussion of the risks and uncertainties

mentioned above and for a discussion of other risks and uncertainties. All forward-looking statements attributable to us are expressly

qualified in their entirety by these cautionary statements as well as others made in this prospectus, our Annual Report and hereafter

in our other SEC filings and public communications. You should evaluate all forward-looking statements made by us in the context of these

risks and uncertainties. Note that forward-looking statements speak only as of the date of this prospectus or, in the case of any accompanying

prospectus supplement or documents incorporated by reference, the date of any such document. Except as required by applicable law, we

do not undertake any obligation to publicly correct or update any forward-looking statement.

SUMMARY

This summary highlights information contained elsewhere in this

prospectus and should be read together with the information contained in other parts of this prospectus, any prospectus supplement and

the documents we incorporate by reference. It may not contain all the information that may be important to you. You should carefully read

this prospectus and the document referred to in “Where You Can Find More Information and Incorporation of Certain Information by

Reference” for more information about us, including our financial statements.

Our Company

We acquire, develop, and operate airport concessions. We are a leading

private airport operator in the world. As of the date of this prospectus, we operate 53 airports globally in Latin America, Europe, and

Eurasia. Since 1998, when we acquired the AA2000 Concession Agreement, we have expanded the environments and geographies in which we operate

by acquiring airport concessions in Armenia, Uruguay, Ecuador, Brazil, Italy, and additional concessions in Argentina.

We operate some of the largest and most important airports in the countries

where we conduct operations, including a large international airport, such as Ezeiza Airport in Argentina, domestic airports, such as

Brasilia Airport in Brazil and Aeroparque Airport in Argentina, airports in tourist destinations, such as Bariloche and Iguazu in Argentina,

Galapagos Ecological Airport in Ecuador and Florence Airport in Italy, as well as mid-sized domestic and tourist destination airports.

Our Common Shares began trading on the NYSE under the symbol “CAAP,”

in connection with our initial public offering, on February 1, 2018.

Corporate Information

We are a public limited liability company (société

anonyme) incorporated under, and governed by, the laws of the Grand Duchy of Luxembourg. We are registered with the Luxembourg Trade

and Companies Register under the number B174140. We were incorporated on December 14, 2012, under the name A.C.I. Airports International

S.à r.l. The name changed to Corporación América Airports S.A. on September 14, 2017, upon conversion from a private

limited liability company (société à responsabilité limitée) to a public limited liability company

(société anonyme). Our registered office is located at 128, Boulevard de la Pétrusse, L-2330, Luxembourg,

Grand Duchy of Luxembourg. Our phone number is +35226258274. Our corporate website is http://www.caap.aero. The information on our website

is not part of, and is not incorporated into, this prospectus or the registration statement of which it forms a part. We have appointed

Puglisi & Associates as our agent for service of process in the United States, located at 850 Library Avenue, Suite 204, Newark, Delaware

19711.

RISK FACTORS

Investing in the securities to be offered pursuant to this prospectus

may involve a high degree of risk. You should carefully consider the important factors set forth under the heading “Risk Factors”

in our Annual Report, incorporated herein by reference, and in the accompanying prospectus supplement for such issuance before investing

in our Common Shares. We may include further risk factors in future annual reports on Form 20-F and future reports on Form 6-K incorporated

by reference in this prospectus or in a prospectus supplement. For further details, see the section entitled “Where You Can Find

More Information and Incorporation of Certain Information by Reference.”

Any of the risk factors referred to above could significantly and negatively

affect our business, prospects, results of operations and financial condition, which may reduce our ability to pay dividends and lower

the trading price of our Common Shares. The risks referred to above are those that we currently believe may materially affect us. You

may lose all or a part of your investment.

OFFER STATISTICS AND EXPECTED TIMETABLE

We will set forth in a prospectus supplement or other offering materials

a description of the offer statistics and expected timetable of any offering of securities which may be offered under this prospectus.

The prospectus supplement or any other offering materials may also add, update or change information contained in this prospectus. You

should carefully read this prospectus, any prospectus supplement or other offering materials before you invest in any of our securities.

CAPITALIZATION AND INDEBTEDNESS

Our capitalization and indebtedness will be set forth in a prospectus

supplement to this prospectus or in a report on Form 6-K subsequently furnished to the SEC and specifically incorporated herein by reference.

USE OF PROCEEDS

The use of proceeds from any offering of Common Shares by us will be

set forth in a prospectus supplement to this prospectus or in a report on Form 6-K subsequently furnished to the SEC and specifically

incorporated herein by reference.

All of the Common Shares offered by the Selling Shareholder pursuant

to this prospectus will be sold by the Selling Shareholder for its account. We will not receive any of the proceeds from these sales.

The Selling Shareholder will pay any underwriting discounts and commissions and expenses incurred by it for brokerage, accounting, tax

or legal services or any other expenses incurred by it in disposing of its Common Shares. We will bear all other costs, fees and expenses

incurred in effecting the registration of the shares covered by this prospectus, including, without limitation, all registration and filing

fees, NYSE listing fees and fees and expenses of our counsel and our independent registered public accountants.

SELLING SHAREHOLDER

This prospectus relates to the possible resale by the Selling Shareholder

of up to 7,022,471 of our Common Shares. The Selling Shareholder may from time to time offer and sell any or all of the Common Shares

set forth below pursuant to this prospectus. When we refer to the “Selling Shareholder” in this prospectus, we mean the entity

listed in the table below, and the pledgees, donees, transferees, assignees, successors and others who later come to hold any of the Selling

Shareholder’s interest in Common Shares other than through a public sale.

The following table sets forth, as of the date of this prospectus,

the name of the Selling Shareholder and the aggregate amount of Common Shares that the Selling Shareholder may offer pursuant to this

prospectus. The percentage of Common Shares owned by the Selling Shareholder both prior to and following the offering of any Common Shares

pursuant to this prospectus, is based on 163,222,707 Common Shares outstanding as of the date hereof and does not take into account any

Common Shares issued by us pursuant to this prospectus.

We cannot advise you as to whether the Selling Shareholder will in

fact sell any or all of such Common Shares. See “Plan of Distribution.”

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Before the Offering |

|

|

Number of

Ordinary

Shares Being

Offered |

|

|

After the Offering |

|

|

Name and Address of Beneficial

Owner |

|

Number of

Common Shares |

|

|

Percentage of

Outstanding

Ordinary |

|

|

|

Number of

Common Shares |

|

|

Percentage of

Outstanding

Common Shares |

|

| A.C.I. Airports S.à r.l. (1) |

|

|

131,450,833 |

|

|

|

80.53 |

% |

|

|

7,022,471 |

|

|

|

— |

|

|

|

— |

|

| (1) |

A.C.I. Airports S.à r.l., a private limited liability company (société à responsabilité limitée) incorporated in the Grand Duchy of Luxembourg, is 100% controlled by Corporación América International S.à r.l. (“CAI”), a private limited liability company (société à responsabilité limitée) also incorporated in the Grand Duchy of Luxembourg. CAI is 100% controlled by Southern Cone Foundation (“SCF”), a foundation created under the laws of Liechtenstein, our ultimate controlling shareholder. SCF manages assets for the benefit of the foundation’s beneficiaries. The potential beneficiaries of the foundation are certain members of the Eurnekian family as well as religious, charitable and educational institutions designated by the foundation’s board of directors. The foundation’s board of directors is currently composed of four individuals and decisions are made by majority vote. The foundation’s board of directors has broad authority to manage the affairs of the foundation and to designate its beneficiaries and additional board members. The registered address of both ACI Airports S.à r.l. and CAI is 128, Boulevard de la Pétrusse, L-2330, Luxembourg, Grand Duchy of Luxembourg. The address of SCF is Zollstrasse 9, FL-9490, Vaduz, Liechtenstein. |

DESCRIPTION OF SHARE CAPITAL

We are a public limited liability company (société

anonyme) incorporated in the Grand Duchy of Luxembourg. The following is a summary of some of the terms of our Common Shares, based on

our articles of association and the Luxembourg corporate law. The following summary is subject to, and is qualified in its entirety by

reference to, the provisions of our articles of association, as last amended on May 23, 2023, the form of which has been filed as an exhibit

hereto. You may obtain copies of our articles of association as described under “Where You Can Find More Information and Incorporation

of Certain Information by Reference” in this prospectus.

Type and Class of Securities

Our authorized share capital consists of 225,000,000

Common Shares with a nominal value of U.S.$1.00 per share. We have 163,222,707 Common Shares issued and outstanding, of which 2,311,896

are held as treasury shares as of the date of this prospectus. All of our issued and outstanding Common Shares are fully paid, and the

board of directors may not call on or compel our shareholders to contribute additional amounts to the Company.

Our Common Shares are listed on the NYSE under

the symbol “CAAP” and may be freely transferred under our amended articles of association, subject to applicable law.

Common Shares

Common Shares are issued in registered form only

and no certificates will be issued. The Company is entitled to treat the registered holder of any share as the absolute owner thereof

and is not bound to recognize any equitable claim or other claim or interest in such share on the part of any other person.

Issuance of Common Shares

Our shareholders have authorized the board of

directors to issue Common Shares up to the maximum amount of the authorized unissued share capital of the Company for a period of five

years from the date of the deed renewing such authorization, which period may be further renewed, to such persons, and on such terms and

for such consideration as the board of directors may determine.

Pre-emptive Rights

In the event of any capital increase whether in

cash or in kind, the holders of our Common Shares shall have pre-emptive rights to subscribe for additional Common Shares proportionally

to their existing equity in our share capital, except as noted below. The exercise period for such pre-emptive rights is determined by

the board of directors, but must be at least 14 days from the date of the publication of the offering in the Luxembourg Official

Gazette (Recueil électronique des sociétés et associations) and a journal published in the Grand

Duchy of Luxembourg. If holders of Common Shares do not elect to exercise their pre-emptive rights, the other holders of pre-emptive rights

shall benefit from secondary pre-emptive subscription rights for unsubscribed shares; provided, however, that the general meeting (or

the board of directors, as authorized from time to time by the general meeting) may limit or withdraw such pre-emptive subscription rights

in accordance with applicable law and our articles of association. The board of directors is also authorized for a period of five years

commencing on May 23, 2023, to cancel or limit the pre-emptive rights of the shareholders in accordance with our articles of association

and in connection with the issuance of shares (i) for payment in cash or in kind, or (ii) in connection with a conversion of

profits and reserves (including share premium and capital surplus).

Meetings of Shareholders

The board of directors shall convene at least

one general shareholders meeting each calendar year (the “annual general meeting”) for the purpose of, among other things,

approving the annual accounts, deciding on the allocation of the annual profit, if any, and as the case may be, electing or renewing the

mandates of directors. Under Luxembourg law, the annual general meeting must be held within six months of the end of the fiscal year.

A general meeting can be adjourned at the request of one or more shareholders representing at least 10.0% of the issued share capital.

The board of directors may convene a general meeting

whenever in its judgment such a meeting is necessary. The board of directors must convene a general meeting within a period of one month

upon notice, which notice must set forth certain information specified in the articles of association, to the Company from shareholders

holding at least the 10.0% threshold on the date of such notice. In addition, one or more shareholders who together hold at least 10.0%

of the issued share capital on the date of the notice to the Company, which notice must set forth certain information specified in the

articles of association, may require that the Company include on the agenda of such general meeting one or more additional items. At least

eight days’ notice to shareholders is required for a general meeting. No business may be transacted at a general meeting, other

than business that is properly brought before the general meeting in accordance with our articles of association.

Voting Rights

Holders of our Common Shares are entitled to one

vote per share on all matters submitted to a vote of holders of Common Shares. Luxembourg law does not provide for cumulative voting in

the election of directors. Voting of shareholders at a general meeting may be in person, by proxy or by voting bulletin. Our articles

of association specify how the Company shall determine the shareholders of record entitled to notice of or to vote at any meeting of shareholders

or any adjournment thereof.

Amendments to the Articles of Association

Except where our articles of association authorize

the board of directors to approve an increase in share capital and change the registered office and subsequently record such change

in the presence of a Luxembourg notary, our articles of association require a special resolution approved at an extraordinary general

shareholders’ meeting to amend the articles of association. The agenda of the extraordinary general shareholders’ meeting

must indicate the proposed amendments to the articles of association. Any resolutions to amend the articles of association must be taken

before a Luxembourg notary and such amendments must be published in accordance with Luxembourg law. Resolutions to amend the articles

of association may only be passed in a general meeting where at least one half of the share capital is represented, and the agenda

indicates the proposed amendments to the articles of association, and the text of those which pertain to the purpose or the form of the

Company. If the required quorum is not obtained, a second general meeting may be convened by an announcement filed with the Luxembourg

Trade and Companies Register and published in the Luxembourg Official Gazette (Recueil Électronique des Sociétés

et Associations) and in a Luxembourg newspaper at least 15 days before the relevant meeting. The applicable majority shall be

66.67% of all votes validly cast.

Variation of Share Rights

Under Luxembourg law, where a resolution of an

extraordinary general shareholders meeting will change the rights of our Common Shares or any other outstanding class of shares, the resolution

must, in order to be valid, fulfill the quorum and voting requirements for an extraordinary general meeting with respect to each such

class.

Permitted Transfers of Common Shares

The Common Shares are freely transferable subject

to compliance with transfer formalities under applicable law.

Dividend Rights

Under Luxembourg law, dividends may only be declared

from the freely available distributable reserves of the Company. Interim dividends may be declared by the board of directors, subject

to certain mandatory legal requirements as detailed in the articles of association. The general shareholders meeting would in the normal

course be asked to declare as final the interim dividends paid during the year. The shareholders may declare dividends at a general meeting.

Dividends may be paid in U.S. dollars, Euro

or any other currency chosen by the board of directors or the general meeting and dividends may be paid at such places and times as may

be determined by the board of directors within the limits of any decision made at the general shareholders meeting. Dividends may also

be paid in kind in assets of any nature, and the valuation of those assets shall be established by the board of directors according to

valuation methods determined in its discretion.

Distributions on winding up of the Company

The Company may be dissolved, at any time, by

a resolution of the general meeting adopted in the manner required for amendment of the articles of association. In the event of dissolution

of the Company, the liquidation shall be carried out by one or more liquidators (who may be physical persons or legal entities) appointed

by the general meeting which authorized such liquidation. The general meeting shall also determine the powers and the remuneration of

the liquidator(s). Under the liquidation of the Company, the surplus assets of the Company available for distribution among shareholders

shall be distributed in accordance with the rules on distributions set forth in our articles of association, by way of advance payments

or after payment (or provisions, as the case may be) of the Company’s liabilities.

Registration Rights and Indemnification Agreement

We entered into a registration rights and indemnification

agreement with the Selling Shareholder. This agreement grants the Selling Shareholder the right to demand up to five registrations for

the sale of our Common Shares. Additionally, the agreement provides the Selling Shareholder and its affiliate transferees customary “piggyback”

registration rights. The registration rights and indemnification agreement also provide that we will pay certain expenses relating to

such registrations and indemnify such holders of registrable securities against certain liabilities, which may arise under the Securities

Act.

Board of Directors

Our articles of association provide that our business

is to be managed and conducted by or under the direction of our board of directors. In managing the business of the Company, the board

of directors is vested with the broadest powers to perform or cause to be performed any actions necessary or useful in connection with

the purpose of the Company. All powers not expressly reserved by the Luxembourg corporate law or by the articles of association to the

general shareholders meeting shall fall within the authority of the board of directors.

Our board of directors is composed of up to nine

directors, appointed by the general shareholders meeting. The members of the board of directors shall be elected for a term not exceeding

six years, and shall be eligible to stand for re-election. A director may be removed with or without cause and/or replaced, at any time,

by a resolution adopted at the general shareholders meeting. The general shareholders meeting shall also determine the number of directors,

the remuneration and their term of office. In the event of any director vacancy, the remaining directors may elect at a meeting of the

board of directors, by majority vote, to fill such vacancy or vacancies, as the case may be, until the following general shareholders

meeting.

Executive Committee

The management of the Company is delegated to

an executive committee (comité de direction) consisting of a maximum of five members including, inter alia, a Chief Executive

Officer, a Chief Financial Officer, a Head of Legal and Compliance and other members of the senior management designated from time to

time by the board of directors. The executive committee has the broadest powers possible under Luxembourg law and remains under the supervision

and control of the board of directors.

Mergers and de-mergers

A merger by absorption whereby a Luxembourg company,

after its dissolution without liquidation, transfers to the absorbing company all of its assets and liabilities in exchange for the issuance

to the shareholders of the company being acquired of shares in the acquiring company, or a merger effected by transfer of assets to a

newly incorporated company, must, in principle, subject to certain exceptions, be approved by a special resolution of shareholders of

the Luxembourg company to be held before a notary. Similarly, a de-merger of a Luxembourg company is, in principle, subject to certain

exceptions subject to the approval by a special resolution of shareholders.

Shareholder Suits and Information Rights

Class actions and derivative actions are generally

not available to shareholders under Luxembourg law. Minority shareholders holding securities entitled to vote at the general meeting that

resolved on the granting of discharge to the directors and holding at least 10.0% of the voting rights of the Company may bring an action

against the directors on behalf of the Company.

Minority shareholders holding at least 10.0% of

the voting rights of the Company may also ask the directors questions in writing concerning acts of management of the Company or one of

its subsidiaries, and if the Company fails to answer these questions within one month, these shareholders may apply to the Luxembourg

courts to appoint one or more experts instructed to submit a report on these acts of management. Furthermore, consideration would be given

by a Luxembourg court in summary proceedings to acts that are alleged to constitute an abuse of majority rights against the minority shareholders.

Indemnification of Directors and Officers

Our articles of association provide that we will,

to the extent permitted by law, indemnify our directors and officers against liability and expenses reasonably incurred or paid by them

in connection with claims, actions, suits or proceedings in which they become involved as a party or otherwise by virtue of performing

or having performed as a director or officer, and against amounts paid or incurred by them in the settlement of such claims, actions,

suits or proceedings, if such person acted in good faith and in a manner the person reasonably believed to be in, and not opposed to,

the best interests of the Company, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s

conduct was unlawful. The indemnification extends, among other things, to legal fees, costs and amounts paid in the context of a settlement.

We have entered into separate indemnification agreements with our directors and executive officers. Except for proceedings to enforce

rights to indemnification or advancement of expenses, we shall not be obligated to indemnify any such officer or director in connection

with a proceeding initiated by such person when such proceeding (or part thereof) was consented to by the board of directors.

Our articles of association provide that we may

purchase and maintain insurance or furnish similar protection or make other arrangements, including, but not limited to, providing a trust

fund, letter of credit or surety bond on behalf of our directors or officers against any liability asserted against them in their capacity

as a director or officer.

Access to Books and Records and Dissemination

of Information

The register of shareholders of the Company is

available for inspection, at the Company’s registered office, by shareholders.

Each year, the shareholders have the right to

inspect, at the Company’s registered office, for at least eight calendar days prior to the annual general meeting, among other things,

(i) the annual accounts, as well as the list of directors and of the approved statutory auditor(s) (réviseur(s) d’entreprises

agréé(s)), (ii) the report of the approved statutory auditors, and (iii) in case of amendments to our articles of association,

the text of the proposed amendments and the draft of the resulting consolidated articles of association. Each shareholder is entitled

to obtain these free of charge, upon request. Under Luxembourg law, it is generally accepted that a shareholder has the right to receive

responses to questions concerning items on the agenda for a general meeting of shareholders, if such responses are necessary or useful

for a shareholder to make an informed decision concerning such agenda item, unless a response to such questions could be detrimental to

our interests.

Registrar and Transfer Agent

We have appointed Equiniti Trust Company, LLC

(formerly known as American Stock Transfer & Trust Company, LLC) as our U.S. registrar and transfer agent.

Repurchase of Common Shares

Pursuant to our articles of association, our board

of directors may redeem our Common Shares in accordance with Luxembourg law on such terms and in such manner as may be authorized by the

general meeting of shareholders in an ordinary resolution, subject to the rules of any stock exchange on which our Common Shares are traded.

Reduction of Share Capital

The share capital of the Company may be reduced

by a resolution adopted by the general meeting of shareholders in the manner required for the amendment of the articles of association.

Non-Distributable Reserve

Our articles of association provide for the creation

of a non-distributable reserve. We recorded this non-distributable reserve in the amount of U.S.$1,353.6 million. The non-distributable

reserve may be reduced by a resolution adopted by the general meeting of shareholders in the manner required for in the amendment of the

articles of association.

Annual Accounts

The board of directors shall draw up the annual

accounts of the Company that shall be submitted to the approval of the shareholders at the annual general meeting. Except in some cases

provided for by Luxembourg law, our board of directors must also annually prepare management reports on the annual accounts and consolidated

accounts. The annual accounts and consolidated accounts are audited by an approved statutory auditor (réviseur d’entreprises

agréé).

The annual accounts and the consolidated accounts,

after approval by the annual general meeting of shareholders, will be filed with the Luxembourg Trade and Companies Register.

ENFORCEMENT OF CIVIL

LIABILITIES

We are organized under

the laws of Luxembourg. The majority of our assets are located outside the United States. Furthermore, the majority of our directors and

officers and some experts named in this prospectus reside outside the United States and a substantial portion of their assets are located

outside the United States. Investors may not be able to effect service of process within the United States upon us or these persons or

to enforce judgments obtained against us or these persons in U.S. courts, including judgments in actions predicated upon the civil liability

provisions of the U.S. federal securities laws. Likewise, it may also be difficult for an investor to enforce in U.S. courts judgments

obtained against us or these persons in courts located in jurisdictions outside the United States, including judgments predicated upon

the civil liability provisions of the U.S. federal securities laws. It may also be difficult for an investor to bring an original action

in a Luxembourg court predicated upon the civil liability provisions of the U.S. federal securities laws against us or these persons.

Furthermore, Luxembourg law does not recognize a shareholder’s right to bring a derivative action on behalf of the Company, except

in limited cases. Minority shareholders holding securities entitled to vote at the general meeting and holding at least 10.0% of the voting

rights of the Company may bring an action against the directors on behalf of the Company. Minority shareholders holding at least 10.0%

of the voting rights of the Company may also ask the directors questions in writing concerning acts of management of the Company or one

of its subsidiaries, and if the Company fails to answer these questions within one month, these shareholders may apply to the Luxembourg

courts to appoint one or more experts instructed to submit a report on these acts of management.

As there is no treaty

in force on the reciprocal recognition and enforcement of judgments in civil and commercial matters between the United States and Luxembourg,

courts in Luxembourg will not automatically recognize and enforce a final judgment rendered by a U.S. court. A valid judgment in civil

or commercial matters obtained from a court of competent jurisdiction in the United States may be entered and enforced through a court

of competent jurisdiction in Luxembourg, subject to compliance with the enforcement procedures (exequatur). The enforceability

in Luxembourg courts of judgments rendered by U.S. courts will be subject prior any enforcement in Luxembourg to the procedure and the

conditions set forth in the Luxembourg procedural code, which conditions may include the following as of the date of this prospectus (which

may change):

| · | the judgment of the U.S. court is final and enforceable (exécutoire) in the United States; |

| · | the U.S. court had jurisdiction over the subject matter leading to the judgment (that is, its jurisdiction was in compliance with

both Luxembourg private international law rules and with the applicable domestic U.S. federal or state jurisdictional rules); |

| · | the U.S. court has applied to the dispute the substantive law that would have been applied by Luxembourg courts; |

| · | the judgment was granted following proceedings where the counterparty had the opportunity to appear and, if it appeared, to present

a defense, and the decision of the foreign court must not have been obtained by fraud, but in compliance with the rights of the defendant; |

| · | the U.S. court has acted in accordance with its own procedural laws; |

| · | the judgment of the U.S. court does not contravene Luxembourg international public policy; and |

| · | the U.S. court proceedings were not of a criminal or tax nature. |

We indemnify our directors

for and hold them harmless against all claims, actions, suits, or proceedings brought against them, subject to limited exceptions. The

rights and obligations among or between us and any of our current or former directors and officers will be generally governed by the laws

of Luxembourg and subject to the jurisdiction of the Luxembourg courts, unless such rights or obligations do not relate to or arise out

of their capacities listed above. Although there is doubt as to whether U.S. courts would enforce such provision in an action brought

in the United States under U.S. federal or state securities laws, such provision could make enforcing judgments obtained outside Luxembourg

more difficult to enforce against our assets in Luxembourg or jurisdictions that would apply Luxembourg law.

PLAN OF DISTRIBUTION

We may offer and sell and the Selling Shareholder, which as used herein

includes donees, pledgees, transferees or other successors-in-interest selling our Common Shares or interests in our Common Shares received

after the date of this prospectus from the Selling Shareholder as a gift, pledge, partnership distribution or other transfer, may, from

time to time, sell, transfer or otherwise dispose of certain of its Common Shares or interests in Common Shares, on any stock exchange,

market or trading facility on which the Common Shares are traded or in private transactions. These dispositions may be at fixed prices,

at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the

time of sale, or at negotiated prices.

We and the Selling Shareholder may use any one or more of the following

methods when disposing of shares or interests therein:

| · | on the NYSE or any other national securities exchange or U.S. inter-dealer system of a registered national securities association

on which our Common Shares may be listed or quoted at the time of sale; |

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| · | one or more underwritten offerings; |

| · | block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block

as principal to facilitate the transaction; |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| · | an exchange distribution in accordance with the rules of the applicable exchange; |

| · | privately negotiated transactions; |

| · | short sales effected after the date the registration statement of which this prospectus is a part is declared effective by the SEC; |

| · | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| · | broker-dealers may agree with the Selling Shareholder to sell a specified number of such shares at a stipulated price per share; and |

| · | a combination of any such methods of sale. |

The Selling Shareholder may, from time to time, pledge or grant a security

interest in some of the Common Shares owned by it and, if the Selling Shareholder defaults in the performance of its secured obligations,

the pledgees or secured parties may offer and sell the Common Shares, from time to time, under this prospectus, or under an amendment

or supplement to this prospectus amending the list of the Selling Shareholder to include the pledgee, transferee or other successors in

interest as the Selling Shareholder under this prospectus. The Selling Shareholder also may transfer the Common Shares in other circumstances,

in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our Common Shares or interests therein,

we and the Selling Shareholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn

engage in short sales of our Common Shares in the course of hedging the positions they assume. We and the Selling Shareholder may also

sell our Common Shares short and deliver these securities to close out our or their short positions, as applicable, or loan or pledge

our Common Shares to broker-dealers that in turn may sell these securities. We and the Selling Shareholder may also enter into option

or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require

the delivery to such broker-dealer or other financial Institution of shares offered by this prospectus, which shares such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to us or the Selling Shareholder from the sale

of our Common Shares, as applicable, will be the purchase price of our Common Shares less discounts or commissions, if any. We and the

Selling Shareholder reserve the right to accept and, together with our or its agents from time to time, as applicable, to reject, in whole

or in part, any proposed purchase of our Common Shares to be made directly or through agents. We will not receive any of the proceeds

from any offering by the Selling Shareholder.

The Selling Shareholder also may in the future resell a portion of

the Common Shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria

and conform to the requirements of that rule, or pursuant to other available exemptions from the registration requirements of the Securities

Act.

The Selling Shareholder and any underwriters, broker-dealers or agents

that participate in the sale of our Common Shares or interests therein may be “underwriters” within the meaning of Section

2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the Common Shares may be underwriting

discounts and commissions under the Securities Act. If the Selling Shareholder is an “underwriter” within the meaning of Section

2(11) of the Securities Act, then the Selling Shareholder will be subject to the prospectus delivery requirements of the Securities Act.

Underwriters and their controlling persons, dealers and agents may be entitled, under agreements entered into with us and the Selling

Shareholder, to indemnification against and contribution toward specific civil liabilities, including liabilities under the Securities

Act.

To the extent required, the Common Shares to be sold, the respective

purchase prices and public offering prices, the names of any agents, dealer or underwriter, and any applicable discounts, commissions,

concessions or other compensation with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if

appropriate, a post-effective amendment to the registration statement that includes this prospectus.

To facilitate the offering of the Common Shares offered by us or the

Selling Shareholder, certain persons participating in the offering may engage in transactions that stabilize, maintain or otherwise affect

the price of our Common Shares. This may include over-allotments or short sales, which involve the sale by persons participating in the

offering of more shares than were sold to them. In these circumstances, these persons would cover such over-allotments or short positions

by making purchases in the open market or by exercising their over-allotment option, if any. In addition, these persons may stabilize

or maintain the price of our Common Shares by bidding for or purchasing shares in the open market or by imposing penalty bids, whereby

selling concessions allowed to dealers participating in the offering may be reclaimed if shares sold by them are repurchased in connection

with stabilization transactions. The effect of these transactions may be to stabilize or maintain the market price of our Common Shares

at a level above that which might otherwise prevail in the open market. These transactions may be discontinued at any time.

The Selling Shareholder may use this prospectus in connection with

resales of the Common Shares. The Selling Shareholder may be deemed to be an underwriter under the Securities Act in connection with the

Common Shares they resell and any profits on the sales may be deemed to be underwriting discounts and commissions under the Securities

Act. Unless otherwise set forth in a prospectus supplement, the Selling Shareholder will receive all the net proceeds from the resale

of the Common Shares sold by it.

LEGAL MATTERS

The validity of the Common Shares will be passed upon for us by Allen

& Overy, Luxembourg with respect to matters of Luxembourg law, and certain legal matters in connection with this offering will be

passed upon for us by Shearman & Sterling LLP.

EXPERTS

The financial statements and management’s assessment of the effectiveness

of internal control over financial reporting (which is included in Management’s Report on Internal Control over Financial Reporting)

incorporated in this prospectus by reference to the Annual Report on Form 20-F for the year ended December 31, 2022 have been so incorporated

in reliance on the report of Price Waterhouse & Co. S.R.L., an independent registered public accounting firm, given on the authority

of said firm as experts in auditing and accounting.

Corporación América Airports S.A.

U.S.$250,000,000 Common Shares and

7,022,471 Common Shares Offered by the Selling

Shareholder

PROSPECTUS

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

| Item 8. |

Indemnification of Directors and Officers |

Under Luxembourg law, the Registrant may not indemnify a director or

officer for criminal liability, gross negligence, willful misconduct, or an intentional breach of his/her statutory duties.

The Registrant’s articles of association provide for the following

provisions: a director or agent of the Registrant shall be indemnified by the Registrant to the fullest extent permitted by Luxembourg

law, against liability and expenses, judgements, fines and amounts paid in settlement actually and reasonably incurred or paid by him

in connection with any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative

brought by a third party in which he becomes involved in as a party by virtue of his being or having been such a director or agent and

against all amounts incurred in settlement thereof.

The Registrant provides directors’ and officers’ liability

insurance for the members of its Board of Directors against civil liabilities and liabilities under the Securities Act, which they may

incur in connection with their activities on behalf of the Registrant.

The exhibit index attached hereto is incorporated herein by reference.

(a) The Registrant hereby undertakes:

(1) To file, during any period in which

offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required

by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts

or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which

individually or in the aggregate, represent a fundamental change in the information set forth in this Registration Statement. Notwithstanding

the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed

that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the

form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more

than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Tables” in the effective

Registration Statement; and

(iii) To include any material information

with respect to the plan of distribution not previously disclosed in this Registration Statement or any material change to such information

in this Registration Statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii)

and (a)(1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs

is contained in reports filed with or furnished to the SEC by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act

that are incorporated by reference in this Registration Statement, or is contained in a form of prospectus filed pursuant to Rule 424(b)

that is part of this Registration Statement;

(2) That, for the purpose of determining

any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating

to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof;

(3) To remove from registration by means

of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering;

(4) To file a post-effective amendment

to this Registration Statement to include any financial statements required by Item 8.A of Form 20-F at the start of any delayed offering

or throughout a continuous offering. Financial Statements and information otherwise required by Section 10(a)(3) of the Securities Act

need not be furnished, provided that the Registrant includes in the prospectus, by means of a post-effective amendment, financial

statements required pursuant to this paragraph and other information necessary to ensure that all other information in the prospectus

is at least as current as the date of those financial statements. Notwithstanding the foregoing, with respect to registration statements

on Form F-3, a post-effective amendment need not be filed to include financial statements and information required by Section 10(a)(3)

of the Securities Act or Item 8.A of Form 20–F if such financial statements and information are contained in periodic reports filed

with or furnished to the SEC by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference

in the Form F-3;

(5) That, for the purpose of determining

liability under the Securities Act to any purchaser:

(A) Each prospectus filed by the Registrant

pursuant to Rule 424(b)(3) shall be deemed to be part of this Registration Statement as of the date the filed prospectus was deemed part

of and included in this Registration Statement; and

(B) Each prospectus required to be filed

pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made

pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act

shall be deemed to be part of and included in this Registration Statement as of the earlier of the date such form of prospectus is first

used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided

in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be

a new effective date of this Registration Statement relating to the securities in this Registration Statement to which the prospectus

relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided,

however, that no statement made in a registration statement or prospectus that is part of this Registration Statement or made in a document

incorporated or deemed incorporated by reference into this Registration Statement or prospectus that is part of this Registration Statement

will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made

in this Registration Statement or prospectus that was part of this Registration Statement or made in any such document immediately prior

to such effective date;

(6) That, for the purpose of determining

liability of a registrant under the Securities Act to any purchaser in the initial distribution of the securities, the Registrant undertakes

that in a primary offering of securities of the Registrant pursuant to this Registration Statement, regardless of the underwriting method

used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following

communications, the Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) any preliminary prospectus or prospectus of the Registrant relating to the offering required to be filed pursuant to Rule 424; (ii)

any free writing prospectus relating to the offering prepared by or on behalf of the Registrant or used or referred to by the Registrant;

(iii) the portion of any other free writing prospectus relating to the offering containing material information about the Registrant or

its securities provided by or on behalf of the Registrant; and (iv) any other communication that is an offer in the offering made by the

Registrant to the purchaser.

(b) The Registrant hereby undertakes that, for

purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to section

13(a) or section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant

to section 15(d) of the Exchange Act) that is incorporated by reference in this Registration Statement shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

(c) Insofar as indemnification for liabilities

arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing

provisions, or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification is against public policy

as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities

(other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant

in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection

with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed

in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant

certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form F-3 and has duly caused this

Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Buenos Aires, Argentina,

on August 28, 2023.

| |

|

|

|

| |

CORPORACIÓN AMÉRICA AIRPORTS S.A. |

| |

|

|

| |

By: |

|

/s/ Andres Zenarruza |

| |

|

|

Andres Zenarruza

Head of Legal & Compliance |

| |

|

|

|

| |

By: |

|

/s/ Jorge Arruda Filho |

| |

|

|

Jorge Arruda Filho

Chief Financial Officer |

POWER OF ATTORNEY

Each person whose signature appears below constitutes and appoints

each of Andres Zenarruza and Jorge Arruda Filho as his or her true and lawful attorney-in-fact and agent, with full power of substitution

and resubstitution for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all (i) amendments

(including post-effective amendments) and additions to this Registration Statement and (ii) any and all additional registration statements

pursuant to Rule 462(b) of the Securities Act, as amended, and to file the same, with all exhibits thereto, and other documents in connection

therewith, with the SEC, granting unto each said attorney-in-fact and agent full power and authority to do and perform each and every

act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or

could do in person, hereby ratifying and confirming all that each of said attorneys-in-fact and agent or either of them or their or his

or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration

Statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

|

/s/ Martín F. Antranik Eurnekian

Martín Francisco Antranik Eurnekian |

|

Chief Executive Officer and Director

(Principal Executive Officer) |

|

August 28, 2023 |

|

/s/ Jorge Arruda Filho

Jorge Arruda Filho |

|

Chief Financial Officer

(Principal Financial Officer)

|

|

August 28, 2023 |

|

/s/ Martin Cossatti

Martin Cossatti |

|

Head of Accounting, Planning and

Tax

(Principal Accounting Officer) |

|

August 28, 2023 |

|

/s/ Máximo Luis Bomchil

Máximo Luis Bomchil |

|

Director |

|

August 28, 2023 |

|

/s/ Roderick H. McGeoch

Roderick H. McGeoch |

|

Director |

|

August 28, 2023 |

|

/s/ David Arendt

David Arendt |

|

Director |

|

August 28, 2023 |

|

/s/ Valérie Pechon

Valérie Pechon |

|

Director |

|

August 28, 2023 |

|

/s/ Carlo Alberto Montagna

Carlo Alberto Montagna |

|

Director |

|

August 28, 2023 |

|

/s/ Daniel Marx

Daniel Marx |

|

Director |

|

August 28, 2023 |

Signature of Authorized Representative in the

United States

Pursuant to the Securities Act, the undersigned, the duly authorized

representative in the United States of Corporación América Airports S.A., has signed this Registration Statement in the

city of Newark, State of Delaware, on August 28, 2023.

| |

Authorized U.S. Representative |

| |

By:

|

|

/s/ Donald J. Puglisi

|

| |

|

|

Donald J. Puglisi

Managing Director |

EXHIBIT INDEX

|

* |

To be filed, if necessary, after effectiveness of this Registration

Statement by an amendment thereto or incorporated by reference from documents filed or to be filed with the SEC under the Exchange Act. |

Exhibit 4.1

CORPORACIÓN AMÉRICA AIRPORTS

S.A.

Société anonyme

128, Boulevard de la Pétrusse, L-2330 Luxembourg,

Grand Duchy of Luxembourg

R.C.S. Luxembourg: B 174140

| STATUTS COORDONNES AU 23 MAI 2023 |

| 1. | Form, name and number of shareholders |

There exists a public limited liability company

(société anonyme) under the name of “Corporación América Airports S.A.” (the Company),

governed by the laws of the Grand Duchy of Luxembourg and in particular the law dated 10 August 1915 on commercial companies, as

amended (the Companies Act), and by the present articles of incorporation (the Articles, and a reference to an “Article”

shall be construed as a reference to an article of these Articles).

| 1.2 | Number of shareholders |

The Company may have one shareholder (the Sole

Shareholder) or several shareholders. The Company shall not be dissolved upon the death, suspension of civil rights, insolvency, liquidation

or bankruptcy of the Sole Shareholder.

Where the Company has only one shareholder, any

reference to the shareholders in the Articles shall be a reference to the Sole Shareholder.

| 2.1 | Place and transfer of the registered office |

The registered office of the Company is established

in the municipality of Luxembourg. It may be transferred within such municipality or to any other place in the Grand Duchy of Luxembourg

by a resolution of the board of directors of the Company (the Board), which is authorised to amend the Articles, to the extent

necessary, to reflect the transfer and the new location of the registered office.

| 2.2 | Branches, offices, administrative centres and agencies |

The Board shall further have the right to set

up branches, offices, administrative centres and agencies wherever it shall deem fit, either within or outside the Grand Duchy of Luxembourg.

The Company is formed for an unlimited duration.

The corporate purpose of the Company is (i) the

acquisition, holding and disposal, in any form, by any means, whether directly or indirectly, of participations, rights and interests

in, and obligations of, Luxembourg and foreign companies, (ii) the acquisition by purchase, subscription, or in any other manner,

as well as the transfer by sale, exchange or in any other manner of stock, partnership interests, bonds, debentures, notes and other securities

or financial instruments of any kind (including notes or parts or units issued by Luxembourg or foreign mutual funds or similar undertakings)

and receivables, claims or loans or other credit facilities and agreements or contracts relating thereto, and (iii) the ownership,

administration, development and management of a portfolio of assets (including, among other things, the assets referred to in (i) and

(ii) above).

The Company may borrow in any form. It may enter

into any type of loan agreement and it may issue notes, bonds, debentures, certificates, shares, beneficiary parts, warrants and any kind

of debt or equity securities including under one or more issuance programmes. The Company may further list all or part of its shares on