Constellation Brands Authorizes $2 Billion in Share Buybacks, Targets 7% to 9% Growth in Beer

November 02 2023 - 1:50PM

Dow Jones News

By Ben Glickman

Constellation Brands authorized up to $2 billion in additional

share buybacks and outlined its medium-term growth targets.

The Victor, N.Y.-based beer and wine seller said Thursday ahead

of its investor day that it was aiming for medium-term growth in

its beer business of 7% to 9%. The company has forecast 8% to 9%

growth in beer sales in fiscal 2024.

Constellation is also forecasting medium-term wine and spirits

sales growth of 1% to 3%. The company previously said it was

forecasting a 0.5% drop to a 0.5% rise in organic sales in fiscal

2024.

The company is targeting double-digit earnings per share growth

in the medium term, excluding Canopy, which the company owns a

stake in.

Constellation said that other than its share-repurchase program,

it is focused on allocation capital to strengthening its balance

sheet, returning to cash to shareholders, investing in organic

growth and executing tuck-in acquisitions.

Write to Ben Glickman at ben.glickman@wsj.com

(END) Dow Jones Newswires

November 02, 2023 13:35 ET (17:35 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

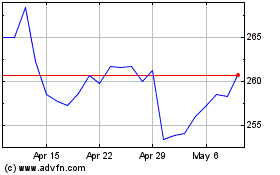

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From Apr 2024 to May 2024

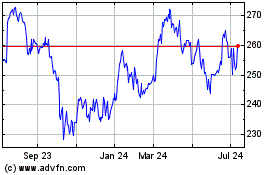

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From May 2023 to May 2024