SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2022

Commission File Number 1-12260

COCA-COLA FEMSA, S.A.B. de C.V.

(Translation of Registrant’s name into English)

United Mexican States

(Jurisdiction of incorporation or organization)

Calle Mario Pani No. 100,

Sante Fe Cuajimalpa,

Cuajimalpa de Morelos,

05348, Ciudad de México,

México

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports

under cover of Form 20-F or Form 40-F:

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(1): _______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7): _______

Indicate by check mark whether by furnishing the information

contained in this

Form, the registrant is also thereby furnishing the

information to the

Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes ¨ No

x

If "Yes" is marked, indicate below the file

number assigned to the registrant in

connection with Rule 12g3-2(b): 82-_____________

COCA-COLA

FEMSA ANNOUNCES THE TOTAL CONSIDERATION AND

ACCEPTANCE OF NOTES FOR ITS PREVIOUSLY ANNOUNCED TENDER OFFERS

MEXICO CITY, MEXICO – September 9, 2022 – Coca-Cola

FEMSA, S.A.B. de C.V. (NYSE:KOF) (“KOF”) today announced the total consideration and acceptance for its previously

announced offers to purchase for cash KOF’s notes of the series set forth in the table below (all such notes, the “Notes”

and each such series, a “series” of Notes), for an aggregate purchase price, excluding accrued interest and additional amounts,

if any (the “Aggregate Purchase Price”), of up to US$250 million (the “Tender Cap”), subject to

the acceptance priority procedures and proration described in the Offer to Purchase (as defined below) from each registered holder of

the Notes (each a “Holder” and, collectively, the “Holders”). We refer to our offer to purchase

each series of Notes as an “Offer” and collectively as the “Offers.” The Offers are being made pursuant

to the terms and subject to the conditions set forth in the offer to purchase dated August 25, 2022 (as amended or supplemented from time

to time, the “Offer to Purchase”).

The following table sets forth certain information about the Offers,

including the total consideration payable for the Notes validly tendered (and not validly withdrawn) on or prior to 5:00 p.m. New York

City time yesterday, September 8, 2022 (the “Early Tender Time”), and accepted for purchase by KOF (the “Total

Consideration”).

|

Notes |

CUSIP/ISIN |

Principal

Amount

Outstanding |

Acceptance

Priority Level |

Repurchase

Yield |

Total

Consideration(1) |

Amount

Tendered as of the Early Tender Time |

Amount

Accepted |

Approximate

Proration Factor |

5.250% Senior Notes

due 2043 |

191241 AF5/

US191241AF58 |

US$600,000,000 |

1 |

5.177% |

US$1,009.25 |

110,858,000 |

110,858,000 |

N/A |

2.750% Senior Notes

due 2030 |

191241 AH1/

US191241AH15 |

US$1,250,000,000 |

2 |

4.399% |

US$897.26 |

366,873,000 |

209,474,000 |

54.85% |

| (1) | Per US$1,000 principal amount of Notes. The Total Consideration was calculated in accordance with the

formula set forth in Schedule 1 to the Offer to Purchase, based on a fixed spread and the yield of a specified reference security for

each series of Notes as of 11:00 a.m., New York City time today, September 9, 2022. The Total Consideration for each series of Notes includes

an early tender premium in the amount of US$30 per US$1,000 principal amount of Notes validly tendered (and not validly withdrawn) and

accepted for purchase pursuant to the Offers (the “Early Tender Premium”). |

In order to accept for purchase additional Notes validly tendered

(and not validly withdrawn), KOF is increasing the Tender Cap from US$250,000,000 to US$299,836,078. All other terms of the Offers as

described in the Offer to Purchase remain the same.

Because the purchase of all Notes validly tendered in the Offers would

cause KOF to purchase an aggregate principal amount of Notes that would result in an Aggregate Purchase Price in excess of the Tender

Cap (as increased as herein described), KOF has accepted for purchase all tendered 5.250% Senior Notes due 2043 and only US$209,474,000

principal amount of tendered 2.750% Senior Notes due 2030 (the “2030 Notes”). KOF will pay holders of 2030 Notes validly

tendered (and not validly withdrawn) on or prior to the Early Tender Time on a pro rata basis according to the pro ration procedures

described in the Offer to Purchase.

Notes that have been validly tendered cannot be withdrawn, except

as may be required by applicable law. Holders of Notes who tender after the Early Tender Time will not have any of their Notes accepted

for purchase. Any tendered Notes that are not accepted for purchase will be returned or credited without expense to the holder’s

account.

The initial settlement date on which KOF will make payment for Notes

accepted in the Offers is expected to be September 13, 2022 (the “Initial Settlement Date”).

Holders of Notes that validly tendered (and not validly withdrawn)

on or prior to the Early Tender Time and whose Notes have been accepted for purchase are entitled to receive the applicable Total Consideration

set forth in the table above, which includes the Early Tender Premium set forth therein, and to receive accrued and unpaid interest on

their accepted Notes from the last interest payment date to, but not including, the Initial Settlement Date, and additional amounts, if

any, as further described in the Offer to Purchase.

The Offers will expire at 11:59 p.m., New York City time, on September

22, 2022.

* * *

KOF has engaged HSBC Securities (USA) Inc. and J.P. Morgan Securities

LLC as dealer managers in connection with the Offers (the “Dealer Managers” and each, a “Dealer Manager”).

Global Bondholder Services Corporation is acting as the tender and information agent for the Offers.

This press release is neither an offer to purchase nor a solicitation

of an offer to sell the Notes. The Offers are not being made to Holders in any jurisdiction in which KOF is aware that the making of the

Offers would not be in compliance with the laws of such jurisdiction. In any jurisdiction in which the securities laws or blue sky laws

require the Offers to be made by a licensed broker or dealer, the Offers will be deemed to be made on KOF’s behalf by the Dealer

Managers or one or more registered brokers or dealers that are licensed under the laws of such jurisdiction. Any questions or requests

for assistance regarding the Offers may be directed to HSBC Securities (USA) Inc. at (888) HSBC-4LM (toll-free) or J.P. Morgan Securities

LLC at (866) 846-2874 (toll-free). Requests for additional copies of the Offer to Purchase and related documents may be directed to Global

Bondholder Services Corporation at (212) 430-3774 or (855) 654-2014 (toll-free).

Neither the Offer to Purchase nor any documents related to the Offers

have been filed with, and have not been approved or reviewed by any federal or state securities commission or regulatory authority of

any country. No authority has passed upon the accuracy or adequacy of the Offer to Purchase or any documents related to the Offers, and

it is unlawful and may be a criminal offense to make any representation to the contrary.

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking

statements are information of a non-historical nature or which relate to future events and are subject to risks and uncertainties. No

assurance can be given that the transactions described herein will be consummated or as to the ultimate terms of any such transactions.

KOF undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future

events or for any other reason.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: Sepember 9, 2022

COCA-COLA FEMSA, S.A.B. DE C.V.

By: /s/ Constantino Spas Montesinos

Name: Constantino Spas Montesinos

Title: Chief Financial Officer

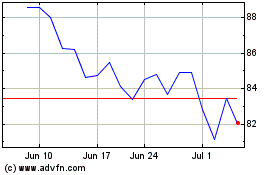

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From Apr 2024 to May 2024

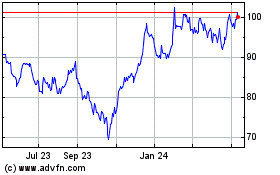

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From May 2023 to May 2024