SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13A-16

OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2023

(Commission File No. 1-14862 )

BRASKEM S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of registrant's name into English)

Rua Eteno, 1561, Polo Petroquimico de Camacari

Camacari, Bahia - CEP 42810-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1). _____

Indicate by check mark if the registrant is

submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7). _____

Indicate by check mark whether the

registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____.

São

Paulo, December 26, 2023.

To

Securities and Exchange Commission

of Brazil (CVM)

At.: Superintendent

of Company Relations – SEP

Company Oversight

Department 1 – GEA-1

Ref.: Official Letter 388/2023/CVM/SEP/GEA-1

- BRASKEM - Request for clarification on media report

Dear Sirs,

We refer to Official

Letter 388/2023/CVM/SEP/GEA-1 ("Official Letter"), dated December 22, 2023, in which you requested clarifications from Braskem

S.A. ("Braskem" or "Company"), as transcribed below:

“Dear

Sirs,

1.

We refer to the news item published on this date on the O Estado de São Paulo newspaper, under the title: "The amount of provisions

and disputes between AL politicians worry analysts", which contains the following statements:

"The

Companhia Brasileira de Trens Urbanos de Alagoas has also sued the company, asking for compensation of R$1.2 billion, for inconvenience

to the company and its users."

2.

In view of the above, we request that you clarify whether the news is true, and, if so, explain the reasons why you understood that it

is not a material fact, as well as comment on other information considered important on the topic.”

In this regard,

Braskem clarifies that in February 2021, it became aware of the filing of an action by Companhia Brasileira de Trens Urbanos ("CBTU"),

initially only a preliminary injunction for maintaining the terms of the cooperation agreement signed previously by Braskem and CBTU ("CBTU

Action"). The request was denied in lower and appellate courts, given the fulfillment of the obligations undertaken by Braskem under

the terms of cooperation.

On February 24,

2021, CBTU filed an amendment to the initial petition, requesting the payment of compensation for losses and damages in the amount of

R$ 222 million and moral damages in the amount of R$ 500 thousand, as well as the obligations to do, including the construction of a new

rail line to replace the stretch that passed through the risk area. On September 30, 2023, the value of this lawsuit was updated to R$1.46

billion.

1

In addition,

Braskem entered into a memorandum of understanding with CBTU to reach a mutual solution, through which it was agreed to suspend the CBTU

Action during the negotiation period, which has made progress in the technical understanding about the topic. As a result of a joint petition

by the parties, the CBTU Action was suspended until January 2024. The Management, supported by the opinion of external legal advisors,

classifies the probability of loss in this case as "possible", which is why no Material Fact has been released.

Finally, the

Company reinforces that it has been updating the status of the CBTU Action and other ongoing actions against the Company in its accounting

and financial information, including consolidated Financial Statements and Reference Form, which contain specific sections dealing with

the geological event in Alagoas and on the amounts provisioned based on the assessment of the Company and its external advisors, taking

into account the short- and long-term effects of the technical studies, the existing information and the best estimate of the expenses

for implementing the various measures relating to the event.

Being what we

had for the moment, we subscribe, making ourselves available for further clarifications if necessary.

São Paulo, December 26 2023.

Pedro Van Langendonck Teixeira de Freitas

Chief Financial and Investor Relations

Officer

Braskem S.A.

2

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Date: December 26, 2023

| |

BRASKEM S.A. |

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Pedro van Langendonck Teixeira de Freitas |

| |

|

|

| |

|

Name: |

Pedro van Langendonck Teixeira de Freitas |

| |

|

Title: |

Chief Financial Officer |

DISCLAIMER ON FORWARD-LOOKING STATEMENTS

This

report on Form 6-K may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995. These statements are statements that are not historical facts, and are based on our management’s current view and estimates

of future economic and other circumstances, industry conditions, company performance and financial results, including any potential

or projected impact of the geological event in Alagoas and related legal proceedings and of COVID-19 on our business, financial

condition and operating results. The words “anticipates,” “believes,” “estimates,” “expects,”

“plans” and similar expressions, as they relate to the company, are intended to identify forward-looking statements.

Statements regarding the potential outcome of legal and administrative proceedings, the implementation of principal operating and

financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting our

financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the

current views of our management and are subject to a number of risks and uncertainties, many of which are outside of the our control.

There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions

and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such

assumptions or factors, including the projected impact of the geological event in Alagoas and related legal proceedings and the

unprecedented impact of COVID-19 pandemic on our business, employees, service providers, stockholders, investors and other stakeholders,

could cause actual results to differ materially from current expectations. Please refer to our annual report on Form 20-F for the

year ended December 31, 2019 filed with the SEC, as well as any subsequent filings made by us pursuant to the Exchange Act, each

of which is available on the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact

any forward-looking statements in this presentation.

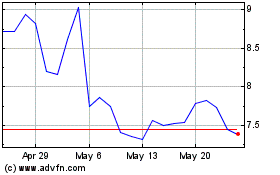

Braskem (NYSE:BAK)

Historical Stock Chart

From Apr 2024 to May 2024

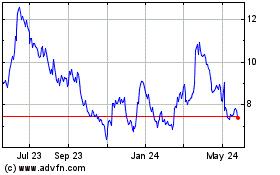

Braskem (NYSE:BAK)

Historical Stock Chart

From May 2023 to May 2024