Blackstone, Wellcome Out Of Race For RBS Branches - Source

April 26 2010 - 5:29AM

Dow Jones News

A consortium of Blackstone Group (BX) and U.K. charity Wellcome

Trust has left the race for Royal Bank of Scotland Group PLC's

(RBS) 318 U.K. branches because the bid wasn't competitive enough,

a person familiar with the situation said Monday.

A final shortlist for the branches, currently valued at up to

GBP2 billion, is expected by the end of this week. Spain's Banco

Santander SA (STD) and Banco Bilbao Vizcaya Argentaria SA (BBVA),

National Australia Bank Ltd. (NAB.AU) and Richard Branson's

privately held Virgin Money are still in the race, the person

added.

Once a final group is picked, due diligence on the assets will

begin, for a period of about six weeks.

A deal is expected in the second half of the year, although the

actual transfer of operations probably won't take place until

2011.

RBS, 83%-government owned, is selling branches in England and

Wales, along with NatWest branches in Scotland, and the accounts of

some SME customers across the U.K., under European Union

requirements.

Combined, the branches have GBP23.6 billion in assets and 6,000

employees.

The bank received the largest state aid in the world following

its near collapse during the financial crisis in 2008. The EU has

ordered it to cut market shares in some segments to make sure the

bank isn't at a competitive advantage to peers that stayed

independent.

-By Patricia Kowsmann, Dow Jones Newswires. Tel

+44(0)207-842-9295, patricia.kowsmann@dowjones.com

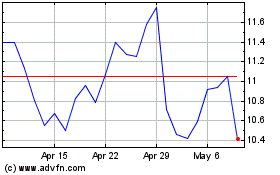

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

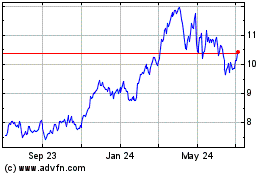

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

From Jul 2023 to Jul 2024