Barnes Group Inc. (NYSE: B), a diversified global manufacturer

and logistics services company, today reported financial results

for the fourth quarter and full year 2011. Fourth quarter 2011

sales totaled $283.3 million, up 9.7% from $258.2 million in the

fourth quarter of 2010. Income from continuing operations was $23.8

million or $0.43 per diluted share, up 86% from the fourth quarter

of 2010.

During the fourth quarter of 2011, Barnes Group completed the

sale of its Barnes Distribution Europe (BDE) businesses which were

comprised of the Company's European KENT, Toolcom and BD France

distribution businesses and reported within the Company's Logistics

and Manufacturing Services segment. The financial results of BDE,

including the loss on sale for the periods presented, have been

segregated and treated as discontinued operations for reporting

purposes. For the year, the loss from discontinued operations, net

of tax, was $26.9 million, or ($0.48) per diluted share. The loss

on sale of $26.1 million includes a non-cash goodwill impairment

charge of $16.8 million.

For the full year 2011, Barnes Group generated sales of $1,169

million, up 13.7%. Income from continuing operations was $91.6

million, or $1.64 per diluted share, compared to $54.0 million, or

$0.96 per diluted share in 2010.

“Barnes Group’s fourth quarter results cap a strong year of

performance for our Company,” said Gregory F. Milzcik, Barnes Group

Inc. President and Chief Executive Officer. “We generated solid

organic growth with meaningful margin flow-through leading to an

expansion in operating margins to 10.9%, up 250 basis points for

the year. Coupled with our continuing focus on profitable growth

and improved productivity, we delivered a 70% increase in income

from continuing operations for 2011. In addition, we exit 2011

having achieved strong fourth quarter earnings per share from

continuing operations, and a healthy backlog of $582 million, up

21% from 2010.”

($ millions; except per share data)

Three months ended

December 31, Twelve months ended December

31, 2011 2010

Change 2011 2010

Change Net Sales $ 283.3 $ 258.2 $ 25.1 9.7 % $

1,169.4 $ 1,028.6 $ 140.7 13.7 % Operating Income $ 28.9 $

19.8 $ 9.0 45.5 % $ 127.6 $ 86.4 $ 41.2 47.6 % % of Sales 10.2 %

7.7 % 2.5 pts. 10.9 % 8.4 % 2.5 pts. Income from Continuing

Operations $ 23.8 $ 12.8 $ 11.0 85.6 % $ 91.6 $ 54.0 $ 37.6 69.6 %

Net Income $ 0.1 $ 11.5 ($11.5 ) (99.4 ) % $ 64.7 $ 53.3 $ 11.4

21.5 % Income from Continuing Operations Per Diluted Share $

0.43 $ 0.23 $ 0.20 87.0 % $ 1.64 $ 0.96 $ 0.68 70.8 % Loss

from Discontinued Operations Per Diluted Share ($0.43 ) ($0.02 )

($0.41 ) ($0.48 ) ($0.01 ) ($0.47 ) Net Income Per Diluted

Share $ 0.00 $ 0.21

($0.21 ) $ 1.16

$ 0.95 $ 0.21

Logistics and Manufacturing Services

- Fourth quarter 2011 sales were $122.0

million, up 10% from $110.7 million in the same period last year.

The increase in sales was driven by strong organic sales growth in

our aerospace aftermarket business. Foreign exchange had a minimal

impact on fourth quarter 2011 sales.

- Operating profit of $15.7 million for

the fourth quarter of 2011 was up 65% compared to prior year period

of $9.5 million. Operating profit benefited from the impact of

higher sales and additional productivity improvements, partially

offset by higher management fees related to our aerospace

aftermarket Revenue Sharing Programs (RSPs) and increased employee

related costs.

- Full year 2011 sales were $492.9

million, up 11% from $443.9 million in 2010. The increase was

primarily due to strong organic sales growth in our aerospace

aftermarket and North American Distribution businesses. Foreign

exchange positively impacted sales by $3.2 million in 2011.

- Full year 2011 operating profit

increased 65% to $64.8 million from 2010 primarily due to the

profit impact of higher sales volumes. Also contributing to the

increase in operating profit were productivity improvements,

including the favorable impact of a lower cost structure in the

North American Distribution business. Segment operating profit

increases were partially offset by higher employee related costs

and management fees related to RSPs.

Precision Components

- Fourth quarter 2011 sales were $163.6

million, up 9% from $149.5 million in the same period last year.

Organic sales growth of $13.7 million was driven by the segment’s

aerospace OEM business and the North American and European

industrial manufacturing businesses which benefited from improved

industrial and transportation end-markets. Foreign exchange

positively affected the quarter’s sales by approximately $0.4

million.

- Operating profit was $13.2 million in

the fourth quarter, up 28% from the same period last year.

Operating profit benefited from higher sales levels combined with

productivity gains and lean initiatives. These improvements were

partially offset by added costs for new product introductions and

the outsourcing of certain manufacturing processes, as well as

higher employee related costs.

- Full year 2011 sales were $687.5

million, up 15% from $595.9 million in 2010. The 2011 organic sales

growth of $74.9 million was primarily driven by the industrial

manufacturing businesses based in North America and Europe

reflecting improvements in the transportation and aerospace

end-markets. The impact of foreign exchange increased sales by

approximately $16.7 million in 2011.

- Full year 2011 operating profit was up

33% to $62.8 million compared to $47.3 million in 2010. Operating

profit improved primarily due to the benefit from higher sales

levels combined with productivity improvements and lean

initiatives. These improvements in operating profit were partially

offset by higher costs associated with investments in new product

introductions and outsourcing of certain manufacturing

processes.

Additional Information

- Interest expense in 2011 decreased $9.7

million from 2010 to $10.3 million as a result of lower average

interest rates and lower debt discount amortization related to the

3.75% Convertible Notes. The lower average interest rates reflect

the significant shift to a higher percentage of variable rate debt

due to the retirement of the 7.80% Notes and the redemption of the

3.75% Convertible Notes, which were funded with the variable rate

credit facility, and the expiration of the interest rate swap

agreements.

- Other expense was $0.4 million in 2011

compared to $2.6 million in 2010, consisting primarily of foreign

exchange transaction losses of $0.2 million in 2011 which decreased

from $1.7 million in 2010.

- The Company’s 2011 effective tax rate

from continuing operations was 21.7%, compared to 15.4% in 2010.

The rate increase was primarily driven by a shift in earnings to

higher-tax jurisdictions and the incremental tax effect of the

repatriation of a portion of current year foreign earnings to U.S.

The company repatriated $17.5 million and $7.5 million in 2011 and

2010, respectively.

2012 Outlook

“During 2011, we experienced improving conditions across our

end-markets and generated a double-digit increase in both orders

and backlog. We expect our positive momentum to continue into 2012,

especially with the strength in the global commercial aerospace

industry. Further, with the sale of BDE, a greater level of

management’s attention can be directed toward expanding our

operations both organically and through acquisitions, bringing new

products and processes to market and growing our geographic reach,”

added Milzcik.

Barnes Group Inc. expects 2012 revenue to grow 6% to 9% from

2011 and forecasts operating margins of approximately 12%. Earnings

from continuing operations per diluted share are forecasted to be

in the range of $1.78 to $1.93, up 9% to 18% from 2011.

“Our improved financial performance and generally favorable

end-markets will allow us to invest further in our businesses. For

2012, we expect capital expenditures to increase to a range of $45

to $50 million and cash conversion of greater than 90%,” said

Christopher J. Stephens, Jr., Senior Vice President, Finance and

Chief Financial Officer, Barnes Group Inc.

Conference Call

Barnes Group Inc. will conduct a conference call with investors

to discuss fourth quarter and full year 2011 results at 8:30 a.m.

EST today, February 17, 2012. A webcast of the live call and an

archived replay will be available on the Barnes Group investor

relations link at www.BGInc.com. The conference is also available

by direct dial at (888) 679-8035 in the U.S. or (617) 213-4848

outside of the U.S. (request the Barnes Group Earnings Call),

Participant Code: 31082129.

In addition, the call will be recorded and available for

playback beginning at 12:00 p.m. (EST) on Friday, February 17, 2012

by dialing (617) 801-6888, Passcode: 17248138.

About Barnes Group

Founded in 1857, Barnes Group Inc. (NYSE:B) is an international

aerospace and industrial components manufacturer and logistics

services company serving a wide range of end markets and customers.

The products and services provided by Barnes Group are critical

components for far-reaching applications that provide

transportation, communication, manufacturing and technology to the

world. Barnes Group’s approximately 4,400 dedicated employees, at

more than 50 locations worldwide, are committed to achieving

consistent and sustainable profitable growth. For more information,

visit www.BGInc.com. Barnes Group, the Critical Components

People.

Forward-Looking Statements

This release may contain certain forward-looking statements as

defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are made based upon management's good

faith expectations and beliefs concerning future developments and

their potential effect upon the Company and can be identified by

the use of words such as "anticipated," "believe," "expect,"

"plans," "strategy," "estimate," "project," and other words of

similar meaning in connection with a discussion of future operating

or financial performance. These forward-looking statements are

subject to risks and uncertainties that may cause actual results to

differ materially from those expressed in the forward-looking

statements. The risks and uncertainties described in our periodic

filings with the Securities and Exchange Commission, include, among

others, uncertainties arising from the current or worsening

disruptions in financial markets; future financial performance of

the industries or customers that we serve; changes in market demand

for our products and services; integration of acquired businesses;

restructuring costs or savings; the impact of the acquisition of

the BDE businesses by Berner SE and any other future strategic

actions, including acquisitions, joint ventures, divestitures,

restructurings, or strategic business realignments, and our ability

to achieve the financial and operational targets set in connection

with any such actions; introduction or development of new products

or transfer of work; changes in raw material or product prices and

availability; foreign currency exposure; our dependence upon

revenues and earnings from a small number of significant customers;

a major loss of customers; the outcome of pending and future claims

or litigation or governmental, regulatory proceedings,

investigations, inquiries, and audits; uninsured claims and

litigation; outcome of contingencies; future repurchases of common

stock; future levels of indebtedness; and numerous other matters of

global, regional or national scale, including those of a political,

economic, business, competitive, environmental, regulatory and

public health nature. The Company assumes no obligation to update

our forward-looking statements.

BARNES GROUP INC. CONSOLIDATED STATEMENTS OF INCOME

(Dollars in thousands, except per share data)

Unaudited Three

months ended December 31, Twelve months ended December

31, 2011 2010 % Change 2011

2010 % Change Net sales $ 283,286 $ 258,170

9.7 $ 1,169,355 $ 1,028,617 13.7 Cost of sales 188,147

171,686 9.6 772,398 678,186 13.9 Selling and administrative

expenses 66,262 66,639 (0.6 )

269,402 264,033 2.0 254,409

238,325 6.7 1,041,800

942,219 10.6 Operating income 28,877 19,845 45.5

127,555 86,398 47.6 Operating margin 10.2 % 7.7 % 10.9 % 8.4

% Interest expense 2,365 4,732 (50.0 ) 10,271 19,984 (48.6 )

Other expense (income), net 167 460

(63.7 ) 395 2,609 (84.9 ) Income

from continuing operations before income taxes 26,345 14,653 79.8

116,889 63,805 83.2 Income taxes 2,586

1,850 39.8 25,316 9,827 NM

Income from continuing operations 23,759 12,803 85.6 91,573

53,978 69.6 Loss from discontinued operations, net of income

taxes (23,693 ) (1,281 ) NM (26,858 ) (700 ) NM

Net income $ 66 $ 11,522 (99.4 ) $

64,715 $ 53,278 21.5 Common dividends $ 5,433

$ 4,302 26.3 $ 18,629 $ 17,461 6.7

Per common share: Basic: Income from continuing

operations $ 0.43 $ 0.23 87.0 $ 1.66 $ 0.97 71.1 Loss from

discontinued operations, net of income taxes (0.43 )

(0.02 ) NM (0.49 ) (0.01 ) NM Net income $ - $

0.21 NM $ 1.17 $ 0.96 21.9 Diluted:

Income from continuing operations $ 0.43 $ 0.23 87.0 $ 1.64 $ 0.96

70.8 Loss from discontinued operations, net of income taxes

(0.43 ) (0.02 ) NM (0.48 ) (0.01 ) NM Net

income $ - $ 0.21 NM $ 1.16 $ 0.95 22.1

Dividends 0.10 0.08 25.0 0.34 0.32 6.3 Weighted

average common shares outstanding: Basic 54,888,879 54,757,849 0.2

55,214,586 55,259,732 (0.1 ) Diluted 55,451,632 55,561,753 (0.2 )

55,931,882 55,925,187 NM

BARNES GROUP INC.

OPERATIONS BY REPORTABLE BUSINESS SEGMENT (Dollars in

thousands) Unaudited

Three months ended December 31, Twelve months

ended December 31, 2011 2010 % Change

2011 2010 % Change Net sales Logistics

and Manufacturing Services $ 122,029 $ 110,745 10.2 $ 492,910 $

443,941 11.0 Precision Components 163,572 149,514 9.4

687,546 595,911 15.4 Intersegment sales (2,315 )

(2,089 ) (10.8 ) (11,101 ) (11,235 ) 1.2

Total net sales $ 283,286 $ 258,170 9.7 $

1,169,355 $ 1,028,617 13.7 Operating profit

Logistics and Manufacturing Services $ 15,702 $ 9,540 64.6 $

64,764 $ 39,140 65.5 Precision Components 13,175

10,305 27.9 62,791 47,258

32.9 Total operating profit 28,877 19,845 45.5

127,555 86,398 47.6 Interest expense 2,365 4,732 (50.0 )

10,271 19,984 (48.6 ) Other expense (income), net 167

460 (63.7 ) 395 2,609

(84.9 ) Income from continuing operations before

income taxes $ 26,345 $ 14,653 79.8 $ 116,889

$ 63,805 83.2

BARNES GROUP INC.

CONSOLIDATED BALANCE SHEETS (Dollars in thousands)

Unaudited

December 31, 2011

December 31, 2010 Assets Current assets Cash and cash

equivalents $ 62,505 $ 13,450 Accounts receivable 200,460 197,715

Inventories 216,520 216,382 Deferred income taxes 28,829 10,449

Prepaid expenses and other current assets 21,680

12,212 Total current assets 529,994 450,208

Deferred income taxes 47,661 42,722 Property, plant and equipment,

net 210,784 218,434 Goodwill 366,104 384,241 Other intangible

assets, net 272,092 290,798 Other assets 13,730

16,854 Total assets $ 1,440,365 $ 1,403,257

Liabilities and Stockholders' Equity Current liabilities

Notes and overdrafts payable $ 12,364 $ 4,930 Accounts payable

92,524 98,191 Accrued liabilities 92,250 86,602 Long-term debt -

current 540 93,141 Total current liabilities

197,678 282,864 Long-term debt 333,148 259,647 Accrued

retirement benefits 152,696 112,886 Other liabilities 34,443 35,741

Total stockholders' equity 722,400 712,119

Total liabilities and stockholders' equity $ 1,440,365 $

1,403,257

BARNES GROUP INC. CONSOLIDATED

STATEMENTS OF CASH FLOWS (Dollars in thousands)

Unaudited Twelve months ended

December 31, 2011 2010 Operating

activities: Net income $ 64,715 $ 53,278 Adjustments to

reconcile net income to net cash from operating activities:

Depreciation and amortization 58,904 52,770 Amortization of

convertible debt discount 2,158 5,727 (Gain) loss on disposition of

property, plant and equipment (379 ) 266 Stock compensation expense

8,319 7,655 Withholding taxes paid on stock issuances (1,124 ) (440

) Loss on the sale of businesses 26,128 - Changes in assets and

liabilities, net of the effects of acquisitions/divestitures:

Accounts receivable (24,707 ) (35,891 ) Inventories (12,384 )

(24,006 ) Prepaid expenses and other current assets 59 (3,139 )

Accounts payable 615 12,466 Accrued liabilities 11,226 11,456

Deferred income taxes 5,386 (1,566 ) Long-term retirement benefits

(18,367 ) (12,135 ) Other 475 (681 )

Net cash provided by operating activities 121,024 65,760

Investing activities: Proceeds from disposition of property,

plant and equipment 3,620 1,498 Proceeds from the sale of

businesses, net of cash sold 22,492 - Investment in restricted cash

(11,664 ) - Capital expenditures (37,082 ) (28,759 ) Business

acquisitions, net of cash acquired (3,495 ) - Other (4,483 )

(3,038 ) Net cash used by investing activities

(30,612 ) (30,299 )

Financing activities: Net change

in other borrowings 7,168 347 Payments on long-term debt (411,661 )

(359,542 ) Proceeds from the issuance of long-term debt 392,390

359,917 Premium paid on convertible debt redemption (9,803 ) -

Proceeds from the issuance of common stock 28,579 5,746 Common

stock repurchases (34,066 ) (28,100 ) Dividends paid (18,629 )

(17,461 ) Excess tax benefit on stock awards 8,056 - Other

(2,229 ) (207 ) Net cash used by financing activities

(40,195 ) (39,300 ) Effect of exchange rate changes on cash

flows (1,162 ) (138 ) Increase (decrease) in

cash and cash equivalents 49,055 (3,977 ) Cash and cash

equivalents at beginning of year 13,450 17,427

Cash and cash equivalents at end of year $ 62,505

$ 13,450

BARNES GROUP INC.

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO

FREE CASH FLOW (Dollars in thousands) Unaudited

Twelve months ended December 31,

2011 2010 Free cash flow: Net cash

provided by operating activities $ 121,024 $ 65,760 Capital

expenditures (37,082 ) (28,759 ) Free cash

flow(1) $ 83,942 $ 37,001

Free cash flow to

net income (excluding the loss on the sale of businesses) cash

conversion ratio: Free cash flow (from above) $ 83,942 $

37,001 Net income 64,715 53,278 Add: Loss on the sale of

businesses 26,128 - Net income

(excluding the loss on the sale of businesses) $ 90,843 $

53,278 Free cash flow to net income (excluding the

loss on the sale of businesses) cash conversion ratio 92 % 69 %

(1) The Company defines free cash flow as net cash provided by

operating activities less capital expenditures. The Company

believes that the free cash flow metric is useful to investors and

management as a measure of cash generated by business operations

that can be used to invest in future growth, pay dividends,

repurchase stock and reduce debt. This metric can also be used to

evaluate the Company's ability to generate cash flow from business

operations and the impact that this cash flow has on the Company's

liquidity.

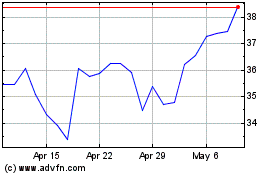

Barnes (NYSE:B)

Historical Stock Chart

From Apr 2024 to May 2024

Barnes (NYSE:B)

Historical Stock Chart

From May 2023 to May 2024