UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of December, 2023

Commission File Number: 001-09246

Barclays PLC

(Name of Registrant)

1 Churchill Place

London E14 5HP

England

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

The Report comprises the following:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

BARCLAYS PLC

(Registrant) |

| Date: December 11, 2023 |

By: |

/s/ Garth Wright |

| |

|

Name: Garth Wright |

| |

|

Title: Assistant Secretary |

Barclay PLC - 6-K

Exhibit 99.1

NOT FOR DISTRIBUTION IN OR INTO ANY JURISDICTION

WHERE IT IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS DOCUMENT

December 11, 2023

BARCLAYS PLC ANNOUNCES AN INVITATION TO

PURCHASE NOTES FOR CASH

Barclays PLC (the “Issuer”)

has today launched an invitation to holders (the “Noteholders”) of the notes set out in the table below (the “Notes”)

issued by the Issuer to tender any and all of the Notes for purchase by the Issuer for cash (the “Offer”), subject

to applicable offer and distribution restrictions.

The Offer is being made on the terms and subject

to the conditions and restrictions set out in a tender offer memorandum dated December 11, 2023 (the “Tender Offer Memorandum”)

and the related notice of guaranteed delivery. Capitalized terms used and not otherwise defined in this announcement have the meanings

given to them in the Tender Offer Memorandum.

The Offer

|

Description

of

the Notes |

CUSIP/ISIN |

Aggregate Principal

Amount Outstanding |

Fixed Spread

(Basis Points) |

Reference U.S. Treasury Security

|

Bloomberg Reference Page

|

| 4.375% Fixed Rate Subordinated Notes due 2024 |

06738E AC9 / US06738EAC93 |

US$1,250,000,000 |

0 |

0.375% U.S. Treasury Note due September 15, 2024 |

PX3 |

The Issuer reserves the right, in its sole and

absolute discretion, not to accept any Tender Instructions, not to purchase Notes or to extend, re-open, withdraw or terminate the Offer

and to amend or waive any of the terms and conditions of the Offer in any manner, subject to applicable laws and regulations.

Tenders of Notes for purchase must be made

through the Clearing Systems in accordance with the procedures set out in the Tender Offer Memorandum. The Issuer intends to announce,

inter alia, its decision whether to accept valid tenders of Notes for purchase pursuant to the Offer in an announcement following

the Expiration Deadline.

Notes validly tendered may be revoked at any

time prior to the Expiration Deadline, but not thereafter.

Rationale for the Offer

The Offer is made as part of the Issuer’s

ongoing management of its liabilities, providing the Noteholders with an opportunity to have their Notes repurchased, while maintaining

a prudent approach to the management of the Group’s capital position. The Group will continue to meet all of its capital requirements

irrespective of the outcome of the Offer. The Group intends to continue issuing senior unsecured and subordinated liabilities in all major

currency markets. The Offer is not conditional upon any future capital markets issuance.

Purchase

Price and Accrued Interest Payment

The Purchase Price for the Notes will be calculated

by the Dealer Manager by reference to the Fixed Spread over the yield to maturity of the Reference U.S. Treasury Security at 2:00 p.m.

(New York City time) on December 15, 2023 (the “Price Determination Time”). The Issuer will pay accrued and unpaid

interest in respect of all Notes validly tendered and delivered and accepted for purchase by the Issuer pursuant to the Offer, from (and

including) September 11, 2023 to (but excluding) the Settlement Date.

Tender Offer Period

The Offer commences on December 11, 2023 and

will end at 5:00 p.m. (New York City time) on December 15, 2023 (the “Expiration Deadline”), unless extended by the

Issuer, in which case notification to that effect will be given by or on behalf of the Issuer by the delivery of notices to the

relevant Clearing Systems for communication to Direct Participants and the issue of a press release to the Notifying News Service.

Such press release will also be furnished to the SEC under cover of Form 6-K on the date of the press release.

Noteholders wishing to participate in the Offer

must deliver, or arrange to have delivered on their behalf, a valid Tender Instruction that is received by the Tender Agent by the Expiration

Deadline.

Expected Timetable of Events

The times and dates below are indicative only.

This timetable is subject to change and dates and times may be extended or amended by the Issuer in accordance with the terms of the Offer

as described in the Tender Offer Memorandum. Accordingly, the actual timetable may differ significantly from the timetable below. Unless

otherwise stated in the Tender Offer Memorandum, announcements in connection with the Offer will be made by publication through the delivery

of notices to the relevant Clearing Systems for communication to Direct Participants and the issue of a press release to the Notifying

News Service. Such announcements will also be furnished to the SEC under cover of Form 6-K on the date of the announcement.

| Time and Date |

Event |

| December 11, 2023 |

Commencement of the Offer

Offer announced.

Tender Offer Memorandum available from

the Dealer Manager and the Tender Agent. |

| 2:00 p.m. (New York City time) on December 15, 2023 |

Price Determination Time

The Dealer Manager will calculate the

Purchase Price for the Notes in the manner described in the Tender Offer Memorandum by reference to the Fixed Spread over the yield to

maturity, calculated by the Dealer Manager in accordance with standard market practice, of the Reference U.S. Treasury Security, based

on the bid side price of such Reference U.S. Treasury Security as displayed on Bloomberg Reference Page PX3 (or, if such Bloomberg Reference

Page is unavailable or manifestly erroneous, such other recognized quotation source as the Dealer Manager may in its sole and absolute

discretion select).

The Issuer will announce the Purchase

Price as soon as reasonably practicable after it has been determined. |

| 5:00 p.m. (New York City time) on December 15, 2023 |

Revocation Deadline

Noteholders may revoke tenders at any

time prior to the Expiration Deadline. |

| 5:00 p.m. (New York City time) on December 15, 2023 |

Expiration Deadline

Deadline for receipt by the Tender Agent

of all Tender Instructions in order for Noteholders to be able to participate in the Offer and to be eligible to receive the Purchase

Price and Accrued Interest Payment on the Settlement Date. |

| December 18, 2023 |

Announcement of Result of Offer

The Issuer will announce its decision

whether to accept valid tenders of Notes for purchase pursuant to the Offer (including, if applicable, the expected Settlement Date) and the results of the Offer. |

| 5:00 p.m. (New York City time) on December 19, 2023 |

Deadline for Delivery of Notes

Tendered by Guaranteed Delivery Procedures

If any Noteholder desires to tender their Notes

and (1) such Notes certificates are not immediately available or cannot be delivered to the Tender Agent, (2) such Noteholder cannot comply

with the procedure for book-entry transfer, or (3) such Noteholder cannot deliver the other required documents to the Tender Agent by

the Expiration Deadline, such Noteholder must tender their Notes according to the guaranteed delivery procedure described in the Tender

Offer Memorandum and deliver their Notes by 5:00 p.m. (New York City time) on December 19, 2023. |

| December 20, 2023 |

Settlement

Expected Settlement Date. Payment of

the Purchase Price and any Accrued Interest Payment for the Notes accepted for purchase pursuant to the Offer. |

Noteholders are advised to check with any

bank, securities broker or other intermediary through which they hold Notes when such intermediary would require to receive instructions

from a Noteholder in order for that Noteholder to be able to participate in, or (in the limited circumstances in which revocation is permitted)

revoke their instruction to participate in, the Offer before the deadlines specified above. The deadlines set by any such intermediary

and each Clearing System for the submission of Tender Instructions will be earlier than the relevant deadlines specified above. See “Procedures

for Participating in the Offer” in the Tender Offer Memorandum.

For Further Information

A complete description of the terms and conditions

of the Offer is set out in the Tender Offer Memorandum and the related notice of guaranteed delivery. Further details about the transaction

can be obtained from:

The Dealer Manager

Barclays Capital Inc.

745 Seventh Avenue

New York, New York 10019

United States

Telephone: +1 (212) 528-7581

US Toll Free Number: +1 (800) 438-3242

Attention: Liability Management Group

Email: us.lm@barclays.com

The Tender Agent

Global Bondholder Services Corporation

65 Broadway – Suite 404

New York, New York 10006

United States

Telephone: +1 (212) 430-3774

U.S. Toll Free Number: +1 (855) 654-2014

Fax: +1 (212) 430-3775

Attention: Corporation Actions

Email: contact@gbsc-usa.com

A copy of the Tender Offer Memorandum and the notice

of guaranteed delivery is available to eligible persons upon request from the Tender Agent and at https://www.gbsc-usa.com/barclays/.

* * *

DISCLAIMER

This announcement must be read in conjunction

with the Tender Offer Memorandum. No offer or invitation to acquire or exchange any securities is being made pursuant to this announcement.

This announcement and the Tender Offer Memorandum contain important information, which must be read carefully before any decision is made

with respect to the Offer. If any Noteholder is in any doubt as to the action it should take, it is recommended to seek its own legal,

tax and financial advice, including as to any tax consequences, from its stockbroker, bank manager, lawyer, accountant or other independent

financial adviser. Any individual or company whose Notes are held on its behalf by a broker, dealer, bank, custodian, trust company or

other nominee must contact such entity if it wishes to participate in the Offer. None of the Issuer, the Dealer Manager or the Tender

Agent (or any person who controls, or is a director, officer, employee or agent of such persons, or any affiliate of such persons) makes

any recommendation as to whether Noteholders should participate in the Offer.

General

Neither this announcement, the Tender Offer

Memorandum nor the electronic transmission thereof constitutes an offer to buy or the solicitation of an offer to sell Notes (and tenders

of Notes for purchase pursuant to the Offer will not be accepted from Noteholders) in any circumstances in which such offer or solicitation

is unlawful. In those jurisdictions where securities, blue sky or other laws require the Offer to be made by a licensed broker or dealer

and the Dealer Manager or any of its affiliates is such a licensed broker or dealer in any such jurisdiction, the Offer shall be deemed

to be made by the Dealer Manager or such affiliate, as the case may be, on behalf of the Issuer in such jurisdiction.

In addition, each Noteholder participating

in the Offer will be deemed to give certain representations in respect of the other jurisdictions referred to below and generally as set

out in “Procedures for Participating in the Offer” in the Tender Offer Memorandum. Any tender of Notes for purchase

pursuant to the Offer from a Noteholder that is unable to make these representations will not be accepted.

Each of the Issuer, the Dealer Manager and

the Tender Agent reserves the right, in its sole and absolute discretion, to investigate, in relation to any tender of Notes for purchase

pursuant to the Offer, whether any such representation given by a Noteholder is correct and, if such investigation is undertaken and as

a result the Issuer determines (for any reason) that such representation is not correct, such tender or submission may be rejected.

United Kingdom

The communication of this announcement, the

Tender Offer Memorandum and any other documents or materials relating to the Offer is not being made, and such documents and/or materials

have not been approved, by an authorized person for the purposes of section 21 of the Financial Services and Markets Act 2000, as amended.

Accordingly, such documents and/or materials are not being distributed to, and must not be passed on to, the general public in the United

Kingdom. The communication of such documents and/or materials as a financial promotion is only being made to those persons in the United

Kingdom falling within the definition of investment professionals (as defined in Article 19(5) of the Financial Services and Markets Act

2000 (Financial Promotion) Order 2005, as amended (the “Financial Promotion Order”)) or persons who are within Article

43(2) of the Financial Promotion Order or any other persons to whom it may otherwise lawfully be made under the Financial Promotion Order.

France

This announcement, Tender Offer Memorandum

and any other document or material relating to the Offer have only been and shall only be distributed in France to qualified investors

as defined in Article 2(e) of Regulation (EU) 2017/1129, as amended. This announcement, the Tender Offer Memorandum and any other document

or material relating to the Offer have not been and will not be submitted for clearance to nor approved by the Autorité des

marchés financiers.

Italy

Neither the Offer, the Tender Offer Memorandum,

this announcement nor any other documents or materials relating to the Offer has been or will be submitted to the clearance procedure

of the Commissione Nazionale per le Società e la Borsa (“CONSOB”) pursuant to Italian laws and regulations.

The Offer is being carried out in the Republic

of Italy (“Italy”) as an exempted offer pursuant to article 101-bis, paragraph 3-bis of Legislative Decree No. 58 of

24 February 1998, as amended (the “Financial Services Act”) and article 35-bis, paragraph 4 of CONSOB Regulation No.

11971 of 14 May 1999, as amended (the “CONSOB Regulation”).

Noteholders, or beneficial owners of the Notes

located in Italy can tender some or all of their Notes pursuant to the Offer through authorized persons (such as investment firms, banks

or financial intermediaries permitted to conduct such activities in Italy in accordance with the Financial Services Act, CONSOB Regulation

No. 20307 of 15 February 2018, as amended from time to time, and Legislative Decree No. 385 of September 1, 1993, as amended) and in compliance

with applicable laws and regulations or with requirements imposed by CONSOB or any other Italian authority.

Each Intermediary must comply with the applicable

laws and regulations concerning information duties vis-à-vis its clients in connection with the Notes or the Offer.

Belgium

Neither the Tender Offer Memorandum, this announcement

nor any other documents or materials relating to the Offer have been or will be notified to, and neither the Tender Offer Memorandum,

this announcement nor any other documents or materials relating to the Offer have been or will be approved by, the Belgian Financial Services

and Markets Authority (Autoriteit voor Financiële Diensten en Markten/Autorité des Services et Marchés Financiers).

The Offer may therefore not be made in Belgium by way of a public takeover bid (openbaar overnamebod/offre publique d’acquisition)

as defined in Article 3 of the Belgian law of 1 April 2007 on public takeover bids, as amended (the “Belgian Takeover Law”),

save in those circumstances where a private placement exemption is available.

The Offer is conducted exclusively under applicable

private placement exemptions. The Offer may therefore not be advertised and the Offer will not be extended, and neither the Tender Offer

Memorandum, this announcement nor any other documents or materials relating to the Offer have been or will be distributed or made available,

directly or indirectly, to any person in Belgium other than (i) to qualified investors within the meaning of Article 2(e) of Regulation

(EU) 2017/1129, as amended and (ii) in any circumstances set out in Article 6, §4 of the Belgian Takeover Law.

The Tender Offer Memorandum and this announcement

have been issued for the personal use of the above-mentioned qualified investors only and exclusively for the purpose of the Offer. Accordingly,

the information contained in the Tender Offer Memorandum and this announcement may not be used for any other purpose nor may it be disclosed

to any other person in Belgium.

Canada

Any offer or solicitation in Canada must be

made through a dealer that is appropriately registered under the laws of the applicable province or territory of Canada, or pursuant to

an exemption from that requirement. Where the Dealer Manager or any affiliate thereof is a registered dealer or able to rely on an exemption

from the requirement to be registered in such jurisdiction, the Offer shall be deemed to be made by the Dealer Manager, or such affiliate,

on behalf of the Issuer in that jurisdiction.

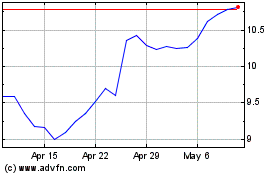

Barclays (NYSE:BCS)

Historical Stock Chart

From Apr 2024 to May 2024

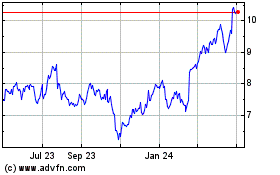

Barclays (NYSE:BCS)

Historical Stock Chart

From May 2023 to May 2024