All-Party Settlement Agreement Reached Providing for the Continuation of Energy Recovery Mechanism

June 08 2006 - 9:00AM

PR Newswire (US)

If approved, the settlement provides for the continuation of the

company's energy recovery mechanism and reduces the company's

"deadband" along with other modifications. SPOKANE, Wash., June 8

/PRNewswire-FirstCall/ -- Avista Corp. (NYSE:AVA) and other parties

have reached an agreement that, if approved, would provide for the

continuation of Avista's energy recovery mechanism (ERM) with

certain agreed-upon modifications and would become effective as of

Jan. 1, 2006. The settlement states the ERM would be reviewed after

five years. (Logo:

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO) The

agreement is subject to approval by the Washington Utilities and

Transportation Commission (WUTC). The parties' recommendation to

approve the settlement is not binding on the WUTC. In Washington,

the ERM is an accounting method to track certain differences

between actual power supply costs and the amount included in base

rates. This difference primarily results from changes in purchased

power and fuel costs, as well as variations in the level of

hydroelectric generation and retail loads. An initial amount of

power supply costs in excess or below the level in retail rates is

either absorbed or retained by the company, which is referred to as

the "deadband." Under the ERM, costs or benefits in excess of the

"deadband" are shared with customers. Under the settlement,

Avista's annual "deadband" would be reduced from $9 million to $4

million, and a 50/50 sharing of annual power supply costs between

the company and its customers would apply to amounts between $4

million and $10 million. Once annual power supply costs exceed $10

million, 90 percent of those costs would be deferred for future

surcharge or rebate. The remaining power supply costs are an

expense of, or benefit to, the company without affecting current or

future customer rates. Other agreed upon modifications address

issues such as long-term power contracts, power generating plant

outages and transmission. During the first quarter of 2006 actual

ERM-related power supply costs were $5.2 million less than that

included in base retail rates, and Avista retained a $5.2 million

benefit under the $9.0 million "deadband." A revision of the ERM

"deadband" and sharing components, per the settlement, would result

in a reversal of $0.6 million of the $5.2 million benefit. If

approved, the settlement seeks to balance the interests of the

company and its customers, while further reducing the volatility in

the company's earnings that has been caused by variations in

hydroelectric generation, as well as prices for fuel and purchased

power. Under the ERM, Avista will continue to make an annual filing

to provide the opportunity for the WUTC and other interested

parties to review the prudence of and audit the ERM deferred power

cost transactions for the prior calendar year. Avista made its

annual filing with WUTC in March 2006. Besides Avista, the parties

to the agreement are the Industrial Customers of Northwest

Utilities, the Public Counsel Section of the Washington Attorney

General, and the staff of the WUTC. The WUTC staff's independent

recommendation to approve the settlement is not binding on the

WUTC. Avista Corp. is an energy company involved in the production,

transmission and distribution of energy as well as other

energy-related businesses. Avista Utilities is a company operating

division that provides service to 338,000 electric and 297,000

natural gas customers in three western states. Avista's

non-regulated subsidiaries include Avista Advantage and Avista

Energy. Avista Corp.'s stock is traded under the ticker symbol

"AVA." For more information about Avista, please visit

http://www.avistacorp.com/. NOTE: Avista Corp. and the Avista Corp.

logo are trademarks of Avista Corporation.

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO

http://photoarchive.ap.org/ DATASOURCE: Avista Corp. CONTACT:

media, Catherine Markson, +1-509-495-2916, or , investors, Jason

Lang, +1-509-495-2930, or , or Avista 24/7 Media Access,

+1-509-495-4174, all of Avista Corp. Web site:

http://www.avistacorp.com/

Copyright

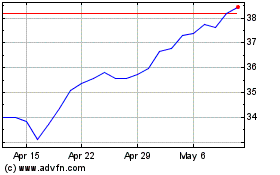

Avista (NYSE:AVA)

Historical Stock Chart

From Jul 2024 to Aug 2024

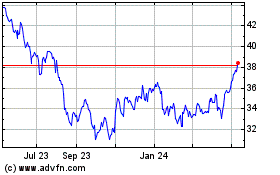

Avista (NYSE:AVA)

Historical Stock Chart

From Aug 2023 to Aug 2024