SPOKANE, Wash., May 3 /PRNewswire-FirstCall/ -- Avista Corp.

(NYSE:AVA) today reported net income of $31.6 million, or $0.64 per

diluted share, for the first quarter of 2006, a significant

increase as compared to net income of $10.2 million, or $0.21 per

diluted share, for the first quarter of 2005. (Logo:

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO) "We had a

strong first quarter due to increased net income for Avista

Utilities, the continued trend of earnings growth from Avista

Advantage and the return to positive results for Avista Energy,"

said Avista Chairman, President and Chief Executive Officer Gary G.

Ely. "After generally earning below our authorized return for the

past several years in our utility operations, we are currently

earning close to our authorized return of approximately 9 percent,"

Ely added. Results for the first quarter of 2006 as compared to the

first quarter of 2005: ($ in thousands, except per-share data) Q1

2006 Q1 2005 Operating Revenues $499,202 $362,664 Income from

Operations $70,938 $38,183 Net Income $31,572 $10,189 Net Income

(Loss) by Business Segment: Avista Utilities $26,172 $18,986 Energy

Marketing & Resource Management $5,046 $(8,358) Avista

Advantage $1,427 $808 Other $(1,073) $(1,247) Contribution to

earnings per diluted share by Business Segment: Avista Utilities

$0.53 $0.39 Energy Marketing & Resource Management $0.10

$(0.17) Avista Advantage $0.03 $0.02 Other $(0.02) $(0.03) Total

earnings per diluted share $0.64 $0.21 First Quarter 2006

Highlights Avista Utilities: The increase in Avista Utilities' net

income for the first quarter of 2006 as compared to the first

quarter of 2005 was due to several factors. Most significantly,

electric resource costs were lower than the amount included in base

retail rates. Electric resource costs were lower as a result of

improved hydroelectric generation from higher than normal

precipitation and warmer than normal temperatures during the first

quarter of 2006, as well as the impact of fuel costs that were

lower than expected. This resulted in Avista Utilities recognizing

a benefit of $5.2 million under the Washington Energy Recovery

Mechanism (ERM) deadband in the first quarter of 2006 as compared

to expensing $0.2 million under the ERM deadband in the first

quarter of 2005. It is important to note that if the ERM deadband

is reduced or eliminated later in 2006 through the pending filing

with the Washington Utilities and Transportation Commission (WUTC),

a portion of the benefit received during the first quarter of 2006

could be reversed resulting in a reduction to earnings. In the

December 2005 Washington general rate case order, Avista Utilities

was directed to make a filing with the WUTC to allow further review

of the ERM. In January 2006, the company made a filing with the

WUTC proposing that the ERM be continued for an indefinite period

of time and that the annual $9 million deadband be eliminated. The

company's goal is to modify the ERM to reduce the volatility of

Avista's earnings resulting from variations in hydroelectric

generation and prices for fuel and purchased power. The current

procedural schedule set by the WUTC would allow for an order on any

changes to the ERM (including any changes to the deadband) to be

issued in late July or in August 2006. The WUTC has previously

stated that any changes to the ERM would be effective for the full

year (beginning January 1, 2006). Also contributing to the increase

in net income was customer growth that was consistent with

expectations, the general rate increase implemented in Washington

on Jan. 1, 2006, and the sale of claims against Enron Corporation

and certain of its affiliates. During the first quarter of 2006,

Avista Utilities made good progress in reducing its power and

natural gas deferrals by $17.5 million. As of March 31, 2006,

deferred power costs were $95.3 million and deferred natural gas

costs were $34.8 million. Avista is currently forecasting

hydroelectric generation to be 104 percent of normal in 2006. This

forecast may be revised based on precipitation, temperatures and

other variables during the year. Energy Marketing and Resource

Management: This business segment had net income for the first

quarter of 2006 as compared to a net loss for the first quarter of

2005. The improved results were primarily due to Avista Energy's

asset management activities and positive results from its natural

gas end-user business and natural gas trading. The improved results

were also due to the difference between the economic management and

the required accounting for certain contracts and physical assets

under the management of Avista Energy. The operations of Avista

Energy are managed on an economic basis, reflecting contracts and

assets under management at estimated market value, consistent with

industry practices, which is different from the required accounting

for certain contracts and physical assets under management. These

differences primarily relate to Avista Energy's management of

natural gas inventory and its control of natural gas-fired

generation through a power purchase agreement, as well as certain

other agreements. These differences had a $2.6 million after-tax

positive effect on results for the first quarter of 2006 compared

to a $6.1 million after-tax negative effect on results for the

first quarter of 2005. A significant portion of the $2.6 million

difference between the economic management and the required

accounting for certain contracts and physical assets under

management for the first quarter of 2006 is expected to reverse in

future periods when the contracts are settled or realized. This

difference could also increase or decrease due to changes in

forward market prices. Part of this reversal is expected to occur

during the second quarter of 2006, which would reduce earnings in

what is typically a weak earnings quarter for Avista Energy. Avista

Advantage: The improvement at Avista Advantage for the first

quarter of 2006 as compared to the first quarter of 2005 was

primarily due to an increase in operating revenues from customer

growth. Avista Advantage's revenues increased by 25 percent for the

first quarter of 2006, as compared to the first quarter of 2005,

while the average cost of processing a bill decreased by 2 percent

for the same period. Avista Advantage has over 350 clients

representing approximately 182,000 billed sites in North America.

Other Business Segment: The net loss in the Other business segment

was less for the first quarter of 2006 as compared to the first

quarter of 2005, primarily due to the improved performance of

Advanced Manufacturing and Development (doing business as METALfx).

Liquidity and Capital Resources: Total debt outstanding decreased

approximately $40 million in the first quarter of 2006 primarily

due to operating cash flows in excess of utility capital

expenditures, dividends and other funding requirements. Utility

capital expenditures totaled approximately $30 million for the

first quarter of 2006. Avista's utility capital budget is

approximately $160 million for 2006, which includes the continued

enhancement of Avista Utilities' transmission system and upgrades

to generating facilities. Avista Utilities is committed to

investment in its generation, transmission and distribution systems

with a focus on increasing capacity and continuing to provide

reliable service to its customers. On April 6, 2006, Avista Corp.

amended its committed line of credit agreement, which was

originally entered into on Dec. 17, 2004. The amended line of

credit captures lower bank fees and borrowing costs. Amendments to

the committed line of credit include a reduction in the total

amount of the facility to $320 million from $350 million and an

extension of the expiration date to April 5, 2011, from Dec. 16,

2009. Avista Corp. chose to reduce the facility based on forecasted

liquidity needs. As of March 31, 2006, Avista Corp. had $23 million

outstanding on its committed line of credit. In March 2006, the

company renewed its accounts receivable sales financing facility

for an additional year, under which the company can sell up to $85

million of its accounts receivable. Potential Holding Company

Formation: In February 2006, the board of directors of Avista Corp.

made the decision to ask shareholders to approve a change in the

company's organization, which would result in the formation of a

holding company. The proposed holding company would become the

parent to the regulated utility, Avista Utilities, and to Avista

Capital, which is the parent to the company's non-utility

subsidiaries. The proposal for the formation of a holding company

is described in the Proxy Statement-Prospectus distributed to

Avista Corp. shareholders in connection with the annual meeting of

shareholders to be held on May 11, 2006. Avista Corp. received

approval from the Federal Energy Regulatory Commission on April 18,

2006, (conditioned on approval by the state regulatory agencies)

and has filed for approval from the utility regulators in

Washington, Idaho, Oregon and Montana, conditioned on approval by

shareholders. If shareholders approve the proposal, and if state

regulatory approvals are received, the holding company organization

could be implemented during the second half of 2006. Earnings

Guidance and Outlook For 2006, Avista Corp. is confirming its

guidance for consolidated earnings to be in the range of $1.30 to

$1.45 per diluted share. The company expects Avista Utilities to

contribute in the range of $1.00 to $1.15 per diluted share for

2006. The outlook for the utility assumes, among other variables,

near normal weather, temperatures and hydroelectric generation. The

2006 outlook for the Energy Marketing and Resource Management

segment is a contribution range of $0.20 to $0.30 per diluted

share, excluding any positive or negative effects related to the

required accounting for certain contracts and physical assets under

management. The company expects Avista Advantage to contribute in a

range of $0.10 to $0.12 per diluted share and the Other business

segment to lose $0.05 per diluted share. Avista Corp. is an energy

company involved in the production, transmission and distribution

of energy as well as other energy-related businesses. Avista

Utilities is a company operating division that provides service to

338,000 electric and 297,000 natural gas customers in three Western

states. Avista's non-regulated subsidiaries include Avista

Advantage and Avista Energy. Avista Corp.'s stock is traded under

the ticker symbol "AVA." For more information about Avista, please

visit http://www.avistacorp.com/. NOTE: Avista Corp. and the Avista

Corp. logo are trademarks of Avista Corporation. NOTE: Avista Corp.

will host a conference call on May 3, 2006, at 10:30 a.m. EDT to

discuss this report with financial analysts. Investors, news media

and other interested parties may listen to the simultaneous webcast

of this conference call. To register for the webcast, please go to

http://www.avistacorp.com/. A replay of the conference call will be

available until May 10, 2006. Call 888-286-8010, passcode 90726018

to listen to the replay. The webcast will be archived at

http://www.avistacorp.com/ for one year. The attached condensed

consolidated statements of income, condensed consolidated balance

sheets, and financial and operating highlights are integral parts

of this earnings release. This news release contains

forward-looking statements, including statements regarding the

company's current expectations for future financial performance and

cash flows, capital expenditures, the company's current plans or

objectives for future operations, future hydroelectric generation

projections and other factors, which may affect the company in the

future. Such statements are subject to a variety of risks,

uncertainties and other factors, most of which are beyond the

company's control and many of which could have significant impact

on the company's operations, results of operations, financial

condition or cash flows and could cause actual results to differ

materially from the those anticipated in such statements. The

following are among the important factors that could cause actual

results to differ materially from the forward-looking statements:

weather conditions, including the effect of precipitation and

temperatures on the availability of hydroelectric resources and the

effect of temperatures on customer demand; changes in wholesale

energy prices that can affect, among other things, cash

requirements to purchase electricity and natural gas for retail

customers, as well as the market value of derivative assets and

liabilities and unrealized gains and losses; volatility and

illiquidity in wholesale energy markets, including the availability

and prices of purchased energy and demand for energy sales; the

effect of state and federal regulatory decisions affecting the

ability of the company to recover its costs and/or earn a

reasonable return; the outcome of pending regulatory and legal

proceedings arising out of the "Western energy crisis" of 2001 and

2002, and including possible retroactive price caps and resulting

refunds; changes in the utility regulatory environment in the

individual states and provinces in which the company operates as

well as the United States and Canada in general; the outcome of

legal proceedings and other contingencies concerning the company or

affecting directly or indirectly its operations; the potential

effects of any legislation or administrative rulemaking passed into

law, including the Energy Policy Act of 2005 which was passed into

law in August 2005; the effect from the potential formation of a

Regional Transmission Organization; wholesale and retail

competition; changes in global energy markets; the ability to

relicense the Spokane River Project at a cost- effective level with

reasonable terms and conditions; unplanned outages at any

company-owned generating facilities; unanticipated delays or

changes in construction costs with respect to present or

prospective facilities; natural disasters that can disrupt energy

delivery as well as the availability and costs of materials and

supplies and support services; blackouts or large disruptions of

transmission systems; the potential for future terrorist attacks,

particularly with respect to utility plant assets; changes in the

long-term climate of the Pacific Northwest; changes in future

economic conditions in the company's service territory and the

United States in general; changes in industrial, commercial and

residential growth and demographic patterns in the company's

service territory; the loss of significant customers and/or

suppliers; failure to deliver on the part of any parties from which

the company purchases and/or sells capacity or energy; changes in

the creditworthiness of customers and energy trading

counterparties; the company's ability to obtain financing through

the issuance of debt and/or equity securities; the effect of any

potential change in the company's credit ratings; changes in

actuarial assumptions, the interest rate environment and the actual

return on plan assets with respect to the company's pension plan;

increasing health care costs and the resulting effect on health

insurance premiums paid for employees and on the obligation to

provide postretirement health care benefits; increasing costs of

insurance, changes in coverage terms and the ability to obtain

insurance; employee issues, including changes in collective

bargaining unit agreements, strikes, work stoppages or the loss of

key executives, as well as the ability to recruit and retain

employees; changes in rapidly advancing technologies, possibly

making some of the current technology quickly obsolete; changes in

tax rates and/or policies; and changes in, and compliance with,

environmental and endangered species laws, regulations, decisions

and policies, including present and potential environmental

remediation costs. For a further discussion of these factors and

other important factors, please refer to the company's Annual

Report on Form 10-K for the year ended Dec. 31, 2005. The

forward-looking statements contained in this news release speak

only as of the date hereof. The company undertakes no obligation to

update any forward-looking statement or statements to reflect

events or circumstances that occur after the date on which such

statement is made or to reflect the occurrence of unanticipated

events. New factors emerge from time to time, and it is not

possible for management to predict all of such factors, nor can it

assess the impact of each such factor on the company's business or

the extent to which any such factor, or combination of factors, may

cause actual results to differ materially from those contained in

any forward- looking statement. AVISTA CORPORATION CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) (Dollars in Thousands

except Per Share Amounts) First Quarter 2006 2005 Operating

revenues $499,202 $362,664 Operating expenses: Resource costs

321,732 222,157 Other operating expenses 62,038 59,329 Depreciation

and amortization 22,428 22,706 Utility taxes other than income

taxes 22,066 20,289 Total operating expenses 428,264 324,481 Income

from operations 70,938 38,183 Other income (expense): Interest

expense, net of capitalized interest (23,324) (22,986) Other income

- net 2,475 1,822 Total other income (expense) - net (20,849)

(21,164) Income before income taxes 50,089 17,019 Income taxes

18,517 6,830 Net income $31,572 $10,189 Weighted-average common

shares outstanding (thousands), basic 48,795 48,478

Weighted-average common shares outstanding (thousands), diluted

49,305 48,901 Total earnings per common share, basic $0.65 $0.21

Total earnings per common share, diluted $0.64 $0.21 Dividends paid

per common share $0.140 $0.135 Issued May 3, 2006 AVISTA

CORPORATION CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Dollars in Thousands) March 31, December 31, 2006 2005 Assets Cash

and cash equivalents $71,090 $25,917 Restricted cash 23,761 25,634

Accounts and notes receivable 347,578 502,947 Current energy

commodity derivative assets 579,406 918,609 Other current assets

242,220 297,261 Total net utility property 2,128,602 2,126,417

Non-utility properties and investments-net 58,189 77,731

Non-current energy commodity derivative assets 409,132 511,280

Other property and investments-net 61,251 61,944 Regulatory assets

for deferred income taxes 109,969 114,109 Other regulatory assets

28,489 26,660 Non-current utility energy commodity derivative

assets 51,431 46,731 Power and natural gas deferrals 130,120

147,622 Unamortized debt expense 46,682 48,522 Other deferred

charges 18,517 17,110 Total Assets $4,306,437 $4,948,494

Liabilities and Stockholders' Equity Accounts payable $336,323

$511,427 Current energy commodity derivative liabilities 547,720

906,794 Current portion of long-term debt 201,476 39,524 Short-term

borrowings 23,490 63,494 Other current liabilities 204,658 208,649

Long-term debt 827,598 989,990 Long-term debt to affiliated trusts

113,403 113,403 Preferred stock (subject to mandatory redemption)

26,250 26,250 Non-current energy commodity derivative liabilities

398,032 488,644 Regulatory liability for utility plant retirement

costs 189,291 186,635 Deferred income taxes 481,531 488,934 Other

non-current liabilities and deferred credits 149,761 153,622 Total

Liabilities 3,499,533 4,177,366 Common stock - net (48,885,732 and

48,593,139 outstanding shares) 626,660 620,598 Retained earnings

and accumulated other comprehensive loss 180,244 150,530 Total

Stockholders' Equity 806,904 771,128 Total Liabilities and

Stockholders' Equity $4,306,437 $4,948,494 Issued May 3, 2006

AVISTA CORPORATION FINANCIAL AND OPERATING HIGHLIGHTS (Dollars in

Thousands) First Quarter 2006 2005 Avista Utilities Retail electric

revenues $145,394 $135,847 Retail kWh sales (in millions) 2,292

2,251 Retail electric customers at end of period 339,281 331,976

Wholesale electric revenues $39,152 $27,734 Wholesale kWh sales (in

millions) 474 498 Sales of fuel $30,937 $9,647 Other electric

revenues $6,525 $3,818 Retail natural gas revenues $166,961

$139,194 Wholesale natural gas revenues $31,215 $114 Transportation

and other natural gas revenues $3,106 $3,362 Total therms delivered

(in thousands) 221,623 183,081 Retail natural gas customers at end

of period 298,765 308,820 Income from operations (pre- tax) $62,912

$51,605 Net income $26,172 $18,986 Energy Marketing and Resource

Management Gross margin (operating revenues less resource costs)

$11,415 $(8,584) Realized gross margin $5,275 $8,928 Unrealized

gross margin $6,140 $(17,512) Income (loss) from operations

(pre-tax) $6,320 $(13,809) Net income (loss) $5,046 $(8,358)

Electric sales (millions of kWhs) 6,979 6,768 Natural gas sales

(thousands of dekatherms) 50,162 54,895 Avista Advantage Revenues

$9,076 $7,240 Income from operations (pre- tax) $2,398 $1,479 Net

income $1,427 $808 Other Revenues $5,294 $3,848 Loss from

operations (pre-tax) $(692) $(1,092) Net loss $(1,073) $(1,247)

Issued May 3, 2006

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO

http://photoarchive.ap.org/ DATASOURCE: Avista Corp. CONTACT:

media, Jessie Wuerst, +1-509-495-8578, or , or investors, Jason

Lang, +1-509-495-2930, or , or Avista 24/7 Media Access,

+1-509-495-4174, all of Avista Corp. Web site:

http://www.avistacorp.com/

Copyright

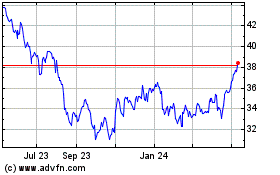

Avista (NYSE:AVA)

Historical Stock Chart

From Jul 2024 to Aug 2024

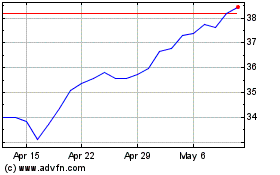

Avista (NYSE:AVA)

Historical Stock Chart

From Aug 2023 to Aug 2024