Texas Railroad Commission Rules on Atmos Energy's Mid-Tex Division Rate Case

March 29 2007 - 6:46PM

Business Wire

Atmos Energy Corporation (NYSE: ATO) today announced that an order

has been issued by the Railroad Commission of Texas (Commission)

relating to the company�s Mid-Tex Division rate case, filed in May

of 2006. The order includes the following: A determination that the

acquisition of the Mid-Tex assets was in the public interest. A

permanent weather normalization adjustment (WNA) mechanism which is

based upon the most recent 10 years of weather experience. The WNA

mechanism provides for a stabilization of customer utility bills in

periods of warmer or colder-than-normal weather. An approved

capital structure of 52 percent debt/48 percent equity. An

authorized return on equity of 10 percent. An annual revenue

increase of approximately $4.5 million, or 66 cents per month for

the average residential customer, effective immediately. A refund

to customers of approximately $2.3 million related to the Gas

Reliability Infrastructure Program (GRIP) annual filings. �This

decision represents an important milestone for our Mid-Tex

Division, with the finding that the acquisition of Mid-Tex by Atmos

was in the public interest, the authorization for a permanent WNA

mechanism, as well as the comprehensive review of our annual GRIP

filings,� said Robert W. Best, chairman, president and CEO of Atmos

Energy. Best added: �We commend the Commission for seeking to

balance the interests of the company and our customers in this

case. We remain committed to working within the regulatory process

to recover our actual expenses, earn our authorized rate of return,

and to continue making investments in our delivery system in the

state of Texas.� Due to the continued strong performance of the

company�s complementary non-regulated marketing business, Atmos

Energy is reaffirming its fiscal 2007 earnings guidance in the

range of $1.90 to $2.00 per diluted share. However, the mark-to

market impact on the marketing company�s physical storage inventory

at September 30, 2007, could affect earnings per diluted share.

Forward-Looking Statements The matters discussed in this news

release may contain �forward-looking statements� within the meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. All statements other than

statements of historical fact included in this news release are

forward-looking statements made in good faith by the company and

are intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of

1995. When used in this news release or in any of the company�s

other documents or oral presentations, the words �anticipate,�

�believe,� �estimate,� �expect,� �forecast,� �goal,� �intend,�

�objective,� �plan,� �projection,� �seek,� �strategy� or similar

words are intended to identify forward-looking statements. Such

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ materially from those

discussed in this news release, including the risks and

uncertainties relating to regulatory trends and decisions, the

company�s ability to continue to access the capital markets and the

other factors discussed in the company�s filings with the

Securities and Exchange Commission. These factors include the risks

and uncertainties discussed in the company�s Annual Report on Form

10-K for the fiscal year ended September 30, 2006, and the

company�s Form 10-Q for the three months ended December 31, 2006.

Although the company believes these forward-looking statements to

be reasonable, there can be no assurance that they will approximate

actual experience or that the expectations derived from them will

be realized. Further, the company undertakes no obligation to

update or revise any of its forward-looking statements, whether as

a result of new information, future events or otherwise. About

Atmos Energy Atmos Energy Corporation, headquartered in Dallas, is

the country�s largest natural gas-only distributor, serving about

3.2 million gas utility customers. Atmos Energy�s utility

operations serve more than 1,500 communities in 12 states from the

Blue Ridge Mountains in the East to the Rocky Mountains in the

West. Atmos Energy�s non-utility operations, organized under Atmos

Energy Holdings, Inc., operate in 22 states. They provide natural

gas marketing and procurement services to industrial, commercial

and municipal customers and manage company-owned natural gas

storage and pipeline assets, including one of the largest

intrastate natural gas pipelines in Texas. Atmos Energy is a

Fortune 500 company. For more information, visit

www.atmosenergy.com.

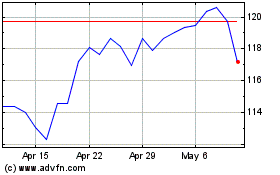

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From May 2024 to Jun 2024

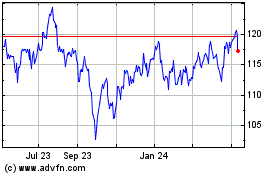

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Jun 2023 to Jun 2024