false000114598600011459862024-03-052024-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 05, 2024 |

ASPEN AEROGELS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36481 |

04-3559972 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

30 Forbes Road Building B |

|

Northborough, Massachusetts |

|

01532 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (508) 691-1111 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

ASPN |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 5, 2024, the Compensation and Leadership Development Committee (the “Committee”) of the Board of Directors of Aspen Aerogels, Inc. (the “Company”) approved the cancellation of the outstanding, unearned portion of the performance-based restricted shares granted to certain employees pursuant to the Company’s 2014 Employee, Director and Consultant Equity Incentive Plan on June 29, 2021 (to Donald R. Young) and June 2, 2022 (to certain other employees). The Committee determined that based on current market conditions, the likelihood of achievement of any of the remaining performance hurdles applicable to the unearned restricted shares is remote, and that the unearned restricted shares therefore had ceased to have incentive value for the grantees. On March 6, 2024, the Company entered into cancellation agreements, pursuant to which the applicable employees agreed to such cancellation.

The following table sets forth, with respect to each applicable employee, the number of unearned restricted shares that were cancelled:

|

|

|

Name: |

Position: |

Cancelled Unvested Restricted Shares: |

Donald R. Young |

President and Chief Executive Officer |

304,666 |

Virginia H. Johnson |

Chief Legal Officer, General Counsel, Corporate Secretary and Chief Compliance Officer |

53,590 |

Gregg R. Landes |

Senior Vice President, Operations and Strategic Development |

53,590 |

Ricardo C. Rodriguez |

Chief Financial Officer and Treasurer |

53,590 |

Keith L. Schilling |

Senior Vice President, Technology |

53,590 |

Corby C. Whitaker |

Senior Vice President, Sales and Marketing |

53,590 |

George L. Gould |

Chief Technology Officer |

53,590 |

The cancelled unearned restricted shares were added to the number of shares available for awards under the Company’s 2023 Equity Incentive Plan. For financial accounting purposes, the cancellation of the unearned restricted shares will result in the immediate charge of approximately $2.2 million of unamortized compensation costs.

The foregoing description of the terms of the cancellation agreements is a summary only, does not purport to be a complete description, and is qualified in its entirety by reference to the full text of such agreements, which are filed as Exhibit 10.1 and Exhibit 10.2 to this Current Report on Form 8-K and are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

+ Management contract or compensatory plan or arrangement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Aspen Aerogels, Inc. |

|

|

|

|

Date: |

March 7, 2024 |

By: |

/s/ Ricardo C. Rodriguez |

|

|

Name: |

Ricardo C. Rodriguez |

|

|

Title: |

Chief Financial Officer and Treasurer |

SEIG Award Cancellation Agreement

THIS SEIG AWARD CANCELLATION AGREEMENT (this “Agreement”) is made effective as of March 6, 2024 (the “Effective Date”) Aspen Aerogels, Inc. (the “Company”), a Delaware corporation having its principal place of business in Northborough, Massachusetts and Donald R. Young (the “Participant”).

WHEREAS, on June 29, 2021, the Company granted to the Participant 461,616 restricted shares of the Company’s common stock, $0.00001 par value per share (the “Restricted Shares”) pursuant to the Company’s 2014 Employee, Director and Consultant Equity Incentive Plan (the “2014 Plan”) and the Performance-Based Restricted Stock Agreement made as of June 29, 2021 between the Company and the Participant (the “Award Agreement”);

WHEREAS, pursuant to the terms and conditions of the Award Agreement and the 2014 Plan, all of the Restricted Shares are unvested and subject to forfeiture upon the failure to achieve certain stock price performance hurdles (the “Performance Hurdles”) and/or the termination of the Participant’s continuous service with the Company prior to the applicable vesting date;

WHEREAS, the Performance Hurdle applicable to 156,950 of the Restricted Shares was achieved in December 2021, and those Restricted Shares (the “Earned Restricted Shares”) remain unvested, subject only to the Participant’s continuous service with the Company through the applicable vesting date;

WHEREAS, the Performance Hurdles applicable to 304,666 of the Restricted Shares (the “Unearned Restricted Shares”) have not been achieved, and the Compensation and Leadership Development Committee of the Board of Directors of the Company (the “Committee”) has determined that based on current market conditions, the likelihood of achievement of any of the Performance Hurdles applicable to the Unearned Restricted Shares is remote, and that the Unearned Restricted Shares therefore have ceased to have incentive value for the Participant;

WHEREAS, the Committee accordingly has cancelled the award of the Unearned Restricted Shares that were granted on June 29, 2021, without any effect upon the Earned Restricted Shares, which Earned Restricted Shares remain outstanding in accordance with the terms and conditions of the Award Agreement; and

WHEREAS, the Participant and the Company desire to enter into this Agreement to evidence the cancellation of the Participant’s Unearned Restricted Shares.

NOW, THEREFORE, in consideration of the premises and the mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

1. Cancellation of Award. Effective as of the Effective Date (a) the portion of the award of Restricted Shares evidenced by the Award Agreement consisting of the Unearned Restricted Shares is cancelled; (b) the Participant relinquishes any and all claim whatsoever to the Unearned Restricted Shares, which are irrevocably forfeited to the Company; and (c) such

cancellation and forfeiture of the Unearned Restricted Shares shall have no effect whatsoever upon the Earned Restricted Shares, which Earned Restricted remain outstanding in accordance with the terms and conditions of the Award Agreement.

2. Entire Agreement. This Agreement constitutes the entire agreement and understanding between the parties hereto with respect to the subject matter hereof and supersedes all prior oral or written agreements and understandings relating to the subject matter hereof.

3. Counterparts. This Agreement may be executed in one or more counterparts, and by different parties hereto on separate counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the day and year first above written.

|

ASPEN AEROGELS, INC. |

|

By: /s/ Ricardo C. Rodriguez |

Name: Ricardo C. Rodriguez |

Title: Chief Financial Officer and Treasurer |

|

|

PARTICIPANT /s/ Donald R. Young |

Donald R. Young |

Form of SEIG Award Cancellation Agreement

THIS SEIG AWARD CANCELLATION AGREEMENT (this “Agreement”) is made effective as of March 6, 2024 (the “Effective Date”) Aspen Aerogels, Inc. (the “Company”), a Delaware corporation having its principal place of business in Northborough, Massachusetts and __________ (the “Participant”).

WHEREAS, on June 2, 2022, the Company granted to the Participant 53,590 restricted shares of the Company’s common stock, $0.00001 par value per share (the “Restricted Shares”) pursuant to the Company’s 2014 Employee, Director and Consultant Equity Incentive Plan (the “2014 Plan”) and the Performance-Based Restricted Stock Agreement made as of June 2, 2022 between the Company and the Participant (the “Award Agreement”);

WHEREAS, pursuant to the terms and conditions of the Award Agreement and the 2014 Plan, all of the Restricted Shares are unvested and subject to forfeiture upon the failure to achieve certain stock price performance hurdles (the “Performance Hurdles”) and/or the termination of the Participant’s continuous service with the Company;

WHEREAS, the Compensation and Leadership Development Committee of the Board of Directors of the Company (the “Committee”) has determined that based on current market conditions, the likelihood of achievement of any of the Performance Hurdles is remote, and that the award of Restricted Shares therefore has ceased to have incentive value for the Participant, and, accordingly, the Committee has cancelled each of the awards of Restricted Shares that were granted on June 2, 2022; and

WHEREAS, the Participant and the Company desire to enter into this Agreement to evidence the cancellation of the Participant’s Restricted Shares.

NOW, THEREFORE, in consideration of the premises and the mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

1. Cancellation of Award. Effective as of the Effective Date (a) the award of Restricted Shares evidenced by the Award Agreement is cancelled in its entirety; (b) the Participant relinquishes any and all claim whatsoever to the Restricted Shares, which are irrevocably forfeited to the Company; and (c) upon such cancellation and forfeiture, the Award Agreement is of no further force or effect whatsoever.

2. Entire Agreement. This Agreement constitutes the entire agreement and understanding between the parties hereto with respect to the subject matter hereof and supersedes all prior oral or written agreements and understandings relating to the subject matter hereof.

3. Counterparts. This Agreement may be executed in one or more counterparts, and by different parties hereto on separate counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the day and year first above written.

|

ASPEN AEROGELS, INC. |

|

By: |

Name: |

Title: |

|

|

PARTICIPANT By: Name: Title: |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

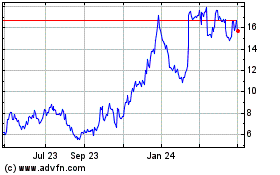

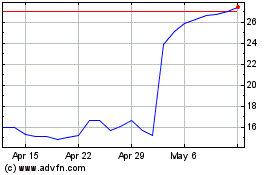

Aspen Aerogels (NYSE:ASPN)

Historical Stock Chart

From Apr 2024 to May 2024

Aspen Aerogels (NYSE:ASPN)

Historical Stock Chart

From May 2023 to May 2024