- Amended Statement of Beneficial Ownership (SC 13D/A)

April 23 2010 - 11:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Amendment No. 1

Under the Securities Exchange Act of 1934

Ashford Hospitality Trust, Inc.

(Name of Issuer)

Common Stock, $0.01 par value

(Title of Class of Securities)

044103109

(CUSIP Number)

Archie Bennett, Jr.

14185 Dallas Parkway, Suite 1100

Dallas, Texas 75254

(972) 490-9600

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

March 24, 2010

(Date of Event which Requires

Filing of this Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition which is the subject of this

Schedule 13D, and is filing this schedule because of Rule 13d-

1(b)(3) or (4), check the following box [ ].

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits.

See Section 240.13d-7 for other parties to whom copies are to be

sent.

*The remainder of this cover page shall be filled out for a

reporting person's initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in

a prior cover page.

The information required on the remainder of this cover page

shall not be deemed to be "filed" for the purpose of Section 18

of the Securities Exchange Act of 1934 ("Act") or otherwise

subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the

Notes).

CUSIP NO. 044103109 13D/A Page 2 of 7

1 NAME OF REPORTING PERSON

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Archie Bennett, Jr.

-------------------------------------------------------------------------

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* (a) [ ]

(b) [ ]

-------------------------------------------------------------------------

3 SEC USE ONLY

-------------------------------------------------------------------------

4 SOURCE OF FUNDS PF/OO

-------------------------------------------------------------------------

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ]

-------------------------------------------------------------------------

6 CITIZENSHIP OR PLACE OF ORGANIZATION

United States

-------------------------------------------------------------------------

|

NUMBER OF |

|

SHARES |7 SOLE VOTING POWER 5,149,942

|------------------------------------------------------

BENEFICIALLY |

|

OWNED BY |8 SHARED VOTING POWER 0

|------------------------------------------------------

EACH |

|

REPORTING |9 SOLE DISPOSITIVE POWER 5,149,942

|------------------------------------------------------

PERSON |

|

WITH |10 SHARED DISPOSITIVE POWER 0

-------------------------------------------------------------------------

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING PERSON

5,149,942

-------------------------------------------------------------------------

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES* [ ]

-------------------------------------------------------------------------

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.99%

-------------------------------------------------------------------------

14 TYPE OF REPORTING PERSON

IN

-------------------------------------------------------------------------

|

CUSIP NO. 044103109 13D/A Page 3 of 7

Schedule 13D

------------

EXPLANATORY NOTE: The Reporting Person owns approximately 8.99%

of the issued and outstanding shares of Common Stock. In

connection with the grant of an equity award (none of which is

currently convertible (or convertible within sixty (60) days)

into shares of Common Stock) to the Reporting Person by the

Issuer, the Reporting Person recalculated his ownership

percentage based on the number of shares of Common Stock

outstanding as of March 1, 2010, as reported in the Issuer's

Annual Report on Form 10-K for the fiscal year ended December 31,

2009, filed March 2, 2010. As a result of such recalculation,

the Reporting Person's ownership percentage, as reported in his

Statement on Schedule 13D filed February 17, 2009 (the "Original

13D"), had increased by more than one percent (1%) due, in large

part, to the Issuer's ongoing stock repurchase program. As a

result of the increase in the Reporting Person's ownership

percentage, the Reporting Person hereby amends and restates, in

its entirety, the Original 13D.

Item 1 Security and Issuer

-------------------

This Amendment No. 1 to Statement on Schedule 13D

("Amendment No. 1") relates to the common stock, par value $0.01

per share (the "Common Stock"), of Ashford Hospitality Trust,

Inc., a Maryland corporation (the "Issuer"), and is being filed

by Archie Bennett, Jr. (the "Reporting Person"). The principal

executive offices of the Issuer are located at 14185 Dallas

Parkway, Suite 1100, Dallas, Texas 75254.

Item 2 Identity and Background

-----------------------

(a) NAME. The name of the Reporting Person is Archie

Bennett, Jr.

(b) BUSINESS ADDRESS. The business address of the Reporting

Person is 14185 Dallas Parkway, Suite 1100, Dallas, Texas 75254.

(c) OCCUPATION AND EMPLOYMENT. The Reporting Person is

currently Chairman of the Board of the Issuer.

(d) CRIMINAL PROCEEDINGS. During the last five years, the

Reporting Person has not been convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors).

(e) CIVIL PROCEEDINGS. During the last five years, the

Reporting Person has not been a party to a civil proceeding of a

judicial or administrative body of competent jurisdiction as a

result of which the Reporting Person was or is subject to a

judgment, decree or final order enjoining future violations of,

or prohibiting or mandating activities subject to, federal or

state securities laws or finding any violation with respect to

such laws.

(f) CITIZENSHIP. The Reporting Person is a citizen of the

United States.

Item 3 Source and Amount of Funds or Other Consideration

-------------------------------------------------

The holdings reported by the Reporting Person herein consist

of (i) 1,591,414 shares of Common Stock held directly or

indirectly by the Reporting Person, (ii) 3,268,528 units of

limited partnership interests ("Common Units") in Ashford

Hospitality Limited Partnership, the Issuer's operating

|

CUSIP NO. 044103109 13D/A Page 4 of 7

subsidiary (the "Partnership"), and (iii) 290,000 special long-

term incentive partnership units in the Partnership ("LTIP Units"

and together with the shares of Common Stock and Common Units

held by the Reporting Person, the "Securities"). The Common

Units are convertible into cash or, at the option of the Issuer,

shares of Common Stock (currently on a 1-for-1 basis). Of the

LTIP Units held by the Reporting Person, 145,000 have achieved

economic parity with the Common Units and (subject to certain

time vesting requirements) are convertible, on a 1-for-1 basis,

into Common Units (which, as noted, are then convertible into

shares of Common Stock). The remainder of the LTIP Units have

not yet achieved economic parity with the Common Units. Unless

and until such parity is achieved, the LTIP Units cannot be

converted into Common Units or Common Stock. The Securities

reported herein were acquired by the Reporting Person in business

transactions between the Issuer and the Reporting Person (or

entities affiliated with the Reporting Person), director stock

grants and personal funds.

Item 4 Purpose of Transaction

----------------------

The Reporting Person acquired the Securities for investment

purposes and not with a view toward or having the effect of

directing control over the Issuer. As a result of the Reporting

Person's position as Chairman of the Board of the Issuer, the

Reporting Person may effect a measure of control over the Issuer.

The Reporting Person will continue to evaluate his ownership and

voting position in the Issuer and may consider the following

future courses of action: (i) continuing to hold the Securities

for investment; (ii) converting LTIP Units into Common Units,

(iii) converting, at the option of the Company, some or all of

the Common Units into shares of Common Stock, (iv) disposing of

all or a portion of the Securities in open market sales or in

privately-negotiated transactions; or (v) acquiring additional

shares of the Securities in the open market or in privately-

negotiated transactions. The Reporting Person has not as yet

determined which of the courses of action specified in this

paragraph he may ultimately take. The Reporting Person's future

actions with regard to this investment are dependent on his

evaluation of a variety of circumstances affecting the Issuer in

the future, including the market price of the Common Stock, the

Issuer's business and the Reporting Person's investment

portfolio.

Other than as set forth above, the Reporting Person does not have

any plans or proposals that would result in any of the following:

(a) the acquisition by any person of additional securities of

the Issuer, or the disposition of securities of the Issuer;

(b) an extraordinary corporate transaction, such as a merger,

reorganization or liquidation, involving the Issuer or any of its

subsidiaries;

(c) a sale or transfer of a material amount of assets of the

Issuer or any of its subsidiaries;

(d) any change in the present Board of Directors or management

of the Issuer, including any plans or proposals to change the

number or terms of Directors or to fill any existing vacancies on

the Board of Directors;

(e) any material change in the present capitalization or

dividend policy of the Issuer;

|

CUSIP NO. 044103109 13D/A Page 5 of 7

(f) any other material change in the Issuer's business or

corporate structure;

(g) changes in the Issuer's charter, bylaws or instruments

corresponding thereto or other actions which may impede the

acquisition of control of the Issuer by any person;

(h) causing a class of securities of the Issuer to be delisted

from a national securities exchange or to cease to be authorized

to be quoted in an interdealer quotation system of a registered

national securities association;

(i) causing a class of equity securities of the Issuer to become

eligible for termination of registration pursuant to Section

12(g)(4) of the Securities Exchange Act of 1934, as amended; or

(j) any action similar to any of those enumerated above.

Item 5 Interest in Securities of the Issuer

------------------------------------

(a) AGGREGATE NUMBER AND PERCENTAGE OF SECURITIES. The

Reporting Person beneficially owns an aggregate of 5,149,942

shares of Common Stock (which includes 3,268,528 Common Units

that are presently convertible, at the option of the Issuer, into

shares of Common Stock), and 290,000 LTIP Units, collectively

representing approximately 8.99% of the Issuer's outstanding

Common Stock. [FN-1]

(b) POWER TO VOTE AND DISPOSE. The Reporting Person has

the sole voting and dispositive power over the Securities

identified in response to Item 5(a) above; provided, however,

neither Common Units nor LTIPs have any voting power unless

converted into Common Stock, and they may only be converted into

shares of Common Stock at the option of the Issuer.

(c) TRANSACTIONS WITHIN THE PAST 60 DAYS. On March 24,

2010, the Reporting Person received a grant from the Issuer of

145,000 LTIP Units, none of which currently are convertible into

Common Units or shares of Common Stock. Other than such grant

described above, the Reporting Person has not effected any

transactions in Securities within the 60-day period immediately

preceding the date hereof.

(d) CERTAIN RIGHTS OF OTHER PERSONS. Not applicable.

(e) DATE CEASED TO BE A 5% OWNER. Not applicable.

[FN-1] In addition to the Securities, the Reporting Person also

directly holds Twenty Thousand (20,000) shares of the

Issuer's 8.45% Series D Cumulative Preferred Stock which

were acquired in open market transactions by the Reporting

Person. The shares of 8.45% Series D Cumulative Preferred

Stock are not convertible into shares of Common Stock.

|

CUSIP NO. 044103109 13D/A Page 6 of 7

Item 6 Contracts, Arrangements, Understandings or

Relationships with respect to Securities of the Issuer

------------------------------------------------------

Not applicable.

Item 7 Material to be filed as Exhibits

--------------------------------

None.

|

CUSIP NO. 044103109 13D/A Page 7 of 7

SIGNATURE

After reasonable inquiry and to the best of my knowledge and

belief, I hereby certify that the information set forth in this

statement is true, complete and correct.

Date: April 14, 2010

/s/ ARCHIE BENNETT, JR.

---------------------------

Archie Bennett, Jr.

|

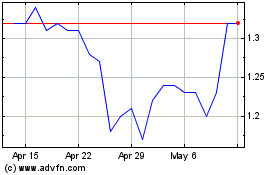

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From May 2024 to Jun 2024

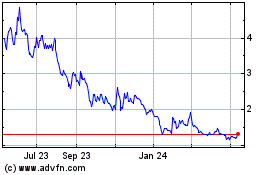

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From Jun 2023 to Jun 2024