UPDATE: Soros Fund Lowers Gold, BofA, JPMorgan Stakes; Adds To Citi, Wells

May 16 2011 - 6:57PM

Dow Jones News

Billionaire investor George Soros's hedge fund sharply lowered

its stake in several gold investments and large commercial banks

J.P. Morgan Chase & Co. (JPM) and Bank of America Corp. (BAC)

in the first quarter. Soros loaded up on shares of Citigroup Inc.

(C) and Wells Fargo & Co. (WFC).

Soros decreased his holdings of the SPDR Gold Trust (GLD), a

gold-backed exchanged-traded fund, by 4.7 million shares to 49,400

shares, valued at $6.9 million at March 31. The fund also cut its

stake in mining company NovaGold Resources Inc. (NG, NG.T) by 9.4

million shares. The position was valued at $45.4 million on March

31. Soros disclosed these position changes in a filing with the

Securities and Exchange Commission late Monday.

Soros, who famously dubbed gold "the ultimate asset bubble," was

one of several big money managers who loaded up on gold, silver and

other precious metals over the past two years amid weakness in the

U.S. dollar. Earlier this month, however, The Wall Street Journal

said Soros and some other leading investment firms sold gold and

other metal stocks.

Soros had bought gold to protect against possible deflation, or

a sustained drop in consumer prices, though the $28 billion fund

now believes there is a reduced chance of such a condition, the

Journal said, citing people close to the matter.

Overall, the value of Soros's stock holdings rose to $8.4

billion at the end of the first quarter, up 9.1% from $7.7 billion

on December 31, 2010.

Soros slashed his stakes in financials including Bank of America

and J.P. Morgan. The fund lowered its Bank of America holding by

1.2 million shares and now owns 29,400 shares. Soros sold 378,050

shares of J.P. Morgan, leaving him with 624,600 shares.

In contrast, his firm tripled its stake in Citigroup to 29.4

million shares. Soros's stake in Wells Fargo climbed six-fold to

3.5 million shares.

Soros also reported a 27.2-million stake of South American

agricultural conglomerate Adecoagro SA (AGRO), which went public in

January. Adecoagro was Soros' highest valued position, worth $366

million on March 31.

Additionally, Soros cut his stake of common stock in Delta Air

Lines Inc. (DAL) by 13 million shares to 1.8 million shares. He

also added a call option on 1 million shares of Delta.

Many investors that manage more than $100 million are required

to file with the SEC Form 13-Fs disclosing their stock holdings

within 45 days of the end of a given quarter, giving the public its

freshest possible glimpse into the portfolios of well-known money

managers. The first-quarter deadline was Monday.

-By Brett Philbin, Dow Jones Newswires; 212-416-2173;

brett.philbin@dowjones.com

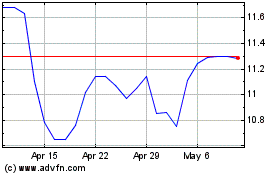

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From Apr 2024 to May 2024

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From May 2023 to May 2024