false000176725800017672582023-08-092023-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

August 9, 2023

Date of Report (date of earliest event reported)

XPEL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Nevada | 001-38858 | 20-1117381 |

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | |

| 711 Broadway St., Suite 320 | 78215 |

| San Antonio | Texas | | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code: (210) 678-3700

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | XPEL | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On August 9, 2023, XPEL, Inc. (“XPEL”) announced its consolidated financial results for the three and six months ended June 30, 2023. A copy of the press release is attached as Exhibit 99.1 to this current report on Form 8-K, and the information set forth therein is incorporated herein by reference and constitutes a part of this report.

The information contained in Item 2.02 of this report and Exhibit 99.1 to this report shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be incorporated by reference into any filings made by XPEL under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

The following exhibit is to be filed as part of this Form 8-K:

| | | | | | | | |

| EXHIBIT NO. | | IDENTIFICATION OF EXHIBIT |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| XPEL, Inc. |

| |

| Dated: August 9, 2023 | By: /s/ Barry Wood |

| Barry Wood |

| Senior Vice President and Chief Financial Officer |

XPEL Reports Record Revenue of $102.2 Million in Second Quarter 2023 With Gross Margin of 43.0%

San Antonio, TX – August 9, 2023 – XPEL, Inc. (Nasdaq: XPEL) a global provider of protective films and coatings, today announced results for the quarter ended June 30, 2023.

Second Quarter 2023 Highlights:

•Revenues increased 21.9% to $102.2 million in the second quarter.

•Gross margin percentage improved to 43.0% in the second quarter, a new high for the Company.

•Net income grew 32.3% to $15.7 million, or $0.57 per share, compared to $11.9 million, or $0.43 per share, in the same quarter of 2022.

•EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) grew 30.5% to $22.4 million, or 21.9% of revenues compared to $17.2 million in second quarter 2022.1

First Six Months Highlights:

•Revenues increased 20.8% to $188.1 million in the first six months of 2023.

•Gross margin percentage improved to 42.5% in the first six months of 2023.

•Net income grew 37.9% to $27.2 million, or $0.98 per share, compared to $19.7 million, or $0.71 per share, in the first six months of 2022.

•EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) grew 36.0% to $39.5 million, or 21.0% of revenues compared to $29.1 million in first six months of 2022.1

Ryan Pape, President and Chief Executive Officer of XPEL, commented, “We had another solid quarter and reached a significant milestone with quarterly revenue exceeding $100 million for the first time in the Company’s history. Consumer recognition for the long-term value of protective films is increasingly moving beyond the enthusiast market and we’re focused on continuing to introduce the XPEL brand to a broader segment of automotive dealerships and auto buyers.”

For the Quarter Ended June 30, 2023:

Revenues. Revenues increased approximately $18.3 million or 21.9% to $102.2 million as compared to $83.9 million in the second quarter of the prior year.

Gross Margin. Gross margin was 43.0% compared to 39.3% in the second quarter of 2022.

Expenses. Operating expenses increased to $23.8 million, or 23.3% of sales, compared to $17.2 million, or 20.5% of sales in the prior year period.

Net income. Net income was $15.7 million, or $0.57 per basic and diluted share, versus net income of $11.9 million, or $0.43 per basic and diluted share in the second quarter of 2022.

EBITDA. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) was $22.4 million, or 21.9% of sales, as compared to $17.2 million, or 20.5% of sales in the prior year.1

For the Six Months Ended June 30, 2023:

Revenues. Revenues increased approximately $32.3 million or 20.8% to $188.1 million as compared to $155.8 million in the first half of the prior year.

Gross Margin. Gross margin was 42.5% compared to 39.0% in the first half of 2022.

Expenses. Operating expenses increased to $44.8 million, or 23.8% of sales, compared to $34.9 million, or 22.4% of sales in the prior year period.

Net income. Net income was $27.2 million, or $0.98 per basic and diluted share, versus net income of $19.7 million, or $0.71 per basic and diluted share in the first half of 2022.

EBITDA. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) was $39.5 million, or 21.0% of sales, as compared to $29.1 million, or 18.7% of sales in the prior year.1

1See reconciliation of non-GAAP financial measures below.

Conference Call Information

The Company will host a conference call and webcast today, August 9, 2023 at 11:00 a.m. Eastern Time to discuss the Company’s second quarter 2023 results.

To access the live webcast, please visit the XPEL, Inc. website at www.xpel.com/investor.

To participate in the call by phone, dial (888) 506-0062 approximately five minutes prior to the scheduled start time. International callers please dial (973) 528-0011. Callers should use access code: 695070

A replay of the teleconference will be available until September 8, 2023 and may be accessed by dialing (877) 481-4010. International callers may dial (919) 882-2331. Callers should use conference ID: 48731.

About XPEL, Inc.

XPEL is a leading provider of protective films and coatings, including automotive paint protection film, surface protection film, automotive and architectural window films, and ceramic coatings. With a global footprint, a network of trained installers and proprietary DAP software, XPEL is dedicated to exceeding customer expectations by providing high-quality products, leading customer service, expert technical support and world-class training. XPEL, Inc. is publicly traded on Nasdaq under the symbol “XPEL”.

1See reconciliation of non-GAAP financial measures below.

Safe harbor statement

This release includes forward-looking statements regarding XPEL, Inc. and its business, which may include, but is not limited to, anticipated use of proceeds from capital transactions, expansion into new markets, and execution of the company's growth strategy. Often, but not always, forward-looking statements can be identified by the use of words such as "plans," "is expected," "expects," "scheduled," "intends," "contemplates," "anticipates," "believes," "proposes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may," "could," "would," "might" or "will" be taken, occur or be achieved. Such statements are based on the current expectations of the management of XPEL. The forward-looking events and circumstances discussed in this release may not occur by certain specified dates or at all and could differ materially as a result of known and unknown risk factors and uncertainties affecting the company, performance and acceptance of the company's products, economic factors, competition, the equity markets generally and many other factors beyond the control of XPEL. Without limitation, the risks and uncertainties affecting XPEL are described in XPEL’s most recent Form 10-K (including Item 1A Risk Factors) filed with the SEC. Although XPEL has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. No forward-looking statement can be guaranteed. Except as required by applicable securities laws, forward-looking statements speak only as of the date on which they are made and XPEL undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

| | | | | |

For more information, contact: | |

| Investor Relations: John Nesbett/Jennifer Belodeau IMS Investor Relations Phone: (203) 972-9200 Email: xpel@imsinvestorrelations.com |

XPEL Inc.

Condensed Consolidated Statements of Income (Unaudited)

(In thousands except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | | | | | | |

| Product revenue | $ | 80,906 | | | $ | 67,040 | | | $ | 148,214 | | | $ | 125,137 | |

| Service revenue | 21,331 | | | 16,850 | | | 39,864 | | | 30,617 | |

| Total revenue | 102,237 | | | 83,890 | | | 188,078 | | | 155,754 | |

| | | | | | | |

| Cost of Sales | | | | | | | |

| Cost of product sales | 49,557 | | | 44,227 | | | 91,737 | | | 82,421 | |

| Cost of service | 8,686 | | | 6,680 | | | 16,388 | | | 12,633 | |

| Total cost of sales | 58,243 | | | 50,907 | | | 108,125 | | | 95,054 | |

| Gross Margin | 43,994 | | | 32,983 | | | 79,953 | | | 60,700 | |

| | | | | | | |

| Operating Expenses | | | | | | | |

| Sales and marketing | 8,147 | | | 5,906 | | | 14,824 | | | 12,218 | |

| General and administrative | 15,656 | | | 11,328 | | | 30,010 | | | 22,696 | |

| Total operating expenses | 23,803 | | | 17,234 | | | 44,834 | | | 34,914 | |

| | | | | | | |

| Operating Income | 20,191 | | | 15,749 | | | 35,119 | | | 25,786 | |

| | | | | | | |

| Interest expense | 338 | | | 322 | | | 860 | | | 542 | |

| Foreign currency exchange loss | 32 | | | 457 | | | 21 | | | 462 | |

| | | | | | | |

| Income before income taxes | 19,821 | | | 14,970 | | | 34,238 | | | 24,782 | |

| Income tax expense | 4,080 | | | 3,068 | | | 7,064 | | | 5,076 | |

| Net income | $ | 15,741 | | | $ | 11,902 | | | $ | 27,174 | | | $ | 19,706 | |

| | | | | | | |

| Earnings per share | | | | | | | |

| Basic | $ | 0.57 | | | $ | 0.43 | | | $ | 0.98 | | | $ | 0.71 | |

| Diluted | $ | 0.57 | | | $ | 0.43 | | | $ | 0.98 | | | $ | 0.71 | |

| Weighted Average Number of Common Shares | | | | | | | |

| Basic | 27,619 | | | 27,613 | | | 27,617 | | | 27,613 | |

| Diluted | 27,631 | | | 27,613 | | | 27,629 | | | 27,613 | |

XPEL Inc.

Condensed Consolidated Balance Sheets

(In thousands except per share data)

| | | | | | | | | | | |

| (Unaudited) | | (Audited) |

| June 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Current | | | |

| Cash and cash equivalents | $ | 14,298 | | | $ | 8,056 | |

| Accounts receivable, net | 23,983 | | | 14,726 | |

| Inventories | 82,714 | | | 80,575 | |

| Prepaid expenses and other current assets | 4,660 | | | 3,464 | |

| | | |

| Total current assets | 125,655 | | | 106,821 | |

| Property and equipment, net | 15,523 | | | 14,203 | |

| Right-of-use lease assets | 15,161 | | | 15,309 | |

| Intangible assets, net | 30,590 | | | 29,294 | |

| Other non-current assets | 1,138 | | | 972 | |

| Goodwill | 28,594 | | | 26,763 | |

| Total assets | $ | 216,661 | | | $ | 193,362 | |

| Liabilities | | | |

| Current | | | |

| Current portion of notes payable | $ | — | | | 77 |

| Current portion of lease liabilities | 3,871 | | 3,885 |

| Accounts payable and accrued liabilities | 31,194 | | 22,970 |

| Income tax payable | 331 | | 470 |

| Total current liabilities | 35,396 | | 27,402 |

| Deferred tax liability, net | 1,481 | | 2,049 |

| Other long-term liabilities | 1,176 | | 1,070 |

| Borrowings on line of credit | 13,000 | | 26,000 |

| Non-current portion of lease liabilities | 12,300 | | 12,119 |

| | | |

| Total liabilities | 63,353 | | 68,640 |

| Commitments and Contingencies (Note 11) | | | |

| Stockholders’ equity | | | |

| Preferred stock, $0.001 par value; authorized 10,000,000; none issued and outstanding | — | | | — | |

| Common stock, $0.001 par value; 100,000,000 shares authorized; 27,620,027 and 27,616,064 issued and outstanding and outstanding, respectively | 28 | | | 28 | |

| Additional paid-in-capital | 11,730 | | | 11,073 | |

| Accumulated other comprehensive loss | (1,448) | | | (2,203) | |

| Retained earnings | 142,998 | | 115,824 |

| Total stockholders’ equity | 153,308 | | 124,722 |

| Total liabilities and stockholders’ equity | $ | 216,661 | | | $ | 193,362 | |

Reconciliation of Non-GAAP Financial Measure

EBITDA is a non-GAAP financial measure. EBITDA is defined as net income (loss) plus interest expense, net, plus income tax expense plus depreciation expense and amortization expense. EBITDA should be considered in addition to, not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. It is not a measurement of our financial performance under GAAP and should not be considered as alternatives to revenue or net income, as applicable, or any other performance measures derived in accordance with GAAP and may not be comparable to other similarly titled measures of other businesses. EBITDA has limitations as an analytical tool and you should not consider it in isolation or as a substitute for analysis of our operating results as reported under GAAP.

EBITDA does not reflect the impact of certain cash charges resulting from matters we consider not to be indicative of ongoing operations and other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure.

EBITDA Reconciliation

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| (Unaudited) | | (Unaudited) |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net Income | 15,741 | | | 11,902 | | | 27,174 | | | 19,706 | |

| Interest | 338 | | | 322 | | | 860 | | | 542 | |

| Taxes | 4,080 | | | 3,068 | | | 7,064 | | | 5,076 | |

| Depreciation | 1,058 | | | 839 | | | 2,030 | | | 1,596 | |

| Amortization | 1,211 | | | 1,054 | | | 2,372 | | | 2,131 | |

| EBITDA | 22,428 | | | 17,185 | | | 39,500 | | | 29,051 | |

v3.23.2

Cover

|

Aug. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 09, 2023

|

| Entity Registrant Name |

XPEL, INC.

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001767258

|

| Soliciting Material |

false

|

| City Area Code |

(210)

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

XPEL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Written Communications |

false

|

| Local Phone Number |

678-3700

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

001-38858

|

| Entity Tax Identification Number |

20-1117381

|

| Entity Address, Postal Zip Code |

78215

|

| Entity Address, Address Line One |

711 Broadway St., Suite 320

|

| Entity Address, State or Province |

TX

|

| Entity Address, City or Town |

San Antonio

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

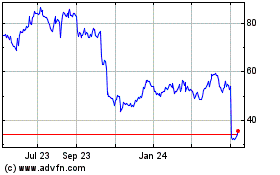

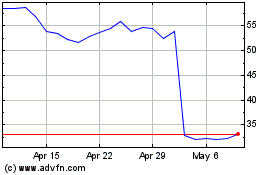

XPEL (NASDAQ:XPEL)

Historical Stock Chart

From Apr 2024 to May 2024

XPEL (NASDAQ:XPEL)

Historical Stock Chart

From May 2023 to May 2024