UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): August 10, 2015

___________

VILLAGE BANK AND TRUST FINANCIAL CORP.

(Exact name of registrant as specified in

its charter)

|

Virginia

(State or other jurisdiction

of incorporation) |

0-50765

(Commission File Number) |

16-1694602

(IRS Employer

Identification No.) |

|

13319 Midlothian Turnpike

Midlothian,

Virginia

(Address of principal executive offices) |

23113

(Zip Code) |

Registrant’s telephone number, including

area code: (804) 897-3900

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item

7.01 Regulation FD Disclosure.

The attached handout

contains information that the members of Village Bank and Trust Financial Corp. (the “Company”) management will use

during visits with investors, analysts, and other interested parties to assist their understanding of the Company through August

2015.

The handout is attached

as Exhibit 99.1 to this report and is being furnished, not filed, under Item 7.01 of this Form 8-K.

Item 9.01 Financial Statements and

Exhibits.

| |

Exhibit No. |

Description |

| |

|

|

| |

99.1 |

Village Bank and Trust Financial Corp. investor presentation. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

VILLAGE BANK AND TRUST FINANCIAL CORP. |

| |

(Registrant) |

|

| |

|

|

|

| |

|

|

|

| Date: August 10, 2015 |

By: |

/s/ C. Harril Whitehurst, Jr. |

|

| |

|

C. Harril Whitehurst, Jr. |

|

| |

|

Executive Vice President and CFO |

|

EXHIBIT INDEX

| |

Exhibit No. |

Description |

| |

|

|

| |

99.1 |

Village Bank and Trust Financial Corp. investor presentation. |

Exhibit 99.1

Investor Presentation August 12, 2015 and Trust Financial Corp.

Cautionary Statement Regarding Forward - Looking Statements This presentation contains forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, Section 21 E of the Securities Exchange Act of 1934 , as amended, and the Private Securities Litigation Reform Act of 1995 . These forward - looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections, and statements of our beliefs concerning future events, business plans, objectives, expected operating results, and the assumptions upon which those statements are based . Forward - looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and are typically identified with words such as “anticipates,” “believes,” “can,” “continue,” “should,” “could,” “would,” “estimates,” “expects,” “intends,” “may,” “plans,” “seeks,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology . A variety of factors could cause our actual results and experiences to differ materially from the anticipated results or other expectations expressed in our forward - looking statements . These factors include, but are not limited to : adverse economic conditions and the impact on us and our customers ; changes in interest rates that impact our loans and deposits ; the impact of competitive products and pricing ; an inability to improve our regulatory capital position ; failure to maximize potential capital raising opportunities or effectively deploy capital ; legislative and regulatory actions impacting the financial services industry ; increased regulatory capital requirements ; an insufficient allowance for loan losses as a result of inaccurate assumptions ; our ability to manage growth ; changes in the quality or composition of our loan or investment portfolios, including adverse developments in borrower industries, declines in real estate values in our markets, or in the repayment ability of individual borrowers or issuers ; failure of our internal controls to work as expected ; environmental liability associated with our lending activities ; inadequate resources to make technological improvements ; interruption or breach in security of our information systems ; and other factors, many of which are beyond our control . Because of these and other uncertainties, our actual future results, performance or achievements, or industry results, may be materially different from the results contemplated by these forward - looking statements . In addition, our past results of operations do not necessarily indicate our future results . Our forward - looking statements speak only as of the date they were made . We do not intend to update these forward - looking statements, even though our situation may change in the future, unless we are obligated to do so under the federal securities laws . We qualify all of our forward - looking statements by these cautionary statements . Additional factors that could cause actual results to differ materially from those expressed in the forward - looking statements are discussed in the Company’s reports (such as our Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K) filed with the Securities and Exchange Commission and available on the SEC’s Web site www . sec . gov . 2

Topics Covered Background Asset Quality Progress Capital Improvement Earnings Initiatives Future Direction I II IV III V 3

Village Bank and Trust Financial Corp. • Holding Company for Village Bank and subs Village Bank • Chartered December 1999 • $424 million in assets* • $299 million in loans* • $374 million in deposits* • 11 branches Village Bank Mortgage Corp. • Acquired 2003 • Sub of Village Bank • Origination Volume: • 2014 - $161MM • 2015F - $200MM • Profitable during recession • Very active with first time home buyer programs • Offices in the Richmond Metropolitan area and Manassas * The June 30, 2015 financial information included in this presentation was derived from the June 30, 2015 call report of Village Bank filed with the Federal Deposit Insurance Corporation. Call reports may be accessed at www.FDIC.gov Village Bank Branches Village Bank Franchise 4

ASSET QUALITY PROGRESS 5

Asset Quality Overview 6

CAPITAL IMPROVEMENT 7

The Results : • Closed March 2015 • 1,051,866 shares of common stock issued • $13.87 per share • Raised net cash of $8.8 million • Extinguished $11.2 million in preferred stock and accrued dividends • Employees and Insiders invested $1.5 million in this raise after investing $1.7MM in November 2013. Accomplished Our O bjectives: • Achieved regulatory compliance • Provided equity capital needed to execute our strategy • Immediately accretive to book value per share • Reduced preferred dividends by over 61% or >$1 million per year • Improved holding company capital structure and liquidity • Preserved Deferred Tax Asset Successful Capital Raise 8

6.52% 6.92% 7.18% 8.50% 8.59% 10.04% 10.90% 12.08% 13.19% 13.39% 0.03 0.04 0.05 0.06 0.07 0.08 0.09 0.1 0.11 0.12 0.13 0.14 2012 2013 2014 Q1-2015 Q2-2015 Leverage ratio Total risk based Required 11% Required 8% Bank Capital Ratios Under new capital guidelines, the Bank must identify high volatility commercial real estate loans and risk weight them at 150% for capital ratio purposes rather than 100% as with other loans. The Bank has not completed its identification of HVCRE loans in its portfolio at June 30, 2015 and has included all commercial construction and land development loans in this category until that analysis is complete. It is expected that a portion of the Bank’s commercial construction and land development loans will be excluded from the HVCRE classification which will have a positive impact on the total risk based capital ratio. 9

EARNINGS INITIATIVES 10

Revenue Growth (Net Interest Income + Non - Interest Income) 11

x Commercial Banking x New leadership with deep C&I roots in our market and several new team members x Added experienced bankers to production team x Hired experienced SBA lender x Moved treasury management specialist to commercial team. Business deposits and services important driver of transaction deposit growth and noninterest income. x Installed sales process, training and incentive plan x Rolling out mobile banking for businesses Q4 2015 x Loan production growing x Consumer Banking x Upgraded ATMs, mobile banking x Expanded our customer care team hours x Introduced new debit card and rewards program x Installed ability to replace lost debit cards in branches x Sales and lending training for branch staff x Increased marketing spending x Installed new lending platform and updated products x Mortgage Banking x Better market activity in the segments in which we are strong. x Enforced performance expectations for loan officers. Result is fewer, more productive loan officers that we can support more effectively with the processing and underwriting team. x Committed marketing dollars to joint marketing arrangements with real estate agents. x Enhanced production incentive program. x Will grow by recruiting loan officers x Put our money to work x Invested excess liquidity in additional guaranteed student loans to earn better returns on high quality, adjustable rate, cash flowing assets. Revenue Growth Initiatives 12

Non - Interest Expense 0 5000 10000 15000 20000 25000 30000 35000 2012 2013 2014 Q1 2014 Q1 2015 $Thousands OREO Expense Other Noninterest Expense 28% Lower 7% Lower 13

FUTURE DIRECTION 14

• Achieve T op Quartile among National Peer Group – Long - term total shareholder returns – Return on Equity – E arnings volatility (lowest volatility quartile ) – Maintain high asset quality during the worst part of the credit cycle • Achieve sustainable earnings growth Long Term Goals 15

Become a High ROE Bank • Low cost funding • Fee income businesses • Cost efficient • Smart capital management Generate Sustained Earnings Growth • Discipline in lending practices • Diversity in earnings drivers • Asset growth in balance with core deposit growth • Prudent interest rate risk management • Excellent execution of the basics of sales, service, risk management, talent development Becoming a Top Performing Bank Starts with offering special value to our customers, but also requires that we… 16

x Complete Capital Raise • Earn release from the Consent Order • Build r evenue and earnings momentum to carry into 2016 and beyond • Generate sufficient earnings momentum to position us to recapture our DTA valuation reserve by the end of 2016 • Successfully execute our strategies for building the value of the Company over the long term 2015 Priorities 17

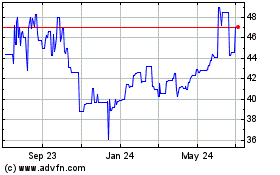

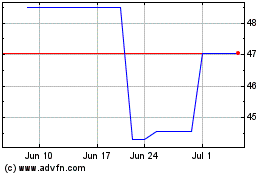

Village Bank and Trust F... (NASDAQ:VBFC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Village Bank and Trust F... (NASDAQ:VBFC)

Historical Stock Chart

From Nov 2023 to Nov 2024