UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Thoughtworks Holding, Inc.

(Name of Issuer)

Common Stock, $0.001 par value

(Title of Class of Securities)

88546E105

(CUSIP Number)

Ramona Mateiu

c/o Thoughtworks Holding, Inc.

200 East Randolph Street, 25th Floor

Chicago, Illinois 60601

Tel. (312) 373-1000

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

September 3, 2024

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on

Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-l(e),

240.13d-l(f) or 240.13d-l(g), check the following box. ☐

| Note: | Schedules filed in paper format shall include a signed original and five copies of the schedule,

including all exhibits. See §240 13d-7 for other parties to whom copies are to be sent. |

| 1 | The remainder of this cover page shall be filled out for a reporting person’s

initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which

would alter disclosures provided in a prior cover page. |

| * | The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes). |

CUSIP No. 88546E105

| 1. |

Names of Reporting Persons

Christopher Murphy |

| 2. |

Check The Appropriate Box if a Member of a Group (See Instructions)

(a) ☒ (b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO |

| 5. |

Check if disclosure of legal proceedings is required pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

Australia and United Kingdom

|

| Number of Shares Beneficially Owned By Each Reporting Person With |

7. |

Sole Voting Power

1,383,640(1) |

| 8. |

Shared Voting Power

0 |

| 9. |

Sole Dispositive Power

1,383,640(1) |

| 10. |

Shared Dispositive Power

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,383,640(1) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

0.4%(2) |

| 14. |

Type of Reporting Person (See Instructions)

IN |

| (1) | Represents (i) 367,571 shares of common stock of the Company (“Common

Stock”) and (ii) 1,016,069 shares of Common Stock underlying options excersiable within 60 days of the date of this filing. |

| (2) | Calculation based on 323,265,179 shares of Common Stock oustanding as of August

14, 2024 (as used by the Company on the Schedule 14C filed by the Company with the SEC on September 3, 2024). |

CUSIP No. 88546E105

| 1. |

Names of Reporting Persons

Erin Cummins |

| 2. |

Check The Appropriate Box if a Member of a Group (See Instructions)

(a) ☒ (b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO |

| 5. |

Check if disclosure of legal proceedings is required pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

United States |

| Number of Shares Beneficially Owned By Each Reporting Person With |

7. |

Sole Voting Power

896,063(1) |

| 8. |

Shared Voting Power

0 |

| 9. |

Sole Dispositive Power

896,063(1) |

| 10. |

Shared Dispositive Power

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

896,063(1) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

0.3%(2) |

| 14. |

Type of Reporting Person (See Instructions)

IN |

| (1) | Represents (i) 238,499 shares of Common Stock and (ii) 657,564 shares of Common

Stock underlying options excersiable within 60 days of the date of this filing. |

| (2) | Calculation based on 323,265,179 shares of Common Stock oustanding as of August

14, 2024 (as used by the Company on the Schedule 14C filed by the Company with the SEC on Septmeber 3, 2024). |

CUSIP No. 88546E105

| 1. |

Names of Reporting Persons

Sudhir Tiwari |

| 2. |

Check The Appropriate Box if a Member of a Group (See Instructions)

(a) ☒ (b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO |

| 5. |

Check if disclosure of legal proceedings is required pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

India |

| Number of Shares Beneficially Owned By Each Reporting Person With |

7. |

Sole Voting Power

529,051(1) |

| 8. |

Shared Voting Power

0 |

| 9. |

Sole Dispositive Power

529,051(1) |

| 10. |

Shared Dispositive Power

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

529,051(1) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

0.2%(2) |

| 14. |

Type of Reporting Person (See Instructions)

IN |

| (1) | Represents (i) 192,370 shares of Common Stock and (ii) 336,681 shares of Common

Stock underlying options excersiable within 60 days of the date of this filing. |

| (2) | Calculation based on 323,265,179 shares of Common Stock oustanding as of August

14, 2024 (as used by the Company on the Schedule 14C filed by the Company with the SEC on September 3, 2024). |

CUSIP No. 88546E105

| 1. |

Names of Reporting Persons

Ramona Mateiu |

| 2. |

Check The Appropriate Box if a Member of a Group (See Instructions)

(a) ☒ (b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO |

| 5. |

Check if disclosure of legal proceedings is required pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

United States |

| Number of Shares Beneficially Owned By Each Reporting Person With |

7. |

Sole Voting Power

422,796(1) |

| 8. |

Shared Voting Power

0 |

| 9. |

Sole Dispositive Power

422,796(1) |

| 10. |

Shared Dispositive Power

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

422,796(1) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

0.1%(2) |

| 14. |

Type of Reporting Person (See Instructions)

IN |

| (1) | Represents (i) 166,467 shares of Common Stock, inlcuding 136,903 shares of Common

Stock owned and held by Ramona Mateiu Declaration of Trust, and (ii) 256,329 shares of Common Stock underlying options excersiable within

60 days of the date of this filing. |

| (2) | Calculation based on 323,265,179 shares of Common Stock oustanding as of August

14, 2024 (as used by the Company on the Schedule 14C filed by the Company with the SEC on September 3, 2024). |

CUSIP No. 88546E105

| 1. |

Names of Reporting Persons

Rachel Laycock |

| 2. |

Check The Appropriate Box if a Member of a Group (See Instructions)

(a) ☒ (b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO |

| 5. |

Check if disclosure of legal proceedings is required pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

United Kingdom |

| Number of Shares Beneficially Owned By Each Reporting Person With |

7. |

Sole Voting Power

278,667(1) |

| 8. |

Shared Voting Power

0 |

| 9. |

Sole Dispositive Power

278,667(1) |

| 10. |

Shared Dispositive Power

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

278,667(1) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

0.1%(2) |

| 14. |

Type of Reporting Person (See Instructions)

IN |

| (1) | Represents (i) 17,318 shares of Common Stock and (ii) 261,349 shares of Common

Stock underlying options excersiable within 60 days of the date of this filing. |

| (2) | Calculation based on 323,265,179 shares of Common Stock oustanding as of August

14, 2024 (as used by the Company on the Schedule 14C filed by the Company with the SEC on September 3, 2024). |

Explanatory Note

This Amendment No. 1 amends and supplements the statement on Schedule

13D filed by Christopher Murphy, Erin Cummins, Sudhir Tiwari, Ramona Mateiu and Rachel Laycock (each, a “Reporting Person”

and collectively, the “Reporting Persons”) with the Securities and Exchange Commission on August 12, 2024 (the “Schedule

13D”) relating to shares of Common Stock, $0.001 par value (“Common Stock”) of Thoughtworks Holding, Inc.,

a Delaware corporation (the “Company”). Capitalized terms used but not defined herein shall have the meaning ascribed

thereto in the Schedule 13D.

Item 4. Purpose of Transaction

The response to Item 4 of the

Schedule 13D is hereby amended and restated in its entirety as follows:

Each

of the Reporting Persons is an executive officer of the Company. The information set forth under Item 2 is incorporated herein by reference.

From time to time the Reporting

Persons have acquired the shares of Common Stock held by them as of the date hereof as a result of equity grants made to them by

the Company as compensation for their services. Certain shares of Common Stock reported by the Reporting Persons herein were acquired

with their personal funds.

Merger Agreement

On

August 5, 2024, the Company entered into the Merger Agreement with Parent and Merger Sub, pursuant to which, subject to the satisfaction

or waiver of certain conditions and on the terms set forth therein, Merger Sub will merge (the “Merger”) with and into

the Company, with the Company continuing as the surviving corporation of the Merger (upon the consummation of the Merger, the “Surviving

Corporation”).

Following

the execution of the Merger Agreement, Turing EquityCo II L.P. (“Significant Company Stockholder”), the holder of a

majority of the issued and outstanding shares of Common Stock, executed and delivered to the Company a written consent adopting the Merger

Agreement, thereby providing the required stockholder approval for the Merger. No further approval of the holders of Common Stock is required

to approve and adopt the Merger Agreement and the transactions contemplated thereby. For a summary description of the Merger Agreement

and the Merger, see the Form 8-K filed by the Company with the SEC on August 5, 2024.

Pursuant

to the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each share of Common Stock

that is issued and outstanding as of immediately prior to the Effective Time (other than such shares (a) owned directly or indirectly

by Parent or Merger Sub or (b) held by any holders of shares of Common Stock who have neither voted in favor of the Merger nor consented

thereto in writing and who have properly and validly exercised (and not withdrawn) their statutory right of appraisal in respect of such

shares in accordance with the General Corporation Law of the State of Delaware) will be cancelled and extinguished and automatically converted

into the right to receive cash in an amount equal to $4.40, without interest thereon (the “Per Share Price”), less

any applicable tax withholdings.

The

Merger Agreement contains certain customary termination rights for the Company and Parent, including in the event that (a) any governmental

authority has issued any final non-appealable order that has the effect of prohibiting the consummation of the Merger, (b) any law has

been enacted that prohibits the consummation of the Merger or (c) the Merger is not consummated by February 5, 2025.

The Rollover

Agreements

Parent has also entered into separate

rollover agreements (each, a “Rollover Agreement”) with (1) Tasmania Parent, Inc. (“Topco”), which

will become the indirect parent of the Company following the Merger, and certain of its affiliates, on the one hand, and (2) each of the

Significant Company Stockholder and the Reporting Persons (each holder, a “Rollover Stockholder”), on the other hand.

Pursuant to the Rollover Agreements, on the closing date of the Merger prior to the Effective Time (the “Exchange Time”),

all shares of Common Stock held by the Significant Company Stockholder and certain shares of Common Stock held by the Reporting Persons

(each, a “Rollover Share”) will be contributed to Topco in exchange for a number of newly issued shares of Topco (a

“Topco Share”) having an aggregate value equal to the Per Share Price multiplied by the aggregate number of Rollover

Shares. The Significant Company Stockholder owns 197,750,138 Rollover Shares. The number of Rollover Shares to be contributed and transferred

to Topco by each Reporting Person will be identified prior to the Exchange Time. Each Reporting

Person also agreed to reinvest a portion of the after-tax proceeds that would otherwise be received

by such Reporting Person in the Merger in respect of certain Company equity awards in exchange

for newly issued Topco Shares, and the assumption and conversion of certain Company equity awards into

equity awards having comparable value that are convertible into Topco Shares, all in accordance with the terms of their Rollover Agreement.

Company equity awards that are assumed and converted in accordance with the Rollover Agreement will continue to vest on the same

schedule and conditions as would have applied pursuant to the Merger Agreement.

The foregoing descriptions of

the Merger Agreement and the form of the Rollover Agreements of the Reporting Persons, and the transactions contemplated thereby, are

qualified in their entirety by reference to such agreements, copies of which are included as Exhibit 1 and Exhibit 2 hereto,

respectively, and are incorporated by reference herein.

Item 5. Interest in Securities of the Issuer

The response to Section (a)-(b) of Item 5 of the

Schedule 13D is hereby amended and restated in its entirety as follows:

The information contained on the cover

pages of this Schedule 13D and the information set forth in Item 4 of this Schedule 13D are incorporated herein by reference.

As a result of the Rollover Agreements,

the Reporting Persons, the Significant Company Stockholder and its investment manager, Apax IX

GP Co. Limited (“Apax IX GP”) may be deemed to constitute a Section 13(d) group, that, inclusive of the approximately

197,750,138 shares of Common Stock beneficially held by the Significant Company Stockholder and Apax IX GP, would beneficially own 201,260,355

shares of the Common Stock, representing 61.8% of the total shares outstanding. The Reporting Persons expressly disclaim any beneficial

ownership of shares of Common Stock beneficially owned by the Significant Company Stockholder and Apax IX GP and such shares are not

the subject of this Schedule 13D. Similarly, each Reporting Person disclaims any beneficial ownership of shares of Common Stock reported

by other Reporting Persons on the cover pages of this Schedule 13D.

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: September 3, 2024

| |

By: |

/s/ Christopher Murphy |

| |

Name: |

Christopher Murphy |

| |

By: |

/s/ Erin Cummins |

| |

Name: |

Erin Cummins |

| |

By: |

/s/ Sudhir Tiwari |

| |

Name: |

Sudhir Tiwari |

| |

By: |

/s/ Ramona Mateiu |

| |

Name: |

Ramona Mateiu |

| |

By: |

/s/ Rachel Laycock |

| |

Name: |

Rachel Laycock |

9

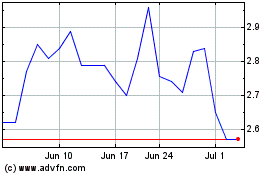

Thoughtworks (NASDAQ:TWKS)

Historical Stock Chart

From Aug 2024 to Sep 2024

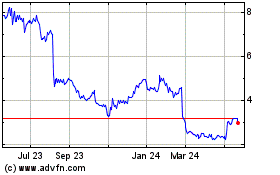

Thoughtworks (NASDAQ:TWKS)

Historical Stock Chart

From Sep 2023 to Sep 2024