Form 8-K - Current report

December 05 2023 - 4:05PM

Edgar (US Regulatory)

FALSE000087423800008742382023-12-052023-12-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 5, 2023

| | | | | | | | | | | | | | |

|

| STERLING INFRASTRUCTURE, INC. |

(Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | | 001-31993 | | 25-1655321 |

(State or other jurisdiction of incorporation

or organization) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | |

1800 Hughes Landing Blvd. The Woodlands, Texas | | | | 77380 |

| (Address of principal executive offices) | | | | (Zip Code) |

| | | | | |

Registrant’s telephone number, including area code: (281) 214-0777 |

| | | | |

|

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Common Stock, $0.01 par value per share | STRL | The NASDAQ Stock Market LLC |

| (Title of Class) | (Trading Symbol) | (Name of each exchange on which registered) |

| | |

|

| | | | | | | | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2 of this chapter). | |

| Emerging growth company | ☐ |

| | | | | | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | |

| Item 8.01 | Other Events. |

| |

| On December 5, 2023, Sterling Infrastructure, Inc. (the “Company") issued a press release announcing the adoption of a stock repurchase program by its Board of Directors. Under the stock repurchase program, the Company may repurchase up to $200 million of its outstanding common stock over the next 24 months. A copy of the Company’s press release announcing the stock repurchase program is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. |

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | |

| SIGNATURES |

|

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| | | | | | | | | | | |

| | STERLING INFRASTRUCTURE, INC. |

| | | |

| Date: | December 5, 2023 | By: | /s/ Ronald A. Ballschmiede |

| | | Ronald A. Ballschmiede |

| | | Chief Financial Officer |

NEWS RELEASE

For Immediate Release:

December 5, 2023

Sterling Announces Authorization of a $200 Million Stock Repurchase Program

THE WOODLANDS, TX – December 5, 2023 – Sterling Infrastructure, Inc. (NasdaqGS: STRL) (“Sterling” or “the Company”) today announced that its Board of Directors has authorized a program to repurchase shares of Sterling’s outstanding common stock. Under the program, Sterling may repurchase up to $200 million of its outstanding common stock over the next 24 months. The timing and amount of any share repurchases will be at the discretion of management and will depend on a variety of factors. Share repurchases under the program may be made from time to time through transactions in the open market, in privately negotiated transactions or by other means in accordance with applicable laws. The share repurchase program does not obligate the Company to repurchase any shares and the Company’s Board of Directors may modify, increase, suspend or terminate the repurchase program at any time.

CEO Remarks

“This share repurchase authorization reflects our confidence in Sterling’s outlook for 2024 and beyond,” stated Joe Cutillo, Sterling’s CEO. “With our strong balance sheet and cash flow, we are well-positioned to pursue a balanced capital allocation strategy that supports our investments in organic growth and strategic acquisitions, while returning capital to shareholders. We remain focused on maximizing shareholder value through prudent capital allocation decisions.”

About Sterling

Sterling Infrastructure, Inc., (“Sterling,” “the Company,” “we,” “our” or “us”), a Delaware corporation, operates through a variety of subsidiaries within three segments specializing in E-Infrastructure, Transportation and Building Solutions in the United States, primarily across the Southern, Northeastern, Mid-Atlantic and Rocky Mountain regions and Hawaii. E-Infrastructure Solutions provides advanced, large-scale site development services for manufacturing, data centers, e-commerce distribution centers, warehousing, power generation and more. Transportation Solutions includes infrastructure and rehabilitation projects for highways, roads, bridges, airports, ports, rail and storm drainage systems. Building Solutions projects include residential and commercial concrete foundations for single-family and multi-family homes, parking structures, elevated slabs and other concrete work. From strategy to operations, we are committed to sustainability by operating responsibly to safeguard and improve society’s quality of life. Caring for our people and our communities, our customers and our investors – that is The Sterling Way.

Joe Cutillo, CEO, “We build and service the infrastructure that enables our economy to run,

our people to move and our country to grow.”

Important Information for Investors and Stockholders

Cautionary Statement Regarding Forward-Looking Statements

This press release contains statements that are considered forward-looking statements within the meaning of the federal securities laws. Forward-looking statements included herein relate to matters that are not based on historical facts and reflect our current expectations as of the date of this press release, including statements about: our outlook, our business strategy, allocation of cash flows and repurchases under the program. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which include: changes in the Company’s cash requirements, financial position, business strategy, general market, economic, tax, regulatory or industry conditions and other factors identified in the Company’s filings with the Securities and Exchange Commission. Accordingly, any forward-looking statements should be considered in light of these risks. The forward-looking statements speak only as of the date made, and we undertake no obligation to publicly update or revise any forward-looking statements for any reason, whether as a result of new information, future events or developments, changed circumstances, or otherwise, notwithstanding any changes in our assumptions, changes in business plans, actual experience or other changes. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf. The timing and amount of any share repurchases will be at the discretion of management and will depend on a variety of factors including, but not limited to, the Company’s operating performance, cash flow and financial position, the market price of the shares and general economic and market conditions. The share repurchase program may be modified, increased, suspended or terminated at any time at the Board of Directors’ discretion.

Investor Relations Company Contact

Sterling Infrastructure, Inc.

Noelle Dilts, VP IR and Corporate Strategy

281-214-0795

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

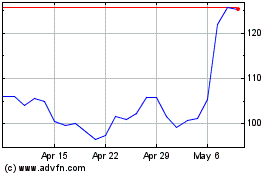

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From Apr 2024 to May 2024

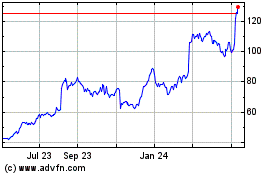

Sterling Infrastructure (NASDAQ:STRL)

Historical Stock Chart

From May 2023 to May 2024