Sportradar Group AG (NASDAQ: SRAD) (“Sportradar” or the “Company”),

a leading global sports technology company focused on creating

immersive experiences for sports fans and bettors, today announced

financial results for its third quarter ended September 30, 2023.

Carsten Koerl, Chief Executive Officer of Sportradar said: “As

the leader in our industry, we aim to consistently deliver value to

our clients, partners and shareholders. For 2023 we remain on track

to deliver a strong growth year and are well positioned to maintain

that momentum into 2024. This week we announced a reduction in our

global workforce as part of a broader set of strategic initiatives

that will enable us to further strengthen our client-centric

organization and focus on the market opportunities ahead of

us.”

Third Quarter 2023 Financial

Highligh

-

Revenue in the third quarter of 2023 increased 12% to €201.0

million compared with the third quarter of 2022 with growth across

all segments.

-

Total Profit from continuing operations for the third quarter of

2023 was €4.6 million compared with €12.8 million for the same

quarter last year. The Company’s Adjusted EBITDA1 for the same

period increased 38% to €50.5 million compared with the third

quarter of 2022, primarily due to strong revenue growth and higher

operating leverage.

- Total Profit from

continuing operations, as a percentage of revenue, for the third

quarter of 2023 was 2% compared with 7% for the same quarter last

year. Adjusted EBITDA margin1 was 25% in the third quarter of 2023,

an increase of 471 bps, compared with 20% in the prior year

period.

- The Company’s

customer Net Retention Rate1 (NRR) was 116% in the third quarter of

2023, demonstrating the Company’s strength in cross selling and

upselling to its clients.

- As of September 30,

2023, Sportradar had total liquidity of €509.7 million including

cash and cash equivalents of €289.7 million and an undrawn credit

facility of €220.0 million.

|

Key Financial Metrics |

|

|

|

| |

Q3 |

Q3 |

Change |

| In millions, in Euros€ |

2023 |

2022 |

% |

|

Revenue |

201.0 |

178.8 |

12% |

| Profit for the period from

continuing operations |

4.6 |

12.8 |

(64%) |

| Profit for the period from

continuing operations as a percentage of revenue |

2% |

7% |

-483 bps |

| Adjusted

EBITDA1 |

50.5 |

36.5 |

38% |

| Adjusted EBITDA

margin1 |

25% |

20% |

+471 bps |

| Net Retention

Rate1 |

116% |

118% |

(2%) |

1 Non-IFRS financial measure or operating metric; see “Non-IFRS

Financial Measures and Operating Metrics” and accompanying tables

for further explanations and reconciliations of non-IFRS measures

to IFRS measures.

Reduction in Global Workforce

This week, the Company announced a reduction in its global

workforce as part of a broader set of strategic initiatives. This

is expected to streamline its operating structure, improve product

ROI and portfolio optimization. When completed, this should result

in an approximate 10% reduction in 2023 labor cost run rates and

contribute positively to future operating leverage.

Recent Company Highlights

- Sportradar and BetMGM extended

their partnership for official NBA data. For the first time,

Sportradar will provide BetMGM products and services that leverage

NBA optical tracking data as a result of its exclusive partnership

with the NBA. This will enable BetMGM to grow its prop markets,

same-game parlays, as well as in-play betting market.

- Sportradar has been selected by the Taiwan Sports Lottery

Company, Ltd. to power its Sports Lottery with a customized

omnichannel sportsbook and player management solution. As part of a

consortium, Sportradar will operate the Sports Lottery through 2033

using the company’s ORAKO end-to-end sportsbook and player account

management system.

- NASCAR and Sportradar announced a four-year extension of their

long-term media rights partnership, which now includes official

betting data. This agreement will include live timing and scoring

data and expanded betting content.

- Sportradar has been chosen by the Tennis Channel to power the

launch of the network’s direct-to-consumer (DTC) streaming

platform, which, for the first time, will include access to Tennis

Channel’s marquee, 24/7 linear-channel alongside thousands of hours

of live and on-demand matches and original programming.

- Sportradar received several industry recognitions, including

Best Live Streaming Supplier at EGR B2B Awards 2023, Marketing

& Services Provider of the Year at SBC Awards 2023 and Sports

Betting Provider of the Year at Sigma Asia Awards 2023.

Additionally, Sportradar was included on Business Insider’s

“Leaders in AI 100” list.

Segment Information

RoW Betting

- Segment revenue in the third quarter

of 2023 increased by 11% to €112.2 million compared with the third

quarter of 2022. This growth was driven primarily by increased

sales of the Company’s Live Odds and Live Data products, which grew

18% year over year.

- Segment Adjusted

EBITDA1 in the third quarter of 2023 increased by 16% to €56.1

million compared with the third quarter of 2022. Segment Adjusted

EBITDA margin1 improved to 50% from 48%, compared with the third

quarter of 2022.

RoW Audiovisual (AV)

- Segment revenue in the third quarter

of 2023 increased by 15% to €38.0 million compared with the third

quarter of 2022. Revenue growth was driven by the new CONMEBOL deal

and growth in sales to new and existing customers.

- Segment Adjusted

EBITDA1 in the third quarter of 2023 increased by 5% to €13.3

million compared with the third quarter of 2022. Segment Adjusted

EBITDA margin1 decreased to 35% from 38% compared with the third

quarter of 2022.

United States

- Segment revenue in the third quarter

of 2023 increased by 11% to €35.1 million compared with the third

quarter of 2022. Results were primarily driven by growth of 19%

collectively in betting and gaming, and audiovisual products.

- Segment Adjusted EBITDA1 in the third quarter of 2023 was €8.2

million compared with €3.4 million in the third quarter of 2022,

indicating the strong improvement in operational leverage in the

U.S. business model despite continuous investments. Segment

Adjusted EBITDA margin12improved to 23% from 11%, compared with the

third quarter of 2022.

The tables below show the information related to each reportable

segment for the three and nine month periods ended September 30,

2023, and 2022.

|

|

Three Months Ended September 30, 2023 |

|

in €'000 |

RoW Betting |

RoW Betting AV |

United States |

Total reportable segments |

All other segments |

Total |

|

Segment revenue |

112,167 |

|

38,031 |

|

35,077 |

|

185,275 |

|

15,762 |

|

201,037 |

|

| Segment Adjusted EBITDA |

56,096 |

|

13,296 |

|

8,160 |

|

77,552 |

|

(2,578 |

) |

74,974 |

|

| Unallocated corporate

expenses2 |

|

|

|

|

|

(24,488 |

) |

| Adjusted

EBITDA1 |

|

|

|

|

|

50,486 |

|

| Adjusted EBITDA

margin1 |

50 |

% |

35 |

% |

23 |

% |

42 |

% |

(16 |

%) |

25 |

% |

|

|

Three Months Ended September 30, 2022 |

|

in €'000 |

RoW Betting |

RoW Betting AV |

United States |

Total reportable segments |

All other segments |

Total |

|

Segment revenue |

100,919 |

|

33,090 |

|

31,556 |

|

165,565 |

|

13,270 |

|

178,835 |

|

| Segment Adjusted EBITDA |

48,215 |

|

12,624 |

|

3,446 |

|

64,285 |

|

(3,854 |

) |

60,431 |

|

| Unallocated corporate

expenses2 |

|

|

|

|

|

(23,947 |

) |

| Adjusted

EBITDA1 |

|

|

|

|

|

36,484 |

|

| Adjusted EBITDA

margin1 |

48 |

% |

38 |

% |

11 |

% |

39 |

% |

(29 |

%) |

20 |

% |

|

|

Nine Months Ended September 30, 2023 |

|

in €'000 |

RoW Betting |

RoW Betting AV |

United States |

Total reportable segments |

All other segments |

Total |

|

Segment revenue |

334,816 |

|

132,154 |

|

112,773 |

|

579,743 |

|

45,292 |

|

625,035 |

|

| Segment Adjusted EBITDA |

154,525 |

|

41,055 |

|

20,425 |

|

216,005 |

|

(8,285 |

) |

207,720 |

|

| Unallocated corporate

expenses2 |

|

|

|

|

|

(80,461 |

) |

| Adjusted

EBITDA1 |

|

|

|

|

|

127,259 |

|

| Adjusted EBITDA

margin1 |

46 |

% |

31 |

% |

18 |

% |

37 |

% |

(18 |

%) |

20 |

% |

2 Unallocated corporate expenses primarily consist of salaries

and wages for management, legal, human resources, finance, office,

technology and other costs not allocated to the segments.

|

|

Nine Months Ended September 30, 2022 |

|

in €'000 |

RoW Betting |

RoW Betting AV |

United States |

Total reportable segments |

All other segments |

Total |

|

Segment revenue |

283,169 |

|

118,754 |

|

86,289 |

|

488,212 |

|

35,688 |

|

523,900 |

|

| Segment Adjusted EBITDA |

136,157 |

|

34,611 |

|

(8,474 |

) |

162,294 |

|

(12,467 |

) |

149,827 |

|

| Unallocated corporate

expenses2 |

|

|

|

|

|

(59,089 |

) |

| Adjusted

EBITDA1 |

|

|

|

|

|

90,738 |

|

| Adjusted EBITDA

margin1 |

48 |

% |

29 |

% |

(10 |

%) |

33 |

% |

(35 |

%) |

17 |

% |

2023 Annual Financial Outlook

Sportradar is providing an updated annual

outlook for revenue and Adjusted EBITDA1 for fiscal 2023 as

follows:

- Revenue in the range of €870 million to

€880 million, representing year-on-year growth between 19% and

21%.

- Adjusted EBITDA1 in the range of €162

million to €167 million, representing year-on-year growth between

29% and 33%.

- Adjusted EBITDA margin1 in the range of

18.4% to 19.2%.

Conference Call and Webcast Information

Sportradar will host a conference call to discuss the third

quarter 2023 results today, November 1, 2023, at 8:00 a.m. Eastern

Time. Those wishing to participate via webcast should access the

earnings call through Sportradar’s Investor Relations website. An

archived webcast with the accompanying slides will be available at

the Company’s Investor Relations website for one year after the

conclusion of the live event.

About Sportradar

Sportradar Group AG (NASDAQ: SRAD), founded in 2001, is a

leading global sports technology company creating immersive

experiences for sports fans and bettors. Positioned at the

intersection of the sports, media and betting industries, the

company provides sports federations, news media, consumer platforms

and sports betting operators with a best-in-class range of

solutions to help grow their business. As the trusted partner of

organizations like the NBA, NHL, MLB, NASCAR, UEFA, FIFA, and

Bundesliga, Sportradar covers close to a million events annually

across all major sports. With deep industry relationships and

expertise, Sportradar is not just redefining the sports fan

experience, it also safeguards sports through its Integrity

Services division and advocacy for an integrity-driven environment

for all involved.

For more information about Sportradar, please

visit www.sportradar.com

CONTACT:

Investor Relations:Christin Armacost, CFA,

Manager Investor Relationsinvestor.relations@sportradar.com

Media: Sandra

Lee, EVP of Global Communicationscomms@sportradar.com

Non-IFRS Financial Measures and

Operating MetricsWe have provided in this press release

financial information that has not been prepared in accordance with

IFRS, including Adjusted EBITDA and Adjusted EBITDA margin, as well

as operating metrics, including Net Retention Rate. We use

these non-IFRS financial measures internally in analyzing our

financial results and believe they are useful to investors, as a

supplement to IFRS measures, in evaluating our ongoing operational

performance. We believe that the use of these non-IFRS

financial measures provides an additional tool for investors to use

in evaluating ongoing operating results and trends and in comparing

our financial results with other companies in our industry, many of

which present similar non-IFRS financial measures to investors.

Non-IFRS financial measures should not be

considered in isolation from, or as a substitute for, financial

information prepared in accordance with IFRS. Investors are

encouraged to review the reconciliation of these non-IFRS financial

measures to their most directly comparable IFRS financial measures

provided in the financial statement tables included below in this

press release.

- “Adjusted EBITDA” represents profit

for the period from continuing operations adjusted for share based

compensation, depreciation and amortization (excluding amortization

of sports rights), impairment loss on other financial assets,

remeasurement of previously held equity-accounted investee,

non-routine litigation costs, professional fees for SOX and ERP

implementations, one-time charitable donation for Ukrainian relief

activities, share of loss of equity-accounted investee (SportTech

AG), loss on disposal of equity-accounted investee (SportTech AG),

impairment loss on goodwill and intangible assets, impairment loss

on assets held for sale, foreign currency (gains) losses, finance

income and finance costs, and income tax expense and certain other

non-recurring items, as described in the reconciliation below.

License fees relating to sports rights are a key component of how

we generate revenue and one of our main operating expenses. Such

license fees are presented either under purchased services and

licenses or under depreciation and amortization, depending on the

accounting treatment of each relevant license. Only licenses that

meet the recognition criteria of IAS 38 are capitalized. The

primary distinction for whether a license is capitalized or not

capitalized is the contracted length of the applicable license.

Therefore, the type of license we enter into can have a significant

impact on our results of operations depending on whether we are

able to capitalize the relevant license. Our presentation of

Adjusted EBITDA removes this difference in classification by

decreasing our EBITDA by our amortization of sports rights. As

such, our presentation of Adjusted EBITDA reflects the full costs

of our sports right's licenses. Management believes that, by

deducting the full amount of amortization of sports rights in its

calculation of Adjusted EBITDA, the result is a financial metric

that is both more meaningful and comparable for management and our

investors while also being more indicative of our ongoing operating

performance. We present Adjusted EBITDA because management believes

that some items excluded are non-recurring in nature and this

information is relevant in evaluating the results of the respective

segments relative to other entities that operate in the same

industry. Management believes Adjusted EBITDA is useful to

investors for evaluating Sportradar’s operating performance against

competitors, which commonly disclose similar performance measures.

However, Sportradar’s calculation of Adjusted EBITDA may not be

comparable to other similarly titled performance measures of other

companies. Adjusted EBITDA is not intended to be a substitute for

any IFRS financial measure. Items excluded from Adjusted EBITDA

include significant components in understanding and assessing

financial performance. Adjusted EBITDA has limitations as an

analytical tool and should not be considered in isolation, or as an

alternative to, or a substitute for, profit for the period, revenue

or other financial statement data presented in our consolidated

financial statements as indicators of financial performance. We

compensate for these limitations by relying primarily on our IFRS

results and using Adjusted EBITDA only as a supplemental

measure.

- “Adjusted EBITDA margin” is the

ratio of Adjusted EBITDA to revenue.

In addition, we define the following operating

metric as follows:

-

“Net Retention Rate” is calculated for a given period by starting

with the reported Trailing Twelve Month revenue, which includes

both subscription-based and revenue sharing revenue, from our top

200 customers as of twelve months prior to such period end, or

prior period revenue. We then calculate the reported trailing

twelve-month revenue from the same customer cohort as of the

current period end, or current period revenue. Current period

revenue includes any upsells and is net of contraction and

attrition over the trailing twelve months but excludes revenue from

new customers in the current period. We then divide the total

current period revenue by the total prior period revenue to arrive

at our Net Retention Rate.

The Company is unable to provide a reconciliation of Adjusted

EBITDA to profit (loss) for the period, its most directly

comparable IFRS financial measure, on a forward- looking basis

without unreasonable effort because items that impact this IFRS

financial measure are not within the Company’s control and/or

cannot be reasonably predicted. These items may include but are not

limited to foreign exchange gains and losses. Such information may

have a significant, and potentially unpredictable, impact on the

Company’s future financial results.

Safe Harbor for Forward-Looking

StatementsCertain statements in this press release may

constitute “forward-looking” statements and information within the

meaning of Section 27A of the Securities Act of 1933, Section 21E

of the Securities Exchange Act of 1934, and the safe harbor

provisions of the U.S. Private Securities Litigation Reform Act of

1995 that relate to our current expectations and views of future

events, including, without limitation, statements regarding future

financial or operating performance, planned activities and

objectives, anticipated growth resulting therefrom, market

opportunities, strategies and other expectations, and expected

performance for the full year 2023. In some cases, these

forward-looking statements can be identified by words or phrases

such as “may,” “might,” “will,” “could,” “would,” “should,”

“expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,”

“estimate,” “predict,” “potential,” “projects”, “continue,”

“contemplate,” “confident,” “possible” or similar words. These

forward-looking statements are subject to risks, uncertainties and

assumptions, some of which are beyond our control. In addition,

these forward-looking statements reflect our current views with

respect to future events and are not a guarantee of future

performance. Actual outcomes may differ materially from the

information contained in the forward-looking statements as a result

of a number of factors, including, without limitation, the

following: economy downturns and political and market conditions

beyond our control, including the impact of the Russia/Ukraine and

other military conflicts and foreign exchange rate fluctuations;

the global COVID-19 pandemic and its adverse effects on our

business; dependence on our strategic relationships with our sports

league partners; effect of social responsibility concerns and

public opinion on responsible gaming requirements on our

reputation; potential adverse changes in public and consumer tastes

and preferences and industry trends; potential changes in

competitive landscape, including new market entrants or

disintermediation; potential inability to anticipate and adopt new

technology; potential errors, failures or bugs in our products;

inability to protect our systems and data from continually evolving

cybersecurity risks, security breaches or other technological

risks; potential interruptions and failures in our systems or

infrastructure; our ability to comply with governmental laws,

rules, regulations, and other legal obligations, related to data

privacy, protection and security; ability to comply with the

variety of unsettled and developing U.S. and foreign laws on sports

betting; dependence on jurisdictions with uncertain regulatory

frameworks for our revenue; changes in the legal and regulatory

status of real money gambling and betting legislation on us and our

customers; our inability to maintain or obtain regulatory

compliance in the jurisdictions in which we conduct our business;

our ability to obtain, maintain, protect, enforce and defend our

intellectual property rights; our ability to obtain and maintain

sufficient data rights from major sports leagues, including

exclusive rights; any material weaknesses identified in our

internal control over financial reporting; inability to secure

additional financing in a timely manner, or at all, to meet our

long-term future capital needs; risks related to future

acquisitions; and other risk factors set forth in the section

titled “Risk Factors” in our Annual Report on Form 20-F for the

fiscal year ended December 31, 2022, and other documents filed with

or furnished to the SEC, accessible on the SEC’s website at

www.sec.gov and on our website at https://investors.sportradar.com.

These statements reflect management’s current expectations

regarding future events and operating performance and speak only as

of the date of this press release. One should not put undue

reliance on any forward-looking statements. Although we believe

that the expectations reflected in the forward-looking statements

are reasonable, we cannot guarantee that future results, levels of

activity, performance and events and circumstances reflected in the

forward-looking statements will be achieved or will occur. Except

as required by law, we undertake no obligation to update or revise

publicly any forward-looking statements, whether as a result of new

information, future events or otherwise, after the date on which

the statements are made or to reflect the occurrence of

unanticipated events.

SPORTRADAR GROUP AGINTERIM CONDENSED

CONSOLIDATED STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME(Expressed in thousands of Euros)

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Continuing

operations |

|

|

|

|

|

|

|

|

Revenue |

201,037 |

|

|

178,835 |

|

|

625,035 |

|

|

523,900 |

|

| Purchased services

and licenses (excluding depreciation and amortization) |

(45,260 |

) |

|

(47,536 |

) |

|

(138,245 |

) |

|

(127,612 |

) |

|

Internally-developed software cost capitalized |

8,415 |

|

|

4,349 |

|

|

19,665 |

|

|

13,125 |

|

| Personnel

expenses |

(75,359 |

) |

|

(68,278 |

) |

|

(237,223 |

) |

|

(184,974 |

) |

| Other operating

expenses |

(22,817 |

) |

|

(20,296 |

) |

|

(65,000 |

) |

|

(60,975 |

) |

| Depreciation and

amortization |

(38,184 |

) |

|

(31,760 |

) |

|

(137,947 |

) |

|

(133,332 |

) |

| Impairment loss on

trade receivables, contract assets and other financial assets |

(626 |

) |

|

(1,173 |

) |

|

(4,527 |

) |

|

(1,807 |

) |

| Remeasurement of

previously held equity-accounted investee |

- |

|

|

- |

|

|

- |

|

|

7,698 |

|

| Share of loss of

equity-accounted investees |

- |

|

|

(1,167 |

) |

|

(3,699 |

) |

|

(1,264 |

) |

| Loss on disposal

of equity-accounted investee |

- |

|

|

- |

|

|

(8,018 |

) |

|

- |

|

| Impairment loss on

goodwill and intangible assets |

(9,854 |

) |

|

- |

|

|

(9,854 |

) |

|

- |

|

| Impairment loss on

assets held for sale |

(5,600 |

) |

|

- |

|

|

(5,600 |

) |

|

- |

|

| Foreign currency

gains (losses), net |

1,187 |

|

|

11,003 |

|

|

(3,714 |

) |

|

39,858 |

|

| Finance

income |

3,179 |

|

|

1,991 |

|

|

9,781 |

|

|

2,715 |

|

| Finance costs |

(5,554 |

) |

|

(11,312 |

) |

|

(17,672 |

) |

|

(29,446 |

) |

| Net income

before tax from continuing operations |

10,564 |

|

|

14,656 |

|

|

22,982 |

|

|

47,886 |

|

| Income tax

expense |

(5,949 |

) |

|

(1,906 |

) |

|

(11,524 |

) |

|

(4,112 |

) |

| Profit for

the period from continuing operations |

4,615 |

|

|

12,750 |

|

|

11,458 |

|

|

43,774 |

|

|

Discontinued operations |

|

|

|

|

|

|

|

| Loss from

discontinued operations |

(495 |

) |

|

- |

|

|

(451 |

) |

|

- |

|

| Profit for

the period |

4,120 |

|

|

12,750 |

|

|

11,007 |

|

|

43,774 |

|

| Other

Comprehensive Income (Loss) |

|

|

|

|

|

|

|

| Items that

will not be reclassified subsequently to profit or

loss |

|

|

|

|

|

|

|

| Remeasurement of

defined benefit liability |

1 |

|

|

- |

|

|

(88 |

) |

|

1,451 |

|

| Related deferred

tax expense (benefit) |

- |

|

|

- |

|

|

11 |

|

|

(210 |

) |

| |

1 |

|

|

- |

|

|

(77 |

) |

|

1,241 |

|

| Items that

may be reclassified subsequently to profit or loss |

|

|

|

|

|

|

|

| Foreign currency

translation adjustment attributable to the owners of the

company |

3,420 |

|

|

7,369 |

|

|

3,062 |

|

|

15,172 |

|

| Foreign currency

translation adjustment attributable to non-controlling

interests |

(25 |

) |

|

27 |

|

|

(17 |

) |

|

31 |

|

| |

3,395 |

|

|

7,396 |

|

|

3,045 |

|

|

15,203 |

|

| Other

comprehensive income for the period, net of tax |

3,396 |

|

|

7,396 |

|

|

2,968 |

|

|

16,444 |

|

| Total

comprehensive income for the period |

7,516 |

|

|

20,146 |

|

|

13,975 |

|

|

60,218 |

|

| |

|

|

|

|

|

|

|

| Profit

(Loss) attributable to: |

|

|

|

|

|

|

|

|

Owners of the Company |

4,335 |

|

|

12,500 |

|

|

11,246 |

|

|

43,636 |

|

|

Non-controlling interests |

(215 |

) |

|

250 |

|

|

(239 |

) |

|

138 |

|

| |

4,120 |

|

|

12,750 |

|

|

11,007 |

|

|

43,774 |

|

| Total

comprehensive income (loss) attributable to: |

|

|

|

|

|

|

|

|

Owners of the Company |

7,756 |

|

|

19,869 |

|

|

14,230 |

|

|

60,049 |

|

|

Non-controlling interests |

(240 |

) |

|

277 |

|

|

(255 |

) |

|

169 |

|

| |

7,516 |

|

|

20,146 |

|

|

13,975 |

|

|

60,218 |

|

| |

|

|

|

|

|

|

|

| Profit and

Profit from continuing operations per Class A share attributable to

owners of the Company |

|

|

|

|

|

|

|

| Basic |

0.02 |

|

|

0.04 |

|

|

0.04 |

|

|

0.15 |

|

| Diluted |

0.01 |

|

|

0.04 |

|

|

0.04 |

|

|

0.14 |

|

| Profit and

Profit from continuing operations per Class B share attributable to

owners of the Company |

|

|

|

|

|

|

|

| Basic |

0.00 |

|

|

0.00 |

|

|

0.00 |

|

|

0.01 |

|

| Diluted |

0.00 |

|

|

0.00 |

|

|

0.00 |

|

|

0.01 |

|

| |

|

|

|

|

|

|

|

|

Weighted-average number of shares (in

thousands) |

|

|

|

|

|

|

|

| Weighted-average

number of Class A shares (basic) |

207,600 |

|

|

206,876 |

|

|

207,283 |

|

|

206,570 |

|

| Weighted-average

number of Class A shares (diluted) |

220,834 |

|

|

217,744 |

|

|

219,676 |

|

|

217,338 |

|

| Weighted-average

number of Class B shares (basic and diluted) |

903,671 |

|

|

903,671 |

|

|

903,671 |

|

|

903,671 |

|

SPORTRADAR GROUP AGINTERIM CONDENSED

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION(Expressed in

thousands of Euros)

| |

|

September 30, |

December 31, |

|

Assets |

|

2023 |

|

2022 |

| Current

assets |

|

|

|

|

|

Cash and cash equivalents |

|

289,701 |

|

|

243,757 |

|

| Trade receivables |

|

61,438 |

|

|

63,412 |

|

| Contract assets |

|

62,483 |

|

|

50,482 |

|

| Other assets and

prepayments |

|

31,529 |

|

|

42,913 |

|

| Income tax receivables |

|

2,078 |

|

|

1,631 |

|

| |

|

447,229 |

|

|

402,195 |

|

| Non-current

assets |

|

|

|

|

| Property and equipment |

|

44,010 |

|

|

37,887 |

|

| Intangible assets and

goodwill |

|

828,285 |

|

|

843,632 |

|

| Equity-accounted investee |

|

- |

|

|

33,888 |

|

| Other financial assets and

other non-current assets |

|

47,916 |

|

|

44,445 |

|

| Deferred tax assets |

|

24,303 |

|

|

27,014 |

|

| |

|

944,514 |

|

|

986,866 |

|

| Assets held for sale |

|

1,415 |

|

|

- |

|

| Total

assets |

|

1,393,158 |

|

|

1,389,061 |

|

| Current

liabilities |

|

|

|

|

| Loans and borrowings |

|

7,321 |

|

|

7,361 |

|

| Trade payables |

|

180,841 |

|

|

204,994 |

|

| Other liabilities |

|

51,682 |

|

|

65,268 |

|

| Contract liabilities |

|

35,505 |

|

|

23,172 |

|

| Income tax liabilities |

|

12,253 |

|

|

8,693 |

|

| |

|

287,602 |

|

|

309,488 |

|

| Non-current

liabilities |

|

|

|

|

| Loans and borrowings |

|

19,834 |

|

|

15,484 |

|

| Trade payables |

|

258,877 |

|

|

269,917 |

|

| Other non-current

liabilities |

|

7,079 |

|

|

10,695 |

|

| Deferred tax liabilities |

|

23,122 |

|

|

26,048 |

|

| |

|

308,912 |

|

|

322,144 |

|

| Liabilities related to assets

held for sale |

|

28 |

|

|

- |

|

| Total

liabilities |

|

596,542 |

|

|

631,632 |

|

| |

|

|

|

|

| Ordinary shares |

|

27,369 |

|

|

27,323 |

|

| Treasury shares |

|

(5,646 |

) |

|

(2,705 |

) |

| Additional paid-in

capital |

|

601,128 |

|

|

590,191 |

|

| Retained earnings |

|

144,762 |

|

|

117,155 |

|

| Other reserves |

|

22,584 |

|

|

19,624 |

|

| Reserves related to assets

held for sale |

|

439 |

|

|

- |

|

| Equity attributable to

owners of the Company |

|

790,636 |

|

|

751,588 |

|

| Non-controlling interest |

|

5,980 |

|

|

5,841 |

|

| Total

equity |

|

796,616 |

|

|

757,429 |

|

| Total liabilities and

equity |

|

1,393,158 |

|

|

1,389,061 |

|

SPORTRADAR GROUP AGINTERIM CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (Expressed in

thousands of

Euros)

| |

|

Nine Months Ended September 30, |

|

|

|

|

2023 |

|

2022 |

| OPERATING

ACTIVITIES: |

|

|

|

|

|

|

Profit for the period from continuing operations |

|

|

11,458 |

|

|

43,774 |

|

| Loss for the period from

discontinued operations |

|

|

(451 |

) |

|

- |

|

| Profit for the period |

|

|

11,007 |

|

|

43,774 |

|

| Adjustments to reconcile

profit for the year to net cash provided by operating

activities: |

|

|

|

|

|

| Income tax expense |

|

|

11,524 |

|

|

4,112 |

|

| Interest income |

|

|

(5,573 |

) |

|

(2,712 |

) |

| Interest expense |

|

|

15,861 |

|

|

29,400 |

|

| Impairment losses on financial

assets |

|

|

202 |

|

|

158 |

|

| Remeasurement of previously

held equity-accounted investee |

|

|

- |

|

|

(7,698 |

) |

| Other financial income (loss),

net |

|

|

(2 |

) |

|

43 |

|

| Foreign currency loss (gain),

net |

|

|

3,714 |

|

|

(39,858 |

) |

| Amortization of intangible

assets |

|

|

127,750 |

|

|

124,651 |

|

| Depreciation of property and

equipment |

|

|

10,197 |

|

|

8,681 |

|

| Equity-settled share-based

payments |

|

|

31,107 |

|

|

20,035 |

|

| Share of loss of

equity-accounted investees |

|

|

3,699 |

|

|

1,264 |

|

| Loss on disposal of

equity-accounted investee |

|

|

8,018 |

|

|

- |

|

| Impairment loss on goodwill

and intangible assets |

|

|

9,854 |

|

|

- |

|

| Impairment loss on assets held

for sale |

|

|

5,600 |

|

|

- |

|

| Other |

|

|

(6,963 |

) |

|

1,728 |

|

| Cash flow from

operating activities before working capital changes, interest and

income taxes |

|

|

225,995 |

|

|

183,578 |

|

| Increase in trade receivables,

contract assets, other assets and prepayments |

|

|

(1,212 |

) |

|

(20,144 |

) |

| Increase in trade and other

payables, contract and other liabilities |

|

|

324 |

|

|

13,374 |

|

| Changes in working

capital |

|

|

(888 |

) |

|

(6,770 |

) |

| Interest paid |

|

|

(15,009 |

) |

|

(26,632 |

) |

| Interest received |

|

|

5,566 |

|

|

2,706 |

|

| Income taxes paid, net |

|

|

(9,216 |

) |

|

(4,633 |

) |

| Net cash from

operating activities |

|

|

206,448 |

|

|

148,249 |

|

| INVESTING

ACTIVITIES: |

|

|

|

|

|

| Acquisition of intangible

assets |

|

|

(145,085 |

) |

|

(117,283 |

) |

| Acquisition of property and

equipment |

|

|

(5,638 |

) |

|

(5,806 |

) |

| Acquisition of subsidiaries,

net of cash acquired |

|

|

(12,286 |

) |

|

(55,901 |

) |

| Contribution to

equity-accounted investee |

|

|

- |

|

|

(27,873 |

) |

| Acquisition of financial

asset |

|

|

(3,716 |

) |

|

- |

|

| Proceeds from disposal of

equity-accounted investee |

|

|

15,172 |

|

|

- |

|

| Collection of loans

receivable |

|

|

41 |

|

|

122 |

|

| Issuance of loans

receivable |

|

|

(650 |

) |

|

- |

|

| Collection of deposits |

|

|

257 |

|

|

31 |

|

| Payment of deposits |

|

|

(600 |

) |

|

(160 |

) |

| Net cash used in

investing activities |

|

|

(152,505 |

) |

|

(206,870 |

) |

| FINANCING

ACTIVITIES: |

|

|

|

|

|

| Payment of lease

liabilities |

|

|

(4,933 |

) |

|

(4,425 |

) |

| Acquisition of non-controlling

interests |

|

|

- |

|

|

(28,246 |

) |

| Transaction costs related to

borrowings |

|

|

- |

|

|

(1,100 |

) |

| Principal payments on bank

debt |

|

|

(510 |

) |

|

(200,554 |

) |

| Purchase of treasury

shares |

|

|

(7,101 |

) |

|

(661 |

) |

| Change in bank overdrafts |

|

|

17 |

|

|

98 |

|

| Net cash used in

financing activities |

|

|

(12,527 |

) |

|

(234,888 |

) |

| Net increase

(decrease) increase in cash |

|

|

41,416 |

|

|

(293,509 |

) |

| Cash and cash equivalents as

of January 1 |

|

|

243,757 |

|

|

742,773 |

|

| Effects of movements in

exchange rates |

|

|

4,528 |

|

|

63,228 |

|

| Cash and cash

equivalents as of September 30 |

|

|

289,701 |

|

|

512,492 |

|

The following table reconciles Adjusted EBITDA

to the most directly comparable IFRS financial performance measure,

which is profit for the period from continuing operations:

|

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|

Adjusted EBTIDA reconciliation:in

€'000 |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

| Profit for the period

from continuing operations |

4,615 |

|

12,750 |

|

11,458 |

|

43,774 |

|

| Share based compensation |

11,368 |

|

7,348 |

|

31,430 |

|

20,035 |

|

| Litigation costs1 |

- |

|

2,975 |

|

- |

|

6,146 |

|

| Professional fees for SOX and

ERP implementations |

100 |

|

946 |

|

404 |

|

3,485 |

|

| One-time charitable donation

for Ukrainian relief activities |

- |

|

- |

|

- |

|

147 |

|

| Depreciation and

amortization |

38,184 |

|

31,760 |

|

137,947 |

|

133,332 |

|

| Amortization of sport

rights |

(26,372 |

) |

(20,668 |

) |

(104,482 |

) |

(100,793 |

) |

| Share of loss of

equity-accounted investee2 |

- |

|

1,167 |

|

3,699 |

|

1,167 |

|

| Loss on disposal of

equity-accounted investee |

- |

|

- |

|

8,018 |

|

- |

|

| Impairment loss on goodwill

and intangible assets |

9,854 |

|

- |

|

9,854 |

|

- |

|

| Impairment loss on assets held

for sale |

5,600 |

|

- |

|

5,600 |

|

- |

|

| Impairment loss (gain) on

other financial assets |

- |

|

(18 |

) |

202 |

|

158 |

|

| Remeasurement of previously

held equity-accounted investee |

- |

|

- |

|

- |

|

(7,698 |

) |

| Foreign currency (gains) loss,

net |

(1,187 |

) |

(11,003 |

) |

3,714 |

|

(39,858 |

) |

| Finance income |

(3,179 |

) |

(1,991 |

) |

(9,781 |

) |

(2,715 |

) |

| Finance costs |

5,554 |

|

11,312 |

|

17,672 |

|

29,446 |

|

| Income tax expense |

5,949 |

|

1,906 |

|

11,524 |

|

4,112 |

|

| Adjusted

EBITDA |

50,486 |

|

36,484 |

|

127,259 |

|

90,738 |

|

(1) Includes legal related costs in connection with a

non-routine litigation.(2) Related to equity-accounted investee

SportTech AG.

The most directly comparable IFRS measure of

Adjusted EBITDA margin is profit for the period from continuing

operations as a percentage of revenue as disclosed below:

| |

|

Three Months EndedSeptember

30, |

Nine Months EndedSeptember

30, |

|

in €'000 |

|

2023 |

2022 |

2023 |

2022 |

| Profit for the

period from continuing operations |

4,615 |

|

12,750 |

|

11,458 |

|

43,774 |

|

| Revenue |

201,037 |

|

178,835 |

|

625,035 |

|

523,900 |

|

| Profit for

the period from continuing operations as a percentage of

revenue |

2 |

% |

7 |

% |

2 |

% |

8 |

% |

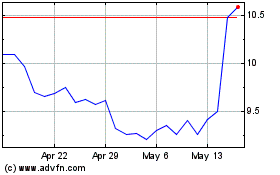

Sportrader (NASDAQ:SRAD)

Historical Stock Chart

From Apr 2024 to May 2024

Sportrader (NASDAQ:SRAD)

Historical Stock Chart

From May 2023 to May 2024