Form 8-K - Current report

December 04 2023 - 4:00PM

Edgar (US Regulatory)

0001844149

false

0001844149

2023-11-28

2023-11-28

0001844149

SPEC:CommonStockParValue0.0001PerShareMember

2023-11-28

2023-11-28

0001844149

SPEC:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf11.50Member

2023-11-28

2023-11-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 28, 2023

Spectaire Holdings Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-40976 |

|

98-1578608 |

(State or other jurisdiction

of

incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

155 Arlington St.,

Watertown, MA

|

|

02472

|

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (508) 213-8991

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

|

Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common stock, par value $0.0001 per share |

|

SPEC |

|

The Nasdaq Stock Market LLC |

| Redeemable warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50 |

|

SPECW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers

On November

28, 2023, the board of directors (the “Board”) of Spectaire Holdings Inc. (the

“Company”) appointed Scott Honour as a member of the Board to fill the vacancy created by the previously announced resignation

of Patricia Sapinsley. Mr. Honour will be subject to election as a Class II director at the 2025 Annual Meeting of Stockholders.

Scott Honour has served as a member of

our Board since November 28, 2023. Prior to the consummation of the Business Combination, Mr. Honour served as the Chairman of the board

of directors of Perception Capital Corp. II. Mr. Honour has over 30 years of private equity investment experience and has been involved

in over 100 transactions totaling over $20 billion in transaction value. Mr. Honour is the Managing Partner of NPG, a private equity firm,

which he co-founded in 2012. He also serves as Chairman of EVO and served as Chairman of SOAC, the first ESG focused SPAC. Prior to that,

Mr. Honour was at The Gores Group, a Los Angeles-based private equity firm, for 10 years, serving as Senior Managing Director and as one

of the firm’s top executives. Mr. Honour also served on the investment committee for The Gores Group. During his time at The Gores

Group, the firm raised four funds, totaling $4 billion in aggregate, and made over 35 investments. Prior to joining The Gores Group, Mr.

Honour was a Managing Director at UBS Investment Bank from 2000 to 2002 and was an investment banker at Donaldson, Lufkin & Jenrette

from 1991 to 2000. Mr. Honour began his career at Trammell Crow Company in 1988. Mr. Honour has served on the board of directors of numerous

public and private companies, including Anthem Sports & Entertainment Inc., 1st Choice Delivery, United Language Group, Renters Warehouse,

Real Dolmen (REM:BB) and Westwood One, Inc. (formerly Nasdaq: WWON), and is a co-founder of Titan CNG LLC and YapStone Inc. Mr. Honour

earned a B.S. and B.A., cum laude, in Business Administration and Economics from Pepperdine University and an M.B.A. in Finance and Marketing

from the Wharton School of the University of Pennsylvania. We believe that Mr. Honour is qualified to serve on the Board due to, among

other things, his extensive leadership and corporate experience.

Mr. Honour

will receive compensation consistent with that provided to the Company’s other non-employee directors. There is no arrangement or

understanding between Mr. Honour and any other persons pursuant to which he was selected as a director.

There is no family relationship between Mr. Honour,

on the one hand, and any director or executive officer of the Company or any person nominated or chosen to become a director or executive

officer of the Company. Additionally, Mr. Honour does not have any direct or indirect material interest in any transaction required to

be disclosed pursuant to Item 404(a) of Regulation S-K.

On November 28, 2023, we entered into an indemnity

agreement with Mr. Honour pursuant to which, subject to limited exceptions, and among other things, we will indemnify Mr. Honour to the

fullest extent permitted by law for claims arising in his capacity as a member of the Board.

The foregoing description of the indemnity agreement

is a summary only and is qualified in its entirety by reference to the form of indemnity agreement, a copy of which is filed as Exhibit

10.13 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on October 27, 2023 and is incorporated

herein by reference.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Spectaire Holdings Inc. |

| Date: December 4, 2023 |

|

|

| |

By: |

/s/ Brian Semkiw |

| |

Name: |

Brian Semkiw |

| |

Title: |

Chief Executive Officer |

2

v3.23.3

Cover

|

Nov. 28, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 28, 2023

|

| Entity File Number |

001-40976

|

| Entity Registrant Name |

Spectaire Holdings Inc.

|

| Entity Central Index Key |

0001844149

|

| Entity Tax Identification Number |

98-1578608

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

155 Arlington St.

|

| Entity Address, City or Town |

Watertown

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02472

|

| City Area Code |

(508)

|

| Local Phone Number |

213-8991

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

SPEC

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Redeemable warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50

|

| Trading Symbol |

SPECW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SPEC_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SPEC_RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

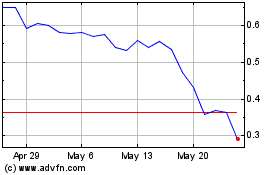

Spectaire (NASDAQ:SPEC)

Historical Stock Chart

From Apr 2024 to May 2024

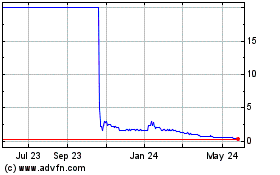

Spectaire (NASDAQ:SPEC)

Historical Stock Chart

From May 2023 to May 2024