0001588972false00015889722023-11-212023-11-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 21, 2023 |

Societal CDMO, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Pennsylvania |

001-36329 |

26-1523233 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1 E. Uwchlan Ave, Suite 112 |

|

Exton, Pennsylvania |

|

19341 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 770 534-8239 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.01 |

|

SCTL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On November 27, 2023, Societal CDMO Gainesville, LLC (“Societal Gainesville”), a Massachusetts limited liability company and wholly owned subsidiary of Societal CDMO, Inc. (the “Company”), entered into a Fifth Amendment to the Purchase and Sale Agreement and Joint Escrow Instructions (the “Amendment”) with Weekley Homes, LLC, a Delaware limited liability company (the “Purchaser”). The Amendment further amends that certain Purchase and Sale Agreement and Joint Escrow Instructions, dated as of August 11, 2022 (as amended from time to time, the “Agreement”), between Societal Gainesville and the Purchaser.

The Amendment provides, among other things, (i) a reduction in the purchase price for certain real estate located in Hall County, Georgia, as more particularly described in the Agreement, from $9,075,000 to $8,067,500 (the “Purchase Price”) and (ii) an additional, non-refundable earnest money deposit of $50,000, to be paid by the Purchaser to Societal Gainesville within one business day of the execution of the Amendment, and to be applied to the Purchase Price.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, which is filed herewith as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As previously reported, on May 23, 2023, the Company received written notice (the “Initial Notice”) from the Nasdaq Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market LLC (“Nasdaq”) that because the closing bid price for the Company’s common stock had been below $1.00 per share for 30 consecutive business days, the Company no longer complied with the minimum bid price requirement pursuant to Nasdaq Listing Rule 5550(a)(2) (“Minimum Bid Price Requirement”). The Initial Notice stated that the Company had 180 calendar days, or until November 20, 2023, to regain compliance with the Minimum Bid Price Requirement.

On November 21, 2023, the Company received a second letter from the Staff advising that the Company had been granted an additional 180 calendar days, or until May 20, 2024 (the “Extended Compliance Period”), to regain compliance with the Minimum Bid Price Requirement in accordance with Nasdaq Listing Rule 5810(c)(3)(A). If at any time during the Extended Compliance Period, the closing bid price of the Company’s common stock is at least $1.00 per share for a minimum of 10 consecutive business days, the Staff will provide written confirmation that the Company has achieved compliance with the Minimum Bid Price Requirement. If the Company cannot demonstrate compliance during the Extended Compliance Period, the Staff will provide notice that the Company’s common stock will be subject to delisting. At that time, the Company may appeal the Staff’s determination to a Hearings Panel (the “Panel”). There can be no assurance that, if the Company does appeal the Staff’s delisting determination to the Panel, such appeal would be successful.

The Company intends to continue to monitor the closing bid price of its common stock and will consider available options to regain compliance with the Minimum Bid Price Requirement, including potentially implementing a reverse stock split (if approved by the Company’s shareholders). There can be no assurance that the Company will be able to regain compliance with the Minimum Bid Price Requirement during the Extended Compliance Period or will otherwise be in compliance with other Nasdaq listing requirements.

Forward-Looking Statements

The statements made herein contain “forward-looking” statements, including, without limitation, statements related to the Company’s compliance with the Minimum Bid Price Requirement and related options to achieve compliance, including potentially implementing a reverse stock split. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. These forward-looking statements are based upon the Company’s current expectations. Forward-looking statements involve risks and uncertainties. The Company’s actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to the Company’s ability to regain compliance with the Minimum Bid Price Requirement, either through an increase in the trading price on the Nasdaq Capital Market or by effecting a reverse stock split. The Company’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (“SEC”) on March 1, 2023, Quarterly Reports on Form 10-Q, filed with the SEC on May 10, 2023, August 14, 2023 and November 8, 2023, and its other filings made with the SEC from time to time contain under the heading, “Risk Factors,” a more comprehensive description of risks to which the Company is subject. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are being filed herewith:

|

|

|

Exhibit

No. |

|

Document |

10.1 |

|

Fifth Amendment to Purchase and Sale Agreement and Joint Escrow Instructions, dated as of November 27, 2023, by and between Societal CDMO Gainesville, LLC and Weekley Homes, LLC. |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Societal CDMO, Inc. |

|

|

|

|

Date: |

November 28, 2023 |

By: |

/s/ J. David Enloe, Jr. |

|

|

|

J. David Enloe, Jr.

President and Chief Executive Officer |

Exhibit 10.1

FIFTH AMENDMENT TO PURCHASE AND SALE AGREEMENT

AND JOINT ESCROW INSTRUCTIONS

THIS FIFTH AMENDMENT TO PURCHASE AND SALE AGREEMENT AND JOINT ESCROW INSTRUCTIONS (this “Amendment”) is entered into on the Effective Date stated below, by and between SOCIETAL CDMO GAINESVILLE, LLC, a Massachusetts limited liability company (“Seller”), and WEEKLEY HOMES, LLC, a Delaware limited liability company (“Buyer”).

RECITALS:

A. Seller and Buyer entered into that certain Purchase and Sale Agreement and Joint Escrow Instructions dated August 11, 2022, as amended by that certain First Amendment to Purchase and Sale Agreement and Joint Escrow Instructions dated November 22, 2022, that certain Second Amendment to Purchase and Sale Agreement and Joint Escrow Instructions dated January 23, 2023, that certain Third Amendment to Purchase and Sale Agreement and Joint Escrow Instructions dated April 21, 2023, and that certain Fourth Amendment to Purchase and Sale Agreement and Joint Escrow Instructions dated October 3, 2023 (collectively, the “Agreement”), for certain property located in Hall County, Georgia, as more particularly described in the Agreement.

B. Seller and Buyer desire to amend the Agreement as set forth below.

AGREEMENT:

NOW, THEREFORE, for and in consideration of the covenants and agreements contained herein, and other good and valuable consideration, the receipt and legal sufficiency of which are hereby acknowledged. Seller and Buyer agree as follows:

1.Incorporation of Recitals. The recitals set forth above are incorporated herein and made a part of this Amendment to the same extent as if set forth herein in full.

2.Defined Terms. Capitalized terms used but not defined in this Amendment will have the meanings given to them in the Agreement.

3.Purchase Price. The first clause of Section 2(b) of the Agreement is hereby deleted in its entirety and replaced with the following:

“The purchase price (“Purchase Price”) for the Property will be Eight Million Sixty-Seven Thousand Five Hundred and 00/100 Dollars ($8,067,500.00). Buyer agrees to pay the Purchase Price as follows:”

4.Additional Earnest Money Deposit. In consideration of Seller’s execution of this Amendment, Buyer shall deposit Fifty Thousand and 00/100 Dollars ($50,000.00) with the Title Company within one (1) business day after execution of this Amendment, which shall be considered part of the Deposit and shall be nonrefundable to Buyer, except as the Deposit is refundable as expressly provided in the Agreement and shall be applicable to the Purchase Price at Closing.

5.Compliance with Certain Conditions. Buyer hereby agrees that it will comply with each of the conditions, numbered 1 through 12, set forth under the heading “Conditions” of the Gainesville Planning and Appeals Board Staff Recommendation dated November 14, 2023, and also shown in Exhibit “A” attached hereto and incorporated herein.

6.Ratification of Agreement; Conflict. The Agreement, as amended by this Amendment, is hereby ratified and affirmed by Seller and Buyer and will continue in full force and effect. If any conflict arises between the terms of this Amendment and the terms of the Agreement, the terms of this Amendment will control.

7.Governing Law. This Amendment will be construed and enforced in accordance with the laws of the State of Georgia.

8.Binding Effect; Entire Agreement. This Amendment: (a) is binding upon and inures to the benefit of the parties and their respective successors and assigns; (b) may be modified or amended only in writing signed by each party; (c) may be executed by electronic signatures, including DocuSign, and in several counterparts, and by the parties on separate counterparts, and each counterpart, when so executed and delivered, will constitute an original agreement, and all such separate counterparts will constitute one and the same agreement; and (d) embodies the entire agreement and understanding between the parties with respect to the subject matter of this Amendment and supersedes all prior agreements relating to such subject matter.

[Signatures commence on following page]

IN WITNESS WHEREOF, the parties have executed this Amendment effective as of the dale of latest date set forth beside Buyer’s or Seller’s signature below (the “Effective Date”).

“SELLER”:

SOCIETAL CDMO GAINESVILLE, LLC,

a Massachusetts limited liability company

By: /s/ Ryan D. Lake

Name: Ryan D. Lake

Title: CFO

Date: 11-27-2023

“BUYER”:

WEEKLEY HOMES, LLC,

a Delaware limited liability company

By: /s/ John Burchfield

Name: John Burchfield

Title: General Counsel

Date: 11-22-2023

Exhibit “A”

Conditions

1. The development standards within the applicant’s narrative, concept plans, zoning booklet and architectural renderings shall be made part of the zoning ordinance, and shall be subject to the Community Development Director approval. Any zoning conditions adopted as part of this zoning ordinance that conflict with these documents shall take precedence over the applicant’s development standards.

2. The proposal shall not exceed 333 age-restricted units (2.75 du/ac). The unit mix shall allow for no more than 100 condominium units and 40 paired villas. The number of detached residential homes shall not be limited so as the total number of all residential units combined do not exceed 333 age-restricted units.

3. The development shall comply with applicable U.S. Department of Housing and Urban Development (HUD) rules for age-restricted communities. The organization established for the management of the development shall comply with HUD rules for verification of occupancy and shall maintain procedures for routinely determining the occupancy of each unit. Such procedures may be part of a normal leasing or purchasing agreement and must provide for regular updates as required by HUD.

4. A mandatory Homeowners Association (HOA) or multiple associations shall be required for the proposed development providing for the financial management, architectural controls, enforcement of community standards and management of all common areas. Any modifications or new construction within the community must be approved by the Architectural Review Board. The Board will be established and operated by the developer until such time the powers are transferred to the HOA(s). A covenant shall be required to be recorded for the proposed development stating that no more than 20% of the total residential units may be rented between all condominiums, detached and attached residential products.

5. The condominium buildings shall not exceed 3 stories in height as measured from the lowest elevation.

6. The proposed 50-foot wide perimeter buffer adjacent to the Waters Edge subdivision shall be remain undisturbed. A mixture of evergreen Cryptomeria, Arborvitae and Eastern Red Cedar trees shall be planted along the western edge of the perimeter buffer adjacent to the proposed single-family detached lots. The minimum height of the trees shall be 10 feet. Tire location, spacing, size and type of trees planted shall be subject to the approval of the Community and Economic Development Department Director.

7. The right-of-way fronting McEver Road shall be landscaped and maintained subject to the approval of the Community & Economic Development Director.

8. All access point design for the subject property shall require review and approval by the Gainesville Public Works Department Director and the Georgia Department of Transportation (GDOT). All required access/traffic/sidewalk improvements associated with the proposed development or any additional improvements identified within the Traffic Impact Study shall be at the full expense of the developer/property owner.

9. All proposed roads shall meet City standards. Sidewalks shall be provided on both sides of all roads and drive aisles/parking areas at a minimum width of 5-feet. The sidewalks shall extend and connect to the existing sidewalk network on McEver Road.

10. All service areas, loading areas, ground or roof top HVAC equipment shall be screened from view from all adjacent uses, roads and Lake Lanier.

11. Outdoor lighting used in this development shall be of non-spill design and placed in a manner so as to minimize direct visibility by the adjacent properties.

12. A uniform sign plan shall be required for the proposed development subject to the approval of the Community and Economic Development Department Director.

v3.23.3

Document And Entity Information

|

Nov. 21, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 21, 2023

|

| Entity Registrant Name |

Societal CDMO, Inc.

|

| Entity Central Index Key |

0001588972

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-36329

|

| Entity Incorporation, State or Country Code |

PA

|

| Entity Tax Identification Number |

26-1523233

|

| Entity Address, Address Line One |

1 E. Uwchlan Ave, Suite 112

|

| Entity Address, City or Town |

Exton

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19341

|

| City Area Code |

770

|

| Local Phone Number |

534-8239

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01

|

| Trading Symbol |

SCTL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

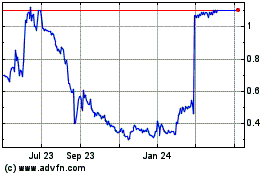

Societal CDMO (NASDAQ:SCTL)

Historical Stock Chart

From Apr 2024 to May 2024

Societal CDMO (NASDAQ:SCTL)

Historical Stock Chart

From May 2023 to May 2024