false000082718700008271872023-07-242023-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 24, 2023

SLEEP NUMBER CORPORATION

(Exact name of registrant as specified in its charter)

Minnesota

(State or other jurisdiction of incorporation) | | | | | |

| |

| 000-25121 | 41-1597886 |

| (Commission File Number) | (IRS Employer Identification No.) |

1001 Third Avenue South, Minneapolis, MN 55404

(Address of principal executive offices) (Zip Code)

(763) 551-7000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | SNBR | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| ITEM 1.01 | ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT |

On July 24, 2023, Sleep Number Corporation, a Minnesota corporation (“Sleep Number”), entered into a Ninth Amendment (the “Ninth Amendment”) amending and supplementing the Amended and Restated Credit and Security Agreement, dated as of February 14, 2018 (as amended, supplemented or otherwise modified from time to time, including by the Ninth Amendment, the “Credit Agreement”), among U.S. Bank National Association (“U.S. Bank”), as Administrative Agent, Swing Line Lender and Issuing Lender, and certain other financial institutions party thereto.

The Ninth Amendment, among other things, extends the increased permissible net leverage ratio of 5.00 to 1.00 to include the quarterly reporting period ending September 30, 2023. The foregoing description of the Ninth Amendment is qualified in its entirety by reference to the complete terms of the Ninth Amendment, which Sleep Number will file as an exhibit to its next Quarterly Report on Form 10-Q.

| | | | | |

| ITEM 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION. |

On July 27, 2023, Sleep Number issued a press release announcing results for the fiscal second quarter ended July 1, 2023. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

| | | | | |

| ITEM 2.03 | CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT. |

The information under Item 1.01 above is incorporated by reference into this Item 2.03.

| | | | | |

| ITEM 9.01. | FINANCIAL STATEMENTS AND EXHIBITS. |

(d) Exhibits.

| | | | | |

| Exhibit No. | Description of Exhibit |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | SLEEP NUMBER CORPORATION |

| | | (Registrant) |

| | | | | |

Dated: July 27, 2023 | | By: | | s Samuel R. Hellfeld |

| | | Name: | | Samuel R. Hellfeld |

| | | Title: | | Executive Vice President, Chief Legal and Risk Officer |

FOR IMMEDIATE RELEASE

SLEEP NUMBER ANNOUNCES SECOND QUARTER 2023 RESULTS

•Second quarter net sales were $459 million; demand down mid-single digits versus the prior year

•Reports second quarter diluted EPS of $0.03

•2023 EPS outlook updated to a range of $1.25 to $1.75 per share

•Announces the appointment of Francis Lee to Executive Vice President and Chief Financial Officer

MINNEAPOLIS – (July 27, 2023) – Sleep Number Corporation (Nasdaq: SNBR) today reported results for the quarter ended July 1, 2023.

“As we continue to navigate a challenging macro environment, our business is well positioned for growth. Demand has steadily improved year-to-date, and we expect this trend to continue in the back-half of the year as we benefit from the launch of our entire next generation smart bed portfolio, the Climate360 smart bed, and the advancement of our ‘Sleep Next Level’ advertising campaign with the start of the NFL season,” said Shelly Ibach, Chair, President and CEO, Sleep Number. “We have taken actions across the business to drive efficiencies and remain on track to expand margins and generate more than $100 million in cash from operations in 2023.”

Today, Sleep Number also announced the appointment of Francis Lee to Executive Vice President and Chief Financial Officer. Details can be found on the Sleep Number newsroom.

Second Quarter Overview

•Net sales decreased 16% to $459 million, with demand down mid-single digits; demand improved throughout the second quarter, although slightly below our expectations

•Gross margin was 57.6% and in line with our expectations; as a reminder prior year second quarter results benefitted from the delivery of more than $100 million in margin-rich backlog

•Operating expenses were reduced by $22 million to $253 million compared with $275 million last year

•Earnings per diluted share of $0.03 compared with $1.54 for the same period last year

Year-to-Date Overview

•Net sales decreased 8% to $985 million, with demand down high-single digits versus prior year

•Gross profit decreased to $575 million compared with $627 million for the prior year; gross margin rate of 58.3% was consistent with the same period last year and up 290 bp versus the back half of last year

•Operating income of $37 million compared with $54 million last year, with an 8% decline in gross margin dollars, partially offset by a $36 million reduction in operating expenses

•Earnings per diluted share of $0.54 compared with $1.60 for the same period last year

Cash Flows Overview

•Net cash from operating activities of $19 million for the first six months of the year, compared with $29 million for the same period last year

•Leverage ratio of 4.7x EBITDAR at the end of the second quarter versus covenant maximum of 5.0x

•Adjusted ROIC of 12.3% for the trailing twelve months

Financial Outlook

The company updated its full-year 2023 diluted EPS outlook to a range of $1.25 to $1.75. The 2023 outlook assumes net sales are down low to mid-single digits versus the prior year and gross margin improvement of more than 150 basis points versus 2022. The company expects to generate more than $100 million of operating cash flow for the year and positive free cash flows. The company anticipates 2023 capital expenditures of $50 million to $60 million.

Sleep Number Announces Second-quarter 2023 Results - Page 2 of 9

Conference Call Information

Management will host its regularly scheduled conference call to discuss the company’s results at 5 p.m. EDT (4 p.m. CDT; 2 p.m. PDT) today. To access the webcast, please visit the investor relations area of the Sleep Number website at https://ir.sleepnumber.com. The webcast replay will remain available for approximately 60 days.

About Sleep Number Corporation

Sleep Number is a wellness technology company. We are guided by our purpose to improve the health and wellbeing of society through higher quality sleep; to date, our innovations have improved over 14.5 million lives. Our wellness technology platform helps solve sleep problems, whether it’s providing individualized temperature control for each sleeper through our Climate360® smart bed or applying our 21 billion hours of longitudinal sleep data and expertise to research with global institutions.

Our smart bed ecosystem drives best-in-class engagement through dynamic, adjustable, and effortless sleep with personalized digital sleep and health insights; our millions of smart sleepers are loyal brand advocates. And our nearly 5,000 mission-driven team members passionately innovate to drive value creation through our vertically integrated business model, including our exclusive direct-to-consumer selling in 670 stores and online.

To learn more about life-changing, individualized sleep, visit a Sleep Number store near you, our newsroom and investor relations sites, or SleepNumber.com

Forward-looking Statements

Statements used in this news release relating to future plans, events, financial results or performance, such as the company’s financial outlook for full-year 2023, including diluted EPS, are forward-looking statements subject to certain risks and uncertainties including, among others, such factors as current and future economic conditions and consumer sentiment; bank failures or other events affecting financial institutions; increases in interest rates, which have increased the cost of servicing the company’s indebtedness; availability of attractive and cost-effective consumer credit options; operating with minimal levels of inventory, which may leave the company vulnerable to supply shortages; Sleep Number’s dependence on, and ability to maintain strong working relationships with key suppliers and third parties; rising commodity costs or third-party logistics costs and other inflationary pressures; risks inherent in global-sourcing activities, including tariffs, geo-political turmoil, war, strikes, labor challenges, government-mandated work closures, outbreaks of pandemics or contagious diseases, and resulting supply shortages and production and delivery delays and disruptions; risks of disruption due to health epidemics or pandemics, such as the COVID-19 pandemic; regional risks related to having global operations and suppliers, including climate and other disasters; the effectiveness of the company’s marketing strategy and promotional efforts; the execution of Sleep Number’s Total Retail distribution strategy; ability to achieve and maintain high levels of product quality; ability to improve and expand Sleep Number’s product line and execute successful new product introductions; ability to prevent third parties from using the company’s technology or trademarks, and the adequacy of its intellectual property rights to protect its products and brand; ability to compete; risks of disruption in the operation of any of the company’s main manufacturing, distribution, logistics, home delivery, product development or customer service operations; the company’s ability to comply with existing and changing government regulation; pending or unforeseen litigation and the potential for associated adverse publicity; the adequacy of the company’s and third-party information systems and costs and disruptions related to upgrading or maintaining these systems; the company’s ability to withstand cyber threats that could compromise the security of its systems, result in a data breach or business disruption; Sleep Number’s ability, and the ability of its suppliers and vendors, to attract, retain and motivate qualified personnel; the volatility of Sleep Number stock; environmental, social and governance (ESG) risks, including increasing regulation and stakeholder expectations; and the company’s ability to adapt to climate change and readiness for legal or regulatory responses thereto. Additional information concerning these and other risks and uncertainties is contained in the company’s filings with the Securities and Exchange Commission (SEC), including the Annual Report on Form 10-K, and other periodic reports filed with the SEC. The company has no obligation to publicly update or revise any of the forward-looking statements in this news release.

# # #

Investor Contact: Dave Schwantes; (763) 551-7498; investorrelations@sleepnumber.com

Media Contact: Julie Elepano; julie.elepano@sleepnumber.com

Sleep Number Announces Second-quarter 2023 Results - Page 3 of 9

SLEEP NUMBER CORPORATION

AND SUBSIDIARIES

Consolidated Statements of Operations

(unaudited – in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| | July 1,

2023 | | % of

Net Sales | | July 2,

2022 | | % of

Net Sales |

| Net sales | $ | 458,789 | | | 100.0 | % | | $ | 549,073 | | | 100.0 | % |

| Cost of sales | 194,544 | | | 42.4 | % | | 224,128 | | | 40.8 | % |

| Gross profit | 264,245 | | | 57.6 | % | | 324,945 | | | 59.2 | % |

| Operating expenses: | | | | | | | |

| Sales and marketing | 197,779 | | | 43.1 | % | | 220,490 | | | 40.2 | % |

| General and administrative | 39,795 | | | 8.7 | % | | 38,727 | | | 7.1 | % |

| Research and development | 15,445 | | | 3.4 | % | | 15,817 | | | 2.9 | % |

| Total operating expenses | 253,019 | | | 55.1 | % | | 275,034 | | | 50.1 | % |

| Operating income | 11,226 | | | 2.4 | % | | 49,911 | | | 9.1 | % |

| Interest expense, net | 9,948 | | | 2.2 | % | | 3,619 | | | 0.7 | % |

| Income before income taxes | 1,278 | | | 0.3 | % | | 46,292 | | | 8.4 | % |

| Income tax expense | 524 | | | 0.1 | % | | 11,359 | | | 2.1 | % |

| Net income | $ | 754 | | | 0.2 | % | | $ | 34,933 | | | 6.4 | % |

| | | | | | | |

| Net income per share – basic | $ | 0.03 | | | | | $ | 1.56 | | | |

| | | | | | | |

| Net income per share – diluted | $ | 0.03 | | | | | $ | 1.54 | | | |

| | | | | | | |

| Reconciliation of weighted-average shares outstanding: |

| Basic weighted-average shares outstanding | 22,460 | | | | | 22,355 | | | |

| Dilutive effect of stock-based awards | 42 | | | | | 358 | | | |

| Diluted weighted-average shares outstanding | 22,502 | | | | | 22,713 | | | |

Sleep Number Announces Second-quarter 2023 Results - Page 4 of 9

SLEEP NUMBER CORPORATION

AND SUBSIDIARIES

Consolidated Statements of Operations

(unaudited – in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended |

| July 1,

2023 | | % of

Net Sales | | July 2,

2022 | | % of

Net Sales |

| Net sales | $ | 985,316 | | | 100.0 | % | | $ | 1,076,203 | | | 100.0 | % |

| Cost of sales | 410,806 | | | 41.7 | % | | 448,960 | | | 41.7 | % |

| Gross profit | 574,510 | | | 58.3 | % | | 627,243 | | | 58.3 | % |

| Operating expenses: | | | | | | | |

| Sales and marketing | 428,267 | | | 43.5 | % | | 460,749 | | | 42.8 | % |

| General and administrative | 79,196 | | | 8.0 | % | | 80,046 | | | 7.4 | % |

| Research and development | 29,888 | | | 3.0 | % | | 32,122 | | | 3.0 | % |

| Total operating expenses | 537,351 | | | 54.5 | % | | 572,917 | | | 53.2 | % |

| Operating income | 37,159 | | | 3.8 | % | | 54,326 | | | 5.0 | % |

| Interest expense, net | 19,050 | | | 1.9 | % | | 5,746 | | | 0.5 | % |

| Income before income taxes | 18,109 | | | 1.8 | % | | 48,580 | | | 4.5 | % |

| Income tax expense | 5,890 | | | 0.6 | % | | 11,573 | | | 1.1 | % |

| Net income | $ | 12,219 | | | 1.2 | % | | $ | 37,007 | | | 3.4 | % |

| | | | | | | |

| Net income per share – basic | $ | 0.55 | | | | | $ | 1.64 | | | |

| | | | | | | |

| Net income per share – diluted | $ | 0.54 | | | | | $ | 1.60 | | | |

| | | | | | | |

| Reconciliation of weighted-average shares outstanding: |

| Basic weighted-average shares outstanding | 22,378 | | | | | 22,558 | | | |

| Dilutive effect of stock-based awards | 165 | | | | | 594 | | | |

| Diluted weighted-average shares outstanding | 22,543 | | | | | 23,152 | | | |

Sleep Number Announces Second-quarter 2023 Results - Page 5 of 9

SLEEP NUMBER CORPORATION

AND SUBSIDIARIES

Consolidated Balance Sheets

(unaudited – in thousands, except per share amounts)

subject to reclassification

| | | | | | | | | | | |

| | July 1,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,798 | | | $ | 1,792 | |

Accounts receivable, net of allowances of $1,475 and $1,267, respectively | 24,102 | | | 26,005 | |

| Inventories | 121,446 | | | 114,034 | |

| | | |

| Prepaid expenses | 21,029 | | | 16,006 | |

| Other current assets | 40,142 | | | 39,921 | |

| Total current assets | 208,517 | | | 197,758 | |

| Non-current assets: | | | |

| Property and equipment, net | 191,067 | | | 200,605 | |

| Operating lease right-of-use assets | 399,989 | | | 397,755 | |

| Goodwill and intangible assets, net | 67,086 | | | 68,065 | |

| Deferred income taxes | 16,230 | | | 7,958 | |

| Other non-current assets | 82,266 | | | 81,795 | |

| Total assets | $ | 965,155 | | | $ | 953,936 | |

| Liabilities and Shareholders’ Deficit | | | |

| Current liabilities: | | | |

| Borrowings under revolving credit facility | $ | 483,800 | | | $ | 459,600 | |

| Accounts payable | 152,205 | | | 176,207 | |

| Customer prepayments | 58,498 | | | 73,181 | |

| Accrued sales returns | 25,476 | | | 25,594 | |

| Compensation and benefits | 38,934 | | | 31,291 | |

| Taxes and withholding | 23,356 | | | 23,622 | |

| Operating lease liabilities | 82,439 | | | 79,533 | |

| Other current liabilities | 57,054 | | | 60,785 | |

| Total current liabilities | 921,762 | | | 929,813 | |

| Non-current liabilities: | | | |

| | | |

| Operating lease liabilities | 356,044 | | | 356,879 | |

| Other non-current liabilities | 106,490 | | | 105,421 | |

| Total non-current liabilities | 462,534 | | | 462,300 | |

| Total liabilities | 1,384,296 | | | 1,392,113 | |

| Shareholders’ deficit: | | | |

Undesignated preferred stock; 5,000 shares authorized, no shares issued and outstanding | | | |

Common stock, $0.01 par value; 142,500 shares authorized, 22,214 and 22,014 shares issued and outstanding, respectively | 222 | | | 220 | |

| Additional paid-in capital | 11,997 | | | 5,182 | |

| Accumulated deficit | (431,360) | | | (443,579) | |

| Total shareholders’ deficit | (419,141) | | | (438,177) | |

| Total liabilities and shareholders’ deficit | $ | 965,155 | | | $ | 953,936 | |

Sleep Number Announces Second-quarter 2023 Results - Page 6 of 9

SLEEP NUMBER CORPORATION

AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(unaudited – in thousands)

subject to reclassification

| | | | | | | | | | | |

| | Six Months Ended |

| | July 1,

2023 | | July 2,

2022 |

| Cash flows from operating activities: | | | |

| Net income | $ | 12,219 | | | $ | 37,007 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 36,749 | | | 31,975 | |

| Stock-based compensation | 9,890 | | | 8,043 | |

| Net loss on disposals and impairments of assets | 181 | | | 179 | |

| Deferred income taxes | (8,272) | | | (3,794) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 1,903 | | | (2,898) | |

| Inventories | (7,412) | | | (15,674) | |

| Income taxes | 1,808 | | | 4,368 | |

| Prepaid expenses and other assets | (5,824) | | | 6,266 | |

| Accounts payable | (10,244) | | | (1,713) | |

| Customer prepayments | (14,683) | | | (14,754) | |

| Accrued compensation and benefits | 7,594 | | | (17,789) | |

| Other taxes and withholding | (2,074) | | | 971 | |

| Other accruals and liabilities | (3,115) | | | (3,496) | |

| Net cash provided by operating activities | 18,720 | | | 28,691 | |

| | | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (29,899) | | | (36,559) | |

| Proceeds from sales of property and equipment | — | | | 23 | |

| Issuance of note receivable | (435) | | | — | |

| | | |

| Net cash used in investing activities | (30,334) | | | (36,536) | |

| | | |

| Cash flows from financing activities: | | | |

| Net increase in short-term borrowings | 14,693 | | | 70,836 | |

| Repurchases of common stock | (3,501) | | | (63,644) | |

| Proceeds from issuance of common stock | 428 | | | 585 | |

| Debt issuance costs | — | | | (42) | |

| Net cash provided by financing activities | 11,620 | | | 7,735 | |

| | | |

| Net increase (decrease) in cash and cash equivalents | 6 | | | (110) | |

| Cash and cash equivalents, at beginning of period | 1,792 | | | 2,389 | |

| Cash and cash equivalents, at end of period | $ | 1,798 | | | $ | 2,279 | |

Sleep Number Announces Second-quarter 2023 Results - Page 7 of 9

SLEEP NUMBER CORPORATION

AND SUBSIDIARIES

Supplemental Financial Information

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | July 1,

2023 | | July 2,

2022 | | July 1,

2023 | | July 2,

2022 |

| Percent of sales: | | | | | | | |

| Retail stores | 87.7 | % | | 89.4 | % | | 87.4 | % | | 86.9 | % |

| Online, phone, chat and other | 12.3 | % | | 10.6 | % | | 12.6 | % | | 13.1 | % |

| Total Company | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | |

| Sales change rates: | | | | | | | |

| Retail comparable-store sales | (20 | %) | | 10 | % | | (10 | %) | | (3 | %) |

| Online, phone and chat | (3 | %) | | 2 | % | | (12 | %) | | 4 | % |

| Total Retail comparable sales change | (18 | %) | | 9 | % | | (10 | %) | | (2 | %) |

Net opened/closed stores and other | 2 | % | | 4 | % | | 2 | % | | 4 | % |

| Total Company | (16 | %) | | 13 | % | | (8 | %) | | 2 | % |

| | | | | | | |

| Stores open: | | | | | | | |

| Beginning of period | 671 | | | 653 | | | 670 | | | 648 | |

| Opened | 7 | | | 10 | | | 19 | | | 23 | |

| Closed | (6) | | | (4) | | | (17) | | | (12) | |

| End of period | 672 | | | 659 | | | 672 | | | 659 | |

| | | | | | | |

| Other metrics: | | | | | | | |

Average sales per store ($ in 000's) 1 | $ | 3,089 | | | $ | 3,526 | | | | | |

Average sales per square foot 1 | $ | 1,007 | | | $ | 1,172 | | | | | |

Stores > $2 million net sales 2 | 71 | % | | 82 | % | | | | |

Stores > $3 million net sales 2 | 31 | % | | 45 | % | | | | |

Average revenue per smart bed unit 3 | $ | 5,990 | | | $ | 6,485 | | | $ | 5,913 | | | $ | 5,601 | |

1 Trailing twelve months Total Retail comparable sales per store open at least one year.

2 Trailing twelve months for stores open at least one year (excludes online, phone and chat sales).

3 Represents Total Retail (stores, online, phone and chat) net sales divided by Total Retail smart bed units.

Sleep Number Announces Second-quarter 2023 Results - Page 8 of 9

SLEEP NUMBER CORPORATION AND SUBSIDIARIES

Earnings before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA)

(in thousands)

We define earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA) as net income plus: income tax expense, interest expense, depreciation and amortization, stock-based compensation and asset impairments. Management believes Adjusted EBITDA is a useful indicator of our financial performance and our ability to generate cash from operating activities. Our definition of Adjusted EBITDA may not be comparable to similarly titled definitions used by other companies. The table below reconciles Adjusted EBITDA, which is a non-GAAP financial measure, to the comparable GAAP financial measure: | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Trailing Twelve Months Ended |

| | July 1,

2023 | | July 2,

2022 | | July 1,

2023 | | July 2,

2022 |

| Net income | $ | 754 | | | $ | 34,933 | | | $ | 11,822 | | | $ | 101,869 | |

| Income tax expense | 524 | | | 11,359 | | | 6,602 | | | 30,442 | |

| Interest expense | 9,948 | | | 3,619 | | | 32,289 | | | 9,406 | |

| Depreciation and amortization | 18,304 | | | 15,920 | | | 71,318 | | | 61,857 | |

| Stock-based compensation | 5,252 | | | 3,910 | | | 15,071 | | | 18,872 | |

| Asset impairments | 170 | | | 80 | | | 294 | | | 266 | |

| Adjusted EBITDA | $ | 34,952 | | | $ | 69,821 | | | $ | 137,396 | | | $ | 222,712 | |

Free Cash Flow

(in thousands) | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Trailing Twelve Months Ended |

| | July 1,

2023 | | July 2,

2022 | | July 1,

2023 | | July 2,

2022 |

Net cash provided by operating activities | $ | 139 | | | $ | 4,133 | | | $ | 26,167 | | | $ | 167,281 | |

| Subtract: Purchases of property and equipment | 14,343 | | | 16,955 | | | 62,794 | | | 71,447 | |

| Free cash flow | $ | (14,204) | | | $ | (12,822) | | | $ | (36,627) | | | $ | 95,834 | |

Calculation of Net Leverage Ratio under Revolving Credit Facility

(in thousands) | | | | | | | | | | | |

| | Trailing Twelve Months Ended |

| | July 1,

2023 | | July 2,

2022 |

| Borrowings under revolving credit facility | $ | 483,800 | | | $ | 443,300 | |

| Outstanding letters of credit | 7,147 | | | 5,947 | |

| Finance lease obligations | 361 | | | 479 | |

| Consolidated funded indebtedness | $ | 491,308 | | | $ | 449,726 | |

Capitalized operating lease obligations 1 | 675,108 | | | 642,213 | |

| | | |

| Total debt including capitalized operating lease obligations (a) | $ | 1,166,416 | | | $ | 1,091,939 | |

| | | |

| Adjusted EBITDA (see above) | $ | 137,396 | | | $ | 222,712 | |

| Consolidated rent expense | 112,518 | | | 107,035 | |

| Consolidated EBITDAR (b) | $ | 249,914 | | | $ | 329,747 | |

| Net Leverage Ratio under revolving credit facility (a divided by b) | 4.7 to 1.0 | | 3.3 to 1.0 |

1A multiple of six times annual rent expense is used as an estimate for capitalizing our operating lease obligations in accordance with our credit facility.

Note - Our Adjusted EBITDA and EBITDAR calculations, Free Cash Flow data and Calculation of Net Leverage Ratio under Revolving Credit Facility are considered non-GAAP financial measures and are not in accordance with, or preferable to, "as reported," or GAAP financial data. However, we are providing this information as we believe it facilitates analysis of the Company's financial performance by investors and financial analysts.

GAAP - generally accepted accounting principles in the U.S.

Sleep Number Announces Second-quarter 2023 Results - Page 9 of 9

SLEEP NUMBER CORPORATION AND SUBSIDIARIES

Calculation of Return on Invested Capital (Adjusted ROIC)

(in thousands)

Adjusted ROIC is a financial measure we use to determine how efficiently we deploy our capital. It quantifies the return we earn on our adjusted invested capital. Management believes Adjusted ROIC is also a useful metric for investors and financial analysts. We compute Adjusted ROIC as outlined below. Our definition and calculation of Adjusted ROIC may not be comparable to similarly titled definitions and calculations used by other companies. The tables below reconcile adjusted net operating profit after taxes (Adjusted NOPAT) and total adjusted invested capital, which are non-GAAP financial measures, to the comparable GAAP financial measures: | | | | | | | | | | | |

| | Trailing Twelve Months Ended |

| | July 1,

2023 | | July 2,

2022 |

| Adjusted net operating profit after taxes (Adjusted NOPAT) | | | |

| Operating income | $ | 50,713 | | | $ | 141,718 | |

Add: Operating lease interest 1 | 27,040 | | | 25,079 | |

| | | |

Less: Income taxes 2 | (21,993) | | | (39,798) | |

| Adjusted NOPAT | $ | 55,760 | | | $ | 126,999 | |

| | | | |

| Average adjusted invested capital | | | |

| Total deficit | $ | (419,141) | | | $ | (442,962) | |

| | | |

Add: Long-term debt 3 | 484,161 | | | 443,779 | |

Add: Operating lease obligations 4 | 438,483 | | | 420,516 | |

| Total adjusted invested capital at end of period | $ | 503,503 | | | $ | 421,333 | |

| | | | |

Average adjusted invested capital 5 | $ | 452,573 | | | $ | 363,986 | |

| | | | |

Adjusted ROIC 6 | 12.3 | % | | 34.9 | % |

| | | | | |

| 1 | Represents the interest expense component of lease expense included in our financial statements under ASC 842, Leases. |

| 2 | Reflects annual effective income tax rates, before discrete adjustments, of 28.3% and 23.9% for July 1, 2023 and July 2, 2022, respectively. |

| |

| 3 | Long-term debt includes existing finance lease liabilities. |

| 4 | Reflects operating lease liabilities included in our financial statements under ASC 842. |

| 5 | Average adjusted invested capital represents the average of the last five fiscal quarters' ending adjusted invested capital balances. |

| 6 | Adjusted ROIC equals Adjusted NOPAT divided by average adjusted invested capital. |

| |

| Note - the Company's adjusted ROIC calculation and data are considered non-GAAP financial measures and are not in accordance with, or preferable to, GAAP financial data. However, we are providing this information as we believe it facilitates analysis of the Company's financial performance by investors and financial analysts. The Company updated its Adjusted ROIC calculation effective beginning with the reporting period ended December 31, 2022, to reflect adjustments consistent with ASC 842. The prior period has been updated to reflect this calculation. |

| GAAP - generally accepted accounting principles in the U.S. |

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

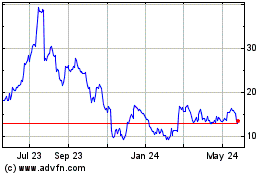

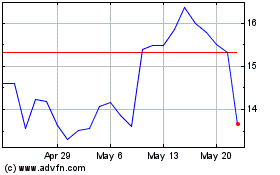

Sleep Number (NASDAQ:SNBR)

Historical Stock Chart

From Apr 2024 to May 2024

Sleep Number (NASDAQ:SNBR)

Historical Stock Chart

From May 2023 to May 2024