PORTERVILLE, Calif., April 23 /PRNewswire-FirstCall/ -- Sierra

Bancorp (NASDAQ:BSRR), parent of Bank of the Sierra, today

announced its financial results for the quarter ended March 31,

2007. Net income for the first quarter of 2007 increased 7% to $4.8

million, or $0.47 per diluted share, compared to $4.5 million, or

$0.43 per diluted share, in the same quarter a year ago. About

$0.01 of the increase in diluted earnings per share is attributable

to lower average diluted shares for the quarter, with the remainder

due to higher earnings. The Company's net interest margin in the

first quarter of 2007 was about the same as in the fourth quarter

of 2006, although it was 50 basis points lower than in the first

quarter of 2006. Sierra Bancorp generated a return on average

equity of 21.4% in the first quarter of 2007 compared to 22.5% in

the same quarter last year. Loans increased by over $17 million, or

2%, in the first quarter of 2007, while total deposits increased by

close to $34 million, or 4%, for the same time period due to growth

in customer deposits. "Our strong first quarter performance was

accentuated by the March opening of our 21st branch, in the city of

Delano, which by all measures was a highly successful opening,"

remarked James C. Holly, President and CEO. "While we recognize the

challenges of increasing core deposits and maintaining a strong net

interest margin, we remain optimistic that we will ultimately be

able to achieve record earnings once again this year, our 30th year

of operations," Holly stated. Financial Highlights The Company's

improved quarterly operating results were primarily due to higher

net interest income resulting from growth in average earning

assets. Average interest-earning assets were $129 million higher in

the first quarter of 2007 than in the first quarter of 2006, but

the contribution of higher earning assets to net interest income

was somewhat diluted by compression in the Company's net interest

margin. The following factors contributed to the net interest

margin decline: the Company's balance sheet is asset-sensitive, and

net interest income tends to decline as short-term interest rates

flatten; the bulk of the growth in earning assets over the past

year was funded by relatively expensive brokered certificates of

deposit or borrowings from the Federal Home Loan Bank (FHLB); and

the ratio of average interest-free demand deposit balances to

average earning assets fell to 24% in the first quarter of 2007

from 29% in the first quarter of 2006. Our loan loss provision was

$150,000 lower in the first quarter of 2007 than in the first

quarter of 2006 due to a lower rate of growth in outstanding loan

balances. The $867,000 in net charge-offs during the first quarter

of 2007 consists primarily of a $370,000 commercial loan and

several unsecured credit lines, which had a high level of specific

reserves already allocated to them at the beginning of the quarter

and thus did not have a significant impact on the loan loss

provision. We tightened our credit criteria for unsecured lines

last year, but because of lines approved before then a level of

charge-offs higher than historically experienced for that loan type

is still possible for the remainder of the year. For the quarter,

service charges on deposits increased by $99,000, or 7%, relative

to the first quarter of 2006. Service charges show improvement due

primarily to returned item and overdraft fees generated by new

consumer checking accounts. Other non-interest income increased by

$293,000, or 27%, due largely to a higher level of income from

bank-owned life insurance (BOLI), although year-over-year increases

in debit and credit card interchange fees, leasing income, and

dividends on FHLB stock also contributed. On the expense side,

salaries and benefits increased by $473,000, or 11%, due in large

part to the fact that lower loan volume led to a $211,000 drop in

the deferral of salary costs associated with successful loan

originations. Adding to the increase in salaries and benefits were

regular annual salary increases, and the addition of employees for

our newest branch in Delano. Occupancy expense fell by $111,000, or

7%, because of property tax refunds resulting from assessor audits

and lower depreciation expense on furniture and equipment. Other

non-interest expenses increased by $273,000, or 11%, due mainly to

an increase of $251,000 in marketing expenses. Marketing expenses

are in line with expectations, and have increased because of costs

associated with our current deposit-oriented marketing initiatives.

Also impacting non-interest expenses were the fact that OREO

properties were written down by $133,000 in the first quarter of

2006 but no write-downs occurred in the first quarter of 2007,

outsourced internal audit review costs were $81,000 higher, and

directors' costs were $60,000 higher. Balance sheet changes during

the first quarter of 2007 include a drop of $12 million, or 22%, in

cash and due from banks, an increase of $17 million, or 2%, in

gross loans and leases, and an increase of $34 million, or 4%, in

total deposits. Total assets increased by only $1 million from

December 31, 2006 to March 31, 2007. The lower balance of cash and

due from banks is the result of a reduction in cash items in

process of collection. Most of the loan growth for the quarter was

centered in real estate loans and commercial loans, both of which

grew by 3%. The growth in deposits was primarily due to customer

deposits generated by our branch system, since the balance of

wholesale-sourced brokered deposits did not change during the

quarter. There was a shift, however, from non-interest bearing

demand deposits into interest bearing demand (NOW) and money market

accounts. Non-interest bearing demand deposits declined by $22

million, or 8%, while NOW/savings account balances increased by $7

million, or 6%, and money market accounts increased by $17 million,

or 15%. Time deposits increased by $31 million, or 9%, due in part

to a $12 million increase in public deposits but mainly because of

additional commercial and consumer time deposits in our branches.

Since deposit growth exceeded the increase in loans, and because

cash and investment balances declined, we were able to reduce our

reliance on FHLB borrowings and fed funds purchased by a combined

$34 million, or 16%. 2006 Reclassifications To provide consistency

with 2007 financial reporting there were minor reclassifications of

income statement amounts originally reported in the first quarter

of 2006, including but not necessarily limited to the following:

Losses on partnership investments totaling $234,000 are now shown

as a reduction of other non-interest income rather than as other

non-interest expenses; and property insurance premiums totaling

$29,000 were moved from other non-interest expenses to occupancy

expense. About Sierra Bancorp Sierra Bancorp is the holding company

for Bank of the Sierra (http://www.bankofthesierra.com/), which is

in its 30th year of operations and is the largest independent bank

headquartered in the South San Joaquin Valley. The Company has $1.2

billion in total assets and currently maintains 21 branch offices,

an agricultural credit center, and an SBA center. In June 2005,

Sierra Bancorp was added to the Russell 2000 index based on

relative growth in market capitalization. In its April 2007

edition, US Banker magazine ranked Sierra Bancorp as the 10th best

performing publicly-traded mid-tier bank in the nation based on

three-year average return on equity, placing us in the top 5% for

banks in that category. The statements contained in this release

that are not historical facts are forward-looking statements based

on management's current expectations and beliefs concerning future

developments and their potential effects on the Company. Readers

are cautioned not to unduly rely on forward looking statements.

Actual results may differ from those projected. These forward-

looking statements involve risks and uncertainties including but

not limited to the health of the national and California economies,

the Company's ability to attract and retain skilled employees,

customers' service expectations, the Company's ability to

successfully deploy new technology and gain efficiencies there

from, the success of branch expansion, changes in interest rates,

loan portfolio performance, the Company's ability to secure buyers

for foreclosed properties, and other factors detailed in the

Company's SEC filings. SIERRA BANCORP CONSOLIDATED INCOME STATEMENT

3-Month Period Ended: (in $000's, unaudited) 3/31/2007 3/31/2006 %

Change Interest Income $21,745 $18,019 20.7% Interest Expense 7,769

4,540 71.1% Net Interest Income 13,976 13,479 3.7% Provision for

Loan & Lease Losses 900 1,050 -14.3% Net Int after Provision

13,076 12,429 5.2% Service Charges 1,575 1,476 6.7% Loan Sale &

Servicing Income 37 13 184.6% Other Non-Interest Income 1,373 1,080

27.1% Gain (Loss) on Investments 5 -- Total Non-Interest Income

2,990 2,569 16.4% Salaries & Benefits 4,664 4,191 11.3%

Occupancy Expense 1,466 1,577 -7.0% Other Non-Interest Expenses

2,854 2,581 10.6% Total Non-Interest Expense 8,984 8,349 7.6%

Income Before Taxes 7,082 6,649 6.5% Provision for Income Taxes

2,329 2,199 5.9% Net Income $4,753 $4,450 6.8% TAX DATA Tax-Exempt

Muni Income $547 $475 15.2% Tax-Exempt BOLI Income $358 $185 93.5%

Interest Income - Fully Tax Equiv $22,040 $18,275 20.6% NET

CHARGE-OFFS $867 $83 944.6% PER SHARE DATA 3-Month Period Ended:

(unaudited) 3/31/2007 3/31/2006 % Change Basic Earnings per Share

$0.49 $0.46 6.5% Diluted Earnings per Share $0.47 $0.43 9.3% Common

Dividends $0.15 $0.13 15.4% Wtd. Avg. Shares Outstanding 9,729,627

9,752,930 Wtd. Avg. Diluted Shares 10,149,351 10,271,219 Book Value

per Basic Share (EOP) $9.49 $8.43 12.6% Tangible Book Value per

Share (EOP) $8.92 $7.86 13.5% Common Shares Outstndg. (EOP)

9,758,779 9,769,880 KEY FINANCIAL RATIOS 3-Month Period Ended:

(unaudited) 3/31/2007 3/31/2006 Return on Average Equity 21.37%

22.46% Return on Average Assets 1.60% 1.70% Net Interest Margin

(Tax-Equiv.) 5.35% 5.85% Efficiency Ratio (Tax-Equiv.) 51.45%

50.84% Net C/O's to Avg Loans (not annualized) 0.10% 0.01% AVERAGE

BALANCES 3-Month Period Ended: (in $000's, unaudited) 3/31/2007

3/31/2006 % Change Average Assets $1,203,998 $1,061,229 13.5%

Average Interest-Earning Assets $1,082,418 $953,215 13.6% Average

Gross Loans & Leases $891,208 $756,109 17.9% Average Deposits

$868,396 $813,560 6.7% Average Equity $90,196 $80,347 12.3%

STATEMENT OF CONDITION (in $000's, End of Period: unaudited)

3/31/2007 12/31/2006 3/31/2006 Annual Chg ASSETS Cash and Due from

Banks $40,908 $52,725 $41,627 -1.7% Securities and Fed Funds Sold

192,815 196,562 197,495 -2.4% Agricultural 11,690 13,193 8,642

35.3% Commercial & Industrial 138,036 133,794 124,404 11.0%

Real Estate 669,738 652,089 577,102 16.1% SBA Loans 22,678 25,946

26,463 -14.3% Consumer Loans 54,815 54,568 50,268 9.0% Consumer

Credit Card Balances 8,189 8,418 8,162 0.3% Gross Loans &

Leases 905,146 888,008 795,041 13.8% Deferred Loan & Lease Fees

(3,662) (3,618) (2,933) 24.9% Loans & Leases Net of Deferred

Fees 901,484 884,390 792,108 13.8% Allowance for Loan & Lease

Losses (11,612) (11,579) (10,297) 12.8% Net Loans & Leases

889,872 872,811 781,811 13.8% Bank Premises & Equipment 18,187

17,978 18,128 0.3% Other Assets 74,062 74,998 63,169 17.2% Total

Assets $1,215,844 $1,215,074 $1,102,230 10.3% LIABILITIES &

CAPITAL Demand Deposits $258,913 $281,024 $280,866 -7.8% NOW /

Savings Deposits 134,685 127,521 148,124 -9.1% Money Market

Deposits 132,642 115,266 112,008 18.4% Time Certificates of Deposit

375,882 344,634 267,167 40.7% Total Deposits 902,122 868,445

808,165 11.6% Junior Subordinated Debentures 30,928 30,928 30,928

0.0% Other Interest-Bearing Liabilities 175,404 209,403 167,228

4.9% Total Deposits & Int.-Bearing Liab. 1,108,454 1,108,776

1,006,321 10.1% Other Liabilities 14,790 15,927 13,555 9.1% Total

Capital 92,600 90,371 82,354 12.4% Total Liabilities & Capital

$1,215,844 $1,215,074 $1,102,230 10.3% CREDIT QUALITY DATA (in

$000's, End of Period: unaudited) 3/31/2007 12/31/2006 3/31/2006

Annual Chg Non-Accruing Loans $649 $689 $914 -29.0% Over 90 Days PD

and Still Accruing -- -- -- 0.0% Foreclosed Assets 76 -- -- 100.0%

Total Non-Performing Assets $725 $689 $914 -20.7% Non-Perf Loans to

Total Loans 0.07% 0.08% 0.11% Non-Perf Assets to Total Assets 0.06%

0.06% 0.08% Allowance for Ln Losses to Loans 1.28% 1.30% 1.30%

OTHER PERIOD-END STATISTICS End of Period: (unaudited) 3/31/2007

12/31/2006 3/31/2006 Shareholders Equity/ Total Assets 7.6% 7.4%

7.5% Loans/Deposits 100.3% 102.3% 98.4% Non-Int. Bearing Dep./

Total Dep. 28.7% 32.4% 34.8% DATASOURCE: Sierra Bancorp CONTACT:

Ken Taylor, EVP/CFO, +1-559-782-4900, or Hope Attenhofer,

SVP/Marketing Director, +1-888-454-BANK, both of Sierra Bancorp Web

site: http://www.bankofthesierra.com/

Copyright

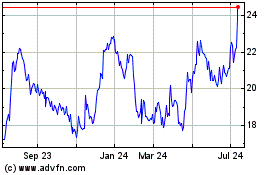

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From May 2024 to Jun 2024

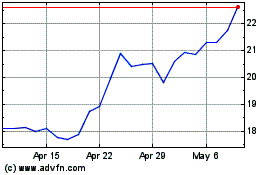

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Jun 2023 to Jun 2024