Filed Pursuant to Rule 424(b)(3)

Registration No. 333-261284

PROSPECTUS SUPPLEMENT NO. 4

(to Prospectus dated April 11, 2023)

Up to 1,582,025 Shares of Class A Common Stock

This prospectus supplement updates and supplements

the prospectus dated April 11, 2023 (the “Prospectus”), which forms a part of our Registration Statement on Form S-3 (No.

333-261284), as amended by Post-Effective Amendment No. 1 to Form S-3 on Form S-1 filed with the U.S. Securities and Exchange Commission

(the “SEC”) on April 3, 2023 (the “Registration Statement”), relating to the offer and sale from time to time

by the selling stockholders identified in the Prospectus, and any of their respective permitted assignees, (each, a “Selling Stockholder”

and collectively, the “Selling Stockholders”) of up to 1,582,025 shares of Class A common stock, par value $0.0001 (the “common

stock”), of Shift Technologies, Inc. (the “Company”). These shares are issuable upon conversion or redemption of the

Company’s 4.75% Convertible Senior Notes due 2026. We are not selling any shares covered by the Prospectus and will not receive

any proceeds from the sale of shares of common stock by the Selling Stockholders pursuant to the Prospectus.

This prospectus

supplement is being filed to update and supplement the information in the Prospectus with the information contained in our (i) Current

Report on Form 8-K, filed with the SEC on July 11, 2023 (the “Current Report No. 1”), (ii) Current Report on Form 8-K, filed

with the SEC on July 18, 2023 (the “Current Report No. 2”), and (iii) Current Report on Form 8-K, filed with the SEC on July

25, 2023 (the “Current Report No. 3” and, together with Current Report No. 1 and Current Report No. 2, the “Current

Reports”), in each case other than portions of the Current Reports deemed to have been furnished and not filed in accordance with

SEC rules. Accordingly, we have attached the Current Reports to this prospectus supplement.

This prospectus supplement updates and supplements

the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus,

including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus, and if

there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information

in this prospectus supplement.

We are an “emerging growth company”

as defined under U.S. federal securities laws and, as such, are subject to reduced public company reporting requirements.

Investing in our securities involves risks that

are described in the “Risk Factors” section beginning on page 7 of the Prospectus and under similar headings in any amendments

or supplements to the Prospectus.

Neither the SEC, nor any state securities commission

has approved or disapproved of these securities or determined if the Prospectus or this prospectus supplement is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is July

25, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported)

July 11, 2023 (July 11, 2023)

SHIFT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38839 |

|

82-5325852 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 290 Division Street, Suite 400, San Francisco, CA |

|

94103 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(855) 575-6739

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

SFT |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) if the Exchange Act. ☐

Item 2.05. Costs Associated with Exit or Disposal Activities.

On July 11, 2023, Shift Technologies, Inc. (the “Company,”

“Shift,” “we” or “us”) announced a plan to restructure and reduce the Company’s workforce (the

“Restructuring Plan”), pursuant to which the Company will focus all resources on its omnichannel used auto operations and

cease investment into the Company’s dealer marketplace business. The Restructuring Plan is part of the Company’s broader efforts

to improve cost efficiency and better align its operating structure with its omnichannel sales operations as the Company continues to

evaluate strategic alternatives to maximize stockholder value. The Restructuring Plan will result in an estimated workforce reduction

of approximately 34%. The Company expects the Restructuring Plan and associated workforce reduction will be substantially completed by

July 11, 2023.

The Company expects to incur charges related to the Restructuring Plan

and associated workforce reduction. As a result of the Restructuring Plan and associated workforce reduction, we expect to incur approximately

$900,000 in non-recurring restructuring charges, consisting primarily of one-time cash severance payments and related costs. The Company

has not yet completed its analysis of additional charges associated with implementation of the Restructuring Plan and associated workforce

reduction, and therefore is not able to make a good faith determination of an estimate of the amount, or range of amounts, of any additional

charges such as contract termination costs. The Company will provide additional disclosure through an amendment to this Current Report

on Form 8-K once it makes a determination of an estimate or range of estimates of such charges, if any.

The charges that the Company expects to incur are subject to a number

of assumptions, and actual expenses may differ materially from the estimates disclosed above.

The Company’s previously announced review of strategic alternatives

by its Board of Directors, management team, and advisors remains ongoing.

Item 2.06 Material Impairments.

To the extent required, the information contained in Item 2.05 of this

Current Report on Form 8-K is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

On July 11, 2023, the Company issued a press release in connection

with the Restructuring Plan. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and

is incorporated herein by reference.

The information set forth in Item 7.01, including Exhibit 99.1, shall

not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Forward-Looking Statements

Certain statements in this Current Report on Form

8-K constitute “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995.

Words contained in this Current Report on Form 8-K such as “believe,” “anticipate,” “expect,” “estimate,”

“plan,” “intend,” “should,” “would,” “could,” “may,” “might,”

“will” and variations of such words and similar future or conditional expressions, are intended to identify forward-looking

statements. These forward-looking statements include, but are not limited to, statements related to the Company’s expectations related

to the Restructuring Plan and the associated workforce reduction. These forward-looking statements are not guarantees of future results

and are subject to a number of risks and uncertainties, many of which are difficult to predict and beyond our control. Important assumptions

and other important factors that may cause actual results to differ materially from those in the forward-looking statements include, but

are not limited to, a material delay in consummating the Restructuring Plan, the Company may incur additional costs not currently contemplated

or that the savings may be less than anticipated, the risk that the Company’s Restructuring Plan and associated workforce reduction

may negatively impact the Company’s business operations and reputation, the Company’s ability to recruit and retain key management

and employees, and those additional risks, uncertainties and factors described in more detail in the Company’s filings with the

Securities and Exchange Commission (“SEC”) from time to time, including under the caption “Risk Factors” in the

Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (including any amendments thereto), and in the

Company’s other filings with the SEC (including any amendments thereto). The Company disclaims any obligation or undertaking to

update, supplement or revise any forward-looking statements contained in this Current Report on Form 8-K except as required by applicable

law or regulation. Given these risks and uncertainties, readers are cautioned not to place undue reliance on the forward-looking statements,

which speak only as of the date hereof.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following exhibit relating to Item 7.01 shall be deemed to be furnished,

and not filed:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SHIFT TECHNOLOGIES, INC. |

| |

|

| Dated: July 11, 2023 |

/s/ Oded Shein |

| |

Name: |

Oded Shein |

| |

Title: |

Chief Financial Officer |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 18, 2023 (July 14, 2023)

SHIFT

TECHNOLOGIES, INC.

(Exact

name of registrant as specified in charter)

| Delaware |

|

001-38839 |

|

82-5325852 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 290

Division Street, Suite 400, San Francisco, CA |

|

94103 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (855) 575-6739

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A common stock, par value $0.0001 per share |

|

SFT |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

July 14, 2023, Shift Technologies, Inc. (the “Company”) entered into a Second Amendment to Inventory Financing and

Security Agreement (the “Second Amendment”), by and among the Company, certain of the Company’s wholly owned

subsidiaries (collectively, the “Borrowers” and each, a “Borrower”), Ally Bank (“Ally

Bank”) and Ally Financial Inc. (“Ally Financial” and, together with Ally Bank, the “Lender”),

which amends the Company’s existing Inventory Financing and Security Agreement dated as of December 9, 2021, as amended by the

Amendment to Inventory Financing and Security Agreement dated as of February 7, 2023 (as so amended, the “Ally Facility”),

by and among the Company, the Borrowers and the Lender.

The

Second Amendment amends the Ally Facility to, among other things, (i) reduce the maximum available credit line (the “Credit

Line”) under the Ally Facility from $75 million to $30 million, (ii) eliminate the option for a Borrower to obtain financing

from the Lender for vehicles for which Dealership does not then hold a lien-free title, and (iii) eliminate the minimum liquidity financial

covenant. The Second Amendment also, in conjunction with the Borrowers entering into an amended Credit Balance Agreement with the Lender,

amends the Borrowers’ minimum cash balance requirement with the Lender to be an amount equal to the lesser of (i) at least 30%

of the amount of the Credit Line and (ii) 100% of the total outstanding principal balance under the Ally Facility.

The

foregoing description of the Second Amendment is qualified in its entirety by reference to the full text of the Second Amendment, which

is filed hereto as Exhibit 10.1 and is incorporated herein by reference.

The Company entered into the Second Amendment in connection with the previously

announced review of strategic alternatives by its Board of Directors, management team and advisors, which remains ongoing.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation Under an Off-balance Sheet Arrangement of a Registrant.

The

information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

| 10.1 |

|

Second Amendment to Inventory Financing and Security Agreement, dated as of July 14, 2023, by and among Shift Technologies, Inc., CarLotz, Inc., a Delaware corporation, CarLotz Group, Inc., CarLotz, Inc., an Illinois corporation, CarLotz California, LLC, Shift Operations LLC, Ally Bank and Ally Financial Inc. |

| 104 |

|

Cover Page Interactive Data File (embedded within the

Inline XBRL document). |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

SHIFT TECHNOLOGIES,

INC. |

| |

|

|

| Dated: July 18, 2023 |

By: |

/s/ Ayman

Moussa |

| |

Name: |

Ayman Moussa |

| |

Title: |

Chief Executive Officer |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported)

July 25, 2023 (July 21, 2023)

SHIFT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38839 |

|

82-5325852 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 290 Division Street, Suite 400, San Francisco, CA |

|

94103 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(855) 575-6739

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13a-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

SFT |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) if the Exchange Act. ☐

Item 5.02 Departure of Directors or Principal

Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

Clementz Transition and Separation Agreement

As previously announced on June 14, 2023, Shift

Technologies, Inc. (the “Company”) implemented an executive leadership succession plan in connection with the transition

of Jeff Clementz from the Company as its Chief Executive Officer, effective June 9, 2023 (the “Transition Effective Date”).

Mr. Clementz also resigned from the Board of Directors (the “Board”) of the Company on the Transition Effective Date.

In order to ensure an orderly transition of responsibilities, Mr. Clementz continued to be employed in a non-executive capacity with the

Company through July 1, 2023 (the “Separation Date”).

In connection with his transition from employment

with the Company, the Company and Mr. Clementz entered into a Transition and Separation Agreement (the “Agreement”)

on July 21, 2023 that reflects the terms of his transition and the benefits he is eligible to receive. The Agreement becomes effective

and enforceable on July 29, 2023 (the “Effective Date”) unless revoked in writing by Mr. Clementz prior to the Effective

Date. Pursuant to the Agreement, and in lieu of all severance benefits otherwise provided for under Mr. Clementz’s prior employment

agreement with the Company, Mr. Clementz will be entitled to receive the following benefits: (i) a cash payment equal to $400,000, payable

in a single lump sum within thirty (30) days following the Effective Date, (ii) payment of his 2023 annual bonus (if any), prorated for

the number of days employed by the Company in 2023 and determined based on actual performance (with any personal goals considered to be

fulfilled), and payable at such time that annual bonuses are otherwise generally paid to employees of the Company and (iii) payment of

COBRA premiums for eighteen (18) months following the Separation Date (to the extent Mr. Clementz elects COBRA continuation coverage),

less amounts equal to the amount active employees pay for such coverage during such time period, and subject to reduction or elimination

if Mr. Clementz becomes entitled to duplicative benefits through other employment. The Agreement also provides that Mr. Clementz will

make himself available to members of the Company’s senior management team through August 31, 2023 (the “Transition Period”).

In addition, the Agreement contains a general

waiver and release of claims by Mr. Clementz in favor of the Company. Mr. Clementz will be subject to certain restrictive covenants following

his termination of employment with the Company, including during the Transition Period.

Mr. Clementz’s transition is not the result

of any disagreements over the Company’s business, operations, or strategic direction.

The foregoing description of the Agreement is

not complete and is qualified in its entirety by reference to the full text of such Agreement, a copy of which is filed hereto as Exhibit

10.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SHIFT TECHNOLOGIES, INC. |

| |

|

| Dated: July 25, 2023 |

/s/ Oded Shein |

| |

Name: |

Oded Shein |

| |

Title: |

Chief Financial Officer |

2

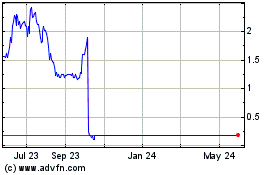

Shift Technologies (NASDAQ:SFT)

Historical Stock Chart

From Apr 2024 to May 2024

Shift Technologies (NASDAQ:SFT)

Historical Stock Chart

From May 2023 to May 2024