Amended Tender Offer Statement by Issuer (sc To-i/a)

March 10 2021 - 8:17AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Amendment No. 2)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

Seneca Foods Corporation

(Name of Subject Company (Issuer) and Filing Person (Offeror))

Class A Common Stock, par value $0.25 per share

(Title of Class of Securities)

817070501

(CUSIP Number of Class of Securities)

Timothy J. Benjamin

Chief Financial Officer

Seneca Foods Corporation

3736 South Main Street

Marion, NY 14505

(315) 926-8100

(Name, address, and telephone numbers of person authorized to receive notices and communications on behalf of filing persons)

with a copy to:

Michael C. Donlon, Esq.

Bond, Schoeneck & King, PLLC

200 Delaware Avenue, Suite 800

Buffalo, NY 14202

(716) 416-7000

CALCULATION OF FILING FEE

|

Transaction Valuation

|

Amount of Filing Fee (1)

|

|

$75,000,000

|

$8,182.50

|

|

(1)

|

The amount of the filing fee, calculated in accordance with Rule 0–11 under the Securities Exchange Act of 1934, as amended, equals $109.10 per million dollars of the value of the transaction.

|

|

☒

|

Check the box if any part of the fee is offset as provided by Rule 0–11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

Amount Previously Paid: $8,182.50

|

Filing Party: Seneca Foods Corporation

|

|

Form or Registration No.: Schedule TO

|

Date Filed: February 8, 2021

|

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

☐ third-party tender offer subject to Rule 14d-1.

☒ issuer tender offer subject to Rule 13e-4.

☐ going-private transaction subject to Rule 13e-3.

☐ amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☒

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

☐ Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

☐ Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

AMENDMENT NO. 2 TO SCHEDULE TO

This Amendment No. 2 (“Amendment No. 2”) amends and supplements the Tender Offer Statement on Schedule TO originally filed by Seneca Foods Corporation, a New York corporation (“Seneca” or the “Company”) on February 8, 2021 as amended by Amendment No. 1 filed on February 8, 2021 (as amended, the “Schedule TO”) in connection with the Company’s offer to purchase up to $75 million in value of shares of its Class A common stock, par value $0.25 per share (the “Class A Shares”), at a price not greater than $46.00 nor less than $40.00 per Class A Share, to the seller in cash, less any applicable withholding taxes and without interest.

This Amendment is intended to satisfy the reporting requirements of Rule 13e-4(c)(4) under the Securities Exchange Act of 1934, as amended. Only those items amended and supplemented are reported in this Amendment No. 2. Except as specifically provided herein, the information contained in the Schedule TO remains unchanged, and this Amendment No.2 does not modify any of the other information previously reported on Schedule TO. You should read Amendment No. 2 together with the Schedule TO, the Offer to Purchase dated February 8, 2019 and the related Letter of Transmittal.

ITEM 11. Additional Information

Item 11 is hereby amended and supplemented as follows:

On March 10, 2020, Seneca issued a press release announcing the final results of the tender offer, which expired at 6:00 p.m., New York City time, on Tuesday, March 9, 2021. A copy of such press release is filed as Exhibit (a)(5)(xviii) to this Amendment No. 2 and is incorporated herein by reference.

ITEM 12. Exhibits.

Item 12 of the Schedule TO is hereby amended and supplemented by adding the following exhibits:

EXHIBIT INDEX

|

Exhibit

Number

|

|

Description

|

|

(a)(1)(i)

|

|

Offer to Purchase, dated February 8, 2021.*

|

|

(a)(1)(ii)

|

|

Form of Letter of Transmittal (including IRS Form W-9).*

|

|

(a)(1)(iii)

|

|

Notice of Guaranteed Delivery.*

|

|

(a)(1)(iv)

|

|

Letter to Brokers, Dealers, Banks, Trust Companies and Other Nominees.*

|

|

(a)(1)(v)

|

|

Letter to Clients for use by Brokers, Dealers, Banks, Trust Companies and Other Nominees.*

|

|

(a)(1)(vi)

|

|

Letter to Participants in the Seneca Foods Corporation Employees’ Savings Plan.*

|

|

(a)(1)(vii)

|

|

Trustee Direction Form for Participants in the Seneca Foods Corporation Employees’ Savings Plan.*

|

|

(a)(5)(i)

|

|

Annual Report on Form 10-K of Seneca Foods Corporation for the fiscal year ended March 31, 2020 filed on July 2, 2020 (incorporated by reference to such filing).

|

|

(a)(5)(ii)

|

|

Seneca Foods Corporation’s Definitive Proxy Statement on Schedule 14A filed on July 6, 2020, but only to the extent that such information was incorporated by reference into the 2020 Annual Report (incorporated by reference to such filing).

|

|

(a)(5)(iii)

|

|

Quarterly Report on Form 10-Q of Seneca Foods Corporation for the fiscal quarter ended June 27, 2020 filed on August 5, 2020 (incorporated by reference to such filing).

|

|

(a)(5)(iv)

|

|

Quarterly Report on Form 10-Q of Seneca Foods Corporation for the fiscal quarter ended September 26, 2020 filed on November 4, 2020 (incorporated by reference to such filing).

|

|

(a)(5)(v)

|

|

Quarterly Report on Form 10-Q of Seneca Foods Corporation for the fiscal quarter ended December 26, 2020 filed on February 3, 2021 (incorporated by reference to such filing).

|

|

(a)(5)(vi)

|

|

Current Report on Form 8-K of Seneca Foods Corporation filed on June 1, 2020 (incorporated by reference to such filing).

|

|

(a)(5)(vii)

|

|

Current Report on Form 8-K of Seneca Foods Corporation filed on June 12, 2020 (incorporated by reference to such filing).

|

|

(a)(5)(viii)

|

|

Current Report on Form 8-K of Seneca Foods Corporation filed on August 18, 2020 (incorporated by reference to such filing).

|

|

(a)(5)(ix)

|

|

Current Report on Form 8-K of Seneca Foods Corporation filed on September 1, 2020 (incorporated by reference to such filing).

|

|

(a)(5)(x)

|

|

Current Report on Form 8-K of Seneca Foods Corporation filed on September 15, 2020 (incorporated by reference to such filing).

|

|

(a)(5)(xi)

|

|

Current Report on Form 8-K of Seneca Foods Corporation filed on October 28, 2020 (incorporated by reference to such filing).

|

|

(a)(5)(xii)

|

|

Current Report on Form 8-K of Seneca Foods Corporation filed on November 4, 2020 (incorporated by reference to such filing).

|

|

(a)(5)(xiii)

|

|

Current Report on Form 8-K of Seneca Foods Corporation filed on February 3, 2021 (incorporated by reference to such filing).

|

|

(a)(5)(xiv)

|

|

Current Report on Form 8-K of Seneca Foods Corporation filed on February 8, 2021 (incorporated by reference to such filing).

|

|

(a)(5)(xv)

|

|

Press Release issued by the Company on February 8, 2021 (incorporated by reference to Exhibit 99.1 to the Company’s Current Report on Form 8-K filed on February 8, 2021).*

|

|

(a)(5)(xvi)

|

|

Summary Advertisement, dated February 8, 2021.*

|

|

(a)(5)(xvii)

|

|

Notice to Directors and Executive Officers of Seneca Foods Corporation Regarding the Potential Complete Blackout in Transactions Involving Equity Securities of Seneca Foods Corporation, dated February 8, 2021 (incorporated by reference to Exhibit 99.1 to the Company’s Current Report on Form 8-K dated February 8, 2021).

|

|

(a)(5)(xviii)

|

|

Press release, dated March 10, 2021.**

|

|

(b)

|

|

Third Amended and Restated Loan and Security Agreement dated as of July 5, 2016 by and among Seneca Foods Corporation, Seneca Foods, LLC, Seneca Snack Company, Green Valley Foods, LLC and certain other subsidiaries of Seneca Foods Corporation, the financial institutions party thereto as lenders, Bank of America, N.A., as agent, issuing bank, syndication agent, and lead arranger (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K dated July 5, 2016).

|

|

(d)(i)

|

|

2007 Equity Incentive Plan effective August 3, 2007 as extended on July 28, 2017 (incorporated by reference to Appendix A to the Company’s Proxy Statement dated June 28, 2007).

|

* Previously filed.

** Filed herewith.

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Date: March 10, 2021

|

SENECA FOODS CORPORATION

By: /s/ Timothy J. Benjamin

Name: Timothy J. Benjamin

Title: Chief Financial Officer

|

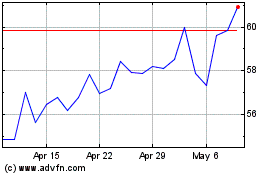

Seneca Foods (NASDAQ:SENEA)

Historical Stock Chart

From Apr 2024 to May 2024

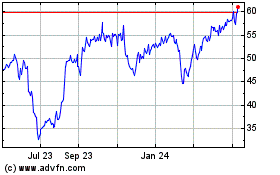

Seneca Foods (NASDAQ:SENEA)

Historical Stock Chart

From May 2023 to May 2024