|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549 SCHEDULE 14A

(Rule 14a-101) Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. _____) Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ Check the appropriate box: ☒ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☐ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material under §240.14a-12 SeaStar Medical Holding Corporation (Name of Registrant as Specified in its Charter) (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: |

☐ Fee paid previously with preliminary materials: |

|

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount previously paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: |

NOTICE & PROXY STATEMENT

2023 Special Meeting of Stockholders

September [6], 2023

10 am MST

SeaStar Medical Holding Corporation

3513 Brighton Blvd, Suite 410

Denver, CO 80216

August , 2023

To Our Stockholders:

You are cordially invited to attend the 2023 Special Meeting of Stockholders (the “Special Meeting”) of SeaStar Medical Holding Corporation at 10 am MST, on Wednesday, September [6], 2023. The Special Meeting will be held virtually, and no physical meeting will be held.

The Notice of Special Meeting of Stockholders and Proxy Statement on the following pages describe the matters to be presented at the Special Meeting. Please see the section titled “Who can attend the Special Meeting?” on page 3 of the Proxy Statement for more information about how to attend the meeting online.

Whether or not you attend the Special Meeting, it is important that your shares and votes are represented. Therefore, I urge you to promptly vote. Instructions for how to vote are contained on the enclosed proxy card. You can submit your vote by phone, via the Internet, or by signing, dating and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. If you decide to attend the virtual Special Meeting, you will be able to vote online at the Special Meeting even if you have previously submitted your proxy card.

Thank you for your support.

Sincerely,

________________________

Eric Schlorff

Director and Chief Executive Officer

PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION – DATED AUGUST 14, 2023

SeaStar Medical Holding Corporation

3513 Brighton Blvd, Suite 410

Denver, CO 80216

Notice of Special Meeting of Stockholders to Be Held Wednesday, September 6, 2023

The Special Meeting of Stockholders (the “Special Meeting”) of SeaStar Medical Holding Corporation, a Delaware corporation (the “Company”), will be held at 10 am MST, on Wednesday, September 6, 2023. The Special Meeting will be held virtually via live webcast. You will be able to attend the Special Meeting online by visiting www.proxydocs.com/ICU and entering your 12-digit control number included on your proxy card that is enclosed with your proxy materials. You will be able to submit questions at the meeting and vote. The Special Meeting will be held for the following purposes:

•To approve an amendment to the Third Amended and Restated Certificate of Incorporation of the Company (the “Charter”) to effect a reverse stock split of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) at a ratio to be determined by the Board of Directors within a range of 1-for-10 to 1-for-100, without reducing the authorized number of shares of the Common Stock, to be effected in the sole discretion of the Board of Directors at any time within one year of the date of the Special Meeting without further approval or authorization of stockholders;

•To approve an amendment to the Charter to increase the authorized number of shares of Common Stock from 100,000,000 shares to 500,000,000 shares

•To approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the potential issuance of shares of Common Stock issuable by the Company pursuant to the conversion or exchange of the Notes (as defined in the proxy statement); and,

•To approve an amendment to the Company's 2022 Omnibus Equity Incentive Plan (the "Plan") to increease the number of authorized shares under the Plan to 1,850,000 shares.

Holders of record of the Company’s Common Stock as of the close of business on August 2, 2023 are entitled to notice of and to vote at the Special Meeting, or at any continuation, postponement or adjournment of the Special Meeting. The Special Meeting may be continued or adjourned from time to time without notice other than by announcement at the Special Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Special Meeting, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials. If you received a copy of the proxy card by mail, you may sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Special Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Special Meeting if you desire to do so, as your proxy is revocable at your option.

By Order of the Board of Directors

________________________

Eric Schlorff

Chief Executive Officer

Denver, CO

August __, 2023

TABLE OF CONTENTS

i

PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION – DATED AUGUST 14, 2023

SeaStar Medical Holding Corporation

3513 Brighton Blvd, Suite 410

Denver, CO 80216

Proxy Statement

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation by the Board of Directors (the “Board”) of SeaStar Medical Holding Corporation of proxies to be voted at our Special Meeting of Stockholders to be held on Wednesday, September [6], 2023 (the “Special Meeting”), at 10 am MST, and at any continuation, postponement, or adjournment of the Special Meeting. The Special Meeting will be held virtually via live webcast. You will be able to attend the Special Meeting online by visiting www.proxydocs.com/ICU and entering your 12-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. You will be able to vote your shares electronically and submit your written questions prior to and during the meeting through the online website.

Holders of record of our Common Stock, par value $0.0001 per share (the “Common Stock”), as of the close of business on August 2, 2023 (the “Record Date”), will be entitled to notice of and to vote at the Special Meeting and at any continuation, postponement, or adjournment of the Special Meeting. As of the Record Date, there were [18,570,971] shares of Common Stock outstanding and entitled to vote at the Special Meeting. Each share of Common Stock is entitled to one vote on any matter presented to stockholders at the Special Meeting.

The Company will begin mailing, or otherwise make available to stockholders, the Notice of Internet Availability of Proxy Materials containing instructions on how to access the proxy materials and how to vote to stockholders on or about August 2023. In this Proxy Statement, “Company”, “we”, “us”, and “our” refer to SeaStar Medical Holding Corporation.

Proposals

At the Special Meeting, our stockholders will be asked:

•To approve an amendment to the Third Amended and Restated Certificate of Incorporation of the Company (the “Charter”) to effect a reverse stock split of the Company’s Common Stock at a ratio to be determined by the Board within a range of 1-for-10 to 1-for-100 (the “Reverse Stock Split”), without reducing the authorized number of shares of the Common Stock, to be effected in the sole discretion of the Board at any time within one year of the date of the Special Meeting without further approval or authorization of stockholders (the “Reverse Stock Split Proposal”);

•To approve an amendment to the Charter to increase the authorized number of shares of Common Stock from 100,000,000 shares to 500,000,000 shares (the “Authorized Shares Proposal”);

•To approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the potential issuance of shares of Common Stock issuable by the Company pursuant to the conversion or exchange of the Notes (as defined herein) (the “Nasdaq Proposal”); and

•To approve an amendment to the Company’s 2022 Omnibus Equity Incentive Plan (the “Plan”) to increase the number of authorized shares under the Plan to 1,850,000 shares (the “Incentive Plan Proposal”).

We know of no other business that will be presented at the Special Meeting. If any other matter properly comes before the stockholders for a vote at the Special Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Recommendations of the Board

The Board of Directors (the “Board”) recommends that you vote your shares as indicated below. If you return a properly completed proxy card, or vote your shares by telephone or Internet, your shares of Common Stock will be voted on your behalf as you direct. If not otherwise specified, the shares of Common Stock represented by the proxies will be voted, and the Board recommends that you vote:

•FOR the approval of an amendment to the Charter to effect a reverse stock split of the Company’s Common Stock at a ratio to be determined by the Board within a range of 1-for-10 to 1-for-100, without reducing the authorized number of shares of the Common Stock, to be effected in the sole discretion of the Board at any time within one year of the date of the Special Meeting without further approval or authorization of stockholders;

•FOR the approval of an amendment to the Charter to increase the authorized number of shares of Common Stock from 100,000,000 shares to 500,000,000 shares; and

•FOR the approval of, for purposes of complying with Nasdaq Listing Rule 5635(d), the potential issuance of shares of Common Stock issuable by the company pursuant to the conversion or exchange of the Notes (as defined in the proxy statement); and

•FOR the approval of an amendment to the Plan to increase the number of authorized shares under the Plan to 1,850,000 shares.

If any other matter properly comes before the stockholders for a vote at the Special Meeting, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Information About This Proxy Statement

Why you received this Proxy Statement. You are viewing or have received these proxy materials because our Board of Directors is soliciting your proxy to vote your shares at the Special Meeting. This Proxy Statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and that is designed to assist you in voting your shares.

Printed Copies of Our Proxy Materials. You have received or will receive printed copies of our proxy materials, and instructions regarding how you can vote are contained on the proxy card included in the materials.

Householding. The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the proxy materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the proxy materials, contact Continental Stock Transfer and Trust Company (the “Transfer Agent”) at 1-800-509-8856 or in writing at Continental Stock Transfer and Trust, 1 State Street 30th Floor, New York, NY 10004-1561.

If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future proxy materials for your household, please contact the Transfer Agent at the above phone number or address.

Questions and Answers About the 2023 special Meeting of Stockholders

Who is entitled to vote at the Special Meeting?

The Record Date for the Special Meeting is August 2, 2023, which was approved by our Board of Directors. You are entitled to vote at the Special Meeting only if you were a stockholder of record at the close of business on that date, or if you hold a valid proxy for the Special Meeting. Each outstanding share of Common Stock is entitled to one vote for all matters before the Special Meeting. At the close of business on the Record Date, there were [18,570,941] shares of Common Stock outstanding and entitled to vote at the Special Meeting.

2

How many shares must be present to hold the Special Meeting?

A quorum must be present at the Special Meeting for any business to be conducted. The presence at the Special Meeting online or by proxy of the holders of a majority of the Common Stock issued and outstanding and entitled to vote on the Record Date, or [9,285,486] shares, will constitute a quorum.

Who can attend the Special Meeting?

The Company has decided to hold the Special Meeting online. You may attend and participate in the Special Meeting online by visiting the following website: www.proxydocs.com /ICU. To attend and participate in the Special Meeting you will need the 12-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 12-digit control number or otherwise vote through the bank or broker. You will be able to vote your shares electronically and submit your written questions prior to and during the meeting through the online website.

If you decide to join the Special Meeting online, we encourage you to access the meeting prior to the start time. Online check-in will begin at 9:50 am MST, and you should allow ample time for the check-in procedures.

What if a quorum is not present at the Special Meeting?

If a quorum is not present at the scheduled time of the Special Meeting, the Chairperson of the Special Meeting is authorized by our Amended and Restated Bylaws (the “Bylaws”) to adjourn the meeting, without the vote of stockholders.

What does it mean if I receive more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each set of proxy materials, please submit your proxy by phone, via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

How do I vote?

Stockholders of Record. If you are a stockholder of record, you may vote:

•by Internet—You can vote over the Internet at www.proxypush.com/ICU by following the instructions on the proxy card

•by Telephone—You can vote by telephone by calling 1-866-868-2739 and following the instructions on the proxy card

•by Mail—You can vote by mail by signing, dating and mailing the proxy card, which you may have received by mail; or

•at the Meeting—You can use the 12-digit control number included in your proxy card or on the instructions that accompanied your proxy materials to vote electronically during the meeting.

Internet and telephone voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 pm MST on September [5], 2023. To participate in the Special Meeting online, including to vote via the Internet or telephone, you will need the 12-digit control number included on your proxy card or on the instructions that accompanied your proxy materials.

Whether or not you expect to attend the Special Meeting, we urge you to vote your shares as promptly as possible to ensure your representation and the presence of a quorum at the Special Meeting. If you submit your proxy ahead of time, you may still decide to attend the Special Meeting and vote your shares at the meeting.

3

Beneficial Owners of Shares Held in “Street Name.” If your shares are held in “street name” through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Internet and telephone voting also may be offered to stockholders owning shares through certain banks and brokers. To vote your shares online at the Special Meeting, you should contact your bank or broker to obtain your 12-digit control number or otherwise vote through the bank or broker.

Can I change my vote after I submit my proxy?

Yes. If you are a registered stockholder, you may revoke your proxy and change your vote:

•by submitting a duly executed proxy bearing a later date

•by granting a subsequent proxy through the Internet or telephone

•by giving written notice of revocation to the Secretary of the Company prior to or at the Special Meeting; or

•by voting online at the Special Meeting.

Your most recent proxy card or Internet or telephone proxy is the one that is counted. Your attendance at the Special Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Secretary before your proxy is voted or you vote online at the Special Meeting.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote online at the Special Meeting using your 12-digit control number or otherwise voting through your bank or broker.

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board of Directors. The Board of Directors’ recommendations are indicated on page 1 of this Proxy Statement, as well as with the description of each proposal in this Proxy Statement.

Will any other business be conducted at the Special Meeting?

We know of no other business that will be presented at the Special Meeting. If any other matter properly comes before the stockholders for a vote at the Special Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Will there be a question-and-answer session during the Special Meeting?

As part of the Special Meeting, we will hold a live Q&A session, during which we intend to answer questions submitted during or prior to the meeting that are pertinent to the Company and the meeting matters, as time permits. Only stockholders that have accessed the Special Meeting as a stockholder by following the procedures outlined above in “Who can attend the Special Meeting?” will be permitted to submit questions during the Special Meeting through the Special Meeting webpage. We have the discretion to decline responses to any questions submitted by stockholders.

Additional information regarding the Q&A session will be available in the “Rules of Conduct” available on the Special Meeting webpage for stockholders that have accessed the Special Meeting as a stockholder by following the procedures outlined above in “Who can attend the Special Meeting?”.

How many votes are required for the approval of the proposals to be voted upon and how will abstentions and

4

broker non- votes be treated?

|

|

|

Proposal |

Votes Required |

Effect of Votes Withheld/Abstentions and Broker Non-Votes |

Proposal 1: Reverse Stock Split Proposal |

The affirmative vote of the majority of the votes cast |

Abstentions and broker non-votes will have no effect on the outcome of this proposal. |

Proposal 2: Authorized Shares Proposal |

The affirmative vote of the majority of the votes cast |

Abstentions and broker non-votes will have no effect on the outcome of this proposal. |

Proposal 3: Nasdaq Proposal |

The affirmative vote of the majority of the votes cast |

Abstentions and broker non-votes will have no effect on the outcome of this proposal. |

Proposal 4: Incentive Plan Proposal |

The affirmative vote of the majority of the votes cast |

Absentions and broker non-votes will have no effect on the outcome of this prosoal. |

What is a “vote withheld” and an “abstention” and how will votes withheld and abstentions be treated?

Votes withheld and abstentions are counted as present and entitled to vote for purposes of determining a quorum. Votes withheld and abstentions have no effect on the outcome of the Reverse Stock Split Proposal, the Authorized Shares Proposal, the Nasdaq Proposal, or the Incentive Plan Proposal.

What is the difference between being a “record holder” and holding shares in “street name”?

A record holder holds shares in his or her name. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf.

Am I entitled to vote if my shares are held in “street name”?

Yes. If your shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card if you received printed copies of our proxy materials. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions. To vote your shares online at the Special Meeting, you should contact your bank or broker to obtain your 12-digit control number or otherwise vote through the bank or broker.

What are broker non-votes and do they count for determining a quorum?

Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters without instructions from the beneficial owner of those shares. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on non-routine matters, such as the approval of issuance of shares of Common Stock. Broker non-votes count for purposes of determining whether a quorum is present.

Where can I find a list of stockholders?

A complete list of such stockholders will be open to the examination of any stockholder for a period of ten days prior to the Special Meeting for a purpose germane to the meeting by sending an email to Investor Relations at JCAIN@LHAI.COM, stating the purpose of the request and providing proof of ownership of Company Common Stock. The list of these stockholders will also be available during the Special Meeting after entering the 12-digit control number included on your proxy card or on the instructions that accompanied your proxy materials.

5

Where can I find the voting results of the Special Meeting?

We plan to announce preliminary voting results at the Special Meeting, and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC after the Special Meeting.

6

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information regarding the beneficial ownership of Common Stock on June 30, 2023 by:

•each person known by the Company to be the beneficial owner of more than 5% of outstanding Common Stock;

•each of the Company’s current named executive officers and directors; and

•all current executive officers and directors of the Company as a group.

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security or the right to acquire such power within 60 days. Except as indicated by the footnotes below, the Company believes, based on the information furnished to it, that the persons and entities named in the table below will have sole voting and investment power with respect to all stock that they beneficially own, subject to applicable community property laws.

Common stock issuable upon exercise of warrants or options currently exercisable within 60 days are deemed outstanding solely for purposes of calculating the percentage of total voting power of the beneficial owner thereof.

Subject to the paragraph above, the percentage ownership of Common Stock is based on 18,121,238 shares of Common Stock outstanding as of June 30, 2023.

|

|

|

|

|

|

|

|

|

Name and Address of Beneficial Owner |

|

Number of Shares Beneficially Owned |

|

|

% of Class |

|

Five Percent Holders |

|

|

|

|

|

|

LMFAO Sponsor, LLC (1) |

|

|

8,325,500 |

|

|

|

45.9 |

% |

Saba Capital Management, L.P. (2) |

|

|

972,567 |

|

|

|

5.4 |

% |

3i, LP (3) |

|

|

1,325,200 |

|

|

|

7.3 |

% |

Dow Employees’ Pension Plan Trust (4) |

|

|

4,751,567 |

|

|

|

26.2 |

% |

Union Carbide Employees’ Pension Plan Trust (5) |

|

|

3,167,706 |

|

|

|

17.5 |

% |

Directors and Executive Officers (6) |

|

|

|

|

|

|

Eric Schlorff (7) |

|

|

624,662 |

|

|

|

3.5 |

% |

Rick Barnett (8) |

|

|

21,425 |

|

|

* |

|

Allan Collins, MD (8) |

|

|

21,425 |

|

|

* |

|

Kenneth Van Heel (9) |

|

|

16,834 |

|

|

* |

|

Andres Lobo |

|

|

— |

|

|

* |

|

Bruce Rodgers (1) |

|

|

— |

|

|

* |

|

Richard Russell (1) |

|

|

20,000 |

|

|

* |

|

Caryl Baron (10) |

|

|

83,170 |

|

|

* |

|

Kevin Chung, MD |

|

|

23,803 |

|

|

* |

|

All directors and executive officers as a group (9 persons) |

|

|

811,319 |

|

|

|

4.5 |

% |

* Less than 1%.

(1)Includes (i) 2,587,500 shares of Common Stock and (ii) 5,738,000 shares of Common Stock issuable upon the exercise of private warrants held by the Sponsor that became exercisable upon consummation of the Business Combination. Sponsor is the record holder of the shares reported herein. The sole manager of the Sponsor is LM Funding America, Inc. (“LMFA”), of which Bruce Rodgers is the Chief Executive Officer, President, and Chairman of the Board of Directors and Richard Russell is the Chief Financial Officer, Treasurer, and Secretary. Although Mr. Rodgers and Mr. Russell have membership interests in the Sponsor, the board of directors of LMFA has sole voting and investment discretion with respect to the shares held of record by the Sponsor, and as such, neither Mr. Rodgers nor Mr. Russell is deemed to have beneficial ownership of the Common Stock held directly

by the Sponsor. The business address of the Sponsor is 1200 W. Platt St., Suite 100, Tampa, Florida 33606. Mr Russell purchased 20,000 shares on the open market.

(2)According to Schedule 13G filed on February 14, 2022. The business address of Saba Capital Management, L.P. is 405 Lexington Avenue, 58th Floor, New York, NY 10174.

(3)Includes (i) 1,215,690 shares of Common Stock and (ii) and 528,352 shares of Common Stock subject to warrants exercisable within 60 days of June 30, 2023. The business address of 3i, LP is 140 Broadway, 38th Floor, New York, NY 10005.

(4)Includes (i) 4,449,841 shares of Common Stock and (ii) 301,726 shares of Common Stock subject to warrants exercisable within 60 days of June 30, 2023. The business address of the Dow Employees’ Pension Plan Trust is Sylvia Stoesser Center, 2211 H.H. Dow Way, Midland, MI 48674.

(5)Includes (i) 2,966,555 shares of Common Stock and (ii) 201,151 shares of Common Stock subject to warrants exercisable within 60 days of June 30, 2023. The business address of the Union Carbide Employees’ Pension Plan Trust is Sylvia Stoesser Center, 2211 H.H. Dow Way, Midland, MI 48674.

(6)Unless otherwise noted, the business address of each of the following entities or individuals is c/o SeaStar Medical Holding Corporation, 3513 Brighton Blvd Ste 410, Denver, CO 80216.

(7)Includes 2,908 shares of Common Stock issuable upon exercise of stock options within 60 days of June 30, 2023, the vested portion of the 198,530 RSUs granted on April 4, 2022 where 50% plus monthly vesting (115,806 RSUs) on the first anniversary of the grant date, and then monthly for 2 years, and 417,386 vested RSUs that were from a conversion of Transaction Bonus.

(8)Includes 848 shares of Common Stock issuable upon exercise of stock options within 60 days of June 30, 2023, and the vested portion of the 8,422 RSUs granted on April 4, 2022, where 50% vested, plus monthly vesting (5,614 RSUs) on the first anniversary of the grant date and then monthly for 1 year.

(9)Includes 848 shares of Common Stock issuable upon exercise of stock options within 60 days of June 30, 2023, and the vested portion of the 8,422 RSUs granted on April 4, 2022, where 50% vested, plus monthly vesting (5,614 RSUs) on the first anniversary of the grant date and then monthly for 1 year.

(10)Includes 848 shares of Common Stock issuable upon exercise of stock options within 60 days of June 30, 2023, the vested portion of the s 42,112 RSUs granted on April 4, 2022, where 50% vested, plus monthly vesting (24,564 RSUs) on the first anniversary of the grant date and then monthly for 2 years, and 41,799 shares (net withholding) related to a performance award.

(11)Includes 23,803 shares that were purchased on the open market.

Proposal 1: Approval of an Amendment to our Charter to Effect the Reverse Stock Split

General

At the Special Meeting, our stockholders will be asked to approve a proposal to amend the Charter of the Company to effect a reverse stock split of the issued and outstanding shares of our Common Stock, at an exchange ratio to be determined by the Board in the range of between 1-for-10 to 1-for-100 shares outstanding, to be effected in the sole discretion of the Board at any time within one year of the date of the Special Meeting. Such authority will expire at the one-year anniversary of the Special Meeting is the Reverse Stock Split has not been effected by then. Upon the effectiveness of such amendment to the Charter to effect the reverse stock split, or the reverse stock split effective time, the issued and outstanding shares of our Common Stock immediately prior to the reverse stock split effective time will be reclassified into a smaller number of shares such that a Company stockholder will own one new share of our Common Stock for each 10 to 100 (or any number in between) shares of issued Common Stock held by such stockholder immediately prior to the reverse stock split effective time, as specified. If the Reverse Stock Split is implemented, pursuant to the amendment to the Company’s Charter that gives effect to the Reverse Stock Split, the total number of authorized shares of Common Stock will remain unchanged.

By approving this Proposal No. 1, Company stockholders will: (a) approve an amendment to the Charter pursuant to which any whole number of issued and outstanding shares of Common Stock between and including 10 to 100 (or any number in between) could be combined and reclassified into one share of Common Stock; and (b) authorize the Company’s Board to file only one such amendment, as determined by the Board in its sole discretion, and to abandon each amendment not selected by the Board. Should the Company receive the required stockholder approval for this Proposal No. 1, and following such stockholder approval, the Board determines that effecting the reverse stock split is in the best interests of Company and its stockholders, the reverse stock split will become effective as specified in the amendment filed with the Secretary of State of the State of Delaware. The amendment filed thereby will contain the number of shares selected by the Board within the limits set forth in this Proposal No. 1 to be combined and reclassified into one share of our Common Stock. Accordingly, upon the effectiveness of the amendment to the Charter to effect the reverse stock split, or the reverse stock split effective time, every 10 to 100 shares (or any number in between) of our Common Stock outstanding immediately prior to the reverse stock split effective time will be combined and reclassified into one share of our Common Stock.

The amendment to the Charter to effect the reverse stock split, as more fully described below, will effect the reverse stock split but will not change the number of authorized shares of our Common Stock or Preferred Stock, or the par value of our Common Stock or Preferred Stock.

The form of this proposed certificate of amendment to the Charter is attached to this Proxy Statement as Appendix A.

Notwithstanding approval of this Proposal No. 1 by Company stockholders, the Board may, in its sole discretion, abandon the proposed amendment and determine prior to the effectiveness of any filing with the Secretary of State of the State of Delaware not to effect the reverse stock split, as permitted under Section 242(c) of the Delaware General Corporation Law.

Outstanding Shares

Our Charter currently authorizes us to issue a maximum of 100,000,000 shares of Common Stock, par value $0.0001 per share, and 10,000,000 shares of preferred stock. Our issued and outstanding securities as of the Record Date are [18,570,971] shares of Common Stock and 0 shares of Preferred Stock.

Purpose

The Board approved the proposal to amend the Charter to effect a reverse stock split for the following reasons:

•the Board believes effecting the Reverse Stock Split will result in an increase in the minimum bid price of our Common Stock and allow the Company to have its Common Stock remain listed on The Nasdaq Capital Market;

•the Board believes that the increase in the number of available shares of Common Stock following the Reverse Stock Split will provide the Company with the ability to support its future anticipated growth and would provide greater flexibility to consider and respond to future business opportunities and needs as they arise, including equity financings;

•the Board believes a higher stock price may help generate investor interest in the Company and help the Company attract and retain employees.

If the reverse stock split successfully increases the per share price of our Common Stock, the Board also believes this increase may increase trading volume in our Common Stock and facilitate future financings by the Company.

Nasdaq Requirements for Continued Listing

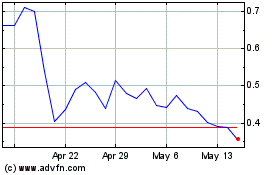

As previously disclosed in our Current Report on Form 8-K filed on June 30, 2023, the Company received a deficiency letter from the Nasdaq Stock Market (“Nasdaq”) notifying the Company that the closing bid price for the Common Stock was below the minimum $1.00 per share requirement for 30 consecutive business days for continued inclusion on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Requirement”), and the Company has been provided an initial period of 180 calendar days to regain compliance with the Bid Price Requirement. To regain compliance with the Bid Price Requirement, the closing bid price for the Common Stock must be at least $1.00 for a minimum of 10 consecutive business days.

One of the effects of the Reverse Stock Split will be to effectively increase the proportion of authorized shares that are unissued relative to those that are issued. This could result in the Company’s management being able to issue more shares without further stockholder approval. The Reverse Stock Split will not affect the number of authorized shares of Company’s capital stock that will continue to be authorized pursuant to the Charter, as amended.

The Board has considered the potential harm to us if we were not able to regain compliance with the Bid Price Requirement, which would result in our Common Stock being delisted from the Nasdaq Capital Market. If our Common Stock were delisted from the Nasdaq Capital Market, trading of our Common Stock would most likely take place on an over-the-counter market established for unlisted securities, such as the Pink Sheets or the OTC Bulletin Board. An investor would likely find it less convenient to sell, or to obtain accurate quotations in seeking to buy, our Common Stock on an over-the-counter market. As a result, many investors would likely not buy or sell our Common Stock due to difficulty in accessing over-the-counter markets, policies preventing them from trading in securities not listed on a national exchange or other reasons. In addition, as a delisted security, our Common Stock would be subject to SEC rules regarding “penny stock,” which impose additional disclosure requirements on broker-dealers. The regulations relating to penny stocks, coupled with the typically higher cost per trade to the investor of penny stocks due to factors such as broker commissions generally representing a higher percentage of the price of a penny stock than of a higher-priced stock, would further limit the ability of investors to trade in our Common Stock. For these reasons and others, delisting would likely adversely affect the liquidity, trading volume and price of our Common Stock, causing the value of an investment in us to decrease and having an adverse effect on our business, financial condition and results of operations, including our ability to attract and retain qualified employees and to raise capital.

The Board believes that a reverse stock split is a potentially effective means for the Company to maintain compliance with Nasdaq Listing Rules and to avoid, or at least mitigate, the likely adverse consequences of our Common Stock being delisted from the Nasdaq Capital Market by producing the immediate effect of increasing the bid price of our Common Stock. The Reverse Stock Split is also expected to enable the Company to support its anticipated growth, provide greater flexibility to consider and respond to future business opportunities and to recruit, retain and reward key employees.

Potential Increased Investor Interest

On July 31, 2023, our Common Stock closed at $0.52 per share. An investment in our Common Stock may not appeal to brokerage firms that are reluctant to recommend lower-priced securities to their clients. Investors may also be dissuaded from purchasing lower-priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks. Moreover, analysts at many brokerage firms do not monitor the trading activity or otherwise provide research coverage of lower-priced stocks. Also, our Board believes that most investment funds are reluctant to invest in lower-priced stocks.

There are risks associated with the Reverse Stock Split, including that the reverse stock split may not result in an increase in the per share price of our Common Stock.

The Company cannot predict whether the Reverse Stock Split will increase the market price for our Common Stock. The history of similar stock split combinations for companies in like circumstances is varied. There is no assurance that:

•the market price per share of our Common Stock after the Reverse Stock Split will rise in proportion to the reduction in the number of shares of our Common Stock outstanding before the reverse stock split

•the reverse stock split will result in a per share price that will attract brokers and investors who do not trade in lower-priced stocks

•the reverse stock split will result in a per share price that will increase the ability of the Company to attract and retain employees; or

•the market price per share will achieve the $1.00 minimum bid price requirement for a sufficient period for our Common Stock to regain compliance for continued listing on Nasdaq.

The market price of our Common Stock will also be based on the performance of the Company and other factors, some of which are unrelated to the number of shares outstanding. If the reverse stock split is effected and the market price of our Common Stock declines, the percentage decline as an absolute number and as a percentage of the overall market capitalization of the Company may be greater than would occur in the absence of a reverse stock split. Furthermore, the liquidity of our Common Stock could be adversely affected by the reduced number of shares that would be outstanding after the reverse stock split.

Principal Effects of the Reverse Stock Split

The reverse stock split will be realized simultaneously for all shares of our Common Stock and options to purchase shares of our Common Stock outstanding immediately prior to the reverse stock split effective time. The reverse stock split will affect all holders of shares of our Common Stock outstanding immediately prior to the reverse stock split effective time uniformly and each such stockholder will hold the same percentage of our Common Stock outstanding immediately following the reverse stock split as that stockholder held immediately prior to the reverse stock split, except for immaterial adjustments that may result from the treatment of fractional shares as described below. The reverse stock split will not change the par value of our Common Stock or Preferred Stock and will not reduce the number of authorized shares of our Common Stock or Preferred Stock. Our Common Stock issued pursuant to the reverse stock split will remain fully paid and non-assessable. The reverse stock split will not affect the Company’s continuing to be subject to the periodic reporting requirements of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”).

Procedure for Effecting Reverse Stock Split and Exchange of Stock Certificates

If the Company’s stockholders approve the amendment to the Charter effecting the reverse stock split, and if the Company’s Board still believes that a reverse stock split is in the best interests of the Company and its stockholders, the Company will file the certificate of amendment to the Charter with the Secretary of State of the State of Delaware following the determination by the Company’s Board of the appropriate split ratio. Beginning at the reverse stock split effective time, each stock certificate representing pre-split shares will be deemed for all corporate purposes to evidence ownership of post-split shares.

As soon as practicable after the reverse stock split effective time, stockholders will be notified that the reverse stock split has been effected. the Company expects that the Transfer Agent will act as exchange agent for purposes of implementing the exchange of stock certificates. Holders of pre-split shares will be asked to surrender to the exchange agent stock certificates representing pre-split shares in exchange for stock certificates (or book-entry positions) representing post-split shares in accordance with the procedures to be set forth in a letter of transmittal to be sent by the Company. No new certificates (or book-entry positions) will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent. Shares held in book-entry form will be automatically exchanged. Any pre-split shares submitted for transfer, whether pursuant to a sale or other disposition, or otherwise, will automatically be exchanged for post-split shares. Stockholders should not destroy any stock certificate(s) and should not submit any certificate(s) unless and until requested to do so.

Fractional Shares

No fractional shares will be issued in connection with the Reverse Stock Split. Stockholders of record who otherwise would be entitled to receive fractional shares will receive one whole share of Common Stock in lieu of such fractional share.

Potential Anti-Takeover Effect

Although the increased proportion of unissued authorized shares to issued shares could, under certain circumstances, have an anti-takeover effect, for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of the Company’s Board or contemplating a tender offer or other transaction for the combination of the Company with another company, the reverse stock split proposal is not being proposed in response to any effort of which the Company is aware to accumulate shares of our Common Stock or obtain control of the Company, nor is it part of a plan by management to recommend a series of similar amendments to the Company’s Board and stockholders. The Company’s Board does not currently contemplate recommending the adoption of any actions that could be construed to affect the ability of third parties to take over or change control of the Company.

Material U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following is a discussion of certain material U.S. federal income tax consequences of the reverse stock split that may be applicable to U.S. Holders (as defined below) of our Common Stock. This discussion does not purport to be a complete analysis of all potential tax consequences and is based upon current provisions of the Internal Revenue Code of 1986, as amended (the “Code”), existing Treasury Regulations, judicial decisions and published rulings and administrative pronouncements of the Internal Revenue Service (the “IRS”), all in effect as of the date hereof and all of which are subject to differing interpretations or change. Any such change or differing interpretation, which may be retroactive, could alter the tax consequences to holders of our Common Stock as described in this summary.

This discussion does not address all U.S. federal income tax consequences relevant to holders of our Common Stock. In addition, it does not address consequences relevant to holders of our Common Stock that are subject to particular U.S. or non-U.S. tax rules, including, without limitation, to holders of our Common Stock that are:

•persons who do not hold our Common Stock as a “capital asset” within the meaning of Section 1221 of the Code

•brokers, dealers or traders in securities

•banks, insurance companies, or other financial institutions

•real estate investment trusts or regulated investment companies

•tax-exempt entities, organizations or arrangements

•governments or any agencies, instrumentalities or controlled entities thereof

•treated as partnerships, S corporations, grantor trusts, disregarded entities or other pass-through entities or arrangements (or investors or holders of beneficial interests therein)

•liable for the alternative minimum tax under the Code

•persons who hold their shares as part of a hedge, straddle, wash sale, synthetic security, conversion transaction or other integrated transaction

•persons that have a functional currency other than the U.S. dollar

•persons who hold shares of our Common Stock that may constitute “qualified small business stock” under Section 1202 of the Code or “Section 1244 stock” for purposes of Section 1244 of the Code

•persons who acquired their shares of Common Stock in a transaction subject to the gain rollover provisions of Section 1045 of the Code

•persons subject to special tax accounting rules as a result of any item of gross income being taken into account in an “applicable financial statement” (as defined in the Code)

•persons deemed to sell our Common Stock under the constructive sale provisions of the Code

•persons who hold our Common Stock in a tax-deferred account (such as an individual retirement account or a plan qualifying under Section 401(k) of the Code)

•persons who acquired their shares of our Common Stock pursuant to the exercise of options or otherwise as compensation or through a retirement plan or through the exercise of a warrant or conversion rights under convertible instruments; and

•United States expatriates or former citizens or long-term residents of the United States.

Holders of our Common Stock subject to particular U.S. or non-U.S. tax rules, including those listed above, are urged to consult their own tax advisors regarding the consequences to them of the reverse stock split.

If an entity or arrangement that is treated as a partnership for U.S. federal income tax purposes holds our Common Stock, the U.S. federal income tax treatment of a partner or owner of the entity or arrangement will generally depend upon the status of the partner or owner, the activities of the entity or arrangement and certain determinations made at the partner or owner level.

The following discussion does not address the tax consequences of the reverse stock split under state, local and non-U.S. tax laws, nor does it address the application of any tax treaty. Furthermore, the following discussion does not address any tax consequences of transactions effectuated before, after or at the same time as the reverse stock split, whether or not they are in connection with the reverse stock split.

STOCKHOLDERS SHOULD CONSULT THEIR TAX ADVISORS WITH RESPECT TO THE TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT BASED ON THEIR PARTICULAR SITUATIONS, INCLUDING UNDER THE U.S. FEDERAL ESTATE OR GIFT TAX LAWS, UNDER THE LAWS OF ANY STATE, LOCAL OR NON-U.S. TAXING JURISDICTION, AND UNDER ANY APPLICABLE INCOME TAX TREATY.

This discussion applies only to holders of our Common Stock that are U.S. Holders. For purposes of this discussion, a “U.S. Holder” is a beneficial owner of our Common Stock that, for U.S. federal income tax purposes, is or is treated as:

•an individual who is a citizen or resident of the United States

•a corporation or any other entity treated as a corporation created or organized in or under the laws of the United States, any state thereof, or the District of Columbia

•an estate, the income of which is subject to U.S. federal income tax regardless of its source; or

•a trust if either (i) a court within the United States is able to exercise primary supervision over the administration of such trust, and one or more United States persons (within the meaning of Section 7701(a)(30) of the Code) is authorized or has the authority to control all substantial decisions of such trust, or (ii) the trust has a valid election in effect under applicable Treasury Regulations to be treated as a United States person for U.S. federal income tax purposes.

Tax Consequences to the Company

We believe that the Reverse Stock Split will constitute a “recapitalization” under Section 368(a)(1)(E) of the Code. Assuming the Reverse Stock Split qualifies as a recapitalization under Section 368(a)(1)(E), we should not recognize taxable income, gain or loss in connection with the Reverse Stock Split.

Tax Consequences to U.S. Holders

Provided the Reverse Stock Split qualifies as a recapitalization within the meaning of Section 368(a)(1)(E) of the Code for U.S. federal income tax purposes, a U.S. Holder generally should not recognize gain or loss in connection with the Reverse Stock Split for U.S. federal income tax purposes, except with respect to any additional fractions of a share of our common stock received as a result of the rounding up of any fractional shares that would otherwise be issued, as discussed below. Subject to the following discussion regarding a U.S. Holder’s receipt of a whole share of our common stock in lieu of a fractional share, a U.S. Holder’s aggregate tax basis in the shares of our common stock received pursuant to the Reverse Stock Split should equal the aggregate tax basis of the shares of our common stock surrendered, and such U.S. Holder’s holding period in the shares of our common stock received pursuant to the Reverse Stock Split should include the holding period in the shares of our common stock surrendered. U.S. Treasury Regulations provide detailed rules for allocating the tax basis and holding period of shares of common stock surrendered in a recapitalization to shares received in the recapitalization. U.S. Holders of shares of our common stock acquired on different dates and at different prices should consult their own tax advisors regarding the allocation of the tax basis and holding period of such shares.

No fractional shares of our common stock will be issued as a result of the Reverse Stock Split. Instead, if the Reverse Stock Split would result in a U.S. Holder receiving fractional shares, the number of shares to be issued to such U.S. Holder will be rounded up to the nearest whole share. The U.S. federal income tax consequences of the receipt of such additional fraction of a share of common stock are not clear. A U.S. Holder who receives one whole share of common stock in lieu of a fractional share may recognize income or gain in an amount not to exceed the excess of the fair market value of such share over the fair market value of the fractional share to which such U.S. Holder was otherwise entitled. The Company is not making any representation as to whether the receipt of one whole share in lieu of a fractional share will result in income or gain to any stockholder, and stockholders are urged to consult their own tax advisors as to the possible tax consequences of receiving a whole share in lieu of a fractional share in connection with the Reverse Stock Split.

The U.S. federal income tax discussion set forth above does not discuss all aspects of U.S. federal income taxation that may be relevant to a particular stockholder in light of such stockholder’s circumstances and income tax situation. Accordingly, we urge you to consult with your own tax advisor with respect to all of the potential U.S. federal, state, local and foreign tax consequences to you of the Reverse Stock Split.

Interests of the Board

No member of the Board has a substantial interest, directly or indirectly, in the matters set forth in the Reverse Stock Split Proposal, except to the extent of each member’s ownership of shares of our Common Stock or options or warrants to purchase shares of our Common Stock. The Reverse Stock Split would result in an increase in the number of available shares of Common Stock, some of which could be used as compensation for non-employee directors or executive directors in connection with equity compensation plans. All such plans have been approved (or will be approved) by the stockholders of the Company at general meetings.

Required Vote of Stockholders

This proposal requires that the number of votes cast in favor exceeds the number of votes cast against approval of this proposal. Abstentions are not considered votes cast and will therefore have no effect on this proposal. Under applicable Nasdaq listing rules, brokers are not permitted to vote shares held for a customer on “non-routine” matters (such as this proposal) without specific instructions from the customer. Therefore, broker non-votes are not considered votes cast and will also have no effect on the outcome of this proposal.

Recommendation of the Board of Directors

The Board of Directors unanimously recommends that stockholders vote FOR the approval of an amendment to the Charter to effect the Reverse Stock Split.

Proposal 2: Approval of an Amendment to our Charter to Increase the Number of Shares of Common Stock Authorized for Issuance from 100,000,000 Shares to 500,000,000 Shares

General

Our Board has determined that it is advisable to increase our authorized Common Stock from 100,000,000 shares to 500,000,000 shares and has voted to recommend that our stockholders adopt an amendment to our Charter effecting the proposed increase. The full text of the proposed amendment to the Charter is attached to this proxy statement as Appendix B. If approved by our stockholders, we intend to file the amendment with the Secretary of State of Delaware as soon as practicable following the Special Meeting, and the amendment will be effective upon filing. If the proposal is not approved by our stockholders, our Charter will continue as currently in effect.

Current Capital Structure

As of August 2, 2023, we had 110,000,000 authorized shares, with 100,000,000 shares designated as Common Stock, $0.0001 par value per share, of which [18,570,971] shares were issued and outstanding, and 10,000,000 shares of undesignated preferred stock, $0.0001 par value per share, of which no shares were issued and outstanding. Of the remaining 81,429,029 authorized shares of Common Stock, 10,593,147 shares are reserved for issuance upon the conversion of certain convertible notes, 5,860,422 shares are reserved for future issuance pursuant to an equity line of credit, 17,393,195 shares are reserved for issuance upon the exercise of outstanding warrants, 1,762,273 shares are reserved for issuance upon the exercise of issued and outstanding equity awards and 590,698 shares are reserved for future issuance under our equity incentive plans. This leaves 45,229,294 shares of our authorized common stock unreserved and available for future issuance.

The proposed amendment would not increase or otherwise affect our authorized preferred stock, nor would it have any effect on par value. Our Common Stock is all of a single class, with equal voting, distribution, liquidation and other rights. The additional Common Stock to be authorized by adoption of the amendment would have rights identical to our currently outstanding Common Stock. Should our Board issue additional shares of Common Stock, existing stockholders would not have any preferential rights to purchase any newly authorized shares of Common Stock solely by virtue of their ownership of shares of our Common Stock, and their percentage ownership of our then outstanding Common Stock could be reduced. The issuance of additional shares of Common Stock could have the effect of diluting existing stockholder earnings per share, book value per share and voting power.

Background and Purpose of the Amendment

The limited number of unreserved shares of Common Stock available for future issuance will likely adversely affect our ability to raise the capital needed to continue our planned operations. We will need additional funding to continue our operations and carry out our development plan. While it is possible that we may be able to pursue and complete capital raising transactions that do not require the issuance of additional shares of our Common Stock, we may find it more difficult to obtain financing to fund our ongoing operations, and any financing we are able to obtain may not be on as favorable terms to us as would a financing with the use of our Common Stock. An increase in the number of authorized shares of our Common Stock will also allow us the flexibility to issue shares of Common Stock for other corporate purposes, such as potential strategic partnerships, acq 17uisitions or other strategic transactions though we currently have no commitments to do so. If we are unable to raise capital when and as needed to fund our planned operations, we may be required to curtail or cease our operations entirely and to proceed with a liquidation of the Company.

As a result, the Board believes it is vital to our best interests to have sufficient additional authorized but unissued shares of Common Stock available to provide flexibility for corporate action in the future. The Board believes that the availability of additional authorized shares of Common Stock for issuance from time to time in the Board’s discretion in connection with expected future financings or for other corporate purposes is critical both to our ability to continue our operations in the near-term as well as to our long-term success and, therefore, is in the best interests of the Company and our stockholders.

We are requesting stockholder approval of an amendment to our Third Amended and Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock from 100,000,000 authorized shares to 500,000,000 authorized shares.

Effects of the Amendment

If the proposed amendment of our Third Amended and Restated Certificate of Incorporation is approved, the number of authorized shares of Common Stock of our Company will be increased from 100,000,000 to 500,000,000. Should we need additional authorized shares of capital stock in the future, we would need to seek stockholder approval for such an increase.

Potential Anti-takeover Effects

Since this amendment will provide that the number of authorized shares of Common Stock will be 500,000,000, the amendment, if effected, will result in an increase in the number of authorized but unissued shares of our Common Stock and could, under certain circumstances, have an anti-takeover effect, although this is not the purpose or intent of our Board. An increase in our authorized shares could potentially deter takeovers, including takeovers that our Board has determined are not in the best interest of our stockholders, in that additional shares could be issued (within the limits imposed by applicable law and Nasdaq) in one or more transactions that could make a change in control or takeover more difficult. The amendment could make the accomplishment of a given transaction more difficult even if it is favorable to the interests of stockholders. For example, we could issue additional shares of Common Stock without further stockholder approval so as to dilute the stock ownership or voting rights of persons seeking to obtain control without our agreement. Similarly, the issuance of additional shares to certain persons allied with our management could have the effect of making it more difficult to remove our current management by diluting the stock ownership or voting rights of persons seeking to cause such removal. The amendment therefore may have the effect of discouraging unsolicited takeover attempts. By potentially discouraging initiation of any such unsolicited takeover attempts, the amendment may limit the opportunity for our stockholders to dispose of their shares at the higher price generally available in takeover attempts or that may be available under a merger proposal.

We have not proposed the increase in the number of authorized shares of Common Stock with the intention of using the additional authorized shares for anti-takeover purposes, but we would be able to use the additional shares to oppose a hostile takeover attempt or delay or prevent changes in our control or our management. Although the amendment has been prompted by business and financial considerations and not by the threat of any known or threatened hostile takeover attempt, stockholders should be aware that the effect of the amendment could facilitate future attempts by us to oppose changes in our control and perpetuate our management, including transactions in which the stockholders might otherwise receive a premium for their shares over then current market prices. We cannot provide assurances that any such transactions will be consummated on favorable terms or at all, that they will enhance stockholder value, or that they will not adversely affect our business or the trading price of our Common Stock.

Required Vote of Stockholders

This proposal requires that the number of votes cast in favor exceeds the number of votes cast against approval of this proposal. Abstentions are not considered votes cast and will therefore have no effect on this proposal. Under applicable Nasdaq listing rules, brokers are not permitted to vote shares held for a customer on “non-routine” matters (such as this proposal) without specific instructions from the customer. Therefore, broker non-votes are not considered votes cast and will also have no effect on the outcome of this proposal.

Recommendation of the Board of Directors

The Board of Directors unanimously recommends that stockholders vote FOR the approval of an amendment to the Charter to increase the number of shares of Common Stock authorized for issuance from 100,000,000 shares to 500,000,000 shares.

Proposal 3: Approval of the Potential Issuance of Shares of Common Stock Pursuant to the Notes

Background and Overview

The company currently has an aggregate of $6,000,000 outstanding in principal and accrued interest under certain promissory notes (the “Notes”) with LM Funding America, Inc. (“LMFA”), LMFAO Sponsor, LLC (“Sponsor”) and Maxim Group, LLC (“Maxim”) as lenders (collectively, the “Lenders”). In order to enable the Company to maintain a strong balance sheet and reduce the amount of its debt, the Company intends to restructure such debts with Lenders by converting the Notes into shares of Common Stock of the Company. The following describes in more detail the terms of these Notes.

Credit Agreement with LMFA and Amended Promissory Note

On October 28, 2022, SeaStar Medical, Inc. (“SeaStar Medical”) and LMFA entered into the First Amendment to Credit Agreement dated September 9, 2022 between LMFA and SeaStar Medical (the “First Amendment to Credit Agreement”), pursuant to which the parties amended the Credit Agreement and entered into an Amended and Restated Promissory Note (the “First LMFA Note”) to (i) extend the maturity date of the loan under the Credit Agreement to October 30, 2023; (ii) permit the First LMFA Note be prepaid without premium or penalty; (iii) require the Company to use 5.0% of the gross cash proceeds received from any future debt and equity financing to pay outstanding balance of First LMFA Note, provided that such repayment is not required for the first $500,000 of cash proceeds; (iv) reduce the interest rate of the First LMFA Note from 15% to 7% per annum; and (iv) reduce the default interest rate from 18% to 15% . The First LMFA Note contains customary representations and warranties, affirmative and negative covenants and events of default. In addition, on October 28, 2022, the parties entered into a Security Agreement (the “LMFA Security Agreement”), pursuant to which the Company and SeaStar Medical granted LMFA a security interest in substantially all of the assets and property of the Company and SeaStar Medical, subject to certain exceptions, as collateral to secure the Company’s obligations under the amended Credit Agreement. In addition, SeaStar Medical entered into a Guaranty, dated October 28, 2022 (the “LMFA Guaranty”), pursuant to which SeaStar Medical unconditionally guarantees and promises to pay to Sponsor the outstanding principal amount under the First LMFA Note.

On November 2, 2022, the Company entered into an additional promissory note in the amount of $0.3 million with LMFA pursuant to the Credit Agreement. The promissory note is noninterest bearing and is due on demand at any time on or after March 31, 2023. The note was paid in full in January 2023.

On July 13, 2023, the Company entered into an additional promissory note in the amount of $100,000 with LMFA pursuant to the Credit Agreement (the “Second LMFA Note” and, together with the First LMFA Note, the “LMFA Notes”). The maturity date of the Second LMFA Note is August 11, 2023. Other terms of the Second LMFA Note is substantially the same as the First LMFA Note.

Sponsor Promissory Note

On October 28, 2022, the Company entered into a Consolidated Amended and Restated Promissory Note with Sponsor as the lender, for an aggregate principal amount of $2,785,000 (the “Sponsor Note”) to amend and restate in its entirety (i) the Promissory Note, dated July 29, 2022, for $1,035,000 in aggregate principal amount issued by LMF Acquisition Opportunities, Inc. (“LMAO”) to the Sponsor and (ii) the Amended and Restated Promissory Note, dated July 28, 2022, for $1,750,000 in aggregate principal amount, issued by LMAO to the Sponsor (collectively, the “Original Notes”). The Sponsor Note amended and consolidated the Original Notes to: (i) extend maturity dates of the Original Notes to October 30, 2023; (ii) permit outstanding amounts due under the Sponsor Note to be prepaid without premium or penalty; and (iii) require the Company to use 5.0% of the gross cash proceeds received from any future debt and equity financing to pay outstanding balance of Sponsor Note, provided that such repayment is not required for the first $500,000 of cash proceeds. The Sponsor Note carries an interest rate of 7% per annum and contains customary representations and warranties and affirmative and negative covenants. The Sponsor Note is also subject to customary events of default, the occurrence of which may result in the Sponsor Promissory Note then outstanding becoming immediately due and payable, with interest being increased to 15.0% per annum. In addition,

on October 28, 2022, the parties entered into a Security Agreement (the “Sponsor Security Agreement”), pursuant to which the Company and SeaStar Medical granted Sponsor a security interest in substantially all of the assets and property of the Company and SeaStar Medical, subject to certain exceptions, as collateral to secure the Company’s obligations under the Sponsor Note. In addition, SeaStar Medical entered into a Guaranty, dated October 28, 2022 (the “Sponsor Guaranty”), pursuant to which SeaStar Medical unconditionally guarantees and promises to pay to Sponsor the outstanding principal amount under the Sponsor Note.

Maxim Promissory Note

Pursuant to an engagement letter between SeaStar Medical and Maxim dated October 28, 2022, SeaStar Medical, or the Company following the consummation of the Business Combination, was required to pay Maxim, as its financial advisor and/or placement agent, certain professional fees. Upon the closing of the Business Combination, the parties agreed that $4,182,353 of such amount would be paid in the form of a promissory note. Accordingly, on October 28, 2022, the Company entered into a promissory note with Maxim as the lender, for an aggregate principal amount of $4,182,353 (the “Maxim Note”). The Maxim Note has a maturity date of October 30, 2023 and outstanding amount may be prepaid without premium or penalty. If the Company receives any cash proceeds from a debt or equity financing transaction prior to the maturity date, then the Company is required to prepay the indebtedness equal to 25.0% of the gross amount of the cash proceeds, provided that such repayment obligation shall not apply to the first $500,000 of the cash proceeds received by the Company. Interest on the Maxim Note is due at 7.0% per annum. The Maxim Note contains customary representations and warranties, and affirmative and negative covenants. The Maxim Note is also subject to customary events of default, the occurrence of which may result in the Maxim Note then outstanding becoming immediately due and payable, with interest being increased to 15.0% per annum.

Amendments to the Notes

On March 15, 2023, in connection with the first closing pursuant to a convertible note financing of the Company (the “3i Financing”), the Company and the Lenders amended the First LMFA Note, the Sponsor Note, and the Maxim Note, extending their maturity dates to June 15, 2024. In consideration for such extension, the Company agreed to pay the Lenders an aggregate amount of $0.1 million in cash upon receipt of proceeds from the issuance of the notes at the second closing under the securities purchase agreement. The mandatory repayment provisions of the notes were waived for the first senior unsecured convertible note drawn on March 15, 2023, but are not waived for subsequent draws.

On May 12, 2023, in connection with the second closing pursuant to the 3i Financing, the Company and the Lenders further amended the First LMFA Note, the Sponsor Note, and the Maxim Note. The mandatory repayment provisions for the second senior unsecured convertible note drawn on May 12, 2023, but not for subsequent draws, were (i) waived with respect to the First LMFA Note and the Sponsor Note, and (ii) modified to reduce the prepayment amount with respect to the Maxim Note.

While the Notes do not provide for the conversion of outstanding principal amounts and accrued interest thereunder into the Company’s capital stock, the Company is contemplating amending the Notes to provide for such conversion into, or an exchange pursuant to the Section 3(a)(9) of the Securities Act of 1933, as amended (the “Securities Act”), for, the Company’s Common Stock in satisfaction of the Company’s repayment obligations thereunder.

Why We are Seeking Stockholder Approval of the Nasdaq Proposal

As discussed above, it is important for the Company to reduce its debt and maintain a strong balance sheet as a part of sound financial planning. Accordingly, the Company intends to negotiate with the Lenders to permit the Company to convert all or part of the outstanding principal amount and accrued interest into shares of common stock of the Company. However, pursuant to Nasdaq Rule 5635(d), stockholder approval is required prior to the issuance of securities in a transaction, other than a public offering, involving the sale, issuance or potential issuance by the Company of common stock (or securities convertible into or exercisable for common stock), which equals 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance, at a price less than the lower of: (i) the closing price immediately preceding the signing of the binding agreement, or (ii) the average closing price of the common stock for the five trading days immediately preceding the signing of the binding

agreement for the transaction. In light of this rule, we are seeking stockholder approval of the potential issuance of shares of Common Stock upon the potential conversion or exchange of the Notes held by the Lenders.

Effect on Current Stockholders if the Proposal is Approved

Each additional share of Common Stock that would be issuable to the Lenders would have the same rights and privileges as each share of our currently outstanding Common Stock. The issuance of shares of Common Stock to the Lenders will not affect the rights of the holders of our outstanding Common Stock, but such issuances will have a dilutive effect on the existing stockholders, including the voting power and economic rights of the existing stockholders, and may result in a decline in our stock price or greater price volatility. Further, any sales in the public market of our shares of Common Stock issuable to the Lenders could adversely affect prevailing market prices of our shares of Common Stock.

Assuming all repayments on the outstanding principal of Notes are satisfied in shares of Common Stock with a conversion or exchange price of $0.525, the closing price of our Common Stock on August 3, 2023, we estimate that we would issue approximately 12,000,000 shares of our Common Stock to the Lenders in satisfaction of such repayments.

Effect on Current Stockholders if the Proposal is Not Approved

The Company is not seeking the approval of its stockholders to authorize its entry into the Credit Agreement, the Notes, and any related documents, as the Company has already done so and such documents already are binding obligations of the Company. The failure of the Company’s stockholders to approve the Nasdaq Proposal will not negate the existing terms of the documents, which will remain binding obligations of the Company.

If the stockholders do not approve this proposal, the Company will be unable to issue 20.0% or more of the Company’s outstanding shares of Common Stock as potential satisfaction of the Company’s repayment obligations under the Notes. As a result, the Company may be obligated to satisfy our obligations under the Notes, including, but not limited to, repayments, in cash. If all repayments on the outstanding Notes are satisfied in cash, we estimate that we would pay approximately $6.4 million in satisfaction of such repayments.