0001819113FALSE12-3100018191132023-12-052023-12-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 5, 2023

SCIENCE 37 HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39727 | | 84-4278203 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

800 Park Offices Drive, Suite 3606 Research Triangle Park, NC | | 27709 |

| (Address of principal executive offices) | | (Zip Code) |

(984) 377-3737

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Shares of Common stock, par value $0.0001 per share | | SNCE | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modification to Rights of Security Holders.

The information set forth in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On December 4, 2023, Science 37 Holdings, Inc. (the “Company”) filed a Certificate of Amendment (the “Amendment”) to its Second Amended and Restated Certificate of Incorporation (as amended to date, the “Certificate of Incorporation”) with the Secretary of State of the State of Delaware to effect a one-for-twenty (1-for-20) reverse stock split (the “Reverse Stock Split”) of its outstanding common stock, par value $0.0001 per share (the “Common Stock”). The Reverse Stock Split will become effective on December 8, 2023 at 12:01 a.m. Eastern Time (the “Effective Time”).

At the Company’s Special Meeting of Stockholders held on November 29, 2023, the stockholders approved a proposal to authorize a reverse stock split of the Company’s Common Stock, at a ratio within the range of 1-for-5 to 1-for-30, with such ratio to be determined in the discretion of the Company’s Board of Directors (the “Board”) . The

Board approved the Reverse Stock Split ratio on November 29, 2023.

As a result of the Reverse Stock Split, at the Effective Time, every twenty (20) shares of the Company’s outstanding pre-Reverse Stock Split Common Stock will automatically be combined into one (1) share of outstanding Common Stock. The Company’s post-Reverse Stock Split Common Stock will begin trading on The Nasdaq Stock Market LLC when the market opens on December 8, 2023 under the existing ticker symbol “SNCE” and a new CUSIP number of 808644207. The Reverse Stock Split will not change the authorized number of shares or the par value of the Common Stock or preferred stock, nor any voting rights of the Common Stock. The Reverse Stock Split will reduce the number of shares of Common Stock outstanding from approximately 119 million to approximately 6 million. Proportionate adjustments will also be made to all outstanding securities entitling their holders to purchase shares of Common Stock or acquire shares of Common Stock, including stock options, restricted stock units, and rights under the 2021 Employee Stock Purchase Plan.

No fractional shares will be issued in connection with the Reverse Stock Split. Stockholders who would otherwise be entitled to receive a fractional share will be entitled to receive one full share of post-Reverse Stock Split Common Stock, in lieu of receiving such fractional shares.

The Company's transfer agent, Continental Stock Transfer & Trust Company, is acting as the exchange agent for the Reverse Stock Split. Registered stockholders holding pre-split shares of the Company’s Common Stock electronically in book-entry form are not required to take any action to receive post-split shares. Stockholders owning shares via a broker, bank, trust or other nominee will have their positions automatically adjusted to reflect the Reverse Stock Split, subject to such broker’s particular processes, and will not be required to take any action in connection with the Reverse Stock Split.

The foregoing description is qualified in its entirety by the full text of the Certificate of Amendment, a copy of which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On December 5, 2023, the Company issued a press release announcing that it had filed the Certificate of Amendment with the Secretary of State of the State of Delaware and other matters related to the Reverse Stock Split. The press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 7.01 and the press release attached to this Current Report on Form 8-K as Exhibit

99.1 shall be deemed to be “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or

the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

The information set forth in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

The Company has registration statements on Form S-3 (File Nos. 333-260828 and 333-270285) and registration statements on Form S-8 (File Nos. 333-262610, 333-266801, 333-268303 and 333-275359) on file with the Securities and Exchange Commission (the “Commission”). Commission regulations permit the Company to incorporate by reference future filings made with the Commission pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the termination of the offerings covered by registration statements filed on Form S-3 or Form S-8, as applicable. The information incorporated by reference is considered to be part of the prospectus included within each of those registration statements. Information in this Item 8.01 of this Current Report on Form 8-K is therefore intended to be automatically incorporated by reference into each of the active registration statements listed above, thereby amending them. Pursuant to Rule 416(b) under the Securities Act, the amount of undistributed shares of Common Stock deemed to be covered by the effective registration statements of the Company described above are proportionately reduced as of the Effective Time to give effect to the Reverse Stock Split.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | | |

| 3.1 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | Science 37 Holdings, Inc. |

| | | |

| Date: | December 5, 2023 | By: | /s/ Christine Pellizzari |

| | | Name: | Christine Pellizzari |

| | | Title: | Chief Legal and Human Resources Officer |

CERTIFICATE OF AMENDMENT

TO THE

SECOND AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

SCIENCE 37 HOLDINGS, INC.

Science 37 Holdings, Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”), hereby certifies as follows:

| | | | | |

| 1. | The name of the Corporation is Science 37 Holdings, Inc. The Corporation was incorporated under the name LifeSci Acquisition II Corp. by the filing of its original Certificate of Incorporation with the Secretary of State of the State of Delaware on December 18, 2019 (the “Original Certificate”). |

| | | | | |

| 2. | An Amended and Restated Certificate of Incorporation, which amended and restated the Original Certificate in its entirety, was filed with the Secretary of State of the State of Delaware on November 20, 2020 (the “Amended Certificate”). |

| | | | | |

| 3. | A Second Amended and Restated Certificate of Incorporation, which amended and restated the Amended Certificate in its entirety, was filed with the Secretary of State of the State of Delaware on October 6, 2021 (as amended from time to time, the “Existing Certificate”). |

| | | | | |

| 4. | ARTICLE IV of the Existing Certificate of the Corporation is hereby amended to add the following paragraph at the end of Article IV as a new Section C: |

Upon the effectiveness of the Certificate of Amendment of the Certificate of Incorporation adding this Section C (the “Effective Time”), each twenty (20) shares of the Corporation’s Common Stock, par value $0.0001 per share, issued and outstanding immediately prior to the Effective Time shall automatically be combined into one (1) validly issued, fully paid and non-assessable share of Common Stock, par value $0.0001 per share, without any further action by the Corporation or the respective holders thereof (such combination, the “Reverse Stock Split”). No fractional shares will be issued in connection with the Reverse Stock Split. Any fractional shares that would otherwise be issuable as a result of the Reverse Stock Split will be rounded up to the nearest whole share. The number of authorized shares of Common Stock of the Corporation and the par value of the Common Stock shall remain as set forth in the Second Amended and Restated Certificate of Incorporation.

| | | | | |

| 5. | The foregoing amendment has been duly approved by the Board of Directors of the Corporation in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware. |

| | | | | |

| 6. | The foregoing amendment has been duly approved by the stockholders of the Corporation in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware. |

| | | | | |

| 7. | This Certificate of Amendment shall become effective at 12:01 a.m. Eastern time on December 8, 2023. |

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be executed by a duly authorized officer of the Corporation as of December 4, 2023.

| | | | | | | | | | | | | | | | | | | | |

| SCIENCE 37 HOLDINGS, INC. |

| | | | | | | |

| | | | | | | |

| By: | | | /s/ David Coman | | | |

| | | | David Coman | | | |

| | | | Chief Executive Officer | | | |

Science 37 Holdings, Inc. Announces 1-for-20 Reverse Stock Split effective December 8, 2023

RESEARCH TRIANGLE PARK, N.C., December 5, 2023—Science 37 Holdings, Inc. (Nasdaq: SNCE) (“Science 37” or the “Company”), the clinical research industry-leading Metasite™, announced today that it will effect a 1-for-20 reverse stock split (“Reverse Stock Split”) of its outstanding common stock, par value $0.0001 per share (“Common Stock”), that will become effective on December 8, 2023, at 12:01 a.m., Eastern Time. Science 37’s Common Stock will continue to trade on The Nasdaq Capital Market (“Nasdaq”) under the existing symbol “SNCE” and will begin trading on a split-adjusted basis when the market opens on December 8, 2023. The new CUSIP number for the Common Stock following the Reverse Stock Split will be 808644207.

The Reverse Stock Split is part of the Company’s plan to regain compliance with the $1.00 minimum bid price requirement for maintaining its listing on Nasdaq. There is no guarantee the Company will meet the minimum bid price requirement.

At the Company’s Special Meeting of Stockholders held on November 29, 2023, the Company’s stockholders approved a proposal to authorize a reverse stock split of the Company’s Common Stock, at a ratio within the range of 1-for-5 to 1-for-30. The Company’s board of directors approved a 1-for-20 reverse split ratio, and on December 4, 2023, the Company filed a Certificate of Amendment to its Second Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split effective December 8, 2023.

As a result of the Reverse Stock Split, every 20 pre-split shares of Common Stock outstanding will become one share of common stock. The Reverse Stock Split will reduce the number of shares of Common Stock outstanding from approximately 119 million to approximately 6 million. Proportional adjustments also will be made to outstanding equity awards, and to the number of shares issued and issuable under the Company's stock incentive plans and certain existing agreements. The Reverse Stock Split will not change the par value of the Common Stock nor the authorized number of shares of Common Stock or preferred stock.

No fractional shares will be issued in connection with the Reverse Stock Split. All fractional shares will be rounded up to the nearest whole share. The Reverse Stock Split will affect all stockholders uniformly and will not alter any stockholder’s percentage interest in the Company’s equity (other than as a result of the rounding of shares to the nearest whole share in lieu of issuing fractional shares).

The Company’s transfer agent, Continental Stock Transfer & Trust Company, will serve as exchange agent for the Reverse Stock Split. Registered stockholders holding pre-split shares of the Company’s Common Stock electronically in book-entry form are not required to take any action to receive post-split shares. Stockholders owning shares via a broker, bank, trust or other nominee will have their positions automatically adjusted to reflect the Reverse Stock Split, subject to such broker’s particular processes, and will not be required to take any action in connection with the Reverse Stock Split.

Additional information about the Reverse Stock Split can be found in the Company’s definitive proxy statement filed with the U.S. Securities and Exchange Commission (the “SEC”) on October 27, 2023, which is available on the SEC’s website at www.sec.gov.

About Science 37

Science 37 Holdings, Inc.’s (Nasdaq: SNCE) mission is to accelerate clinical research by enabling universal trial access for patients. Through our Metasite™ we reach an expanded population beyond the traditional site, delivering on our goal of clinical research that works for everyone—with greater patient diversity. Patients gain the flexibility to participate from the comfort of their own homes, at their local community provider, or at a traditional site when needed. Our Metasite is powered by a proprietary technology platform with in-house medical and operational experts that drive uniform study orchestration, enabling greater compliance and high-quality data. To learn more, visit www.science37.com, or email science37@science37.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws, including statements regarding the products offered by Science 37 and the markets in which it operates, and Science 37’s anticipated growth and profitability. These forward-looking statements generally are identified by the words “believe,” “can,” “could”, “seek”, “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “might”, “should,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions. Forward-looking statements are predictions,

projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) the ability to maintain the listing of Science 37’s securities on The Nasdaq Stock Market LLC, (ii) volatility in the price of Science 37’s securities due to a variety of factors, including changes in the competitive and highly regulated industries in which Science 37 operates, variations in performance across competitors, changes in laws and regulations affecting Science 37’s business, changes in its capital structure, and general economic and financial market conditions, including fluctuations in currency exchange rates, economic instability, and inflationary conditions, (iii) the ability to implement business plans, forecasts, and other expectations, and to identify and realize additional opportunities, (iv) the risk that Science 37 may never achieve or sustain profitability, (v) the risk that Science 37 will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all, (vi) failure to realize anticipated cost savings, and (vii) risks related to general economic and financial market conditions. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Science 37’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 6, 2023 and in the other documents filed by Science 37 from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Science 37 assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Science 37 does not give any assurance that Science 37 will achieve its expectations.

MEDIA INQUIRIES:

Grazia Mohren

Science 37

PR@science37.com

INVESTOR RELATIONS:

Steve Halper

LifeSci Advisors

Investors@science37.com

# #

v3.23.3

Cover

|

Dec. 05, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 05, 2023

|

| Entity Registrant Name |

SCIENCE 37 HOLDINGS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39727

|

| Entity Tax Identification Number |

84-4278203

|

| Entity Address, Address Line One |

800 Park Offices Drive

|

| Entity Address, Address Line Two |

Suite 3606

|

| Entity Address, City or Town |

Research Triangle Park

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

27709

|

| City Area Code |

984

|

| Local Phone Number |

377-3737

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Shares of Common stock, par value $0.0001 per share

|

| Trading Symbol |

SNCE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001819113

|

| Amendment Flag |

false

|

| Current Fiscal Year End Date |

--12-31

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

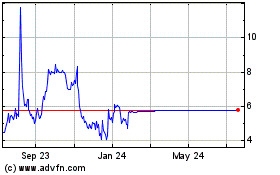

Science 37 (NASDAQ:SNCE)

Historical Stock Chart

From Apr 2024 to May 2024

Science 37 (NASDAQ:SNCE)

Historical Stock Chart

From May 2023 to May 2024