Driven by 5% Net Sales Growth and 6% Gross

Profit Growth

ScanSource, Inc. (NASDAQ: SCSC), a leading global provider of

technology products and solutions, today announced financial

results for the first quarter ended September 30, 2018.

Quarter ended September 30, 2018

2017 Change (in millions,

except per share data) Net sales $ 972.9

$ 924.6 5 %

Operating income

21.4 7.6 182 %

Non-GAAP operating income(1)

32.7 30.6 7 %

GAAP net income 14.3 4.1 245 %

Non-GAAP net income(1)

22.9 19.4 18 %

GAAP diluted

EPS $ 0.56 $ 0.16 250 %

Non-GAAP diluted

EPS(1)

$ 0.89 $ 0.76 17 % (1) Non-GAAP

results exclude amortization of intangible assets related to

acquisitions, change in fair value of contingent consideration and

other non-GAAP items. A reconciliation of non-GAAP financial

information to GAAP financial information is presented in the

Supplementary Information (Unaudited) below.

“We had a strong start to our fiscal year with excellent results

across the board,” said Mike Baur, CEO, ScanSource, Inc. “Both

Worldwide segments contributed to our organic sales growth of 6.5%,

as we kept our strategic focus on putting our customers first and

helping them grow their businesses.”

Quarterly Results

For the first quarter of fiscal year 2019, net sales increased

5% to $972.9 million, reflecting sales growth in both Worldwide

segments. Organic sales, which exclude the impact from foreign

currency translation and recent acquisitions, grew 6.5%

year-over-year. Operating income increased to $21.4 million, as the

expense for the change in contingent consideration related to

Network1 decreased. Non-GAAP operating income increased 7% to $32.7

million, driven by higher sales volumes and higher gross

margins.

On a GAAP basis, net income for the first quarter of fiscal year

2019 totaled $14.3 million, or $0.56 per diluted share, compared

with net income of $4.1 million, or $0.16 per diluted share, for

the prior-year quarter. Non-GAAP net income for the first quarter

of fiscal year 2019 increased 18% to $22.9 million, or $0.89 per

diluted share, compared to $19.4 million, or $0.76 per diluted

share, for the prior-year quarter.

Forecast for Next Quarter

For the second quarter of fiscal year 2019, ScanSource expects

net sales to range from $1.01 billion to $1.07 billion, diluted

earnings per share to range from $0.70 to $0.76 per share and

non-GAAP diluted earnings per share to range from $0.92 to $0.98

per share. Non-GAAP diluted earnings per share exclude amortization

of intangible assets related to acquisitions and change in fair

value of contingent consideration and other non-GAAP items.

Webcast Details and CFO Commentary

At approximately 4:15 p.m. ET today, a CFO commentary, as a

supplement to this press release and the Company’s conference call,

will be available on ScanSource’s website, www.scansource.com

(Investor Relations section). ScanSource will present additional

information about its financial results and outlook in a conference

call today, November 6, 2018, at 5:00 p.m. ET. A webcast of

the call will be available for all interested parties and can be

assessed at www.scansource.com (Investor Relations section). The

webcast will be available for replay for 60 days.

Safe Harbor Statement

This press release contains “forward-looking” statements,

including the forecast of sales and earnings per share for next

quarter, that involve risks and uncertainties. Any number of

factors could cause actual results to differ materially from

anticipated or forecasted results, including, but not limited to,

changes in interest and exchange rates and regulatory regimes

impacting the Company’s international operations, the impact of tax

reform laws, the failure of acquisitions to meet the Company’s

expectations, the failure to manage and implement the Company’s

organic growth strategy, credit risks involving the Company’s

larger customers and vendors, termination of the Company’s

relationship with key vendors or a significant modification of the

terms under which it operates with a key vendor, the decline in

demand for the products and services that the Company provides,

reduced prices for the products and services that the Company

provide due both to competitor and customer action, and other

factors set forth in the “Risk Factors” contained in the Company’s

annual report on Form 10-K for the year ended June 30, 2018, filed

with the Securities and Exchange Commission. Except as may be

required by law, the Company expressly disclaims any obligation to

update these forward-looking statements to reflect events or

circumstances after the date of this press release or to reflect

the occurrence of unanticipated events.

Non-GAAP Financial Information

In addition to disclosing results that are determined in

accordance with United States Generally Accepted Accounting

Principles (“GAAP”), the Company also discloses certain non-GAAP

financial measures, which are summarized below. Non-GAAP financial

measures are used to understand and evaluate performance, including

comparisons from period to period. Non-GAAP results exclude

amortization of intangible assets related to acquisitions, change

in fair value of contingent consideration, acquisition costs and

other non-GAAP adjustments.

Net sales on a constant currency basis, excluding acquisitions:

The Company discloses the percentage change in net sales excluding

the translation impact from changes in foreign currency exchange

rates between reporting periods and excluding the net sales from

acquisitions prior to the first full year from the acquisition

date. This measure enhances the comparability between periods to

help analyze underlying trends on an organic basis.

Non-GAAP operating income, non-GAAP pre-tax income, non-GAAP net

income and non-GAAP diluted earnings per share: To evaluate current

period performance on a more consistent basis with prior periods,

the Company discloses non-GAAP operating income, non-GAAP pre-tax

income, non-GAAP net income and non-GAAP diluted earnings per share

(non-GAAP diluted “EPS”). These non-GAAP results exclude

amortization of intangible assets related to acquisitions, change

in the fair value of contingent consideration, acquisition costs

and other non-GAAP adjustments. Non-GAAP operating income, non-GAAP

net income, and non-GAAP diluted EPS measures are useful in

assessing and understanding the Company’s operating performance,

especially when comparing results with previous periods or

forecasting performance for future periods.

Return on invested capital (“ROIC”): Management uses ROIC as a

performance measurement to assess efficiency in allocating capital

under the Company’s control to generate returns. Management

believes this metric balances the Company’s operating results with

asset and liability management, is not impacted by capitalization

decisions and correlates with shareholder value creation. In

addition, it is easily computed, communicated and understood. ROIC

also provides management a measure of the Company’s profitability

on a basis more comparable to historical or future periods.

ROIC assists management in comparing the Company’s performance

over various reporting periods on a consistent basis because it

removes from operating results the impact of items that do not

reflect core operating performance. ROIC is calculated as adjusted

EBITDA over invested capital. Adjusted earnings before interest

expense, income taxes, depreciation and amortization (“Adjusted

EBITDA”) excludes the change in fair value of contingent

consideration and acquisition costs, in addition to other non-GAAP

adjustments. Invested capital is defined as average equity plus

average daily funded interest-bearing debt for the period.

Management believes the calculation of ROIC provides useful

information to investors and is an additional relevant comparison

of the Company’s performance during the year.

These non-GAAP financial measures have limitations as analytical

tools, and the non-GAAP financial measures that the Company reports

may not be comparable to similarly titled amounts reported by other

companies. Analysis of results and outlook on a non-GAAP basis

should be considered in addition to, and not in substitution for or

as superior to, measurements of financial performance prepared in

accordance with GAAP. A reconciliation of the Company’s non-GAAP

financial information to GAAP is set forth in the Supplementary

Information (Unaudited) below.

About ScanSource, Inc.

ScanSource, Inc. (NASDAQ: SCSC) is a leading global provider of

technology products and solutions, focusing on point-of-sale (POS),

payments, barcode, physical security, unified communications and

collaboration and telecom and cloud services. ScanSource’s teams

provide value-added solutions and operate from two segments:

Worldwide Barcode, Networking & Security, which includes POS

Portal, and Worldwide Communications & Services, which includes

Intelisys and Canpango. ScanSource is committed to helping its

customers choose, configure and deliver the industry’s best

solutions across almost every vertical market in North America,

Latin America and Europe. Founded in 1992 and headquartered in

Greenville, South Carolina, ScanSource was named one of the 2018

Best Places to Work in South Carolina and on FORTUNE magazine’s

2018 List of World’s Most Admired Companies. ScanSource ranks #653

on the Fortune 1000. For more information, visit

www.scansource.com.

ScanSource, Inc. and Subsidiaries Condensed

Consolidated Balance Sheets (Unaudited) (in thousands)

September 30, 2018 June 30,

2018* Assets Current assets: Cash and cash equivalents $

18,858 $ 25,530 Accounts receivable, less allowance of $45,340 at

September 30, 2018 and $45,561 at June 30, 2018 677,499 678,940

Inventories 672,696 595,948 Prepaid expenses and other current

assets 64,643 61,744 Total current assets 1,433,696

1,362,162 Property and equipment, net 71,625 73,042 Goodwill

311,334 298,174 Identifiable intangible assets, net 131,393 136,806

Deferred income taxes 21,283 22,199 Other non-current assets 52,068

52,912 Total assets $ 2,021,399 $ 1,945,295

Liabilities and Shareholders’

Equity

Current liabilities: Accounts payable $ 629,242 $ 562,564 Accrued

expenses and other current liabilities 86,762 90,873 Current

portion of contingent consideration 50,806 42,975 Income taxes

payable 9,014 13,348 Current portion of long-term debt 335

551 Total current liabilities 776,159 710,311 Deferred

income taxes 1,650 1,769 Long-term debt, net of current portion

4,764 4,878 Borrowings under revolving credit facility 276,760

244,000 Long-term portion of contingent consideration 29,367 65,258

Other long-term liabilities 54,802 52,703 Total

liabilities 1,143,502 1,078,919

Shareholders’ equity:

Common stock 70,035 68,220 Retained earnings 896,655 882,333

Accumulated other comprehensive income (loss) (88,793 ) (84,177 )

Total shareholders’ equity

877,897 866,376

Total liabilities and shareholders’

equity

$ 2,021,399 $ 1,945,295 * Derived from audited

financial statements.

ScanSource, Inc. and

Subsidiaries Condensed Consolidated Income Statements

(Unaudited) (in thousands, except per share data)

Quarter ended September 30, 2018

2017 Net sales $ 972,900 $ 924,559 Cost of goods sold

860,685 818,642 Gross profit 112,215 105,917 Selling,

general and administrative expenses 77,931 73,187 Depreciation

expense 3,265 3,240 Intangible amortization expense 5,003 5,011

Change in fair value of contingent consideration 4,584

16,881 Operating income 21,432 7,598 Interest expense 2,627

1,585 Interest income (451 ) (881 ) Other expense, net 32

114 Income before income taxes 19,224 6,780 Provision for

income taxes 4,902 2,633 Net income $ 14,322 $

4,147 Per share data: Net income per common share, basic $

0.56 $ 0.16 Weighted-average shares outstanding,

basic 25,599 25,434 Net income per common

share, diluted $ 0.56 $ 0.16 Weighted-average shares

outstanding, diluted 25,755 25,579

ScanSource, Inc. and Subsidiaries Supplementary

Information (Unaudited) Net

Sales by Segment: Quarter ended September 30,

2018 2017 % Change Worldwide

Barcode, Networking & Security: (in thousands) Net

sales, as reported $ 655,113 $ 620,329 5.6 % Foreign exchange

impact (a) 7,513 — Net sales, constant currency

(non-GAAP) 662,626 620,329 6.8 % Less: Acquisitions (23,465 )

(14,553 ) Net sales, constant currency excluding acquisitions

(non-GAAP) $ 639,161 $ 605,776 5.5 %

Worldwide Communications & Services: Net sales, as

reported $ 317,787 $ 304,230 4.5 % Foreign exchange impact (a)

13,307 — Net sales, constant currency (non-GAAP)

331,094 304,230 8.8 % Less: Acquisitions (964 ) — Net sales,

constant currency excluding acquisitions (non-GAAP) $ 330,130

$ 304,230 8.5 %

Consolidated: Net

sales, as reported $ 972,900 $ 924,559 5.2 % Foreign exchange

impact (a) 20,820 — Net sales, constant currency

(non-GAAP) 993,720 924,559 7.5 % Less: Acquisitions (24,429 )

(14,553 ) Net sales, constant currency excluding acquisitions

(non-GAAP) $ 969,291 $ 910,006 6.5 % (a)

Year-over-year net sales growth rate excluding the translation

impact of changes in foreign currency exchange rates. Calculated by

translating the net sales for the quarter ended September 30, 2018

into U.S. dollars using the average foreign exchange rates for the

quarter ended September 30, 2017.

ScanSource, Inc.

and Subsidiaries Supplementary Information (Unaudited)

Net Sales by

Geography: Quarter ended September 30, 2018

2017 % Change United States and Canada: (in

thousands) Net sales, as reported $ 737,957 $ 686,650 7.5 %

Less: Acquisitions (24,429 ) (14,553 ) Net sales, excluding

acquisitions (non-GAAP) $ 713,528 $ 672,097 6.2 %

International: Net sales, as reported $ 234,943 $

237,909 (1.2 )% Foreign exchange impact (a) 20,820 —

Net sales, constant currency (non-GAAP) 255,763 237,909 7.5 % Less:

Acquisitions — — Net sales, constant currency

excluding acquisitions (non-GAAP) $ 255,763 $ 237,909

7.5 %

Consolidated: Net sales, as reported $ 972,900

$ 924,559 5.2 % Foreign exchange impact (a) 20,820 —

Net sales, constant currency (non-GAAP) 993,720 924,559 7.5 % Less:

Acquisitions (24,429 ) (14,553 ) Net sales, constant currency

excluding acquisitions (non-GAAP) $ 969,291 $ 910,006

6.5 % (a) Year-over-year net sales growth rate excluding the

translation impact of changes in foreign currency exchange rates.

Calculated by translating the net sales for the quarter ended

September 30, 2018 into U.S. dollars using the average foreign

exchange rates for the quarter ended September 30, 2017.

ScanSource, Inc. and Subsidiaries Supplementary

Information (Unaudited) (in thousands, except per share

data)

Non-GAAP Financial Information: Quarter ended September

30, 2018

Operatingincome

Pre-taxincome

Netincome

DilutedEPS

GAAP measure $ 21,432 $ 19,224 $ 14,322 $ 0.56 Adjustments:

Amortization of intangible assets 5,003 5,003 3,798 0.15 Change in

fair value of contingent consideration 4,584 4,584 3,487 0.14

Acquisition costs (a) 355 355 355 0.01 Restructuring costs 1,328

1,328 955 0.04 Non-GAAP measure $ 32,702

$ 30,494 $ 22,917 $ 0.89

Quarter

ended September 30, 2017

Operatingincome

Pre-taxincome

Netincome

DilutedEPS

GAAP measure $ 7,598 $ 6,780 $ 4,147 $ 0.16 Adjustments:

Amortization of intangible assets 5,011 5,011 3,261 0.13 Change in

fair value of contingent consideration 16,881 16,881 11,005 0.43

Acquisition costs (a) 172 172 172 0.01 Legal settlement, net of

attorney fees 952 952 771 0.03 Non-GAAP

measure $ 30,614 $ 29,796 $ 19,356 $ 0.76

(a) Acquisition costs are non-deductible for tax purposes.

ScanSource, Inc. and Subsidiaries

Supplementary Information (Unaudited) (in thousands,

except percentages) Non-GAAP

Financial Information:

Quarter endedSeptember

30,

2018 2017 Return on invested capital (ROIC),

annualized (a) 12.9 % 13.0 %

Reconciliation of

Net Income to Adjusted EBITDA

Net income (GAAP) $ 14,322 $ 4,147 Plus: Interest expense 2,627

1,585 Plus: Income taxes 4,902 2,633 Plus: Depreciation and

amortization 9,268 8,864 EBITDA (non-GAAP) 31,119

17,229 Adjustments: Change in fair value of contingent

consideration 4,584 16,881 Acquisition costs 355 172 Restructuring

costs 1,328 — Legal settlement, net of attorney fees — 952

Adjusted EBITDA (numerator for ROIC) (non-GAAP) $ 37,386

$ 35,234

Invested Capital

Calculation

Equity - beginning of the quarter $ 866,376 $ 837,145 Equity - end

of the quarter 877,897 852,976 Adjustments: Change in fair value of

contingent consideration, net of tax 3,487 11,005 Acquisition costs

355 172 Restructuring costs, net of tax 955 — Legal settlement, net

of attorney fees, net of tax — 771 Average equity

874,535 851,035 Average funded debt (b) 272,277 224,956

Invested capital (denominator for ROIC) (non-GAAP) $

1,146,812 $ 1,075,991 (a) Calculated as net

income plus interest expense, income taxes, depreciation and

amortization (EBITDA), plus change in fair value of contingent

consideration and other adjustments, annualized and divided by

invested capital for the period. Invested capital is defined as

average equity plus average daily funded interest-bearing debt for

the period. (b) Average funded debt is calculated as the

average daily amounts outstanding on short-term and long-term

interest-bearing debt.

ScanSource, Inc. and

Subsidiaries Supplementary Information (Unaudited)

Non-GAAP Financial Information:

Forecast for Quarterending

December 31, 2018

Range Low Range High GAAP diluted EPS $ 0.70 $ 0.76

Adjustments: Amortization of intangible assets 0.14 0.14 Change in

fair value of contingent consideration 0.07 0.07 Acquisition costs

0.01 0.01 Non-GAAP diluted EPS $ 0.92 $ 0.98

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181106005931/en/

ScanSource, Inc.Gerald Lyons, 864-286-4854Executive Vice

President, Chief Financial OfficerorMary M. Gentry,

864-286-4892Vice President, Treasurer and Investor Relations

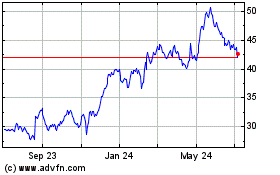

ScanSource (NASDAQ:SCSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

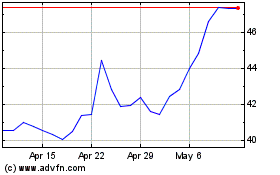

ScanSource (NASDAQ:SCSC)

Historical Stock Chart

From Apr 2023 to Apr 2024