Sanofi Shares Tumble After Warning of Profit Hit From Investment, Taxes

October 27 2023 - 4:43AM

Dow Jones News

By Adria Calatayud

Shares of Sanofi fell sharply after the company warned it

expects business earnings for next year to be hit by its plans to

boost investment in research and development and changes in global

tax regulations.

At 0809 GMT on Friday, shares in the French pharmaceutical giant

were down 16% at EUR84.83.

Sanofi said it expects business earnings per share--one of its

preferred metrics, which strips out exceptional items--to be

roughly flat in 2024 compared with this year when excluding the

impact of an expected tax-rate change. Including the expected hit

from the tax changes, business EPS is expected to decline by low

single digits, it said.

The company expects its effective tax rate to rise to 21% in

2024 from 19% this year.

In 2025, the company expects business EPS to rebound strongly,

helped by sales growth and a cost-cutting plan that it expects to

achieve 2 billion euros ($2.11 billion) in savings from 2024 to the

end of the following year.

"We believe the preliminary guidance for 2024 and 2025 business

EPS will be the primary focus for investors today," Barclays

analysts wrote in a note to clients.

The new forecasts were issued as Sanofi outlined a plan to

separate its consumer-healthcare business from its pharma

operations, and reported results for the third quarter that

narrowly missed consensus estimates.

Net sales for the third quarter fell to EUR11.96 billion from

EUR12.48 billion in the same period last year, while business net

profit fell 11% to EUR3.20 billion. The company attributed the

earnings fall to the loss of exclusivity of its Aubagio drug for

relapsing multiple sclerosis.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

October 27, 2023 04:28 ET (08:28 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

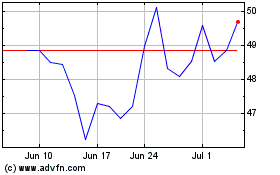

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

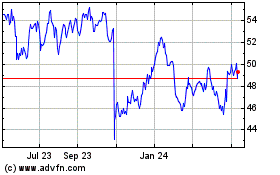

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Apr 2023 to Apr 2024