Earnings Preview: Jabil Circuit - Analyst Blog

December 16 2011 - 10:38AM

Zacks

Jabil Circuit Inc. (JBL) is set to announce its

fiscal first quarter 2012 results on Tuesday, December 20, after

the closing bell. In the run up to the earnings results, we did not

notice a substantial movement in analysts’ estimates for the

quarter.

Prior Quarter Highlights

The company reported fourth quarter 2011 earnings of 54 cents

per share, beating the Zacks Consensus Estimate by a nickel.

Earnings per share (EPS) increased 81.9% from 30 cents

(including stock-based compensation but excluding amortization)

reported in the year-ago quarter. The strong results were primarily

driven by solid top-line growth and operating margin expansion in

the quarter. Moreover, a decline in operating expenses helped the

bottom-line.

Full details are available on: Jabil Beats on Lower Cost

Current Quarter Expectations

For the first quarter of 2012, Jabil expects net revenue in the

range of $4.3 billion to $4.5 billion. The Zacks Consensus Estimate

has the quarter’s revenues at $4.41 billion, in the middle of the

guided range.

Diversified Manufacturing is expected to be up 3.0%

sequentially, Enterprise and Infrastructure is anticipated to

remain flat year over year, while High Velocity is forecasted to

increase 6.0% on a sequential basis in the first quarter.

For the quarter, Jabil forecasts operating income (excluding

stock-based compensation) in the $185.0 million to $205.0 million

range (4.3% to 4.5% of the total revenue). Jabil expects non-GAAP

earnings per share to be between 62 cents and 70 cents. At the time

of the fourth quarter 2011 earnings release, the Zacks Consensus

Estimate for Jabil was 55 cents, which was significantly lower than

the guided range.

Estimation Revisions Trend

Over the past 30 days, two of the seven analysts covering the

stock revised their estimates upward for the quarter, while none

lowered their estimates. Nonetheless, the Zacks Consensus Estimate

for the first quarter stayed at 58 cents per share. Analysts’

estimates range from 57 cents to 61 cents.

Analysts believe that increasing adoption of clean technology

and alternative energy will provide Jabil the growth momentum.

Moreover, the lean cost structure, increasing cash flow generation

capabilities and an improving balance sheet are positives going

forward.

Our Take

Jabil exceeded the analysts’ estimates in three of the preceding

four quarters, while it failed to beat the estimates once. The

average surprise in these four quarters is a positive 5.28%, and

another positive earnings surprise is expected from the

company.

Jabil is expected to benefit from strong growth in the Mobility,

Aerospace and Defense, Healthcare, Instrumentation and Industrial,

Clean Tech, Networking and Storage segments over the long term.

Moreover, an expanding global business and an improving balance

sheet are positives for the stock.

However, we believe that the volatile macro environment in

Europe will remain an overhang on the stock in the near term. The

company also faces competition from Flextronics

International Ltd (FLEX) and Sanmina-SCI

Corp. (SANM). We maintain a Neutral rating on Jabil over

the long term (6–12 months).

Currently, Jabil has a Zacks #2 Rank, which implies a Buy rating

on a short-term basis.

FLEXTRONIC INTL (FLEX): Free Stock Analysis Report

JABIL CIRCUIT (JBL): Free Stock Analysis Report

SANMINA-SCI CP (SANM): Free Stock Analysis Report

Zacks Investment Research

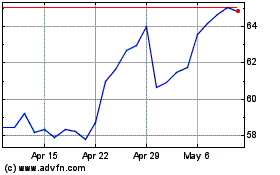

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From Apr 2024 to May 2024

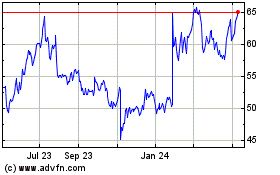

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From May 2023 to May 2024