SAN JOSE, Calif., Nov. 4 /PRNewswire-FirstCall/ -- Sanmina-SCI

Corporation (the "Company") (NASDAQ:SANM), a leading global

Electronics Manufacturing Services (EMS) company, today reported

financial results for the fourth quarter and fiscal year ended

October 3, 2009. Fourth Quarter Fiscal 2009 Highlights -- Revenue

of $1.35 billion, exceeded outlook of $1.2 - $1.3 billion -- GAAP

gross margin of 7 percent, 70 basis point sequential improvement --

Non-GAAP gross margin of 7.1 percent, 70 basis point sequential

improvement -- Cash flow from operations was $45.8 million --

Ending cash balance of $899.2 million Revenue for the fourth

quarter was $1.35 billion, up 12 percent, compared to $1.21 billion

in the prior quarter ended June 27, 2009. Revenue for the fiscal

year ended October 3, 2009 was $5.18 billion, compared to $7.20

billion for the year ended September 27, 2008. GAAP Financial

Results(1)(3) GAAP net loss in the fourth quarter was $32.3

million, a diluted loss per share of $0.41, compared to a net loss

of $41.1 million and a diluted loss per share of $0.51 in the prior

quarter. GAAP net loss for the full year was $136.2 million, a

diluted loss per share of $1.65, compared to net loss of $511.3

million, a diluted loss per share of $5.78 in fiscal 2008. Non-GAAP

Financial Results(1)(2)(3) Non-GAAP gross profit in the fourth

quarter was $96.4 million, or 7.1 percent of revenue, up 70 basis

points, compared to gross profit of $77.1 million, or 6.4 percent

of revenue in the third quarter. Non-GAAP gross profit for the

fiscal year 2009 was $339.9 million, or 6.6 percent of revenue,

compared to gross profit of $531.2 million, or 7.4 percent for the

fiscal year 2008. Non-GAAP operating income was $34.5 million, or

2.6 percent of revenue, up 120 basis points, compared to $17.1

million, or 1.4 percent of revenue in the prior quarter. Non-GAAP

operating income for fiscal 2009 was $94.3 million, or 1.8 percent

of revenue, compared to $205.6 million, or 2.9 percent of revenue

for fiscal 2008. Non-GAAP net income in the fourth quarter was $94

thousand, a diluted earnings per share of $0.00, compared to a net

loss of $10.9 million and $0.14 diluted loss per share in the prior

quarter. Non-GAAP net loss for the full year was $42.5 million,

$0.52 diluted loss per share, compared to net income of $69.6

million, a diluted earnings per share of $0.79 in fiscal 2008.

Three Month Twelve Month Periods Periods ------- ------- (In

millions, Q4: Q3: Q4: FY: FY: except per 2009 2009 2008(3) 2009

2008(3) share data) ---- ---- ---- ---- ---- ---------- GAAP: -----

Revenue $1,354.0 $1,209.2 $1,703.6 $5,177.5 $7,202.4 Net income

(loss) $(32.3) $(41.1) $(473.9) $(136.2) $(511.3) Earnings (loss)

per share(1) $(0.41) $(0.51) $(5.35) $(1.65) $(5.78) Non-GAAP(2):

Revenue $1,354.0 $1,209.2 $1,703.6 $5,182.5 $7,202.4 Gross profit

$96.4 $77.1 $132.8 $339.9 $531.2 Gross margin 7.1% 6.4% 7.8% 6.6%

7.4% Operating income $34.5 $17.1 $59.3 $94.3 $205.6 Operating

margin 2.6% 1.4% 3.5% 1.8% 2.9% Net income (loss) $0.1 $(10.9)

$24.0 $(42.5) $69.6 Earnings (loss) per share(1) $0.00 $(0.14)

$0.27 $(0.52) $0.79 --------------------- ----- ------ ----- ------

----- "I am pleased with Sanmina-SCI's progress despite a

challenging economy and optimistic that the worst is now behind us.

We delivered solid results for the quarter with 12 percent growth

in revenue and 70 basis point improvement in gross margin over the

prior quarter. We expect to further expand margins through our

diversified end-markets, efficient manufacturing processes and

increase in demand. Our new business strategy and lean cost

structure offer distinct advantages to our customers that

differentiate us from the competition and position us for future

profitable growth," stated Jure Sola, Chairman and Chief Executive

Officer. Debt Redemption On October 15, 2009 the Company called for

redemption on November 16, 2009 of all of its outstanding Senior

Floating Rate Notes due 2010. The aggregate principal amount of the

Notes currently outstanding is $175.7 million. Upon redemption,

holders of the Notes will receive the principal amount of the Notes

plus accrued and unpaid interest thereon to but excluding the

redemption date. The Company plans to fund the redemption using

existing cash resources. The Company's next debt maturity is 2013.

First Quarter Fiscal 2010 Outlook The following forecast is for the

first fiscal quarter ending January 2, 2010. These statements are

forward-looking and actual results may differ materially. --

Revenue between $1.35 billion to $1.45 billion -- Non-GAAP diluted

earnings per share between $0.10 to $0.15 (1) Earnings Per Share

Calculation The Company completed a reverse split of its common

stock at a ratio of one for six, effective August 14, 2009.

Earnings per share data contained in this release for periods prior

to such date have been calculated on a post split basis. (2)

Non-GAAP Financial Information In the commentary set forth above

and/or in the financial statements included in this earnings

release, we present the following non-GAAP financial measures:

revenue, gross profit, gross margin, operating income, operating

margin, net income (loss) and earnings (loss) per share. In

computing each of these non-GAAP financial measures, we exclude

charges or gains relating to: stock-based compensation expenses,

restructuring costs (including employee severance and benefits

costs and charges related to excess facilities and assets),

integration costs (consisting of costs associated with the

integration of acquired businesses into our operations), impairment

charges for goodwill and intangible assets, amortization expense

and other infrequent or unusual items (including charges for

customer bankruptcy reorganizations), to the extent material or

which we consider to be of a non-operational nature in the

applicable period. See Schedule 1 below for more information

regarding our use of non-GAAP financial measures, including the

economic substance behind each exclusion, the manner in which

management uses non-GAAP measures to conduct and evaluate the

business, the material limitations associated with using such

measures and the manner in which management compensates for such

limitations. A reconciliation from GAAP to non-GAAP results is

included in the financial statements contained in this release and

is also available on the Investor Relations section of our website

at http://www.sanmina-sci.com/. Sanmina-SCI provides first quarter

outlook information only on a non-GAAP basis due to the inherent

uncertainties associated with forecasting the timing and amount of

restructuring, impairment and other unusual and infrequent items.

(3) Basis of Presentation for Continuing Operations The Company

completed the sale of the assets of its personal computing business

and associated logistics services in two transactions that closed

on June 2, 2008 and July 7, 2008, respectively. The Company has

reported this line of business as a discontinued operation in the

financial statements that accompany this press release. Therefore,

results for fiscal 2008 are based on continuing operations. Company

Conference Call Information Sanmina-SCI will hold a conference call

regarding this announcement on Wednesday, November 4, 2009 at 5:00

p.m. ET (2:00 p.m. PT). The access numbers are: domestic

877-273-6760 and international 706-634-6605. The conference will

also be broadcast live over the Internet. You can log on to the

live webcast at http://www.sanmina-sci.com/. Additional information

in the form of a slide presentation is available by logging onto

Sanmina-SCI's website at http://www.sanmina-sci.com/. A replay of

today's conference call will be available for 48-hours. The access

numbers are: domestic 800-642-1687 and international 706-645-9291,

access code is 35607075. About Sanmina-SCI Sanmina-SCI Corporation

is a leading electronics contract manufacturer serving the

fastest-growing segments of the global Electronics Manufacturing

Services (EMS) market. Recognized as a technology leader,

Sanmina-SCI provides end-to-end manufacturing solutions, delivering

superior quality and support to OEMs primarily in the

communications, defense and aerospace, industrial and medical

instrumentation, multimedia, enterprise computing and storage,

renewable energy and automotive technology sectors. Sanmina-SCI has

facilities strategically located in key regions throughout the

world. More information regarding the company is available at

http://www.sanmina-sci.com/. Sanmina-SCI Safe Harbor Statement

Certain statements contained in this press release, including the

Company's expectations for future revenue, earnings per share and

continued margin improvement constitute forward-looking statements

within the meaning of the safe harbor provisions of Section 21E of

the Securities Exchange Act of 1934. Actual results could differ

materially from those projected in these statements as a result of

a number of factors, including continued deterioration of the

market for the Company's customers' products and the global economy

as a whole, which could negatively impact the Company's revenue and

the Company's customers' ability to pay for the Company's products;

customer bankruptcy filings; the sufficiency of the Company's cash

position and other sources of liquidity to operate and expand its

business; impact of the restrictions contained in the Company's

credit agreements and indentures upon the Company's ability to

operate and expand its business; competition negatively impacting

the Company's revenues and margins; any failure of the Company to

effectively assimilate acquired businesses and achieve the

anticipated benefits of its acquisitions; the need to adopt future

restructuring plans as a result of changes in the Company's

business; and the other factors set forth in the Company's

quarterly reports for fiscal 2009 and annual report for fiscal 2008

filed with the Securities Exchange Commission ("SEC"). The Company

is under no obligation to (and expressly disclaims any such

obligation to) update or alter any of the forward-looking

statements made in this earnings release, the conference call or

the Investor Relations section of our website whether as a result

of new information, future events or otherwise, unless otherwise

required by law. SANMF Sanmina-SCI Corporation Condensed

Consolidated Balance Sheets (In thousands) (GAAP) October September

3, 27, 2009 2008 ---- ---- (Unaudited) ASSETS ------ Current

assets: Cash and cash equivalents $899,151 $869,801 Accounts

receivable, net 668,474 986,312 Inventories 761,391 813,359 Prepaid

expenses and other current assets 78,128 100,399 Assets held for

sale 68,902 43,163 ------ ------ Total current assets 2,476,046

2,813,034 --------- --------- Property, plant and equipment, net

543,497 599,908 Other non-current assets 104,354 117,785 -------

------- Total assets $3,123,897 $3,530,727 ========== ==========

LIABILITIES AND STOCKHOLDERS' EQUITY

------------------------------------ Current liabilities: Accounts

payable $780,876 $908,151 Accrued liabilities 140,926 191,022

Accrued payroll and related benefits 98,408 139,522 Current portion

of long-term debt 175,700 - ------- --- Total current liabilities

1,195,910 1,238,695 --------- --------- Long-term liabilities:

Long-term debt 1,262,014 1,481,985 Other 122,833 114,089 -------

------- Total long-term liabilities 1,384,847 1,596,074 ---------

--------- Total stockholders' equity 543,140 695,958 -------

------- Total liabilities and stockholders' equity $3,123,897

$3,530,727 ========== ========== Sanmina-SCI Corporation Condensed

Consolidated Statements of Operations (In thousands, except per

share amounts) (GAAP) (Unaudited) Three Months Twelve Months Ended

Ended ------------ ------------- October September October

September 3, 27, 3, 27, 2009 2008 2009 2008 ------- ---------

------- --------- Net sales $1,353,960 $1,703,579 $5,177,481

$7,202,403 Cost of sales 1,259,630 1,572,688 4,855,003 6,678,297

--------- --------- --------- --------- Gross profit 94,330 130,891

322,478 524,106 ------ ------- ------- ------- Operating expenses:

Selling, general and administrative 60,315 71,206 238,194 317,045

Research and development 3,962 4,815 16,685 19,546 Amortization of

intangible assets 1,072 1,650 4,817 6,600 Restructuring and

integration costs 18,316 13,322 57,260 81,376 Impairment of

goodwill and other assets 2,944 481,999 10,178 483,699 -----

------- ------ ------- Total operating expenses 86,609 572,992

327,134 908,266 ------ ------- ------- ------- Operating income

(loss) 7,721 (442,101) (4,656) (384,160) Interest income 459 4,726

6,499 19,744 Interest expense (30,302) (30,296) (116,988) (127,231)

Other income (expense), net (5,609) (4,211) 2,575 1,316 ------

------ ----- ----- Interest and other expense, net (35,452)

(29,781) (107,914) (106,171) ------- ------- -------- -------- Loss

from continuing operations before income taxes (27,731) (471,882)

(112,570) (490,331) Provision for income taxes 4,554 2,033 23,652

21,005 ----- ----- ------ ------ Net loss from continuing

operations (32,285) (473,915) (136,222) (511,336) Net income (loss)

from discontinued operations, net of tax - (11,264) - 24,987 ---

------- --- ------ Net loss $(32,285) $(485,179) $(136,222)

$(486,349) ======== ========= ========= ========= Basic and diluted

income (loss) per share from: Continuing operations $(0.41) $(5.35)

$(1.65) $(5.78) Discontinued operations $- $(0.13) $- $0.28 Net

loss $(0.41) $(5.48) $(1.65) $(5.50) Weighted-average shares used

in computing basic and diluted per share amounts: 78,604 88,537

82,528 88,454 Sanmina-SCI Corporation Reconciliation of GAAP to

Non-GAAP Measures (in thousands, except per share amounts)

(Unaudited) Three Months Twelve Months Ended Ended ------- -------

October 3, June 27, September 27, October 3, September 27, 2009

2009 2008 2009 2008 ------- -------- --------- ------- ---------

GAAP Revenue $1,353,960 $1,209,150 $1,703,579 $5,177,481 $7,202,403

Adjustments Customer bankruptcy reorganization(1) - - - 5,000 - ---

--- --- ----- --- Non-GAAP Revenue $1,353,960 $1,209,150 $1,703,579

$5,182,481 $7,202,403 ========== ========== ========== ==========

========== GAAP Gross Profit $94,330 $75,760 $130,891 $322,478

$524,106 GAAP gross margin 7.0% 6.3% 7.7% 6.2% 7.3% Adjustments

Stock compensation expense (2) 2,028 1,316 1,704 7,209 6,556

Amortization of intangible assets 24 - 233 257 970 Stock option

investigation costs - - - - (408) Customer bankruptcy

reorganization(1) - - - 10,000 - --- --- --- ------ --- Non-GAAP

Gross Profit $96,382 $77,076 $132,828 $339,944 $531,224 =======

======= ======== ======== ======== Non-GAAP gross margin 7.1% 6.4%

7.8% 6.6% 7.4% GAAP operating income (loss) $7,721 $(1,147)

$(442,101) $(4,656) $(384,160) GAAP operating margin 0.6% -0.1%

-26.0% -0.1% -5.3% Adjustments Stock compensation expense (2) 4,470

3,036 3,735 15,994 13,936 Amortization of intangible assets 1,096

1,072 1,883 5,074 7,570 Stock option investigation - - 467 450

3,152 Customer bankruptcy reorganization(1) - - - 10,000 -

Restructuring and integration costs 18,316 14,135 13,322 57,260

81,376 Impairment of goodwill and other assets 2,944 52 481,999

10,178 483,699 ----- -- ------- ------ ------- Non-GAAP operating

income $34,547 $17,148 $59,305 $94,300 $205,573 ======= =======

======= ======= ======== Non-GAAP operating margin 2.6% 1.4% 3.5%

1.8% 2.9% GAAP net loss $(32,285) $(41,126) $(485,179) $(136,222)

$(486,349) Adjustments Net loss (income) from discontinued

operations, net of tax - - 11,264 - (24,987) --- --- ------ ---

------- GAAP net loss - continuing operations (32,285) (41,126)

(473,915) (136,222) (511,336) Adjustments - continuing operations:

Operating income adjustments (see above) 26,826 18,295 501,406

98,956 589,733 Net gain on derivative financial instruments and

other(3) - - - (4,993) - Impairment of long-term investment 825

2,706 - 4,531 - Gain on sale of assets - - - - (2,622) (Gain) /

loss on repurchase of debt (4) 4,945 - - (8,545) 2,237 Discrete tax

item (5) - 10,146 - 10,146 - Nonrecurring tax items (217) (919)

(3,464) (6,394) (8,418) ---- ---- ------ ------ ------ Non-GAAP net

income (loss) - continuing operations $94 $(10,898) $24,027

$(42,521) $69,594 === ======== ======= ======== ======= Non-GAAP

Basic Income (Loss) Per Share: Continuing operations $0.00 $(0.14)

$0.27 $(0.52) $0.79 Non-GAAP Diluted Income (Loss) Per Share:

Continuing operations $0.00 $(0.14) $0.27 $(0.52) $0.79

Weighted-average shares used in computing Non- GAAP per share

amounts: Basic 78,604 80,051 88,537 82,528 88,454 Diluted 79,209

80,051 88,609 82,528 88,504 (1) Relates to revenue reversal and

inventory reserves associated with a customer's bankruptcy

reorganization announcement. (2) Stock compensation expense was as

follows: Three Months Twelve Months Ended Ended ------- -------

October 3, June 27, September 27, October 3, September 27, 2009

2009 2008 2009 2008 ------- -------- --------- ------- ---------

Cost of sales $2,028 $1,316 $1,704 $7,209 $6,556 Selling, general

and administrative 2,324 1,673 1,951 8,446 7,073 Research and

development 118 47 80 339 307 --- -- -- --- --- Stock compensation

expense - continuing operations 4,470 3,036 3,735 15,994 13,936

Discontinued operations - - 51 - 401 --- --- -- --- --- Stock

compensation expense -total company $4,470 $3,036 $3,786 $15,994

$14,337 ====== ====== ====== ======= ======= (3) Relates primarily

to a gain on interest rate swaps not accounted for as hedging

instruments during a portion of Q1 FY09 due to termination of a

swap. (4) Includes write-off of unamortized debt issuance costs and

OCI on dedesignated portion of interest rate swap in Q4 FY09. (5)

Represents the establishment of a reserve related to a disputed tax

position. Schedule I The tables contained above include non-GAAP

measures of revenue, gross profit, gross margin, operating income,

operating margin, net income and earnings per share. Management

excludes from these measures stock-based compensation,

restructuring and integration expenses, impairment charges,

amortization charges and other infrequent items, including customer

bankruptcy impacts, to the extent material or which we consider to

be of a non-operational nature in the applicable period. Management

excludes these items principally because such charges are not

directly related to the Company's ongoing core business operations.

We use such non-GAAP measures in order to (1) make more meaningful

period-to-period comparisons of Company's operations, both

internally and externally, (2) guide management in assessing

performance of the business, internally allocating resources and

making decisions in furtherance of Company's strategic plan, (3)

provide investors with a better understanding of how management

plans and measures the business and (4) provide investors with a

better understanding of the ongoing, core business. The material

limitations to management's approach include the fact that the

charges and expenses excluded are nonetheless charges required to

be recognized under GAAP. Management compensates for these

limitations primarily by using GAAP results to obtain a complete

picture of the Company's performance and by including a

reconciliation of non-GAAP results back to GAAP in its earnings

releases. Additional information regarding the economic substance

of each exclusion, management's use of the resultant non-GAAP

measures, the material limitations of management's approach and

management's methods for compensating for such limitations is

provided below. Stock-based Compensation Expense, which consists of

non-cash charges for the estimated fair value of stock options and

unvested restricted stock units granted to employees, is excluded

in order to permit more meaningful period-to-period comparisons of

the Company's results since the Company grants different amounts

and value of stock options in each quarter. In addition, given the

fact that competitors grant different amounts and types of equity

award and may use different option valuation assumptions, excluding

stock-based compensation permits more accurate comparisons of the

Company's core results with those of its competitors. Restructuring

and Integration Costs, which consist of severance, lease

termination, exit costs and other charges primarily related to

closing and consolidating manufacturing facilities and those

associated with the integration of acquired businesses into our

operations, are excluded because such charges (1) can be driven by

the timing of acquisitions which are difficult to predict, (2) are

not directly related to ongoing business results and (3) do not

reflect expected future operating expenses. In addition, given the

fact that the Company's competitors complete acquisitions and adopt

restructuring plans at different times and in different amounts

than the Company, excluding these charges permits more accurate

comparisons of the Company's core results with those of its

competitors. Items excluded by the Company may be different from

those excluded by the Company's competitors and restructuring and

integration expenses include both cash and non-cash expenses. Cash

expenses reduce the Company's liquidity. Therefore, management also

reviews GAAP results including these amounts. Impairment Charges,

which consist of non-cash charges resulting primarily from the

Company's net book value exceeding its market capitalization due to

weak macroeconomic conditions, are excluded because such charges

are non-recurring and do not reduce the Company's liquidity. In

addition, given the fact that the Company's competitors may record

impairment charges at different times, excluding these charges

permits more accurate comparisons of the Company's core results

with those of its competitors. Amortization Charges, which consist

of non-cash charges impacted by the timing and magnitude of

acquisitions of businesses or assets, are also excluded because

such charges do not reduce the Company's liquidity or availability

under its credit facilities. In addition, such charges can be

driven by the timing of acquisitions, which is difficult to

predict. Excluding these charges permits more accurate comparisons

of the Company's core results with those of its competitors because

the Company's competitors complete acquisitions at different times

and for different amounts than the Company. Other Items, which

consist of other infrequent or unusual items (including charges for

customer bankruptcy reorganizations and discrete tax events), to

the extent material or non-operational in nature, are excluded

because such items are typically non-recurring, difficult to

predict and generally not directly related to the Company's ongoing

core operations. However, items excluded by the Company may be

different from those excluded by the Company's competitors. In

addition, these expenses include both cash and non-cash expenses.

Cash expenses reduce the Company's liquidity. Management

compensates for these limitations by reviewing GAAP results

including these amounts. DATASOURCE: Sanmina-SCI Corporation

CONTACT: Paige Bombino, Director, Investor Relations of Sanmina-SCI

Corporation, +1-408-964-3610 Web Site: http://www.sanmina-sci.com/

Copyright

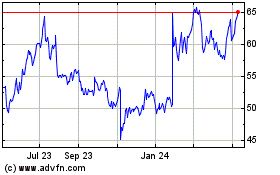

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From Apr 2024 to May 2024

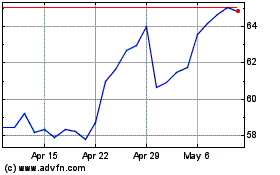

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From May 2023 to May 2024