Safety Insurance Group, Inc. (NASDAQ:SAFT) (“the Company”) today

reported second quarter 2020 results. Net income for the quarter

ended June 30, 2020 was $42.5 million, or $2.78 per diluted share,

compared to net income of $25.9 million, or $1.68 per diluted

share, for the comparable 2019 period. Net income for the six

months ended June 30, 2020 was $40.5 million, or $2.64 per diluted

share, compared to net income of $55.9 million, or $3.63 per

diluted share, for the comparable 2019 period. Non-generally

accepted accounting principles (“non-GAAP”) operating income, as

defined below, for the quarter ended June 30, 2020 was $1.95 per

diluted share, compared to $1.47 per diluted share, for the

comparable 2019 period. Non-GAAP operating income for the six

months ended June 30, 2020 was $3.52 per diluted share, compared to

$2.83 per diluted share, for the comparable 2019 period.

Safety’s book value per share increased to $53.95 at June 30,

2020 from $52.55 at December 31, 2019, primarily as a result of net

income and an increase in unrealized gains, partially offset by

dividends paid and the purchase of treasury shares during the six

months ended June 30, 2020. During the three and six months ended

June 30, 2020 the Company purchased 158,552 and 301,844 shares,

respectively, on the open market at a cost of $11.8 million and

$22.1 million, respectively. Safety paid $0.90 per share in

dividends to investors during the quarter ended June 30, 2020

compared to $0.80 per share in dividends to investors during the

quarter ended June 30, 2019. Safety paid $3.40 per share during the

year ended December 31, 2019.

During this challenging time, the Company has continued to take

many actions that address the health and well-being of our

employees while still serving the needs of our agents and insureds.

Beginning in March 2020, the global pandemic associated with the

novel coronavirus COVID-19 (“COVID-19”) and related economic

conditions caused significant economic effects including temporary

closures of many businesses and reduced consumer activity due to

shelter-in-place, stay-at-home and other governmental actions.

During the second quarter of 2020, the Company announced the

Safety Personal Auto Relief Credit, a 15% policyholder credit,

representing $17.7 million in total premium which was applied to

personal auto policies for the months of April, May and June. This

entire activity was booked as an adjustment to premiums during the

second quarter of 2020. Additionally, as part of our efforts to

assist policyholders, the Company instituted a moratorium on policy

cancellations and assessment of various fees during the three

months ended June 30, 2020 which resulted in a decrease in finance

and other service income of $0.8 million to $3.3 million from $4.1

million for the comparable 2019 period.

Direct written premiums for the quarter ended June 30, 2020

decreased by $28.3 million, or 12.1%, to $205.3 million from $233.6

million for the comparable 2019 period. Direct written premiums for

the six months ended June 30, 2020 decreased by $34.4 million, or

7.9% to $402.6 million from $437.0 million for the comparable 2019

period. The 2020 decrease reflects the personal auto premium relief

as described above. In addition, the decrease is also attributable

to our commercial automobile line of business and is a result of

changes made by Commonwealth Automobile Reinsurers (“CAR”) to

eligibility requirements which impacted the number of policies that

we handle as a Servicing Carrier to the ceded pool. This resulted

in a commensurate decrease in ceded written premium to and assumed

from these programs.

Net written premiums for the quarter ended June 30, 2020

decreased by $19.6 million, or 9.0%, to $197.7 million from $217.3

million for the comparable 2019 period. Net written premiums for

the six months ended June 30, 2020 decreased by $20.6 million, or

5.0%, to $386.6 million from $407.2 million for the comparable 2019

period. Net earned premiums for the quarter ended June 30, 2020

decreased by $14.5 million, or 7.4%, to $181.9 million from $196.4

million for the comparable 2019 period. Net earned premiums for the

six months ended June 30, 2020 decreased by $11.2 million, or 2.8%,

to $379.7 million from $390.9 million for the comparable 2019

period. The decreases in both periods are a result of the premium

relief as described above.

The pandemic has resulted in fewer cars on the road, resulting

in a decrease in frequency, primarily in our private passenger

automobile line of business. As a result, for the quarter ended

June 30, 2020, loss and loss adjustment expenses incurred decreased

by $31.4 million, or 25.7%, to $91.0 million from $122.4 million

for the comparable 2019 period. For the six months ended June 30,

2020, loss and loss adjustment expenses incurred decreased by $36.7

million, or 14.8%, to $211.7 million from $248.4 million for the

comparable 2019 period. Loss, expense, and combined ratios

calculated under U.S. generally accepted accounting principles for

the quarter ended June 30, 2020 were 50.0%, 34.9%, and 84.9%,

respectively, compared to 62.3%, 31.0%, and 93.3%, respectively,

for the comparable 2019 period. Loss, expense, and combined ratios

calculated under U.S. generally accepted accounting principles for

the six months ended June 30, 2020 were 55.7%, 33.3%, and 89.0%,

respectively, compared to 63.5%, 31.0%, and 94.5%, respectively,

for the comparable 2019 period. Total prior year favorable

development included in the pre-tax results for the quarter ended

June 30, 2020 was $9.7 million compared to $10.4 million for the

comparable 2019 period. Total prior year favorable development

included in the pre-tax results for the six months ended June 30,

2020 was $19.3 million compared to $22.3 million for the comparable

2019 period.

The increase in the expense ratios in the respective periods is

partially driven by costs associated with various system

modernization in our claims, billing and underwriting areas, a

reduction in certain expense allowances offered under the Servicing

Carrier program that have decreased with the related written

premium as noted above and an increase in contingent commission

expense. Furthermore, the loss, expense and combined ratios in both

periods reflect a lower earned premium base in their respective

ratio calculations due to the premium relief efforts noted

above.

Net investment income for the quarter ended June 30, 2020

decreased by $0.7 million, or 6.2%, to $9.9 million from $10.6

million for the comparable 2019 period. Net investment income for

the six months ended June 30, 2020 decreased by $1.7 million, or

7.6%, to $20.6 million from $22.3 million for the comparable 2019

period. The decrease in net investment income for the quarter ended

June 30, 2020 is a result of lower yields on our fixed maturities,

specifically bank loans, as well as a decrease in interest income

on our partnership investments. The decrease for the six months

ended June 30, 2020 is a result of fixed maturity amortization

resulting from prepayment activity on certain residential

mortgage-backed securities. Net effective annualized yield on the

investment portfolio for the quarter ended June 30, 2020 was 2.9%

compared to 3.2% for the comparable 2019 period. Net effective

annualized yield on the investment portfolio for the six months

ended June 30, 2020 was 3.0% compared to 3.3% for the comparable

2019 period. Our duration on fixed maturities was 3.3 years at June

30, 2020 and December 31, 2019.

On August 5, 2020, our Board of Directors approved a $0.90 per

share quarterly cash dividend on its issued and outstanding common

stock payable on September 15, 2020 to shareholders of record at

the close of business on September 1, 2020.

Non-GAAP Measures

Management has included certain non-GAAP financial measures in

presenting the Company’s results. Management believes that these

non-GAAP measures better explain the Company’s results of

operations and allow for a more complete understanding of the

underlying trends in the Company’s business. These measures should

not be viewed as a substitute for those determined in accordance

with generally accepted accounting principles (“GAAP”). In

addition, our definitions of these items may not be comparable to

the definitions used by other companies.

Non-GAAP operating income and

non-GAAP operating income per diluted share consist of our GAAP net

income adjusted by the net realized (losses) gains on investments,

net impairment losses on investments, change in net unrealized

gains on equity investments, credit loss expense and taxes related

thereto. For the quarter ended June 30, 2020, an increase of $16.8

million for the change in unrealized gains on equity securities was

recognized within income before income taxes, compared to $3.8

million recognized in the comparable 2019 period. For the six

months ended June 30, 2020, a decrease of $13.2 million for the

change in unrealized gains on equity securities was recognized in

income before income taxes, compared to an increase of $15.6

million recognized in the comparable 2019 period. Net income and

earnings per diluted share are the GAAP financial measures that are

most directly comparable to non-GAAP operating income and non-GAAP

operating income per diluted share, respectively. A reconciliation

of the GAAP financial measures to these non-GAAP measures is

included in the financial highlights below.

About Safety: Safety

Insurance Group, Inc., based in Boston, MA, is the parent of Safety

Insurance Company, Safety Indemnity Insurance Company, and Safety

Property and Casualty Insurance Company. Operating exclusively in

Massachusetts, New Hampshire, and Maine, Safety is a leading writer

of property and casualty insurance products, including private

passenger automobile, commercial automobile, homeowners, dwelling

fire, umbrella and business owner policies.

Additional Information: Press releases, announcements, U.

S. Securities and Exchange Commission (“SEC”) Filings and investor

information are available under “About Safety,” “Investor

Information” on our Company website located at

www.SafetyInsurance.com. Safety filed its December 31, 2019 Form

10-K with the SEC on February 28, 2020 and urges shareholders to

refer to this document for more complete information concerning

Safety’s financial results.

Cautionary Statement under "Safe Harbor" Provision of the

Private Securities Litigation Reform Act of 1995:

This press release contains, and Safety may from time to time

make, written or oral "forward-looking statements" within the

meaning of the U.S. federal securities laws. Forward-looking

statements can be identified by the fact that they do not relate

strictly to historical or current facts. They often include words

such as “believe,” “expect,” “anticipate,” “intend,” “plan,”

“estimate,” “aim,” “projects,” or words of similar meaning and

expressions that indicate future events and trends, or future or

conditional verbs such as “will,” “would,” “should,” “could,” or

“may”. All statements that address expectations or projections

about the future, including statements about the Company’s strategy

for growth, product development, market position, expenditures and

financial results, are forward-looking statements.

Forward-looking statements are not guarantees of future

performance. By their nature, forward-looking statements are

subject to risks and uncertainties. There are a number of factors,

many of which are beyond our control, that could cause actual

future conditions, events, results or trends to differ

significantly and/or materially from historical results or those

projected in the forward-looking statements. These factors include

but are not limited to:

- The competitive nature of our industry and the possible adverse

effects of such competition;

- Conditions for business operations and restrictive regulations

in Massachusetts;

- The possibility of losses due to claims resulting from severe

weather;

- The possibility that the Commissioner of Insurance may approve

future Rule changes that change the operation of the residual

market;

- Our possible need for and availability of additional financing,

and our dependence on strategic relationships, among others;

- The effects of emerging claim and coverage issues on the

Company’s business are uncertain, and court decisions or

legislative or regulatory changes that take place after the Company

issues its policies, including those taken in response to COVID-19

(such as requiring insurers to cover business interruption claims

irrespective of terms or other conditions included in the policies

that would otherwise preclude coverage), can result in an

unexpected increase in the number of claims and have a material

adverse impact on the Company's results of operations;

- The impact of COVID-19 and related risks, including on the

Company's employees, agents or other key partners, could materially

affect the Company's results of operations, financial position

and/or liquidity; and

- Other risks and factors identified from time to time in our

reports filed with the SEC, such as those set forth under the

caption “Risk Factors” in our Form 10-K for the year ended December

31, 2019 filed with the SEC on February 28, 2020.

We are not under any obligation (and expressly disclaim any such

obligation) to update or alter our forward-looking statements,

whether as a result of new information, future events, or

otherwise. You should carefully consider the possibility that

actual results may differ materially from our forward-looking

statements.

Safety Insurance Group, Inc.

and Subsidiaries

Consolidated Balance

Sheets

(Dollars in thousands, except

share data)

June 30,

December 31,

2020

2019

(Unaudited)

Assets

Investments:

Fixed maturities, available for sale, at

fair value (amortized cost: $1,168,666 and $1,192,357, allowance

for expected credit losses of $2,471 at June 30, 2020)

$

1,219,714

$

1,228,040

Equity securities, at fair value (cost:

$164,991 and $151,121)

178,347

177,637

Other invested assets

35,526

37,278

Total investments

1,433,587

1,442,955

Cash and cash equivalents

44,757

44,407

Accounts receivable, net of allowance for

credit losses of $914 at June 30, 2020

199,356

193,369

Receivable for securities sold

2,523

1,784

Accrued investment income

8,000

8,404

Taxes recoverable

411

1,003

Receivable from reinsurers related to paid

loss and loss adjustment expenses

16,018

11,319

Receivable from reinsurers related to

unpaid loss and loss adjustment expenses

116,378

122,372

Ceded unearned premiums

26,073

35,182

Deferred policy acquisition costs

77,350

74,287

Equity and deposits in pools

34,118

29,791

Operating lease right-of-use-assets

33,092

33,998

Other assets

27,251

23,798

Total assets

$

2,018,914

$

2,022,669

Liabilities

Loss and loss adjustment expense

reserves

$

599,747

$

610,566

Unearned premium reserves

440,007

442,219

Accounts payable and accrued

liabilities

60,518

75,016

Payable for securities purchased

7,451

6,377

Payable to reinsurers

11,794

12,911

Deferred income taxes

4,413

5,717

Debt

30,000

—

Operating lease liabilities

33,092

33,998

Other liabilities

14,914

27,459

Total liabilities

1,201,936

1,214,263

Shareholders’ equity

Common stock: $0.01 par value; 30,000,000

shares authorized; 17,724,866 and 17,662,779 shares issued

177

177

Additional paid-in capital

206,130

202,321

Accumulated other comprehensive income,

net of taxes

42,302

28,190

Retained earnings

674,349

661,553

Treasury stock, at cost: 2,581,414 and

2,279,570 shares

(105,980

)

(83,835

)

Total shareholders’ equity

816,978

808,406

Total liabilities and shareholders’

equity

$

2,018,914

$

2,022,669

Safety Insurance Group, Inc.

and Subsidiaries

Consolidated Statements of

Operations

(Unaudited)

(Dollars in thousands, except

share and per share data)

Three Months Ended June

30,

Six Months Ended June

30,

2020

2019

2020

2019

Net earned premiums

$

181,902

$

196,426

$

379,797

$

390,917

Net investment income

9,916

10,574

20,626

22,325

(Losses) earnings from partnership

investments

(3,449

)

735

(2,110

)

1,570

Net realized (losses) gains on

investments

(721

)

483

(1,352

)

319

Change in net unrealized gains on equity

investments

16,828

3,754

(13,160

)

15,555

Net impairment losses on investments

(a)

—

(54

)

—

(274

)

Credit loss expense

39

—

(2,471

)

—

Finance and other service income

3,255

4,084

7,484

8,169

Total revenue

207,770

216,002

388,814

438,581

Losses and loss adjustment expenses

90,974

122,393

211,720

248,420

Underwriting, operating and related

expenses

63,514

60,908

126,596

121,342

Interest expense

130

23

177

45

Total expenses

154,618

183,324

338,493

369,807

Income before income taxes

53,152

32,678

50,321

68,774

Income tax expense

10,658

6,744

9,817

12,894

Net income

$

42,494

$

25,934

$

40,504

$

55,880

Earnings per weighted average common

share:

Basic

$

2.80

$

1.70

$

2.66

$

3.66

Diluted

$

2.78

$

1.68

$

2.64

$

3.63

Cash dividends paid per common

share

$

0.90

$

0.80

$

1.80

$

1.60

Number of shares used in computing

earnings per share:

Basic

15,120,039

15,220,822

15,175,409

15,181,034

Diluted

15,237,295

15,346,234

15,292,186

15,326,121

(a) No portion of the other-than-temporary

impairments recognized in the period indicated were included in

Other Comprehensive Income for the period ended June 30, 2019.

Reconciliation of Net Income to

Non-GAAP Operating Income

Net income

$

42,494

$

25,934

$

40,504

$

55,880

Exclusions from net income:

Net realized losses (gains) on

investments

721

(483

)

1,352

(319

)

Change in net unrealized gains on equity

investments

(16,828

)

(3,754

)

13,160

(15,555

)

Net impairment losses on investments

-

54

-

274

Credit loss expense

(39

)

-

2,471

-

Income tax expense (benefit) on exclusions

from net income

3,391

878

(3,566

)

3,276

Non-GAAP operating income

$

29,739

$

22,629

$

53,921

$

43,556

Net income per diluted share

$

2.78

$

1.68

$

2.64

$

3.63

Exclusions from net income:

Net realized losses (gains) on

investments

0.05

(0.03

)

0.09

(0.02

)

Change in net unrealized gains on equity

investments

(1.10

)

(0.24

)

0.86

(1.01

)

Net impairment losses on investments

-

-

-

0.02

Credit loss expense

-

-

0.16

-

Income tax expense (benefit) on exclusions

from net income

0.22

0.06

(0.23

)

0.21

Non-GAAP operating income per diluted

share

$

1.95

$

1.47

$

3.52

$

2.83

Safety Insurance Group, Inc.

and Subsidiaries

Additional Premium

Information

(Unaudited)

(Dollars in thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2020

2019

2020

2019

Written Premiums

Direct

$

205,301

$

233,595

$

402,647

$

436,982

Assumed

7,128

8,175

15,106

16,420

Ceded

(14,693

)

(24,485

)

(31,059

)

(46,179

)

Net written premiums

$

197,736

$

217,285

$

386,694

$

407,223

Earned Premiums

Direct

$

192,945

$

210,334

$

403,096

$

417,642

Assumed

7,767

8,213

16,869

17,528

Ceded

(18,810

)

(22,121

)

(40,168

)

(44,253

)

Net earned premiums

$

181,902

$

196,426

$

379,797

$

390,917

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200805005937/en/

Safety Insurance Group, Inc. Office of Investor Relations

877-951-2522 InvestorRelations@SafetyInsurance.com

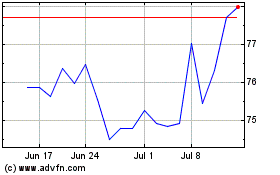

Safety Insurance (NASDAQ:SAFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

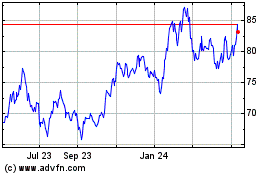

Safety Insurance (NASDAQ:SAFT)

Historical Stock Chart

From Apr 2023 to Apr 2024