Royal Gold, Inc. (NASDAQ: RGLD) (together with its

subsidiaries, “Royal Gold” or the “Company,” “we” or “our”) reports

net income of $23.6 million, or $0.36 per share, on revenue of

$97.6 million in its fiscal second quarter ended December 31, 2018

(“second quarter”). Second quarter reported earnings included an

income tax benefit resulting from the Company’s updated analysis of

the tax impacts attributable to H.R. 1, originally known as the Tax

Cuts and Jobs Act (the “Act”), which was partially offset by a

decrease in the fair value of equity securities.

Second Quarter Key Metrics Compared to Prior Year

Quarter:

- Revenue of $97.6 million, a decrease of

14.6%

- Operating cash flow of $58.8 million, a

decrease of 22.2%

- Volume of 79,600 GEOs,1 a decrease of

11.3%

- Dividends paid of $16.4 million, an

increase of 4.3%

- Average price of $1,226 per gold ounce,

a decrease of 3.8%

______________________

1 Gold Equivalent Ounces (“GEOs”) are calculated as revenue

divided by the average gold price for the same period. GEOs net of

stream payments were 64,800 in the second quarter, compared to

74,100 in the prior second quarter.

“Our second quarter consolidated operating performance was

consistent with our guidance,” commented Tony Jensen, President and

CEO. “We were pleased to see several positive developments in our

portfolio during the quarter, including good operating performance

at Mount Milligan despite water supply challenges, continued

improvement in production levels at Rainy River, and the start of

commercial production at the Pyrite Leach Project at Peñasquito. As

we look forward in calendar 2019, we expect to see continued

improvement at Rainy River and further positive news with respect

to resolving water supply issues at Mount Milligan.”

“We also took our first step toward realizing value for our

equity interest in the Peak Gold Project (“Peak Gold”) near Tok,

Alaska,” Mr. Jensen continued. “We believe that Peak Gold is a very

attractive opportunity for an operating company that can bring

additional talent to advance the project towards production. Royal

Gold will remain committed to the project over the long term

through our existing royalty interests, and our considerations for

any potential transfer of ownership will include a commitment to

advance the project as a priority while respecting best practices

for responsible development.”

Recent Developments

Mount Milligan

At the Mount Milligan mine, Centerra Gold Inc. (“Centerra”)

reported that there were sufficient water resources in the fourth

calendar quarter of 2018 to enable the mill facility to run at a

higher than anticipated throughput rate, allowing the operation to

achieve the upper end of gold and copper production guidance for

the 2018 calendar year. Calendar year 2018 gold production was

194,993 ounces compared to the guidance range of 175,000 to 195,000

ounces, and copper production was 47.1 million pounds compared to

the guidance range of 40 million to 47 million pounds. During the

fourth quarter of calendar 2018, production from Mount Milligan was

60,271 ounces of gold and 11.8 million pounds of copper.

For calendar year 2019, Centerra expects mill throughput at

Mount Milligan to be reduced during the remainder of the winter

season to properly manage the water balance until the water flow

increases in the spring. Once the spring melt has commenced,

typically in April, Centerra expects mill throughput levels to

return to full capacity. In the second half of calendar 2019,

Centerra expects to achieve an average throughput of approximately

55,000 tonnes per calendar day. For the full calendar year,

Centerra expects Mount Milligan’s payable gold production to be in

the range of 155,000 to 175,000 ounces, and payable copper

production to be in the range of 65 to 75 million pounds.

With respect to water sourcing and permitting activities at

Mount Milligan, Centerra reports that permit applications are in

process to allow the mine to draw additional flow during the spring

melt period for the next three years from each of Philip Lake,

Rainbow Creek and Meadows Creek. This additional water would be

stored in the tailings storage facility for use during the

remainder of the year, which Centerra expects to be sufficient to

allow operations to continue at a rate of 55,000 tonnes per

calendar day. Centerra also reports that it is completing an

inventory of regional water sources to identify other potential

long-term water sources that could provide additional water through

to the end of the mine life.

Rainy River

Improved operating performance at the Rainy River mine, owned

and operated by New Gold Inc. (“New Gold”), continued during the

fourth calendar quarter of 2018. Quarterly gold production was

77,202 ounces, a 39% increase over the prior quarter due mainly to

higher grade, recovery and throughput rate. Mill processing reached

a run rate of 25,835 tonnes per operating day, the first full

quarter in which the mill averaged a daily run rate above the

target 24,000 tonnes per day, and the average throughput was 20,558

tonnes per calendar day at an 80% availability. New Gold expects to

replace the ball mill trunnion during the first calendar quarter of

2019 and that recoveries will continue to improve throughout the

calendar year.

New Gold also announced that the underground development plan at

Rainy River was deferred to 2020, and that it will review

alternative underground mining scenarios during calendar 2019 with

the overall objective of reducing capital requirements and

improving the return on investment for the underground portion of

the mine.

Adviser Retained to Assist with Peak Gold Project

Royal Gold retained Scotia Capital Inc. (“Scotia”) to assist in

identifying parties interested in advancing Peak Gold. We own a 40%

indirect equity interest in Peak Gold, held through our wholly

owned subsidiary Royal Alaska, LLC, and 809,744 common shares (or

approximately 12.7%) of Contango ORE, Inc. (“CORE”), our joint

venture partner. In addition to the ownership interests in Peak

Gold and CORE equity, the Company also has the right to sell up to

20% of CORE’s aggregate membership interest in the joint venture

(for a total sale of up to 60% of the joint venture membership

interest) and holds two net smelter return royalties on the Peak

Gold land package.

Second Quarter 2019 Overview

Second quarter revenue was $97.6 million compared to $114.3

million in the prior year quarter, with stream revenue totaling

$67.7 million and royalty revenue totaling $29.9 million. The

decrease in total revenue for the second quarter compared to the

prior year quarter was due to lower average gold, silver and copper

prices, as well as lower overall sales and production. Lower gold

stream sales from Andacollo and Pueblo Viejo were partially offset

by higher gold and copper sales from Mount Milligan and initial

contributions from Rainy River, while a decrease in royalty revenue

was due to lower production at Peñasquito and Cortez.

Second quarter cost of sales was approximately

$18.2 million, compared to $19.9 million in the prior

year quarter. The decrease was primarily due to lower gold sales

from Andacollo. Cost of sales is specific to the Company’s stream

agreements and is the result of the purchase of gold, silver and

copper for a cash payment.

General and administrative expenses decreased to

$7.4 million in the second quarter from $9.6 million

during the prior year quarter. The decrease during the current

period was primarily due to a decrease in legal costs related to

the settlement of the Voisey’s Bay royalty calculation dispute

during the first quarter of fiscal 2019.

Depreciation, depletion and amortization expense decreased

to $38.8 million in the second quarter from $42.0

million in the prior year quarter. The decrease was primarily

attributable to a decrease in gold sales at Andacollo and Pueblo

Viejo, partially offset by an increase in metal sales at Mount

Milligan and Rainy River.

On July 1, 2018, the Company adopted new Accounting Standards

Update guidance which impacts how changes in fair value of equity

securities are recognized at each reporting period. As a result,

for the three months ended December 31, 2018, the Company

recognized a loss of $3.6 million on changes in fair value of

equity securities related to the holdings in CORE and Rubicon

Minerals Corporation. The new guidance could increase earnings

volatility in the future.

The Company recognized a second quarter income tax benefit of

$2.1 million, compared to an expense of $48.4 million during

the prior year quarter. The effective tax rate for the second

quarter was (10.3)% compared to 148.5% for the prior year quarter.

The lower than expected effective tax rate is due to approximately

$6.0 million of discrete tax items recorded in the quarter

attributable to true-ups made after completing the Company’s

analysis of the Act and consideration of recently-issued U.S.

Treasury and IRS guidance. The Company does not anticipate future

material changes due to evolving guidance; however, many aspects of

the law remain unclear and further regulatory guidance could impact

the Company’s effective tax rate.

At December 31, 2018, the Company had current assets of

$203.7 million compared to current liabilities of

$37.2 million, resulting in working capital of

$166.5 million. This compares to current assets of

$125.8 million and current liabilities of $51.4 million

at June 30, 2018, resulting in working capital of $74.4

million.

During the second quarter, liquidity needs were met from

$79.4 million in net revenue and available cash resources. As

of December 31, 2018, the Company had no amounts

outstanding and the full $1 billion available under its revolving

credit facility. Working capital, combined with the Company’s

undrawn revolving credit facility, resulted in approximately $1.2

billion of total liquidity at December 31, 2018.

Property Highlights

A summary of second quarter and historical production reported

by operators of the Company’s stream and royalty properties can be

found on Tables 1 and 2. Calendar year 2018 operator production

estimates for certain properties in which the Company has interests

compared to actual production at those properties through December

31, 2018 can be found on Table 3. Results of the streaming business

for the second quarter, compared to the prior year quarter, can be

found on Table 4. Highlights at certain of the Company’s principal

producing and development properties during the second quarter,

compared to the prior year quarter, are detailed in the Quarterly

Report on Form 10-Q.

CORPORATE PROFILE

Royal Gold is a precious metals stream and royalty company

engaged in the acquisition and management of precious metal

streams, royalties and similar production-based interests. As of

December 31, 2018, the Company owns interests on 191 properties on

five continents, including interests on 41 producing mines and 17

development stage projects. Royal Gold is publicly traded on the

Nasdaq Global Select Market under the symbol “RGLD.” The Company’s

website is located at www.royalgold.com.

Note: Management’s conference call reviewing the second

quarter results will be held on Thursday, February 7, 2019, at noon

Eastern Time (10:00 a.m. Mountain Time). The call will be webcast

and archived on the Company’s website for a limited time.

Second Quarter Earnings Call

Information:

Dial-In Numbers: 855-209-8260 (U.S.); toll

free 855-669-9657 (Canada); toll free 412-542-4106 (International)

Conference Title: Royal Gold Webcast URL:

www.royalgold.com under Investors, Events

& Presentations

Cautionary “Safe Harbor” Statement Under the Private

Securities Litigation Reform Act of 1995: With the exception of

historical matters, the matters discussed in this press release are

forward-looking statements that involve risks and uncertainties

that could cause actual results to differ materially from

projections or estimates contained herein. Such forward-looking

statements include statements about solid quarterly results; future

production contributions from Peñasquito, Mount Milligan and Rainy

River; expectations for continued improvement at Rainy River and

positive water supply developments at Mount Milligan; the value to

be realized from the Company’s interests in Peak Gold and CORE

common shares following a strategic review process; the belief that

Peak Gold is an attractive opportunity for an operating company;

calendar year 2019 mill throughput, water availability and total

payable gold and copper production from Mount Milligan; the impact,

if any, on Mount Milligan of Centerra’s water permit applications,

whether or not granted, and its regional water source inventory;

New Gold’s expectations for improved mill recoveries and the impact

of its review of underground mining scenarios; changes in taxes and

tax rates resulting from future tax legislation and regulatory

guidance; and operators’ estimated and actual production for

calendar year 2018, 2019 and future years, and their estimates of

reserves and mineralized material. Net gold and metal reserves

attributable to Royal Gold’s stream, royalty and other interests

are subject to certain assumptions and, like reserves, do not

reflect actual ounces that will be produced. Like any stream,

royalty or similar interest on a non-producing or

not-yet-in-development project, our interests on development

projects are subject to certain risks, such as the ability of the

operators to bring the projects into production and operate in

accordance with their feasibility studies and mine plans, and the

ability of Royal Gold to make accurate assumptions regarding

valuation and timing and amount of payments. In addition, many of

our interests are subject to risks associated with conducting

business in a foreign country, including application of foreign

laws to contract and other disputes, foreign environmental laws and

enforcement and uncertain political and economic environments.

Factors that could cause actual results to differ materially from

projections include, among others, precious metals, copper and

nickel prices; performance of and production at the Company's

stream and royalty properties; the ability of operators to finance

project construction to completion and bring projects into

production as expected, including development stage mining

properties, mine and mill expansion projects and other development

and construction projects; operators’ delays in securing or

inability to secure or maintain necessary governmental permits;

decisions and activities of the operators of the Company's stream

and royalty properties; unanticipated grade, environmental,

geological, seismic, metallurgical, processing, liquidity or other

problems the operators of the Company’s stream and royalty

properties may encounter; operators’ inability to access sufficient

raw materials, water or power; changes in operators’ project

parameters as plans continue to be refined; changes in estimates of

reserves and mineralization by the operators of the Company’s

stream and royalty properties; contests to the Company’s stream and

royalty interests and title and other defects in the properties

where the Company holds stream and royalty interests; errors or

disputes in calculating stream deliveries and royalty payments, or

deliveries or payments not made in accordance with stream and

royalty agreements; economic and market conditions; changes in laws

governing the Company and its stream and royalty interests or the

operators of the properties subject to such interests, and other

subsequent events; as well as other factors described in the

Company's Annual Report on Form 10-K, Quarterly Reports on Form

10-Q, and other filings with the Securities and Exchange

Commission. Most of these factors are beyond the Company’s ability

to predict or control. The Company disclaims any obligation to

update any forward-looking statement made herein. Readers are

cautioned not to put undue reliance on forward-looking

statements.

Statement Regarding Third-Party Information: Certain

information provided in this press release, including production

estimates for calendar 2019, has been provided to us by the

operators of the relevant properties or is publicly available

information filed by these operators with applicable securities

regulatory bodies, including the Securities and Exchange

Commission. Royal Gold has not verified, and is not in a position

to verify, and expressly disclaims any responsibility for the

accuracy, completeness or fairness of such third-party information

and refers the reader to the public reports filed by the operators

for information regarding those properties.

TABLE 1

Second Quarter Fiscal 2019

Revenue and Operators’ Reported

Production for Principal Stream and Royalty Interests

(In thousands, except reported

production in oz. and lbs.)

Three Months Ended Three Months Ended

December 31, 2018 December 31, 2017

Reported Reported

Stream/Royalty Metal(s)

Revenue Production1

Revenue Production1

Stream:

Mount Milligan $ 28,169 $

21,632 Gold 17,700 oz. 12,600 oz. Copper 2.4 Mlbs. 1.8 Mlbs.

Pueblo Viejo $ 18,230 $ 26,355 Gold 8,900 oz. 14,500 oz. Silver

509,500 oz. 469,600 oz. Wassa and Prestea Gold $ 9,550 7,800 oz. $

8,629 6,800 oz. Andacollo Gold $ 7,635 6,200 oz. $ 21,601 17,000

oz. Other $ 4,095 $ 1,070 Gold 2,900 oz. 800 oz. Silver

36,000 oz. N/A Total stream revenue $ 67,679 $

79,287

Royalty:

Peñasquito $ 4,660 $ 6,190 Gold 53,400 oz. 71,100 oz. Silver

5.0 Moz. 5.1 Moz. Lead 36.1 Mlbs. 33.4 Mlbs. Zinc 83.1 Mlbs. 94.4

Mlbs. Cortez Gold $ 2,335 19,900 oz. $ 2,934 25,000 oz. Other

Various $ 22,918 N/A $ 25,937 N/A Total royalty revenue $ 29,913 $

35,061

Total Revenue $ 97,592 $

114,348

Six Months Ended Six Months Ended

December 31, 2018 December 31, 2017

Reported Reported Stream/Royalty

Metal(s) Revenue

Production1 Revenue

Production1 Stream:

Pueblo Viejo $ 37,717 $ 51,758 Gold 18,100 oz. 27,400 oz.

Silver 1.0 Moz. 1.0 Moz. Mount Milligan $ 37,015 $ 53,584 Gold

23,300 oz. 31,300 oz. Copper 3.2 Mlbs. 4.4 Mlbs. Andacollo Gold $

35,378 28,900 oz. $ 33,938 26,700 oz. Wassa and Prestea Gold $

17,611 14,400 oz. $ 17,699 13,900 oz. Other $ 9,995 $ 1,070 Gold

7,400 oz. 800 oz. Silver 67,500 oz. N/A

Total stream revenue $ 137,716 $ 158,049

Royalty:

Peñasquito $ 8,297 $

13,986 Gold 103,700 oz. 205,100 oz. Silver 9.2 Moz. 11.0 Moz. Lead

65.9 Mlbs. 69.6 Mlbs. Zinc 147.3 Mlbs. 186.8 Mlbs. Cortez Gold $

2,939 26,900 oz. $ 5,922 54,900 oz. Other Various $ 48,633 N/A $

48,867 N/A Total royalty revenue $ 59,869 $ 68,775

Total

revenue $ 197,585 $ 226,824

TABLE 2

Operators’ Historical

Production

Property Operator

Stream/Royalty Reported Production For The

Quarter Ended1

Metal(s) Dec. 31,

2018 Sep. 30, 2018 Jun.

30, 2018 Mar. 31, 2018

Dec. 31, 2017 Stream:

Mount Milligan Centerra 35% of payable gold

Gold 17,700 oz.

5,500 oz. 20,700 oz.

25,800 oz. 12,600 oz.

18.75% of payable copper

Copper 2.4 Mlbs. 0.8

Mlbs. 1.6 Mlbs. 4.3 Mlbs.

1.8 Mlbs. Pueblo Viejo Barrick (60%) 7.5% of

gold produced up to 990,000 ounces; 3.75% therafter

Gold 8,900 oz. 9,200 oz.

13,200 oz. 8,500 oz.

14,500 oz.

75% of payable silver up to 50 million ounces; 37.5%

therafter Silver 509,500 oz.

540,200 oz. 616,300 oz.

260,800 oz. 469,600 oz.

Andacollo Teck 100% of gold produced

Gold 6,200 oz.

22,700 oz. 12,400 oz.

5,400 oz. 17,000 oz. Wassa and Prestea

Golden Star 10.5% of gold produced up

to 240,000 ounces; 5.5% therafter Gold

7,800 oz. 6,500 oz. 2,800

oz. 6,300 oz. 6,800

oz.

Royalty:

Peñasquito Goldcorp 2.0% NSR

Gold

53,400 oz. 50,300 oz.

79,600 oz. 91,200 oz.

71,100 oz. Silver 5.0 Moz.

4.2 Moz. 5.0 Moz.

5.0 Moz. 5.1 Moz. Lead

36.1 Mlbs. 29.9 Mlbs.

26.6 Mlbs. 26.0 Mlbs.

33.4 Mlbs.

Zinc 83.1 Mlbs.

64.2 Mlbs. 73.7 Mlbs.

88.0 Mlbs. 94.4 Mlbs. Cortez

Barrick GSR1 and GSR2, GSR3, NVR1

Gold 19,900 oz. 7,000

oz. 3,900 oz. 18,900

oz. 25,000 oz.

FOOTNOTES

Tables 1 and 2

1 Reported production relates to the amount of metal sales

that are subject to the Company’s stream and royalty interests for

the stated period, as reported to the Company by operators of the

mines. 2 Individually, no stream or royalty included within the

“Other” category contributed greater than 5% of the Company’s total

revenue for either period, except Rainy River for the six months

ended December 31, 2018. The “Other” category for streams is the

Rainy River gold and silver stream. 3 The gold stream percentage at

Wassa and Prestea increased to 10.5% from 9.25%, effective January

1, 2018.

TABLE 3

Calendar 2018 Operator’s Production

Estimate vs Actual Production

Calendar 2018 Operator's Production Calendar 2018

Operator's Production Estimate1

Actual2,3 Gold Silver

Base Metals Gold

Silver Base Metals

Stream/Royalty (oz.)

(oz.) (lbs.) (oz.)

(oz.) (lbs.)

Stream:

Andacollo4 66,700

59,600

Mount Milligan5 175,000 - 195,000

195,000

Copper

40 - 47 million

47.1 million Pueblo

Viejo6 575,000 - 590,000 Not provided

581,000 Not provided

Wassa and Prestea7 225,000 - 235,000

224,900

Royalty:

Cortez GSR1 48,300

44,600

Cortez GSR2

2,200

5,200

Cortez GSR3 50,500

49,800

Cortez NVR1

31,600

36,600

Peñasquito8 310,000 Not provided

220,000 14.1 million

Lead

160 million

82.5 million Zinc

300 million

225.9 million 1 Production estimates received from the

operators are for calendar 2018. There can be no assurance that

production estimates received from the operators will be achieved.

Please refer to the cautionary language regarding forward-looking

statements and the statement regarding third party information

contained in this press release, as well as the Risk Factors

identified in Part I, Item 1A, of the Company’s Fiscal 2018 Form

10-K for information regarding factors that could affect actual

results. 2 Actual production figures shown are from the operators

and cover the period January 1, 2018 through December 31, 2018,

except for Peñasquito which covers the period from January 1, 2018

through September 30, 2018. 3 Actual production figures for Cortez

are based on information provided to the Company by Barrick, and

actual production figures for Andacollo, Mount Milligan, Pueblo

Viejo, Peñasquito (gold) and Wassa and Prestea are the publicly

reported figures of the operators of those properties. 4 The

estimated and actual production figures shown for Andacollo are

contained gold in concentrate. 5 The estimated and actual

production figures shown for Mount Milligan are payable gold and

copper in concentrate. 6 The estimated and actual production

figures shown for Pueblo Viejo are payable gold in doré and

represent Barrick’s 60% interest gold produced from Pueblo Viejo.

The operator did not provide estimated silver production. 7 The

estimated gold production figures shown for Wassa and Prestea are

payable gold in concentrate and doré. 8 The estimated and actual

gold production figures shown for Peñasquito are payable gold in

concentrate and doré. The estimated and actual lead and zinc

production figures shown are payable lead and zinc from

concentrate. The operator did not provide estimated silver

production and the actual silver production figure shown is payable

silver in concentrate and doré.

TABLE 4

Stream Summary

Three Months Ended Three Months Ended As

of As of December 31, 2018 December 31,

2017 December 31, 2018 June 30, 2018 Gold

Stream Purchases (oz.) Sales (oz.)

Purchases (oz.) Sales (oz.)

Inventory (oz.) Inventory (oz.) Andacollo 10,700

6,200 13,500 17,000 4,500 7,400 Pueblo Viejo 10,400 8,900 12,600

14,500 10,400 9,200 Mount Milligan 10,300 17,700 17,700 12,700 —

300 Wassa and Prestea 4,700 7,900 6,000 6,800 700 3,900 Rainy River

4,500 2,900 1,000 800 1,600 800 Total 40,600 43,600 50,800 51,800

17,200 21,600

Three Months Ended Three Months

Ended As of As of December 31, 2018

December 31, 2017 December 31, 2018 June 30,

2018 Silver Stream Purchases (oz.) Sales

(oz.) Purchases (oz.) Sales (oz.) Inventory

(oz.) Inventory (oz.) Pueblo Viejo 469,000 509,500

260,200 469,600 469,000 540,200 Rainy River 41,700 36,000 11,900 —

41,700 32,300 Total 510,700 545,500 272,100 469,600 510,700 572,500

Three Months Ended Three Months Ended As

of As of December 31, 2018 December 31,

2017 December 31, 2018 June 30, 2018 Copper

Stream Purchases (Mlbs.) Sales (Mlbs.)

Purchases (Mlbs.) Sales (Mlbs.) Inventory

(Mlbs.) Inventory (Mlbs.) Mount Milligan 2.5 2.4 2.7 1.8

0.9 —

Six Months Ended Six Months

Ended As of As of December 31, 2018

December 31, 2017 December 31, 2018 June 30,

2018 Gold Stream Purchases (oz.) Sales

(oz.) Purchases (oz.) Sales (oz.) Inventory

(oz.) Inventory (oz.) Andacollo 26,000 28,900 26,500

26,700 4,500 7,400 Mount Milligan 23,000 23,300 36,400 31,300 — 300

Pueblo Viejo 19,300 18,100 23,100 27,400 10,400 9,200 Wassa and

Prestea 11,200 14,300 13,400 13,900 700 3,900 Rainy River 8,100

7,400 1,000 800 1,600 800 Total 87,600 92,000 100,400 100,100

17,200 21,600

Six Months Ended Six Months

Ended As of As of December 31, 2018

December 31, 2017 December 31, 2018 June 30,

2018 Silver Stream Purchases (oz.) Sales

(oz.) Purchases (oz.) Sales (oz.) Inventory

(oz.) Inventory (oz.) Pueblo Viejo 978,400 1,049,700

730,200 1,006,200 469,000 540,200 Rainy River 76,900 67,400 11,900

— 41,700 32,300 Total 1,055,300 1,117,100 742,100 1,006,200 510,700

572,500

Six Months Ended Six Months Ended

As of As of December 31, 2018 December 31,

2017 December 31, 2018 June 30, 2018 Copper

Stream Purchases (Mlbs.) Sales (Mlbs.)

Purchases (Mlbs.) Sales (Mlbs.) Inventory

(Mlbs.) Inventory (Mlbs.) Mount Milligan 4.2 3.2 5.3 4.4

0.9 —

ROYAL GOLD, INC.

Consolidated Balance Sheets

(Unaudited, in thousands except share

data)

December 31, 2018 June 30, 2018

ASSETS Cash and

equivalents $ 156,536 $ 88,750 Royalty receivables 25,659 26,356

Income tax receivable 12,793 40 Stream inventory 7,954 9,311

Prepaid expenses and other 793 1,350

Total current assets 203,735 125,807 Stream and royalty interests,

net 2,419,908 2,501,117 Other assets 51,463

55,092 Total assets $ 2,675,106 $ 2,682,016

LIABILITIES Accounts payable $ 2,291 $ 9,090 Dividends

payable 17,359 16,375 Income tax payable 10,739 18,253 Withholding

taxes payable 2,348 3,254 Other current liabilities 4,439

4,411 Total current liabilities 37,176 51,383

Debt 358,897 351,027 Deferred tax liabilities 90,700 91,147

Uncertain tax positions 35,590 33,394 Other long-term liabilities

5,773 13,796 Total liabilities

528,136 540,747 Commitments and contingencies

EQUITY Preferred stock, $.01 par value, 10,000,000 shares

authorized; and 0 shares issued — — Common stock, $.01 par value,

200,000,000 shares authorized; and 65,396,339 and 65,360,041 shares

outstanding, respectively 654 654 Additional paid-in capital

2,197,254 2,192,612 Accumulated other comprehensive loss - (1,201 )

Accumulated losses (86,238 ) (89,898 ) Total Royal

Gold stockholders’ equity 2,111,670 2,102,167 Non-controlling

interests 35,300 39,102 Total equity

2,146,970 2,141,269 Total liabilities

and equity $ 2,675,106 $ 2,682,016

ROYAL GOLD, INC.

Consolidated Statements of Operations and

Comprehensive Income

(Unaudited, in thousands except for per

share data)

Three Months Ended Six Months Ended December 31, December

31, December 31, December 31, 2018 2017 2018

2017 Revenue $ 97,592 $ 114,348 $ 197,585 $ 226,824 Costs

and expenses Cost of sales 18,162 19,863 34,689 40,282 General and

administrative 7,423 9,555 17,349 16,455 Production taxes 909 602

2,201 1,145 Exploration costs 842 1,358 5,204 4,561 Depreciation,

depletion and amortization 38,807 42,008

81,358 81,701 Total costs and

expenses 66,143 73,386 140,801

144,144 Operating income 31,449 40,962

56,784 82,680 Fair value changes in equity securities (3,631

) — (5,099 ) — Interest and other income 487 645 590 1,634 Interest

and other expense (7,410 ) (9,034 ) (15,287 )

(17,651 ) Income before income taxes 20,895 32,573 36,988

66,663 Income tax expense 2,148 (48,360

) (1,967 ) (55,904 ) Net income (loss) 23,043 (15,787

) 35,021 10,759 Net loss attributable to non-controlling interests

543 1,022 3,575

3,105 Net income (loss) attributable to Royal Gold common

stockholders $ 23,586 $ (14,765 ) $ 38,596 $ 13,864

Net income (loss) $ 23,043 $ (15,787 ) $ 35,021 $

10,759 Adjustments to comprehensive income (loss), net of tax

Unrealized change in market value of available-for-sale securities

— (390 ) — (193 )

Comprehensive income (loss) 23,043 (16,177 ) 35,021 10,566

Comprehensive loss attributable to non-controlling interests

543 1,022 3,575 3,105

Comprehensive income (loss) attributable to Royal Gold

stockholders $ 23,586 $ (15,155 ) $ 38,596 $ 13,671

Net income (loss) per share available to Royal Gold

common stockholders: Basic earnings (loss) per share $ 0.36

$ (0.23 ) $ 0.59 $ 0.21 Basic weighted average shares

outstanding 65,395,457 65,306,766

65,385,161 65,271,131 Diluted earnings

(loss) per share $ 0.36 $ (0.23 ) $ 0.59 $ 0.21

Diluted weighted average shares outstanding

65,473,400 65,306,766 65,485,423

65,460,430 Cash dividends declared per common share $

0.265 $ 0.25 $ 0.515 $ 0.49

ROYAL GOLD, INC.

Consolidated Statements of Cash Flows

(Unaudited, in thousands)

Three Months Ended Six Months Ended December 31,

December 31, December 31, December 31, 2018 2017 2018

2017 Cash flows from operating activities: Net income (loss)

$ 23,043 $ (15,787 ) $ 35,021 $ 10,759 Adjustments to reconcile net

income (loss) to net cash provided by operating activities:

Depreciation, depletion and amortization 38,807 42,008 81,358

81,701 Amortization of debt discount and issuance costs 3,961 3,734

7,864 7,413 Non-cash employee stock compensation expense 1,625

2,021 4,070 4,395 Fair value changes in equity securities 3,631 —

5,099 — Deferred tax expense (benefit) 1,374 29,685 (307 ) 28,958

Other — 65 — (158 ) Changes in assets and liabilities: Royalty

receivables (553 ) (206 ) 697 (2,399 ) Stream inventory 2,057 435

1,356 524 Income tax receivable (6,412 ) (1,343 ) (12,753 ) (5,197

) Prepaid expenses and other assets 1,244 1,326 2,305 (328 )

Accounts payable (2,966 ) (673 ) (7,026 ) (1,658 ) Income tax

payable 2,727 3,410 (7,514 ) 9,445 Withholding taxes payable (203 )

(11 ) (906 ) 26 Uncertain tax positions (1,069 ) 2,067 2,197 4,560

Other liabilities (8,435 ) 8,894 (7,993

) 9,193 Net cash provided by operating activities $

58,831 $ 75,625 $ 103,468 $ 147,234

Cash flows from investing activities: Acquisition of stream

and royalty interests (52 ) 5 (55 ) — Purchase of equity securities

(3,569 ) — (3,569 ) — Other 34 (194 )

(87 ) (94 ) Net cash used in investing activities $ (3,587 )

$ (189 ) $ (3,711 ) $ (94 ) Cash flows from financing

activities: Repayment of revolving credit facility — (50,000 ) —

(100,000 ) Net payments from issuance of common stock (245 ) (12 )

(2,217 ) (3,541 ) Common stock dividends (16,378 ) (15,709 )

(32,754 ) (31,391 ) Contributions from non-controlling interest

2,790 — 2,790 — Other (1,953 ) 22 210

77 Net cash used in financing activities $

(15,786 ) $ (65,699 ) $ (31,971 ) $ (134,855 ) Net increase in cash

and equivalents 39,458 9,737 67,786 12,285 Cash and equivalents at

beginning of period 117,078 88,395

88,750 85,847 Cash and equivalents at

end of period $ 156,536 $ 98,132 $ 156,536 $

98,132

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190206005630/en/

Royal GoldAlistair BakerDirector, Business

Development(720) 554-6995

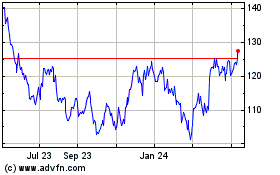

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Apr 2023 to Apr 2024