Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

September 06 2023 - 4:49PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

(Rule

13d-101)

INFORMATION

TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO

§ 240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

§

240.13d-2(a)

(Amendment

No. 17)1

Rockwell

Medical, Inc.

(Name

of Issuer)

Common

Stock, par value 0.0001 per share

(Title

of Class of Securities)

774374102

(CUSIP

Number)

DAVID

S. RICHMONd

richmond

brothers, Inc.

3568

Wildwood Avenue

Jackson,

Michigan 49202

(517)

435-4040

GUY

P. LANDER

CARTER

LEDYARD & MILBURN LLP

28 LIBERTY STREET, NEW YORK, NY 10005

212-732-3200

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

July 11, 2023

(Date

of Event Which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §

240.13d-7 for other parties to whom copies are to be sent.

| 1 | The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page. |

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

CUSIP

No. 774374102

| 1 |

|

NAME

OF REPORTING PERSON

Richmond

Brothers, Inc. |

|

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

(b) ☐ |

| 3 |

|

SEC

USE ONLY

|

|

| 4 |

|

SOURCE

OF FUNDS

OO |

|

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

MICHIGAN |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE

VOTING POWER

17,100 |

| |

8 |

|

SHARED

VOTING POWER

-

0 - |

| |

9 |

|

SOLE

DISPOSITIVE VOTING POWER

17,100 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

38,410 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

55,510 |

|

| 12 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

Less than 1% |

|

| 14 |

|

TYPE

OF REPORTING PERSON

IA,

CO |

|

CUSIP

No. 774374102

| 1 |

|

NAME

OF REPORTING PERSON

RBI

Private Investment I, LLC |

|

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

(b) ☐ |

| 3 |

|

SEC

USE ONLY

|

|

| 4 |

|

SOURCE

OF FUNDS

WC |

|

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

DELAWARE |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE

VOTING POWER

5,894 |

| |

8 |

|

SHARED

VOTING POWER

-

0 - |

| |

9 |

|

SOLE

DISPOSITIVE VOTING POWER

5,894 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

-

0 - |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,894 |

|

| 12 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

Less

than 1% |

|

| 14 |

|

TYPE

OF REPORTING PERSON

OO |

|

CUSIP

No. 774374102

| 1 |

|

NAME

OF REPORTING PERSON

RBI

Private Investment II, LLC |

|

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

(b) ☐ |

| 3 |

|

SEC

USE ONLY

|

|

| 4 |

|

SOURCE

OF FUNDS

WC |

|

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

DELAWARE |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE

VOTING POWER

3,498 |

| |

8 |

|

SHARED

VOTING POWER

-

0 - |

| |

9 |

|

SOLE

DISPOSITIVE VOTING POWER

3,498 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

-

0 - |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,498 |

|

| 12 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

Less

than 1% |

|

| 14 |

|

TYPE

OF REPORTING PERSON

OO |

|

CUSIP

No. 774374102

| 1 |

|

NAME

OF REPORTING PERSON

The

RBI Opportunities Fund, LLC |

|

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

(b) ☐ |

| 3 |

|

SEC

USE ONLY

|

|

| 4 |

|

SOURCE

OF FUNDS

WC |

|

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

DELAWARE |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE

VOTING POWER

- 0 - |

| |

8 |

|

SHARED

VOTING POWER

-

0 - |

| |

9 |

|

SOLE

DISPOSITIVE VOTING POWER

- 0 - |

| |

10 |

|

SHARED

DISPOSITIVE POWER

-

0 - |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

- 0 - |

|

| 12 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0% |

|

| 14 |

|

TYPE

OF REPORTING PERSON

OO |

|

CUSIP

No. 774374102

| 1 |

|

NAME

OF REPORTING PERSON

The

RBI Opportunities Fund II, LLC |

|

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

(b) ☐ |

| 3 |

|

SEC

USE ONLY

|

|

| 4 |

|

SOURCE

OF FUNDS

WC |

|

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

DELAWARE |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE

VOTING POWER

- 0 - |

| |

8 |

|

SHARED

VOTING POWER

-

0 - |

| |

9 |

|

SOLE

DISPOSITIVE VOTING POWER

- 0 - |

| |

10 |

|

SHARED

DISPOSITIVE POWER

-

0 - |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

- 0 - |

|

| 12 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0% |

|

| 14 |

|

TYPE

OF REPORTING PERSON

OO |

|

CUSIP

No. 774374102

| 1 |

|

NAME

OF REPORTING PERSON

RBI

PI Manager, LLC |

|

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

(b) ☐ |

| 3 |

|

SEC

USE ONLY

|

|

| 4 |

|

SOURCE

OF FUNDS

AF |

|

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

DELAWARE |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE

VOTING POWER

9,392 |

| |

8 |

|

SHARED

VOTING POWER

-

0 - |

| |

9 |

|

SOLE

DISPOSITIVE VOTING POWER

9,392 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

-

0 - |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

9,392 |

|

| 12 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

Less than 1% |

|

| 14 |

|

TYPE

OF REPORTING PERSON

OO |

|

CUSIP

No. 774374102

| 1 |

|

NAME

OF REPORTING PERSON

Richmond

Brothers 401(k) Profit Sharing Plan |

|

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

(b) ☐ |

| 3 |

|

SEC

USE ONLY

|

|

| 4 |

|

SOURCE

OF FUNDS

WC |

|

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

MICHIGAN |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE

VOTING POWER

10,558 |

| |

8 |

|

SHARED

VOTING POWER

-

0 - |

| |

9 |

|

SOLE

DISPOSITIVE VOTING POWER

10,558 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

-

0 - |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

10,558 |

|

| 12 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

Less

than 1% |

|

| 14 |

|

TYPE

OF REPORTING PERSON

EP |

|

CUSIP

No. 774374102

| 1 |

|

NAME

OF REPORTING PERSON

David

S. Richmond |

|

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

(b) ☐ |

| 3 |

|

SEC

USE ONLY

|

|

| 4 |

|

SOURCE

OF FUNDS

OO,

PF |

|

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

USA |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE

VOTING POWER

13,544 |

| |

8 |

|

SHARED

VOTING POWER

28,332 |

| |

9 |

|

SOLE

DISPOSITIVE VOTING POWER

13,544 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

70,894 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

84,438 |

|

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

Less than 1% |

|

| 14 |

|

TYPE OF REPORTING PERSON

IN |

|

CUSIP

No. 774374102

| 1 |

|

NAME

OF REPORTING PERSON

Matthew

J. Curfman |

|

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☒

(b) ☐ |

| 3 |

|

SEC

USE ONLY

|

|

| 4 |

|

SOURCE

OF FUNDS

OO,

PF |

|

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

USA |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE

VOTING POWER

-

0 - |

| |

8 |

|

SHARED

VOTING POWER

27,668 |

| |

9 |

|

SOLE

DISPOSITIVE VOTING POWER

-

0 - |

| |

10 |

|

SHARED

DISPOSITIVE POWER

66,068 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

66,068 |

|

| 12 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

Less

than 1% |

|

| 14 |

|

TYPE

OF REPORTING PERSON

IN |

|

CUSIP

No. 774374102

The following constitutes Amendment

No. 17 to the Schedule 13D filed by the undersigned (“Amendment No. 17”). This Amendment No. 17 amends the Schedule 13D Item

5. As set forth below, as a result of the Issuer issuing approximately 14,000,000 Shares, each of the Reporting Persons ceased to be the

beneficial owner of more than five percent of the Shares on July 11, 2023. The filing of this Amendment No. 17 represents the final amendment

to the Schedule 13D and constitutes an exit filing for the Reporting Persons.

| Item 1. |

Security and Issuer. |

No material change.

| Item 2. |

Identity and Background. |

No material change.

| Item 3. |

Source and Amount of Funds or Other Consideration. |

Not applicable.

| Item 4. |

Purpose of Transaction. |

No

material change.

| Item 5. |

Interest in Securities of the Issuer. |

Item 5 to Schedule 13D is hereby

amended and restated, in pertinent part, as follows:

The aggregate percentage of

Shares reported owned by each person named herein is based upon 28,489,663 Shares outstanding as of July 11, 2023, which is the total

number of Shares outstanding based on information contained in the Issuer’s Form 8-K as filed with the Securities and Exchange Commission

on July 11, 2023. The Reporting Persons beneficially own those Shares as follows

| |

(a) |

As of the date hereof, Richmond Brothers directly beneficially owned 17,100 Shares, and an additional 38,410 Shares were held in the Separately Managed Accounts. As the investment advisor to the Separately Managed Accounts, Richmond Brothers may also be deemed the beneficial owner of the 55,510 Shares held in the Separately Managed Accounts. |

Percentage: Less than 1%

| |

(b) |

1. Sole power to vote or direct vote: 17,100

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 17,100

4. Shared power to dispose or direct the disposition: 38,410 |

| |

(a) |

As of the date hereof, RBI PI beneficially owned 5,894 Shares. |

Percentage: Less than 1%

| |

(b) |

1. Sole power to vote or direct vote: 5,894

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 5,894

4. Shared power to dispose or direct the disposition: 0 |

CUSIP

No. 774374102

| |

(a) |

As

of the date hereof, RBI PII beneficially owned 3,498 Shares. |

Percentage:

Less than 1%

| |

(b) |

1.

Sole power to vote or direct vote: 3,498

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 3,498

4. Shared power to dispose or direct the disposition: 0 |

| |

(a) |

As of the date hereof, RBI Opportunities beneficially owned 0 Shares. |

Percentage: 0%

| |

(b) |

1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 0 |

| |

(a) |

As of the date hereof, RBI Opportunities II beneficially owned 0 Shares. |

Percentage: 0%

| |

(b) |

1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 0 |

CUSIP

No. 774374102

| |

(a) |

As the manager of RBI PI, RBI PII, RBI Opportunities and RBI Opportunities II, RBI Manager may be deemed the beneficial owner of the (i) 5,894 Shares owned by RBI PI, (ii) 3,498 Shares owned by RBI PII, (iii) 0 Shares beneficially owned by RBI Opportunities and (iv) 0 Shares beneficially owned by RBI Opportunities II. |

Percentage: Less than 1%

| |

(b) |

1. Sole power to vote or direct vote: 9,392

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 9,392

4. Shared power to dispose or direct the disposition: 0 |

| |

(a) |

As of the date hereof, the RBI Plan beneficially owned 10,558 Shares. |

Percentage: Less than 1%

| |

(b) |

1. Sole power to vote or direct vote: 10,558

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 10,558

4. Shared power to dispose or direct the disposition: 0 |

| |

(a) |

As of the date hereof, Mr. Richmond beneficially owned 84,438 Shares, including 674 Shares directly owned by his spouse. As the Chairman of Richmond Brothers, manager of RBI Manager and a trustee of the RBI Plan, Mr. Richmond may also be deemed the beneficial owner of the (i) 17,100 Shares owned directly by Richmond Brothers, (ii) 38,410 Shares held in the Separately Managed Accounts, (iii) 5,894 Shares owned by RBI PI, (iv) 3,498 Shares owned by RBI PII, (v) 0 Shares beneficially owned by RBI Opportunities, (vi) 0 Shares beneficially owned by RBI Opportunities II and (vii) 10,558 Shares owned by the RBI Plan. |

Percentage: Less than 1%

| |

(b) |

1. Sole power to vote or direct vote: 13,544

2. Shared power to vote or direct vote: 28,332

3. Sole power to dispose or direct the disposition: 13,544

4. Shared power to dispose or direct the disposition: 70,894 |

CUSIP

No. 774374102

| |

(a) |

As of the date hereof, Mr. Curfman beneficially owned 66,068 Shares. As the President of Richmond Brothers and a trustee of the RBI Plan, Mr. Curfman may also be deemed the beneficial owner of the (i) 17,100 Shares owned directly by Richmond Brothers, (ii) 38,410 Shares held in the Separately Managed Accounts and (iii) 10,558 Shares owned by the RBI Plan. |

Percentage: Less than 1%

| |

(b) |

1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 27,668

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 66,068 |

The

filing of this Schedule 13D shall not be deemed an admission that the Reporting Persons are, for purposes of Section 13(d) of the Securities

Exchange Act of 1934, as amended, the beneficial owners of any Shares he or it does not directly own. Each of the Reporting Persons specifically

disclaims beneficial ownership of the Shares reported herein that he or it does not directly own.

| |

(c) |

The

transactions in the securities of the Issuer by the Reporting Persons during the past sixty days are set forth in Schedule A and

are incorporated herein by reference. Such transactions were effected in the open market. |

| |

(e) |

Each of the Reporting Persons ceased to be the beneficial owner of more than five percent of the Shares on July 11, 2023. |

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Not applicable.

| Item 7. |

Material to be Filed as Exhibits. |

No material change.

CUSIP

No. 774374102

SIGNATURES

After

reasonable inquiry and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement

is true, complete and correct.

Dated: September 6, 2023

| |

Richmond Brothers, Inc. |

| |

|

|

| |

By: |

/s/ David S. Richmond |

| |

|

Name: |

David S. Richmond |

| |

|

Title: |

Chairman |

| |

RBI Private Investment I, LLC |

| |

|

| |

By: |

RBI PI Manager, LLC |

| |

|

Manager |

| |

|

|

| |

By: |

/s/ David S. Richmond |

| |

|

Name: |

David S. Richmond |

| |

|

Title: |

Manager |

| |

RBI Private Investment II, LLC |

| |

|

| |

By: |

RBI PI Manager, LLC |

| |

|

Manager |

| |

|

|

| |

By: |

/s/ David S. Richmond |

| |

|

Name: |

David S. Richmond |

| |

|

Title: |

Manager |

| |

The RBI Opportunities Fund, LLC |

| |

|

| |

By: |

RBI PI Manager, LLC |

| |

|

Manager |

| |

|

|

| |

By: |

/s/ David S. Richmond |

| |

|

Name: |

David S. Richmond |

| |

|

Title: |

Manager |

CUSIP

No. 774374102

| |

The RBI Opportunities Fund II, LLC |

| |

|

| |

By: |

RBI PI Manager, LLC |

| |

|

Manager |

| |

|

|

| |

By: |

/s/ David S. Richmond |

| |

|

Name: |

David S. Richmond |

| |

|

Title: |

Manager |

| |

By: |

RBI PI Manager, LLC |

| |

|

|

| |

By: |

/s/ David S. Richmond |

| |

|

Name: |

David S. Richmond |

| |

|

Title: |

Manager |

| |

By: |

Richmond Brothers 401(k) Profit Sharing Plan |

| |

|

|

| |

By: |

/s/ David S. Richmond |

| |

|

Name: |

David S. Richmond |

| |

|

Title: |

Trustee |

| |

/s/ David S. Richmond |

| |

David S. Richmond |

| |

|

| |

/s/ Matthew J. Curfman |

| |

Matthew J. Curfman |

CUSIP

No. 774374102

SCHEDULE

A

Transactions

in the Securities of the Issuer During the past sixty days

Richmond Brothers, Inc.

(Through the Separately Managed Accounts)

| Action | |

Price ($) | | |

Quantity | | |

Net Amnt | | |

Trade Date |

| Sell | |

| 2.39000 | | |

| -84.00000 | | |

| 200.76 | | |

08/29/2023 |

| Sell | |

| 2.36230 | | |

| -271.50000 | | |

| 636.40 | | |

08/28/2023 |

| Sell | |

| 2.41130 | | |

| -275.00000 | | |

| 663.10 | | |

08/23/2023 |

| Sell | |

| 2.26970 | | |

| -143.00000 | | |

| 319.62 | | |

08/22/2023 |

| Sell | |

| 2.26040 | | |

| -271.50000 | | |

| 608.74 | | |

08/21/2023 |

| Sell | |

| 2.25000 | | |

| -302.00000 | | |

| 679.49 | | |

08/18/2023 |

| Sell | |

| 2.21000 | | |

| -242.00000 | | |

| 534.81 | | |

08/17/2023 |

| Sell | |

| 2.20810 | | |

| -104.00000 | | |

| 229.64 | | |

08/17/2023 |

| Sell | |

| 2.20370 | | |

| -146.00000 | | |

| 321.74 | | |

08/17/2023 |

| Sell | |

| 2.81010 | | |

| -155.00000 | | |

| 430.62 | | |

08/09/2023 |

| Sell | |

| 3.11430 | | |

| -59.00000 | | |

| 183.74 | | |

08/08/2023 |

| Sell | |

| 3.11500 | | |

| -23.00000 | | |

| 71.65 | | |

08/08/2023 |

| Sell | |

| 3.11140 | | |

| -14.00000 | | |

| 43.56 | | |

08/08/2023 |

| Sell | |

| 3.01840 | | |

| -79.00000 | | |

| 238.45 | | |

08/07/2023 |

| Sell | |

| 3.01500 | | |

| -198.00000 | | |

| 596.97 | | |

08/07/2023 |

| Sell | |

| 3.05690 | | |

| -151.00000 | | |

| 461.59 | | |

08/07/2023 |

| Sell | |

| 3.32000 | | |

| -108.00000 | | |

| 353.61 | | |

08/03/2023 |

| Sell | |

| 3.40000 | | |

| -453.00000 | | |

| 1,540.18 | | |

08/03/2023 |

| Sell | |

| 3.32170 | | |

| -116.00000 | | |

| 380.37 | | |

08/03/2023 |

| Sell | |

| 3.62230 | | |

| -27.00000 | | |

| 97.80 | | |

07/26/2023 |

| Sell | |

| 3.49050 | | |

| -467.00000 | | |

| 1,630.04 | | |

07/25/2023 |

| Sell | |

| 3.63170 | | |

| -2.00000 | | |

| 7.26 | | |

07/24/2023 |

| Sell | |

| 4.03610 | | |

| -433.00000 | | |

| 1,747.61 | | |

07/17/2023 |

| Sell | |

| 5.85500 | | |

| -404.00000 | | |

| 2,365.40 | | |

07/10/2023 |

| Sell | |

| 5.87030 | | |

| -239.00000 | | |

| 1,402.98 | | |

07/10/2023 |

| Sell | |

| 5.88010 | | |

| -338.00000 | | |

| 1,987.45 | | |

07/10/2023 |

| Sell | |

| 5.81000 | | |

| -82.00000 | | |

| 476.42 | | |

07/10/2023 |

| Sell | |

| 5.73000 | | |

| -6.00000 | | |

| 34.38 | | |

07/10/2023 |

| Sell | |

| 5.77800 | | |

| -380.00000 | | |

| 2,195.62 | | |

07/10/2023 |

| Sell | |

| 5.87000 | | |

| -272.00000 | | |

| 1,596.62 | | |

07/10/2023 |

| Sell | |

| 5.68000 | | |

| -310.00000 | | |

| 1,755.83 | | |

07/07/2023 |

| Sell | |

| 5.29270 | | |

| -201.00000 | | |

| 1,063.82 | | |

07/06/2023 |

| Sell | |

| 5.32230 | | |

| -27.00000 | | |

| 143.70 | | |

07/06/2023 |

Richmond

Brothers 401(K) profit sharing plaN

| Action | |

Price ($) | | |

Quantity | | |

Net Amnt | | |

Trade Date |

| Buy | |

| 2.46000 | | |

| 73.00000 | | |

| -179.58 | | |

08/23/2023 |

17

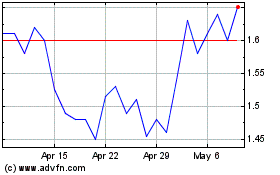

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Apr 2024 to May 2024

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From May 2023 to May 2024