0001041024

false

0001041024

2023-07-10

2023-07-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or

15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): July 10, 2023

Rockwell

Medical, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

000-23661 |

38-3317208 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

30142

S. Wixom Road, Wixom, Michigan

48393

(Address of principal executive offices, including

zip code)

(248) 960-9009

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of Each Class | |

Trading

Symbol | |

Name of Each exchange on which registered |

| Common Stock, par value $0.0001 | |

RMTI | |

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

Asset Purchase Agreement

On July 10, 2023, Rockwell Medical, Inc.

(the “Company”) executed and consummated the transactions contemplated by an Asset Purchase Agreement (the “Purchase

Agreement”) with Evoqua Water Technologies LLC, a Delaware limited liability company (“Evoqua”).

Subject to the terms and conditions of the Purchase

Agreement, at the closing of the transaction (the “Closing”), the Company purchased from Evoqua substantially all of the assets

of Evoqua that are related to its business of manufacturing, marketing, distributing, and selling hemodialysis concentrates products in

powder and liquid form (the “Concentrates Business”) for an aggregate purchase price, subject to certain adjustments pursuant

to the terms of the Purchase Agreement, of $11,000,000 in cash paid at Closing and equal annual installments of $2,500,000 payable on

each of the first and second anniversaries of the Closing.

The Purchase Agreement contains customary representations,

warranties and covenants of the parties. The Company has agreed that, from and following the Closing, the Company will not solicit certain

employees of Evoqua for a specified period of time.

The Company, on the one hand, and Evoqua, on the

other hand, have agreed to indemnify each other from and against losses the respective parties may incur arising out of breaches of the

other party’s representations, warranties and covenants contained in the Purchase Agreement and for certain other liabilities, subject

to specified survival limitations and other customary exceptions and limitations.

The foregoing description of the Purchase Agreement

and the transactions contemplated thereby does not purport to be complete and is subject to, and qualified in its entirety by, the full

text of the Purchase Agreement, which the Company intends to file with its quarterly report on Form 10-Q for the quarter ended June 30,

2023.

The Purchase Agreement will be filed with the quarterly report on Form 10-Q

for the quarter ended June 30, 2023 in order to provide information regarding its terms. It is not intended to provide any other

factual information about the Company, Evoqua, or their respective owners, subsidiaries and affiliates. The representations, warranties

and covenants contained in the Purchase Agreement (i) were made solely for purposes of the Purchase Agreement and as of the date

of the Purchase Agreement, (ii) were solely for the benefit of the parties to the Purchase Agreement, (iii) may be subject to

qualifications and limitations agreed upon by the parties to the Purchase Agreement, including being qualified by confidential disclosures

made for the purposes of allocating contractual risk among the parties to the Purchase Agreement instead of establishing these matters

as facts and (iv) may be subject to standards of materiality applicable to the contracting parties that differ from those applicable

to security holders of the Company. Investors and security holders of the Company should not rely on the representations, warranties and

covenants or any description thereof as characterizations of the actual state of facts or condition of the Company. Moreover, information

concerning the subject matter of the representations, warranties and covenants may change after the date of the Purchase Agreement, which

subsequent information may or may not be fully reflected in public disclosures by the Company.

Warrant Exercise and Reload Warrants

On July 10, 2023, the Company entered into a letter agreement

(the “Letter Agreement”) with Armistice Capital Master Fund Ltd. (“Armistice”), which held a warrant (the “Prior

Warrant”) to purchase 9,900,990 shares of common stock of the Company (the “Common Stock”) with an exercise price of

$1.39 per share, offering Armistice the opportunity to exercise the Prior Warrant for cash, provided the Prior Warrant was exercised for

cash on or prior to 5:00 P.M. Eastern Time on July 10, 2028 (the “End Date”). In addition, Armistice would receive

a “reload” warrant (the “Reload Warrant”) to purchase 3,750,000 shares of Common Stock with an exercise price

of $5.13 per share, the closing price as reported by the Nasdaq Capital Market on July 7, 2023. The terms of the Reload Warrant and

Letter Agreement provide for customary resale registration rights. The Letter Agreement also provides that for a period of 45 days after

the issuance of the Reload Warrant, the Company’s may not sell shares of Common Stock pursuant to its sales agreement with Cantor

Fitzgerald & Co., dated as of April 8, 2022, at price per share less than $6.25. The Reload Warrant may be exercised at

all times prior to the fifty-fourth month anniversary of its issuance date. The Prior Warrant and the Reload Warrant both provide that

a holder (together with its affiliates) may not exercise any portion of the Prior Warrant or the Reload Warrant to the extent that the

holder would own more than 9.99% of the Company’s outstanding Common Stock immediately after exercise, as such percentage ownership

is determined in accordance with the terms of the such warrant. To the extent the exercise of the Prior Warrant would result in Armistice

holding more than 9.99% of the Company’s outstanding Common Stock, such shares of Common Stock in excess of 9.99% will be held in

abeyance. The Letter Agreement amended the Prior Warrant to extend the expiration date thereof to one year following the original expiration

date set forth therein.

Armistice exercised the Prior Warrant on July 10, 2023, and the

Company received gross proceeds of approximately $13.8 million from the exercise of the Prior Warrant as a result of such exercise and

pursuant to the terms of the Letter Agreement. As of July 10, 2023, following the exercise of the Prior Warrant, the Company had

28,489,663 shares of common stock outstanding. The Letter Agreement and Reload Warrant were entered into pursuant to Section 4(a)(2) of

the Securities Act of 1933, as amended, and Regulation D as promulgated thereunder.

The

foregoing summaries of the Reload Warrant and the Letter Agreement are subject to, and qualified in their entirety by reference to, the

Reload Warrant and the Letter Agreement, which the Company intends to file with its quarterly report on Form 10-Q for the

quarter ended June 30, 2023.

| Item 2.02 | Results of Operations and Financial Condition. |

To the extent required by Form 8-K, the disclosures in Item 8.01

below are incorporated herein by reference.

| Item 3.02 | Unregistered Sales of Equity Securities. |

To the extent required by Form 8-K, the disclosures in Item 1.01

above are incorporated herein by reference.

| Item 3.03 | Material Modifications to Rights of Security Holders. |

To the extent required by Form 8-K, the disclosures in Item 1.01

above are incorporated herein by reference.

| Item 7.01 | Regulation FD Disclosure. |

On July 11, 2023, the Company issued a press release announcing

its entry into the Purchase Agreement, a copy of which is furnished as Exhibit 99.2 to this Form 8-K and incorporated herein

by reference.

As provided in General Instruction B.2 of Form 8-K, the information

in this Item 7.01, including Exhibit 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, nor shall such information or Exhibit 99.2 be deemed to be incorporated by reference in any filing under the

Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

For the twelve months ended December 31, 2022, the Company’s

net loss per share on a basic and fully-diluted basis would have been $(1.31), assuming the exercise in full of all outstanding pre-funded

warrants.

The Company expects its revenue for the three months ended June 30,

2023 to be between $18.0 million and $18.3 million. Revenue for the second quarter of 2023 was lower than the first quarter of 2023 due

to several factors including timing of purchasing and shipping orders. In June 2023, approximately $1.0 million of hemodialysis concentrates

shipped but will not be booked as revenue until the third quarter of 2023. In addition, the Company began a route optimization plan to

reduce its distribution expenses, which altered purchasing timing for certain customers. However, this expense reduction plan should not

affect overall revenue.

As of June 30, 2023, the Company had approximately

$15.1 million in cash and cash equivalents. After the Closing, the Company had approximately $15.3 million in cash and cash

equivalents.

The Company's estimated preliminary financial results for the three

months ended June 30, 2023 are subject to the completion of the Company’s financial closing procedures and any adjustments

that may result from the completion of the quarterly review of the Company’s consolidated financial statements. As a result, such

preliminary estimates may differ from the actual results that will be reflected in the Company’s consolidated financial statements

for the quarter when they are completed and publicly disclosed.

For the trailing twelve months ended April 30, 2023, the revenue

and EBITDA for Evoqua’s hemodialysis business was approximately $18 million and over $3.3 million, respectively.

Forward-Looking Statements

This Form 8-K contains “forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Generally, the words “anticipate,” “estimate,” “expect,” “project,”

“intend,” “plan,” "contemplate," "predict," “forecast,” “likely,”

“believe,” “target,” “will,” “could,” “would,” “should,” "potential,"

"may" and similar expressions or their negative, may, but are not necessary to, identify forward-looking statements. Such

forward-looking statements, including those regarding the timing, and consummation and anticipated benefits of the transaction described

herein and the Company’s estimated preliminary financial results for the three months ended June 30, 2023, involve risks and

uncertainties. The Company’s experience and results may differ materially from the experience and results anticipated

in such statements. The accuracy of such statements is subject to a number of risks, uncertainties and assumptions including, but are

not limited to, the following factors: litigation relating to the transactions discussed in this Form 8-K; risks that the proposed

transaction with Evoqua disrupts the current plans or operations of the Company; the ability of the Company to retain and

hire key personnel; competitive responses to the proposed transaction with Evoqua; unexpected costs, charges or expenses resulting from

the transaction with Evoqua; potential adverse reactions or changes to relationships with customers, suppliers, distributors and other

business partners resulting from the announcement or completion of the transaction with Evoqua; the Company’s ability to achieve

the synergies expected from the transaction with Evoqua, as well as delays, challenges and expenses associated with integrating the Concentrates

Business; the impact of overall industry and general economic conditions, including inflation, interest rates and related monetary policy

by governments in response to inflation; geopolitical events, and regulatory, economic and other risks associated therewith; and continued

uncertainty resulting from broader macroeconomic conditions. Other factors that might cause such a difference include those discussed

in Evoqua Water Technologies Corp.’s and the Company’s filings with the SEC, which include their Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

All forward-looking statements made herein are based on information

currently available to the Company as of the date of this Report. The Company undertakes no obligation to publicly

update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required

by law.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ROCKWELL MEDICAL, INC. |

| |

|

|

| Date: July 11, 2023 |

By: |

/s/ Mark Strobeck |

| |

|

Mark Strobeck |

| |

|

Chief Executive Officer |

Exhibit 99.1

Rockwell Medical Acquires Hemodialysis Concentrates

Business from Evoqua Water Technologies

Adds profitable business that generates approximately

$18 million in annual revenue and will add over $3.3 million in annual EBITDA for Rockwell Medical.

Significantly expands Rockwell Medical's

geographic footprint, customer base, and product offerings; Adds fully automated manufacturing know-how and capacity.

Rockwell Medical increases its 2023 revenue

guidance to between $82.0 million and $86.0 million.

Conference call and webcast will be held

today at 8:00 am ET

Wixom,

Michigan, July 11, 2023 – Rockwell Medical, Inc. (the "Company") (Nasdaq: RMTI), a

healthcare company that develops, manufactures, commercializes, and distributes a portfolio of hemodialysis products to dialysis providers

worldwide, today announced that the Company acquired the hemodialysis concentrates business from Evoqua Water Technologies ("Evoqua")

for $11 million up front in cash plus two milestone payments of $2.5 million each at 12- and 24-months from the closing of the transaction. Rockwell Medical purchased

this business through its cash balance. At closing of the transaction, Rockwell Medical had approximately $15.3 million in cash and cash

equivalents.

Under the terms of the agreement, Rockwell Medical acquired Evoqua's

concentrates business which includes all contracts, all intellectual property, all U.S. Food and Drug Administration 510(k) clearances,

and all assets primarily associated with, and related to, Evoqua's concentrates business nationwide including liquid and powder bicarbonate

and liquid acid.

Evoqua's operations are fully automated and afford Rockwell the valuable

opportunity to manufacture its hemodialysis concentrates products at a lower cost and add significant capacity to the Company's production

line. By assuming responsibility for Evoqua’s concentrates customer contracts, Rockwell will further expand its footprint in the

United States and assume a larger market share of the already growing hemodialysis concentrates market. Additionally, the Company will

now become the leading supplier of liquid bicarbonate products to dialysis centers in the United States.

"We are

excited by this acquisition and believe that the transaction is transformative for our business," said Mark

Strobeck, Ph.D., President and CEO of Rockwell Medical. "Evoqua's hemodialysis concentrates business is profitable, complementary

to Rockwell's business, and immediately accretive to our top and bottom line. Additionally, this transaction enhances Rockwell's presence

in the hemodialysis marketplace and offers us technological solutions that will enable us to automate our processes and add significant

capacity to our production line. This is the first of many opportunities that we plan to pursue so that we can serve more clinics and

in turn, more patients."

Conference Call and Webcast Details

Rockwell Medical will host a live conference

call and webcast today at 8:00am ET to discuss this acquisition. A replay will be available online for

thirty (30) days.

Date: Tuesday,

July 11, 2023

Time: 8:00am

ET

Live

Number: (888) 210-2212 // (International) 1 (646) 960-0390

Conference

Call ID: 9066444

Webcast

and Replay: www.RockwellMed.com/Acquisition

About Rockwell

Medical

Rockwell Medical, Inc. (Nasdaq: RMTI) is a healthcare company that develops, manufactures,

commercializes, and distributes a portfolio of hemodialysis products for dialysis providers worldwide. Rockwell Medical's mission is to

provide dialysis clinics and the patients they serve with the highest quality products supported by the best customer service in the industry.

Rockwell is focused on innovative, long-term growth strategies that enhance its products, its processes, and its people, enabling the

Company to deliver exceptional value to the healthcare system and provide a positive impact on the lives of hemodialysis patients. Hemodialysis

is the most common form of end-stage kidney disease treatment and is usually performed at freestanding outpatient dialysis centers, at

hospital-based outpatient centers, at skilled nursing facilities, or in a patient’s home. Rockwell

Medical's products are vital to vulnerable patients with end-stage kidney disease, and the Company is relentless in providing unmatched

reliability and customer service. Rockwell Medical is the second largest supplier of acid and bicarbonate concentrates for dialysis patients

in the United States and has the vision of becoming the leading global supplier of hemodialysis concentrates. Certified as a Great Place

to Work® in 2023, Rockwell Medical is Driven to Deliver Life-Sustaining

Dialysis SolutionsTM. For more information, visit www.RockwellMed.com.

Forward-Looking Statements

Certain statements in this press

release may constitute "forward-looking statements" within the meaning of the federal securities laws. Words such as, "may,"

"might," "will," "should," "believe," "expect," "anticipate," "estimate,"

"continue," "could," "can," "would," "develop," "plan," "potential,"

"predict," "forecast," "project," "intend," "look forward to," "remain confident,"

“are determined,” “are on track,” “are resolute in our vision,” "work to," "drive towards,"

“focused on,” or the negative of these terms, and similar expressions, or statements regarding intent, belief, or current

expectations, are forward looking statements. There can be no assurance that Rockwell Medical will: achieve its projected total revenue

and gross profit for 2023; achieve projected synergies and associated EBITDA addition; be able to manufacture its concentrates at a lower

cost; attain and retain a lager share of the hemodialysis concentrates market; be successful in evaluating and pursuing potential business

development opportunities. While Rockwell Medical believes these forward-looking statements are reasonable, undue reliance should

not be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These

forward-looking statements are based upon current estimates and assumptions and are subject to various risks and uncertainties (including,

without limitation, those set forth in Rockwell Medical's SEC filings), many of which are beyond our control and subject to change.

Actual results could be materially different. Risks and uncertainties include, but are not limited to those risks more fully discussed

in the "Risk Factors" section of our Annual Report on Form 10-K for the year ended December 31, 2022, as such

description may be amended or updated in any future reports we file with the SEC. Rockwell Medical expressly disclaims

any obligation to update our forward-looking statements, except as may be required by law.

# # #

CONTACT:

Heather R. Hunter

SVP, Chief Corporate Affairs Officer

(248) 432-1362

IR@RockwellMed.com

v3.23.2

Cover

|

Jul. 10, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 10, 2023

|

| Entity File Number |

000-23661

|

| Entity Registrant Name |

Rockwell

Medical, Inc.

|

| Entity Central Index Key |

0001041024

|

| Entity Tax Identification Number |

38-3317208

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

30142

S. Wixom Road

|

| Entity Address, City or Town |

Wixom, Michigan

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48393

|

| City Area Code |

248

|

| Local Phone Number |

960-9009

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001

|

| Trading Symbol |

RMTI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

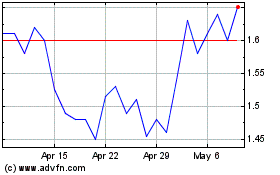

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Apr 2024 to May 2024

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From May 2023 to May 2024