false

0001812727

0001812727

2023-11-14

2023-11-14

0001812727

RELI:CommonStock0.086ParValuePerShareMember

2023-11-14

2023-11-14

0001812727

RELI:SeriesWarrantsToPurchaseSharesOfCommonStockParValue0.086PerShareMember

2023-11-14

2023-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest reported): November 14, 2023

Reliance

Global Group, Inc.

(Exact

name of registrant as specified in its charter)

| Florida |

|

001-40020 |

|

46-3390293 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

Number) |

300

Blvd. of the Americas, Suite 105, Lakewood, NJ 08701

(Address

of principal executive offices)

(732)

380-4600

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2.)

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CF$ 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on which Registered |

| Common Stock, $0.086 par

value per share |

|

RELI |

|

The Nasdaq Capital Market |

| Series A Warrants to purchase

shares of Common Stock, par value $0.086 per share |

|

RELIW |

|

The Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

5.07. |

Submission

of Matters to a Vote of Security Holders. |

On

November 14, 2023, Reliance Global Group, Inc. (the “Company”) held its 2023 virtual annual meeting of stockholders to vote

on the following matters:

1.

Election of Directors

Each

of the following five nominees was elected to the Company’s Board of Directors, in accordance with the voting results listed below,

to serve for a term of one year, until the next annual meeting of stockholders and until their successors have been duly elected and

have qualified.

| Nominee |

|

For |

|

Against |

|

Abstain |

|

Broker

Non-Votes |

| Ezra

Beyman |

|

1,058,822 |

|

27,687 |

|

3,286 |

|

296,904 |

| Alex

Blumenfrucht |

|

1,058,225 |

|

28,244 |

|

3,326 |

|

296,904 |

| Scott

Korman |

|

1,054,964 |

|

31,525 |

|

3,306 |

|

296,904 |

| Ben

Fruchtzweig |

|

1,049,067 |

|

31,283 |

|

9,445 |

|

296,904 |

| Sheldon

Brickman |

|

1,048,781 |

|

37,689 |

|

3,325 |

|

296,904 |

2.

Articles Amendment to Increase in Authorized Shares

Stockholders

voted to approve the amendment of the Company’s articles of incorporation, as amended, to increase the total number of authorized

shares of our common stock, $0.086 par value per share, from 133,333,333 shares to 2,000,000,000 shares, in accordance with the voting

results listed below:

| For |

|

Against |

|

Abstain |

|

Broker

Non-Votes |

| 1,198,993 |

|

184,858 |

|

2,848 |

|

- |

3.

2023 Equity Incentive Plan

Stockholders

voted to approve the 2023 Equity Incentive Plan, in accordance with the voting results listed below:

| For |

|

Against |

|

Abstain |

|

Broker

Non-Votes |

| 1,034,875 |

|

50,117 |

|

4,803 |

|

296,904 |

In

addition, on November 14, 2023, the Company held a virtual special meeting of the Series A warrant holders to vote on the following matter:

1.

Reduction in Exercise Price of Series A Warrants

Series

A warrant holders voted to approve the amendment of the Warrant Agent Agreement, dated February 8, 2021, by and between the Company and

VStock Transfer, LLC (the “Warrant Agreement”), pursuant to which the Series A warrants were issued, in order to reduce the

exercise price of the Series A warrants issued and outstanding under the Warrant Agreement from the stated $6.60 (post-reverse split

effective exercise price of $99.00) per share to $6.13 per share, subject to adjustment, in accordance with the voting results listed

below:

| For |

|

Against |

|

Abstain |

|

Broker

Non-Votes |

| 853,640 |

|

257,515 |

|

265 |

|

- |

Item

7.01. Regulation FD Disclosure.

On

November 16, 2023, the Company issued a press release announcing the branding consolidation of its agencies under the RELI Exchange umbrella. A copy of the press release is attached hereto

as Exhibit 99.1 and incorporated herein by reference.

The

information included in this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or

the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information set forth under this

Item 7.01 shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required

to be disclosed solely to satisfy the requirements of Regulation FD.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Reliance

Global Group, Inc. |

| |

|

|

| Dated:

November 16, 2023 |

By: |

/s/

Ezra Beyman |

| |

|

Ezra

Beyman |

| |

|

Chief

Executive Officer |

Exhibit

99.1

Reliance

Global Group Embraces ‘OneFirm’ Approach for Future Growth

Consolidates

All Reliance Owned Agencies Under the RELI Exchange Brand

Anticipated

Benefits Include Enhanced Efficiencies, Cross Talent Utilization, and Cross-Selling

Reliance

is Positioned for Seamless Integration of

Accretive Acquisitions and Rapid Scalability

SMIC

Now Under the RELI Exchange Umbrella

LAKEWOOD,

N.J., November 16, 2023 — Reliance Global Group, Inc. (Nasdaq: RELI; RELIW) (“Reliance”, “we”

or the “Company”), today formally announces its OneFirm vision and branding consolidation under the RELI Exchange umbrella.

Ezra

Beyman, CEO of Reliance, commented, “As we continue to grow, the Company is furthering its ‘OneFirm’

approach which brings together Reliance Global Group’s individual agencies under the single umbrella of

RELI Exchange. We’re confident this move will bring substantial benefits and efficiencies to our agents, their clients,

our investors, and the Company. OneFirm is expected to significantly enhance the Company’s market presence across the U.S.,

as Reliance Global Group’s agencies will operate under the unified brand of RELI Exchange across all business lines and

all markets. We anticipate that this will fortify our relationships with carriers, enabling us to realize more profitable commission

and bonus contracts, due to expected increases in business volume. Additionally, this platform will propel

our RELI Exchange agency partners by providing them the ability to effectively secure policies across a broad

range of insurance products and markets. Moreover, OneFirm will continue to bring the Company together as one cohesive

unit, creating cross-selling and cross talent sharing opportunities for our internal agents and agency partners. Early

financial benefits of our OneFirm platform are already evident by the Company’s 19% year-over-year increase

in revenues and the decreased operational losses by more than 21% during the first nine months of 2023, as previously

reported. Furthermore, we believe the OneFirm unified approach will position us to scale rapidly as we continue to seek out and

integrate accretive acquisitions which we believe will further broaden Reliance Global Group’s industry and market reach.”

Moshe

Fishman, Director of Insurtech and Operations, stated, “Implementing the ‘OneFirm’ strategy has begun

to yield positive results for the Company, as demonstrated in the recent 2023 third quarter business update. With the U.S. insurance

market’s vast potential, currently valued at $2.7 trillion and anticipated to grow by 26% to $3.4 trillion by 2027, we believe

the timing couldn’t be more perfect for us to adopt a comprehensive company-wide operating and branding strategy. OneFirm

positions the Company to capture a larger share of this expanding market and will provide RELI Exchange with substantial advantages,

including the ability to leverage the exceptional talent currently employed across our organization, the capability for enhanced

data access and sharing, segmentation of specialized support services, and a reduction in overall operating expenses by streamlining

operations and redeploying existing talent to revenue generating roles as and where appropriate. Our ‘OneFirm’ platform

also positions the Company well to absorb additional talent per expected industry shifts, where an increasing number of

captive agents make the move from their current roles, to seek out more profitable and lucrative opportunities

to build their businesses.”

Reliance’s Chief Financial Officer,

Joel Markovits commented, “We are super charged and excited about OneFirm and going to market collectively under RELI Exchange branding.

We expect these enhancements to increase our top and bottom-line results and we move forward with high expectations and a tenacity for

success to continue in our efforts to build stockholder value. As always, we thank our investors for their support and look forward to

accomplishing even more, in the months and years to come.”

About

Reliance Global Group, Inc.

Reliance

Global Group, Inc. (NASDAQ: RELI, RELIW) is an InsurTech pioneer, leveraging artificial intelligence (AI), and cloud-based technologies,

to transform and improve efficiencies in the insurance agency/brokerage industry. The Company’s business-to-business InsurTech

platform, RELI Exchange, provides independent insurance agencies an entire suite of business development tools, enabling them

to effectively compete with large-scale national insurance agencies, whilst reducing back-office cost and burden. The Company’s

business-to-consumer platform, 5minuteinsure.com, utilizes AI and data mining, to provide competitive online insurance quotes

within minutes to everyday consumers seeking to purchase auto, home, and life insurance. In addition, the Company operates its own portfolio

of select retail “brick and mortar” insurance agencies which are leaders and pioneers in their respective regions throughout

the United States, offering a wide variety of insurance products. Further information about the Company can be found at https://www.relianceglobalgroup.com.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995. Statements other than statements of historical facts included in this press release may constitute forward-looking

statements and are not guarantees of future performance, condition or results and involve a number of risks and uncertainties. In some

cases, forward-looking statements can be identified by terminology such as “may,” “should,” “potential,”

“continue,” “expects,” “anticipates,” “intends,” “plans,” “believes,”

“estimates,” and similar expressions and include statements such as the Company having built a best-in-class InsurTech platform,

making RELI Exchange an even more compelling value proposition and further accelerating growth of the platform, rolling out several other

services in the near future to RELI Exchange agency partners, building RELI Exchange into the largest agency partner network in the U.S.,

the Company moving in the right direction and the Company’s highly scalable business model driving significant shareholder value.

Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those

described from time to time in our filings with the Securities and Exchange Commission and elsewhere and risks as and uncertainties related

to: the Company’s ability to generate the revenue anticipated and the ability to build the RELI Exchange into the largest agency

partner network in the U.S., and the other factors described in the Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2022, as the same may be updated from time to time. The foregoing review of important factors that could cause actual events

to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included

herein and elsewhere, including the risk factors included in the Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2022, the Company’s Quarterly Reports on Form 10-Q, the Company’s Current Reports on Form 8-K and other subsequent

filings with the Securities and Exchange Commission. The Company undertakes no duty to update any forward-looking statement made herein.

All forward-looking statements speak only as of the date of this press release.

Contact:

Crescendo

Communications, LLC

Tel:

+1 (212) 671-1020

Email:

RELI@crescendo-ir.com

v3.23.3

Cover

|

Nov. 14, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 14, 2023

|

| Entity File Number |

001-40020

|

| Entity Registrant Name |

Reliance

Global Group, Inc.

|

| Entity Central Index Key |

0001812727

|

| Entity Tax Identification Number |

46-3390293

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity Address, Address Line One |

300

Blvd. of the Americas

|

| Entity Address, Address Line Two |

Suite 105

|

| Entity Address, City or Town |

Lakewood

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

08701

|

| City Area Code |

(732)

|

| Local Phone Number |

380-4600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock 0. 086 Par Value Per Share [Member] |

|

| Title of 12(b) Security |

Common Stock, $0.086 par

value per share

|

| Trading Symbol |

RELI

|

| Security Exchange Name |

NASDAQ

|

| Series Warrants To Purchase Shares Of Common Stock Par Value 0. 086 Per Share [Member] |

|

| Title of 12(b) Security |

Series A Warrants to purchase

shares of Common Stock, par value $0.086 per share

|

| Trading Symbol |

RELIW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RELI_CommonStock0.086ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RELI_SeriesWarrantsToPurchaseSharesOfCommonStockParValue0.086PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

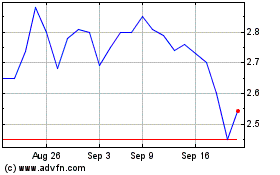

Reliance Global (NASDAQ:RELI)

Historical Stock Chart

From Apr 2024 to May 2024

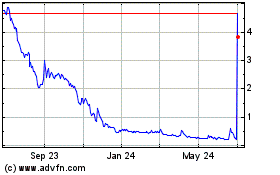

Reliance Global (NASDAQ:RELI)

Historical Stock Chart

From May 2023 to May 2024