0001774170

false

0001774170

2023-08-08

2023-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): August 8, 2023

POWERFLEET,

INC.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-39080 |

|

83-4366463 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

|

of Incorporation) |

|

File

Number) |

|

Identification

No.) |

| 123

Tice Boulevard, Woodcliff Lake, New Jersey |

|

07677 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code (201) 996-9000

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.01 per share |

|

PWFL |

|

The

Nasdaq Global Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

2.02. | Results

of Operations and Financial Condition. |

On

August 8, 2023, PowerFleet, Inc. (the “Registrant”) issued a press release regarding financial results for the fiscal quarter

ended June 30, 2023. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The

information in this report is being furnished pursuant to Item 2.02 of Form 8-K. In accordance with General Instruction B.2. of Form

8-K, the information in this report, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of

the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, except as may be expressly set forth by specific reference in

such a filing.

Forward-Looking

Statements

This

report, including Exhibit 99.1 furnished herewith, contains forward-looking statements within the meaning of federal securities laws.

Forward-looking statements include statements with respect to the Registrant’s beliefs, plans, goals, objectives, expectations,

anticipations, assumptions, estimates, intentions, and future performance, and involve known and unknown risks, uncertainties and other

factors, which may be beyond the Registrant’s control, and which may cause its actual results, performance or achievements to be

materially different from future results, performance or achievements expressed or implied by such forward-looking statements. All statements

other than statements of historical fact are statements that could be forward-looking statements. For example, forward-looking statements

include statements regarding: prospects for additional customers; potential contract values; market forecasts; projections of earnings,

revenues, synergies, accretion or other financial information; emerging new products; and plans, strategies and objectives of management

for future operations, including growing revenue, controlling operating costs, increasing production volumes and expanding business with

core customers. The risks and uncertainties referred to above include, but are not limited to, future economic and business conditions,

the loss of key customers or reduction in the purchase of products by any such customers, the failure of the market for the Registrant’s

products to continue to develop, the inability to protect the Registrant’s intellectual property, the inability to manage growth,

the effects of competition from a variety of local, regional, national and other providers of wireless solutions, and other risks detailed

from time to time in the Registrant’s filings with the Securities and Exchange Commission, including the Registrant’s most

recent annual report on Form 10-K. These risks could cause actual results to differ materially from those expressed in any forward-looking

statements made by, or on behalf of, the Registrant. Unless otherwise required by applicable law, the Registrant assumes no obligation

to update any forward-looking statements, and expressly disclaims any obligation to do so, whether as a result of new information, future

events or otherwise.

| Item 9.01. | Financial

Statements and Exhibits. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

POWERFLEET, INC. |

| |

|

|

| |

By: |

/s/

David

Wilson |

| |

Name: |

David

Wilson |

| |

Title: |

Chief

Financial Officer |

Date:

August 8, 2023

Exhibit

99.1

Powerfleet

Reports Second Quarter and First Half 2023 Financial Results

Strong

Growth in High Margin SaaS Revenues with Company Positioned for Accelerated Growth in Second Half of 2023

Second

Quarter 2023 Service Revenue was 66% of Total Revenue, up from 57% in the Prior Period, Driving an Expansion in Total Company Gross Margins

to 50% from 47%

WOODCLIFF

LAKE, NJ – August 8, 2023 – Powerfleet, Inc. (Nasdaq: PWFL), reported results for the second quarter and

six months ended June 30, 2023.

SECOND

QUARTER 2023 FINANCIAL AND OPERATIONAL HIGHLIGHTS

| ● |

Total

service revenue increased by 13% on a constant currency basis, compared to Q2 2022.

|

| |

|

| ● |

Total

service revenue increased sequentially by 3.3% on a constant currency basis, demonstrating

traction in the company’s transformation

to a SaaS centric business model.

|

| |

|

| ● |

Total

service revenue increased to 66% of total revenue, up from 57% in the prior year, driving

an expansion in gross margins to 50% from 47%.

|

| |

|

| ● |

Services

gross margin in the go forward core business (excluding Argentina, Brazil, and South Africa

business units) increased to 71% with total gross margin for the core business of 53%.

|

| |

|

| ● |

EBITDA

increased sequentially by 31% to $1.8 million versus first quarter 2023, pro forma for EBITDA

burn from the Movingdots acquisition.

|

| |

|

| ● |

Subscriber

count totaled 697,177, an increase of 3% from the prior quarter and 9% year-on-year. |

FIRST

HALF 2023 FINANCIAL HIGHLIGHTS (COMPARED TO FIRST HALF 2022)

| ● |

Transformation

into a high value sticky SaaS recurring business continues at pace in our core go forward markets with North American service revenue

growing 16% annually, complemented by service revenue in Israel growing 10% on a constant currency basis. |

| |

|

| ● |

Growth

in services revenue drove expansion in gross margin to 50% from 45% and improved gross profit by $2 million during the controlled

product to SaaS sales funnel and revenue mix transition. |

| |

|

| ● |

Improved

underlying cash generation with cash from operations increasing by $4 million. |

| |

|

| ● |

With

improved cash generation and liquidity, reinitiated paying the dividend on the convertible preferred instrument in cash versus payment

in kind (PIK) |

| |

|

| ● |

Taken

the necessary steps to reduce annual run rate expense by $4 million per year exiting third quarter. Central to commitment to ensure

Movingdots acquisition is adjusted EBITDA neutral. |

| |

|

| ● |

Released

a highly advanced, sustainability module on Unity platform, at budget and on time; supports asset electrification, and bolsters ESG

reporting requirements with net reduction of CO2 emissions. |

MANAGEMENT

COMMENTARY

“Our

transformation into a superior valued business centered on high quality, sticky, recurring SaaS revenue is reflected in our key performance

indicators,” said Powerfleet CEO Steve Towe. “While we are still relatively early in our journey, strong proof points

are now evident in the shape of our P&L, our mix of revenue and associated SaaS growth rates of 12% for the quarter and 15% for the

half of 2023 on a constant currency basis. In the first half 2023, service revenue in our strategically important North American business

grew by an impressive 16%, complemented by Israel, which was up 10% on a constant currency basis. New logo SaaS wins, centered around

our Unity platform and advanced Safety solutions, were strong in Q2, alongside service gross margins of 71% and total gross margin of

53% in our core business unit. These fundamental SaaS metrics are very strong indicators supporting our longer-term strategic business

value creation objectives.

“We

believe that all the heavy lifting transformation items we have executed over recent months have set the foundation for greater earnings

potential, a more compelling business model, and a lower cost of capital for our shareholders.”

David

Wilson, Powerfleet CFO, added: “Our Unity platform continues to track ahead of schedule, and I have no doubt that the pace

of delivery and the level of capabilities within Unity are greatly enhanced by the Movingdots acquisition. That said, the importance

of being good stewards of capital remains paramount and we have successfully executed the necessary steps to achieve our previously stated

$3 million expense reduction challenge. Additionally, we have taken actions to secure an additional $1 million in annualized expense

reductions. With $4 million of secured cost savings, we are positioned to exceed our commitment to ensure Movingdots is an adjusted EBITDA

neutral transaction exiting the third quarter.”

SECOND

QUARTER 2023 FINANCIAL RESULTS

Total

revenue was $32.1 million, compared to $34.6 million in the same year-ago period, with growth in services revenue offsetting lower product

sales.

Services

revenues totaled $21.0 million, up $1.3 million year-over-year, accounting for 66% of total revenue. On a constant currency basis, services

revenue grew by 13%, reflecting the company’s successful execution of its SaaS growth strategy.

Products

revenue was $11.0 million, or 34% of total revenue, compared to $14.8 million, or 43% of total revenue in the prior year period. Total

revenue performance reflects actively shedding low margin and non-core hardware business.

Gross

profit margin expanded to 50.0% from 46.9% in the prior year period, driven by an improved mix of high-margin services revenue versus

products revenue, deal discipline for product sales, terminating unprofitable contracts and eliminating low margin product lines.

In

line with expectations, operating expenses increased to $19.2 million from $17.8 million in the same year-ago period, with the increase

solely attributable to the Movingdots acquisition.

Net

loss attributable to common stockholders totaled $4.3 million, or $(0.12) per basic and diluted share (based on 35.6 million weighted

average shares outstanding), compared to net loss attributable to common stockholders of $1.3 million, or $(0.04) per basic and diluted

share (based on 35.4 million weighted average shares outstanding), in the same year-ago period.

Adjusted

EBITDA, a non-GAAP metric, totaled $647,000, compared to $3.3 million in the same year-ago period reflecting Adjusted EBITDA losses from

the Movingdots acquisition. See the section below titled “Non-GAAP Financial Measures” for more information about adjusted

EBITDA and its reconciliation to GAAP net income (loss).

Powerfleet

had $22.0 million in cash and cash equivalents and a working capital position of $38.3 million at quarter-end.

SIX

MONTH 2023 FINANCIAL RESULTS

Total

revenue was $64.9 million, compared to $67.8 million in the same year-ago period, with growth in services revenue offsetting lower product

sales.

Services

revenues totaled $41.5 million, up approximately $3.0 million year-over-year, accounting for 64% of total revenue. On a constant currency

basis, services revenue grew by 15%, reflecting the company’s successful execution of its SaaS growth strategy.

Products

revenue was $23.4 million, or 36% of total revenue, compared to $29.2 million, or 43% of total revenue in the prior year period. Total

revenue performance reflects actively shedding low margin and non-core business.

Gross

profit margin expanded to 50.3% from 45.2% in the prior year period, driven by an improved mix of high-margin services revenue versus

products revenue.

Net

loss attributable to common stockholders, inclusive of a $7.5 million gain on bargain purchase for Movingdots, totaled $780,000, or $0.01

per basic and diluted share (based on 35.6 million and 35.7 million weighted average shares outstanding for basic and diluted respectively),

compared to net loss attributable to common stockholders of $(5.5) million, or $(0.15) per basic and diluted share (based on 35.4 million

weighted average shares outstanding), in the same year-ago period.

Adjusted

EBITDA, a non-GAAP metric, totaled $2.0 million, compared to $2.7 million in the prior year period reflecting Adjusted EBITDA losses

from the Movingdots acquisition. See the section below titled “Non-GAAP Financial Measures” for more information about adjusted

EBITDA and its reconciliation to GAAP net income (loss).

INVESTOR

CONFERENCE CALL

Powerfleet

management will discuss these results and business outlook on a conference call today (Tuesday, August 8, 2023) at 8:30 a.m. Eastern

time (5:30 a.m. Pacific time).

Powerfleet

management will host the presentation, followed by a question-and-answer session.

Join

the live Webcast

Toll

Free Dial In: 888-506-0062

International

Dial In: 973-528-0011

Participant

Access Code: 360336

The

conference call will be available for replay here and via the investor section of the company’s website at ir.powerfleet.com.

If

you have any difficulty connecting with the conference call, please contact Powerfleet’s investor relations team at 949-574-3860.

NON-GAAP

FINANCIAL MEASURES

To

supplement its financial statements presented in accordance with Generally Accepted Accounting Principles (GAAP), Powerfleet provides

certain non-GAAP measures of financial performance. These non-GAAP measures include adjusted EBITDA and total revenue and services revenue

excluding foreign exchange effect. Reference to these non-GAAP measures should be considered in addition to results prepared under current

accounting standards, but are not a substitute for, or superior to, GAAP results. These non-GAAP measures are provided to enhance investors’

overall understanding of Powerfleet’s current financial performance. Specifically, Powerfleet believes the non-GAAP measures provide

useful information to both management and investors by excluding certain expenses, gains and losses that may not be indicative of its

core operating results and business outlook. These non-GAAP measures are not measures of financial performance or liquidity under GAAP

and, accordingly, should not be considered as an alternative to net income or cash flow from operating activities as an indicator of

operating performance or liquidity. Because Powerfleet’s method for calculating the non-GAAP measures may differ from other companies’

methods, the non-GAAP measures may not be comparable to similarly titled measures reported by other companies. Reconciliation of all

non-GAAP measures included in this press release to the nearest GAAP measures can be found in the financial tables included in this press

release.

POWERFLEET,

INC. AND SUBSIDIARIES

RECONCILIATION

OF GAAP TO ADJUSTED EBITDA FINANCIAL MEASURES

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Net loss attributable to common stockholders | |

$ | (1,334,000 | ) | |

$ | (4,274,000 | ) | |

$ | (5,458,000 | ) | |

$ | (780,000 | ) |

| Non-controlling interest | |

| 1,000 | | |

| 6,000 | | |

| 2,000 | | |

| 3,000 | |

| Preferred stock dividend and accretion | |

| 1,216,000 | | |

| 1,297,000 | | |

| 2,412,000 | | |

| 2,572,000 | |

| Interest (income) expense, net | |

| 560,000 | | |

| 457,000 | | |

| 991,000 | | |

| 974,000 | |

| Other (income) expense, net | |

| (3,000 | ) | |

| 0 | | |

| (2,000 | ) | |

| (1,000 | ) |

| Income tax (benefit) expense | |

| 40,000 | | |

| 39,000 | | |

| (663,000 | ) | |

| 436,000 | |

| Depreciation and amortization | |

| 2,044,000 | | |

| 2,267,000 | | |

| 4,133,000 | | |

| 4,500,000 | |

| Stock-based compensation | |

| 1,629,000 | | |

| 852,000 | | |

| 2,086,000 | | |

| 1,684,000 | |

| Foreign currency translation | |

| (1,349,000 | ) | |

| (362,000 | ) | |

| (1,690,000 | ) | |

| (942,000 | ) |

| Severance related expenses | |

| 468,000 | | |

| 425,000 | | |

| 847,000 | | |

| 559,000 | |

| Gain on Bargain purchase - Movingdots | |

| - | | |

| (283,000 | ) | |

| - | | |

| (7,517,000 | ) |

| Movingdots Related Expenses | |

| - | | |

| 223,000 | | |

| - | | |

| 540,000 | |

| Adjusted EBITDA | |

$ | 3,272,000 | | |

$ | 647,000 | | |

$ | 2,658,000 | | |

$ | 2,028,000 | |

ABOUT

POWERFLEET

Powerfleet

(Nasdaq: PWFL; TASE: PWFL) is a global leader of internet of things (IoT) software-as-a-service (SaaS) solutions that optimize the performance

of mobile assets and resources to unify business operations. Our data science insights and advanced modular software solutions help drive

digital transformation through our customers’ and partners’ ecosystems to help save lives, time, and money. We help connect

companies, enabling customers and their customers to realize more effective strategies and results. Powerfleet’s tenured and talented

team is at the heart of our approach to partnership and tangible success. The company is headquartered in Woodcliff Lake, New Jersey,

with our Pointer Innovation Center (PIC) in Israel and field offices around the globe. For more information, please visit www.powerfleet.com.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

press release contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements include statements

with respect to Powerfleet’s beliefs, plans, goals, objectives, expectations, anticipations, assumptions, estimates, intentions,

and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond Powerfleet’s

control, and which may cause its actual results, performance or achievements to be materially different from future results, performance

or achievements expressed or implied by such forward-looking statements. All statements other than statements of historical fact are

statements that could be forward-looking statements. For example, forward-looking statements include statements regarding prospects for

additional customers; potential contract values; market forecasts; projections of earnings, revenues, synergies, accretion, or other

financial information; emerging new products; and plans, strategies, and objectives of management for future operations, including growing

revenue, controlling operating costs, increasing production volumes, and expanding business with core customers. The risks and uncertainties

referred to above include, but are not limited to, future economic and business conditions, the ability to recognize the anticipated

benefits of the acquisition of Movingdots, the loss of key customers or reduction in the purchase of products by any such customers,

the failure of the market for Powerfleet’s products to continue to develop, the inability to protect Powerfleet’s intellectual

property, the inability to manage growth, the effects of competition from a variety of local, regional, national and other providers

of wireless solutions, and other risks detailed from time to time in Powerfleet’s filings with the Securities and Exchange Commission,

including Powerfleet’s most recent annual report on Form 10-K. These risks could cause actual results to differ materially from

those expressed in any forward-looking statements made by, or on behalf of, Powerfleet. Unless otherwise required by applicable law,

Powerfleet assumes no obligation to update the information contained in this press release, and expressly disclaims any obligation to

do so, whether a result of new information, future events, or otherwise.

Powerfleet

Investor Contact

Matt

Glover

Gateway

Group, Inc.

PWFL@gatewayir.com

(949)

574-3860

Powerfleet

Media Contact

Andrea

Hayton

Powerfleet,

Inc.

ahayton@powerfleet.com

(610)

401-1999

POWERFLEET,

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS DATA

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | |

| Revenue: | |

| | |

| | |

| | |

| |

| Products | |

$ | 14,818,000 | | |

$ | 11,012,000 | | |

$ | 29,210,000 | | |

$ | 23,416,000 | |

| Services | |

| 19,776,000 | | |

| 21,038,000 | | |

| 38,545,000 | | |

| 41,473,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Revenues | |

| 34,594,000 | | |

| 32,050,000 | | |

| 67,755,000 | | |

| 64,889,000 | |

| Cost of revenue: | |

| | | |

| | | |

| | | |

| | |

| Cost of products | |

| 11,336,000 | | |

| 8,550,000 | | |

| 23,314,000 | | |

| 17,552,000 | |

| Cost of services | |

| 7,028,000 | | |

| 7,467,000 | | |

| 13,812,000 | | |

| 14,686,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total cost of revenues: | |

| 18,364,000 | | |

| 16,017,000 | | |

| 37,126,000 | | |

| 32,238,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross Profit | |

| 16,230,000 | | |

| 16,033,000 | | |

| 30,629,000 | | |

| 32,651,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| 15,817,000 | | |

| 16,987,000 | | |

| 30,729,000 | | |

| 33,774,000 | |

| Research and development expenses | |

| 2,001,000 | | |

| 2,179,000 | | |

| 5,230,000 | | |

| 3,902,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Operating Expenses | |

| 17,818,000 | | |

| 19,166,000 | | |

| 35,959,000 | | |

| 37,676,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (1,588,000 | ) | |

| (3,133,000 | ) | |

| (5,330,000 | ) | |

| (5,025,000 | ) |

| Interest income | |

| 15,000 | | |

| 22,000 | | |

| 28,000 | | |

| 46,000 | |

| Interest expense | |

| (575,000 | ) | |

| (173,000 | ) | |

| (1,019,000 | ) | |

| (310,000 | ) |

| Gain on Bargain purchase - Movingdots | |

| - | | |

| 283,000 | | |

| - | | |

| 7,517,000 | |

| Foreign currency translation of debt | |

| 2,068,000 | | |

| - | | |

| 2,612,000 | | |

| - | |

| Other (expense) income, net | |

| 3,000 | | |

| 69,000 | | |

| 2,000 | | |

| 3,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) / income before income taxes | |

| (77,000 | ) | |

| (2,932,000 | ) | |

| (3,707,000 | ) | |

| 2,231,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax benefit (expense) | |

| (40,000 | ) | |

| (39,000 | ) | |

| 663,000 | | |

| (436,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) / income before non-controlling interest | |

| (117,000 | ) | |

| (2,971,000 | ) | |

| (3,044,000 | ) | |

| 1,795,000 | |

| Non-controlling interest | |

| (1,000 | ) | |

| (6,000 | ) | |

| (2,000 | ) | |

| (3,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) / income | |

| (118,000 | ) | |

| (2,977,000 | ) | |

| (3,046,000 | ) | |

| 1,792,000 | |

| Accretion of preferred stock | |

| (168,000 | ) | |

| (168,000 | ) | |

| (336,000 | ) | |

| (336,000 | ) |

| Preferred stock dividend | |

| (1,048,000 | ) | |

| (1,129,000 | ) | |

| (2,076,000 | ) | |

| (2,236,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) / income attributable to common stockholders | |

$ | (1,334,000 | ) | |

$ | (4,274,000 | ) | |

$ | (5,458,000 | ) | |

$ | (780,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) / income per share - basic | |

$ | (0.04 | ) | |

$ | (0.12 | ) | |

$ | (0.15 | ) | |

$ | 0.01 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) / income per share - diluted | |

$ | (0.04 | ) | |

$ | (0.12 | ) | |

$ | (0.15 | ) | |

$ | 0.01 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding - basic | |

| 35,386,000 | | |

| 35,605,000 | | |

| 35,359,000 | | |

| 35,577,000 | |

| Weighted average common shares outstanding - diluted | |

| 35,386,000 | | |

| 35,605,000 | | |

| 35,359,000 | | |

| 35,670,000 | |

POWERFLEET,

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEET DATA

| | |

As of | |

| | |

December 31, 2022 | | |

June 30, 2023 | |

| | |

| | |

(Unaudited) | |

| ASSETS | |

| | |

| |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 17,680,000 | | |

$ | 21,729,000 | |

| Restricted cash | |

| 309,000 | | |

| 309,000 | |

| Accounts receivable, net | |

| 32,493,000 | | |

| 31,318,000 | |

| Inventory, net | |

| 22,272,000 | | |

| 22,125,000 | |

| Deferred costs - current | |

| 762,000 | | |

| 338,000 | |

| Prepaid expenses and other current assets | |

| 7,709,000 | | |

| 7,298,000 | |

| Total current assets | |

| 81,225,000 | | |

| 83,117,000 | |

| | |

| | | |

| | |

| Deferred costs - less current portion | |

| - | | |

| - | |

| Fixed assets, net | |

| 9,249,000 | | |

| 10,226,000 | |

| Goodwill | |

| 83,487,000 | | |

| 83,487,000 | |

| Intangible assets, net | |

| 22,908,000 | | |

| 21,871,000 | |

| Right of use asset | |

| 7,820,000 | | |

| 6,936,000 | |

| Severance payable fund | |

| 3,760,000 | | |

| 3,566,000 | |

| Deferred tax asset | |

| 3,225,000 | | |

| 1,942,000 | |

| Other assets | |

| 5,761,000 | | |

| 6,131,000 | |

| Total assets | |

$ | 217,435,000 | | |

$ | 217,276,000 | |

| | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Short-term bank debt and current maturities of long-term debt | |

$ | 10,312,000 | | |

$ | 11,197,000 | |

| Accounts payable and accrued expenses | |

| 26,598,000 | | |

| 24,960,000 | |

| Deferred revenue - current | |

| 6,363,000 | | |

| 6,193,000 | |

| Lease liability - current | |

| 2,441,000 | | |

| 2,448,000 | |

| Total current liabilities | |

| 45,714,000 | | |

| 44,798,000 | |

| | |

| | | |

| | |

| Long-term debt - less current maturities | |

| 11,403,000 | | |

| 9,940,000 | |

| Deferred revenue - less current portion | |

| 4,390,000 | | |

| 4,582,000 | |

| Lease liability - less current portion | |

| 5,628,000 | | |

| 4,715,000 | |

| Accrued severance payable | |

| 4,365,000 | | |

| 4,284,000 | |

| Deferred tax liability | |

| 4,919,000 | | |

| 4,030,000 | |

| Other long-term liabilities | |

| 636,000 | | |

| 668,000 | |

| |

| | | |

| | |

| Total liabilities | |

| 77,055,000 | | |

| 73,017,000 | |

| |

| | | |

| | |

| MEZZANINE EQUITY | |

| | | |

| | |

| Convertible redeemable Preferred stock: Series A | |

| 57,565,000 | | |

| 59,008,000 | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Total Powerfleet, Inc. stockholders’ equity | |

| 82,737,000 | | |

| 85,188,000 | |

| Non-controlling interest | |

| 78,000 | | |

| 63,000 | |

| Total equity | |

| 82,815,000 | | |

| 85,251,000 | |

| Total liabilities and stockholders’ equity | |

$ | 217,435,000 | | |

$ | 217,276,000 | |

POWERFLEET,

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOW DATA

| | |

Six Months Ended June 30, | |

| | |

2022 | | |

2023 | |

| | |

| | |

(Unaudited) | |

| Cash flows from operating activities (net of net assets acquired): | |

| | |

| |

| Net (loss) / income | |

$ | (3,046,000 | ) | |

$ | 1,792,000 | |

| Adjustments to reconcile net loss to cash (used in) provided by operating activities: | |

| | | |

| | |

| Non-controlling interest | |

| 2,000 | | |

| 3,000 | |

| Gain on bargain purchase | |

| - | | |

| (7,517,000 | ) |

| Inventory reserve | |

| 119,000 | | |

| 375,000 | |

| Stock based compensation expense | |

| 2,086,000 | | |

| 1,684,000 | |

| Depreciation and amortization | |

| 4,133,000 | | |

| 4,498,000 | |

| Right-of-use assets, non-cash lease expense | |

| 1,382,000 | | |

| 1,318,000 | |

| Bad debt expense | |

| (364,000 | ) | |

| 826,000 | |

| Deferred taxes | |

| (663,000 | ) | |

| 398,000 | |

| Other non-cash items | |

| 604,000 | | |

| 73,000 | |

| Changes in: | |

| | | |

| | |

| Operating assets and liabilities | |

| (6,953,000 | ) | |

| (2,110,000 | ) |

| | |

| | | |

| | |

| Net cash (used in) provided by operating activities | |

| (2,700,000 | ) | |

| 1,340,000 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Acquisitions, net of cash assumed | |

| - | | |

| 8,722,000 | |

| Purchase of investment | |

| - | | |

| (100,000 | ) |

| Capitalized software development costs | |

| - | | |

| (1,677,000 | ) |

| Capital expenditures | |

| (2,013,000 | ) | |

| (2,108,000 | ) |

| | |

| | | |

| | |

| Net cash (used in) investing activities | |

| (2,013,000 | ) | |

| 4,837,000 | |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Payment of preferred stock dividend | |

| - | | |

| (1,128,000 | ) |

| Repayment of long-term debt | |

| (2,897,000 | ) | |

| (2,658,000 | ) |

| Short-term bank debt, net | |

| 2,330,000 | | |

| 2,736,000 | |

| Purchase of treasury stock upon vesting of restricted stock | |

| (186,000 | ) | |

| (48,000 | ) |

| Proceeds from exercise of stock options | |

| - | | |

| 36,000 | |

| | |

| | | |

| | |

| Net cash (used in) provided by financing activities | |

| (753,000 | ) | |

| (1,062,000 | ) |

| | |

| | | |

| | |

| Effect of foreign exchange rate changes on cash and cash equivalents | |

| (3,282,000 | ) | |

| (1,066,000 | ) |

| Net increase in cash, cash equivalents and restricted cash | |

| (8,748,000 | ) | |

| 4,049,000 | |

| Cash, cash equivalents and restricted cash - beginning of period | |

| 26,760,000 | | |

| 17,989,000 | |

| | |

| | | |

| | |

| Cash, cash equivalents and restricted cash - end of period | |

$ | 18,012,000 | | |

$ | 22,038,000 | |

POWERFLEET,

INC. CORE BUSINESS

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS DATA

| | |

Three Months Ended | |

| | |

June 30, 2023 | |

| | |

| Total Powerfleet | | |

| BASA / 3rd

party Cellocator | | |

| Core Business | |

| | |

| (Unaudited) | | |

| (Unaudited) | | |

| (Unaudited) | |

| Revenue: | |

| | | |

| | | |

| | |

| Products | |

$ | 11,012,000 | | |

$ | 322,838 | | |

$ | 10,689,162 | |

| Services | |

| 21,038,000 | | |

| 3,105,099 | | |

| 17,932,901 | |

| | |

| | | |

| | | |

| | |

| Total Revenues | |

| 32,050,000 | | |

| 3,427,937 | | |

| 28,622,063 | |

| Cost of revenue: | |

| | | |

| | | |

| | |

| Cost of products | |

| 8,550,000 | | |

| 241,769 | | |

| 8,308,231 | |

| Cost of services | |

| 7,467,000 | | |

| 2,205,391 | | |

| 5,261,609 | |

| | |

| | | |

| | | |

| | |

| Total cost of revenues: | |

| 16,017,000 | | |

| 2,447,160 | | |

| 13,569,840 | |

| | |

| | | |

| | | |

| | |

| Gross Profit | |

| 16,033,000 | | |

| 980,777 | | |

| 15,052,223 | |

POWERFLEET,

INC. PRE-MOVINGDOTS ACQUISITION

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS DATA

| | |

Three Months Ended | |

| | |

June 30, 2023 | |

| | |

Total Powerfleet | | |

Movingdots | | |

Powerfleet Pre-Acquisition Business | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | |

| Revenue: | |

| | |

| | |

| |

| Products | |

$ | 11,012,000 | | |

$ | 6,700 | | |

$ | 11,005,300 | |

| Services | |

| 21,038,000 | | |

| 181,842 | | |

| 20,856,158 | |

| |

| | | |

| | | |

| | |

| Total Revenues | |

| 32,050,000 | | |

| 188,542 | | |

| 31,861,458 | |

| Cost of revenue: | |

| | | |

| | | |

| | |

| Cost of products | |

| 8,550,000 | | |

| (3,134 | ) | |

| 8,553,134 | |

| Cost of services | |

| 7,467,000 | | |

| 153,249 | | |

| 7,313,751 | |

| |

| | | |

| | | |

| | |

| Total cost of revenues: | |

| 16,017,000 | | |

| 150,115 | | |

| 15,866,885 | |

| |

| | | |

| | | |

| | |

| Gross Profit | |

| 16,033,000 | | |

| 38,427 | | |

| 15,994,573 | |

| |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| 16,987,000 | | |

| 683,801 | | |

| 16,303,199 | |

| Research and development expenses | |

| 2,179,000 | | |

| 654,773 | | |

| 1,524,227 | |

| |

| | | |

| | | |

| | |

| Total Operating Expenses | |

| 19,166,000 | | |

| 1,338,574 | | |

| 17,827,426 | |

| |

| | | |

| | | |

| | |

| Loss from operations | |

| (3,133,000 | ) | |

| (1,300,147 | ) | |

| (1,832,853 | ) |

| |

| | | |

| | | |

| | |

| Adjusted EBITDA | |

| 647,000 | | |

| (1,167,000 | ) | |

| 1,814,000 | |

CONSTANT

CURRENCY

Constant

currency information has been presented to illustrate the impact of changes in currency rates on the company’s results. The constant

currency information has been determined by adjusting the current financial reporting period results to the prior period average exchange

rates, determined as the average of the monthly exchange rates applicable to the period. The measurement has been performed for each

of the company’s currencies. The constant currency growth percentage has been calculated by utilizing the constant currency results

compared to the prior period results.

The

constant currency information represents non-GAAP information. The company believes this provides a useful basis to measure the performance

of its business as it removes distortion from the effects of foreign currency movements during the period; however, this information

should be considered as supplemental in nature and should not be considered in isolation or as a substitute for the related financial

information prepared in accordance with GAAP. See the section above titled “Non-GAAP Financial Measures” for more information.

Due

to a portion of the company’s customers who are invoiced in non-U.S. Dollar denominated currencies, the company also calculates

subscription revenue growth rate on a constant currency basis, thereby removing the effect of currency fluctuation on results of operations.

| | |

Six Months Ended June 30, | | |

Year Over Year Change | |

| ($ in Thousands) | |

2022 | | |

2023 | | |

$ | | |

% | |

| | |

| | |

| | |

| | |

| |

| Service Revenue: | |

| | | |

| | | |

| | | |

| | |

| Service Revenue as reported | |

$ | 38,545 | | |

$ | 41,478 | | |

$ | 2,933 | | |

| 7.6 | % |

| Conversion impact of U.S. Dollar | |

| | | |

$ | 2,887 | | |

$ | 2,887 | | |

| | |

| Service revenue on a constant currency basis | |

$ | 38,545 | | |

$ | 44,365 | | |

$ | 5,820 | | |

| 15.1 | % |

| | |

Six Months Ended June 30, | | |

Year Over Year Change | |

| ($ in Thousands) | |

2022 | | |

2023 | | |

$ | | |

% | |

| | |

| | |

| | |

| | |

| |

| Product Revenue: | |

| | | |

| | | |

| | | |

| | |

| Product Revenue as reported | |

$ | 29,210 | | |

$ | 23,411 | | |

$ | (5,799 | ) | |

| (19.9 | )% |

| Conversion impact of U.S. Dollar | |

| | | |

$ | 300 | | |

$ | 300 | | |

| | |

| Product revenue on a constant currency basis | |

$ | 29,210 | | |

$ | 23,711 | | |

$ | (5,499 | ) | |

| (18.8 | )% |

| | |

Six Months Ended June 30, | | |

Year Over Year Change | |

| ($ in Thousands) | |

2022 | | |

2023 | | |

$ | | |

% | |

| | |

| | |

| | |

| | |

| |

| Total Revenue: | |

| | | |

| | | |

| | | |

| | |

| Total Revenue as reported | |

$ | 67,755 | | |

$ | 64,889 | | |

$ | (2,866 | ) | |

| (4.2 | )% |

| Conversion impact of U.S. Dollar | |

| | | |

$ | 3,187 | | |

$ | 3,187 | | |

| | |

| Total revenue on a constant currency basis | |

$ | 67,755 | | |

$ | 68,076 | | |

$ | 321 | | |

| 0.5 | % |

| | |

Three Months Ended June 30, | | |

Year Over Year Change | |

| ($ in Thousands) | |

2022 | | |

2023 | | |

$ | | |

% | |

| | |

| | |

| | |

| | |

| |

| Service Revenue: | |

| | | |

| | | |

| | | |

| | |

| Service Revenue as reported | |

$ | 19,777 | | |

$ | 21,044 | | |

$ | 1,267 | | |

| 6.4 | % |

| Conversion impact of U.S. Dollar | |

| | | |

$ | 1,299 | | |

$ | 1,299 | | |

| | |

| Service revenue on a constant currency basis | |

$ | 19,777 | | |

$ | 22,343 | | |

$ | 2,566 | | |

| 13.0 | % |

| | |

Three Months Ended June 30, | | |

Year Over Year Change | |

| ($ in Thousands) | |

2022 | | |

2023 | | |

$ | | |

% | |

| | |

| | |

| | |

| | |

| |

| Product Revenue: | |

| | | |

| | | |

| | | |

| | |

| Product Revenue as reported | |

$ | 14,818 | | |

$ | 11,006 | | |

$ | (3,812 | ) | |

| (25.7 | )% |

| Conversion impact of U.S. Dollar | |

| | | |

$ | 125 | | |

$ | 125 | | |

| | |

| Product revenue on a constant currency basis | |

$ | 14,818 | | |

$ | 11,131 | | |

$ | (3,687 | ) | |

| (24.9 | )% |

| | |

Three Months Ended Jun 30, | | |

Year Over Year Change | |

| ($ in Thousands) | |

2022 | | |

2023 | | |

$ | | |

% | |

| | |

| | |

| | |

| | |

| |

| Total Revenue: | |

| | | |

| | | |

| | | |

| | |

| Total Revenue as reported | |

$ | 34,595 | | |

$ | 32,050 | | |

$ | (2,545 | ) | |

| (7.4 | )% |

| Conversion impact of U.S. Dollar | |

| | | |

$ | 1,424 | | |

$ | 1,424 | | |

| | |

| Total revenue on a constant currency basis | |

$ | 34,595 | | |

$ | 33,474 | | |

$ | (1,121 | ) | |

| (3.2 | )% |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

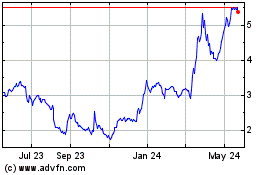

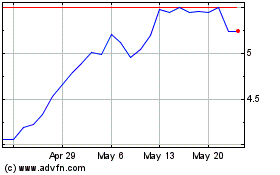

PowerFleet (NASDAQ:PWFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

PowerFleet (NASDAQ:PWFL)

Historical Stock Chart

From Apr 2023 to Apr 2024