false

0001930313

0001930313

2023-10-26

2023-10-26

0001930313

PTWO:UnitsEachConsistingOfOneShareOfClassCommonStockAndOneRedeemableWarrantMember

2023-10-26

2023-10-26

0001930313

PTWO:ClassCommonStock0.0001ParValuePerShareMember

2023-10-26

2023-10-26

0001930313

PTWO:RedeemableWarrantsEachWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2023-10-26

2023-10-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): October 26, 2023

Pono

Capital Two, Inc.

(Exact

name of registrant as specified in its charter)

Delaware

(State

or other jurisdiction of incorporation)

| 001-41462 |

|

88-1192288 |

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

643

Ilalo St. #102

Honolulu,

Hawaii 96813

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code (808) 892-6611

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☒ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Units,

each consisting of one share of Class A Common Stock and one Redeemable Warrant |

|

PTWOU |

|

The

Nasdaq Stock Market LLC |

| Class

A Common Stock, $0.0001 par value per share |

|

PTWO |

|

The

Nasdaq Stock Market LLC |

| Redeemable

Warrants, each warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

PTWOW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

Amendment

to Merger Agreement

As

previously disclosed, on January 31, 2023, Pono Capital Two, Inc., a Delaware corporation (“Pono”), entered into an

Agreement and Plan of Merger (as amended and restated on June 21, 2023, and as further amended on September 8, 2023, the “Merger

Agreement”), by and among Pono, Pono Two Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Pono (“Merger

Sub”), SBC Medical Group Holdings Incorporated, a Delaware corporation (“SBC”), Mehana Capital, LLC, in

its capacity as Purchaser Representative, and Dr. Yoshiyuki Aikawa, in his personal capacity and in the capacity as the Seller Representative.

On

October 26, 2023, Pono entered into the Second Amendment to the Merger Agreement (the “Amendment”) with the

parties thereto. Prior to the Amendment, the Pono board of directors as of the Closing was to be designated as follows: (i) three persons

designated prior to the Closing by SBC, two of whom must qualify as independent directors; (ii) one person designated prior to the Closing

by Pono; and (iii) one person mutually agreed upon and designated prior to the Closing by Pono and SBC, who must qualify as an independent

director. Following the Amendment, the Pono board of directors as of the Closing will be designated as follows: (i) three persons designated

prior to the Closing by SBC, at least one of whom must qualify as an independent director; (ii) one person designated prior to the Closing

by Pono, who must qualify as an independent director; and (iii) one person mutually agreed upon and designated prior to the Closing by

Pono and SBC, who must qualify as an independent director.

The

summary above is qualified in its entirety by reference to the complete text of the Merger Agreement and the Amendment, copies of which

are attached hereto as Exhibits 2.1 and 2.2, respectively, and are incorporated herein. Unless otherwise defined herein, the capitalized

terms used above are defined in the Merger Agreement.

Forward

Looking Statements

Certain

statements herein are “forward-looking statements” within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995 with respect to the proposed business combination. These forward-looking statements

generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,”

“intend,” “strategy,” “aim,” “future,” “opportunity,” “plan,”

“may,” “should,” “will,” “would,” “will be,” “will continue,”

“will likely result” and similar expressions, but the absence of these words does not mean that a statement is not forward-looking.

Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations

and assumptions and, as a result, are subject to risks and uncertainties. Actual results may differ from their expectations, estimates

and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Many factors

could cause actual future events to differ materially from the forward-looking statements contained herein, including but not limited

to: (i) the risk that the Business Combination may not be completed in a timely manner or at all, which may adversely affect the price

of Pono’s securities; (ii) the failure to satisfy the conditions to the consummation of the Business Combination, including the

approval of the A&R Merger Agreement by the stockholders of Pono; (iii) the occurrence of any event, change or other circumstance

that could give rise to the termination of the A&R Merger Agreement; (iv) the outcome of any legal proceedings that may be instituted

against any of the parties to the A&R Merger Agreement following the announcement of the entry into the A&R Merger Agreement

and proposed business combination; (v) redemptions exceeding anticipated levels or the failure to meet The Nasdaq Capital Market’s

initial listing standards in connection with the consummation of the proposed business combination; (vi) the effect of the announcement

or pendency of the proposed business combination on SBC’ business relationships, operating results and business generally; (vii)

risks that the proposed business combination disrupts the current plans of SBC; (viii) the risk that Pono and SBC will need to raise

additional capital to execute its business plans, which may not be available on acceptable terms or at all; (ix) the ability of the parties

to recognize the benefits of the A&R Merger Agreement and the Business Combination; (x) the lack of useful financial information

for an accurate estimate of future capital expenditures and future revenue; (xi) statements regarding SBC’ industry and market

size; (xii) financial condition and performance of SBC and Pono, including the anticipated benefits, the implied enterprise value, the

expected financial impacts of the Business Combination, potential level of redemptions of Pono’s public stockholders, the financial

condition, liquidity, results of operations, the products, the expected future performance and market opportunities of SBC; and (xiii)

those factors discussed in Pono’s filings with the SEC and that that will be contained in the proxy statement relating to the Business

Combination. You should carefully consider the foregoing factors and the other risks and uncertainties that will be described in the

“Risk Factors” section of the proxy statement and other documents to be filed by Pono from time to time with the Securities

and Exchange Commission (“SEC”). These filings identify and address other important risks and uncertainties that could

cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements

speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and while SBC

and Pono may elect to update these forward-looking statements at some point in the future, they assume no obligation to update or revise

these forward-looking statements, whether as a result of new information, future events or otherwise, subject to applicable law. None

of SBC or Pono gives any assurance that SBC and Pono will achieve their respective expectations.

Additional

Information and Where to Find It

Pono

intends to file with the SEC a proxy statement containing information about the proposed transaction and the respective businesses of

SBC and Pono. Pono will mail a definitive proxy statement and other relevant documents after the SEC completes its review. Pono stockholders

are urged to read the preliminary prospectus and proxy statement and any amendments thereto and the final prospectus and definitive proxy

statement in connection with the solicitation of proxies for the special meeting to be held to approve the proposed transaction, because

these documents will contain important information about Pono, SBC, and the Business Combination. The definitive proxy statement will

be mailed to stockholders of Pono as of a record date to be established for voting on the proposed transaction. Stockholders of Pono

will also be able to obtain a free copy of the proxy statement, as well as other filings containing information about Pono without charge,

at the SEC’s website (www.sec.gov). Copies of the proxy statement and Pono’s other filings with the SEC can also be obtained,

without charge, by directing a request to: Pono Capital Two, Inc, 643 Ilalo St. #102, Honolulu, Hawaii 96813 or calling (808) 892-6611.

No

Offer or Solicitation

This

Current Report on Form 8-K does not constitute (i) a solicitation of a proxy, consent, or authorization with respect to any securities

or in respect of the proposed business combination, or (ii) an offer to sell or the solicitation of an offer to buy any securities, or

a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation,

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the requirements of the Securities Act.

Participants

in the Solicitation

SBC

and Pono and their respective directors and officers and other members of management and employees may be deemed participants in the

solicitation of proxies in connection with the Business Combination. Pono stockholders and other interested persons may obtain, without

charge, more detailed information regarding directors and officers of Pono in Pono’s Annual Report on Form 10-K filed with the

SEC on March 9, 2023. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies

from Pono’s stockholders in connection with the proposed business combination will be included in the definitive proxy statement

Pono intends to file with the SEC.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

The

following exhibits are being filed herewith:

| Exhibit

No. |

|

Description |

| 2.1† |

|

Amended and Restated Agreement and Plan of Merger, dated June 21, 2023, by and among Pono, Merger Sub, SBC, Yoshiyuki Aikawa, and the Seller Representative (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on June 22, 2023). |

| 2.2 |

|

Second

Amendment to Amended and Restated Agreement and Plan of Merger, dated October 26, 2023, by and among Pono, Merger Sub, SBC,

Yoshiyuki Aikawa, and the Seller Representative. |

| 104

|

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

| † |

Certain

of the exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(b)(2). The Registrant

agrees to furnish a copy of all omitted exhibits and schedules to the Securities and Exchange Commission upon its request. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

PONO

CAPITAL TWO, INC. |

| |

|

|

| Date:

October 26, 2023 |

By: |

/s/

Darryl Nakamoto |

| |

|

Darryl

Nakamoto |

| |

|

Chief

Executive Officer |

Exhibit

2.2

SECOND

AMENDMENT TO THE

AMENDED

AND RESTATED AGREEMENT AND PLAN OF MERGER

Dated

as of October 26, 2023

This

Second Amendment to the Amended and Restated Agreement and Plan of Merger (this “Amendment”) is made and entered into as

of the date first set forth above (the “Amendment Date”) by and among (i) Pono Capital Two, Inc., a company incorporated

in Delaware (together with its successors, the “Purchaser”), (ii) Pono Two Merger Sub, Inc., a Delaware corporation and a

wholly-owned subsidiary of the Purchaser (“Merger Sub”), (iii) Mehana Capital LLC, a Delaware limited liability company,

in the capacity as the representative from and after the Effective Time (as defined below) for the stockholders of the Purchaser (other

than the Company Security Holders (as defined below) as of immediately prior to the Effective Time and their successors and assignees)

in accordance with the terms and conditions of this Agreement (the “Purchaser Representative”), (iv) Yoshiyuki Aikawa, in

the capacity as the representative from and after the Effective Time for the Company Security Holders (as defined below) as of immediately

prior to the Effective Time in accordance with the terms and conditions of this Agreement (the “Seller Representative”),

and (v) SBC Medical Group Holdings Incorporated, a Delaware corporation (the “Company”). The Purchaser, Merger Sub, the Purchaser

Representative, the Seller Representative and the Company are sometimes referred to herein individually as a “Party” and,

collectively, as the “Parties.”

WHEREAS

the Parties are all of the Parties to that certain Amended and Restated Agreement and Plan of Merger dated as of June 21, 2023, as amended

by the First Amendment to the Amended and Restated Agreement and Plan of Merger dated as of September 8, 2023 (as so amended and

as may be amended, modified or supplemented from time to time, the “Merger Agreement”); and

WHEREAS,

the Parties now desire to amend the Merger Agreement;

NOW

THEREFORE, in consideration of the mutual agreements contained herein and for good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, and intending to be legally bound hereby, the Parties hereby agree as follows:

| 1. | Definitions.

Capitalized terms used but not defined herein shall have the meanings assigned to such terms

in the Merger Agreement. |

| | |

| 2. | Amendment.

Pursuant to the provisions of Section 10.08 of the Merger Agreement, the second sentence

of Section 5.17(a) of the Merger Agreement is hereby amended and restated in its entirety

to provide as follow: “Immediately after the Closing, the Parties shall take all necessary

action to designate and appoint to the Post-Closing Purchaser Board, three (3) persons designated

prior to the Closing by the Company, at least one (1) of whom is required to qualify as an

independent director under Nasdaq rules; one (1) person designated prior to the Closing by

Purchaser who is required to qualify as an independent director under Nasdaq rules; and one

(1) person mutually agreed on prior to the Closing by the Company and the Purchaser who is

required to qualify as an independent director under Nasdaq rules.” |

| 3. | Effect

of Amendment; Full Force and Effect. This Amendment shall form a part of the Merger Agreement

for all purposes, and each Party shall be bound hereby and this Amendment and the Merger

Agreement shall be read and interpreted as one combined instrument. From and after the Amendment

Date, each reference in the Merger Agreement to “this Agreement,” “hereof,”

“hereunder,” “herein,” “hereby” or words of like import

referring to the Merger Agreement shall mean and be a reference to the Merger Agreement as

amended by this Amendment. Except as herein expressly amended or otherwise provided herein,

each and every term, condition, warranty and provision of the Merger Agreement shall remain

in full force and effect, and such are hereby ratified, confirmed and approved by the Parties. |

| | |

| 4. | Governing

Law. This Amendment shall be governed by, construed and enforced in accordance with the

Laws of the State of Delaware without regard to the conflict of laws principles thereof. |

| | |

| 5. | Counterparts.

This Amendment may be executed in one or more counterparts, each of which shall be deemed

to be an original, but all of which shall constitute one and the same agreement. Delivery

of an executed counterpart of a signature page to this Amendment by electronic means, including

DocuSign, Adobe Sign or other similar e-signature services, e-mail or scanned pages shall

be effective as delivery of a manually executed counterpart to this Amendment. |

[Signature

Pages Follow]

IN

WITNESS WHEREOF, each of the Parties has caused this Amendment to be duly executed on its behalf as of the Amendment Date.

| PONO

CAPITAL TWO, INC. |

|

| |

|

|

| By: |

/s/

Darryl Nakamoto |

|

| Name: |

Darryl

Nakamoto |

|

| Title: |

Chief

Executive Officer |

|

| |

|

|

| Mehana

Capital LLC |

|

| |

|

|

| By: |

/s/

Dustin Shindo |

|

| Name: |

Dustin

Shindo |

|

| Its:

|

Manager |

|

| |

|

|

| PONO

TWO MERGER SUB, INC. |

|

| |

|

|

| By: |

/s/

Darryl Nakamoto |

|

| Name:

|

Darryl

Nakamoto |

|

| Title:

|

Chief

Executive Officer |

|

| |

|

|

| SBC

MEDICAL GROUP HOLDINGS INCORPORATED |

|

| |

|

|

| By: |

/s/

Yoshiyuki Aikawa |

|

| Name: |

Yoshiyuki

Aikawa |

|

| Title:

|

Chief

Executive Officer |

|

| |

|

|

| /s/

Yoshiyuki Aikawa |

|

| YOSHIYUKI

AIKAWA |

|

[Signature

Page to Second Amendment to Amended and Restated Agreement and Plan of Merger]

v3.23.3

Cover

|

Oct. 26, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 26, 2023

|

| Entity File Number |

001-41462

|

| Entity Registrant Name |

Pono

Capital Two, Inc.

|

| Entity Central Index Key |

0001930313

|

| Entity Tax Identification Number |

88-1192288

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

643

Ilalo St. #102

|

| Entity Address, City or Town |

Honolulu

|

| Entity Address, State or Province |

HI

|

| Entity Address, Postal Zip Code |

96813

|

| City Area Code |

808

|

| Local Phone Number |

892-6611

|

| Written Communications |

false

|

| Soliciting Material |

true

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one share of Class A Common Stock and one Redeemable Warrant |

|

| Title of 12(b) Security |

Units,

each consisting of one share of Class A Common Stock and one Redeemable Warrant

|

| Trading Symbol |

PTWOU

|

| Security Exchange Name |

NASDAQ

|

| Class A Common Stock, $0.0001 par value per share |

|

| Title of 12(b) Security |

Class

A Common Stock, $0.0001 par value per share

|

| Trading Symbol |

PTWO

|

| Security Exchange Name |

NASDAQ

|

| Redeemable Warrants, each warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable

Warrants, each warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

PTWOW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PTWO_UnitsEachConsistingOfOneShareOfClassCommonStockAndOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PTWO_ClassCommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PTWO_RedeemableWarrantsEachWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

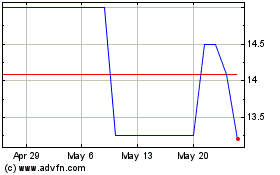

Pono Capital Two (NASDAQ:PTWOU)

Historical Stock Chart

From Apr 2024 to May 2024

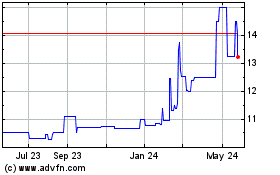

Pono Capital Two (NASDAQ:PTWOU)

Historical Stock Chart

From May 2023 to May 2024